GameStop’s meteoric rise in 2021 captured the attention of stock investors globally. As such, many investors are searching for the next GameStop, hoping to identify stocks with similar upside potential.

This guide examines 10 stocks that could witness similar growth to GameStop in 2025. We also explore what factors to look for to find the next GameStop stock.

Here are 10 stocks that have the potential to be the next GameStop.10 Stocks That Could be the Next GameStop

A Closer Look at the Next Stocks to Blow Up Like GameStop

Investors are flocking to Reddit communities like WallStreetBets to find stock picks that could be the next GameStop.

However, before proceeding, individuals should do their own homework. This is because WallStreetBets is known for its high-risk, high-reward stock picks.

With this in mind, we’ve analyzed 10 stocks with the potential to become the next GameStop – enabling investors to make an informed decision.

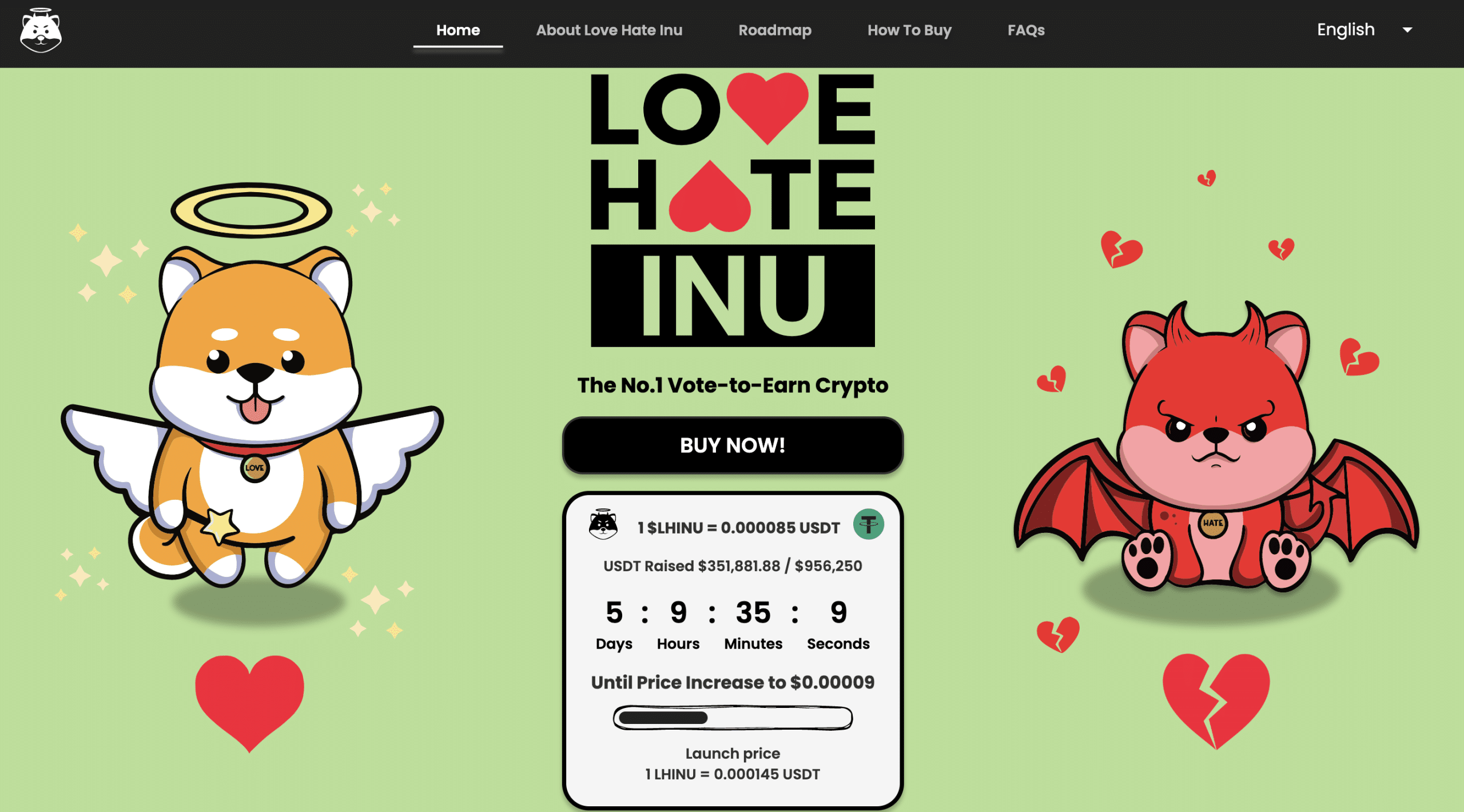

1. Love Hate Inu – New Startup Transforming the Global Voting Industry

Before discussing stocks, let us explore an investment option that is trending on WallStreetBets – Love Hate Inu. In a nutshell, the project is building the world’s first web3 vote-to-earn cryptocurrency platform. In fact, in just five days, the Love Hate Inu presale has raised over $350,000.

According to Reddit, Love Hate Inu is likely to be the next cryptocurrency to explode in 2025. The project utilizes blockchain technology to create a secure and transparent platform for voting. Its engaging polls will cover topics such as politics, entertainment, sports, and social issues.

The Love Hate Inu whitepaper outlines three crucial components for its voting platform. This includes a user-friendly interface for voting, a submission form for creating and sharing polls, and a management dashboard for ensuring security and integrity. To get started, users will need to stake the native token of Love Hate Inu, LHINU.

Best of all, users will receive LHINU tokens as a reward for their participation in votes. To prevent spam and voting manipulation, Love Hate Inu has deployed a real-time staking mechanism. This system takes into account the 30-day average balance of users to determine their voting power.

Although many popular meme tokens have yielded significant returns in the past, they often lack practical application. On the other hand, Love Hate Inu is a meme token that offers real-world use cases and incentives. Through its blockchain-based voting platform, Love Hate Inu will also tap into the rapidly growing survey market.

Given that LHINU is the only cryptocurrency platform in the vote-to-earn space, it has the potential to generate high returns over the long term. As of writing, LHINU tokens are available via a presale campaign at just $0.000085 each. The price will increase to $0.000145 by the eighth and final presale stage, representing a 70% gain for those investing today.

Love Hate Inu will launch its staking platform by Q3 2023. Soon after, the platform will begin distributing vote-to-earn payouts. By Q4 2022, LHINU holders and other brands will be able to develop and advertise their own voting polls on the platform. Intrigued by this innovative V2E crypto project? Read the Love Hate Inu whitepaper and join the Telegram group for more details.

Presale Stage

Token Price

Amount of Tokens

Token Percent

Total Price

Stage End Date

1

$0.000085

11,250,000,000

12.5%

$956,250

(Soft launch) + 7.5 days

2

$0.000090

11,250,000,000

12.5%

$1,012,500

7.5 days

3

$0.000095

11,250,000,000

12.5%

$1,068,750

7.5 days

4

$0.000105

11,250,000,000

12.5%

$1,181,250

7.5 days

5

$0.000115

11,250,000,000

12.5%

$1,293,750

7.5 days

6

$0.000125

11,250,000,000

12.5%

$1,406,250

7.5 days

7

$0.000135

11,250,000,000

12.5%

$1,518,750

7.5 days

8

$0.000145

11,250,000,000

12.5%

$1,631,250

7.5 days

Total

90,000,000,000

100%

$10,068,750

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens

2. AMC Entertainment – Meme Stock With Potential for High Returns

A common strategy to find the next GameStop stock is to look for companies with high short interest. In this regard, AMC Entertainment has caught the attention of many retail investors. AMC Entertainment is a theater chain that was founded in 1920. It operates nearly 950 theaters and 10,500 screens worldwide, focusing on the US, Europe, and the Middle East.

AMC stock benefited hugely from a short squeeze after Redditors invested in their droves in early 2021. However, since then, the stock price has fallen by about 90%. This is not surprising, considering that AMC theaters have reported a 44% drop in attendance from pre-pandemic levels. Consequently, hedge funds are once again shorting AMC stock.

On the flip side, AMC Entertainment saw a year-over-year increase of nearly 55% in revenue in 2022. The operating expense for the year also decreased by about 5%. Many Reddit investors believe that this could positively impact AMC stock in the coming months.

Most importantly, these factors indicate a potential short squeeze for AMC stock – which could be the catalyst for another bull run. Since the turn of 2023, AMC stock has increased by 37%.

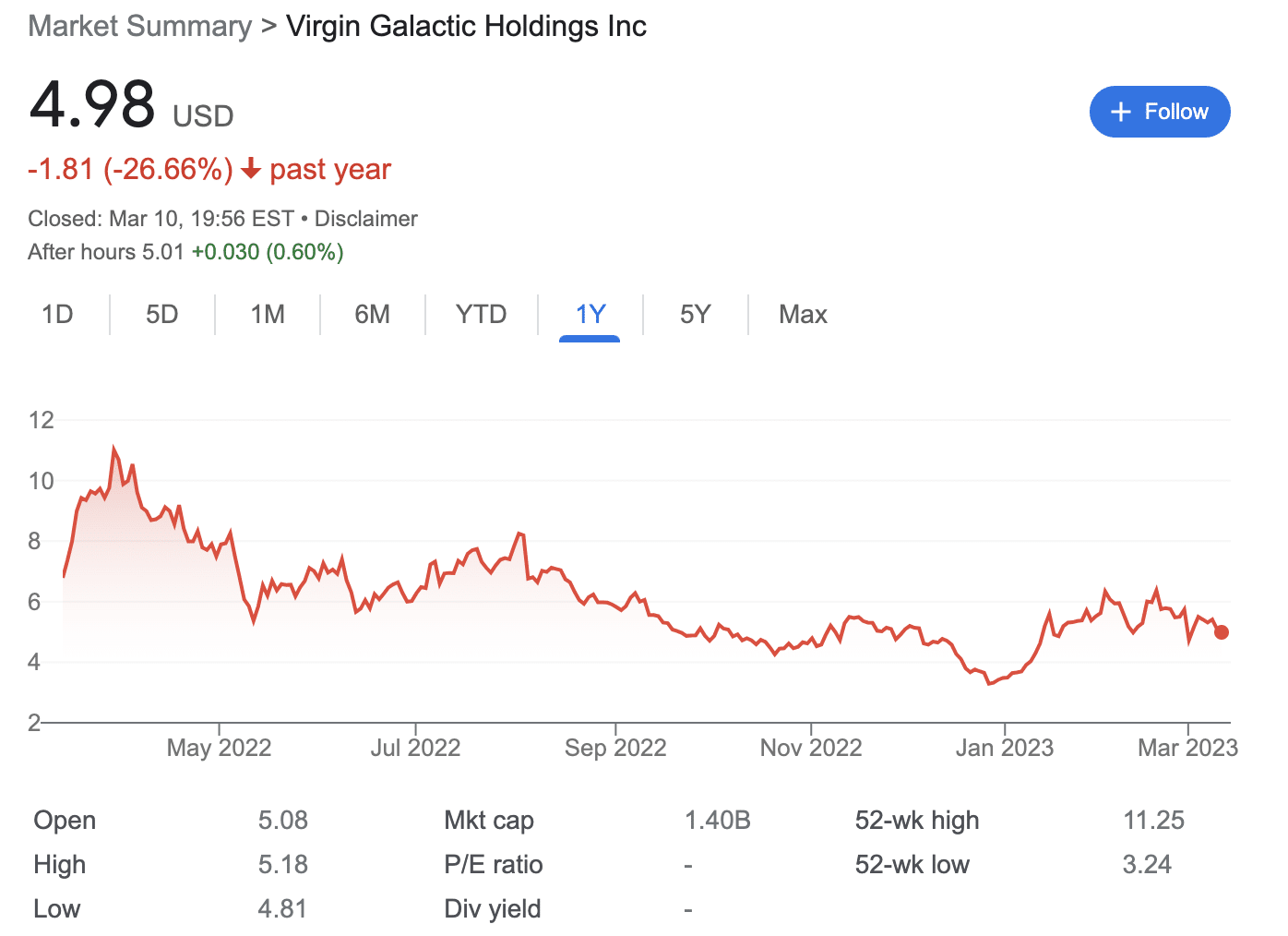

3. Virgin Galactic – Innovative Company Spearheading Space Tourism

Virgin Galactic is one of the pioneers in the space tourism industry. The company offers customers the opportunity to experience luxury space travel. It has already received bookings from over 600 customers, with tickets averaging $450,000.

