Buying and selling stocks in Saudi Arabia has never been easier. The tricky part is knowing where to buy stocks in Saudi Arabia, in terms of safety, fees, supported markets, minimum order requirements, and more.

To help clear the mist, this beginner’s guide not only explains how to buy stocks in Saudi Arabia, but which brokers are suitable for the job.

How to Buy Stocks in Saudi Arabia

Looking at investing in stocks right now through a regulated, low-cost broker?

If so, follow the steps below to learn how to buy stocks in Saudi Arabia in under five minutes with the leading trading platform Evest.

- Step 1: Open an Account: First, visit the Evest website, click on ‘Sign Up’, and complete the registration form. This requires some personal information and contact details, in addition to a password.

- Step 2: Complete KYC: Next, upload two documents to complete the KYC process. This needs to be a (1) government-issued ID and (2) a proof of address.

- Step 3: Deposit Funds: Making a first-time deposit at Evest could not be easier, considering that the broker accepts debit and credit cards, e-wallets, and bank wires. The minimum deposit is $250 via the silver account.

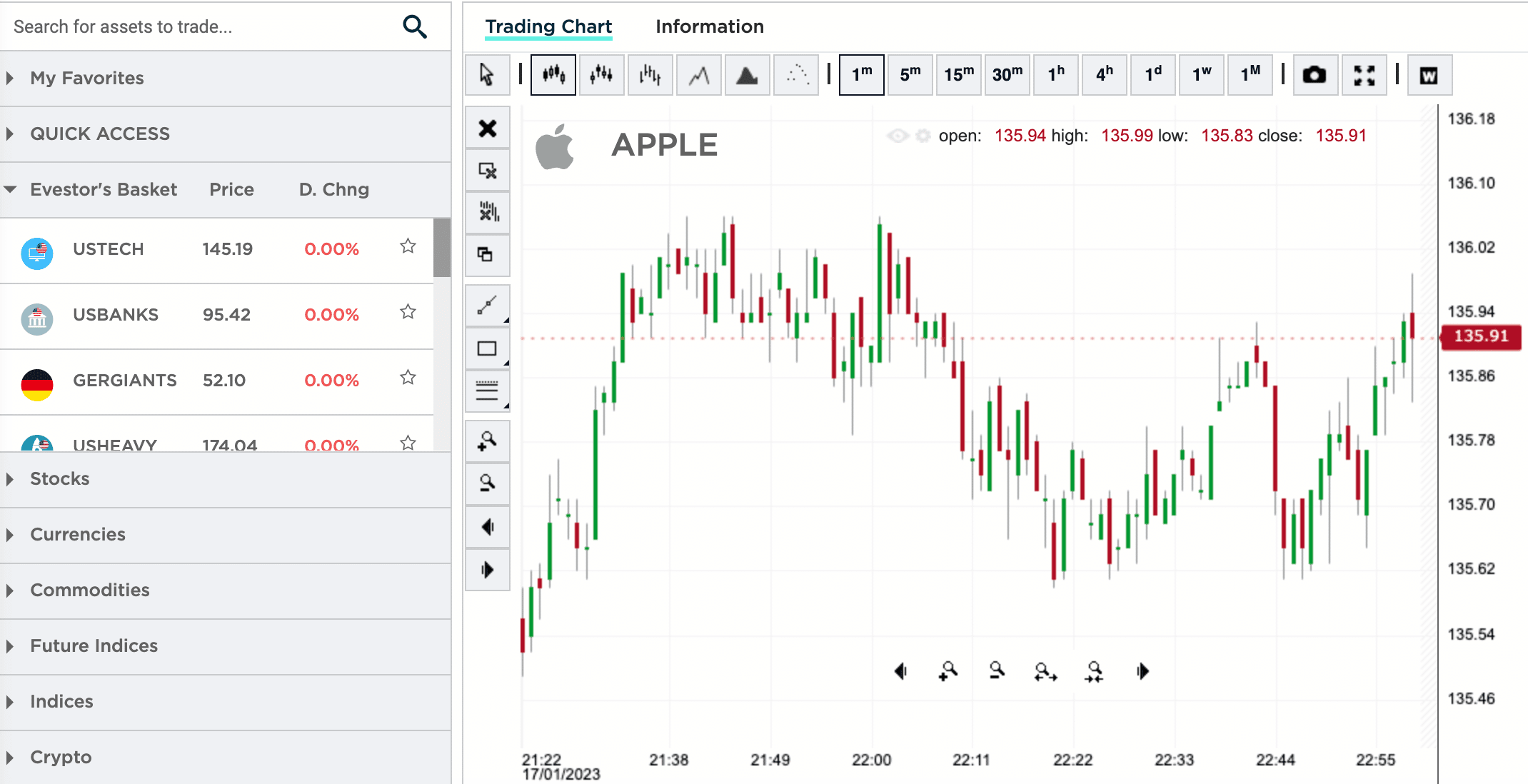

- Step 4: Search for Stocks: Load the web trading platform at Evest and use the search bar to find the required stock. Evest specializes in US-listed stocks such as Apple and Tesla.

- Step 5: Buy Stocks: Finally, type in the amount of money to invest in the chosen stock. Confirm the order to complete the stock purchase.

Looking for a more detailed step-by-step guide on how to buy stocks in Saudi Arabia? Read on to find our comprehensive tutorial for beginners.

Where to Buy Stocks in Saudi Arabia – Best Saudi Online Stock Brokers

This section of our beginner’s guide will reveal where to buy stocks in Saudi Arabia.

The brokers reviewed below specialize in low fees and fast execution, in a regulated environment that is suitable for both newbies and experienced pros alike.

1. Evest – Overall Best Stock Broker in Saudi Arabia

When looking to start investing in stocks for the first time, new investors will find the Evest platform helpful. This online broker provides a variety of asset classes, including forex, indices, commodities, and stocks. All tradable assets are supported by CFDs (contracts for differences), which offer many advantages. We’ve analyzed all the important metrics to put together a practical Evest review.

