To buy stocks in the UAE, the investor will need to open an account with an online broker that offers low fees and support for plenty of exchanges and markets. In most cases, the process from start to finish can be completed in a matter of minutes.

This guide on how to buy stocks in the UAE is intended for those that are completely new to the world of investing. We explain the process of getting started, alongside an overview of how stock trading in the UAE works.

How to Buy Stocks in the UAE With a Regulated Broker

Before delving into our full beginner’s guide on how to buy stocks in the UAE, below we offer a simplified overview of the process when using a regulated broker.

- ✅ Step 1: Open a Brokerage Account – The first step is to choose a low-cost stock broker and proceed to register an account with the provider. Details such as the investor’s full name, residency status, home address, and more will be required by the regulated broker, alongside a copy of a government-issued ID.

- Step 2: Deposit Funds – Many regulated stock brokers support payment methods that are popular in the UAE – such as a debit or credit card. Bank wires and e-wallets like Paypal are often supported too.

- Step 3: Search for Stocks – After funding the account, the investor can search for the stock that they wish to invest in. This is the easiest way to find the respective stock, as some brokers offer access to thousands of markets.

- Step 4: Invest in Shares in the UAE – The final step is to create and place a buy order on the chosen stock. This requires the investor to decide how much they wish to invest – either in dollar terms or the total number of shares.

Keep reading to learn the ins and outs of how to buy stocks in the UAE via a regulated, low-cost broker.

Where to Buy Stocks in the UAE – Popular Stock Brokers Reviewed

The first step required when embarking on an investment journey online is to determine where to buy shares in the UAE. Notable brokers in this space will offer competitive fees across multiple stock markets and exchanges.

Not to mention support for convenient payment methods and small minimum account balances. Below, we explore where to invest in shares in the UAE from the comfort of home.

Note: International stock brokers that accept UAE residents will typically operate in US dollars – as per the reviews below.

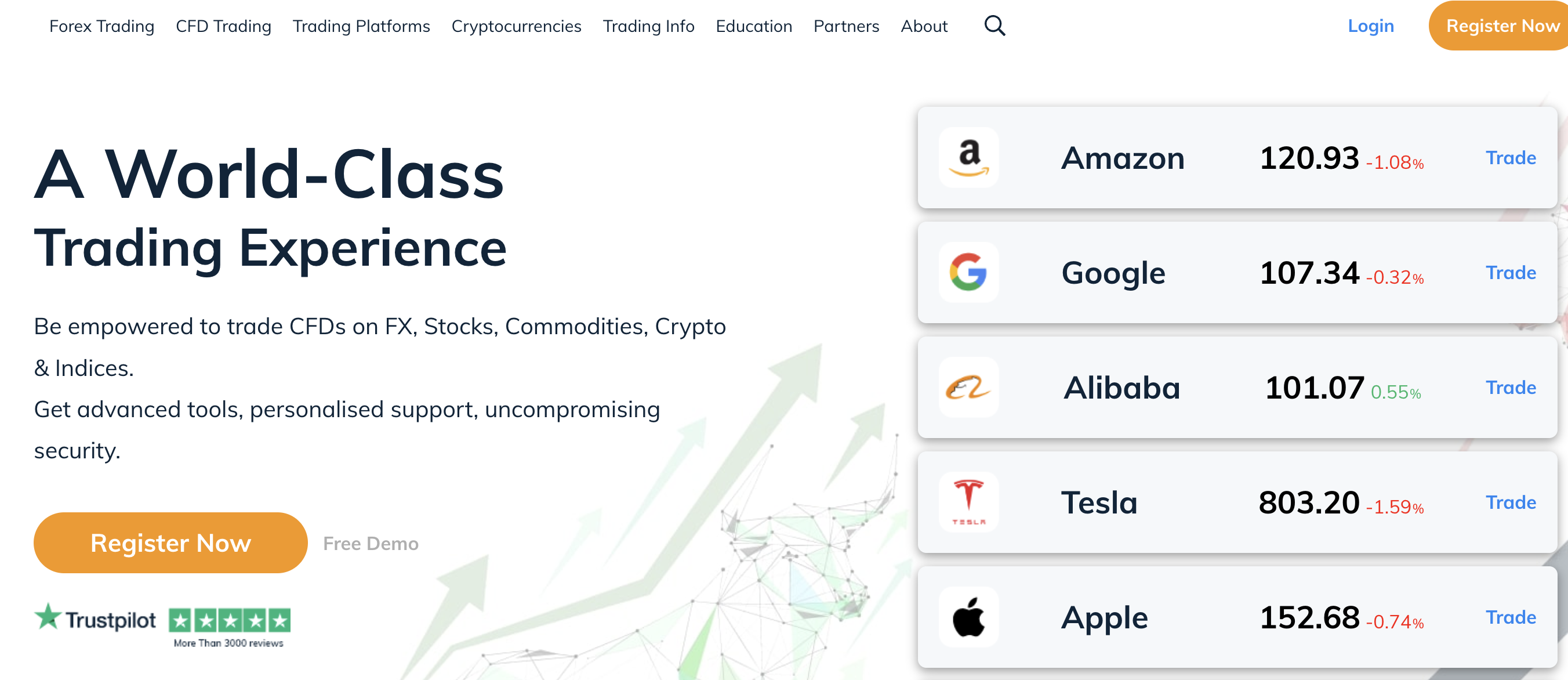

1. Plus500

Users can buy/sell more than 2,800 CFD trading instruments, including stocks, forex, and indices, and it provides access to more than 100 markets and some of the world’s biggest companies, including the likes of Amazon, Netflix, and Alphabet.

At least 1,500 stocks as CFDs can be traded and the platform offers FX trading with low spreads – users can also buy/sell stocks with up to 1:300 leverage, which can bring larger returns (or larger losses).

Plus500 users can sign up in minutes, and there is no subscription fee or joining fee. The minimum deposit is $100 (approx. 367 AED). Certain traders who meet requirements can apply for a Professional Account with increased leverage at no additional cost.

There is also a demo account available for users to familiarize themselves with the platform and practice trading and investing without risking any capital.

The platform supports multiple payment options, including Mastercard and Visa, as well as wire transfer and e-wallets such as Skrill, Apple Pay, or Neteller.

In terms of fees, there are no charges for deposits or withdrawals. There is an inactivity fee of $10 (approx 36.7 AED) for 3 months of no activity but to avoid this, all you have to do is login. Other platforms require you to make a trade to remain active.

Plus500AE Ltd is authorised and regulated by the Dubai Financial Services Authority (F005651) and features SSL (Secure Sockets Layer) encryption to protect funds.

It also has a dedicated mobile app and offers access to +Insights, an analytics tool that can reveal top trends on the Plus500 platform.

CFD Service. Regulated by the DFSA. Trading carries risk This enables traders in the UAE to speculate on the future value of stocks with leverage. The vast majority of listed stock CFDs at AvaTrade are based in the US – across both the NASDAQ and NYSE. When it comes to fees, there are no account charges when making a deposit or withdrawal. The minimum first-time deposit for UAE residents is $100. Payments can be made via a debit/credit card issued by Visa or MasterCard. Moreover, AvaTrade does not charge any trading commissions when entering buy and sell orders.