In addition to its space tourism business, Virgin Galactic also develops technology for other applications, such as hypersonic travel and high-altitude research. This diversified business model could help the company generate additional revenue streams. This will also reduce its dependence on the space tourism market alone.

Virgin Galactic also has an early-mover advantage over its competitors. As the market for space tourism grows, the company can benefit from its established brand and technology. However, Virgin Galactic is also a risky investment, given how new and unpredictable this market is. In 2022, Virgin Galactic reported losses of $500 million, with a 30% decrease in revenue.

Nevertheless, the company plans to begin commercial operations soon, and if successful, the stock price could increase. And this could help Virgin Galactic become the next GameStop stock. As of writing, Virgin Galactic stock is trading at around $5. This is 90% less than the all-time high the stock achieved in February 2021.

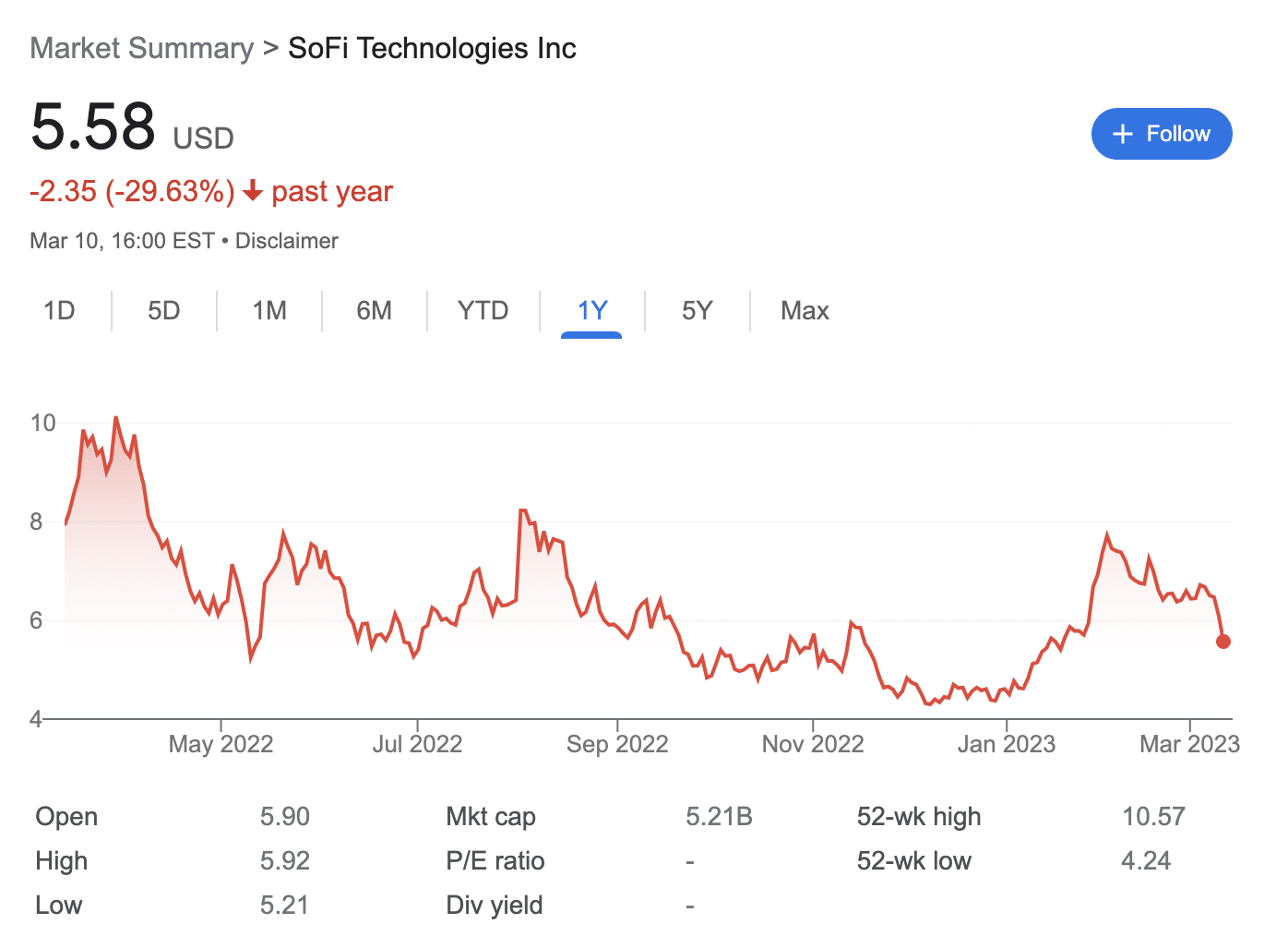

4. SoFi Technologies – FinTech Firm Offering Personal Finance Services

SoFi Technologies is an online personal finance company. It offers a variety of services, including loans, investing, and banking. It was launched in 2011 and introduced an online platform and mobile app to disrupt the traditional financial industry.

However, over the years, competition in the personal finance industry has become fierce. Moreover, fewer investors seek exposure to Fintech stocks like SoFi amidst uncertain economic conditions. As a result, the price of SoFi stock has decreased by around 30% in the past year alone.

Nevertheless, the company recently reported strong earnings. In 2022, SoFi Technologies generated revenues of over $1.5 billion, up 55% from the previous year. Moreover, in February 2023, prominent Mizuho analyst Dan Dolev stated that rising interest rates could work in SoFi’s favor.

On top of this, SoFi recently received regulatory approval to become a bank-holding company. This allows SoFi to use bank deposits to fund loans. Considering these factors, SoFi has the potential to be the next GameStop according to Reddit.

5. Tilray – Popular Pharmaceutical Company With Exposure to Legal Cannabis

Tilray is often touted as one of the best Cannabis stocks in the market. This Canadian pharmaceutical company produces and sells medical and recreational cannabis products. However, over the past few years, Tilray stock has suffered from some industry-wide challenges. This includes competition from the black market, lukewarm sales, and slow retail store rollout.

Moreover, the company is still unable to distribute products in the US market. The 2020 US Presidential election gave investors hope that marijuana would be legalized at the federal level. But it did not materialize. This has resulted in a prolonged selloff on cannabis stocks like Tilray.

The legalization of marijuana in the US will be a key tailwind for Tilray in the coming years. For this reason, analysts remain bullish that Tilray could be the next GameStop stock. In its most recent earnings report, Tilray revealed a 23% increase in revenue compared to the previous year. Tilray also has an alcohol segment that could help it weather the current cannabis storm.

Many Reddit investors are looking at Tilray as a high-risk-reward option. Tilray stock has lost over 50% of its value over the past 12 months. In turn, this penny stock is trading at under $2.50 at the time of writing.

6. Bed Bath & Beyond – Struggling Consumer Discretionary Stock With Huge Upside Potential

Home-decor chain Bed Bath & Beyond has seen its stock price drop by more than 90% over the past five years. The main reason for this is declining sales and shrinking gross margins. Additionally, the company struggles to compete with major retailers like Amazon and Walmart.

These challenges are further exacerbated by the inadequate expansion of its own e-commerce marketplace. Moreover, the home-decor chain closed approximately 550 retail locations over the last few months alone. Bed Bath & Beyond also reported a decline in net revenues and wider operating losses. However, Bed Bath & Beyond is taking steps to make changes.

In February 2023, the company announced the completion of a $1 billion equity offering. It also disclosed plans for store closures to lower cash burn and focus on restructuring. Given the company’s challenges, the equity raise is considered a success by many WallStreetbets investors.

This sentiment could potentially help Bed Bath & Beyond become the next GameStop stock. As of writing, Bed Bath & Beyond is one of the most shorted stocks on Wall Street. The stock is trading at less than $2 at the time of writing. For investors with a high-risk profile, this low price makes Bed Bath & Beyond one of the best penny stocks to buy right now.

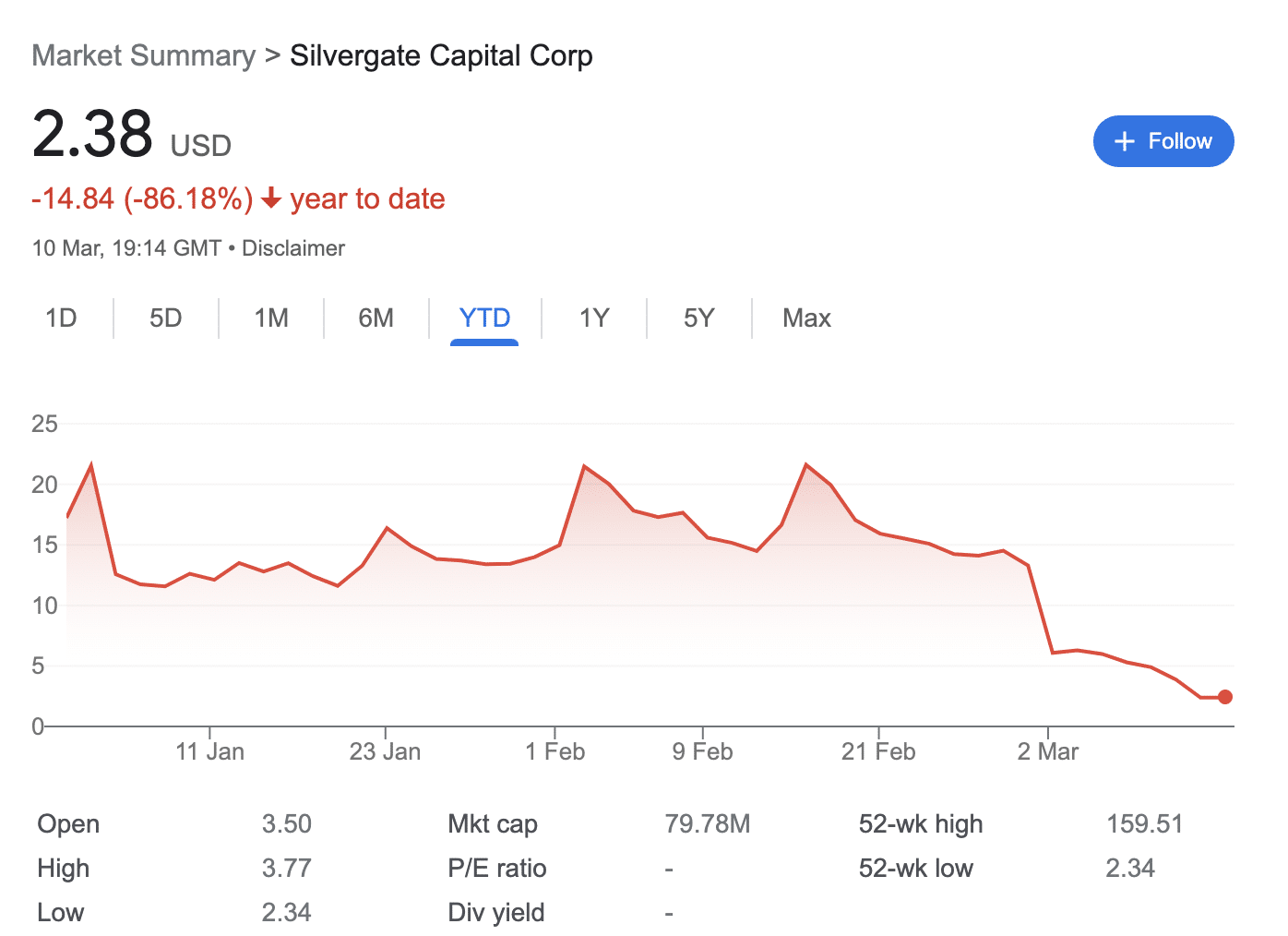

7. Silvergate Capital – Cryptocurrency Stock With High Short Interest

When searching for the next stock like GameStop, it is hard to ignore Silvergate Capital. This cryptocurrency bank suffered significant losses in 2022 due to the wider bear market. Typically, cryptocurrency institutions deposit interest-free funds into Silvergate. The bank will then invest these funds in bonds to generate profits from interest.

However, with several crypto exchanges collapsing in 2022, many investors pulled out their capital from Silvergate. As such, the bank’s deposits dried up overnight. This led to significant losses in Q4 2022. In recent months, the number of short sellers continues to rise. In fact, Silvergate Capital is now the most shorted stock in the market.

Nonetheless, positive developments in the crypto market could help Silvergate Capital recover its position. And there are indicators that the crypto market is recovering. For instance, the price of Bitcoin and Ethereum has increased by around 30% since the beginning of 2023. WallSteetBets investors view this as a positive indicator for Silvergate Capital.

8. Beyond Meat – Benefit From Potential Growth in the Plant-Based Food Industry

Beyond Meat – a plant-based meat producer, experienced rapid growth after going public in May 2019. However, the pandemic caused disruptions to its growth as restaurants closed down and scaled back their orders. Additionally, concerns about inflation have transitioned consumers back towards cheaper animal-based meat products.

As a result, Beyond Meat stock did not witness any meaningful growth in 2022. In fact, 2022 revenues fell by 10% compared to the previous year. Additionally, new competitors, such as Impossible Foods, Tyson Foods, and Kellogg’s, have entered the plant-based meat market.

However, financial analysts have predicted that inflation will cool down by mid-2023. This could boost consumer spending and the market’s appetite for plant-based meat products. Furthermore, Beyond Meat still has an early mover’s advantage in this space.

These tailwinds could enable Beyond Meat to generate stable growth again. As such, many argue that Beyond Meat could emerge as the next GameStop stock.

9. Carvana – Tech Company That Pioneered the Online Auto Retail Market

Carvana is an e-commerce car dealer that allows consumers to purchase vehicles entirely online and have them delivered to their homes. The company witnessed significant growth in both 2020 and 2021. This was fueled by cheap debt and a shift toward online vehicle shopping. However, the company is yet to turn an annual profit.

It now faces challenges with rising interest rates and a slumping market for used cars. Over the past 12 months, Carvana has lost over 90% of its stock value. Wall Street analysts suggest that the company may have to raise new capital. In other words, Carvana might issue new shares to stay afloat. But this could further dilute investor value.

However, there are factors that can help Carvana. It has a significant first-mover advantage in the online car-buying space. Moreover, Carvana’s strong brand and user experience have helped it build a loyal customer base. The company also has a solid logistics infrastructure to support its online sales model.

Although Carvana stock was shorted heavily towards the end of 2022, buying pressure has since increased. Since the beginning of 2023, the price of Carvana stock has risen by nearly 60%.

10. Upstart – Fintech Company Offering AI Solutions for Approving Loans

Upstart is a fintech company that uses AI to help banks and financial institutions approve loans. It uses non-traditional data points, such as education and work history. This gives it a competitive edge in the lending industry. However, rising interest rates mean that its lending partners have become more cautious in funding new loans. And as such, Upstart is facing challenges.

To counter this slowdown, Upstart began funding loans from its own balance sheet. This led to a reversal of its original business model and declining profits. Due to the increased risk, shorting interest in Upstart stock has risen sharply. Over the past 12 months, the price of Upstart stock decreased by over 80%.

However, it’s important to note that Upstart’s future largely depends on macroeconomic headwinds rather than internal issues. In other words, the company has long-term growth potential. This can be realized once ongoing economic uncertainties settle down. Additionally, there is a growing interest in artificial intelligence, and thus – Upstart is one of the best AI stocks in 2025.

These factors could potentially spark a short squeeze for Upstart stock. Over the prior quarter, the price of Upstart stock has increased by over 20%.

Why do People Look for the Next GameStop?

In 2021, GameStop, a brick-and-mortar video game store chain, ran into deep financial issues. However, the price of GameStop stock soared by more than 1,700% in just a few days. This was due to a group of amateur investors on Reddit. This sudden rise in value enabled those who invested in the stock early to make huge profits in a short period of time.

- The GameStop frenzy revealed that stocks can be influenced by retail investors.

- This has since inspired many first-timers to invest in stocks, especially young people who previously shied away from the market.

- Moreover, commission-free trading apps have made investing more accessible and democratic than ever.

However, it’s essential to understand that investing in stocks comes with risks. While finding the next GameStop could potentially yield profits, the process can also result in losses.

Hence, investors need to conduct thorough research and understand the risks before buying stocks.

Gamestop Stock History

To find the next GameStop stock, investors should gain a better understanding of the ‘meme stock’ phenomenon. The concept emerged in 2021. And it all started with GameStop.

As noted above, GameStop is a brick-and-mortar video game retailer founded in 1984. The company went public in 2002, trading under the ticker symbol GME on the New York Stock Exchange.

At the time of its IPO, GameStop stock was priced at $2.49 (adjusted for stock splits). Between 2002 and 2017, the price of GameStop stock ranged from $2 and $15. However, by 2018, the price of GameStop stock began to decline once again. This was partly due to the shift towards downloadable games.

In 2020, the COVID-19 pandemic resulted in store closures, further impacting the company’s financials. Then in 2021, the short squeeze happened.

Here’s an overview of the event:

- In early 2021, a group of amateur investors on Reddit’s WallStreetBets forum coordinated to buy GameStop stock. This caused the price of the stock to increase exponentially.

- The WallStreetBets group used social media platforms like Reddit and Twitter to spread the word about their GameStop buying campaign and to encourage others to join in.

- This surge in buying activity caused short-sellers to lose billions of dollars. In turn, this forced them to buy GameStop stock to cover their positions.

- As short-sellers bought more shares, the price continued to rise, creating a feedback loop known as a ‘short squeeze.’

- The short squeeze caused the GameStop stock price to reach a high of $347, up from around $20 just a few weeks earlier.

Needless to say, this frenzy attracted widespread media attention. It even led to increased regulatory scrutiny on issues such as market manipulation, social media influence on the stock market, and short-selling practices.

The price of GameStop stock eventually declined to more reasonable levels. Nevertheless, the company used the surge in its stock price to raise additional capital.

GameStop’s board of directors underwent significant changes as new directors were appointed. However, the incident forever changed the way investors view the stock market.

As of writing, GameStop stock is trading at around $17. This is over 95% below the all-time-high price that was achieved in 2021.

How Redditors Find the Next Gamestop Stock

Finding the next GameStop stock is a highly speculative endeavor. After all, Reddit forums are filled with personal opinions.

However, there are some strategies that investors may use to identify the next stock to blow up like GameStop. Read on to find the most effective way of finding the next Gamestop stock.

High Level of Short Interest

Short-squeezed stocks typically have a high percentage of their outstanding shares sold by bearish investors.

- This indicates that many investors think that the price of the stock will fall.

- But if the price starts to rise, short sellers often panic and try to cover their positions by buying shares.

- This can lead to a rapid increase in demand and a price surge.

Earlier, we reviewed some of the top stocks that are being heavily shorted right now. This includes AMC, Bed Bath & Beyond, and Silvergate Capital. Investors can watch similar stocks to identify the next GameStop stock.

Strong Social Media Presence

Social media can have a significant impact on stock prices, as seen with GameStop. Social media discussions can easily lead to a frenzy of buying and selling.

Therefore, it is smart to follow stocks that are widely discussed across social media platforms – especially Reddit.

Monitor Market News

When positive news or events are announced about a company, this can influence its stock price. For example, according to businesswire.com GameStop will report Q4 fiscal results for 2022 later this month. Many investors will be monitoring this closely to determine how well this meme stock performed last year.

This can happen when the company reports better-than-expected earnings, secures a major contract, or releases a new product that generates excitement in the market.

This positive news can trigger a surge in demand for the stock, which can quickly lead to a short squeeze.

Conduct Thorough Research

It is essential to conduct thorough research on any stock before making an investment. This is because stocks with strong fundamentals may be more likely to experience a price surge in the future.

Therefore, investors should understand a company’s business model and analyze its financial statements before risking any money.

Conclusion

With investing more accessible than ever, retail clients continue to assess what’s the next GameStop to buy. Based on our research, the most trending asset online isn’t a stock – but a cryptocurrency startup.

Put simply, Love Hate Inu is creating a blockchain-based platform with a unique vote-to-earn mechanism. The platform will reward users for their participation in the voting process.

It has also devised a secure framework that ensures transparent and fair voting systems. Right now, Love Hate Inu is in the presale stage. This means that investors can get a first-mover advantage by purchasing its LHINU tokens at a discount.

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens

FAQs

Which is the next GameStop stock in 2023?

Will GME stock go up in 2023?

Is AMC the next GameStop?

Is American Airlines the next GameStop?

Is Blackberry the next GameStop?