With Apple’s App Tracking Transparency (ATT) policy putting a $10 billion dent in the revenues of tech giants, companies are finding innovative strategies to combat these losses. Initiated in April 2021, ATT upended digital advertising by requiring explicit user consent for data tracking across apps and websites, shaking the industry at its roots. But how are the affected companies responding to this disruption?

The core of this policy demanded that businesses obtain explicit approval from app users before tracking their activities or data for advertising purposes on other apps or websites. This mandate threw a wrench in the gears of many mobile marketers and advertisers, making it less straightforward to access user data crucial for customer acquisition.

Apple’s move impacted many industry giants as well. In fact, as disclosed by the Financial Times, the ATT feature triggered nearly $10 billion in losses for key players like Facebook, Snap, Twitter, and YouTube.

Ringing the Bell of Consent: Timing is Crucial

To comply with the ATT policy, many companies began using in-app pop-up notifications, offering users the option to permit or deny tracking on a per-app or per-game basis. While the policy was clear, Apple did not provide guidelines regarding the appropriate timing for these pop-up notifications, leading to an industry-wide question: when is the perfect moment to seek users’ consent for data tracking?

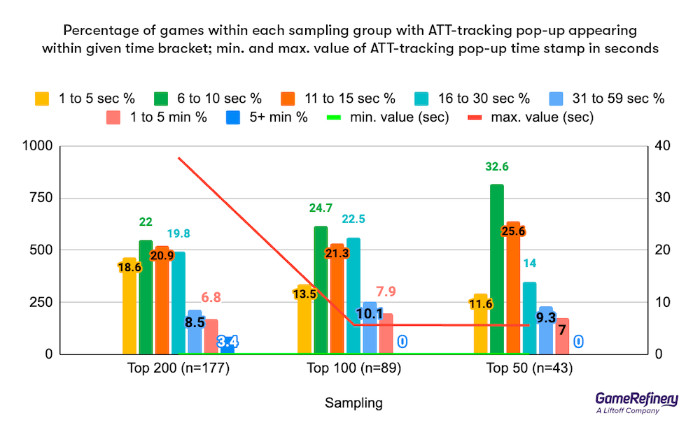

A study conducted by mobile gaming experts, Game Refinery, attempted to shed light on this predicament. Their analysis revealed that the majority of the 200 top-grossing US games implemented ATT pop-ups within a 25-minute timeframe.

However, it was also observed that 11% of games did not feature any pop-ups within the same timeframe, possibly due to the pop-up appearing later in the game or the developers opting out of data tracking altogether.

Goldilocks’ Game Time: The ‘Just Right’ Window for App Tracking Transparency Pop-ups

A deeper dive into the top 50 grossing games showed that the ATT pop-ups were exhibited within 1 second to 2 minutes and 20 seconds of gameplay. In this group, 84% of the games presented the pop-up within the first 30 seconds, and a notable 58% displayed the pop-up between 6 and 15 seconds. These results suggest that there may exist a ‘golden window’ for ATT pop-up timing, typically within the first six to 30 seconds of gameplay.

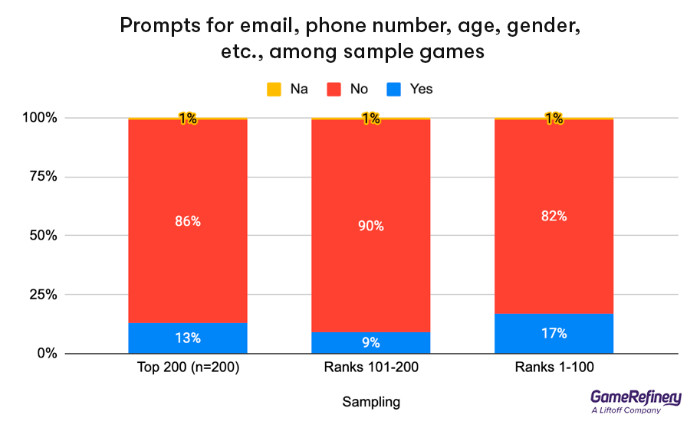

The analysis also revealed that a smaller fraction of the games (13%) offered additional prompts for user information like email addresses, phone numbers, age, gender, and other personal data. This approach varied depending on the games’ revenue rankings, with 17% of the top 100 grossing games featuring such prompts, compared to 9% of the games ranked between 101 and 200.