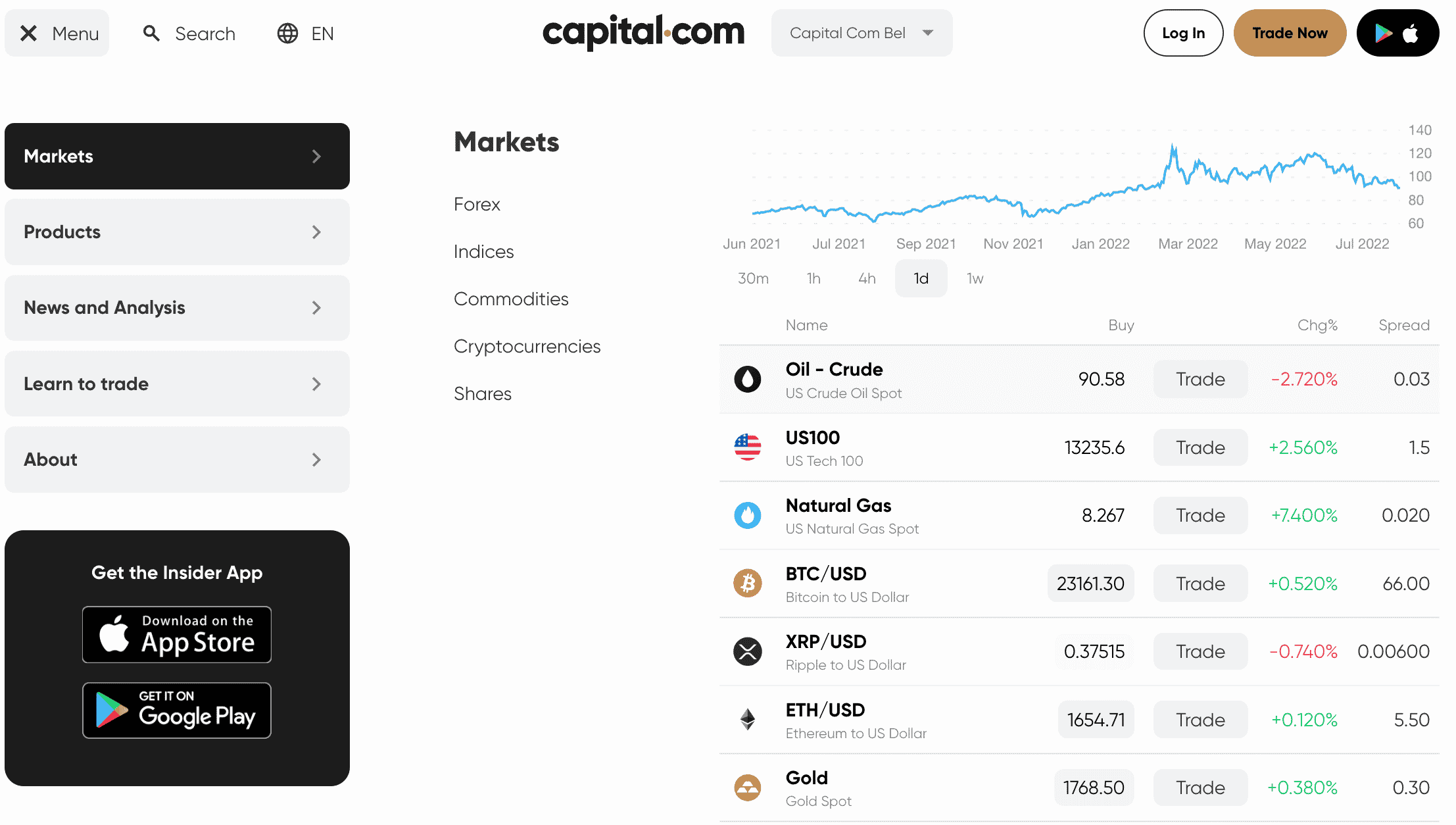

You can fund your Capital.com trading account with a debit card, credit card, or wire transfer. The minimum deposit is 20 USD/EUR/GBP or 80 AED for bank cards.The minimum withdrawal amount is 50 USD/EUR/GBP or 190 AED. If you have under 50 USD/EUR/GBP or 190 AED on your trading account, you can only withdraw the whole balance. After setting up an account and making a deposit, Capital.com offers access to many stock exchanges from around the world. Examples here include markets in the US, UK, Singapore, Netherlands, Germany, and more. When placing a stock trading order at Capital.com, the user will have the option of a long or short position. In simple terms, a long position indicates that the user believes the stock price will rise. While, a short order means the opposite – i.e, the stock price will decline. In other words, UAE residents can enter positions in an attempt to profit from either rising or falling markets. In terms of its pricing structure, no deposit or withdrawal fees are charged by Capital.com. There are no trading commissions charged to enter or exit a position, either. However, when keeping a position open overnight, CFD financing fees will apply. This is why CFD stock trading is more conducive to short-term strategies. All of the financial instruments listed on Capital.com can be traded with leverage. Clients will often have access to leverage of 1:5 on stock CFDs. Leverage levels on other assets may be higher or lower. Alternative CFD markets at Capital.com are inclusive of ETFs, cryptocurrencies, indices, commodities, and forex. Experienced traders might consider using Capital.com via MT4 software, which comes inclusive with lots of technical charts and economic indicators. Users can also trade via the Capital.com trading suite for web browsers. Capital.com is licensed and authorized by SCA in the UAE, CySEC, ASIC, and the FCA.

