While many believe that AI would disrupt the job market and lead to widespread job losses, it has been a boon for San Francisco as AI-related hiring is helping the city beat the slowdown blues.

According to the city’s most recent employment update, the tech sector in San Francisco and neighboring San Mateo County added 2,800 jobs in May.

To put that in perspective, that’s nearly 38% of the jobs that the city lost amid the tech layoffs.

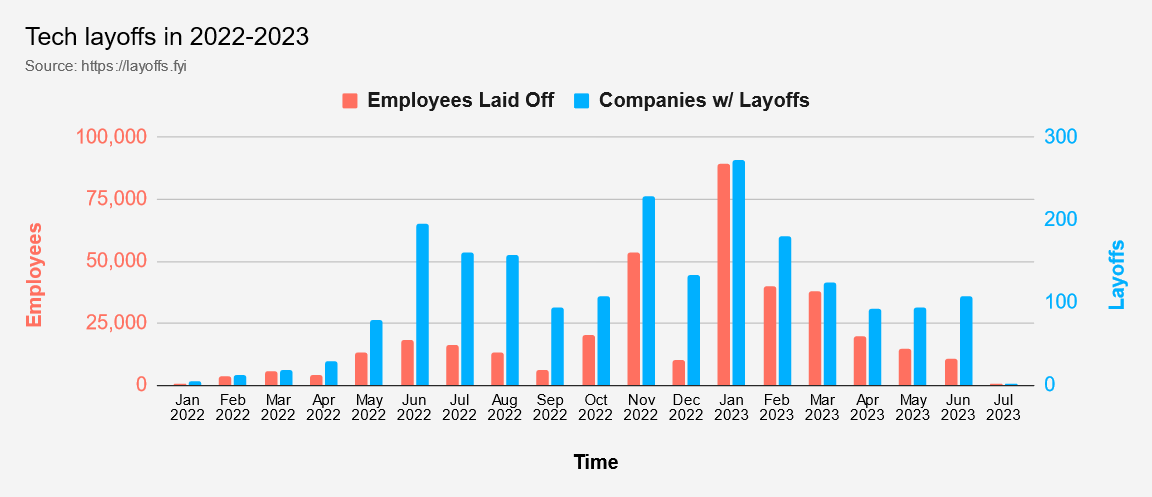

All major tech companies with the notable exception of Apple have announced mass layoffs over the last year. According to Layoffs.fyi, 833 tech companies globally have laid off over 210,000 employees.

Meanwhile, even as US tech companies have been on a firing spree, the US job market has been quite strong and added an average of 314,000 jobs every month this year.

The June jobs report is scheduled for today and economists predict that nonfarm payrolls increased by 240,000 in the month.

The strong job market has been a headache for US Fed as it makes its task of taming inflation even tougher. While higher interest rates are invariably negative for most stocks some investing strategies can outperform in high inflation.

Payroll processing firm ADP reports 497K jobs added in June, most in over a year. Our thesis for inflation & Fed rates staying higher for longer is over 50% more job openings than people unemployed will keep labor costs high. Expect a Fed hike in July to pressure PE multiples.

— Dan Niles (@DanielTNiles) July 6, 2023

Coming back to San Francisco, it is home to both ChatGPT’s parent company OpenAI as well as Anthropic.

AI-Related Hiring Picks Up in San Francisco

The AI-related hiring has helped the city’s labor market recover from job cuts as Bay Area companies like Alphabet, Salesforce, and Meta Platforms have announced mass layoffs.

Meta is cutting its workforce by about a quarter which in percentage terms is the highest among FAANG peers.

Investors have meanwhile cheered Meta’s cost cuts and with gains of over 140% it is the best-performing FAANG stock and the second-best S&P 500 stock this year.

According to San Francisco’s chief economist Ted Egan, “The stock market, especially Big Tech, is doing very well this year and that tends to be a leading indicator for hiring, especially in San Francisco.”