Transparency Triumphs – Winning User Trust

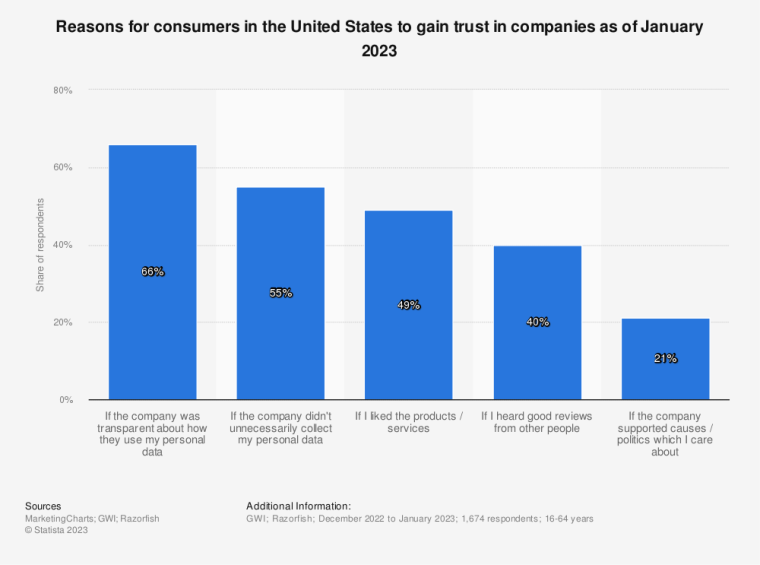

Despite the high stakes and potential financial gain, the core of the ATT policy is an issue of trust and transparency.

Statista disclosed in January of 2023 that the most important consideration for consumers in the United States when trusting companies is whether they are transparent about their use of personal data, with 66% of consumers stating this as the deciding factor.

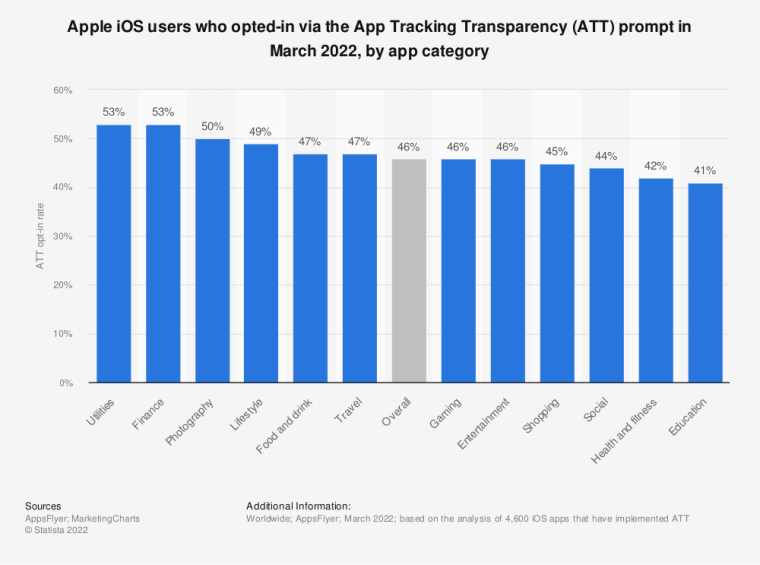

The effectiveness of the ATT implementation relies heavily on user acceptance or rejection of these pop-up notifications. According to Statista’s research, acceptance rates of the ATT pop-ups varied across different app categories in March 2022. The top spot was shared by Utilities and Finance apps, both garnering an acceptance rate of 53%. On the other end of the spectrum, Education apps saw the lowest acceptance rate at 41%. Overall, across all categories, the ATT acceptance rate was 46%.

Data Profits: The High-Stakes Game of User Information

It’s no secret that companies dealing in the data trade have been cashing in on a massive scale, profiting from selling user data. To put things in perspective, the global smartphone user base is predicted to rise by a staggering 910.3 million users (+17.33 percent) between 2023 and 2028, according to Statista research.

Given the increasing smartphone user base, estimated to reach a peak of 6.2 billion users in 2028, the volume of data up for grabs is immense. The sheer scale of this presents an attractive opportunity for companies to profit from selling user data to advertisers, making the stakes in the ATT game incredibly high.