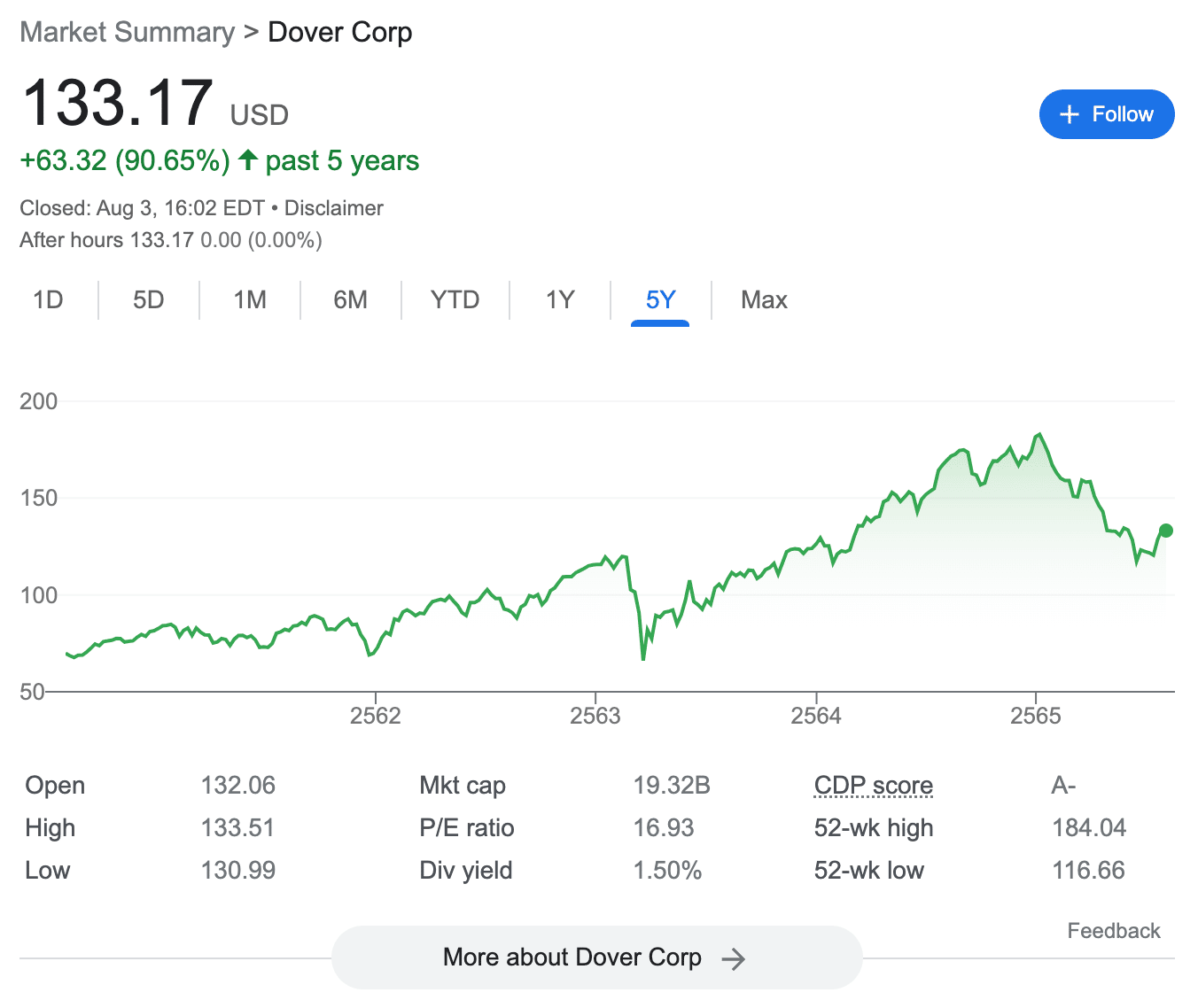

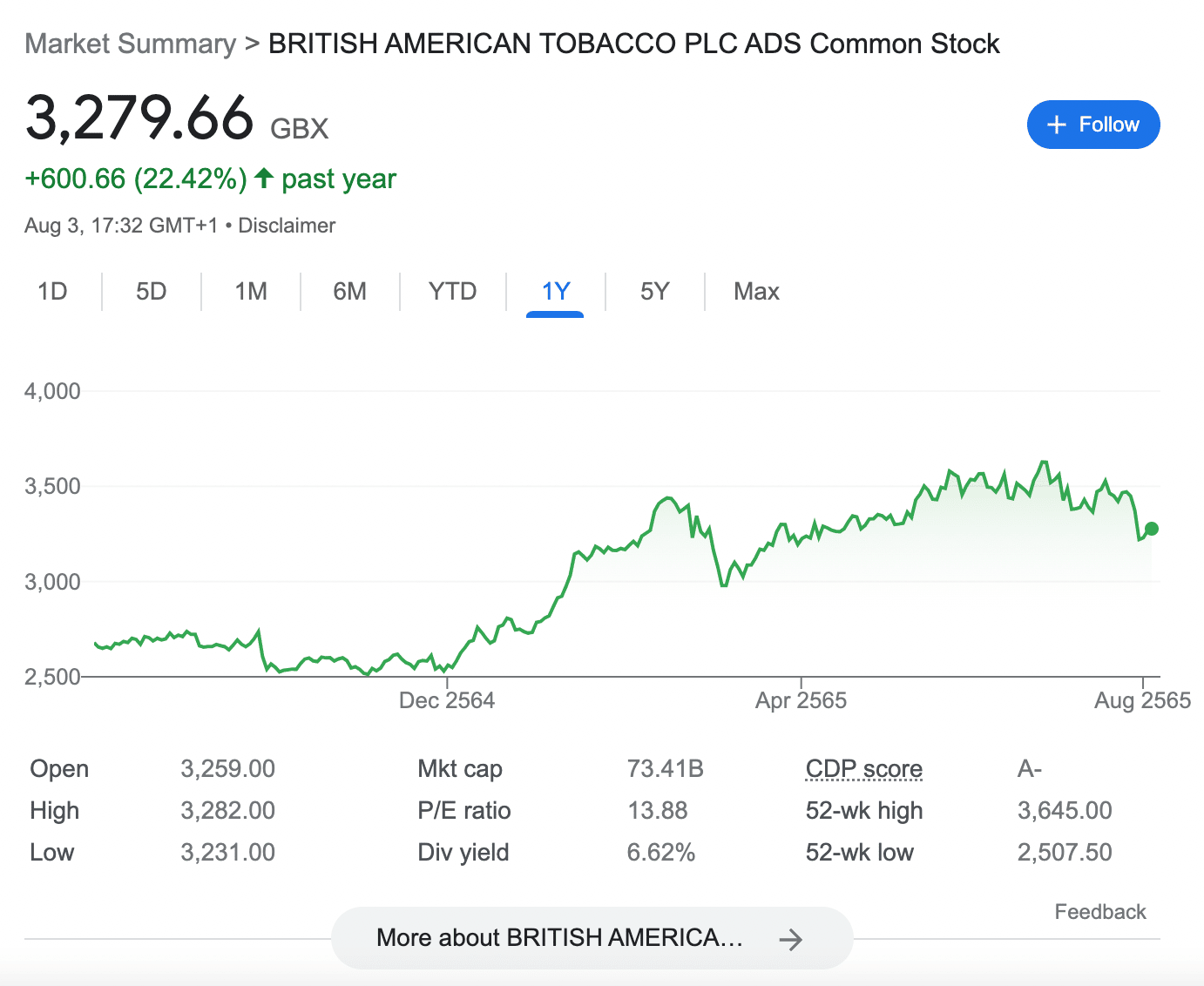

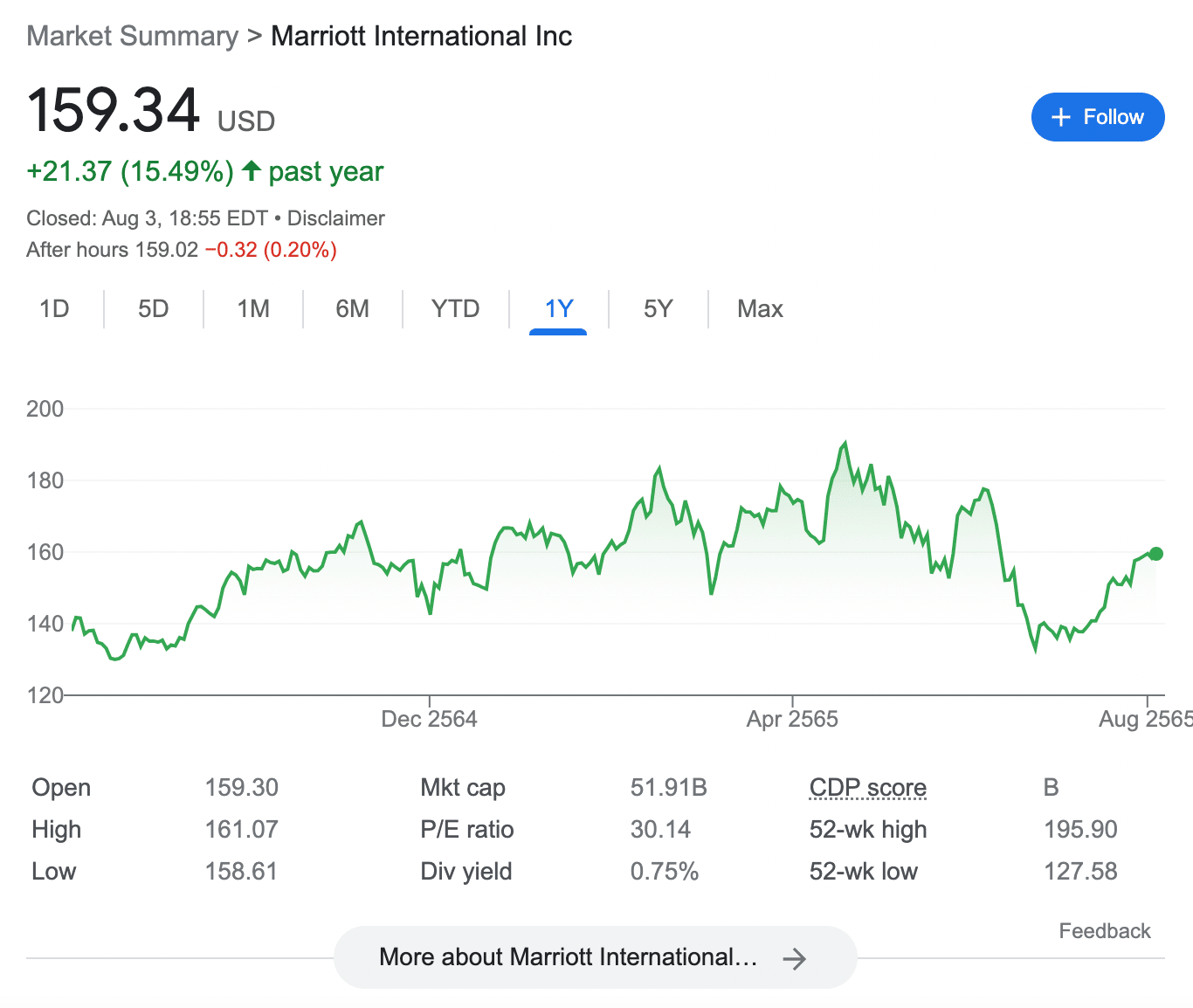

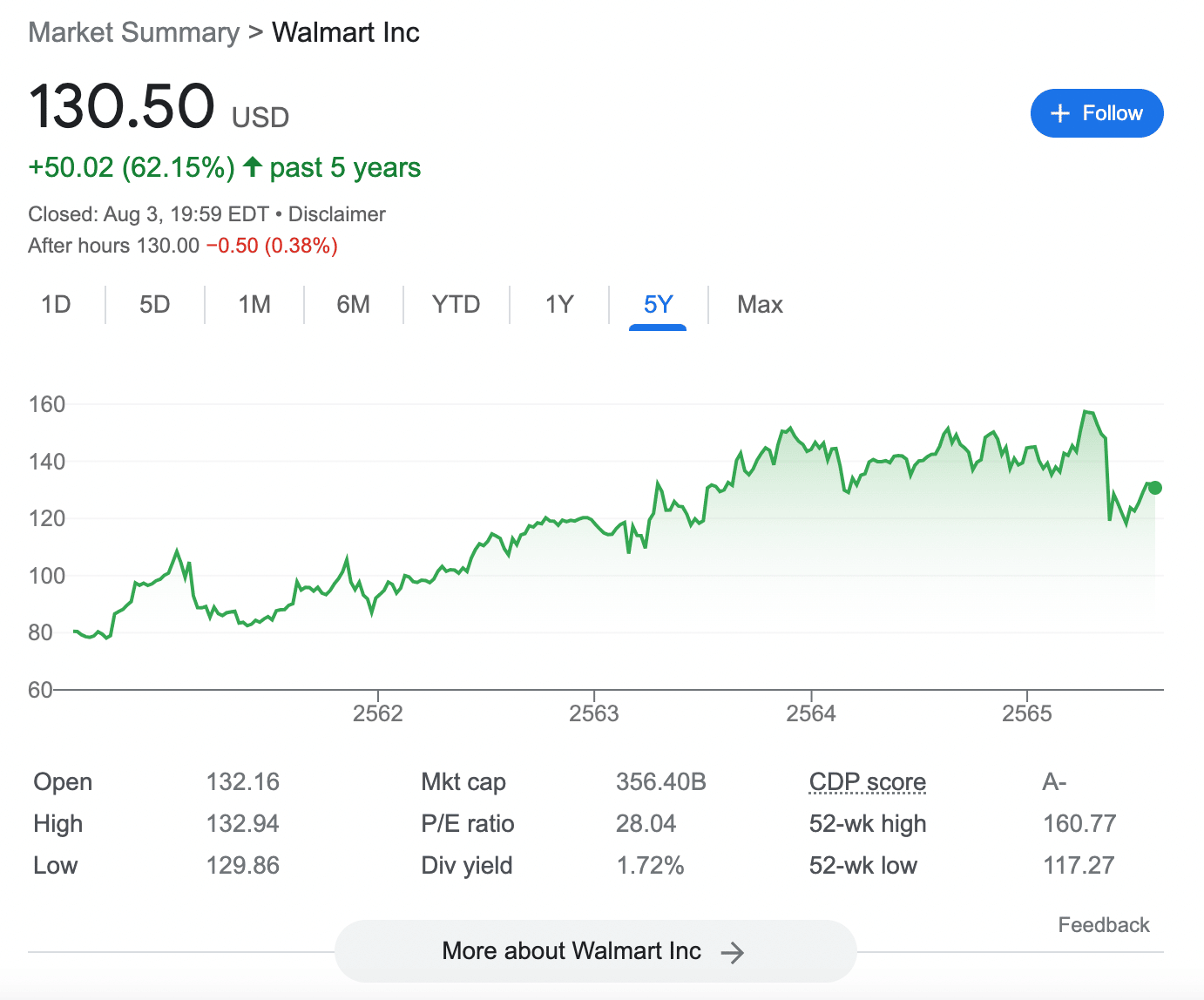

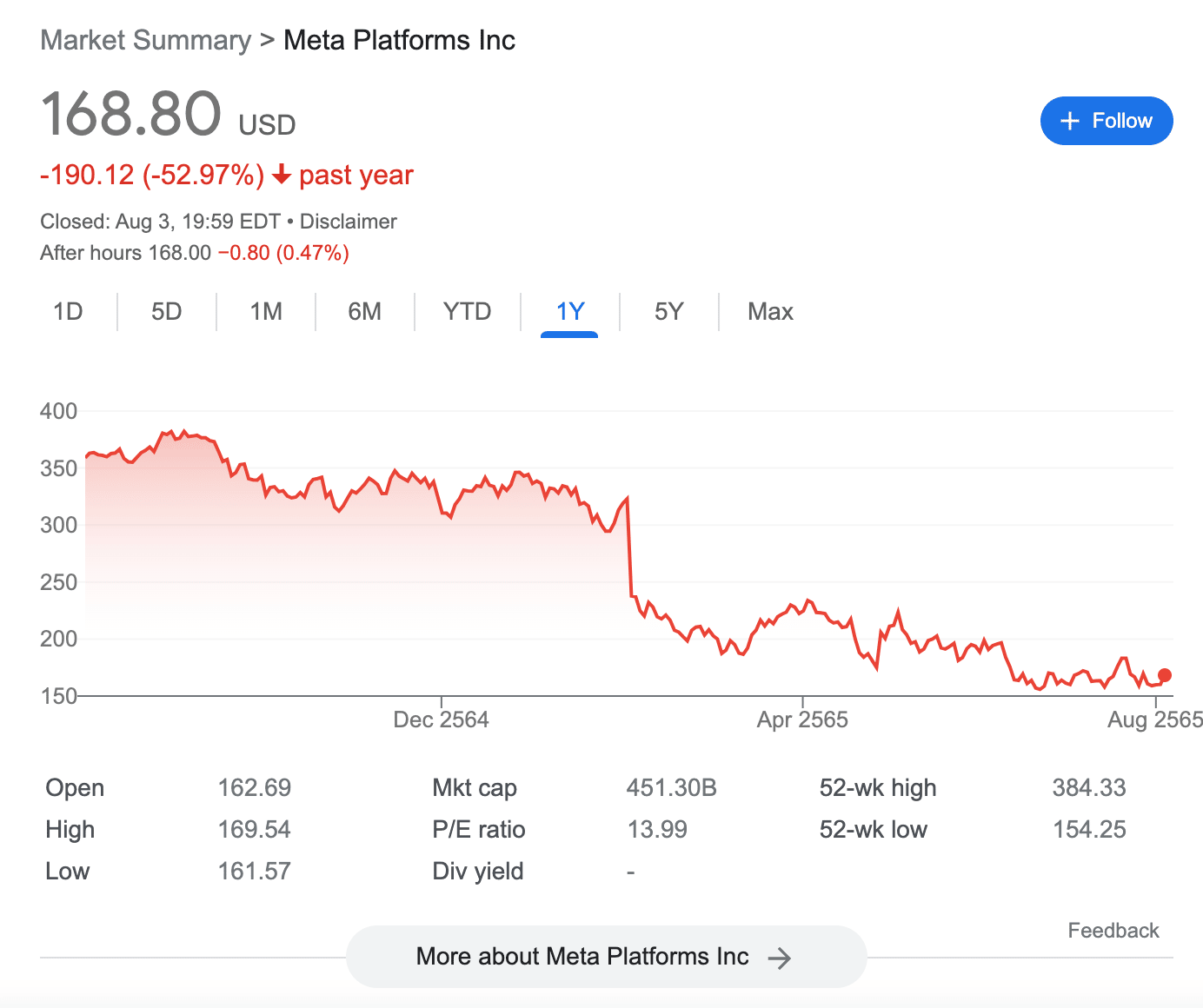

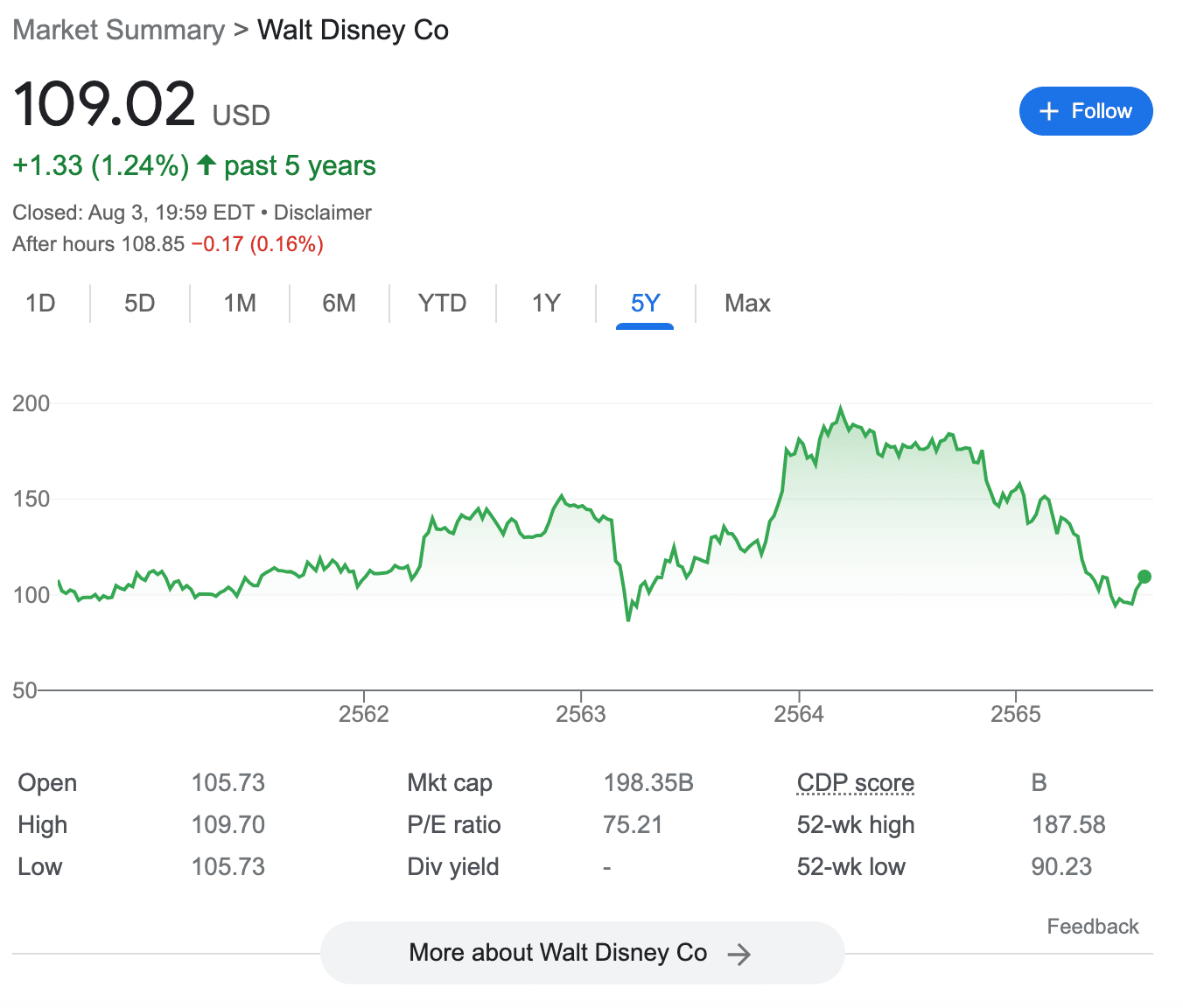

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority. XTB is a trading platform that is largely used for the purpose of trading forex pairs. However, XTB also offers access to other asset classes, such as indices, commodities, ETFs, crypto, and of course, stocks. However, it should be noted that just like Capital.com, XTB only offers stocks in the form of CFD instruments. Therefore, no ownership of the respective stock will take place. Nevertheless, UAE residents can use XTB to trade stock CFDs via a long or short position. Hence, users can attempt to profit from both rising and falling stock prices. Moreover, XTB does not charge any trading commissions on either buy or sell orders. It is also possible to trade stock CFDs at XTB with leverage of up to 1:10. This means that a $1,000 position can be entered with a stake of $100. When it comes to supported markets, XTB offers stock CFDs across multiple exchanges – which includes everything from the US, UK, and Italy to Switzerland, Poland, and Germany. Interactive Brokers is a stock and forex broker that is available in dozens of countries globally – including the UAE. The platform offers access to stocks and other asset classes from more than 33 countries, across 150 trading markets. When buying and selling stocks on Interactive Brokers, trading commissions will vary depending on the account type and the specific exchange. For instance, US-listed stocks on the NYSE and NASDAQ cost $0.05 per share on the IBKR Pro Fixed account. While on the IBKR Pro Tiered account, stock trading positions on US-listed markets will cost $0.0035 per share. This commission is reduced when monthly trading volumes surpass 300,000 shares – which includes both buy and sell positions. In addition to stocks, Interactive Brokers also offers access to mutual funds, ETFs, fixed-rate bonds, IPOs, and more. Interactive Brokers notes that account minimums will be displayed when opening the account. When it comes to fees, Saxo Bank charges variable commissions depending on the account type and the respective stock exchange. For example, those on a classic account – which requires a minimum deposit of €2,000, enable US stocks to be traded at $0.02 per share ($7 minimum). Take note, that the other two account types offered by Saxo Bank require a minimum deposit of €200,000 or €2 million. In addition to traditional stocks, Saxo Bank also offers leverage CFDs across thousands of markets. Pepperstone offers leverage on all supported stock CFDs, alongside the ability to go long or short on any markets. Pepperstone also offers out-of-hours trading, which can come in handy when investors from the UAE seek to access stocks from a different time zone. There is no minimum deposit requirement at Pepperstone when registering from the UAE. Pepperstone commissions on stock trading positions vary depending on the exchange. US stocks cost $0.002 per share, for instance. Stock CFDs from both the UK and Germany can be traded at a commission of 0.10%, while Australian markets cost 0.07%. Pepperstone also offers CFD markets across forex, indices, ETFs, and cryptocurrencies. This is yet another CFD trading platform on our list – meaning that users can go long or short on stocks, as well as apply leverage. At IQ Option, leverage of up to 1:20 is offered on stocks. At just 192 stocks, the number of markets offered by IQ Option is somewhat limited. Moreover, all stocks listed on the platform are from the US markets. Nonetheless, the minimum deposit to get started with an account is $10. Accepted payment methods include debit/credit cards, bank wires, and e-wallets. In terms of fees, IQ Option operates a spread-only pricing model, meaning that no trading commissions are charged. For a recap on which popular share trading platform in the UAE to choose, refer to the comparison table outlined below: When an investor buys stocks in the UAE, they are purchasing a very small slice of the company. The specific percentage of the company owned by the investor will depend on the number of shares held. After the transaction is complete – which is typically conducted by an online broker, the investor will hope that the value of the stock increases. This is, however, dependent on market forces and thus – stock prices can both rise and fall. Nonetheless, if the value of the stock goes up and the investor cashes out, they will make a profit. Here’s an example: Of course, if the stock price declines and the investor cashes out, this will result in a loss. When holding stocks in a portfolio, the investor might be entitled to dividends. If the company in question pays a dividend, the investor will get their share, which is based on the number of stocks held. There are thousands of stocks to choose from to create a portfolio of investments. Depending on the chosen stock broker, this might include markets in the US, Europe, Asia, and more. Creating a diversified portfolio of stocks from different sectors and economies is often a shrewd move to take when investing. This will ensure that the investor avoids being overexposed to a small number of markets. In terms of finding popular shares to buy in the UAE, risk-averse investors might decide to stick with large, blue-chip stocks. These are established companies that, generally, are a lot less prone to volatile market swings. On the other hand, those with a higher appetite for risk might look at growth stocks. These are companies