People looking to buy stocks in the Netherlands can access domestic and global markets with ease.

This beginner’s guide will detail how to buy stocks in the Netherlands without paying any trading commission.

Traders will also find a rundown of the 10 stocks to watch, as well as comprehensive reviews of regulated brokers in the market.

How to Buy Stocks in the Netherlands – Detailed Guide

Dutch residents can start trading stocks today by signing up with a reputable broker.

- ✅ Step 1: Open an Account with a Regulated Broker – First, click ‘Trade Now’ to open an account. Enter a username and password and complete the sign-up form by adding information such as a name, home address, and email. Complete the KYC process to continue.

- Step 2: Deposit Funds – Payment methods usually include credit/debit cards, e-wallets, iDEAL and more. Enter an amount to deposit and the card/wallet details to continue.

- Step 3: Search for Shares – Traders can either view all equities on the main platform or use the search bar to look for the respective company. Once found, select it to place an order.

- Step 4: Buy Shares in the Netherlands – Once the trader knows what stocks to buy, they can enter any amount to place an order.

We provide a more detailed account of how to buy stocks in the Netherlands further down.

Cryptoassets are a highly volatile unregulated investment product.

Where to Buy Stocks in the Netherlands – Regulated Stock Brokers Reviewed

It’s important for traders to pay careful attention when choosing where to buy shares in the Netherlands. Brokers vary when it comes to trading fees, account minimums, and features.

1. Capital.com – Overall Most Popular Share Trading Platform in the Netherlands

Capital.com is a popular share trading platform in the Netherlands. This is a CFD broker and this type of financial instrument offers traders the flexibility of speculating on stocks without owning them.

A key advantage is the ability to make gains from rising stock prices as well as falling markets. For instance, if the trader thinks a share price will rise, they can place a buy order. If they think it will fall, they can create a sell order.

It’s also possible to trade stock CFDs with leverage at Capital.com. The leverage ratio offered on stock CFDs is 1:5. As such, what would be a $1,000 trading order could become $5,000.

Newbies will need to be careful when leveraging positions. As well as magnifying the gains on successful positions, it will also amplify losses when speculating incorrectly. All CFDs are commission-free at Capital.com. Other assets include forex, cryptocurrencies, indices, ETFs, and more.

The minimum deposit is $20 and there is no transaction fee charged. Dutch traders can make a deposit via iDEAL, credit/debit card, Trustly, WebMoney, MultiBanko, Klarna/Sofort, Qiwi, Skrill, or Neteller. However, bank wires attract a higher minimum deposit of $250.

Capital.com is available as a web trading platform and also a mobile app. There is a decent selection of tools for technically minded traders. This is inclusive of customizable drawing tools and more than 75 indicators.

Newbies learning how to buy shares in the Netherlands will have access to a paper trading account. There is also a section aimed at beginners called ‘Learn to Trade’, which includes a variety of guides.

| Supported Shares | 5,000+ |

| Share Trading Commission | 0% |

| Minimum Share Purchase | $1 |

| Minimum Deposit | $20 |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Interactive Brokers – Popular Stock Broker for Advanced Traders

More experienced traders looking for a popular stock broker in the Netherlands might consider Interactive Brokers for its sophisticated Pro platform.

IBKR Pro offers multiple order types and advanced charting tools, market scanners, indicators, and more. Fractional investing is only available for US traders here. As such, the order size for Dutch traders will be the full price of the share in question.

Traders can fund their accounts via wire/SEPA transfer. The fee system is rather complicated at Interactive Brokers. That is to say, the amount payable will depend on the market people wish to trade in and also on the volume.

For example, stocks listed in Europe, the Middle East, and Africa are charged a minimum fee of between 0.015% and 0.05% per trade. UK stocks come with a fee between 0.015% and 0.050% depending on volume.

| Supported Shares | 10,000+ |

| Share Trading Commission | Depends on the market and volume |

| Minimum Share Purchase | N/A (fractional trading only on US accounts) |

| Minimum Deposit | No minimum |

3. DEGIRO – Award-Winning Stock Broker With Access to US Markets

DEGIRO has been providing a brokerage service since 2008 and offers access to a range of markets. Traders can access 50 exchanges spanning 30 countries.

