The prospect of buying stocks can be daunting for those entirely new to the investment space.

In this beginner’s guide, we cover everything there is to know about how to buy stocks in India. We discuss how to select a regulated broker, what fees to expect, and how to place a stock purchase order.

How to Buy Stocks in India

Here is a rundown of how to buy stocks in India, explained in four simple steps:

- ✅ Step 1: Open an Account with a Regulated Broker

The first step is to find a regulated and low-cost trading platform that offers access to the international stock market. To trade stocks via a regulated broker, new users must create an account and verify their identity. - Step 2: Deposit Funds

Once the account is created, investors can proceed to deposit funds. - Step 3: Search for Stock

To find a specific stock, users can simply search for the company on a broker’s site. - Step 4: Trade Stocks

Specify the stake amount to execute the trade.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Following the order confirmation, a regulated broker will open the position and add the stock to the user’s portfolio.

Where to Buy Stocks in India – Regulated Stock Brokers Reviewed

For those unaware, investors cannot directly engage with the stock exchange. Instead, they must go through a brokerage that executes trades on the client’s behalf.

Below, we list the best online stock brokers in India that our readers can consider for 2025.

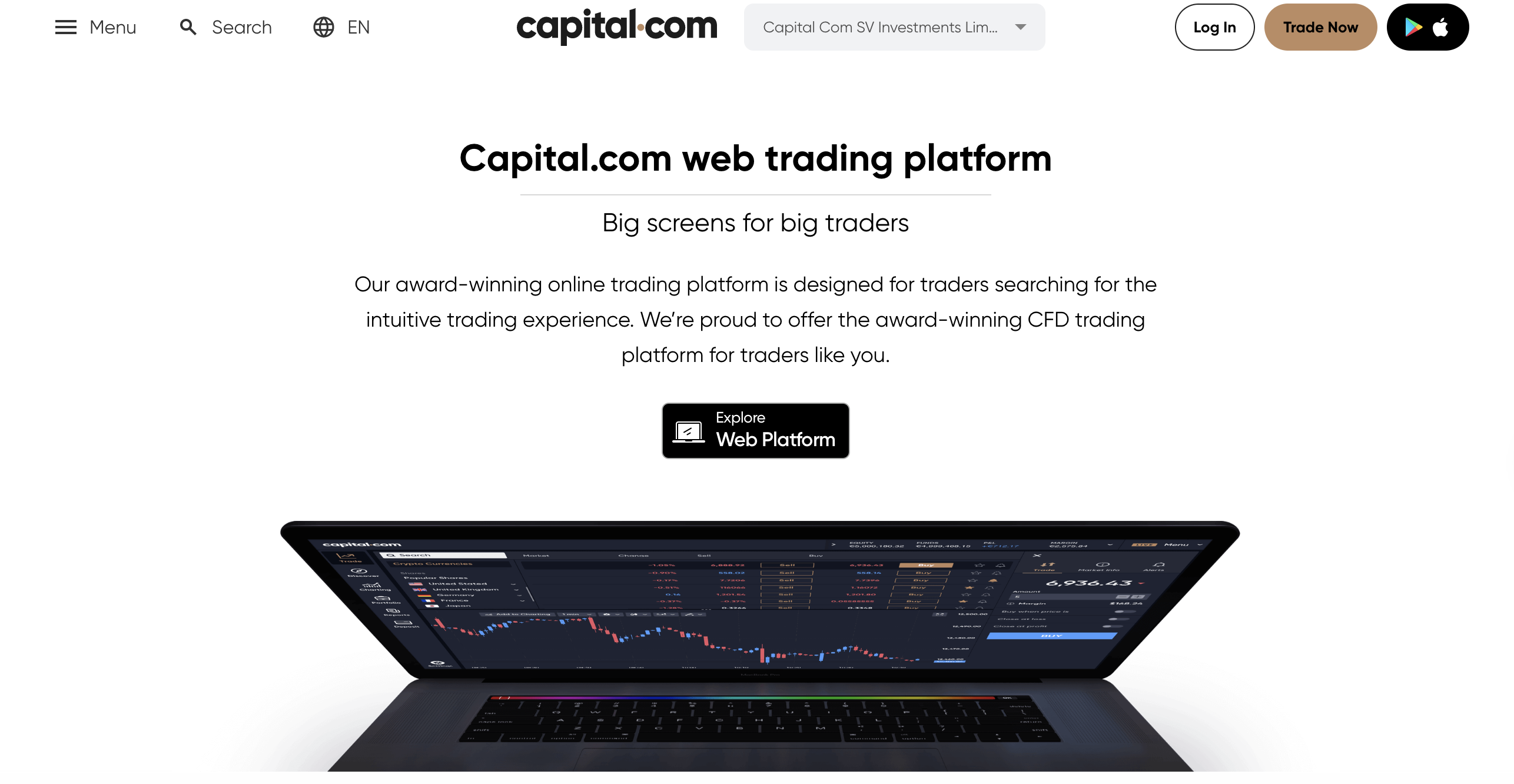

1. Capital.com – Overall Most Popular Stock Broker in India

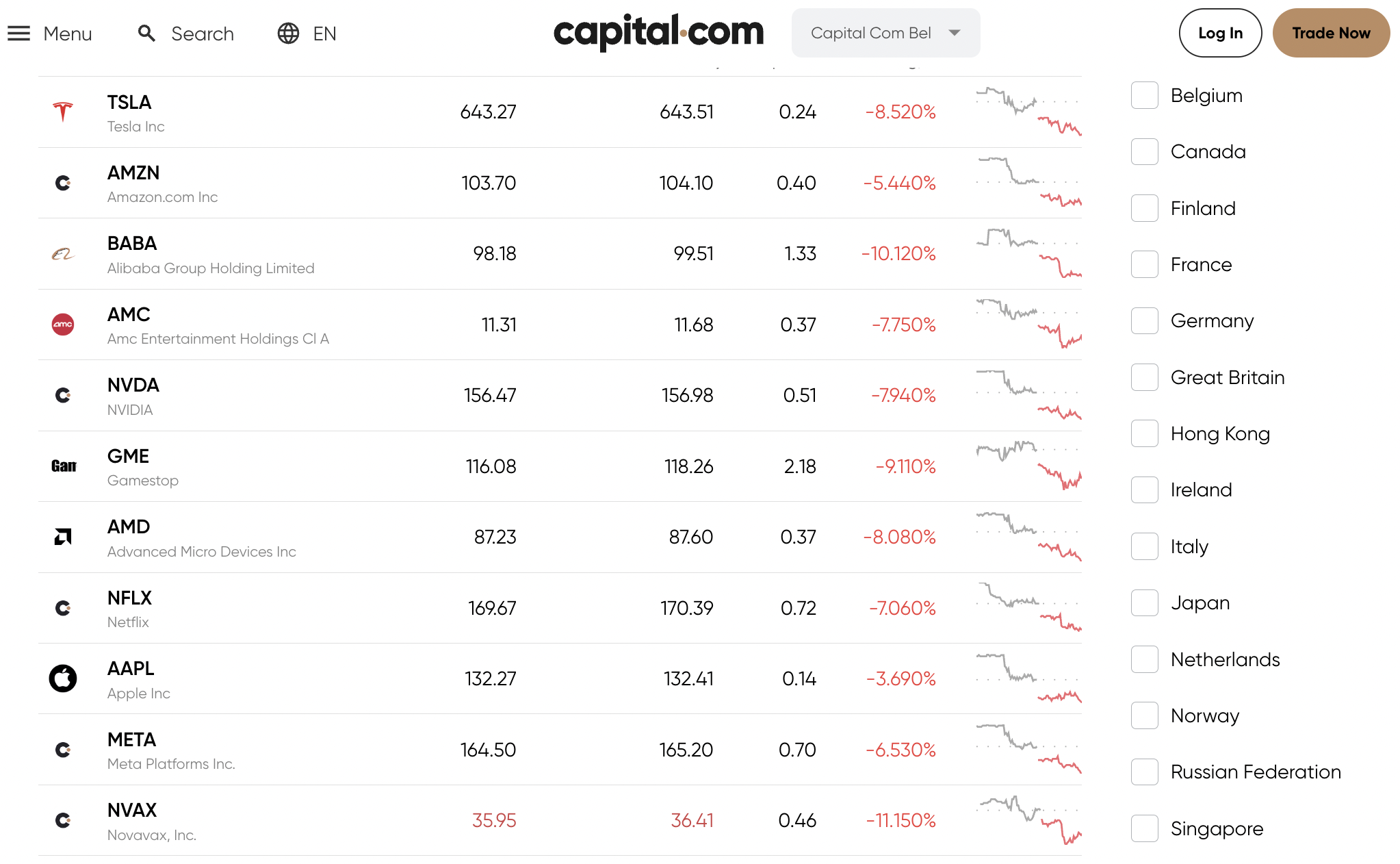

Capital.com is one of India’s most popular trading platforms, which allows its users to trade stock CFDs. It lists over 5,400 equities across 19 international markets.

Moreover, this massive selection of stocks can also be traded with a leverage of up to 1:5. When trading stock CFDs via Capital.com, investors will not be buying the underlying asset. Instead, investors will be trading a financial instrument that tracks the value of the stock. This means that Capital.com allows its traders to go long and short on stocks.

Moreover, this is a 100% commission-free platform. There are also no deposit or withdrawal fees, no matter which payment method is chosen. Capital.com is also a multi-asset platform that supports forex, commodities, and digital assets, which makes it one of the most popular crypto exchanges and most popular forex brokers in India.

One of the most prominent features of Capital.com is its advanced trading platform. The broker offers support for technical indicators and charting tools for users to make informed investment decisions. It also allows its customers to control their positions with multiple order types.

The platform also offers a demo account with a pre-loaded balance of $100,000 – so that new users can practice trading and learn the basics of the stock market. Moreover, the broker offers tons of education resources, including real-time market updates. Capital.com is regulated by the FCA, CySEC, FSA, CySEC, and the NBRB. Apart from stocks.

| Stocks Available | 5,400 + stock CFDs |

| Fractional Shares? | Yes, via CFDs |

| Pricing System | 0% commission on all markets |

| Minimum Deposit | $20 on debit/credit cards (around ₹1,600) |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Zerodha Broking – Indian Broker With Competitive Fees

Zerodha is one of the most popular stock brokers in India, supporting various traditional investment products, from equities and derivatives to mutual funds and fixed income. It gives its customers access to over 5,000 stocks on the Indian stock exchanges.

Moreover, Zerodha also allows its customers to invest in companies through IPOs. Being a trading member of the NSE and BSE, Zerodha is registered with the Securities & Exchange Board of India. It has an intuitive dashboard for users to manage their investments.

Zerodha has also developed a flagship trading platform named Kite – that comes with streaming market data and advanced charts. Kite is also available via smartphones and is widely considered a popular stock broker app in India. Zerodha charges a flat fee of ₹20 or 0.03% (whichever is lower) for intraday stock trades.

It offers free equity delivery to a user’s Demat account, which is where share certificates are stored in electronic format. Zerodha allows users to transfer funds instantly from a registered bank account using UPI for free. Alternatively, instant payment methods are also facilitated via Kite, but this comes with a fee of ₹9. The broker also accepts bank transfers and cheque deposits.

| Stocks Available | 5,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹20 or 0.03% for intraday trades – whichever is lower |

| Minimum Deposit | ₹0 |

3. Upstox – Popular Indian Stockbroker With Multiple Asset Classes

Another leading online broker in India is Upstox, which was launched in 2009. The platform supports stocks, mutual funds, commodities, forex, and IPOs. Moreover, to help its customers make the right investment decisions, Upstox also offers key information such as company profiles, market analysis, and technical data.

Investors can also use Upstox to gain access to equity derivatives, including futures and options. In terms of fees, Upstox charges a flat ₹20 commission on stocks, commodities, and currency orders.

However, it charges no fees for investments into IPOs and mutual funds. Users of Upstox can transfer funds via Netbanking, UPI, GPay, or traditional bank transfer. Other than Netbanking, all other payment methods are processed fee-free. To open a Demat account with Upstox, users will have to pay ₹199 + GST.

| Stocks Available | 5,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹20 for stocks, ₹0 for IPOs |

| Minimum Deposit | ₹20 |

4. 5Paisa – Indian Broker Supporting US Stocks

With that said, like Upstox, 5Paisa implements a flat fee of ₹20 on stocks – which is related to the stamp duty levied for all investment products. Nonetheless, deposits made via UPI and IMPs are processed for free, but Netbanking comes at an extra cost of ₹10 per transaction.

Another prominent feature about 5Paisa is that it offers personalized portfolio advisory services. In other words, those wondering what stocks to watch in India can talk to a 5Paisa advisor and can build a diversified portfolio based on individual risk thresholds.

| Stocks Available | 4,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹20 |

| Minimum Deposit | ₹450 |

5. Samco – Indian Brokerage Platform for Automated Trading

Additionally, users can also do a trial run before signing up as a client. On top of this, Samco comes with support for multiple advanced trading platforms. The broker has also predesigned mini portfolios that allow its users to diversify into a basket of stocks in one click. For trading, Samco gives its users access to the BSE, NSE, MCX, and NCDEX.

Samco charges a flat commission of ₹20 or 0.02%, whichever is lower. However, unlike Zerodha, it does not offer free equity deliveries. Samco facilitates deposits via UPI, bank transfer, cheque, and the StockNote app. Maintenance fees on Demat accounts are ₹0 for the first year, but after that, users will be charged ₹400 annually.

| Stocks Available | 3,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹20 or 0.02% – whichever is lower |

| Minimum Deposit | ₹0 |

6. Wisdom Capital – Low-Cost Stock Broker in India

It also allows its users to open a Demat as well as a trading account for free. Wisdom Capital supports the trading of equities, commodities, futures, and options.

The broker also comes with multiple trading platforms that users can pick from based on their experience and investment objectives. Like the majority of online brokers in India, Wisdom Capital supports margin trading. In terms of payments, it only accepts online bank transfers, meaning there is no support for UPI or GPay.

| Stocks Available | 5,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹0.01% for intraday trades |

| Minimum Deposit | ₹0 |

7. ProStocks – Indian Stockbroker With Multiple Trading Plans

Alternatively, customers can also choose a flat-fee plan. In this case, users only have to pay a ₹15 flat fee for every executed trade. This is ideal for long-term investors and less-frequent traders.

Regardless of the plan selected, all users get access to powerful tools on ProStocks – accessible via the web platform and its mobile app. When compared to the other brokers discussed today, ProStocks has a limited suite of investment products – as it only supports stocks, currencies, and derivatives. The broker facilitates payments via UPI, Netbanking, and bank transfer.

| Stocks Available | 1,000+ |

| Fractional Shares? | Yes |

| Pricing System | ₹15 for intraday trades, or ₹899 per month |

| Minimum Deposit | ₹0 |

Popular India Stock Brokers Compared

Refer to our comparison table below to find a popular stock broker in India.

| Stock Brokers | Stocks available | Fractional shares | Pricing system | Minimum deposit | Payment Methods Available | Deposit Fees |

| Capital.com | 5,400 stock CFDs | Yes, via CFDs | 0% commission | $20 for debit/credit cards, $250 for bank transfer | Debit/credit cards, Netbanking, UPI, GPay, bank transfer | ₹0 |

| Zerodha Broking | 5,000+ | Yes | ₹20 or 0.03% | ₹0 | Netbanking, UPI, GPay, bank transfer, cheque | ₹0, ₹9 for Kite |

| Upstox | 4000+ | Yes | ₹20 | ₹20 | Netbanking, UPI, bank transfer | ₹0 |

| 5Paisa | 4000+ | Yes | ₹20 | ₹450 | Netbanking, UPI, bank transfer | ₹0, ₹10 for Netbanking |

| Samco | 3,000+ | Yes | ₹20 or 0.02% | ₹0 | UPI, bank transfer, cheque, StockNote app | ₹0 |

| Wisdom Capital | 5,000 + | Yes | 0.01% | ₹0 | Bank transfer | ₹0 |

| ProStocks | 1,000+ | Yes | ₹15 for intraday trades, or ₹899 per month | ₹0 | UPI, Netbanking, bank transfer | ₹0 |

The Basics of Buying Stocks in India

In simple terms, when buying stocks, an investor will essentially own a small portion of the respective company. If the value of the stock increases, the individual will be able to generate returns on their investment.

That being said, it is not as simple as buying low and selling high.

- The value of a stock varies depending on several factors, such as the company’s stability, financial standing, general market sentiment, and more.

- Therefore, there is an inherent risk associated with stocks – and consequently, it is crucial that individuals do their due diligence before investing in a company.

Over the prior decade or so, traditional brokerage firms have ventured into the online space, making it incredibly convenient to buy stocks not only in the Indian markets but also on foreign exchanges.

Pro Tip: When considering how to buy shares online in India, individuals will come across the term – ‘Demat account’. In India, all security transactions are handled digitally, and a Demat account is where information regarding an individual’s trading history is held – including the share certificates they own. All individuals who wish to invest or trade in India must open a Demat account – which can be done via an online broker.

How do I Find Popular Shares in India?

Now that we have covered the basics of stock investing – let us consider how to determine what shares to watch in India.

Below, we have included some crucial points investors can consider when picking popular shares to invest in India.

Determine Investment Goals

Everyone’s purpose for investing is to make money.

However, some investors might focus on generating passive income or capital appreciation, whereas others might want to make gains in the short term.

- For instance, investors who are interested in trading stocks need not buy shares in a company. Instead, they can capitalize on a market opportunity by trading stock CFDs via a platform such as Capital.com. This allows investors to profit from the short-term volatility of a stock, regardless of whether the company has long term growth potential or not.

- On the other hand, those who are seeking capital appreciation over the long term might prefer stocks that pay dividends. This way, investors will also be able to generate passive income, which they can then reinvest or withdraw.

As is evident, an individual’s investment strategy will ultimately decide the stocks suitable for their portfolio.

Research Market Sentiment

When thinking of how to buy stocks in India, investors must keep an eye out for market trends. Needless to say, news, announcements, and even opinions can have an impact on how the stock market moves collectively.

For example, several Indian tech companies, such as NIIT, saw massive growth during the pandemic, driven by the demand for online learning systems. In the same period, the travel and hospitality industries took a massive hit.

At the other end of the scale, there are stocks that have the capability to generate returns regardless of market cycles.

For instance, the food and medical sectors typically always perform well. Therefore, when searching for popular shares to buy right now, investors should keep up with the general market trends.

Evaluate the Fundamentals

Just because a company operates in a trending market will not automatically make it a worthwhile investment. This is where fundamental analysis comes in.

Before investing, individuals should take a deep dive into the financial statement of the company, studying its earnings reports and past performance.

There are also accounting metrics that investors can consider, such as the P/E and P/B ratios, as well as the EPS, which can indicate whether or not a company is a sound investment.

10 Popular Stocks to Watch in India

In this section, we take a look at 10 stocks to watch in the long term in India.

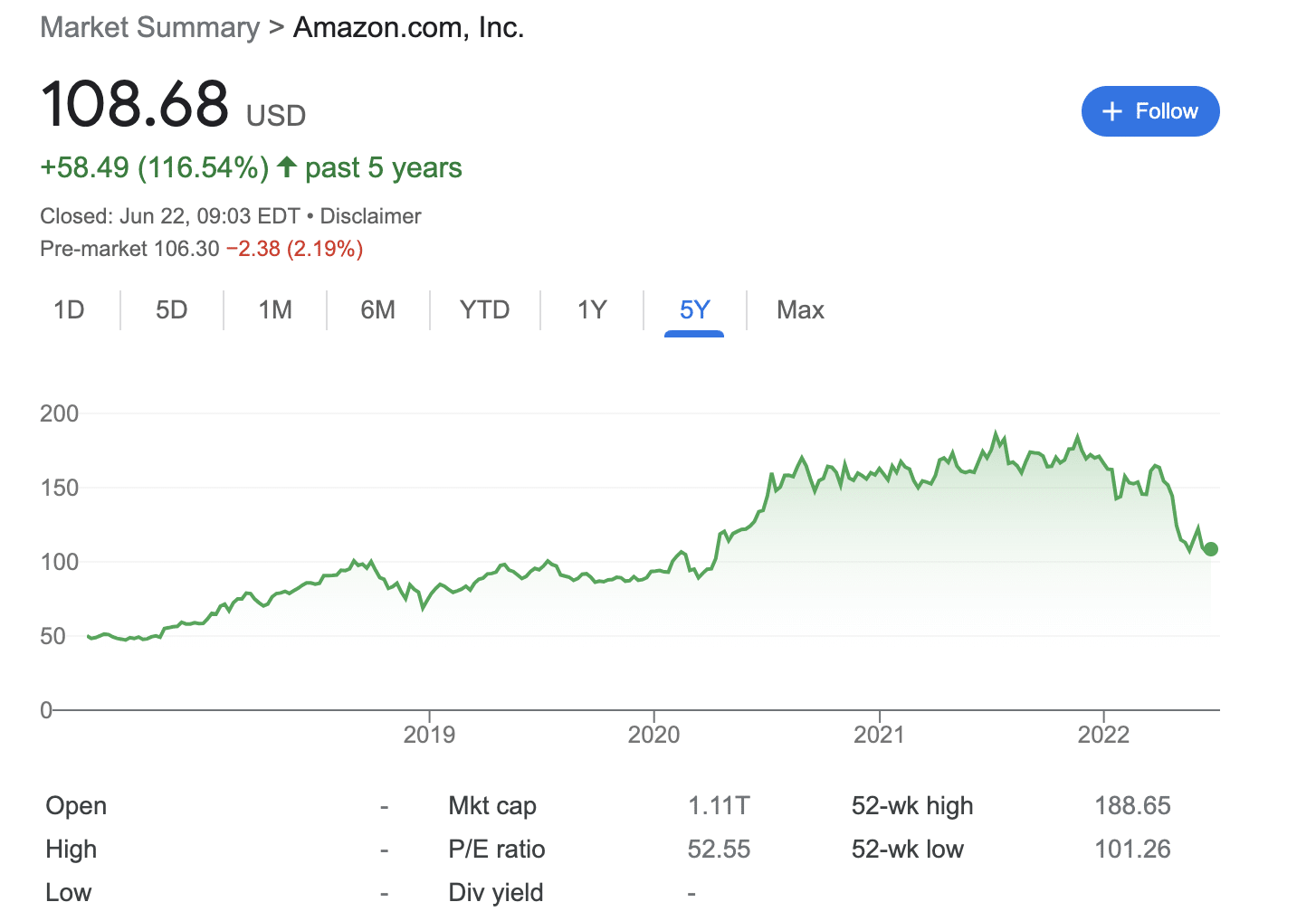

1. Amazon – Overall Most Popular Stock

As a leading company in the global e-commerce market, Amazon does not need an elevator pitch as an investment opportunity. After all, during the COVID-19 pandemic, Amazon managed to reap significant profits through its innovative strategies. In the last five years, the company has witnessed a growth of around 120% in the stock market.

E-Commerce is not the only forte of Amazon. Its subsidiary, Amazon Web Services, is also one of the most widely used cloud computing platforms. The firm is also involved in media streaming, as well as conventional grocery services. Considering these factors, Amazon still has plenty of room to grow.

Moreover, after the recent stock split, Amazon is also considered undervalued by market analysts. However, Amazon trades on the NYSE, and as such – for Indian residents, the main concern might be how to buy international stocks in India.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Intuitive Surgical – Popular Stock in the Biotech Field

Another popular stock is Intuitive Surgical, a company that designs and manufactures robotic products for minimally-invasive surgery.

Its da Vinci devices are used by surgeons across the world to perform complex procedures. Moreover, Intuitive Surgical is dominant in this space, and with the increasing adoption of robotic surgical systems, it has plenty of growth potential.

Although the company has not reported any significant jump in sales, it has generated steady growth. Moreover, there isn’t any reckless spending that is sometimes prevalent in fast-growing companies.

Over the past five years, Intuitive Surgical has generated a return of about 90% for its investors.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

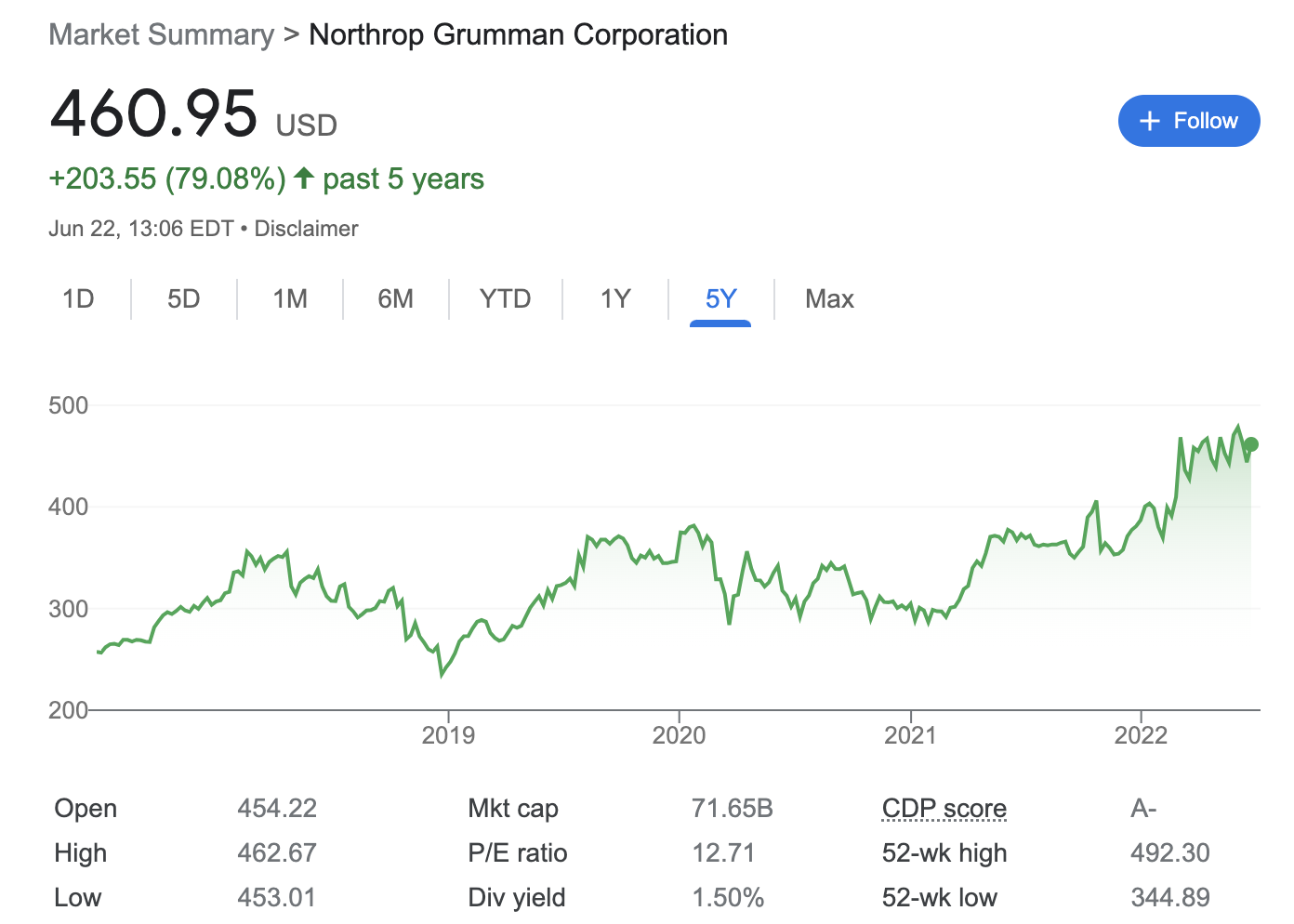

3. Northrop Grumman – Defense Stock in the US

Northrop Grumman is an American multinational aerospace and defense technology company. As one of the prominent arms providers in the US, it is set to benefit from the Russia-Ukrainian conflict.

Northrop Grumman’s RQ-4 Global Hawk is already being used widely for surveillance flights over the Ukrainian border.

Moreover, as of writing, Northrop Grumman offers a running dividend yield of 1.50%.

Crucially, despite the general bearish market of 2022, the stock of this company has seen a growth of over 20% in the past six months.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

4. Citigroup – Popular Stock for Dividends

Citigroup is a multinational investment company headquartered in the US. In India, this firm operates through its subsidiary Citibank and has several branches across the country.

The company is in the middle of strategic repositioning, and analysts expect that the firm will emerge structurally improved, which could drive its growth in the future.

In terms of its stock market performance, the last few years were not particularly favorable for Citigroup.

Nevertheless, the firm offers a running dividend yield of around 4.3% as of writing. In other words, investors can collect passive income while waiting for the company to complete its transformation.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

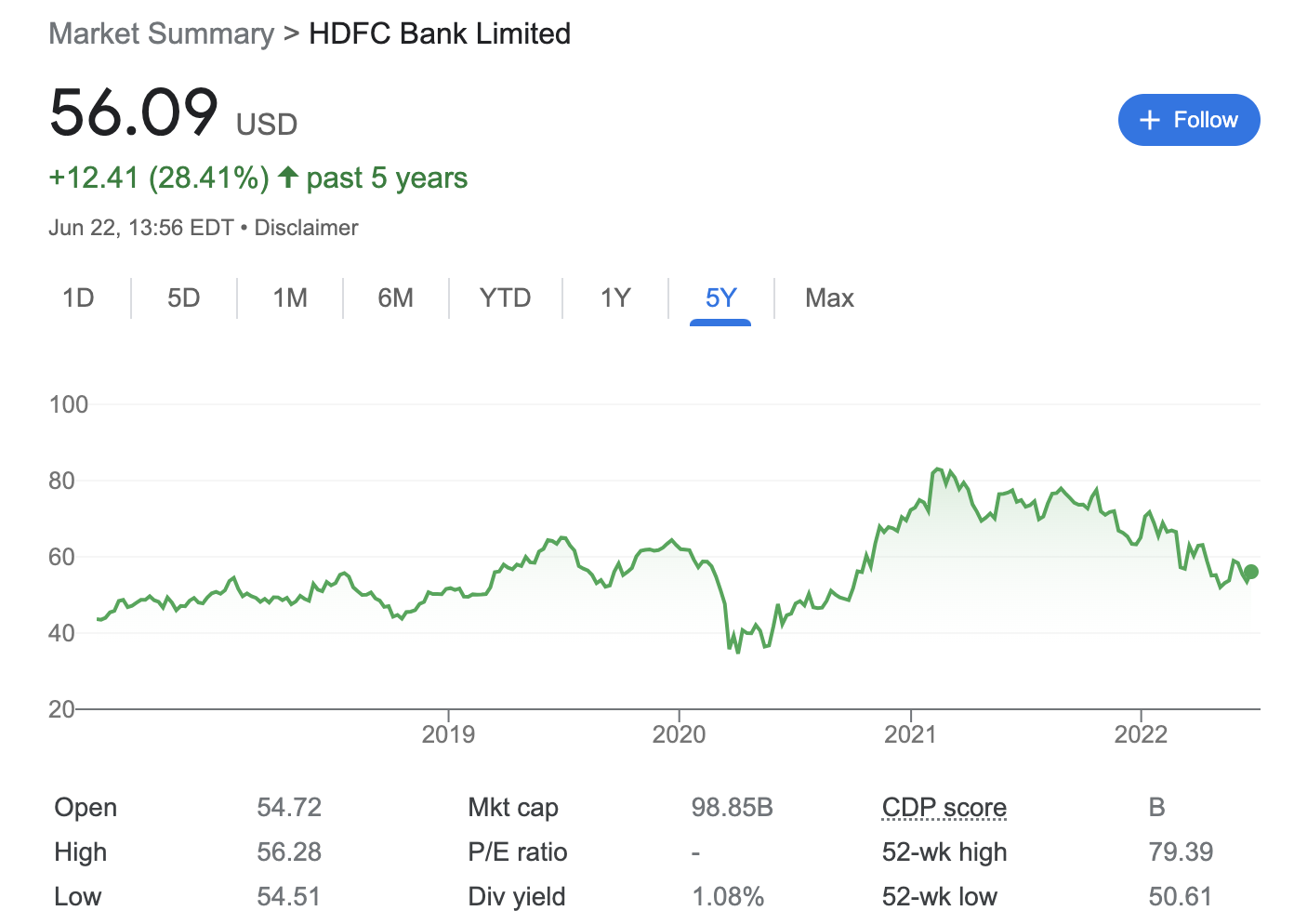

5. HDFC – Invest in India’s Leading Private Bank

HDFC is an India-based private sector bank with branches across the world. The company is listed not only on the NSE but also on the NYSE in the US.

The bank has demonstrated excellent balance sheet growth, and as per its Q1 2022 earnings report, the company’s revenue increased by more than 17% year-over-year.

Furthermore, HDFC has seen an increase of nearly 30% in its stock value over the previous five years. The firm also pays dividends to its shareholders, although it is marginal at around 1% at the time of writing.

In addition to this, HDFC also has a diverse portfolio of subsidiaries, including banking, insurance, asset management, venture capital, and other financial services.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

6. BYD – Chinese EV Company With Long-Term Prospects

BYS is a Chinese company primarily engaged in the manufacture and sale of transportation equipment. It is also one of the fastest-growing EV firms globally, second only to Tesla.

Many commentators argue that BYD has better long-term growth potential as it sells a wider category of products.

Additionally, the sales of BYD’s electric vehicles and hybrids are increasing notably. Crucially, unlike Tesla, BYD makes its own batteries and chips, which helped it continue its manufacturing process, despite the shortage of supplies during the pandemic.

What’s more, BYD stock has generated incredible growth of 570% in the last five years alone.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

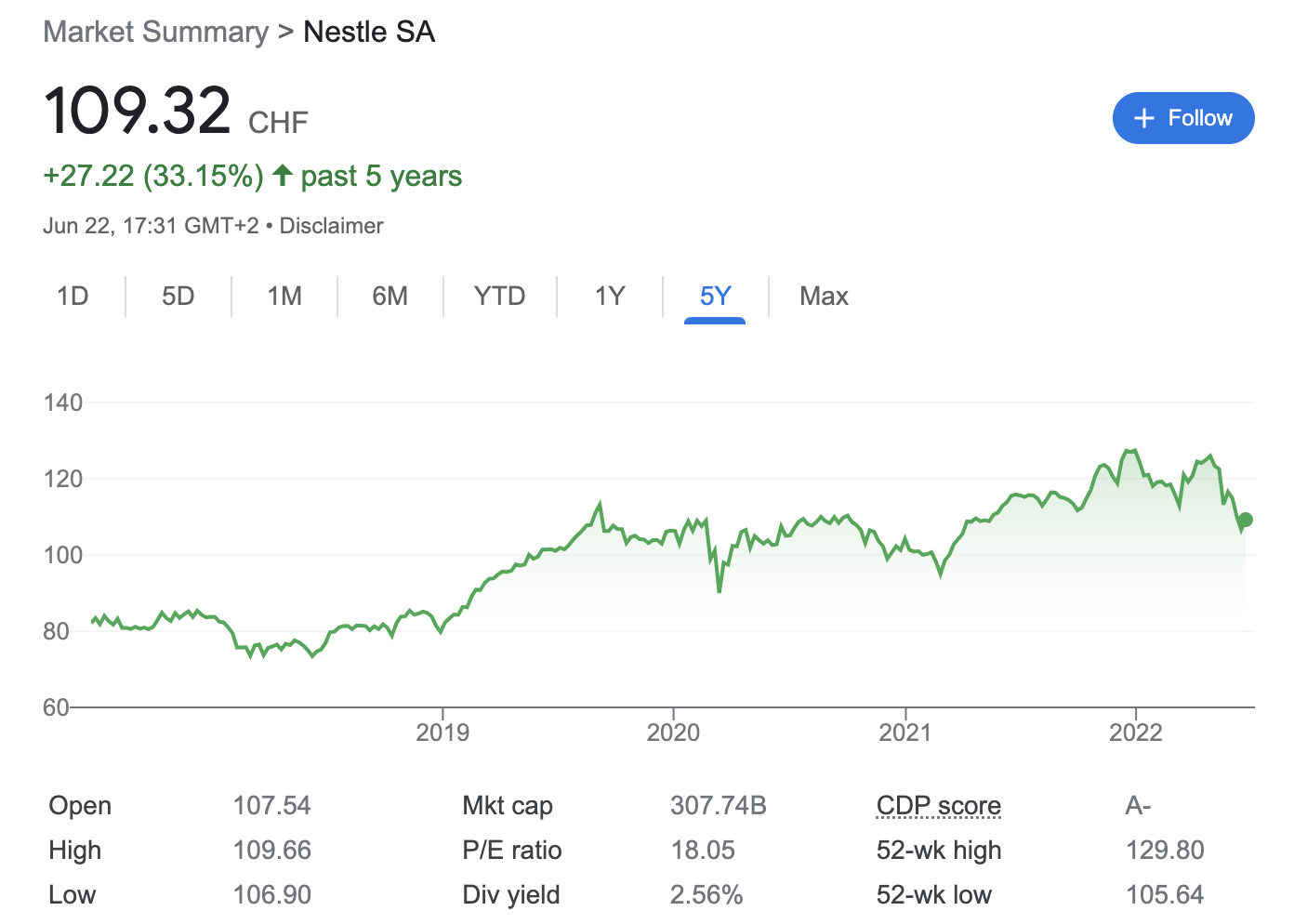

7. Nestle – Stock With Diverse Portfolio of Food and Beverage Products

Nestle is no stranger to Indians. In fact, this brand’s relationship with India dates back to 1912. The company, based in Switzerland, has a diverse portfolio of products, covering almost every food and beverage category.

This makes it an investment worth considering as a hedge during a market downturn.

Nestle’s stock market performance suggests that the company has retained stable growth over the years.

It has managed to raise the price of its products in line with the market conditions and protect its margins. Moreover, Nestle also offers a running dividend yield of around 2.5%.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

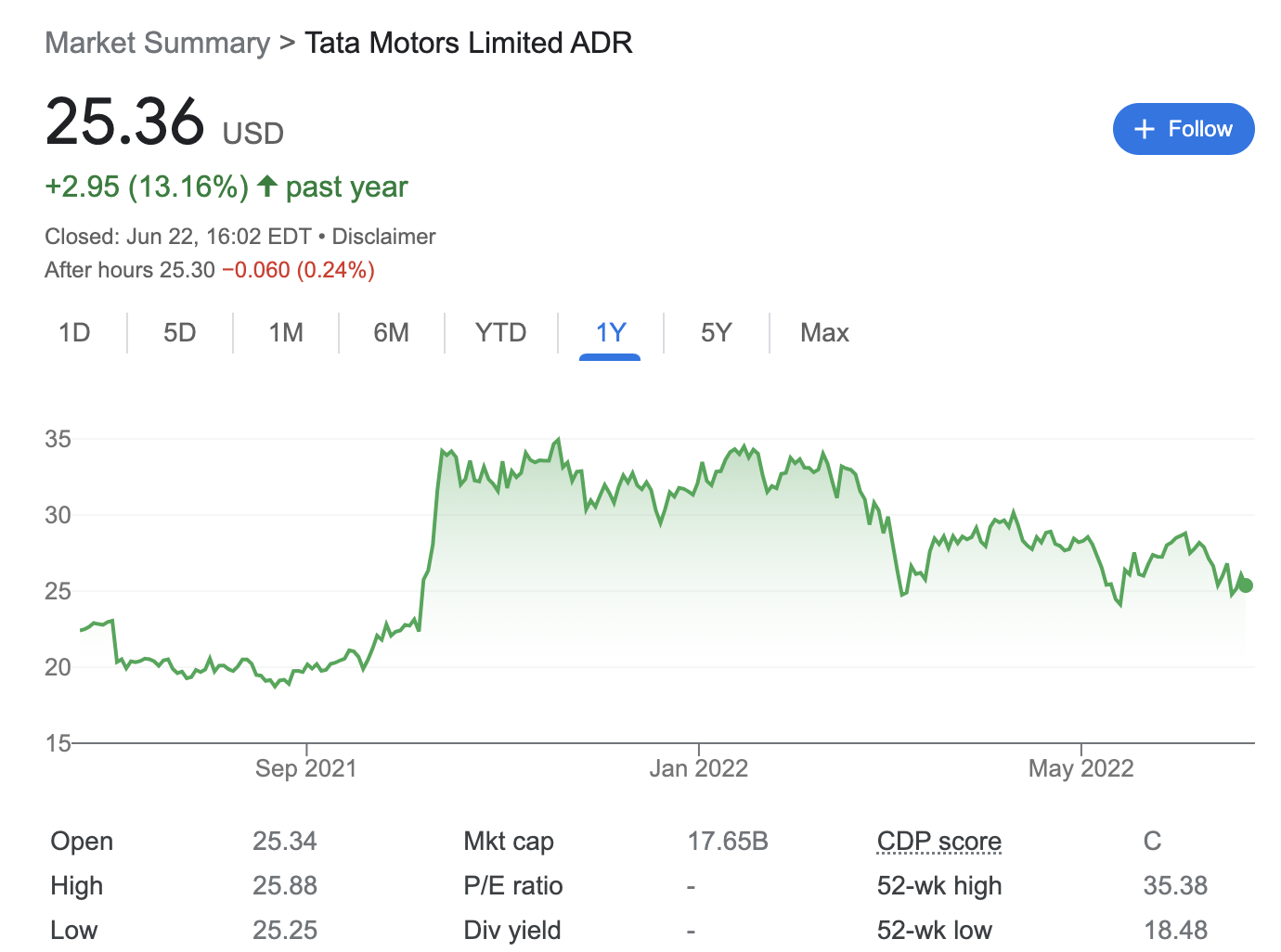

8. Tata Motors – Leading Indian Car Company

Tata Motors is a popular share. The company is the first native car manufacturer in India, albeit, it sells its vehicles in several countries across the globe.

The stock hasn’t performed particularly well over the past decade, however, the company has started showing signs of a rebound.

In the past year, the stock value of this company has gone up by nearly 15%. This is primarily because Tata Motors has managed to address its operational inefficacies through market repositioning, cost savings, and investments in R&D.

This has also led the company to witness an improvement in sales.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

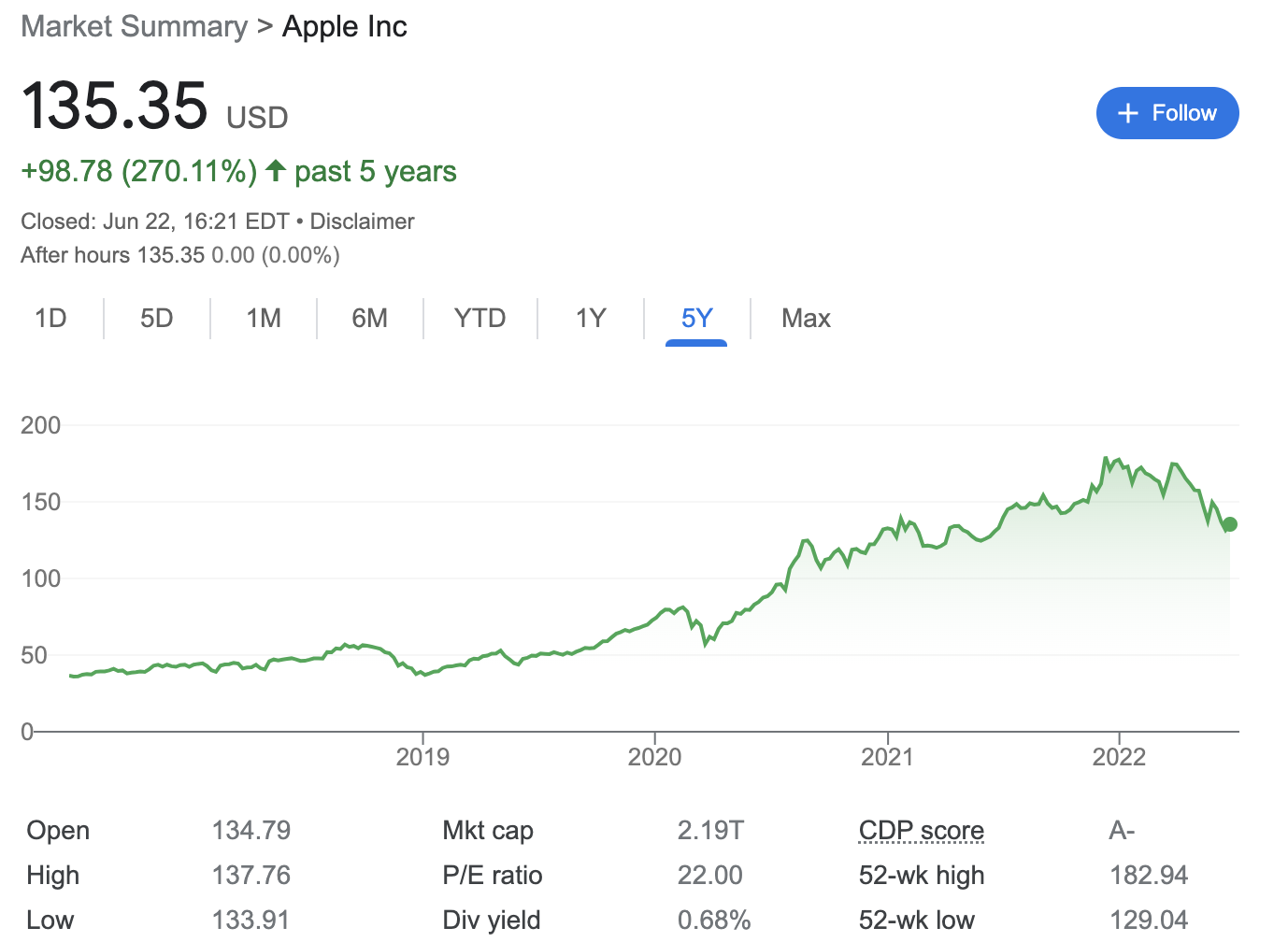

9. Apple – Consumer Brand for Long term Growth

Apple has held its position as one of the players in the tech industry for many years. And it is showing no signs of slowing down.

The company’s latest iPhone model – despite its expensive price tag and supply constraints – was a home run for the firm in terms of sales.

The company is set to launch a variety of new products and services, and is looking to capitalize on the demand for 5G. Apple has consistently generated free cash flow over the years.

On top of this, Apple is also one of the few tech giants to offer dividends to its shareholders.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

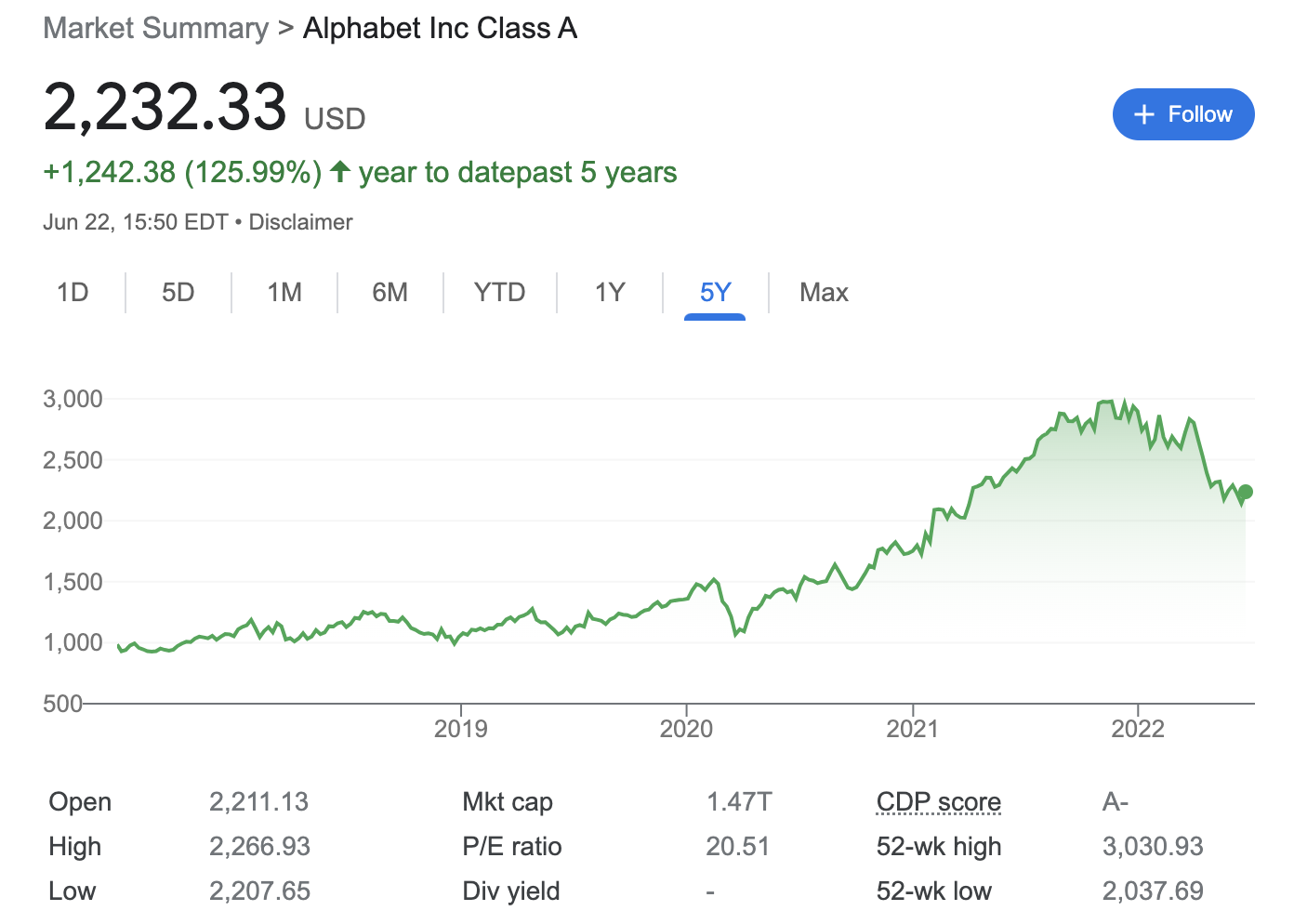

10. Alphabet – Leading Tech Stock

The parent company of Google, Alphabet, recently announced its 20-for-1 stock split. Post this news, the shares of Google increased by nearly 20%.

Alphabet has several revenue sources that make it a popular investment. The Google search engine and YouTube are market leaders in their respective segments.

Moreover, its other products – such as Google Cloud and hardware devices, are also performing well.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How to Buy Penny Stocks in India

In India, penny stocks are referred to as companies with a share price of ₹10 and below.

Such markets are typically only through brokers that support OTC (Over-the-Counter) trading.

That said, when looking at popular penny stocks to buy in India in 2025, investors should understand that these companies are not required to divulge their financial information to the public.

This is because they are not trading via public exchanges, which can increase the investment risk.

Are Shares Taxed in India?

When looking into how to buy stocks in India, investors should also educate themselves about the tax implications. Generally, profits from stock investments are liable for capital gains tax.

Moreover, in India, the tax rate on capital gains varies depending on the duration of the investment and the age of the investor.

How to Buy Stocks for Beginners in India

Our guide on how to buy shares in India for beginners has covered virtually everything one needs to know about investing in the stock market.

So, in this section, we offer a step-by-step breakdown of how to invest in stocks in India.

For those wondering where to buy shares in India – we suggest a regulated broker.

Step 1: Open an Account

Head to a regulated broker’s website and sign up for an account.

Enter the required information to complete the sign-up process. This includes personal information such as a full name, date of birth, residential address, and contact details.

New users will also have to verify their identity – by submitting a copy of their passport, driver’s license, or voter’s ID card.

Step 2: Deposit Funds

Next, make a deposit.

Step 3: Search for Stock

In our example, we are looking to trade the Amazon stock.

To find Amazon, we use the search bar and click on the stock.

Step 4: Trade Stocks

Finally, investors can enter the amount they wish to stake on their chosen stock.

Depending on the investment strategy, traders can place a buy or sell order.

Tips for Buying Stocks in India

Apart from thinking of where to invest in shares in India, users should also consider a few other important aspects before risking their money.

Consider the following tips on how to buy stocks in India:

- Investors should assess how much risk they can afford to take prior to buying stocks. The rule of thumb is only to risk what one can afford to lose.

- Build a diversified portfolio of stocks across different sectors. Today, it is possible to diversify into international markets with ease.

- Before investing, make sure to set a profit target. This will help prevent beginners from making irrational trading decisions based on market volatility.

- Always do independent research before choosing stocks to invest in – rather than relying on third-party advice.

While guides such as ours can offer assistance, individuals should take it upon themselves to research and identify opportunities suitable for their investment profile.

Conclusion

The process of investing in shares in India has changed considerably over the past few years. Today, individuals can research popular shares to buy in India and make an investment right from the comfort of their home. Moreover, there are also investment apps that let users buy and sell stocks from anywhere and anytime.

FAQs

Should I buy stocks on NSE or BSE?

How do beginners buy stocks in India?

Can I buy 1 share of stock in India?

Is this the right time to buy shares in India?

Which are popular low price shares to watch today in India?

How to buy stocks online in India?

Is buying stocks legal in India?