that are yet to realize their full potential, so both the risk and reward potential are much higher than blue-chip stocks. Another way that investors can find popular shares to buy right now in the UAE in 2025 is to look for undervalued stocks. A stock could be deemed undervalued when its true value is yet to be realized in its share price. A good strategy here is to consider looking at the P/E ratio of an individual stock and compare this to the sector average. With all that being said, experienced investors will often advise beginners to stick with index funds when first learning how to buy stocks in the UAE. This will allow the investor to risk capital on the broader stock market, as opposed to choosing individual companies. Those hoping to find popular shares to buy right now on the ADX should know that in comparison to the US markets, domestic stocks have historically generated sub-par returns. As such, those wondering how to buy international shares in the UAE might consider the companies discussed below, which look at the top 10 stocks to watch right now from US exchanges. Note: When deciding what shares to buy now in the UAE, investors must ensure that they conduct their own research and consider the risk of loss. Tesla is the first stock to consider from this list of popular shares to invest in. Tesla is a US-based market leader in the electric vehicle space. In fact, although the firm was only founded in 2003, Tesla is now the largest car maker globally in terms of market capitalization – beating the likes of Ford, Toyota, and Volkswagen by a considerable amount. With that being said, Tesla is involved in many products and services in addition to manufacturing electric vehicles. This includes the development of its own driverless car technology that is backed by artificial intelligence. Tesla is also involved in solar panels, megawatt batteries, and other renewable energies. Marathon Petroleum is a US-based oil company that specializes in the refining and transportation of petroleum. This is a popular stock for those looking to gain exposure to record oil prices. While the S&P 500 has generated losses of 5% over the prior 12 months, Marathon Petroleum has made gains of 70%. Moreover, based on stock prices as of writing, Marathon Petroleum is a US-based oil company that specializes in the refining and transportation of petroleum. This is a popular stock for those looking to gain exposure to record oil prices. While the S&P 500 has generated losses of 5% over the prior 12 months, Marathon Petroleum is offering a running dividend yield of 2.5%. As per its most recent earnings report, Marathon Petroleum increased quarterly revenues by 67% year on year. As of writing, the firm is carrying a P/E ratio of 6.2 times. Another US-based energy company that has benefited from ever-increasing oil and gas prices is Devon Energy. The firm has generated even higher gains than Marathon Petroleum over the prior 12 months at 124%. In addition to outperforming the broader market, Devon Energy stock is also paying a running dividend yield of over 9% as of writing. In its most recent quarterly earnings call, Devon Energy posted a 73% rise in revenue year over year, alongside a 169% increase in EBITDA. Amazon is a Big Tech firm listed on the NASDAQ exchange. The company operates a highly diversified business model that covers a range of industries. At the forefront of this is its online retail division, which dominates the e-commerce space by a considerable margin. Amazon is also involved in cloud computing, artificial intelligence, content streaming, grocery deliveries, drone technology, and more. Amazon stock recently split on a 20-for-1 basis, with the view of making its shares more affordable to retail clients. Over the prior 12 months, Amazon stock is down 16%. However, over a five-year timeframe, Amazon stock has generated gains of over 180%. Note: Those wondering how to buy Amazon shares in the UAE can do so at any of the online brokers we reviewed earlier. Dover is a US-based conglomerate with a foothold in a variety of industries. This includes everything from support services and digital goods to consumer supplies and aftermarket parts. Crucially, those wondering what stocks to buy now for dividend consistency might consider Dover. The reason for this is that Dover has increased the size of its dividend for 66 consecutive years. This means that Dover has remained consistent with its dividend policy even during bear markets and broader recessions. As of writing, the firm is offering a running dividend yield of 1.50%. Over the prior five years of trading, Dover stock has increased in value by 90%. Its most recent earnings report generated a year-over-year increase in revenue of 6.25%. When compared to the 5% loss that the S&P 500 has generated over the prior 12 months, British American Tobacco is yet another US stock that continues to outperform the market. In the prior year, the firm witnessed a stock price increase of 22%. Moreover, British American Tobacco, based on prices as of writing, is offering a running dividend yield of 6.6%, alongside a P/E ratio of 13 times. On a year-over-year basis, British American Tobacco reported a revenue increase of 5.7% in its most recent earning report. Net income over the same period did, however, decline by 42%. Hospitality was one of the most affected sectors during the COVID-19 stay-at-home restrictions. However, with global travel numbers now slowly, but surely, returning to pre-COVID levels, hotel chains like Marriott International are proving popular with investors. This is reflected in the stock price of Marriott International over the prior 12 months, which