According to a Washington Post report, venture capital (VC) funds have poured almost $2 billion into San Francisco-based AI startups this year.

CBRE estimates that since 2019 there have been over 500 VC deals among San Francisco-based AI companies with cumulative funding of $17.7 billion.

In the second quarter, OpenAI raised $300 million in funding at an estimated valuation of upto $29 billion. Microsoft has committed to invest “multi-billion” dollars spread over multiple years into OpenAI.

Startup Funding Has Dried Up

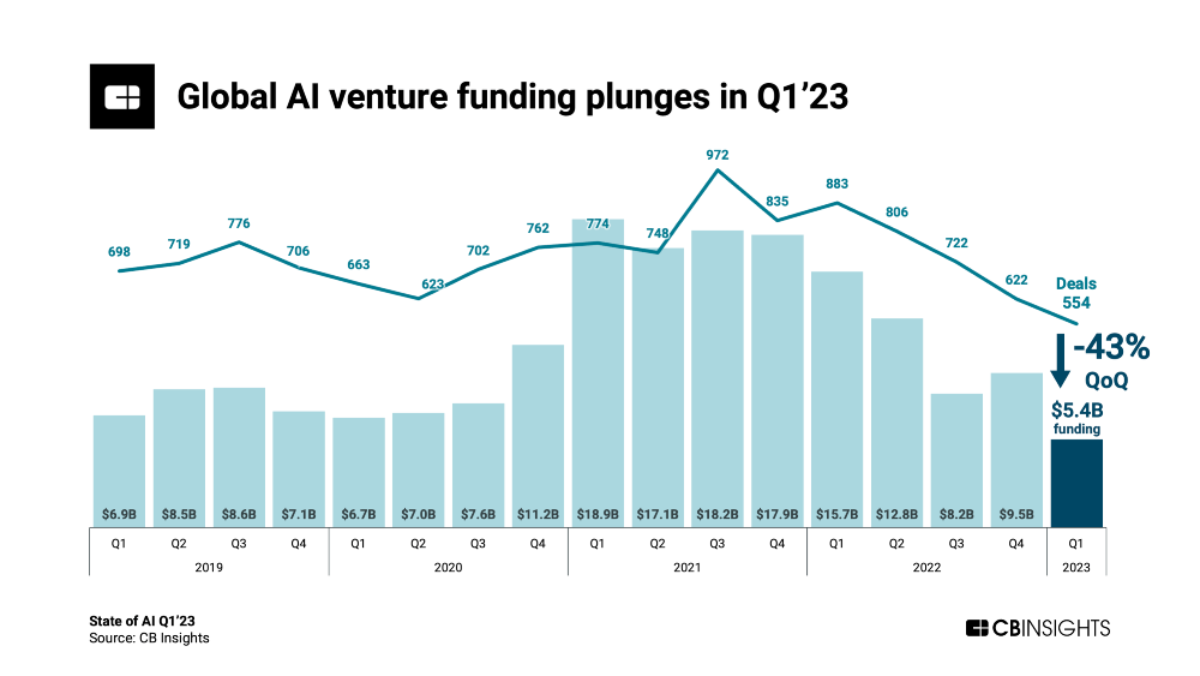

Startup funding activity has been quite tepid this year. While there is a global euphoria over AI and most tech companies are either investing in enhancing their AI capabilities or acquiring AI startups, the venture capital (VC) funding data tells a different story.

Global AI venture funding plunged in Q1 2023 in line with the slump in the overall VC industry. According to Crunchbase, global VC funding into AI startups fell 43% YoY to $5.4 billion in the first quarter of the year.

However, in what looks encouraging for AI companies, Crunchbase noted that eight of the 38 unicorns in the first five months of this year are AI companies.

While generative AI has caught the attention of tech leaders, regulators globally are also scrambling to come up with enabling regulations to prevent fraud and protect data privacy.