Traders can buy US stocks in the Netherlands on a commission-free basis but need to pay a handling fee of €0.50. For stocks listed on certain exchanges such as the Netherlands and others in Europe, the fee is €3.90, on top of the aforementioned €0.50 handling fee.

Debit Money is Degiro’s answer to margin trading. Beginners should buy stocks on a margin with caution, as it’s a matter of investing with more than they have. Traders can borrow up to 33% of the value of the share via Debit Money.

Notably, fractional trading is not supported by DEGIRO.

| Supported Shares | Shares from 50 exchanges across 30 countries |

| Share Trading Commission | Depends on the market – 0% commission on US stocks, plus a €0.5 handling fee |

| Minimum Share Purchase | Depends on asset – fractional trading is not supported |

| Minimum Deposit | No minimum |

4. XTB – More Than 1,500 Stock CFDs to Trade

There is no minimum deposit and options include credit card, debit card, Paysafe (formerly Skrill), and bank transfer. In terms of fees, after 12 months of inactivity, €10 per month is charged.

For the most part, no commission is charged on stock CFDs. However, Italian stocks command a fee between €0.25 and €100 depending on the volume traded. The mark-up on all stock CFD trades is included in the spread, which is 0.30%.

Note that in some cases, a 30% withholding tax will be deducted from the dividends of US companies. Withdrawals under €100 attract a €25 fee. Deposits are free from charge and can be made via credit card, bank transfer, and also Skrill, PayPal, and ECOMMPAY.

| Supported Shares | 1,700+ |

| Share Trading Commission | Markup included in the spread at 0.30% |

| Minimum Share Purchase | 0.01 units |

| Minimum Deposit | No minimum |

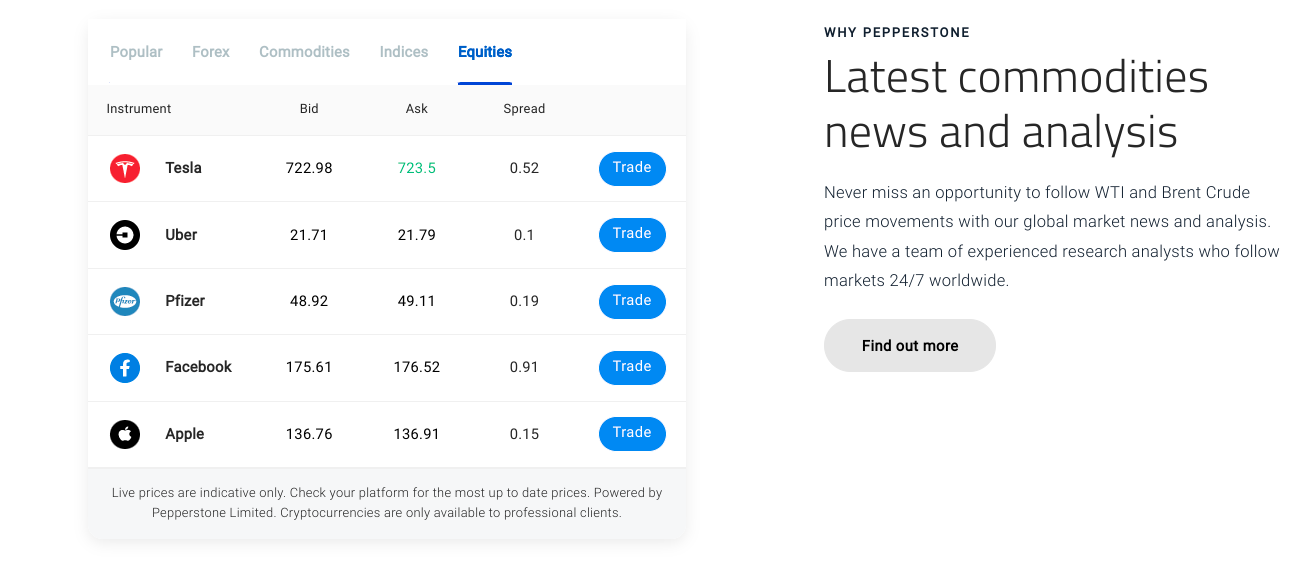

5. Pepperstone – Regulated Trading Platform With 900 Share CFDs

Pepperstone offers a range of share CFDs, which includes those listed in the US, UK, Australia, and beyond. The fee to trade CFDs at Pepperstone depends on the market.

US stocks attract a fee of $0.02 per share. The platform states that non-US accounts have an additional commission fee of €3.19 to pay. Dutch traders can make a deposit via credit/debit card, PayPal, Neteller, Skrill, or bank transfer.

This platform recommends a minimum deposit of AU$200 or equivalent, so about €130. Pepperstone has partnered with the social investing platform DupliTrade. This allows people to automate trading positions.

Pepperstone is also compatible with cTrader, TradingView, MT4, and MT5. Dutch traders with more experience can leverage their stock CFD trades by up to 1:5. The platform is regulated by ASIC, the FCA, and DFSA.

| Supported Shares | 900+ stock CFDs |

| Share Trading Commission | Varies depending on market. From $0.02 per share |

| Minimum Share Purchase | Not stated |

| Minimum Deposit | Approx €130 EUR is recommended |

6. AvaTrade – Well-Established Share CFD Platform With MT5

While there is a range of stock CFDs, some can only be traded on the MT5 platform. The minimum trade on MT5 is just 0.001 units. In terms of trading fees, there is no commission payable, which only leaves the spread. However, there is an inactivity fee of €50 payable.

This will be charged to the account after three months of inactivity. After a year, the fee charged is €100. Multiple base currencies are supported, including euros. There is a minimum deposit of €100 at AvaTrade.

Supported deposit methods include wire transfers and credit/debit cards. This platform is also compatible with MT4. The AvaTradeGO mobile app is packed with features and allows people to trade shares on the move.

| Supported Shares | 1,000+ stock CFDs |

| Share Trading Commission | 0% |

| Minimum Share Purchase | 0.01 lot on MT5 |

| Minimum Deposit | €100 |

Popular Netherlands Stock Brokers Compared

Below we offer a comparison of popular stock market brokers in Netherlands:

| Stock Brokers | Supported Shares | Commission | Min Share Purchase | Min Deposit |

| Capital.com | 5,000+ | 0% | $1 | $20 |

| Interactive Brokers | 10,000+ | Depends on the market and volume | N/A. Fractional trading only in US | No minimum |

| DEGIRO | 50 exchanges across 30 countries | Depends on the market – 0% commission on US stocks, plus €0.5 handling fee | Depends on asset – fractional trading not supported | No minimum |

| XTB | 1,700 | Markup included in spread at 0.30% | 0.01 lot | No minimum |

| Pepperstone | 600+ US, 200 Australia, 100 UK, and more | From $0.02 per share | Not stated | Approx €130 EUR is recommended |

| AvaTrade | 1,000 | 0% | 0.01 lot on MT4 and MT5 | €100 |

The Basics of Buying Stocks in the Netherlands

Learning how to buy stocks in the Netherlands can be daunting for beginners. That said, there are some basic steps that newbie traders can take to get started.

The first step is to research a popular stock trading platform in the Netherlands thoroughly. For instance, traders should ensure the platform supports the payment method they wish to use, lists plenty of stocks, and charges low fees to buy and sell shares.

Moreover, holding a regulatory license from bodies such as the FCA, ASIC, CySEC, and NBRB is a sign of a reputable and professionally managed trading platform.

After deciding what shares to watch in the Netherlands, traders need to carry out research on the company they wish to invest in. This will include looking at the company’s financial reports.

Those here to learn how to buy international shares in the Netherlands will need to ensure the brokerage covers more than one stock exchange. For instance, Euronext Amsterdam is local to the Netherlands.

Some of the other international marketplaces available to Dutch traders include US exchanges like the NASDAQ and the NYSE, the LSE in the UK, and the HKG in Hong Kong. Capital.com lists stocks from 19 regions.

How do I Find Popular Stocks to Buy in the Netherlands?

Learning how to buy stocks in the Netherlands is the first step to becoming a trader.

However, it’s also wise for people to have a basic understanding of how to find stocks to buy and sell.

Check Which Markets are Popular With Other Investors

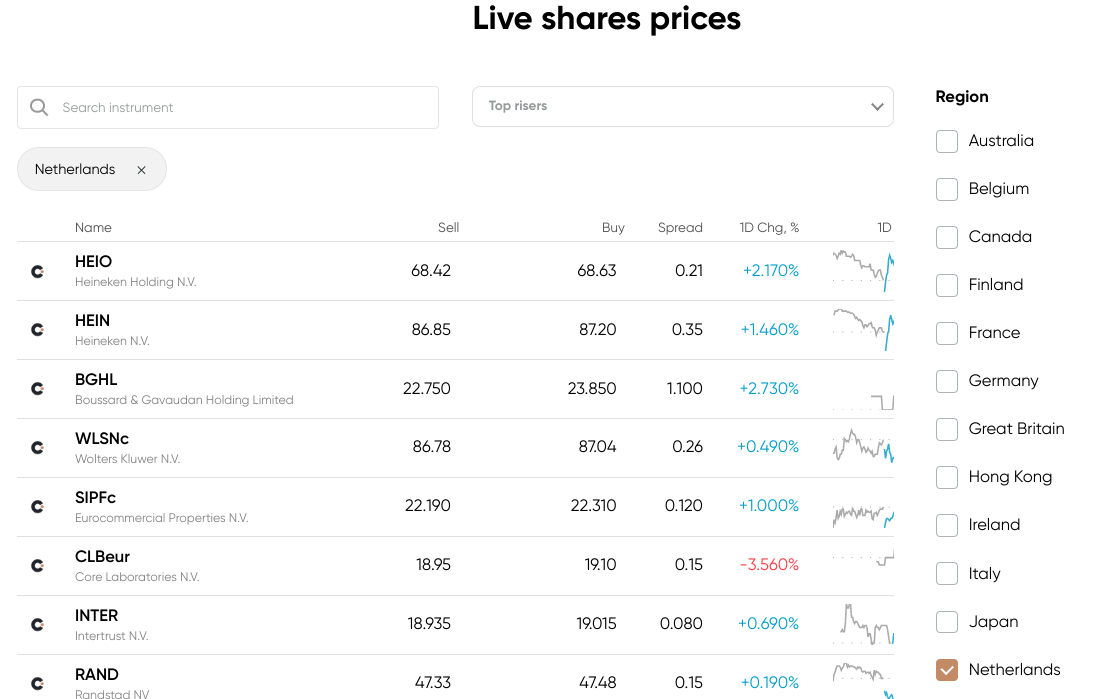

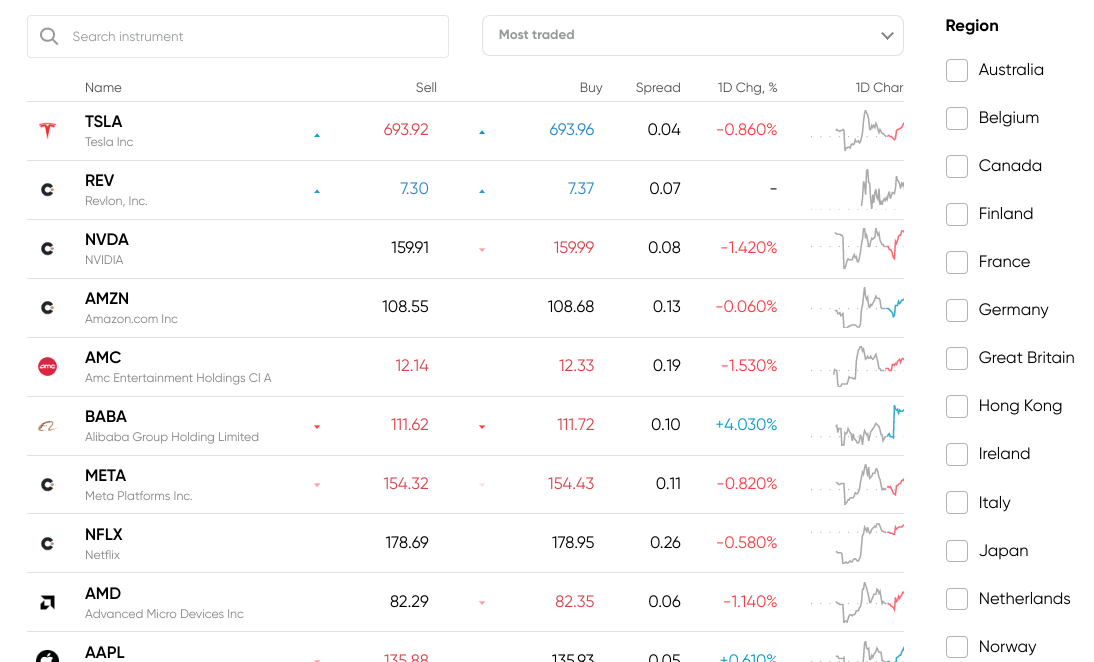

Those looking for popular shares in Netherlands in 2023 could check out which markets are trending.

See an example below:

- During the global COVID-19 pandemic, many retail investors turned their attention to stay-at-home stocks

- This includes companies that benefited from the restrictions and lockdowns imposed

- Notable examples include Etsy, Zoom, Pinterest, Netflix, Amazon, and Roku

Importantly, trends can be short or long-term, and sometimes intermediate. For instance, the latter could include so-called meme stocks, which rally suddenly.

Look for Stocks With Upside Potential

Some stocks are considered to be undervalued or fail to reach their full potential (usually due to a variety of external factors).

- It makes sense that occasionally some of the hundreds of industries that make up our economy may experience stagnant or even declining income

- This can turn investors off and lead them to jump ship. In turn, the company’s stock price plummets

- The aviation and hospitality sector during the COVID-19 outbreak is a contemporary example

Uncertainty, whilst risky, can sometimes present traders with the opportunity to buy stocks.

This is, of course, in the hope the stock appreciates later once the industry recovers.

10 Popular Stocks to Watch in the Netherlands in 2025

Below we explore 10 popular stocks to watch. Do note that there is a selection of stocks from various markets – so they will be quoted in different currencies, such as US dollars and euros.

Furthermore, some stocks are listed on multiple exchanges. For instance, Shell has a primary listing on the LSE but also trades on the NYSE and Euronext Amsterdam.

1. Tesla – Growth Stock and Market Leader in the Electric Vehicle Space

Tesla is an EV manufacturer and clean energy company based in the US. Dutch traders looking to buy US stocks in the Netherlands will have no doubt come across Telsa. The company was founded in 2003 and is a market leader in EVs.

In its most recent quarterly financials, the company reported increased revenue of almost 81% year-on-year, as well as a whopping 657% rise in net income. Tesla’s diluted EPS (earnings per share) was also up by over 633%.

Therefore, there are no worries about the company’s health. Based on the price right now, those who figured out how to buy Tesla stocks at the beginning of 2020 would be seeing gains of more than 700%. That’s in just a little over two years.

Among large-cap growth stocks, Tesla has a unique distinction. The company has displayed the ability to negotiate a worldwide supply bottleneck and surpass Wall Street forecasts.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Shell – British Multinational Oil and Gas Company With Dividends

Shell is a dividend-paying stock. In Shell’s earnings report in the first quarter of 2022, it announced a 4% increase in the quarterly dividend to $0.25 per share.

At the time of writing, the dividend yield of Shell is 3.94%. Moreover, in March 2022, the company reported its quarterly financials. Revenue increased by over 51% year-on-year, and net income went up by almost 26%.

Shell’s operating income increased by over 126%. Oil and gas prices are through the roof because of inflation and the Russia/Ukraine conflict. Therefore, Shell is benefiting from the current economic landscape.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. Etsy – Stay-at-Home Stock With Gains of Over 400% in Five Years

Etsy specializes in handcrafted products, antiques, and creative materials. These products fall under a variety of categories, including jewelry, art materials, home furnishings, décor, toys, and more.

Before the COVID-19 outbreak, Etsy was flourishing, thanks to its ability to match creative entrepreneurs with clients seeking items that are out of the ordinary or personalized.

Etsy expanded rapidly during the pandemic. Etsy’s marketplace sales volume increased by 177% in the first quarter of 2022 compared to pre-pandemic levels. Additionally, the business survived despite Amazon creating its own ‘Handmade’ platform.

Over five years of trading, Etsy stock has produced gains of almost 405% for investors. Amazon stock only increased by 120% in the same timeframe. We checked out the financials and in the first quarter of 2022, Etsy beat its EPS estimates by almost 21%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

4. Just Eat – Global Take Away Service With Upside Potential

Just Eat is an online meal delivery marketplace. The business leverages its platforms to connect customers with eateries. It provides services across many nations. This includes the Netherlands, the US, Australia, Germany, and more. Its headquarters are in Amsterdam, where Just Eat was established in 2000.

The company benefited from a rapidly expanding customer base during the COVID-19 pandemic. According to its most recent quarterly financial, revenue was up over 99% year-on-year. Just Eat anticipates a return to positive adjusted EBITDA in 2023.

The company has also made a success in strengthening its on-demand grocery delivery offering, including new collaborations with Albert Heijn and Spar in the Netherlands.

It’s possible that the company’s long-term worldwide strategic collaboration with McDonald’s could lead to improvements in operations and efficiency. That said, this could be a stock for those with an appetite for risk. It’s on the up, but over five years of trading, it’s lost 50% of its value.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

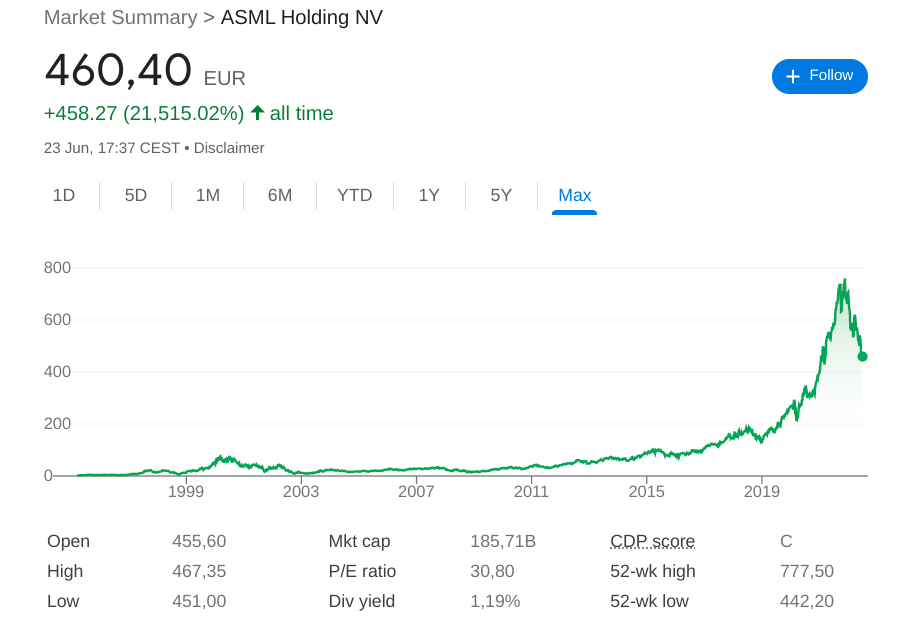

5. ASML – Dutch Chip Equipment Manufacturer With Niche Product

The Netherlands-based company ASML has emerged as a popular provider of photolithography systems. The product is used in the manufacturing of integrated circuits worldwide.

ASML’s market share has virtually doubled despite competition from Japanese giants Nikon and Canon. This is because no other provider has mastered ‘extreme ultraviolet’ (EUV) lithography for chip fabrication.

As such, ASML has a niche product and enjoys an advantage over the competition. In 10 years of trading, the market capitalization of ASML has increased by more than €100 billion. In terms of its stock price, this has gone up by over 300% in five years.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

6. MercadoLibre – Latin Americas Answer to Amazon in Early Growth Stage

MercadoLibre was founded in 1999 and is Latin America’s biggest online retailer and payment processor. MercadoLibre is based in Buenos Aires, Argentina. The e-commerce retailer is also active in Venezuela, Colombia, Brazil, Peru, Mexico, Chile, and other locations.

This company also has a successful payments service. It provides six integrated services for digital payments and e-commerce. For instance, the company operates a fast-expanding payments network called Mercado Pago, as well as a lending platform, and a logistics service called Mercado Envios.

In five years of trading, MercadoLibre stock has increased by over 146%. In its quarterly financials for March 2022, the company announced an increase in revenue of more than 63%, net income rose by over 290% and net profit margin was up 217%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

7. CF Industries – UK’s Biggest Fertilizer Producer

CF Industries has been operational since 1946 and the company manufactures and distributes agricultural fertilizers. The company has nine manufacturing complexes globally, which include those in the US and the UK.

Over five years of trading, CF Industries stock has risen by over 194%. The company’s March 2022 quarterly financials revealed that revenue was up almost 174% year on year.

CF Industry’s net income increased by almost 485% year-on-year, and the net profit margin rose by nearly 114%. Strong worldwide demand and a constrained global supply caused by difficulties associated with Russia’s invasion of Ukraine have both contributed to the company’s success.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

8. Block – Booming Finance App Business That Facilitates Bitcoin Purchases

Block, formally Square, is a US-based financial services and digital payments company with a difference. The company has carved itself a niche by providing services to the lower-income and under-banked clients that need it most.

The company’s personal finance tool for consumers is called Cash App. This enables users to make purchases using Cash Card (a Visa card). They can send money to friends, set up direct deposits, and purchase stocks and Bitcoin.

The service also offers rewards in Bitcoin. This could be one of the most popular stocks to watch since electronic payments are becoming an increasingly significant component of the global economy. In the last five years of trading, Block stock has increased by over 172%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

9. Unilever – One of the World’s Largest Consumer Goods Suppliers

This British company was founded in 1929. It is a huge multinational business that manufactures and markets everything from soap and beauty brands to cleaning products, food, and condiments. Big brands include Hellmans and Dove.

Despite the far reach of this company and its impressive number of products and brands, Unilever’s stock has been struggling in 2022. That said, the company has taken on Nelson Peltz as its new CEO.

Peltz is known for turning around the fortunes of Proctor & Gamble. Therefore, investors holding shares in Unilever are hoping that Peltz can do the same for this company.

Despite inflationary headwinds, Unilever reported a revenue increase of almost 7% in its most recent financials. Moreover, net income went up by over 27%, and net profit margin increased by almost 20%. Unilever pays dividends and as of writing, a running yield of over 4.50% is on offer.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

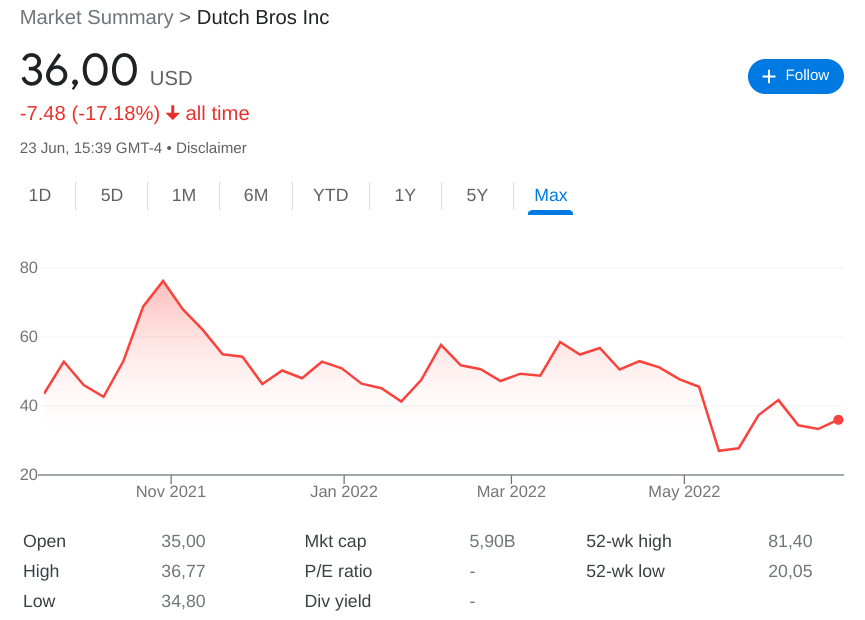

10. Dutch Bros – Popular Coffee Shop in Expansion Mode Despite Inflation

Dutch Bros is a coffee drive-thru chain. Two brothers who are of Dutch descent created the firm in 1992. The company now has over 500 stores, more than 200 of which are franchised.

The company is extremely popular for its coffee and also its service. This shows in Dutch Bros financial reports. That said, the company didn’t escape inflation.

Revenue was up over 54% in the quarterly report released in March 2022, however, net profit was down. The coffee shop chain is still in a growth period. Dutch Bros has gone from saying it will add 125 new shops to its chain by the end of 2022.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How to Buy Penny Stocks in the Netherlands

Getting to grips with penny stocks is the same as buying any other shares in the Netherlands. A penny stock simply refers to the value per share, which is usually $1 or less.

Are Shares Taxed in the Netherlands?

In the Netherlands, shares typically fall under box 2 or box 3 of taxation. Investors must pay 26.9% tax on the dividend if the stock falls within box 2.

The Dutch tax authorities compute a presumed profit for box 3, which results in investors paying an income tax of around 0.5% to 1.75% on the value of the assets.

How to Buy Shares for Beginners in the Netherlands

See a guide of how to trade stocks below:

Step 1: Open an Account with a Regulated Broker

Visit a broker’s site and sign up. Enter an email and password, as well as a name and residential address.

A broker will also ask for a date of birth and some other basic information.

Step 2: Verify Account

Account verification is simple. Traders need to upload a photo ID and a proof of address document. The first part could be a passport or a driving license.

For the latter, a utility bill or bank statement is accepted.

Step 3: Deposit Funds

Most regulated brokers offer several payment methods. Deposit an amount to fund the account with.

Step 4: Search for Share

Enter a company name in the search bar.

Here, we are searching for Tesla. When the correct stock appears, click it.

Step 5: Buy Shares

CFDs allow people to speculate on stocks in either direction. Those who think the price will rise should place a buy order.

Alternatively, traders who think a stock price will fall can try to capitalize on this by placing a sell order.

Tips for Buying Stocks in the Netherlands

This guide has detailed how to invest in shares in the Netherlands and listed options available to Dutch traders.

However, to aid traders in choosing popular shares to watch, we’ve listed a few tips:

- Consider goals: Traders will need to think about the overarching goal of opting to buy stocks. For instance, is the goal to buy stock and hold on to it for years? If a company has a history of consistency or growth in terms of financials, it will probably be more appealing to long-term investors. Well-established growth stocks are worth considering as they have the potential to appreciate over time.

- Choose a regulated broker: Picking a trustworthy platform to buy and sell stocks is essential. One way to ensure this is the case is to check out the regulatory status of the brokerage in question.

- Think about diversifying: When researching popular shares to watch, consider adding more than one company to the portfolio. A simple way to do this without spending too much is to invest in stocks in fractional amounts. Another option is to invest in an ETF, index fund, or Copy Trading.

Conclusion

In this guide, we’ve covered everything there is to know about how to invest in stocks in the Netherlands. To invest in shares safely, traders will need a professional and regulated brokerage service.