has seen an increase of 15%. Over a five-year period, the stock is up more than 50%. Marriott International has since reintroduced its dividend policy. As of writing, the firm is offering a modest running dividend yield of 0.75%. Walmart is behind the largest number of US supermarket and discount store chains. This stock is popular with investors when the state of the economy remains uncertain, not least because Walmart products and services remain in demand during all economic conditions. Although Walmart is down 8% over the prior 12 months of trading, the stock has generated gains of over 60% on a five-year basis. Furthermore, Walmart, as of writing, is offering a running dividend yield of 1.7%. Its most recent earnings report generated a very modest revenue increase of 2.3% year over year, but a net loss of 24%. Meta Platforms is the parent company of Facebook, WhatsApp, and Instagram, alongside dozens of other subsidiaries. Across its portfolio of social media platforms, the firm serves several billion monthly active users. Meta Platforms recently changed its name from Facebook, with the view of highlighting its intentions to target the metaverse phenomenon. Meta Platforms stock, over the prior year of trading, is down more than 50%. The firm does not pay a dividend, and as of writing, it carries a P/E ratio of nearly 14 times. Its most recent earnings call was disappointing, with Meta Platforms reporting a 0.88% decline in revenue year over year, and a 35% drop in net income. Note: Those wondering how to buy shares in Facebook in the UAE can access Meta Platforms stock at all of the brokers we reviewed earlier. Disney is a hallmark US company with a diversified portfolio of products and services. In addition to its movie and TV studios, Disney is also rising as a direct competitor to Netflix through its popular streaming service. In fact, Disney+, as per the firm’s most recent earnings report, announced a total subscriber base of over 137 million. This is an increase of nearly 8 million subscribers when compared to the prior quarter. Disney has witnessed a sizable decline over the prior 12 months, with losses surpassing 36%. There is currently no dividend policy in place for Disney, and the firm carries a P/E ratio of 75 times as of writing. Many investors in the UAE will search for popular shares to buy right now on the ADX. In order to invest in shares on the Abu Dhabi Securities Exchange, traders will need to use a popular stock broker in the UAE. The process works as follows: The most popular stock market brokers in the UAE offer low fees and a regulated trading environment. It is also wise to choose a popular stock trading platform in the UAE that supports both domestic and international stocks. This will enable the investor to create a diversified portfolio. Penny stocks are share prices of less than $1. Although not always the case, penny stocks are usually companies with a small market capitalization and will often trade on OTC markets. This means that not even popular stock brokers in Dubai will be able to give UAE retail clients access to companies in this space. Instead, the OTC markets are often only accessible to accredited and institutional investors. As a beginner, seasoned investors will suggest starting off with established, blue-chip companies that have a long-standing track record in their respective markets. Blue chip companies are a lot less volatile than penny stocks and thus more suitable for newbies. There is no capital gains tax imposed on stock trading profits in the UAE. This is an advantage for residents of the UAE, as many other jurisdictions enforce a tax on realizable stock gains. Beginners looking for a comprehensive guide on how to invest in stocks in the UAE can follow the step-by-step guide below. This explains how to: After choosing a suitable stock broker that is regulated by a tier-one body, begin the account opening process. This will require some personal information, such as: Regulated stock brokers also need to collect a tax identification number. All regulated stock brokers must adhere to KYC (Know Your Customer) regulations. As an investor joining a broker for the first time, the broker will ask for: Some brokers are known to verify documents instantly, while others can take several days. Before having the option of buying stocks, the investor will need to add some trading capital to the account. Depending on the chosen broker, payment methods might include a bank wire and/or a debit/credit card. Some brokers are known to accept e-wallets too. Deposit times will depend on the payment method used. Most regulated brokers will offer a search box. This enables the investor to find the specific stock that they wish to add to their portfolio, rather than needing to search the platform manually. The investor will need to place a trading order to buy their chosen stock. Some brokers require the investor to buy at least one share, while others support fractional ownership. Either way, the investor will need to specify their total investment stake and confirm the order. Assuming that the respective stock market is currently open, the broker will add the purchased shares to the investor’s portfolio. This beginner’s guide has explained the ins and outs of how to buy stocks in the UAE. In addition to discussing trending stocks in the market, we have also discussed popular stock brokers that currently serve UAE residents. Before embarking on a stock trading journey for the first time, it is important that the investor understands the risks involved. Doing plenty of independent research is strongly advised – especially when it comes to choosing stocks to buy.

