Learning how to invest in stocks in Hong Kong is a relatively straightforward process. After choosing a suitable brokerage site and opening an account, the investor will need to make a deposit before deciding on which shares to buy.

This beginner’s guide will not only explain how to buy stocks in Hong Kong without paying any commission – but how to build a diversified portfolio on a do-it-yourself basis.

How to Buy Stocks in Hong Kong With a Regulated Broker

Below, we offer a brief explanation of how to buy stocks in Hong Kong with a regulated broker.

- ✅ Step 1: Open a Brokerage Account – To buy stocks in Hong Kong, the investor will first need to open a brokerage account. This will require the investor to provide the broker with some personal information and contact details. In most cases, the broker will also ask the investor to upload a government-issued ID.

- Step 2: Deposit Funds – Accepted deposit methods will vary from one broker to the next, but will often include a bank wire nonetheless. The broker might also accept debit/credit cards and e-wallets. Be sure to meet the minimum deposit requirement stipulated by the broker.

- Step 3: Search for Stocks – Most online brokers have a search box. Type in the name of the stock into the search box to go straight to the relevant investment page.

- Step 4: Buy Stocks in Hong Kong – The investor will now need to create a buy order. This can be achieved by typing in the total investment amount and confirming the stock investment.

Read on for a more comprehensive explanation of how to buy stocks in Hong Kong.

Where to Buy Stocks in Hong Kong – Popular Stock Brokers in Hong Kong Reviewed

Traders entering the financial markets for the first time will initially need to spend some time deciding where to invest in shares in Hong Kong.

There are a variety of regulated brokers that support Hong Kong residents, so the investor will need to do some independent research to find a suitable platform.

In the sections below, we offer comprehensive reviews of popular brokers that enable investors to buy stocks in Hong Kong.

Note: International stock brokers that allow Hong Kong residents to invest in shares are typically denominated in US dollars.

1. Capital.com

Moreover, the minimum deposit requirement at this platform is $20 when opting for a debit/credit card or e-wallet. Alternatively, when depositing funds through a bank wire, the minimum increases to $250. In total, Capital.com offers more than 5,400 stock CFDs.

This includes a wide variety of Hong Kong-listed stocks, such as PetroChina, ASM Pacific Technology, Nine Dragons Paper, and CK Hutchinson. It is also possible to trade stock CFDs from multiple exchanges in Europe, the US, the UK, and plenty of other regions. The platform supports fractional stakes, so users are only required to risk a small amount of capital on each position.

As traders will be speculating on CFDs, this enables the user to trade with leverage. This has the impact of amplifying both profits and losses, so leverage should be utilized with great care. Capital.com supports long and short orders when opening a trade, so positions can be entered to predict both rising and falling markets.

When it comes to fees, Capital.com does not charge any trading commissions. There are no fees to open an account, or to make a deposit or withdrawal. Fees will apply for positions kept open overnight, as per the nature of CFDs. Capital.com offers tools that will enable traders to perform technical analysis.

This includes drawing tools and more than 75 indicators. It is also possible to connect a Capital.com account to MT4. Capital.com users might also consider downloading the iOS/Android app, which connects to the main account. Capital.com also offers CFDs in the form of forex, commodities, indices, and ETFs.

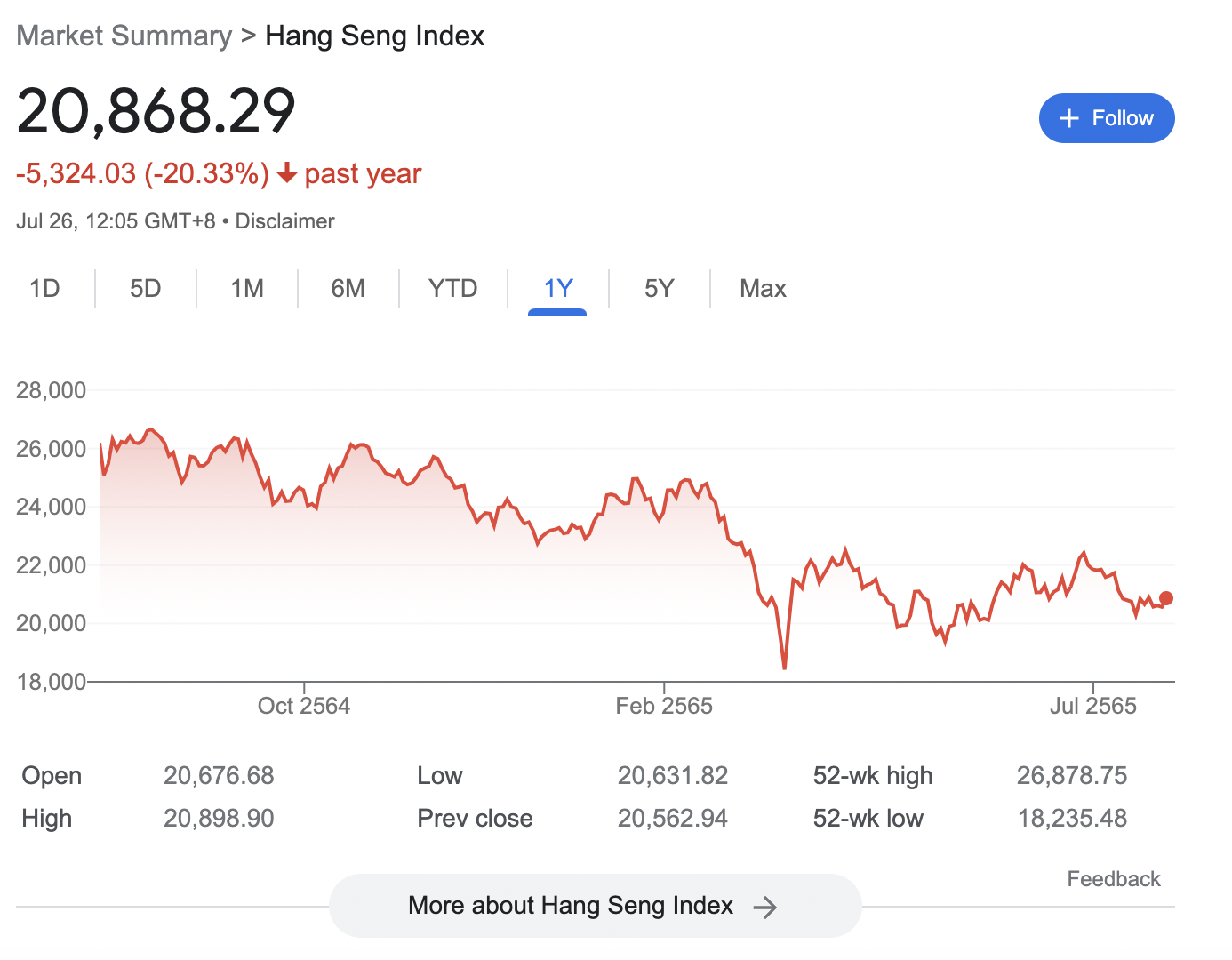

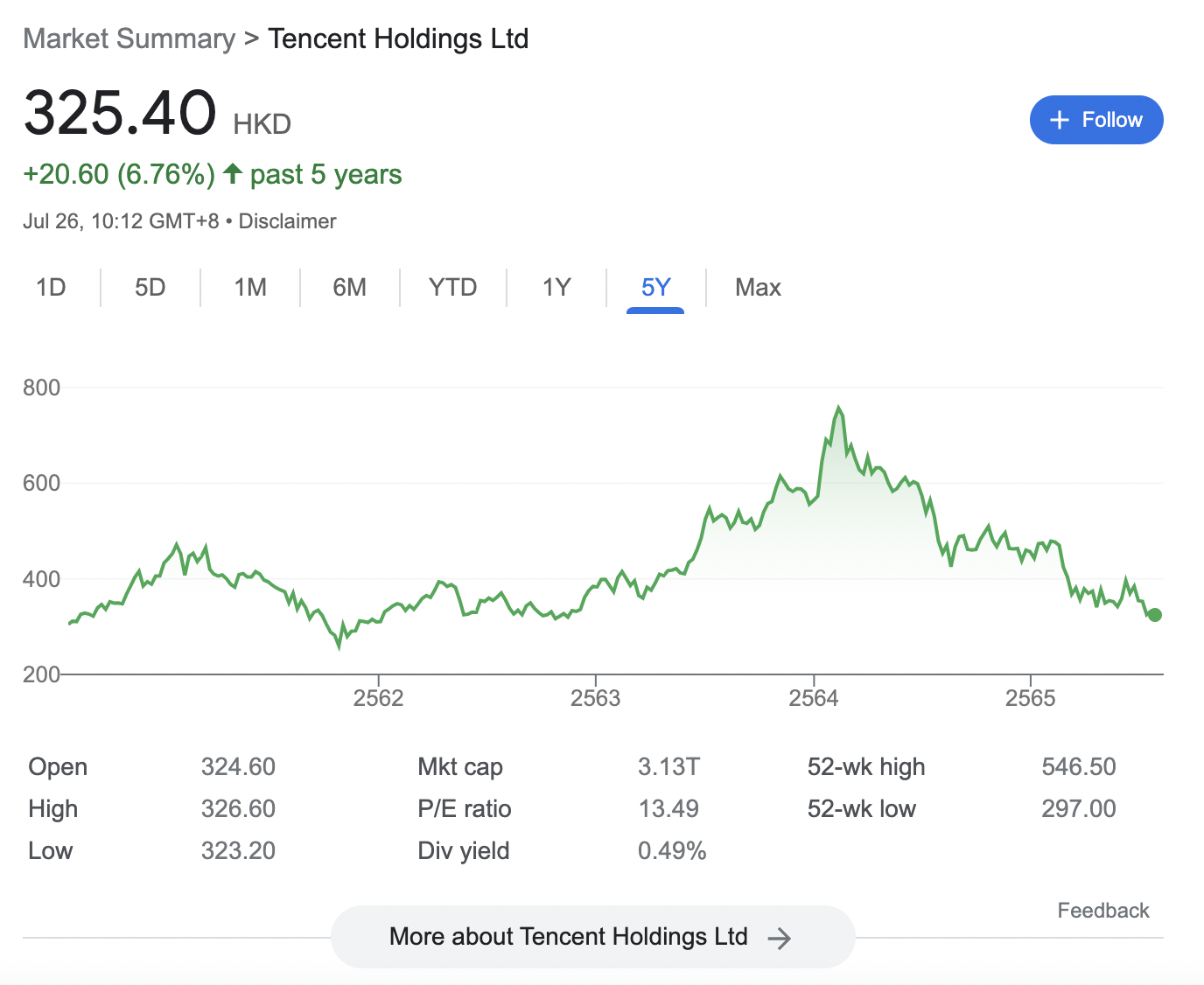

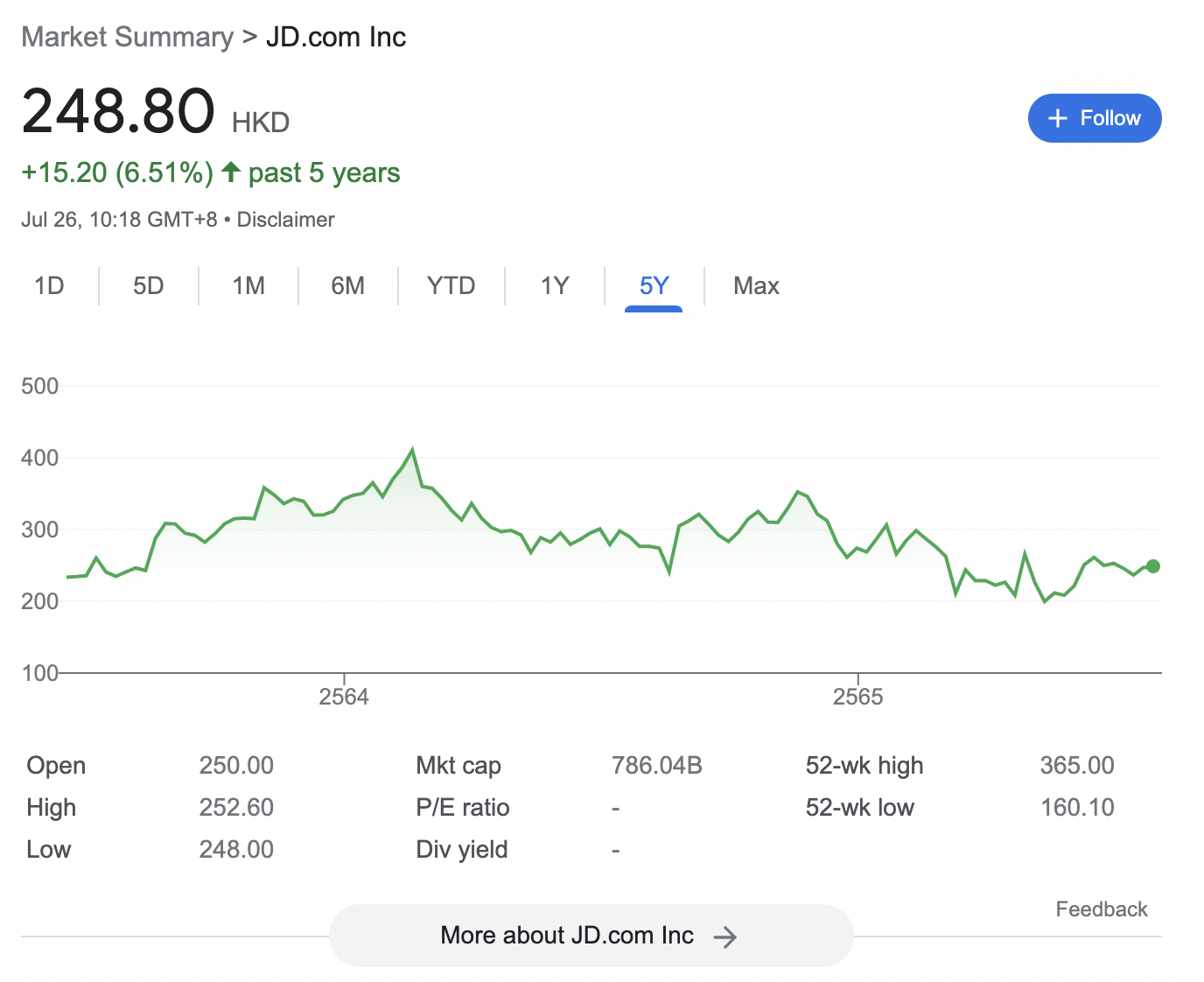

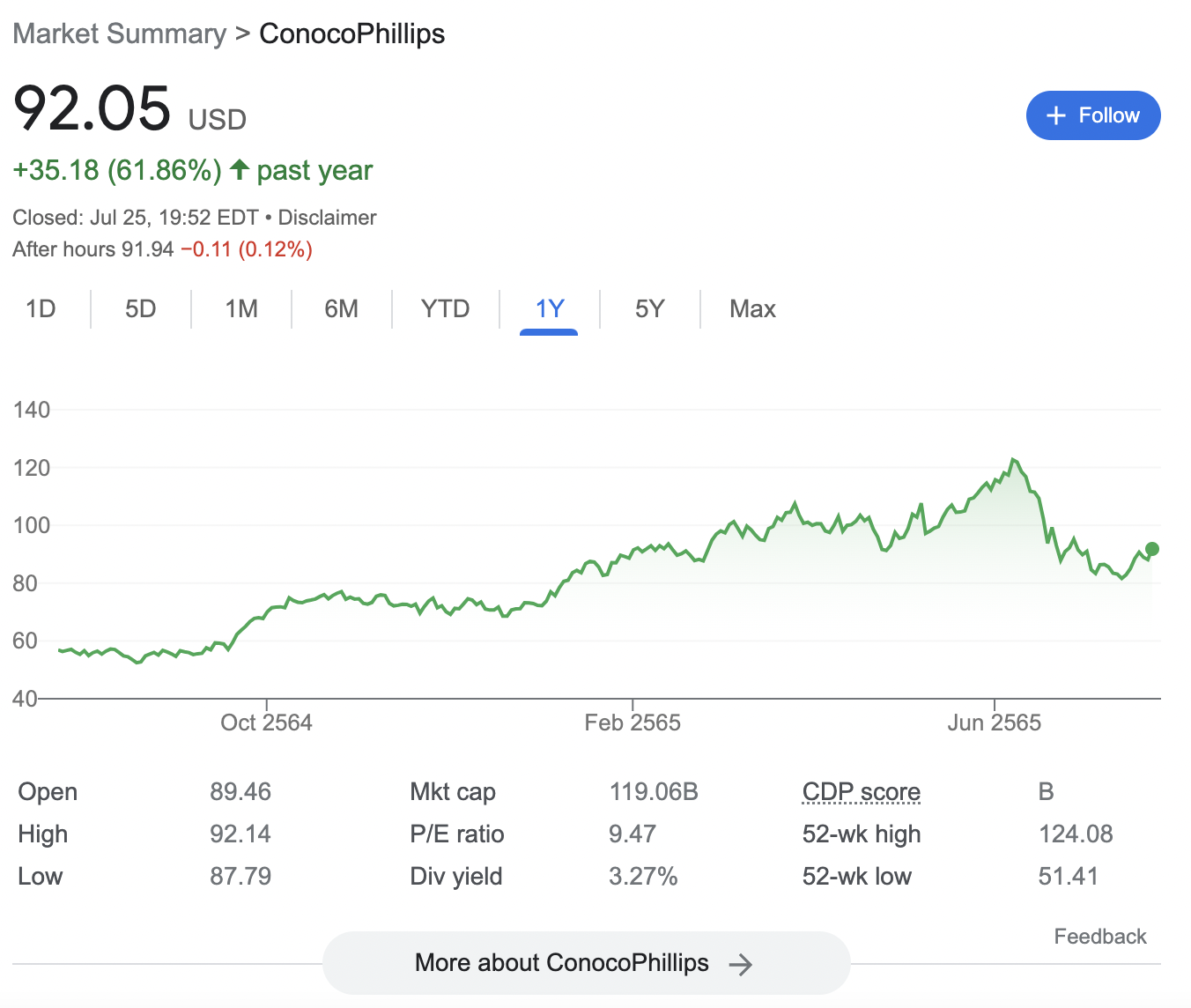

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Interactive Brokers is a global brokerage firm with a local office in Hong Kong. Interactive Brokers offers access to more than 150 markets across 33 countries. This is inclusive of thousands of Hong Kong-listed and international stocks, as well as currencies, ETFs, bonds, and mutual funds. Interactive Brokers also support financial derivatives, such as futures and options. When it comes to investment fees, this will depend on the exchange that the stocks are listed on, the monthly trading volume of the user, and the respective account type. For example, when buying Hong Kong-listed stocks, Interactive Brokers charges 0.05% and 0.08% of the total trade size, across a tiered and fixed account respectively. Higher monthly volumes will be entitled to a lower commission on the tiered account. Those in the market for popular US stock to buy now will pay a commission of no more than $0.0035 ($0.35 minimum) and $0.005 ($1 minimum) per share, on the tiered and fixed accounts respectively. When trading stocks at Interactive Brokers, account holders will have access to margin. According to Interactive Brokers, “margin rates are 75% lower than the industry average”. Once an account has been opened with Interactive Brokers, investors can choose from a web-based client portal or the Trader Workstation, which comes in the form of downloadable software. The classic account requires a minimum deposit of 10,000 HKD, and claims to offer “tight entry prices” and “best-in-class digital service and support”. The platinum account requires a minimum funding amount of 1.5 million HKD and comes with a fee reduction of up to 30%. The VIP account requires a minimum deposit of 8 million HKD and offers the lowest prices possible at Saxo Bank, alongside a number of other perks. Nonetheless, the classic account enables users in Hong Kong to buy domestic stocks at 0.05% – at a minimum commission of 18 HKD. Both the NASDAQ and NYSE can be accessed at $0.008 per share, at a minimum of $3. Other supported stock exchanges at Saxo Bank are priced differently. Traders in Hong Kong can also access margin accounts at Saxo Bank, and collateral rates will depend on the rating of the individual stock. This runs from 75% (rating 1) to 0% (rating 6). Finally, Saxo Bank also offers a native mobile app, which is available to download free of charge via the Android/iOS store. In fact, when buying stocks listed on the NYSE or NASDAQ at Schwab, no commissions are charged. The platform also offers access to US-based OTC markets at a commission of $6.95per trade. In addition to stocks, Schwab also supports more than 2,000 ETFs. Moreover, the platform offers more than 36,000 fixed-income assets across both government and corporate bonds. In terms of security, the Schwab Security Guarantee claims to cover 100%of any losses that occurred from unauthorized account activity. Schwab also offers market insights on its brokerage website, which includes news, research, education, and webinars. A stamp duty tax of 0.13% will apply and this is rounded up to the nearest dollar. In addition to this, a trading fee of 0.005% is charged on stock positions. Those wishing to trade stocks on margin can do so at CITIC Securities, albeit this is charged at 2.5% per annum plus the prime rate. This brokerage also offers access to the international markets. US stocks, for example, can be traded at a commission of 0.2%, at a minimum of $20. Australian stocks attract a commission of 0.5%, at a minimum of 50 AUD. Other international exchanges will be priced differently. In comparison to Capital.com, however, AvaTrade only offers US-listed stock CFDs. Moreover, there are only a few hundred equities supported – which have been hand-picked by AvaTrade. Nonetheless, AvaTrade is not only a popular share trading platform in Hong Kong, but all markets are offered on a commission-free basis. It is possible to trade stock CFDs with leverage here and both long/short positions are supported. There are no deposit fees charged by AvaTrade, and accounts are free to open. AvaTrade also offers alternative CFD markets, which include forex, commodities, cryptocurrencies, and indices. The comparison table below summarizes the above Hong Kong stock broker reviews: In a nutshell, buying stocks refers to the process of investing in a company that is listed on a public exchange – such as the Stock Exchange of Hong Kong, London Stock Exchange, or the NASDAQ. In theory, if the company performs well in terms of generating profits and reducing costs, then this will be positively reflected in its stock price. Not all stock investments will represent the success of Tesla. On the contrary, there is every chance that the stock investment will represent a loss. Furthermore, when learning how to buy online stocks in Hong Kong, it is important to remember that share price performance will often be determined by external forces. For example, when COVID was declared a pandemic in early 2020, the vast majority of the stock market took a major hit. This has also been the case in 2022, with rising inflation and fears of an impending recession. Nevertheless, we should also note that when investing in stocks in Hong Kong, the company might be a dividend payer. If this is the case, all stockholders are entered to a share of the payment. The size of the payment will be determined by the number of shares held. When searching for popular shares to buy right now in Hong Kong in 2022, investors will have thousands of options to consider. Not only in terms of the sector – such as banking, retail, or oil – but the respective exchange that the stock is listed on. To help clear the mist, we will now discuss some of the best ways to search for popular stocks to buy in Hong Kong in 2022. The first thing to consider when learning how to buy stocks in Hong Kong is the exchange and market that the investor wishes to gain exposure to. For example, some investors will look to invest in companies listed on the Hong Kong Stock Exchange. On the flip side, many investors will also look at how to buy international shares in Hong Kong. The US market seems to be a popular choice with Hong Kong investors – not least because it hosts two of the largest stock exchanges globally. This covers popular stocks to buy now on the NYSE and the NASDAQ. This is where investors will find US-based large-cap companies like Apple, Microsoft, Amazon, and Tesla. Some investors might also be wondering how to buy Korean stocks like Samsung. Put simply, the investor will need to find a popular stock broker in Hong Kong that offers access to the Korea Exchange (KRX). Each stock will operate within a specific sector. For example, HSBC is a leading stock in the banking sector, while Apple is dominant in the technology space. When learning how to buy stocks in Hong Kong, it is wise to assess which sectors are hot at any given time. On the other hand, there are a number of sectors that are performing unfavorably in the current economic climate. For example, due to rising energy prices and staff shortages, most airline stocks are struggling in 2022. A prime example here is Delta Airlines stock, which is down 25% over the prior year of trading. There are a collection of high-grade stocks that have the financial resources to survive bearish economic conditions. These companies represent viable stocks to hold during a recession. For example, major tech stocks in the US – such as Apple and Amazon, have robust balance sheets that carry tens of billions of dollars in cash. The aforementioned firms have very little debt when compared to the assets on their balance sheets. Moreover, there are also stocks that have increased the size of their dividend payment for over 50 consecutive years, which includes recession-based cycles. Examples here include Coca-Cola and Johnson & Johnson. Ultimately, the key point is that when trying to determine what shares to buy now in Hong Kong, it is sensible to focus on quality companies that not only have a proven track record during bearish periods, but a strong balance sheet. In addition to high-grade companies, many investors will look to buy growth stocks that are newly launched. These are companies that are at the very beginning of their long-term corporate journey and thus – often trade with a small market capitalization. Growth stocks will appeal to investors that wish to speculate on a specific company becoming dominant in its respective sector at some point in the future. With that said, not all growth stocks will perform well. Examples of growth stocks that have since lost considerable amounts of value since going public include Uber, Coinbase, and Grab. Investors learning how to buy stocks in Hong Kong should avoid choosing companies based on third-party viewpoints. Instead, the investor should understand the steps involved when researching stocks on a do-it-yourself basis so that an informed decision can be achieved. Nonetheless, in the sections below, we explore the 10 most popular stocks to watch – as per broader market sentiment. Note: When browsing our list of the top 10 stocks to buy right now, readers should remember that this is based on the subjective views of the author. Tencent is a Chinese conglomerate with a strong focus on technological innovation and entertainment. Headquartered in Shenzhen, this company is listed on the Hong Kong Stock Exchange. As of writing, Tencent carries a P/E ratio of 13 times and is offering a running dividend yield of just under 0.5%. Tencent is one of the largest Hong Kong-listed stocks, with a market capitalization of over 3 trillion HKD. Its most recent earnings report generated a revenue increase of just 0.12% year over year. Net income dropped by over 50% year over year, down to 23 billion HKD. Over the prior year of trading, Tencent stock is down 33%. The stock is up nearly 7% over a five-year timeframe. JD.com is another Chinese stock with its primary listing in Hong Kong. This company specializes in e-commerce services with a strong focus on B2C customers. Founded in 1998, JD.com has since grown to a market capitalization of over 780 billion HKD, as of writing. As per its most recent quarterly earnings report, JD.com revenues were up 17% year over year, to 239 billion HKD. This resulted in earnings per share of 2.53 HKD – a 111% increase year over year. Over the prior 12 months, JD.com stock is down 7%, and up 6% on a five-year basis. ConocoPhillips is a US-based oil company with a focus on hydrocarbon exploration. While the broader stock markets have collectively declined throughout 2022, ConocoPhillips has done the opposite. As we briefly noted earlier, ConocoPhillips stock is up 61% over the prior 12 months. The overarching reason for this is that oil prices are still at record highs, which directly impacts companies like ConocoPhillips. After all, ConocoPhillips can charge more for its products, and thus – wider profit margins can be enjoyed. As of writing, ConocoPhillips stock is trading at a P/E ratio of just over 9 times and carries a market capitalization of nearly $120 billion. The firm is also paying a running dividend yield of over 3.2% as of writing. British American Tobacco is another stock that has outperformed the broader market in 2022. This tobacco giant has enjoyed a stock price growth of 9% over the prior year. In comparison, the Dow Jones is down nearly 9% over the same period. As of writing, British American Tobacco is offering a running dividend yield of over 8.6% and a P/E ratio of 12 times. Looking at the most recent quarterly financials, British American Tobacco reported a 20% increase in net income, up to $1.7 billion. This also resulted in an EBITDA increase of 2.1%. With that being said, over a five-year period, British American Tobacco stock is down 35%. Moreover, its most recent earnings call reported a 1.7% increase in operating expenses. Lenovo is a Chinese technology conglomerate that specializes in a variety of consumer products. This includes electronics, software, and personal computers. The firm also offers business solutions to corporations. Founded in 1984, Lenovo has its primary listing on the Hong Kong Stock Exchange. Over the prior five years of trading, Lenovo stock is up 54%. On a 12-month trailing basis, the stock is up just over 2%. As of writing, Lenovo carries a P/E ratio of 6 times and is offering a running yield of 5%. Its most recent financial quarter outperformed analyst estimates, with a 6% rise in revenue and net income growth of 58% – year over year. Samsung is a Korean-listed stock that is often viewed as a direct competitor to Apple in the smartphone market. With that said, Samsung is also behind a range of other product divisions, such as memory chips, laptops, and consumer appliances. Samsung stock trades with a P/E ratio of over 9.6 times as of writing and is offering a running dividend yield of 2.3%. Those investing in Samsung stock five years ago would be looking at modest gains of 28%. Over a 12-month period, however, Samsung stock is down 22%. On the flip side, its most recent earnings call reported revenue growth of 18% year over year and an EBITDA increase of 38%. Coca-Cola is a dominant market leader in the global beverage sector. This company is another US-listed stock that has outperformed the broader market in 2022. Year-to-date, as of writing, the stock is up nearly 5%. Across a 12-month period, Coca-Cola stock has increased by 9%. As we briefly mentioned earlier, Coca-Cola has paid a dividend for more than 50 consecutive years. In fact, it has increased the size of each dividend annually for this entire period. Coca-Cola, as of writing, is carrying a P/E ratio of over 26 times. As per its most recent financial quarter, the firm witnessed a 16% increase in revenue year over year, up to $10.4 billion. Tesla is a US-based electric vehicle company that was first launched in 2003. As noted earlier, since its 2010 IPO, Tesla stock has increased by more than 30,000%. Over the prior 12 months, Tesla stock has increased by 22%. However, in the first seven months of 2022, the stock is down 33%. Nonetheless, Tesla is also increasing its product and service portfolio to expand beyond just electric cars. This includes driverless technology, megawatt batteries, solar panels, and charging stations. At this moment in time, Tesla does not pay a dividend. However, CEO Elon Musk has previously stated that it might introduce a dividend policy in the very near future. Amazon is the world’s largest e-commerce website. The company first went public in 1997 and as noted earlier, has since witnessed gains of over 130,000%. However, much like Tesla, Amazon has experienced an underwhelming start to 2022. For instance, over the prior 12 months of trading, Amazon stock is down 34%. Over a five-year period, however, the stock is up 137%. As of writing, Amazon is carrying a P/E ratio of 58 times. Another thing to note is that Amazon recently executed a 20-for-1 stock split. This was the firm’s first split since 1999. Finally, as per its most recent earnings call, Amazon stock reported a year over year revenue increase of 7.3%, up to $116 billion. Founded way back in 1886, Johnson & Johnson is a US-based pharmaceutical company that is also involved in consumer goods and medical devices. In a similar nature to Coca-Cola, this stock has increased the size of its annual dividend payment for over 50 consecutive years. As of writing, the firm is paying a running dividend yield of over 2.6% and is carrying a P/E ratio of 25 times. Johnson & Johnson stock has increased by 30% over the prior five years. During the past 12 months, the stock has remained flat, with a very slight increase of 0.3%. The process of investing in penny stocks in Hong Kong will depend on the specific exchange that the company is listed on. For example, in their truest form, penny stocks trade outside of traditional exchanges. Instead, penny stocks can often be found on OTC (Over-the-Counter) markets, which are typically challenging to access as a retail client. Some penny stocks, however, do trade on major exchanges and they retain this title for as long as they carry a share price of $1 or under. Just remember, penny stock investments carry additional risk, as they are often related to companies that attract low levels of liquidity and volatile trading conditions. Retail clients will be pleased to know that there is no capital gains tax in Hong Kong. Moreover, dividends received from companies based outside of Hong Kong are typically not subject to profits tax. However, readers are strongly advised to speak with a qualified tax advisor to assess their personal circumstances. First-time investors might require some guidance on how to buy stocks in Hong Kong. Below, we explain the general process of opening a brokerage account and proceeding to invest in a publicly listed company. Assuming that the investor has already selected a suitable stock broker, the first step is to register an account with the provider. This will initially require the investor to provide some personal information and contact details. As part of anti-money laundering regulations, the stock broker will also need to request some ID. This will need to have been issued by the government and oftentimes will include a passport or driver’s license. Next, before the investor can buy stocks in Hong Kong, they will, of course, need to make a deposit into the brokerage account. Account minimums will vary from one broker to the next, as any applicable fees. Furthermore, while most stock brokers support bank wires, this won’t always be the case with debit/credit cards and e-wallets. This is why it is important for the investor to check which payment methods are supported and what fees are charged before choosing a stock broker. The next step will require the investor to decide on which stock to buy. If the investor has already compiled independent research, they can type the name of the stock into the brokerage search box. In order to buy stocks in Hong Kong, the investor will need to create an order with their chosen broker. This is more simple than it sounds, as the investor will simply need to specify how much money they wish to risk on the trade. Some stock brokers also support fractional trading, which means that there is no requirement to buy a full share. After confirming the order, the broker will add the stocks to the investor’s portfolio. The financial markets give Hong Kong residents the opportunity to grow a long-term portfolio of stocks. When learning how to buy stocks in Hong Kong, investors should ensure that plenty of independent research is conducted before any capital is risked. This will require the investor to explore the fundamentals of the stock – such as its P/E ratio and recent earnings reports. Furthermore, it is also important for investors to choose a stock broker wisely. This means exploring the broker in terms of fees, supported stocks, account minimums, and core trading tools.

Number of Stocks

5,400+

Deposit Fee

FREE

Fee to Trade Amazon Stock

Commission-Free

Minimum Deposit

$20

3. Interactive Brokers

Number of Stocks

Trade stocks globally on 90+ markets

Deposit Fee

FREE

Fee to Buy Amazon Stock

Up to $0.0035 ($0.35 minimum) and $0.005 ($1 minimum) per share, on the tiered and fixed accounts respectively

Minimum Deposit

None

4. Saxo Bank

Number of Stocks

22,000+

Deposit Fee

FREE

Fee to Buy Amazon Stock

$0.008 per share, at a minimum of $3

Minimum Deposit

10,000 HKD on the classic account

5. Schwab

Number of Stocks

Most US-listed stocks + 2,400 ADRs from 80+ countries

Deposit Fee

FREE

Fee to Buy Amazon Stock

$0

Minimum Deposit

Yes – HK residents must contact Schwab

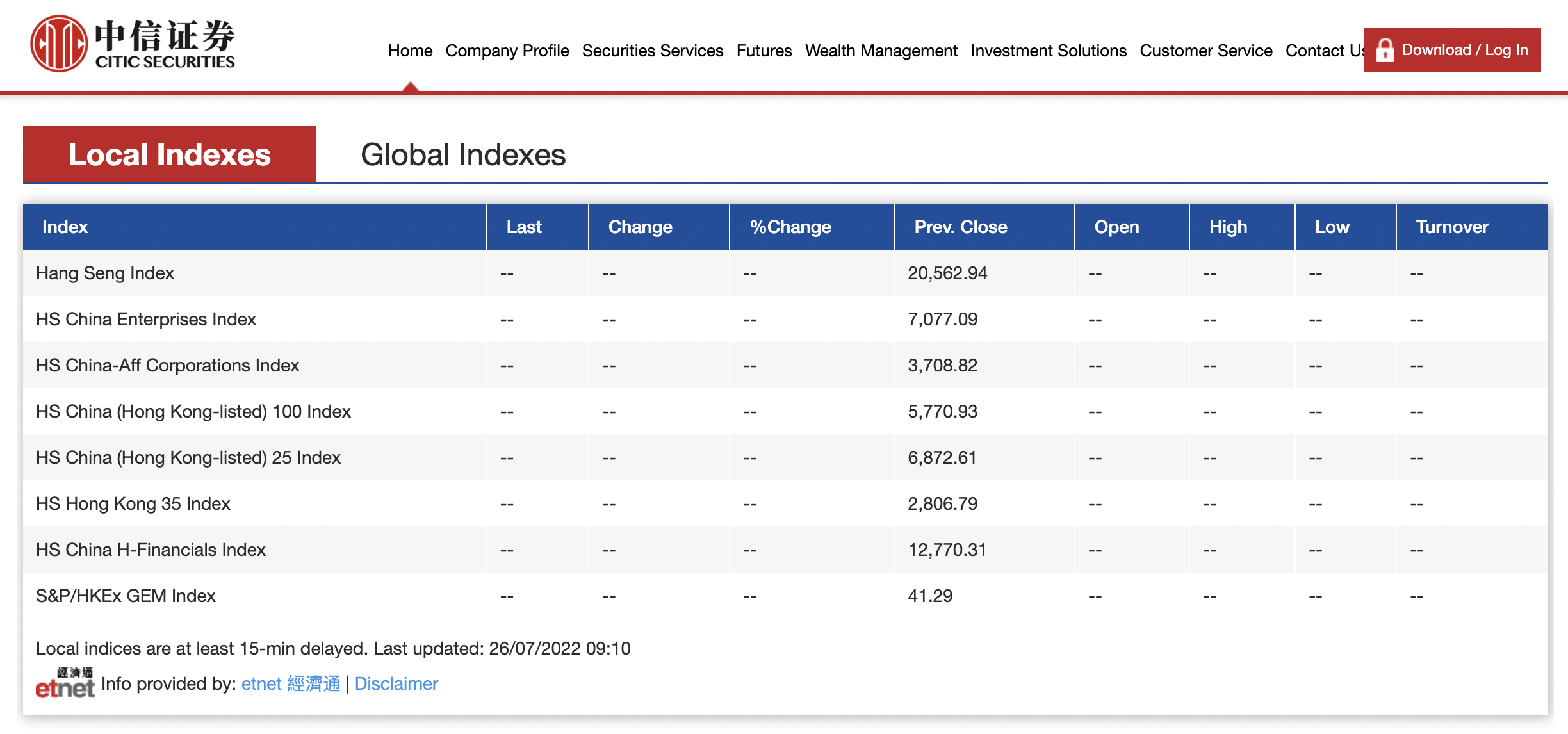

6. CITIC Securities

Number of Stocks

Thousands of stocks across HK and international markets

Deposit Fee

Not stated

Fee to Buy Amazon Stock

0.2% commission ($20 minimum)

Minimum Deposit

Not stated

7. AvaTrade

Popular Hong Kong Stock Brokers Compared

Broker

No. Stocks

Cost of Buying Amazon Stock

Payment Methods

Deposit/Withdrawal Fees

Capital.com

5,400+

0% commission

Debit/credit cards, e-wallets, bank wire

None

Interactive Brokers

Trade stocks globally on 90+ markets

Up to $0.005 ($1 minimum) per share

Bank wire

None

Saxo Bank

22,000+

$0.008 per share, at a minimum of $3

Bank wire

None

Schwab

Most US-listed stocks + 2,400 ADRs

0% commission

Bank wire

None

CITIC Securities

Thousands of stocks across HK and international markets

0.2% commission ($20 minimum)

Not stated

Not stated

AvaTrade

Several hundred US-listed stocks

0% commission

Debit/credit cards, e-wallets, bank wire

None

The Basics of Buying Stocks in Hong Kong

How do I Find Popular Shares to Buy in Hong Kong?

Stock Exchange and Market

Diversify Across Multiple Sectors

Look for Stocks With Robust Balance Sheets

Consider Growth Stocks

Top 10 Popular Stocks to Watch Now in Hong Kong

Tencent

JD.com

ConocoPhillips

British American Tobacco

Lenovo

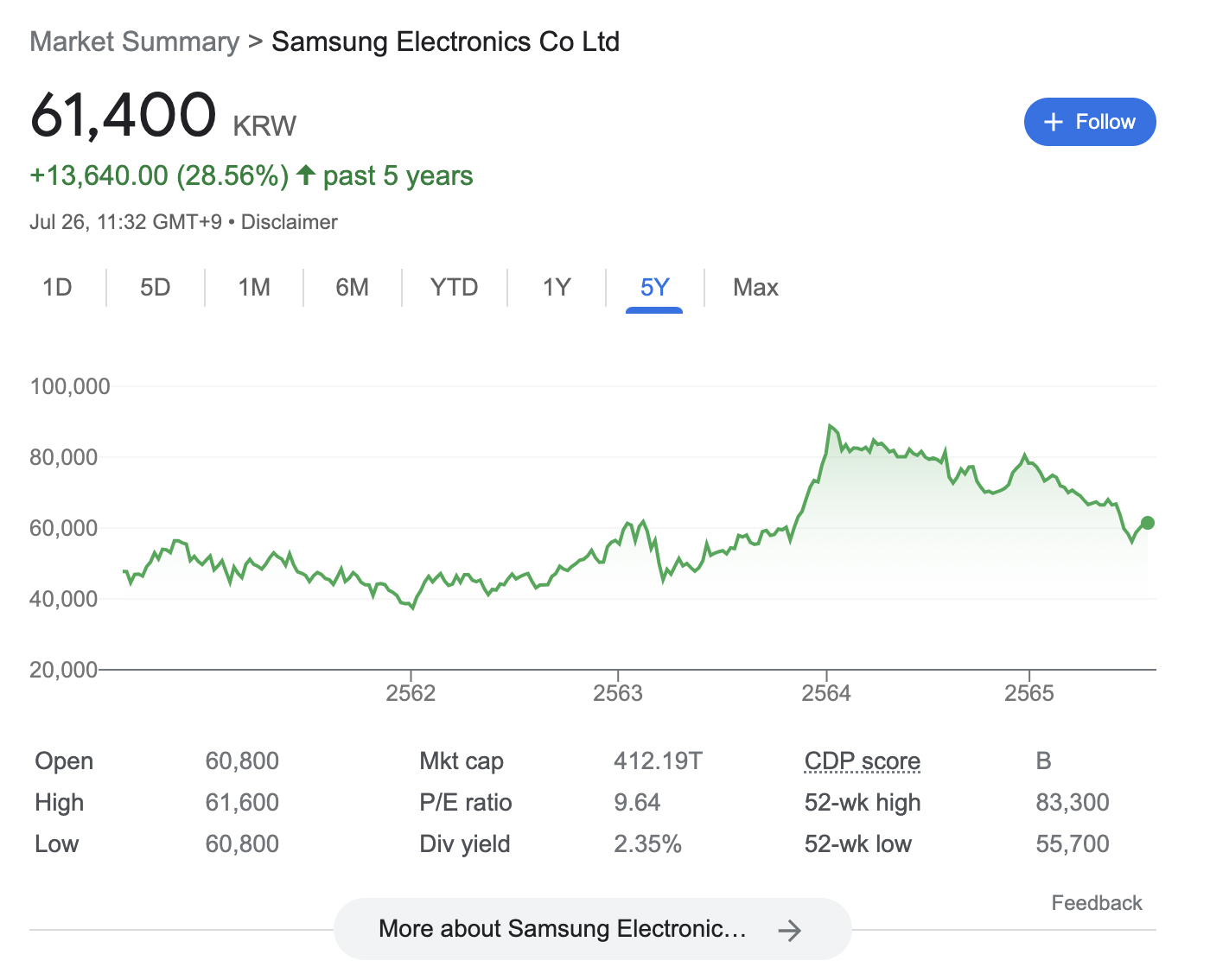

Samsung

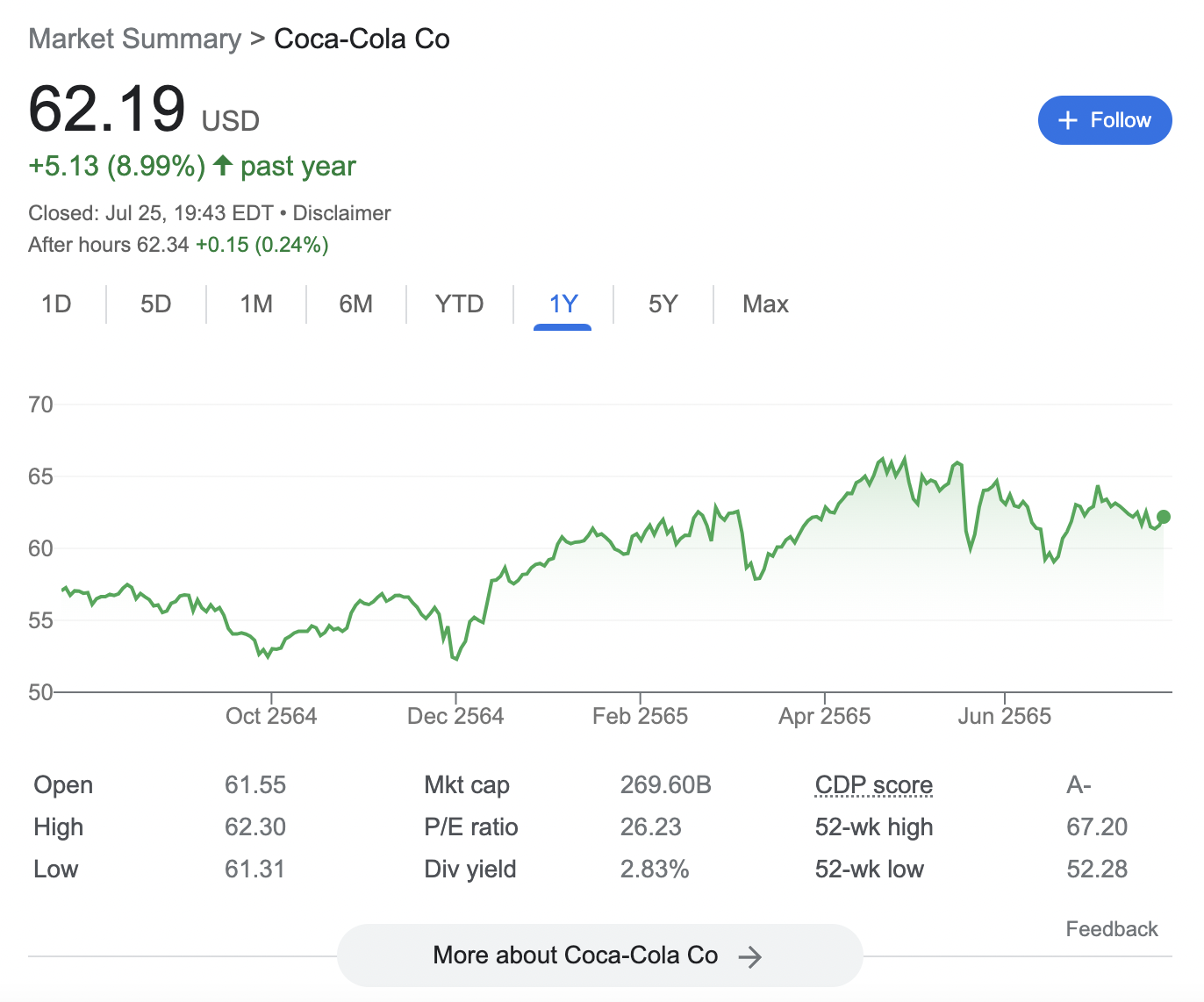

Coca-Cola

Tesla

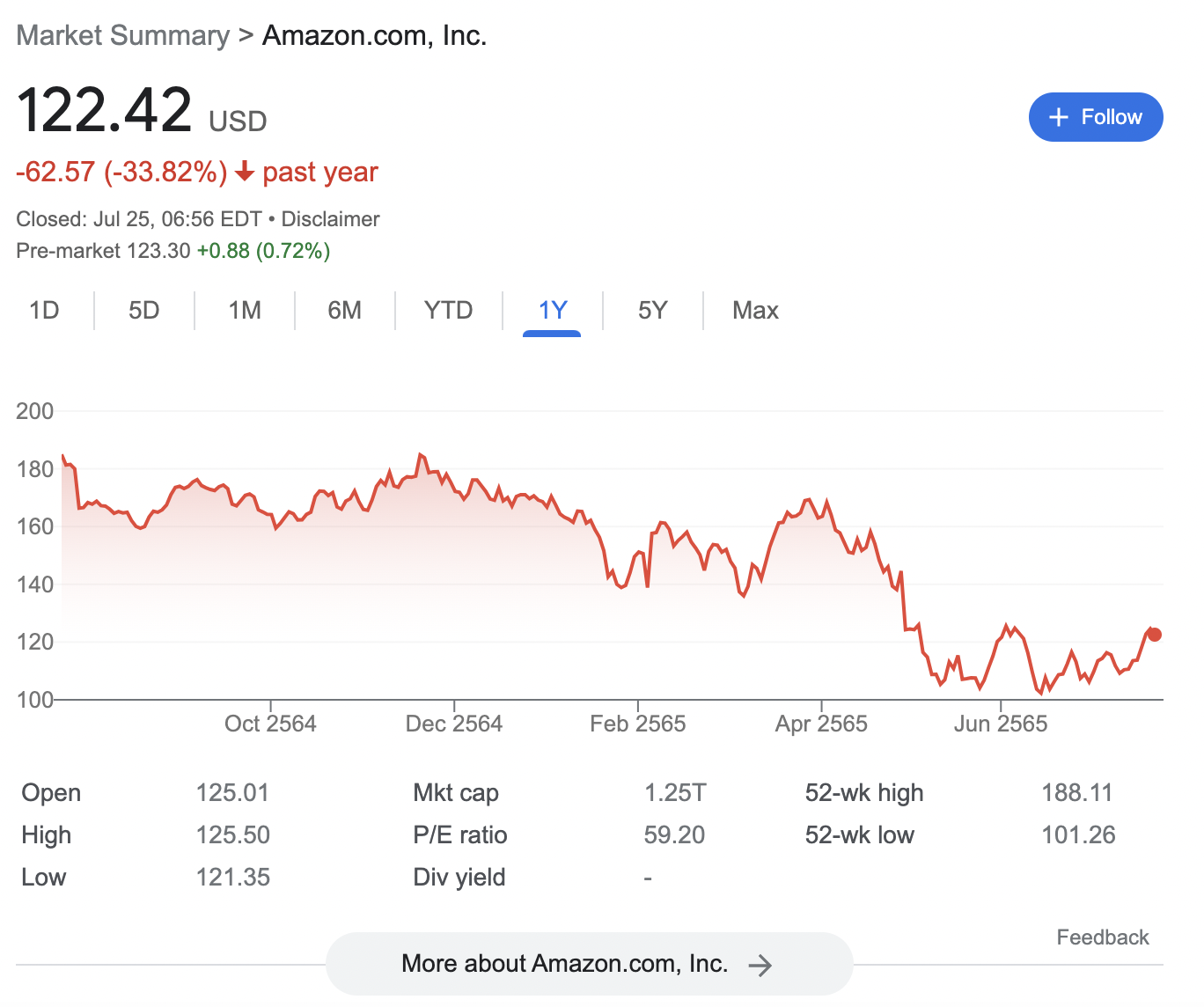

Amazon

Johnson & Johnson

How to Buy Penny Stocks in Hong Kong

Are Shares Taxed in Hong Kong?

How to Buy Stocks for Beginners in Hong Kong

Step 1: Open a Brokerage Account

Step 2: Deposit Funds

Step 3: Decide What Stock to Buy

Step 4: Buy Stock

Conclusion

FAQ

What is the most popular stock to watch in Hong Kong?

Can I buy Tesla stock in Hong Kong?

Which Hong Kong stocks pay dividends?

Where can I buy stocks in Hong Kong?

Which trading platform is popular in Hong Kong?