When you run a small business, you never seem to have enough resources to do everything you’d like to grow your business. One of the resources you may find strapping your business growth is the cash needed to fund everything from salaries to product acquisition to marketing. There are several options available to ensure you have enough cash on hand to allow your business growth. For instance, you can boost your profits, reduce your expenses, or strip the waste from your budget. Right-sized budgeting based on accurate projections of sales and expenses is a critical first step, so let’s start there.

1. Budgeting

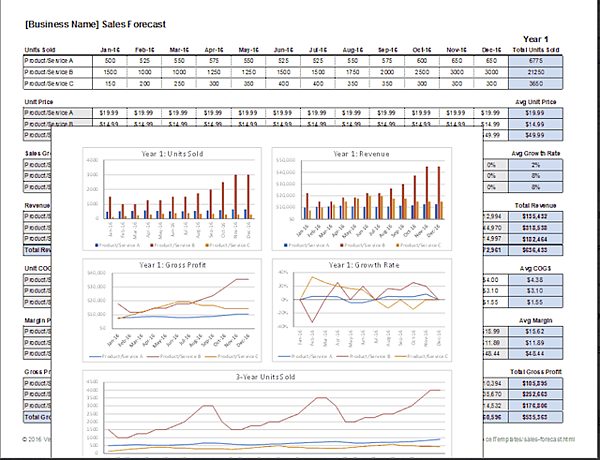

Budgeting is a complex process that greatly impacts your success. Building a budget often starts by projecting sales revenue, called a sales forecast, for the next period, often a year, such as the one below.

Image courtesy of B2C

Forecasting strategies

Building your forecast is accomplished in one of four ways.

- Build-up method – this involves forecasting sales for different product lines, different territories, and/or different salespeople to create a complete sales forecast.

- Trends – another forecasting tool involves extending the current trend line to the next time period. There are more scientific ways to do this rather than just lining up a ruler to extend the curve but you’re basically relying on the fact that conditions won’t change in the next period, which is a really tenuous assumption.

- Expert predictions – that involve forecasts for your business or industry based on knowledge experts who consider a multitude of factors such as the economy, competition, historic trends, etc. Using outside experts ensures their forecasts aren’t biased in a systematic way.

- Objective/ task method – which is often the most accurate because it relies on past performance returns. Hence, if you spent X on advertising in the past, you generated Y in sales, or Z% of customers will buy again in the next 6 months. Thus, you’re building a forecast based on real data, as well as your proposed marketing actions.

Once you have a sales forecast you believe reflects some probability of being accurate, it’s time to portion out the revenue generated across the major spending buckets you have. Commonly, you must consider overhead, such as rent and utilities, salaries and wages, materials costs, maintenance, marketing, and other spending areas. Sometimes managers in each area put together a budget that reflects their anticipated needs based on proposed sales. Often, adding up the individual budgets represents more than the revenue forecasted earlier. There’s usually a lot of give and take to get the budget in balance by taking a little from each budget or using other strategies to bring revenue and expenses into conformity.

Budgeting & forecasting software

If want to improve your company’s budgeting and forecasting, there are several software options to choose from, such as:

- Idu-Concept: This software was designed for forecasting, budgeting and reporting. The platform can also support companies to help them manage their assets and monitor spending. There’s a financial reporting feature that offers accurate data and enhanced visibility.

- Planful: With the help of the Planful software, companies can access powerful analysis and financial planning. Your business benefits from budgeting, reporting, visual analytics, and more. With the right software, it’s easy to manage your money.

2. Leveraging

Leveraging involves using strategies to get more for every dollar you spend and is a great way to get more accomplished without spending more money. Often, leveraging is seen in terms of economic tradeoffs between make versus buy or rent versus own.

Make versus buy refers to how you acquire products to sell. As a small business, you might decide it’s cheaper to buy finished goods or nearly finished goods from a manufacturer and sell them to your customers, which is standard retail practice. And, this isn’t an all-or-nothing approach. For instance, car companies often manufacture brands sold under another company’s brand name and buy brands from other companies. This allows the firm to focus on building a limited product line to achieve economies of scale and ascend the learning curve to lower costs.

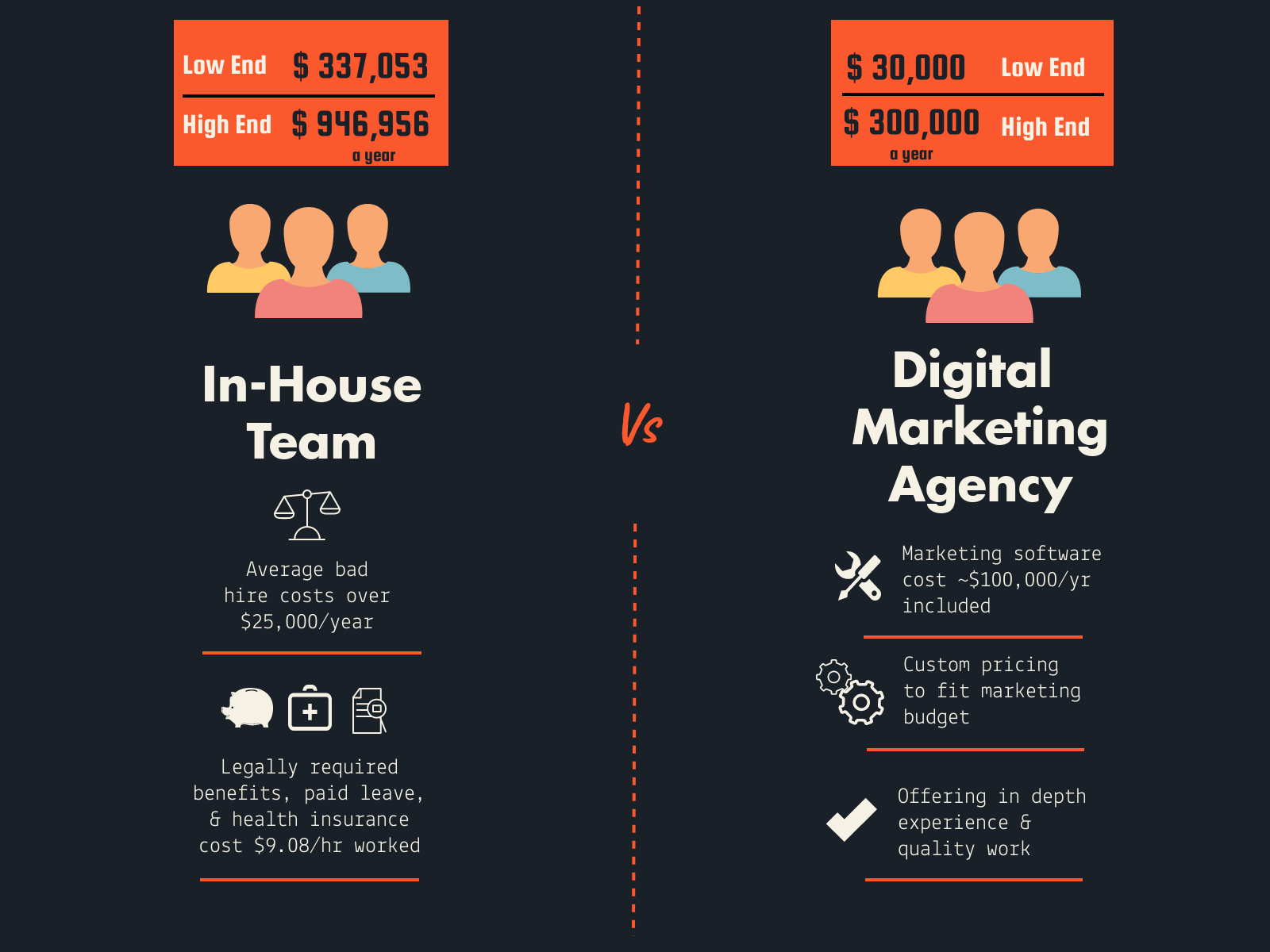

Rent versus own is another leveraging strategy where you rent equipment rather than incurring the high expense of owning the equipment. In the long run, renting is a less than optimal strategy but, given you have limited financial resources, it makes sense rather than paying the high cost to borrow the money need to purchase equipment. The same goes for your employees where hiring an employee comes with additional costs for benefits and other perks, while outsourcing your task to an agency specializing in that type of service means you only pay for what you need. Here’s a graphic showing this situation when it comes to hiring a marketing agency versus employing a marketing staff.

Here are some additional leveraging ideas:

- Go second-hand: Businesses can save money by purchasing second-hand office supplies. From furniture items to electronics, there are plenty of savings from buying good second-hand products.

- Free tools: Check out free software tools to reduce your expenses. Clickup is a great free project management tool, and SEMRush is perfect for marketing and both offer free versions.

- Operate remotely: Save money on rent and utilities by working as a fully remote business. Since many employees prefer this work situation, working remotely might lower your payroll, especially when employees can work from areas with a lower cost of living because they don’t have to come into the office.

3. Non-revenue options

Investments

There are plenty of investment opportunities that are a perfect means to generate income for your business. For example, you might consider investing excess cash in stocks and bonds to earn income from the cash you don’t need right away. Even a short-term investment makes your money work hard rather than just sitting around until you need the money.

Investing, however, comes with substantial risk and you don’t want this strategy to result in less money. When you start out, you might try Robo advisors and investment apps. Robo advisors support your investment by using algorithms to identify investments likely to appreciate over time. Software for algo trading can help you build a portfolio and earn some great returns with money that might otherwise just sit around doing nothing.

Apply for grants

Startups and small companies don’t always have big budgets. The good news is many grant opportunities exist to help you grow your business. Check out these organizations to learn about their grant opportunities:

- Idea Cafe Grant: Apply for the chance to earn $1,000 for innovative ideas from the Idea Cafe. The grant is aimed at companies in their early stages.

- FedEx Small Business Grant: For a chance to get a $50,000 grant to grow your business, enter the FedEx contest. The grant scheme operates on a yearly basis. Companies with a minimum of 6 months of operation are eligible to apply.

- PPP Grants: The US government offers PPP loans to help businesses meet their payroll needs during the pandemic. These loans turn into grants when businesses meet the requirements for maintaining their staff.

- There are a host of other opportunities for help getting your business started or growing your business. Just Google for opportunities that fit your business model.

Work smarter

Most firms have some waste in their budgets — expenses that just don’t translate into increased sales. A word of caution here, however. Just because something doesn’t translate into sales immediately, such as social media marketing or good employee morale, don’t discount the long-term impact of that tactic on the overall performance of your brand. Also, don’t get rid of expenses just because YOU don’t see the relationship between that expense and revenue. For instance, consumers, especially Millennials and GenZ, make purchase decisions after considering their hearts, not just their heads. A company they see as socially responsible, with sustainability at its core, will garner a higher percentage of their wallet than those without these social factors.

4. Improve Your Conversion Rate

The best way to grow your business is to improve your conversion rate as the more money you make, the more you can spend and, if spent efficiently, you grow your business.

There are plenty of ways that you can improve your conversion rate including:

- Improve the UX of your site, including page speed and usability.

- Add video to your website, to engage your users.

- Get testimonials and ratings from customers to increase trust and credibility.

- Ensure that you add a call to action (CTA) on every page and in your email messages. Conduct A/B testing to find the CTA that converts best.

- Use analytics tools to assess your KPIs and make changes to optimize performance.

- Streamline your purchase funnel to reduce clicks and needs to re-enter information.

- You’ll find a bunch more ideas for increasing revenue by reading through this website.

Conclusion

I hope you found these four budgeting, leveraging, and revenue growth strategies offer opportunities for improving your finances and growing your business helpful. I’d love to hear from you, so enter your questions or comments in the form below. I’d also love to hear suggestions for future posts on this site.