Approx No. Stocks

2,800

Min Deposit

$100 or free demo account

Cost to Buy Amazon Stock

0% commission

2. AvaTrade

Approx No. Stocks

630

Min Deposit

$100

Cost to Trade Amazon Stock

0% commission

3. Capital.com

Approx No. Stocks

3,000+

Min Deposit

$20

Cost to Trade Amazon Stock

0% commission

4. XTB

Approx No. Stocks

1,880

Min Deposit

No minimum stated

Cost to Trade Amazon Stock

0% commission

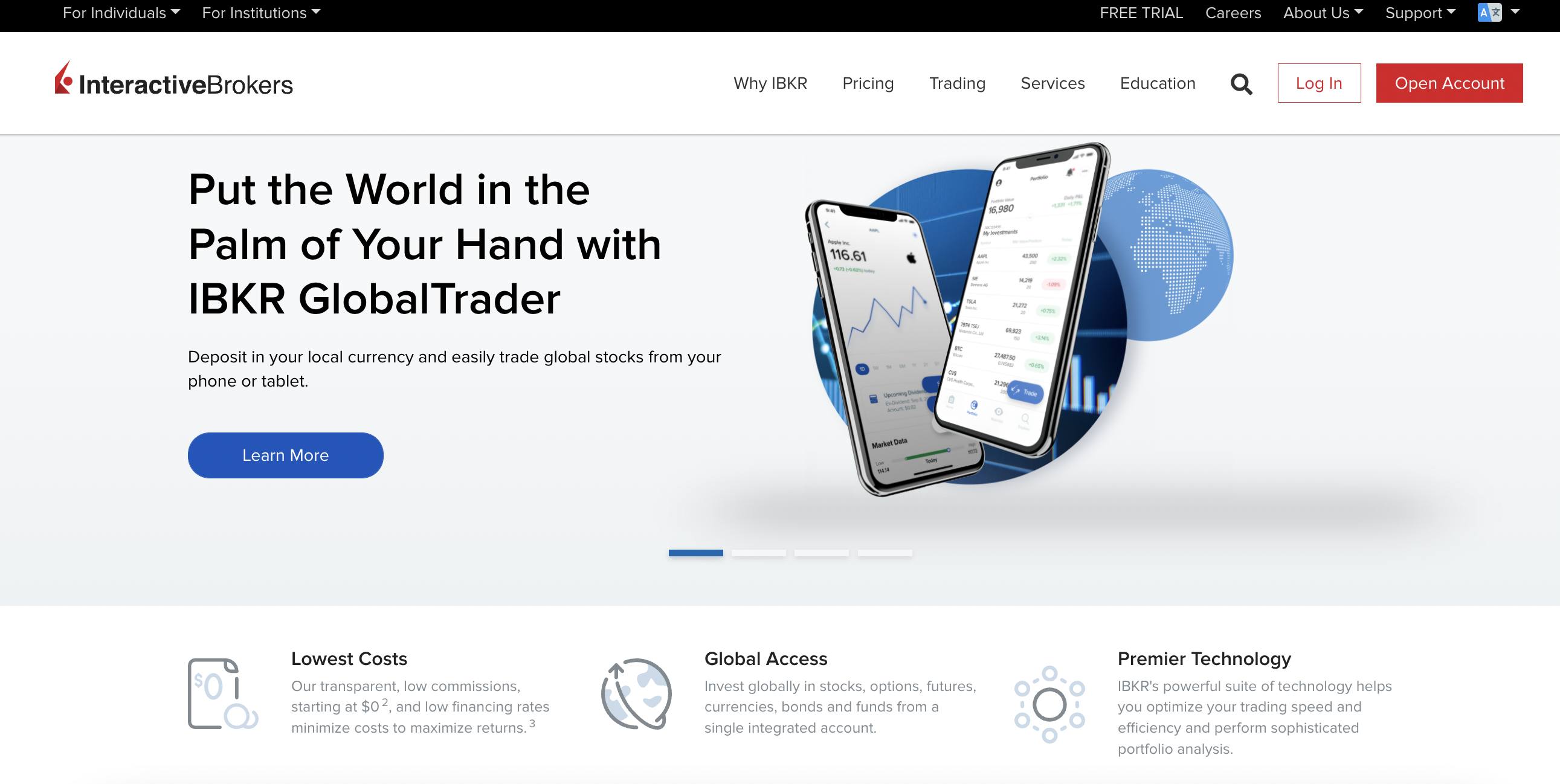

5. Interactive Brokers

Approx No. Stocks

150 markets across 33 countries

Min Deposit

Displayed when opening the account

Cost to Buy Amazon Stock

$0.05 and $0.0035 per share on fixed/tiered accounts respectively.

6. Saxo Bank

Approx No. Stocks

22,000

Min Deposit

€2,000

Cost to Buy Amazon Stock

$0.02 per share ($7 minimum) via the classic account

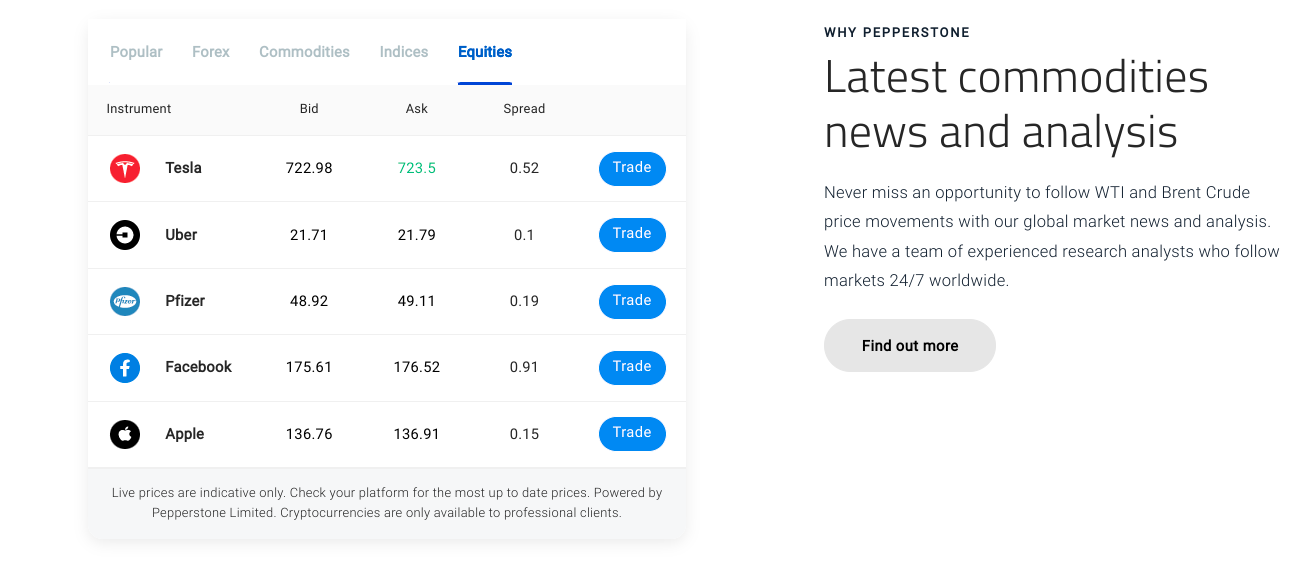

7. Pepperstone

Pepperstone is another broker to consider when learning how to buy stocks in the UAE. This platform specializes in stock CFDs across five key markets – the UK, US, Germany, Hong Kong, and Australia.

Approx No. Stocks

1,000

Min Deposit

No minimum stated

Cost to Trade Amazon Stock

$0.02 per share

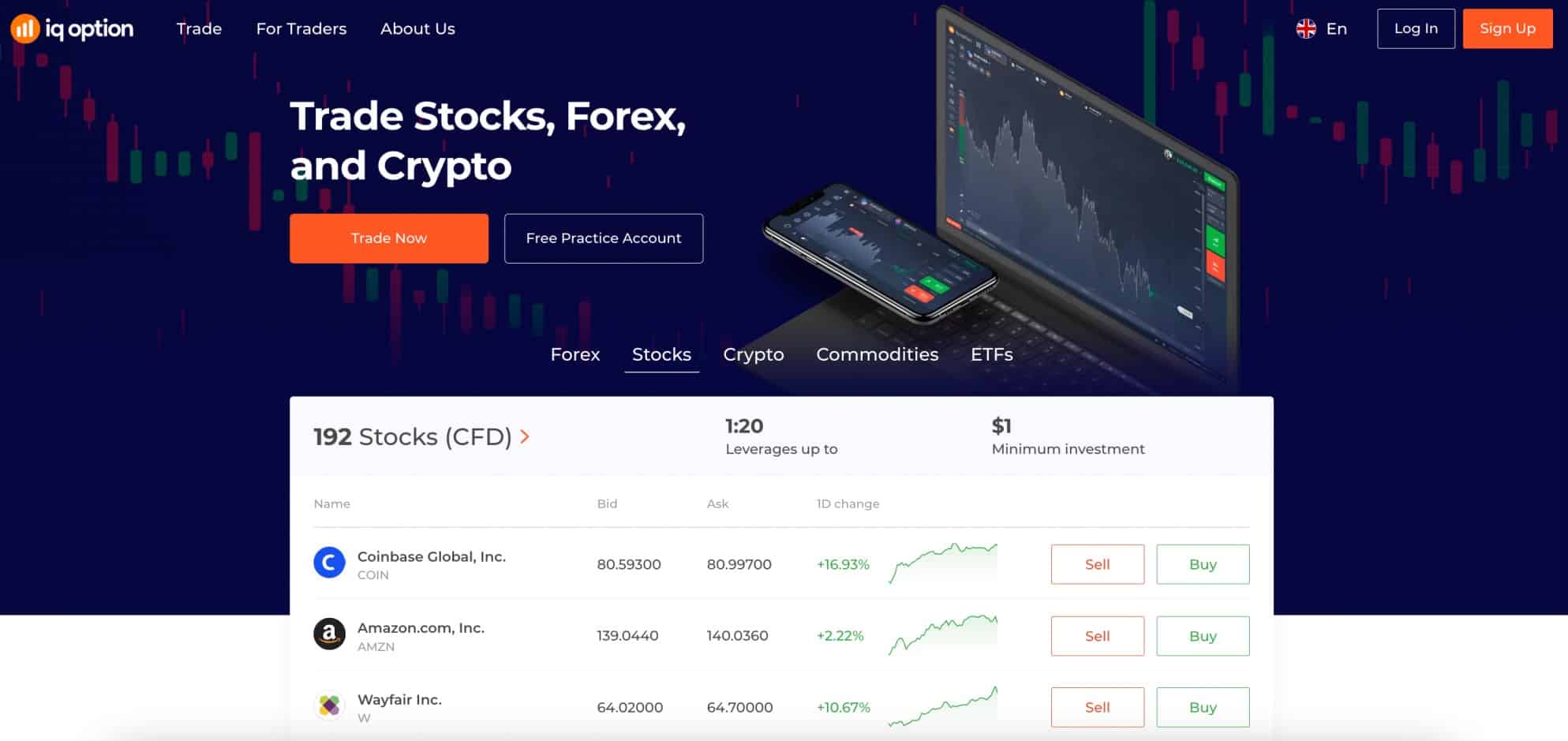

8. IQ Option

Approx No. Stocks

192

Min Deposit

$10

Cost to Trade Amazon Stock

Spread-only

Popular UAE Stock Brokers Compared

Broker

Approx No. Stocks

Min Deposit

Cost to Buy Amazon Stock

Payment Methods

Deposit Fee

Withdrawal Fee

Plus500

2,800

$100

0% commission

Visa, Mastercard, e-wallets, bank wire

$0

$0

Capital.com

3,000

$20

0% commission

Debit/credit card, bank wire

$0

$0

XTB

1,880

$0

0% commission

Debit/credit card, e-wallets, bank wire

0% on debit/credit cards, up to 2% on e-wallets

$0

Interactive Brokers

150 markets across 33 countries

$0

Up to $0.05 per share

Bank wire

$0

$0

Saxo Bank

22,000

€2,000

Up to $0.02 per share

Bank wire

$0

$0

AvaTrade

630

$100

0% commission

Debit/credit card, e-wallets, bank wire

$0

$0

Pepperstone

1,000

$0

$0.02 per share

Debit/credit card, e-wallets, bank wire

$0

$0

IQ Option

192

$100

Spread-only

Debit/credit card, e-wallets, bank wire

$0

$0

The Basics of Buying Stocks in the UAE

How do I Find Popular Shares to Buy in the UAE?

Top 10 Popular Stocks to Watch Now in the UAE

1. Tesla

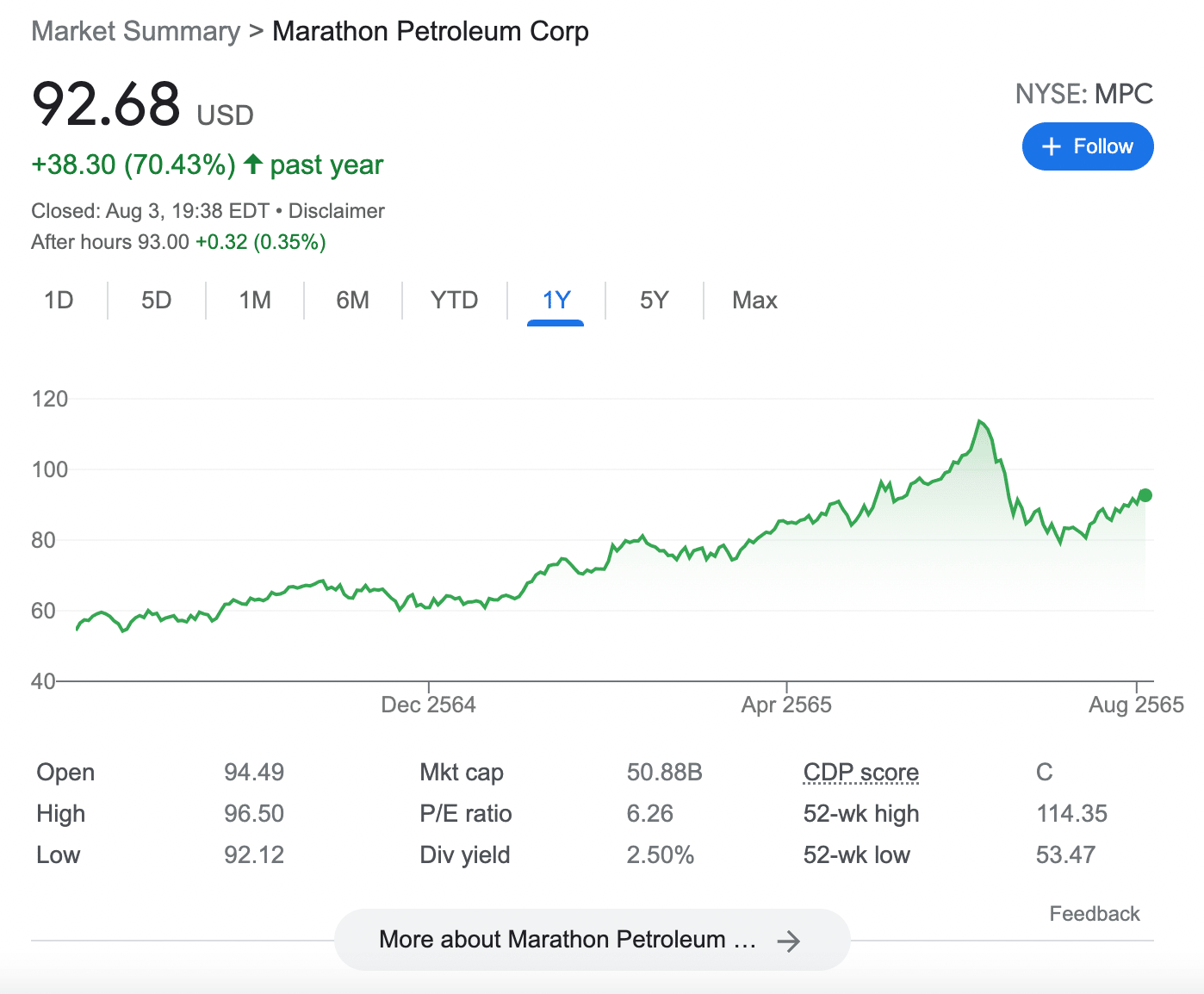

2. Marathon Petroleum

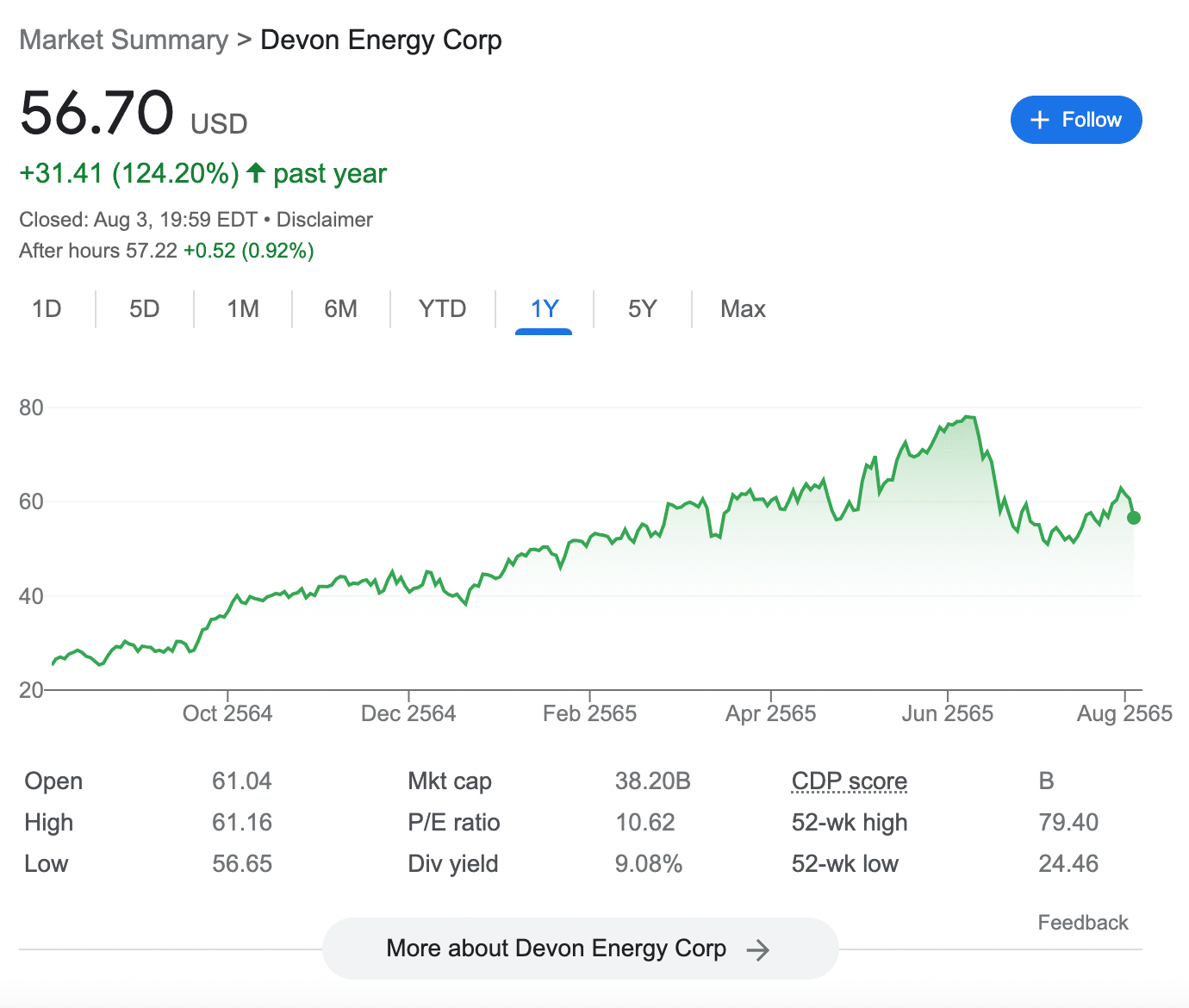

3. Devon Energy

4. Amazon

5. Dover

6. British American Tobacco

7. Marriott International

8. Walmart

9. Meta Platforms

10. Disney

How to Buy Stocks in ADX

How to Buy Penny Stocks in the UAE

Are Shares Taxed in the UAE?

How to Buy Stocks for Beginners in the UAE

Step 1: Register With a Regulated Stock Broker

Step 2: Verify Account

Step 3: Deposit Trading Capital

Step 4: Search for Stock

Step 5: Buy Stock

Conclusion

FAQ

How can I buy International stock in UAE?

How can I buy Tesla shares in UAE?

Which is the most popular stock to watch in UAE?

Which platform is popular for stock trading in UAE?

Is trading stocks legal in the UAE?

Which share market is popular in UAE?

How can I buy stocks in the UAE?