For instance, Evest allows traders in Saudi Arabia to take long or short positions, letting them bet on whether the stock price will rise or fall. This is particularly useful when worldwide stock markets are down. Additionally, Evest lets traders buy and sell stock CFDs with leverage. This means traders can open a position that is worth more than what they currently have in their account.

Many of the stocks available on Evest are listed on the two primary US exchanges – the NASDAQ and the NYSE. This means that investors in Saudi Arabia can trade stocks like Apple, Tesla, British American Tobacco, Microsoft, and many others. Additionally, Evest also hosts stocks from other exchanges, such as German and Japan.

When assessing how to buy stocks in Saudi Arabia, another important metric to consider is fees. In the case of Evest, there are no commissions to pay when trading stocks. Instead, Traders at Evest simply need to cover the spread. This is the difference between the buy and sell price of the respective stock being traded.

Evest does not charge any deposit fees either. Withdrawals cost $5. There are several account types to choose from, each of which comes with a minimum deposit. Those on a budget might consider the silver account, which requires a minimum deposit of $250. There is also an Islamic account in addition to a fee-free demo trading facility.

When trading stocks at Evest, experienced traders can use MetaTrader 5 (MT5). Alternatively, the platform also offers a native web trading platform in addition to a mobile app for iOS and Android. Evest also offers a wide range of other financial products, including commodities, indices, and crypto. Evest is also one of the best forex brokers in Saudi Arabia.

As we’ve mentioned, Evest offers a wide range of financial assets including cryptocurrencies. As the best cryptocurrency exchange in Saudi Arabia many crypto enthusiasts have opened live trading accounts with Evest as it has some of the lowest fees on the market.

We also like that Evest offers educational tools for those wishing to learn how to buy stocks in Saudi Arabia for the first time. This includes a variety of mini-courses covering the basics of trading, stock investment terminology, using MetaTrader, and more. It usually takes just 5-10 minutes to get set up with Evest and the platform supports debit/credit cards, e-wallets, and bank wires.

| No. Stocks | 200+ |

| Pricing System | 0% commission. Spread-only trading. No deposit fees. $5 withdrawal fee. |

| Cost of Buying Amazon Stock | From 4.8 pips |

Pros

Cons

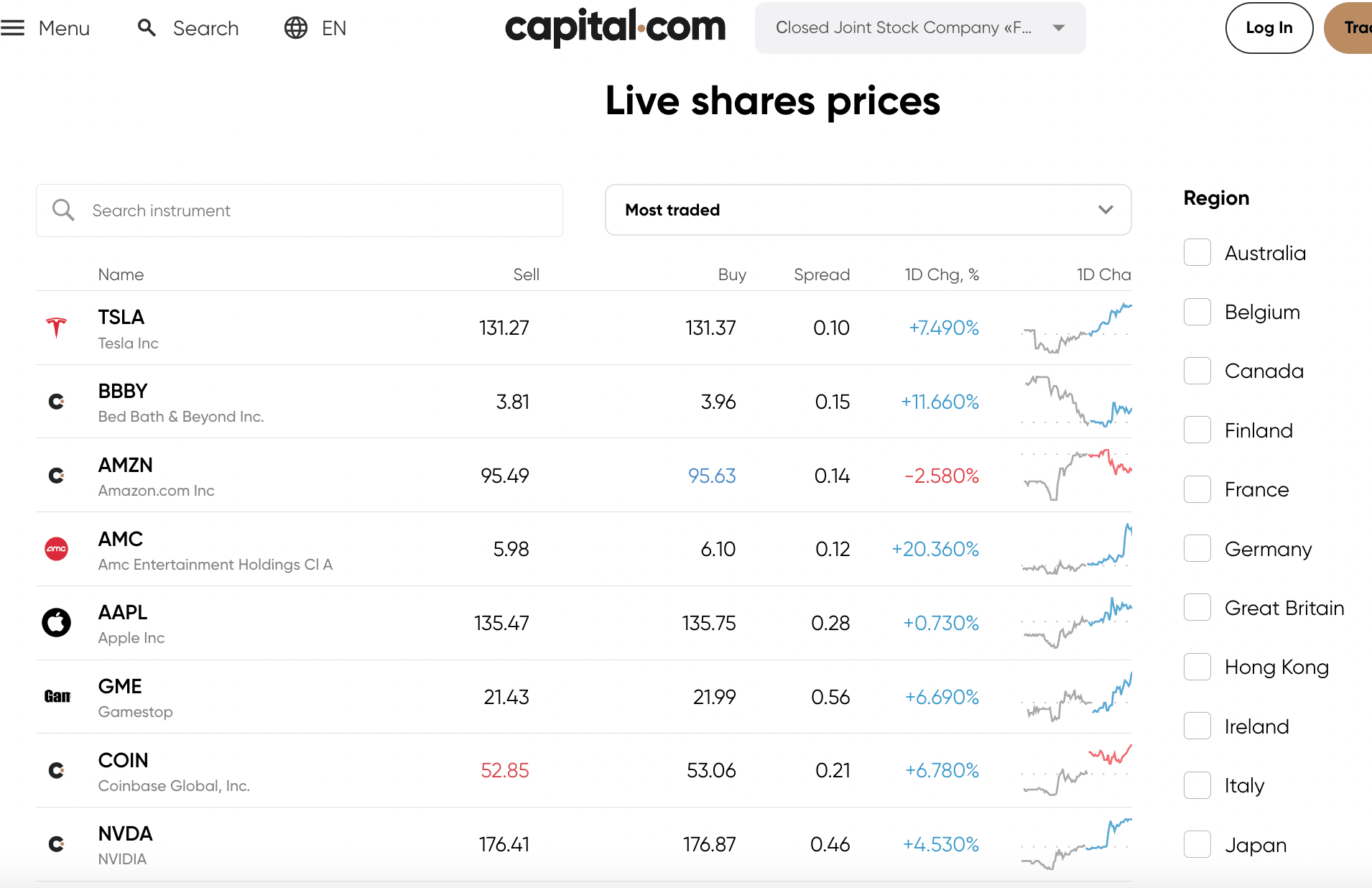

2. Capital.com – Nearly 3,000 Stocks From Multiple Global Exchanges

Stocks can also be traded from exchanges in Singapore, Hong Kong, Australia, and Japan. Irrespective of the exchange, all stocks listed on Capital.com can be traded at 0% commission. Just like Evest, traders only need to cover the spread.

All stocks at Capital.com are traded via CFD instruments, which means that traders can attempt to profit from both rising and falling share prices. Not only that, but Capital.com offers leverage of up to 1:5 when trading stocks (and more on other assets). Traders in Saudi Arabia will also appreciate that Capital.com is heavily regulated.

This includes licensing from the FCA (UK), ASIC (Australia), CySEC (Cyprus), and the NBRB (Belarus). Stocks can be traded on the main Capital.com website via standard browsers or through the provider’s mobile app for iOS and Android. Capital.com also supports integration with MetaTrader 4 (MT4), which is suitable for experienced stock traders.

In addition to stocks, Capital.com also supports cryptocurrencies, forex, commodities, and indices. We found that it takes under five minutes to register an account with Capital.com. The minimum deposit is $250 when opting for a bank wire. However, when making a deposit with an e-wallet or debit/credit card, this is reduced to just $20.

Capital.com does not charge deposit or withdrawal fees. This top-rated trading platform is also great for keeping tabs on the global stock markets. Traders have access to news, developments, and market insights, not to mention charting tools. Educational materials are also supported via the Capital.com ‘Investmate’ app, which includes mini-courses.

| No. Stocks | Nearly 3,000 |

| Pricing System | 0% commission. Spread-only trading. No deposit or withdrawal fees. |

| Cost of Buying Amazon Stock | Spread of approximately $0.14 |

Pros

Cons

Your capital is at risk. 84.19% of retail investor accounts lose money when trading CFDs with this provider.

The Basics of Buying Stocks in Saudi Arabia

Those learning how to buy stocks in Saudi Arabia for the first time should know that the end-to-end process is now very simple. All of which can be completed online, from the comfort of home.

First and foremost, investors should first choose a suitable stock broker that supports Saudi residents – such as Evest or Capital.com. After opening an account and making a deposit, it’s then just a case of choosing some stocks to invest in. After buying a stock, the hope is that the respective company sees its share price increase.

This is determined by the market forces of demand and supply. If the price of the stock increases and the investor cashes out, a profit will be made. For instance, investing in Apple stock at $100 per share and selling for $120 would constitute gains of 20%.

It is now possible to buy stocks from multiple global exchanges in a cost-effective manner. Platforms like Evest and Capital.com, for instance, support 0% commission trading on stocks from the US, Japan, Germany, and more. Additionally, some stocks pay dividends. This means that the investor will receive a share of retained profits from the company, usually every three months.

How Does Stock Trading Online Work?

Stock trading is a short-term strategy, as opposed to investing in shares in the long run. The main concept is to identify a stock that is undervalued and make a purchase from an online broker. The stock trader will typically cash their position out over the course of a few days or weeks. But in other cases, the stock trade might only remain in place for several hours.

This means that stock traders will place more frequent trades than conventional investors, with the view of making smaller but consistent gains nonetheless. Moreover, many stock traders will also consider short-selling a company that appears overvalued. This can be achieved at the click of a button when using a CFD broker like Evest or Capital.com.

Example of Stock Trading in Saudi Arabia

Complete beginners may appreciate a simple example of how stock trading works in Saudi Arabia.

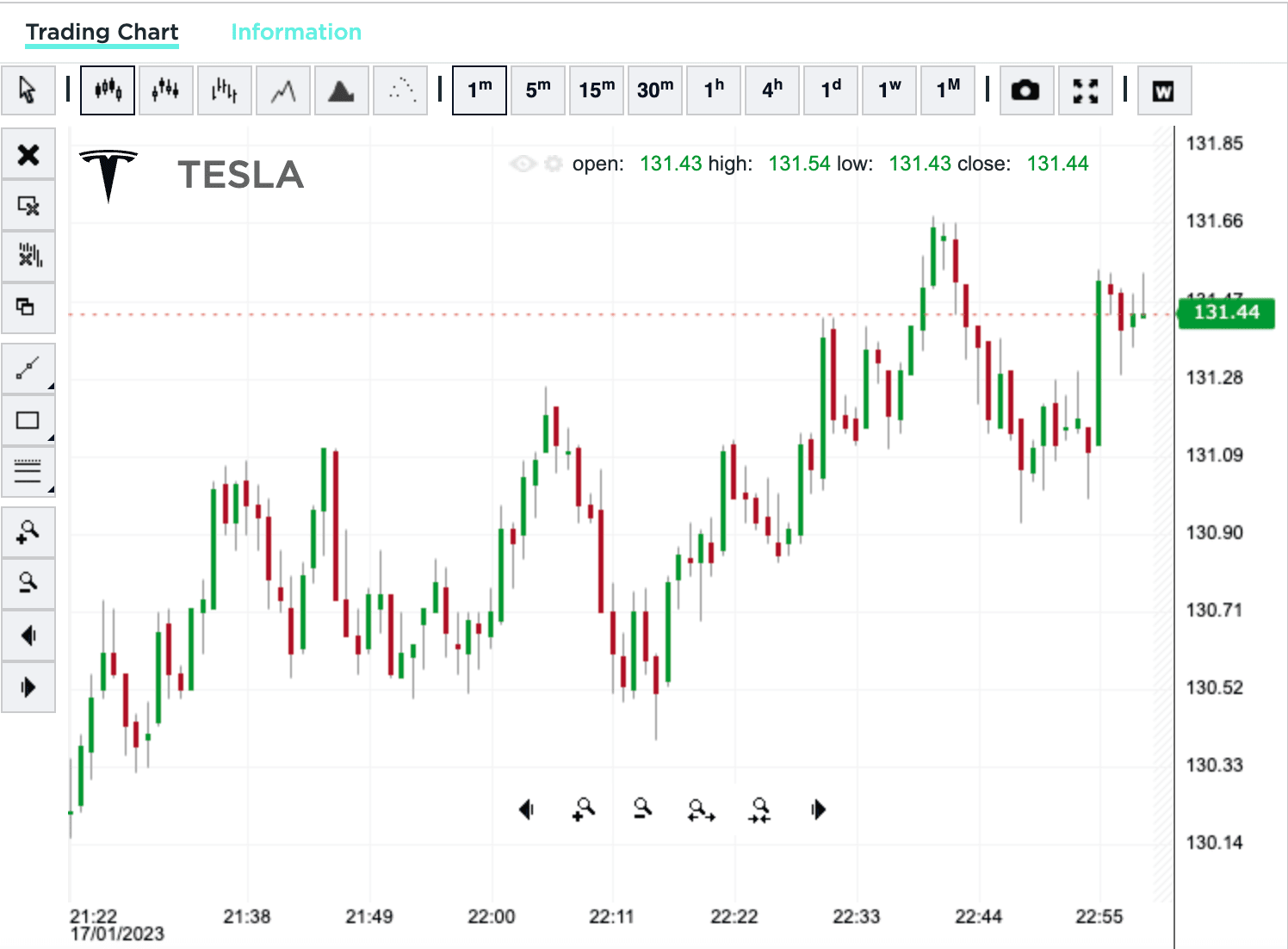

- Let’s say that an investor decides to buy Tesla stock

- At the time of the trade, Tesla stock is priced at $130

- The investor elects to buy 20 Tesla shares, so that’s a total outlay of $2,600

- A couple of weeks later, Tesla stock is trading at $170

- This represents gains of $40 per share

- The investor holds 20 shares, so the overall profit from this trade is $800

As per the above example, in order to realize the profit of $800, the investor will need to close the Tesla stock trade. In doing so, the $800 gains will be added to the brokerage account, plus the original stake of $2,600.

Is it Legal to Buy Stocks in Saudi Arabia?

First and foremost, buying and selling stocks in Saudi Arabia is perfectly legal. With that being said, certain restrictions might apply depending on the required market and asset, as well as the status of the respective investor.

For example, Saudi citizens can easily invest in stocks that are listed on the domestic markets. Expats can too, but this needs to go through the Qualified Foreign Investor Program.

On the other hand, investors in Saudi can also buy stocks from the international markets, such as those found in the US, UK, and Japan. This can be achieved by using a licensed online broker like Evest.

Using an international broker is often the most seamless option for Saudi expats, as there is no requirement to go through the Qualified Foreign Investor Program.

How do I Find the Best Stocks to Buy?

Learning the process of how to invest in stocks in Saudi Arabia is the simple part. The challenging aspect of this investment scene is knowing which stocks to buy.

Read on to discover some proven stock-picking strategies.

Past Performance

A good starting point when searching for the best stocks to buy today is the past performance of the respective company.

While past performance is not indicative of future returns, at the very least, it highlights the growth of the stock in relation to the broader market.

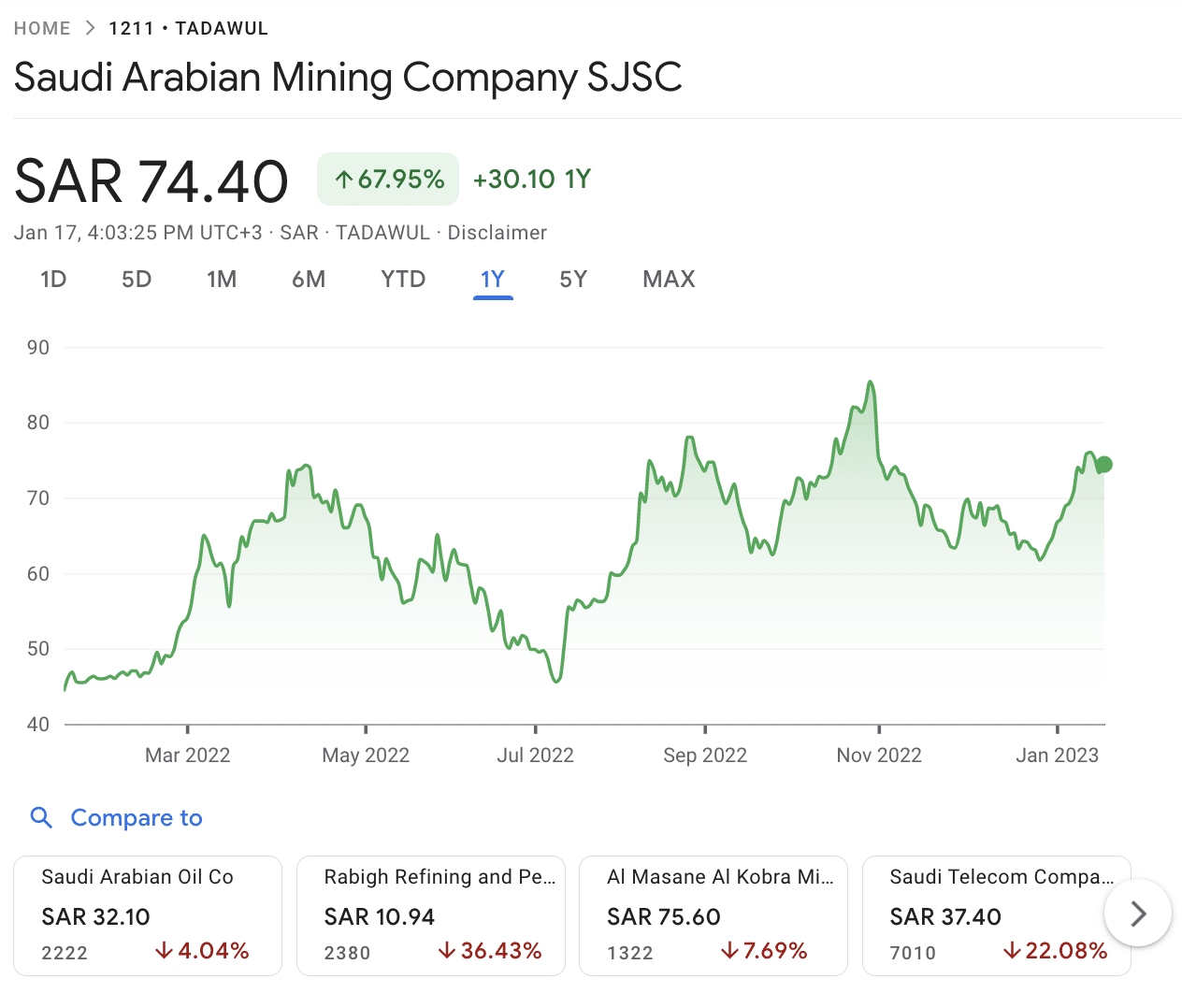

For example, over the prior 12 months, the Tadawul All Share Index – which tracks leading companies on the Saudi Stock Exchange, is down 12%. In comparison, over the same period, Saudi Arabian Mining Company stock is up 67%.

Focus on High-Growth Industries

Another way to find the best stocks to buy today is to focus on high-growth industries that are currently enjoying momentum. A good example of this is the oil industry, which continues to benefit from high global energy prices.

Look for Undervalued Stocks

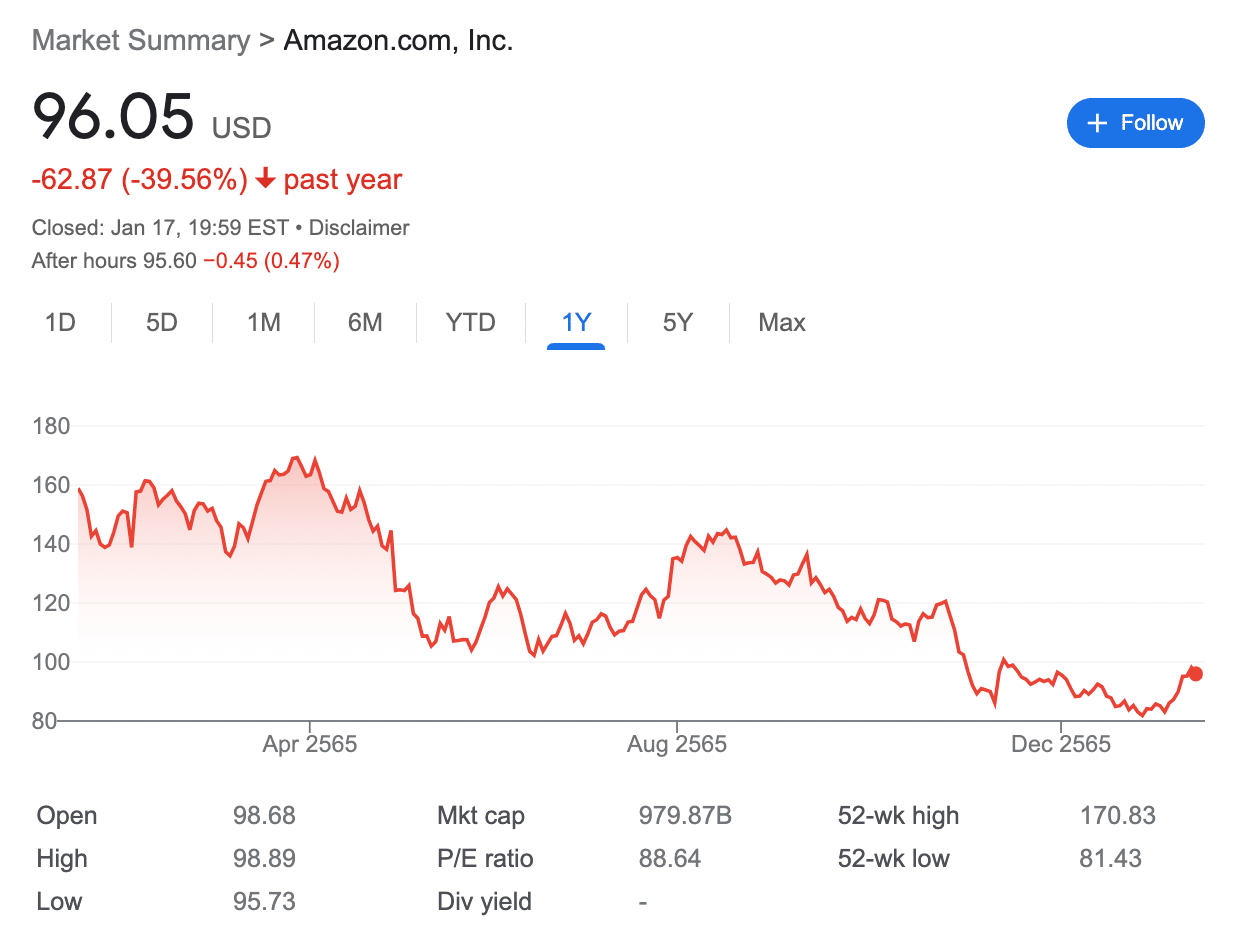

The global stock markets have struggled over the prior year or so, which means that some of the biggest and most solid companies are trading at a huge discount.

For example, outside of the Saudi stock markets, the likes of Amazon and Tesla are down 40% and 60% over the prior 12 months. This enables investors to enter the market at a much more favorable price, in anticipation of the next bull run.

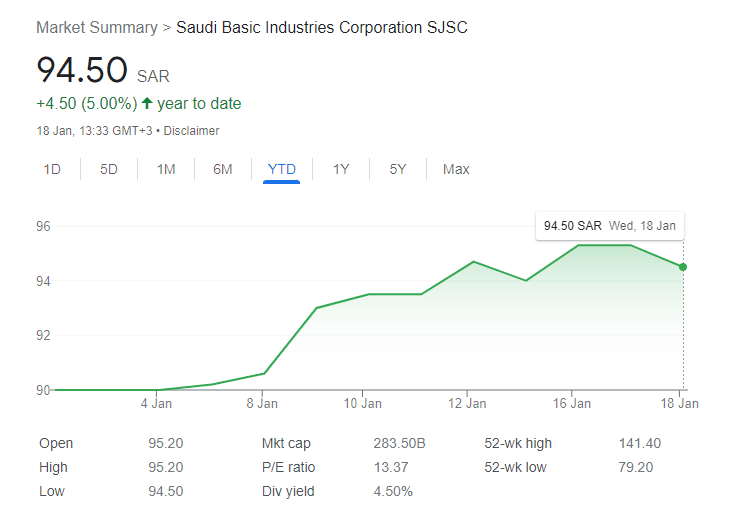

Consider Dividend Stocks

Another option to consider when exploring how to buy stocks in Saudi Arabia is to invest in dividend-paying companies. This enables investors to make gains in addition to stock price growth. Most dividend stocks make a payment every three months.

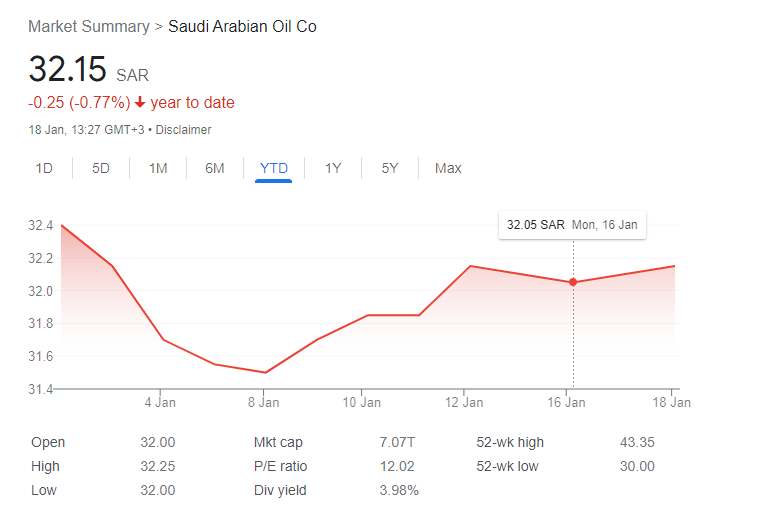

Two of the best dividend stocks in the Saudi markets today are Saudi Aramco and Saudi Basic Industries Corporation. The aforementioned stocks are offering a running yield of 4% and 4.5% as of writing, respectively.

Note: When learning how to invest in dividend stocks, just remember that payments can be cut or even suspended at any given time – especially when the global economy is bearish.

Best Stocks to Buy Now in Saudi Arabia

In this section, we take a look at some of the best stocks to buy in Saudi Arabia from the domestic and international markets, according to analysts.

1. Saudi Aramco – Saudi-Backed Oil Giant

Saudi Aramco is the largest oil company globally. Backed by the Saudi government, the firm went public in 2019, which remains one of the largest IPOs of all time. This stock is listed on the Tadāwul – the domestic stock exchange in Saudi Arabia.

Naturally, revenues at Saudi Aramco are overwhelmingly linked to the global price of oil, so this is something to bear in mind. Saudi Aramco is also a dividend payer. As of writing, the firm is offering a running dividend yield of just under 4%.

2. Saudi Basic Industries Corporation – Market Leader in Chemical Manufacturing

Saudi Basic Industries Corporation – or simply SABIC, is one of the largest chemical manufacturing companies in the Saudi market. Some of the most traded products sold by SABIC include industrial polymers, metals, and petrochemicals.

SABIC is a dividend payer, with a running yield of nearly 4.5% being offered as of writing. Over the prior year of trading, SABIC stock is down 24%. However, many industry commentators argue that this represents an attractive entry price.

3. Saudi Arabian Mining Company – 12-Months Gains of 67%

One of the best stocks to buy today in terms of performance is the Saudi Arabian Mining Company. Over the prior 12 months of trading, this popular stock has generated growth of over 67%.

Over a five-year period, Saudi Arabian Mining Company stock is up over 166%. On the flip side, unlike Saudi Aramco and the Saudi Basic Industries Corporation, this firm does not pay dividends.

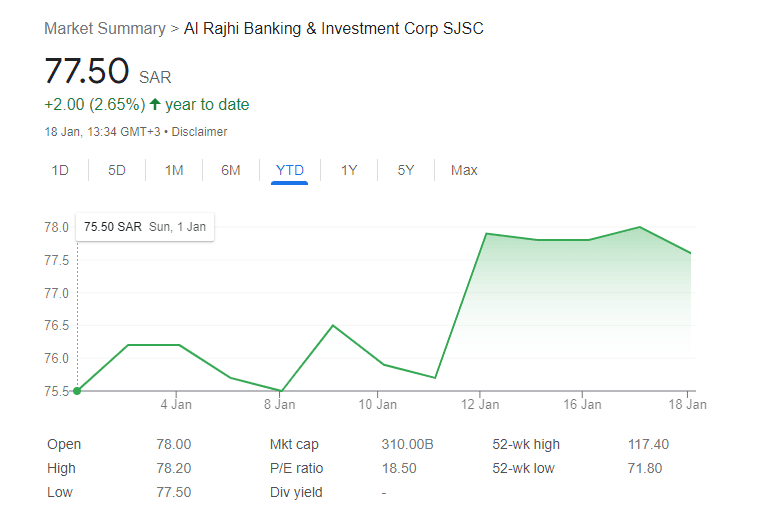

4. Al Rajhi Banking & Investment Corp SJSC – 174% Growth in Five Years of Trading

Another top-performing company to consider when exploring how to buy stocks in Saudi Arabia is Al Rajhi Banking & Investment Corp SJSC. This firm, over the prior five years of trading, has generated gains of over 174%.

This makes it one of the best-performing stocks on the Tadāwul. As of writing, Al Rajhi Banking & Investment Corp SJSC stock carries a market capitalization of over 300 billion SAR.

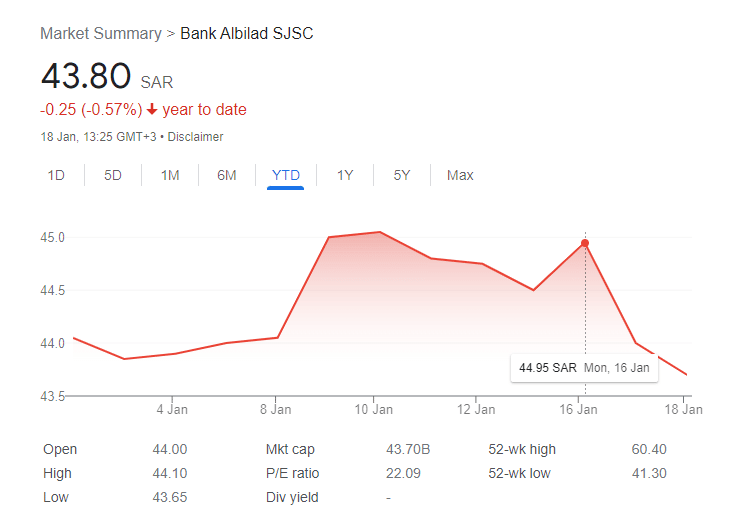

5. Bank Albilad – Growing Bank State With Huge Returns

Bank Albilad is a financial institution launched as recently as 2004. This growth stock has generated sizable gains in recent years, with gains of nearly 230% in the prior five years of trading.

Over the past 12 months, Bank Albilad stock has increased by almost 10%. There is no dividend program in place at Bank Albilad at this moment in time.

Are Stocks Taxed in Saudi Arabia?

According to PricewaterhouseCoopers (PwC), capital gains are taxable at the standard income tax rate. With that being said, any capital gains generated from an investment in Saudi stocks listed on the Tadāwul are exempt from tax.

There are, however, certain conditions to consider, so investors are advised to get advice from a qualified tax professional.

How to Invest Stocks for Beginners in Saudi Arabia – Tutorial

Learning how to buy stocks in Saudi Arabia for the first time, and need a little guidance on the investment process?

In this section, we provide a step-by-step tutorial on getting started with one of the best stock trading platforms in Saudi Arabia – Evest.

Read on to open an account, make a deposit, and place a stock trade in under 10 minutes.

Step 1: Open an Account With Evest

Head over to the Evest website and click on ‘Sign Up’.

The trader will need to enter their name, email, and phone number. The phone number will need to be verified via an SMS code.

Next, Evest will collect some additional information from the trader. This includes basic personal data such as the trader’s nationality, home address, and date of birth.

The trader will also need to choose the account type that they wish to open. The silver account comes with a minimum deposit of $250. There is also an Islamic account in addition to a demo trading facility.

Step 2: Complete KYC Policy

Evest is a regulated broker, so it is legally required to confirm the identity of all registered traders.

This is a straightforward process that requires the trader to upload a copy of a passport or driver’s license. Evest will also need to confirm the residency status of the trader.

For this, the trader can upload a recently-issued document, such as a utility bill or bank statement.

Step 3: Deposit Funds

Now the trader will be asked to deposit some funds. Multiple payment types are accepted, including debit/credit cards, bank wire transfers, and e-wallets like Neteller.

No deposit fees are charged by Evest. Make sure that the minimum deposit requirement is met to avoid any delays.

Step 4: Choose a Trading Platform

Next, the trader will need to choose the best trading platform in Saudi Arabia for their skill set.

For beginners, we would suggest opting for the web trading platform that is backed by Evest. This connects to the Evest mobile app for trading stocks on the move.

For intermediate and seasoned traders, we would suggest opting for MetaTrader5. This offers more in the way of technical indicators and chart analysis tools.

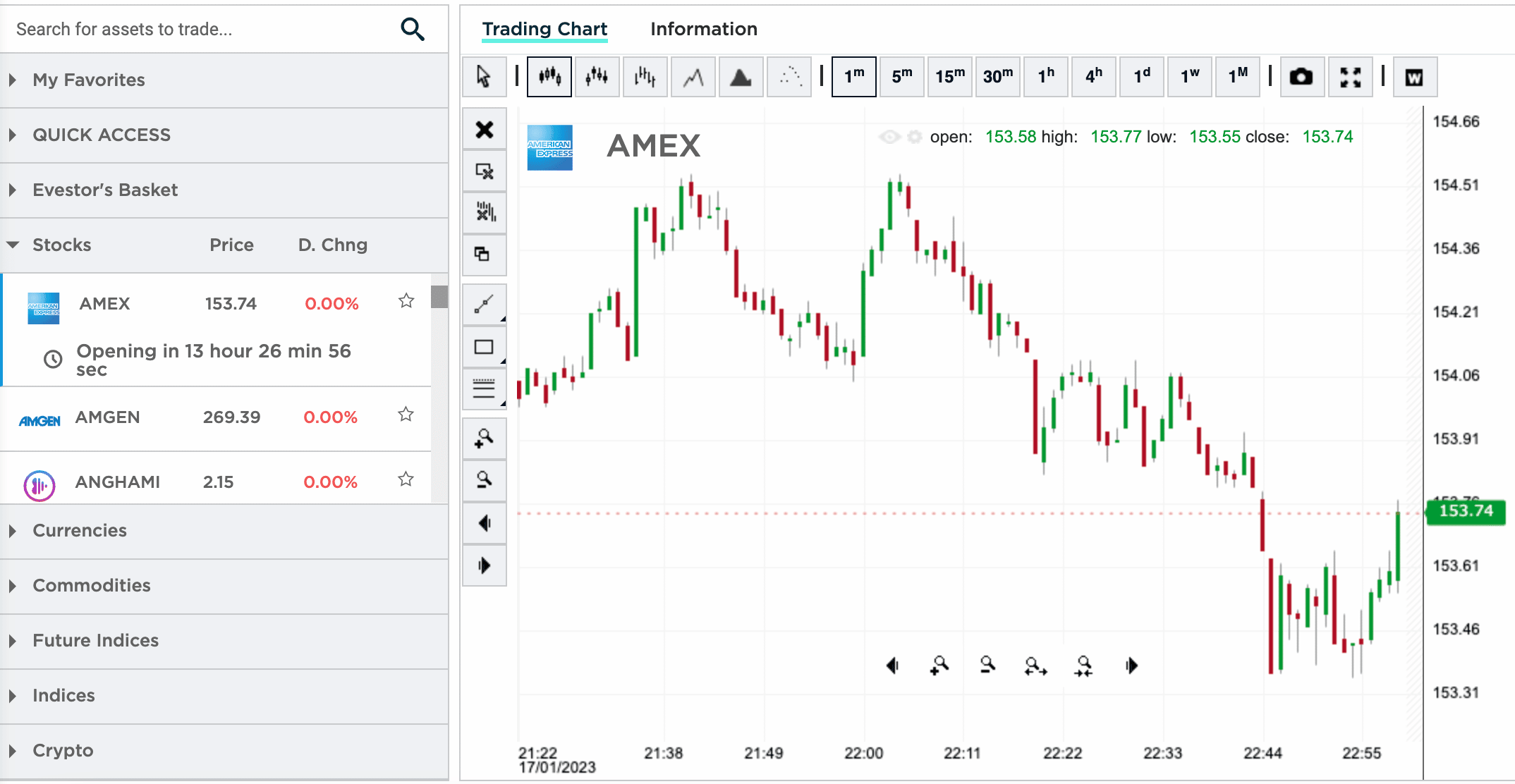

Step 5: Search for a Stock to Trade

The next step is to search for a stock to trade. In our example, we are using the Evest web trading platform.

In the search box, we typed in ‘Amazon’ and clicked on the stock to reveal the charting zone.

Alternatively, click on ‘Stocks’ from the left side of the dashboard and browse the many supported markets.

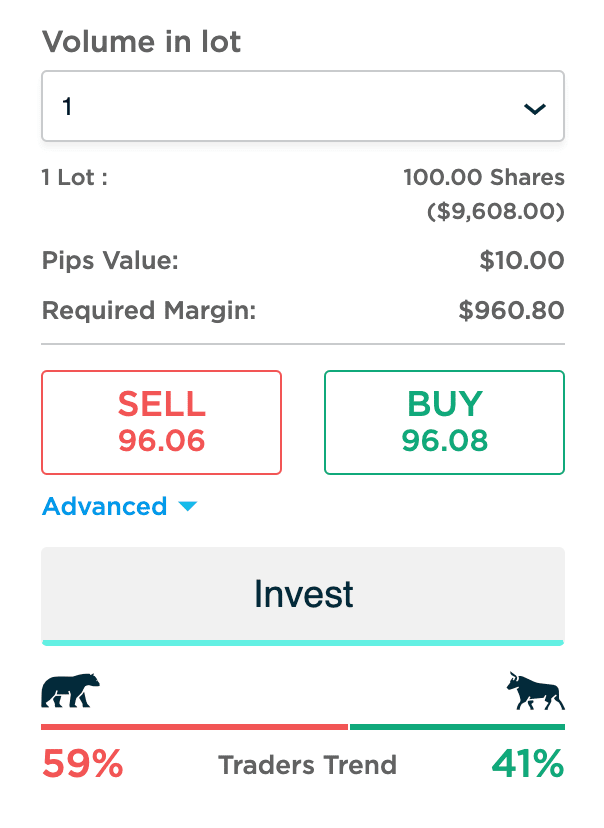

Step 6: Set Up an Order and Place a Stock Trade

Now it’s just a case of placing a stock trading order.

- A ‘Buy’ order should be chosen if the trader believes the stock price will increase

- A ‘Sell’ order should be chosen if the trader believes the stock price will decrease

In the ‘Volume in Lot’ box, the trader will need to enter their total stake. As Evest deals in ‘Lots’, the trader will be speculating on 100 shares of the chosen stock.

However, Evest offers margin trading, so the trader will only need to stake a small percentage of the total value.

Finally, click on the ‘Invest’ button to complete the trade. The trader can close the stock position at any time during standard market hours, as per the respective exchange.

Conclusion

This guide has cleared the mist on how to buy stocks in Saudi Arabia. We have identified the best stock brokers in Saudi Arabia and in terms of user-friendliness, fees, spreads, supported markets, and more – we like Evest.

This top-rated broker offers 0% commission stock trading for multiple global markets, alongside margin, tight spreads, and short-selling capabilities.

Not to mention that Evest requires a minimum deposit of $250 and the platform accepts instant payments via debit/credit cards and e-wallets.