AI is also Leading to Job Losses

Also, while AI-related hiring has helped support the recovery in San Francisco’s job market, there are signs that the emerging technology is leading to job losses elsewhere.

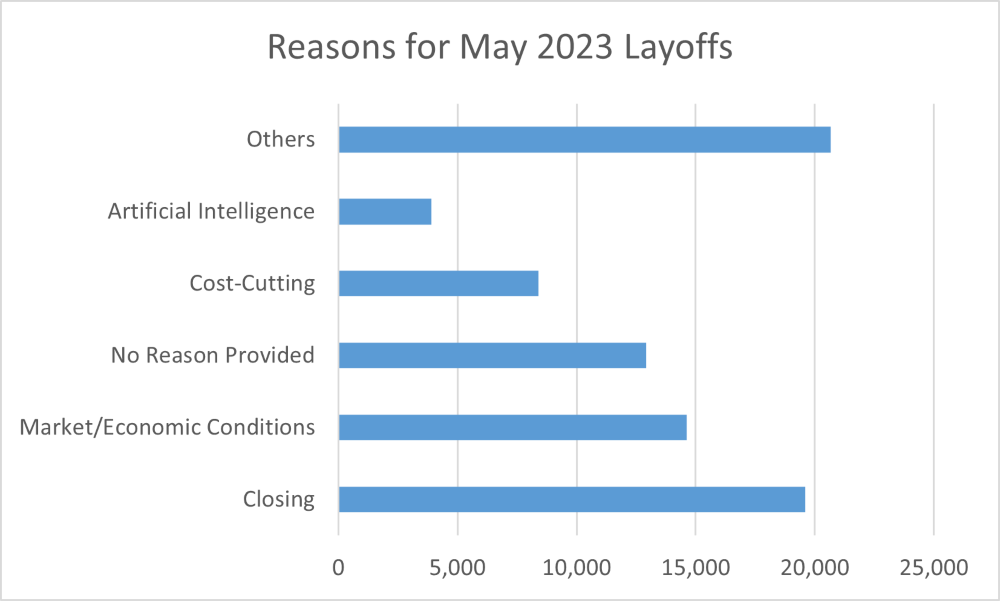

According to a report from Challenger, Gray, and Christmas, 3,900 people lost their jobs due to AI in May.

The report said that 19,598 layoffs in the month were due to the company shutting down – which is the highest in percentage terms.

Market/economic conditions came second with 14,617 layoffs. However, when we look at the YTD layoffs, nearly half of the layoffs were attributable to the factor.

Meanwhile, for the first time ever The Challenger, Gray, and Christmas report listed artificial intelligence as a reason for layoffs and attributed 3,900 job losses to AI.

Dropbox: Laying off 500 people and replacing them with AI

IBM: Pausing hiring for ~7,800 roles that could be done by AI

AI is already replacing jobs

— Genevieve Roch-Decter, CFA (@GRDecter) May 1, 2023

Notably, in April, Dropbox announced that it would lay off 500 employees, or 16% of its workforce. While the company blamed slowing growth for the decision it also attributed it to the AI pivot which made some roles redundant.

IBM is also pivoting to AI and has said that it would pause hiring for the nearly 7,800 roles that can be replaced by AI. Notably, among the many apprehensions related to AI have been related to its impact on existing jobs.

Altman Believes Artificial Intelligence Would Disrupt the Job Market

Even OpenAI CEO Sam Altman warned that AI could “eliminate” many jobs – while adding that it would create “much better ones.” During his Congressional testimony though he admitted that AI “could go very wrong.”

According to the World Economic Forum, a quarter of the jobs globally are set to be impacted by AI in the next five years.

Meanwhile, while many fear that AI would lead to widespread job losses, Goldman Sachs believes that AI would help increase productivity by 1.5% annually until the end of this decade and boost S&P 500 earnings by 30% or higher.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops