When you buy a stock that is undervalued, you are essentially investing in the company at a discount. This is because the stock is trading at a price lower than its perceived intrinsic value.

In this guide, we take an in-depth look at the 12 most undervalued stocks.

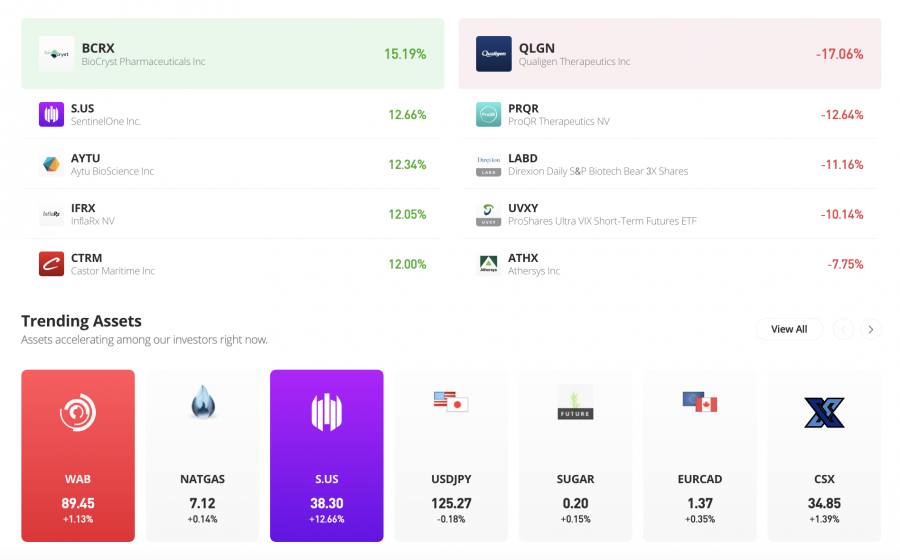

Most Undervalued Stocks to Watch in 2025

The 12 most undervalued stocks can be found in the list below:

- FightOut – Best Alternative to the Most Undervalued Stocks

- Dash 2 Trade – Popular Undervalued Crypto Analytics Project with Exciting Future

- IMPT – Undervalued Stock Alternative Rewarding Carbon Credits

- Coinbase

- Philip Morris

- Diamondback Energy

- Meta Platforms

- Innovative Industrial

- Southwest Airlines

- SoFi Technologies

- Grab

- Disney

We explain why the above stocks are deemed to be trading at a price below their perceived intrinsic value in the following sections.

A Closer Look at the Popular Undervalued Stocks

There are many reasons why a stock might be deemed to be undervalued. Although subjective, in many cases a stock will trade at an undervalued share price because of an overreaction from the broader markets.

This might be something as simple as a company falling short of its forecasted revenues in its most recent earnings report.

Or, a stock might be undervalued because the firm is still operating in a new and unproven industry – or it simply hasn’t had enough time to dominate its respective sector.

Either way, in the sections below, we take a closer look at the popular new stocks.

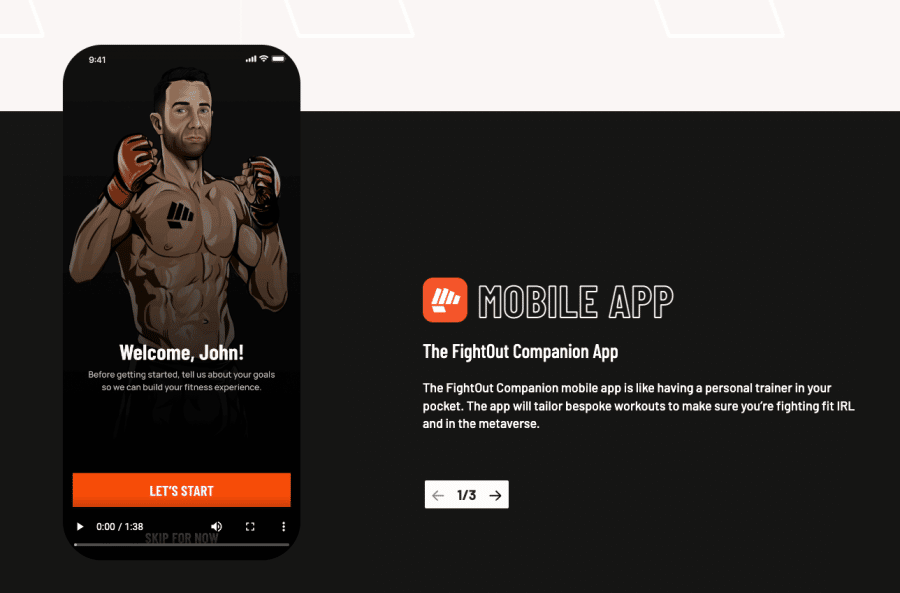

1. FightOut – Best Alternative to the Most Undervalued Stocks

In simple terms, FightOut is a new ‘Move-to-Earn’ (M2E) app that offers an exciting way for users to generate tokenized rewards for completing workouts. However, unlike other M2E apps, FightOut tracks different physical activities and not just steps. These include boxing, yoga, and weight training.

Whenever a user completes a workout, the app will track the related physical movements and award REPS. REPS is FightOut’s in-app token and can be spent in the FightOut Store to buy apparel, equipment, and other valuable items.

Underpinning the whole FightOut project is FGHT, which is likely to be one of the most promising cryptocurrencies of 2023. FightOut users can buy FGHT tokens using their credit/debit card and use them to purchase additional REPS (whilst receiving a 25% bonus). Moreover, FGHT will be the native token of the upcoming ‘FightOut Metaverse’.

FightOut’s compelling rewards mechanics have led many to believe that FGHT tokens are undervalued, as they’re currently being offered at a low price through the ongoing presale phase. Tokens are priced at just $0.0166, although FGHT’s future listing price has already been quoted at $0.0333 – meaning early investors can buy FightOut tokens at a 50% discount.

With plans for FightOut Gyms in the future, the prospects for FGHT look exceedingly bright – making it a viable alternative to the most undervalued stocks. Those looking to learn more about this project can join the official Telegram channel.

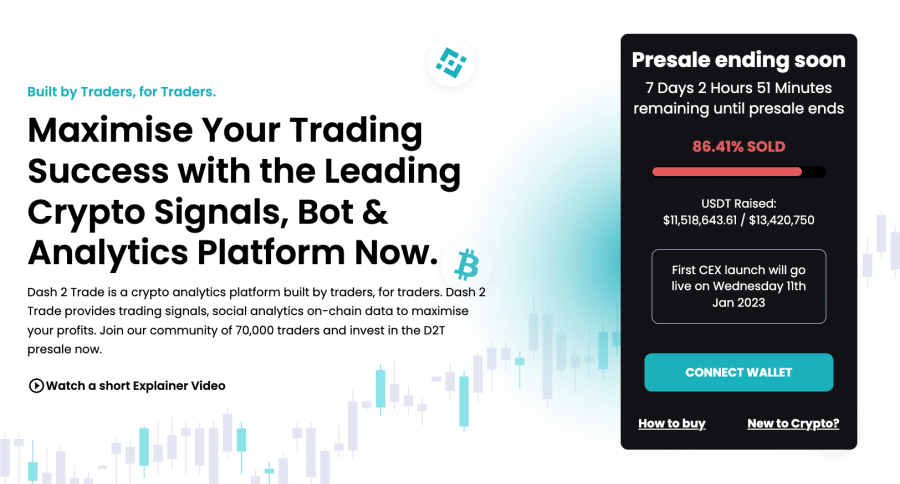

2. Dash 2 Trade – Popular Undervalued Crypto Analytics Project with Exciting Future

For those unaware, Dash 2 Trade is a crypto intelligence platform hosted on the Ethereum blockchain. This platform contains abundant tools, features, and services designed to streamline the trading/investing process for market participants. By using Dash 2 Trade’s features, traders can uncover high-quality projects – bettering their chances of profitability.

Included in the Dash 2 Trade platform are tools like buy/sell trading signals, social sentiment indicators, a presale scoreboard, advanced technical indicators, and even a risk profiler. Users can also utilize Dash 2 Trade’s backtesting feature to create effective strategies that can then be deployed in the live markets.

Underpinning the entire project is D2T – which many believe is the best crypto under $1. D2T is required to access the ‘Starter’ and ‘Premium’ tiers of the Dash 2 Trade platform, which contain the most valuable features. Moreover, D2T will be used for rewards in the project’s trading competitions, with added utility expected in the future.

Although Dash 2 Trade is still in development, investors can buy D2T tokens through the presale – which is scheduled to end on January 5th. Tokens are priced at just $0.0533, ensuring the barrier to entry is as low as possible.

Given the hype around Dash 2 Trade, the D2T token has already been picked up for listings by major exchanges such as LBank, Changelly Pro, and BitMar. D2T will be listed publicly for the first time on January 11th – meaning investors only have a limited time remaining to buy Dash 2 Trade tokens through the presale.

Interested parties can learn more about the project by joining the official Telegram channel.

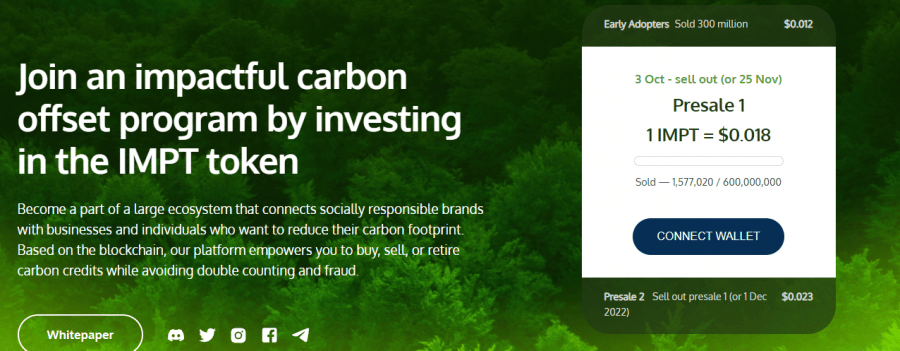

3. IMPT – Undervalued Stock Alternative Rewarding Carbon Credits

Investors wishing to align themselves with publicly traded companies and popular retailers concerned about the environment can do so with IMPT. It’s a blockchain project that has partnered with numerous companies to enable individuals to support organizations striving to reduce their carbon footprint.

IMPT enables investors to choose from hundreds of projects that want to leave a good mark on the environment. The first step to making a difference is for investors to buy the IMPT token. Investors also earn tokens with every purchase at retailers IMPT has established a partnership with. Businesses that care about the environment can receive points by integrating the IMPT platform into their business.

The IMPT whitepaper states that tokens can be converted into carbon credits. Investors can buy, sell or retire carbon credits. If not retired to compensate for the token holder’s carbon footprint, the carbon credits are minted into NFTs, which can be held as investments.

Besides investing in environmental causes, investors and businesses can track their own carbon footprint with IMPT’s social platform. Positive contributors to the environment get rewarded with points. Higher points are awarded to users retiring their carbon credits.

IMPT tokens are one of the greenest cryptocurrencies currently in a presale that have raised over $1 million in a few days. Investors can buy IMPT tokens for $0.018 each.

All the information about the project is available on the IMPT Telegram channel.

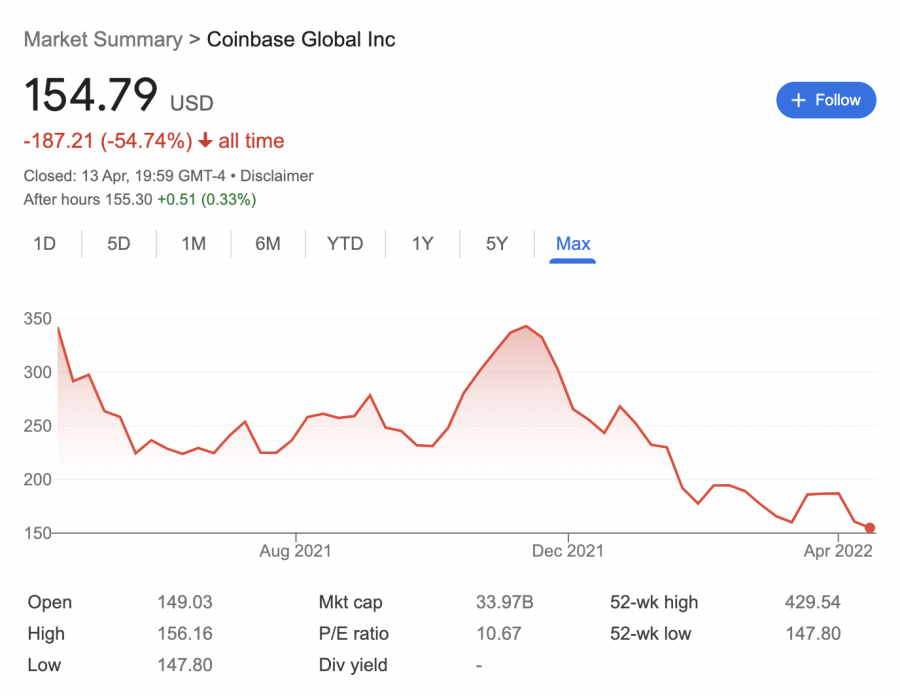

4. Coinbase

If you’re in the market for the most undervalued stock of 2025, another option is Coinbase.

In a nutshell, Coinbase is a US-based crypto exchange that serves tens of millions of customers from around the world. The platform was first founded in 2012 and it was listed on the NASDAQ exchange in April 2021. Coinbase – which opted for a direct listing, attracted a significant amount of interest from growth stock investors in the lead up to its much-anticipated IPO.

However, while the shares opened for trading at $342, Coinbase stock has since moved in the wrong direction. In fact, as of writing, the shares are trading at just over $150. This means that since its IPO, Coinbase stock has more than halved in value. With that being said, we would argue that this stock market decline is unjustified.

After all, Coinbase – after Binance, is the world’s second-largest crypto exchange. The firm makes money irrespective of how the wider crypto markets are performing, because, just like conventional stockbrokers, Coinbase generates revenue from commission fees. As such, Coinbase can be profitable regardless of whether the crypto industry is bullish or bearish.

In addition to its traditional exchange and brokerage services, Coinbase is also launching an NFT marketplace, crypto-backed debit card, and more.

In terms of valuation, it is somewhat unprecedented that Coinbase is still trading with a P/E ratio of just over 10 times. Moreover, the firm is carrying a market capitalization of under $35 billion as of writing.

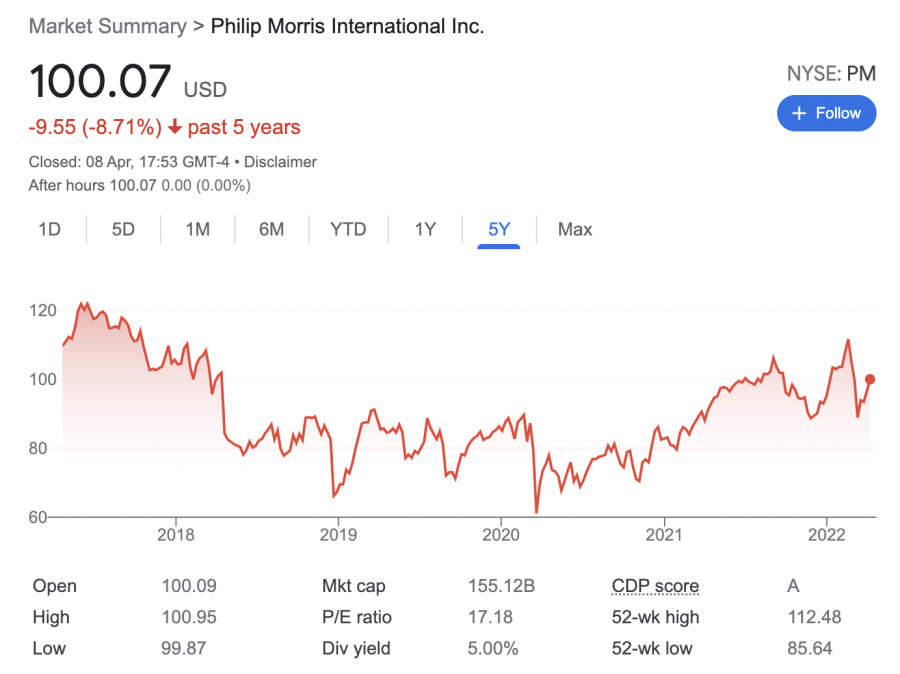

5. Philip Morris

Although the number of active smokers continues to decline globally, tobacco stocks still represent a solid sector to invest in. And at the forefront of this is Phillip Morris, the world’s largest tobacco firm after the state-owned China Tobacco. Philip Morris is behind some of the most recognized tobacco brands in this market – including Marlboro and L&M.

Crucially, stable stocks like Philip Morris can be held in your portfolio long-term, irrespective of how the broader economy is performing. After all, tobacco is a product demanded by consumers during all economic cycles. Moreover, to counter falling demand on a per capita basis, Philip Morris does what all leading tobacco firms do – it simply increases its prices.

Moreover, Philip Morris operates a high cash transient business model. As of writing, the company offers a running yield of 5%. Did you know that Philip Morris is one of the most popular undervalued dividend stocks in 2025?

Another important metric to note about Philip Morris is that the firm dominates the emerging markets with its Marlboro brand. Unlike western regions such as the US and Europe, countries in the emerging markets do not regulate smoking in the same way. Furthermore, management at Philip Morris is also dedicating increased resources to IQOS (Heat Not Burn) products.

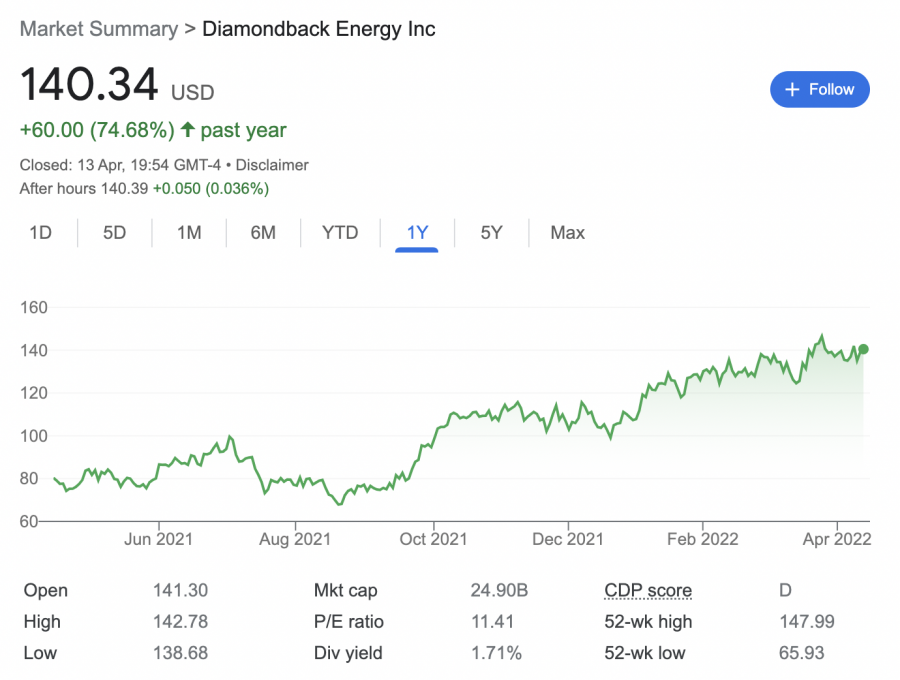

6. Diamondback Energy

In comparison to other companies in this sector, Diamondback Energy is a relatively small oil and gas stock – at least in terms of its market capitalization. As of writing, the firm is still trading with a valuation of under $30 billion. And as such, Diamondback Energy is arguably one of the most undervalued oil stocks to add to your portfolio today.

In terms of performance, Diamondback Energy has benefited tremendously from record-high oil prices. Over the prior 12 months alone the stocks are up 74%. both ExxonMobil and Shell are up 51% over the same period.

As of writing, a running yield of over 1.7% is on offer. Year on year, Diamondback Energy’s quarterly revenues grew by 162% while net income was up 235%.

The firm also increased its cash and equivalents by more than 500%. On the other hand, Diamondback Energy is an independent oil producer that is more sensitive to changing oil prices than many of its peers.

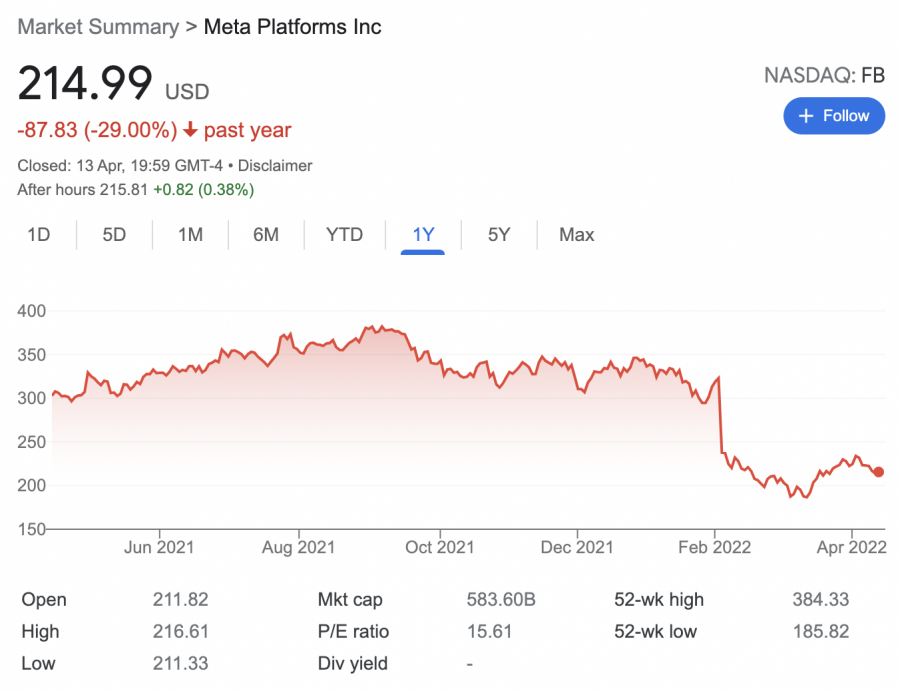

7. Meta Platforms

Meta Platforms – formally known as Facebook, is the world’s largest social media conglomerate. In addition to Facebook, Meta Platforms is also behind Instagram, Messenger, WhatsApp, Oculus, and dozens of other subsidiaries. And as a result, Meta Platforms are used by billions of consumers from around the world.

However, Meta Platforms – which rebranded to highlight its intentions to target the metaverse in the coming years, has had a rough time on the stock markets recently. Over the prior year, for instance, the shares are down 30%. Over a 5-year period, Meta Platforms stock is up just 50%. In comparison, fellow social media platform Twitter is up over 200% during the same period.

With that said, the share value decline of Meta Platforms is a classic example of an overreaction from the broader markets. Crucially, in its most recent earnings report, the firm noted that for the first time since going public – the number of monthly active users on its Facebook platform declined.

When this was announced, over $230 billion was wiped from Meta Platform’s market capitalization in a single day of trading. Based on prices as of writing, we would argue that Meta Platforms is one of the most undervalued stocks today. Although the firm does not pay a dividend, Meta Platforms is trading with a cheap P/E ratio of just over 15 times.

In recent news Meta Platforms is beginning to test tools that will allow creators to create digital experiences in its metaverse Horizon Worlds.

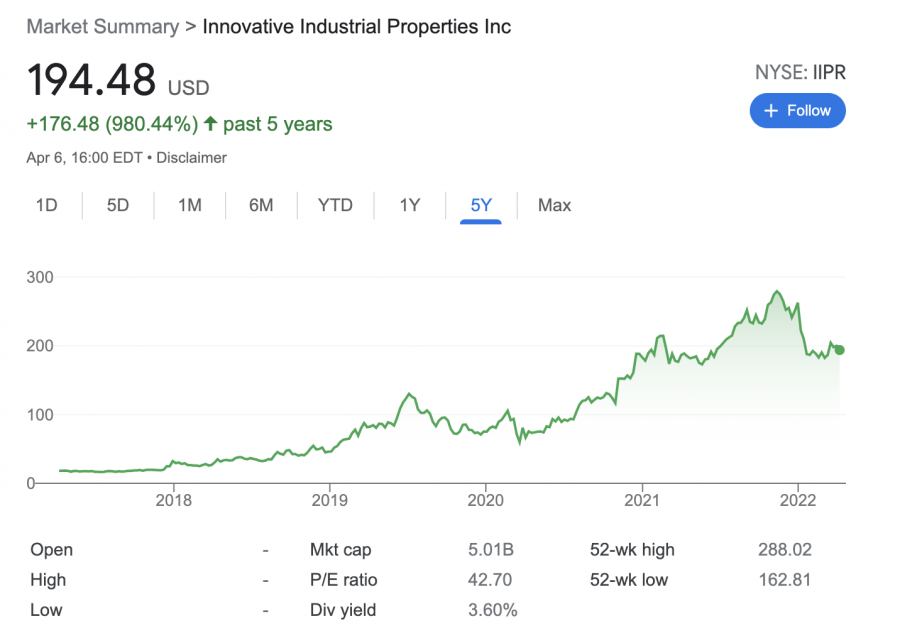

8. Innovative Industrial

It could be argued that cannabis stocks as a whole are hugely undervalued, as companies operating in this sector have struggled in recent years. With that said, if you’re in the market for the overall most undervalued marijuana stocks – it could be worth focusing exclusively on Innovative Industrial.

In a nutshell, Innovative Industrial is a REIT that gives you access to the wider cannabis industry in a more diversified manner. This is because the firm offers core real estate facilities – such as greenhouses and storage locations for state-licensed operators in the legal cannabis industry. Over the past five years of trading, Innovative Industrial has grown in value by nearly 1,000%.

Over a 12-month period, the shares have remained flat. Nonetheless, with a market capitalization of just $5 billion, Innovative Industrial is potentially undervalued – at least in the long run. After all, as more and more states in the US decide to legalize recreational cannabis sales, this will only benefit established market players like Innovative Industrial.

As a REIT, the firm is required to distribute dividends every month. And, as of writing, a running dividend yield of over 3.8% is being offered. Finally, the stock has a P/E ratio of over 40 times.

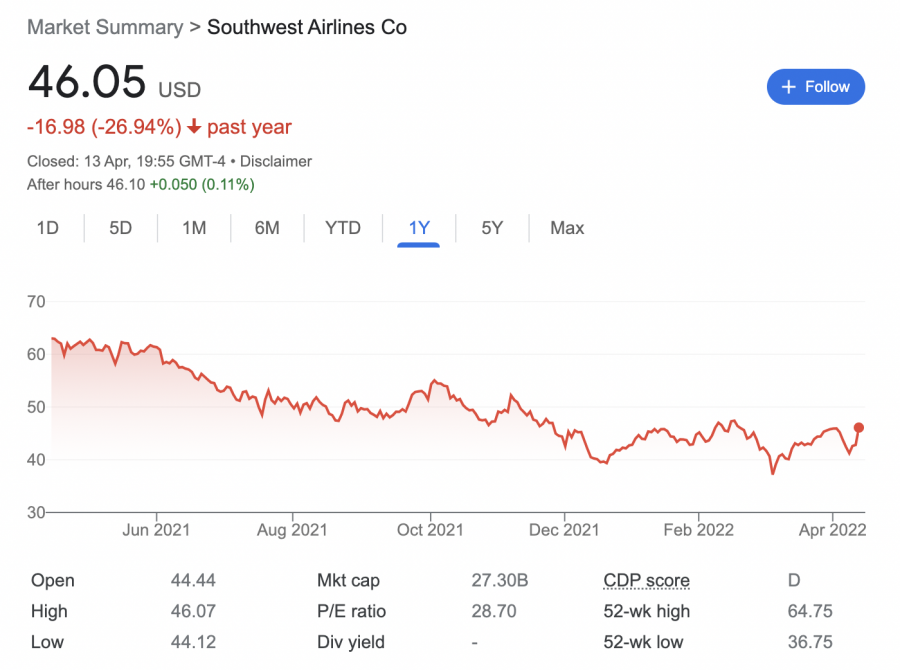

9. Southwest Airlines

Since the pandemic came to fruition, companies operating in the aviation industry have been hit extremely hard. Not only have airline stocks had to contend with ongoing travel restrictions and hugely reduced passenger numbers, but now record-high oil prices. And therefore, it will come as no surprise that many airline stocks are still trading below pre-pandemic levels.

Although this industry is fraught with risk, we would argue that the likes of Southwest Airlines are undervalued and thus – could represent a bargain buy for your portfolio today. While there are many aviation stocks trading on the cheap, Southwest Airlines stands out for us, not least because of its reasonable solid balance sheet.

Not only in terms of survival during times of increased travel restrictions, but to ensure that it continues to increase its domestic and international route expansion program.

When it comes to its stock price action, Southwest Airlines surpassed its pre-covid valuation in April 2021. However, the stocks have since slumped. As such, over the prior 12 months, Southwest Airlines stock is down over 25%.

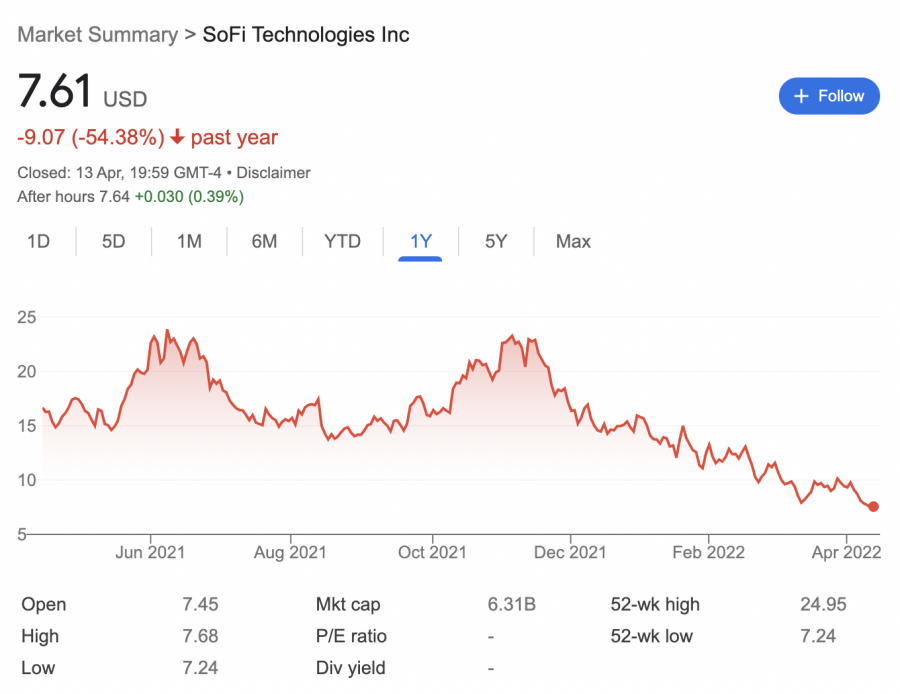

10. SoFi Technologies

SoFi Technologies is behind the popular SoFi website and mobile app – which consolidates a full suite of financial and investment services via a single hub. In addition to stocks, ETFs, and robo-advisory services, SoFi also offers checking accounts, loans, student finance, and much more.

Crucially, at current prices, SoFi Technologies is arguably one of the most undervalued stocks in the ever-growing FinTech, which, until recently, enjoyed rapid growth. A broader market sell-off of tech-related growth stocks has resulted in up-and-coming firms like SoFi Technologies, dropping in value by a large amount.

In fact, in the prior 12 months alone, SoFi Technologies stock is down more than 50%. This means that the firm is now trading at a lower price than its 2020 IPO, which opened at roughly $10 per share.

In terms of the fundamentals, 2021 was a solid year for the firm – with SoFi Technologies attracting an additional 87% in customer numbers. This takes the firm’s customer base to 3.5 million, which, in the grander scheme of things, is still minute. Therefore, there is plenty of upside potential with this undervalued stock.

SoFi Technologies is trading with a market capitalization of under $7 billion. And, perhaps most importantly, it was recently announced that SoFi has had its banking charter application approved by US regulators.

11. Grab

Grab is a Singapore-based super app provider, which is particularly dominant in Thailand, Vietnam, Indonesia, Malaysia, and the Philippines.

In addition to ride-hailing services, Grab offers everything from food delivery and groceries to micro-loans. Due to the exponential rate at which the firm continues to grow in the emerging economies, Grab was one of the most anticipated IPOs of 2020. However, things haven’t quite gone to plan since its NASDAQ listing.

Based on prices as of writing, Grab is trading at a price over 70% lower than its IPO. One of the main reasons for this rapid sell-off is due to Grab’s overly aggressive business model – in which it allocates significant resources to customer incentives.

This has since increased to an annual spend of over $1 billion. However, it should be noted that Grab is still very much a growth stock and thus – expenditure of this nature is not overly uncommon. Moreover, although the firm is still very much a loss-making company, this is to be expected. Ultimately, at current prices, Grab stocks are simply too cheap to turn down.

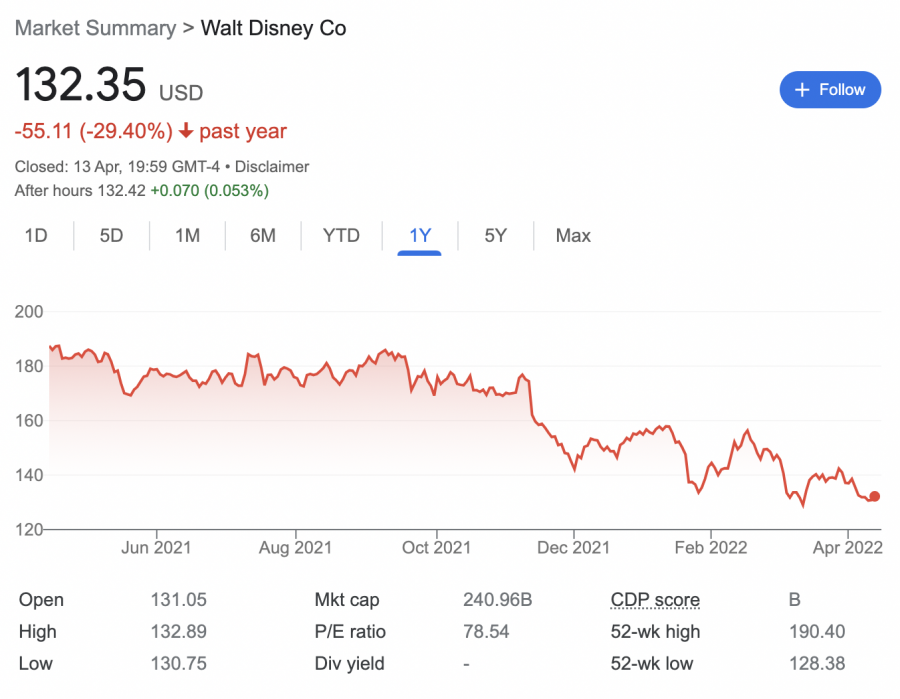

12. Disney

Make no mistake about it – Disney is a high-grade stock that can be relied on for long-term value seekers irrespective of how the economy is performing. Sure, on the one hand, many of Disney’s core services – such as its theme parks, cruise ships, and movie sets, were heavily disrupted in the midst of the pandemic.

However, the firm’s relatively new streaming service – Disney +, continues to perform well. Moreover, now that global economies are finally returning to some sort of normality, Disney stocks appear to be an unmissable bargain at current prices. Although the stocks hit all-time highs of over $190 in early 2021, the shares have since entered a market correction.

As of writing, this blue-chip stock can be purchased for less than $135 per share. And as such, if and when Disney returns to its prior high, this offers a medium-term upside of over 40%. Moreover, although Disney suspended its previously consistent dividend program in 2020 as per the impact of the pandemic, this is sure to return in the very near future.

After all, its decision to temporarily suspend dividends has no correlation to its balance sheet – which is solid.

What are Undervalued Stocks?

The term undervalued stock refers to a public company that is trading at a share price that is perceived to be less than its true value. In other words, the term is subjective, not least because investors determine and view company valuations in different ways.

In many ways, stocks are undervalued because of an overreaction from the markets. For example, we briefly mentioned earlier that when Meta Platforms announced in its most recent earnings report that the number of monthly active users on Facebook had declined in the quarter for the first time, the firm lost over 25% of its share value in just one day of trading.

This resulted in a decline of over $230 billion from its market valuation. However, many would argue that the fact that Facebook slightly underperformed for the quarter does not warrant such a significant stock decline. As a result, this is a perfect example of how to find undervalued stocks on the back of an unnecessary market reaction after the release of an earnings report.

Conclusion

In buying undervalued stocks for your portfolio, you can purchase your chosen shares and try to diversify your investments. This guide has discussed the 12 most undervalued stocks, albeit, it’s important that you also conduct your own research.

Those seeking an alternative to the most undervalued stocks may wish to consider FightOut. Although this is a crypto, rather than a stock, FightOut does offer a compelling use case that could drive value in the future. Furthermore, the project is still in its presale phase, meaning investors can buy FGHT tokens at a discounted rate – leading many to believe that these tokens are currently undervalued.

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain

FAQs on the Most Undervalued Stocks

What stocks are undervalued?

What are undervalued stocks?

How do you invest in undervalued stocks?

How does Warren Buffett find undervalued stocks?

Read More:

- Best Penny Stocks to Watch in 2023

- Best Meme Stocks to Watch in 2023

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks