Ethical stocks are shares of companies that go above and beyond to help the environment, support important social causes, or set a good example for corporate governance. Many investors choose to invest in so-called ESG stocks (environment, social, governance) that represent their values.

Many companies are now making efforts to be more ethical, so investors have a wide variety of ethical stocks to choose from. In this guide, we’ll highlight 11 ethical investing stocks that investors can check out in 2025.

11 Popular Ethical Investing Stocks to Watch in 2025

Let’s dive straight into our list of 11 ethical stocks to watch in 2025:

- ecoterra – New Crypto Project Piloting a Recycle-to-Earn Initiative in 2025

- Tesla – Growth Stock Driving the World to Electric Vehicles

- Beyond Meat – Developing Meatless Foods to Cut Emissions

- Microsoft – Achieving Fully Net Zero by 2050

- Aflac – Significant Contributions to Cancer Research

- Enphase Energy – A Fast-growing Solar Power Stock

- Intuit – Ethical Investing Stock Focused on Equal Pay

- Adobe – Achieving Equal Pay & Net Zero Emissions

- Waste Management – Ethical Stock Cleaning Up Our Waste

- Chipotle – Restaurant Chain Focused on Sustainable, Local Ingredients

- PepsiCo – Beverage Giant Putting a Spotlight on Water Stewardship

What is ethical investing in 2025? Ethical investments have grown in popularity in recent years as investors seek assets that support change for better sustainability moving forward.

A Closer Look at the Most Ethical Stocks According to ESG Ratings

Want to know more about what makes each of these 11 companies popular ethical investing stocks? We’ll take a closer look at the 11 ethical stocks we highlighted above.

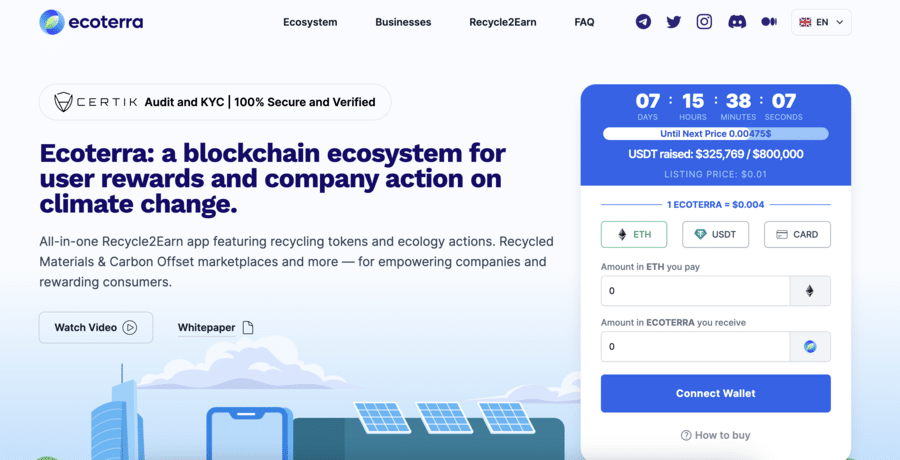

1. ecoterra – New Project Allowing Investors to Earn Crypto Rewards for Recycling

The project incentivizes users to recycle an extensive range of items, thereby boosting the chances of embracing ecologically responsible decisions.

During the initial presale phase, tokens for ecoterra can be obtained for a minimal price of $0.004 USDT, allowing early investors to benefit from reduced rates.

The ecoterra application empowers users to gain $ECOTERRA tokens by scanning items eligible for recycling. Users can stake or retain $ECOTERRA tokens apart from using them for other green initiatives.

The app incorporates diverse features, such as a carbon-offset marketplace, a social platform for tracking environmental consequences, and a market dedicated to recycled materials. These components, integrated based on user feedback, contribute to a holistic approach that fosters eco-friendly actions worldwide.

Ecoterra’s whitepaper details that the app boasts an artificial intelligence-powered database, enabling users to scan items to determine their recyclability swiftly.

Upon identification, the app directs users to the closest Reverse Vending Machine (RVM) for proper disposal. After completing the recycling procedure, users can claim their rewards by capturing a photo of their receipt and submitting it through the application.

This versatility ensures the platform can accommodate RVM users and cater to various industries, including consumer products, technology, fashion, and hospitality.

If ecoterra’s unique method of encouraging sustainable behaviors via financial incentives catches your interest as an investor, join the ecoterra Telegram group to remain updated on the latest progress and developments.

Hard Cap

$6,700,000

Total Tokens

2,000,000,000

Tokens available in presale

1,000,000,000

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, Bank Card

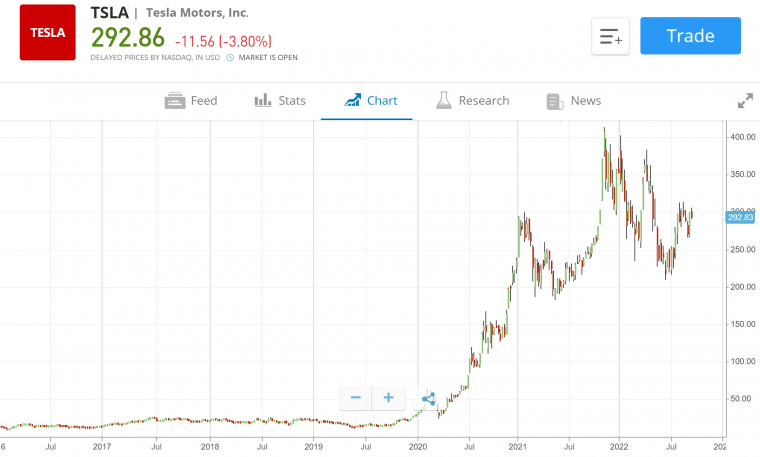

2. Tesla – Growth Stock Driving the World to Electric Vehicles

Interested in impact investing? Tesla is widely considered an ESG investment because the company’s entire business model is built around transitioning the world from gasoline-powered cars to electric vehicles. As of 2022, it’s the largest EV automaker in the US and has made significant investments in battery technology that many experts say will be needed to cut transportation emissions.

On top of that, Tesla is a growth stock that many investors are bullish about. The stock rose nearly 50% in 2021 and some analysts have a price target as high as 81% above the current value. In addition, Tesla stock is currently down around 30% from its all-time high.

ESG investors should note, however, that Tesla was kicked out of the S&P 500’s ESG stocks index earlier this year. That’s because the company receives low scores for its social impact and governance, and Tesla has been criticized for racism and poor work environments. Still, because of Tesla’s environmental impacts, many investors still consider it an ethical investment.

ESG rating: 91

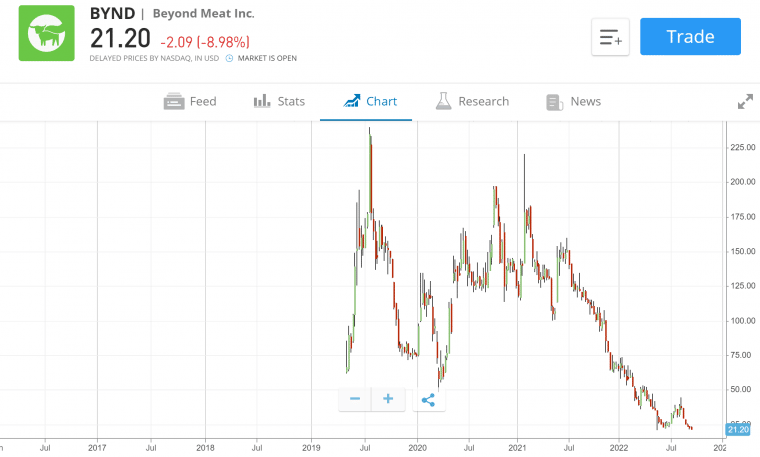

3. Beyond Meat – Developing Meatless Foods to Cut Emissions

Beyond Meat is a meatless food producer that’s reinventing what a veggie burger can be. The company has gone beyond traditional meatless recipes to produce burgers that many consumers say taste and look like beef. While Beyond Meat currently captures only a tiny portion of the burger market it’s trying to disrupt, the potential environmental impact of the company could be significant if it can reduce beef consumption in the US and around the world.

Despite Beyond Meat’s environmental significance, the stock is trading near its 52-week low. The fast food chain McDonalds decided not to go ahead with Beyond Meat burgers on a wide scale after an initial test, although other fast food chains have adopted Beyond Meat products. Beyond Meat also faces competition from other imitation meat producers like Impossible Foods.

Some Wall Street analysts believe Beyond Meat is valued appropriately at its current price. But more bullish analysts suggest the stock could jump to $35 per share, which would represent a gain of nearly 65% from current prices.

ESG rating: 47

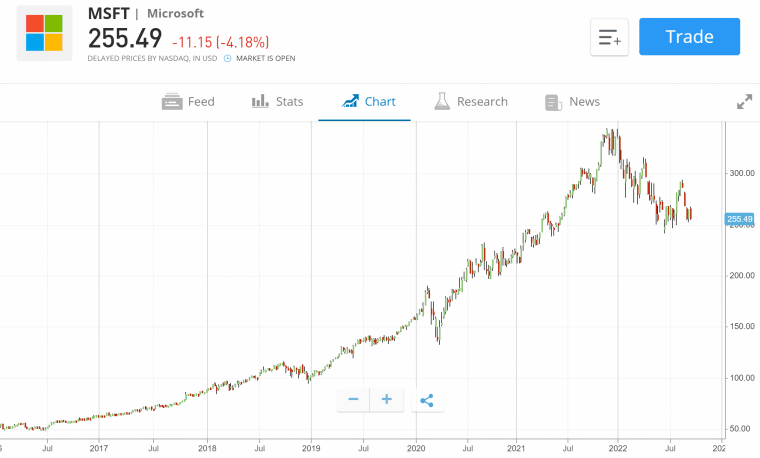

4. Microsoft – Achieving Fully Net Zero by 2050

Microsoft has gone beyond the net-zero emissions pledges that many other companies have made by promising to offset all of the emissions the company produced since it launched in 1975. The company’s goal is to achieve net-zero emissions by 2030, then offset all prior emissions by 2050.

Microsoft also prides itself on the company’s social impact. The company has been outspoken about LGBTQ+ rights and integrates supportive symbols into products like the Xbox.

Microsoft stock is currently trading near its 52-week low, but analyst forecasts suggest the stock could rise as much as 56% in the next 12 months. In addition, Microsoft pays investors a dividend yield of 0.97%, which could be a benefit for ESG investors who also want to invest for income.

ESG rating: 76

5. Aflac – Significant Contributions to Cancer Research

Aflac has quietly been an ethical leader within the insurance industry. The company has taken numerous actions to improve its social footprint, including setting a goal to become carbon-neutral and contributing more than $250 million to green investments.

Aflac has also taken an active role in promoting medical research. The company donated more than $150 million to cancer research in 2021 and supported more than 140,000 pediatric cancer patients and their families during treatment. More recently, Aflac has also begun giving money towards sickle cell research and patients.

Aflac stock is up more than 5% since the start of 2022, bucking the trend of the overall stock market. The company also pays a dividend yield of 2.61%. However, Wall Street Analysts suggest that Aflac may not be an undervalued stock. The median 12-month price target is just 1.0% above the stock’s current price.

ESG rating: 94

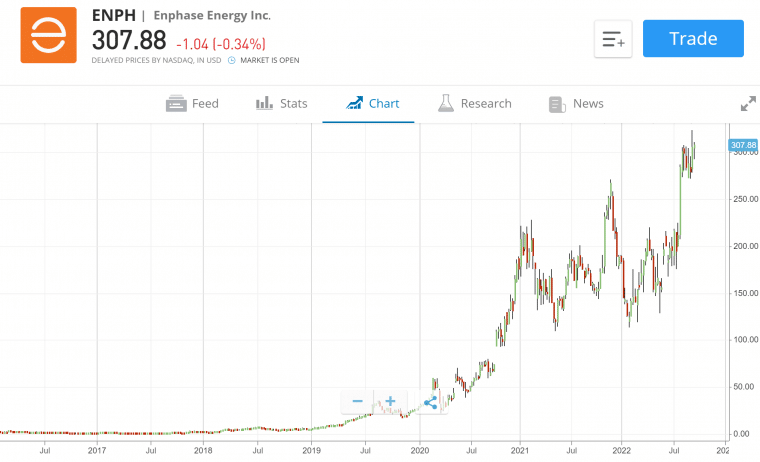

6. Enphase Energy – A Fast-growing Solar Power Stock

Enphase Energy is an explosive growth stock that demonstrates there is potential innovation in the space of ESG investing. This company builds integrated solar panels, batteries, and micro-inverters that can be used to convert large commercial and industrial buildings to solar power. By focusing on the industrial sector, Enphase Energy has somewhat differentiated itself from solar competitors that largely rely on residential solar installations for revenue.

Enphase Energy’s solar systems, if used on a wide scale, could significantly reduce the carbon emissions generated from electricity use by the industrial sector. The company achieved profitability earlier this year and has continued to see its gross margin grow year-over-year. Enphase Energy also has diversity and inclusion initiatives in place to promote social impact at the company.

Enphase Energy stock has gained 93% over the past year and is currently trading just below its 52-week high. However, Wall Street Analysts suggest the company could be slightly overvalued at current prices.

ESG rating: 93

7. Intuit – Ethical Investing Stock Focused on Equal Pay

Intuit is widely seen as one of the most ethical stocks in the finance sector. The company, which makes software products like TurboTax, Quickbooks, and Mint, has achieved equal gender pay across its organization and is working towards achieving equal pay for minorities.

Intuit has also promoted inclusive hiring practices in underserved communities by allowing for more remote work opportunities and investing in “Prosperity Hubs” in economically depressed areas.

Still, ESG investors may want to note that Intuit has faced criticism over some of its practices. For instance, the company has reportedly made it difficult for individuals who are eligible to file taxes for free to do so.

Intuit stock is down 31% since the start of the year and is currently priced 40% below its 52-week high. The stock pays a dividend yield of 0.72%. The median 12-month price target from Wall Street analysts is 26.6% above the stock’s current price.

ESG rating: 91

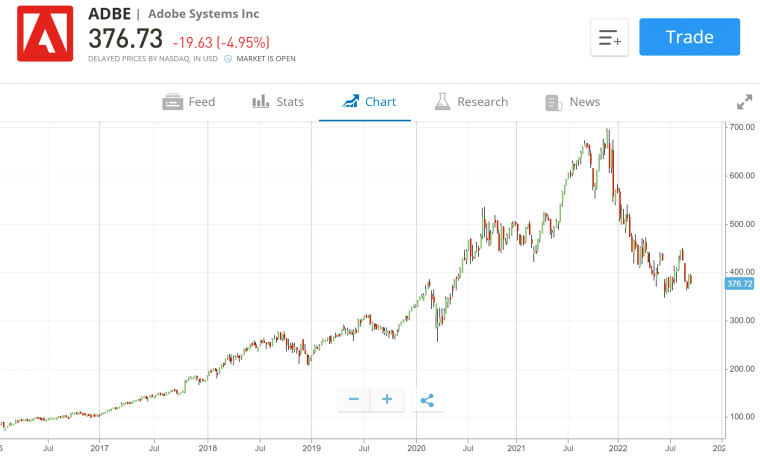

8. Adobe – Achieving Equal Pay & Net Zero Emissions

Adobe is another tech stock that could have potential for ESG investing. The company has ESG initiatives on multiple fronts, including achieving gender pay equity across its global operations and setting a goal to achieve net-zero emissions by 2035. Already, half of the energy that Adobe uses comes from renewable sources. Adobe has also invested more than $80 million in underserved communities.

Adobe falls somewhere in between a growth and value stock. This ethical stock saw a 143% increase in price over the past 5 years but doesn’t pay a dividend as many mature companies do. Adobe has steady revenue from its suite of creative products and the company has been able to grow its margin over time, in part thanks to a switch to a software-as-a-service business model.

Adobe stock is down 33% so far in 2022, but analysts suggest that the company may be undervalued. The median 12-month price target is 19.5% above the stock’s current price.

ESG rating: 70

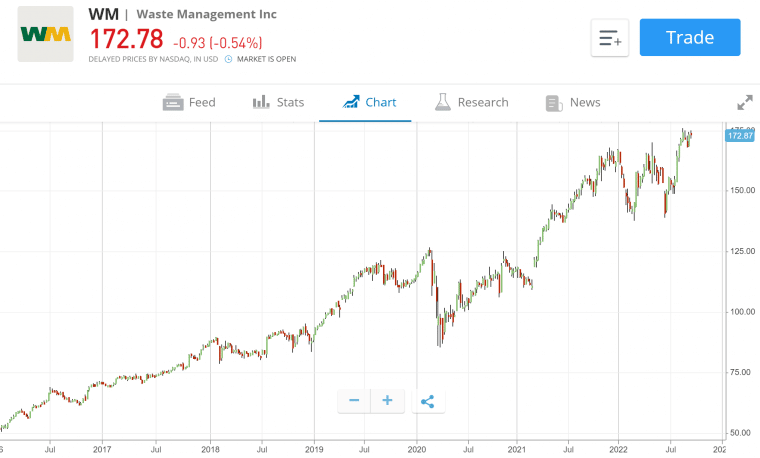

9. Waste Management – Ethical Stock Cleaning Up Our Waste

Waste Management’s business is built around exactly what the name suggests: managing waste. The company operates hundreds of landfills around the US as well as recycling centers and fleets of trucks to collect garbage.

Importantly, Waste Management takes its environmental impact seriously. The company creates landfills that can be filled in and turned into parks once they’re full and has been active in promoting recycling. The company is also converting its nationwide fleet of garbage trucks to be more eco-friendly, which can benefit the environment while also cutting the amount that Waste management spends on fuel.

Since Waste Management’s business is relatively stable even during economic downturns, this ethical investing stock has performed well during the past year. It’s gained 6.1% year-to-date and recently hit a 52-week high. Waste Management also pays investors a dividend yield of 1.51%.

ESG rating: 63

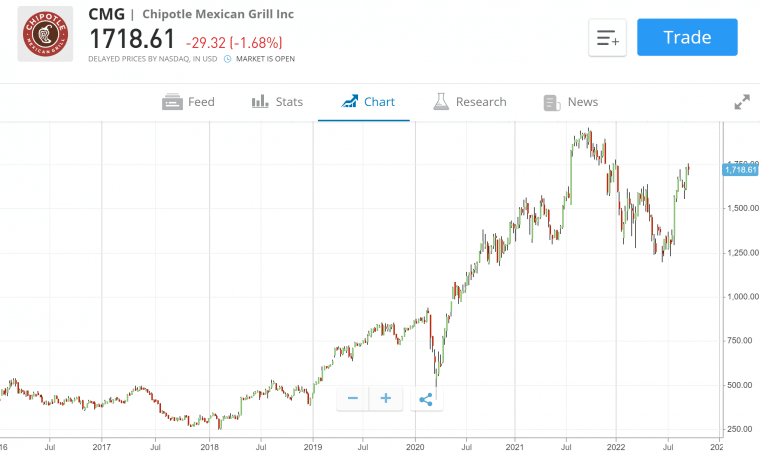

10. Chipotle – Restaurant Chain Focused on Sustainable, Local Ingredients

Investors might not think about a fast-food chain as being one of the most popular ethical stocks. But Chipotle has made significant efforts to source its ingredients in ways that are local and sustainable. The company has partnerships with thousands of small farmers and buys the majority of its meat products from certified human sources.

The downside to this approach, however, is that Chipotle occasionally runs into issues with its supply chain, especially contamination. The company has weathered multiple E. coli outbreaks that badly damaged its reputation.

Chipotle stock is sitting at a 1.3% gain for the year so far and is nearing a 52-week high. Inflation has meant that Chipotle has had to increase prices, but the company has managed to grow its profits year-over-year. Chipotle is not a dividend stock.

ESG rating: 62

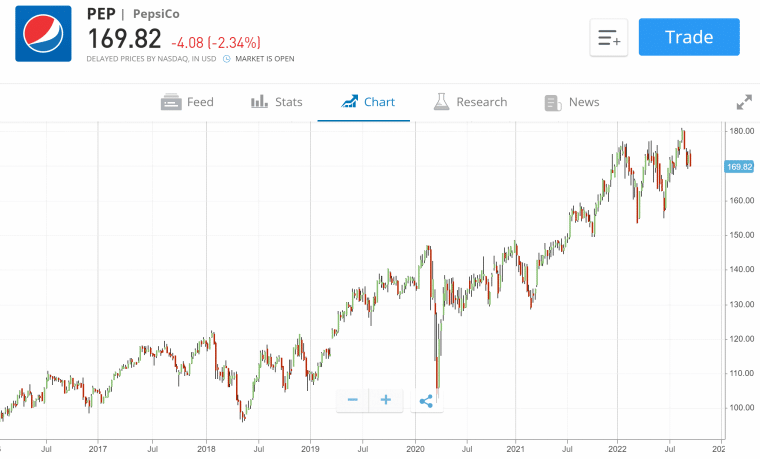

11. PepsiCo – Beverage Giant Putting a Spotlight on Water Stewardship

PepsiCo is one of the world’s largest producers of bottled water. While the plastic that this beverage company uses to bottle its drinks may not be great for the environment, PepsiCo has made efforts to limit its environmental footprint by investing in water stewardship. The company’s goal is to put more water back into each of the aquifers it uses as water sources than it takes out of them.

PepsiCo has also practiced water efficiency at its plants. In 2016, the company announced that it had saved $80 million worth of water just by making changes at a single US plant.

The price of PepsiCo stock has been flat to down slightly since the start of the year, but investors can still benefit from the stock’s 2.70% dividend yield. Wall Street analysts expect a median gain of 7.6% over the next 12 months.

ESG rating: 93

What are Ethical Stocks?

Ethical stocks, also known as ESG stocks, are any stocks belonging to companies that are working to do better for the environment, society, or corporate governance.

Companies can be deemed ethical stocks because they have business models or products that benefit the environment (for example, renewable energy stocks). They can also be considered ethical stocks because they have made investments in reducing their carbon footprint, diversity initiatives, supporting underserved communities, and other social goods.

Importantly, there is no exact definition for what makes a stock ethical. Many companies work to invest in one area – for example, reducing their environmental footprint – at the cost of other areas, such as diversity in their workforce or equal gender pay. It’s up to investors to decide what companies are “ethical” and what ethical investments they care most about.

How to Determine if Stocks are Ethical

There are several ways to investigate popular ethical investing stocks and decide whether their ethics match up with an investor’s own values. First, many stock research platforms now offer ESG analysis for stocks. At a glance, investors can see a stock’s overall ESG rating and how that breaks down across environmental, social, and governance categories.

Investors can also dig deeper when they want to buy ethical investing stocks by reading the ESG reports that many companies release. These go into detail about companies’ ESG investments, including the projects they’re working on and how much progress they have made. Many companies also attract news articles when launching new ESG initiatives.

Investors should keep in mind that companies are quick to point out their ethical investments, but rarely highlight the areas where their ethics fall short. It’s up to investors to seek out criticism of a company’s ESG practices and decide for themselves whether a company is “ethical” in their eyes.

Stock ESG Ratings

Many stock analysis firms and online research platforms issue ESG ratings for the companies they track. ESG ratings can be a way for investors who are interested in investing in ethical investing stocks to find potential candidates to buy.

However, these ESG ratings can take different forms from firm to firm, so it can be difficult for investors to compare them directly. Some firms rate ESG stocks on an overall scale from 0 to 100, while others break down environmental, social, and governance scores and don’t provide an overall rating. Others simply rank stocks against their industry peers.

Why do People Invest in Ethical Stocks?

Many investors want to do more with their investments than just make money. Some will invest in stocks that offer better sustainability in the long term while others are interested in socially responsible investing. They also want to support companies that match their values and are working on projects that they believe in. For example, someone who is concerned about climate change might be more interested in investing in a renewable energy company than in oil stocks.

Other investors believe that buying ethical investing stocks is a smart financial move. They think these stocks will have more long-term value than stocks that aren’t focused on ethics. This belief is based on the idea that, in the long run, companies that don’t match people’s values will fall out of favor and lose business. At the same time, companies that lean into the values that customers care about will build loyal followings that boost their bottom lines.

Conclusion

Ethical investing stocks are those that focus on benefiting the environment, social causes, or corporate governance. While many companies claim to be ethical, it’s up to investors to decide for themselves whether an ethical investing stock matches their values. Investors can access a wide range of ethical stocks using a zero-commission stockbrokers.

An emerging project like ecoterra displays a strong upside potential in the green crypto space. The platform has built a new-age recycle2earn mechanism to reward its users. Currently on presale, buyers can grab the $ECOTERRA tokens for only $0.004 USDT.

FAQs

What is an ethical stock?

What ethical companies can I invest in?

How do you know if a stock is ethical?

Read More:

- How to Invest in Stocks Online for Beginners

- Best Stocks to Watch on Reddit

- Best Meme Stocks to Buy

- Best Penny Stocks