Wish is a multinational, US-built mobile shopping app founded in 2010 by two Google employees. Wish has since grown to accommodate 500 million users, highlighting its popularity. The company went public in 2020, boasting a healthy $33bn valuation. However as of 2022 Wish share prices have dropped below the $2 mark.

In this article, we are going to take a closer look at the investment case for Wish stock, concluding with the buy and sell case for Wish – evaluating arguments for each. In addition, we will review the most popular broker to buy Wish stock through and provider a guide on investing in Wish stock.

Buying Wish Stock – An Overview

One way potential investors can buy Wish stock is through the following steps:

Step 1: Open an account with a regulated broker – Visit a broker’s website and follow the onscreen instructions to open a free account. You will have to enter some personal information at this stage.

Step 2: Upload ID – Before you can deposit funds you must verify your account. In order to do this, you need to upload two valid forms of ID to the platform. These should be verified within minutes.

Step 3: Deposit funds – Now you have verified your account you can deposit funds. This can be done using a number of payment methods including PayPal, Skrill, debit and credit cards, and bank transfer.

Step 4: Buy Wish Stock – Navigate to the search bar and type in Wish. Select the stock and fill out an order form to select how much you would like to purchase.

Step 1: Choose a Stock Broker

Before buying Wish stock, investors need to set up an account with a stockbroker. This will act as the middleman between you and the stock exchange. There are thousands of brokers out there, all boasting unique features and pricing plans. It can be pretty daunting trying to figure out which broker to use. To save you the time researching, we’ve found a place you can buy Wish stock:

Webull

Our second choice for where to buy Wish stock is Webull. It is US-based online exchange that was founded in 2017. It is an option for beginner investors being simple to use and simple to set up an account with. It is also widely accessible, being available to users on both IOS and Android, as well as online.

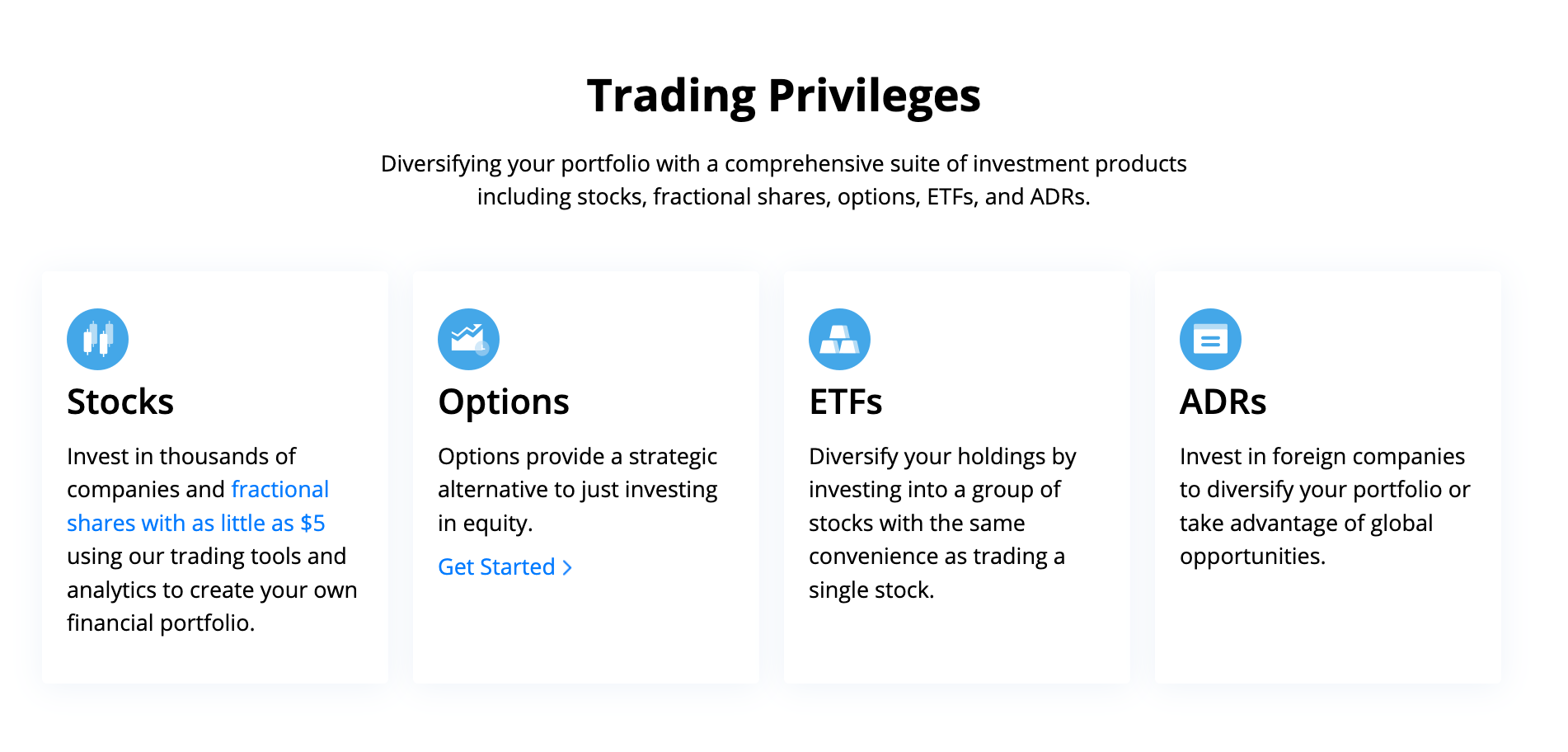

Their stock trading app is zero commission for all stocks and ETFs. Users can also trade options and ADRs which is a cool feature for more experienced investors. There are currently over 3,000 stocks listed on the Webull exchange in addition to 11 cryptos. This can be used for building diversified portfolios to lower risk exposure.

Webull seems to be slightly more geared towards advanced investors. There is a slightly lacking educational side to the app, which doesn’t offer any free educational content. There is also no access to mutual funds, which are a basic asset that many beginner investors tend to hold in portfolios. Whilst the beginner experience may have been compromised, the same cannot be said for more advanced tools. Webull offers integrated charting tools, tonnes of technical indicators, advanced orders, and level 2 data from the Nasdaq. All of these cool features are bundled into the sleek mobile platform.

There is also a very high level of customer support provided by Webull. Customer lines remain open 24/7 if you ever run into any problems regarding your account. There is also a chatbot in the mobile app, and a host of other useful information which can be accessed online.

Taking a look at security, Webull is also a solid option. Two-factor authentication is available on all platforms and fingerprint and biometric facial recognition are used on supported mobiles to protect accounts. Being so secure, Webull has not had a serious data breach for the last 4 years, which is something that many brokers cannot say. Webull takes insurance very seriously, going above and beyond the standard $500k insurance issued by the Securities Investor Protection Corporation (SIPC) in the US. It has an additional insurance policy that provides an aggregate amount of $150m of protection, with a maximum policy of $37.5m per individual. This highlights the in-depth protection levels provided by Webull.

Setting up an account with Webull can be done by visiting the website and following the on-screen instructions. Once this step has been completed, simply fund your account and you can begin to purchase shares for their portfolios instantly. A unique selling point about Webull is that when you set up an account you can receive up to 5 free shares. This can be useful for starting off your stock portfolio.

| Number of stocks | 3,000+ |

| Pricing System | Zero commission (small spread fee) |

| Minimum Trade Size | $5 |

Your capital is at risk.

Step 2: Research Wish Stock

After reading the information above, hopefully, you will have chosen a broker to buy Wish stock with and trade stocks on. However, before buying any stock it’s important that you conduct extensive research into the company itself. You should aim to understand the fundamental business plan of the company, and why it has a competitive advantage. In addition to this, you should look a financial metrics such as price-to-earnings ratios, which will help you determine the true value of the stock. We will cover all of this and more in the section below.

What is Wish

Wish is a global e-commerce app, launched in 2010 by founders Peter Szulczewski and Danny Zhang. It was initially a Pinterest-styled app, where users could create wish lists of items they wanted to purchase. However, in 2013 it started to sell merchandise and quickly grew to over 500,000 daily users.

Wish’s advantage against competitors is that it offers products at massive – and we mean massive – discounts. For example, users can pick up a pair of Bluetooth headphones for under $5, which is a pretty tough bargain to find elsewhere. However, this comes at the cost of (on average) two-to-four-week delivery. This is because Wish mainly outsources products to Chinese wholesale manufacturers, which is also part of the reason it offers such cheap prices.

The company has risen to huge popularity due to these cheap products, being the most downloaded e-commerce app in 2018, with 161 million installs globally. Wish has also gained notoriety for its controversial marketing campaigns, in which users can see some pretty crazy products. These are targeted at individuals using complex algorithms.

The ultra-bargain site is targeted at ordinary working-class Americans, aiming to undercut the market leader Amazon’s pricing strategy. Shoppers scroll through an Instagram-like feed of hundreds of items, 80% of which will return for a second purchase.

Wish Share Price – How Much is Wish Stock Worth

The current price of Wish stock is $1.77, which gives it a market cap of $1.13bn. As Wish isn’t a profitable company yet, it doesn’t have a price-to-earnings (P/E) ratio. However, we can compare its price-to-sales (P/S) and price-to-book (P/B) ratios to competitors to determine its value. At the current share price, Wish has modest P/S and P/B ratios of 0.51 and 1.38 respectively. We can compare these to market leader Amazon which has a P/S ratio of 3.1 and a P/B ratio of 10. This highlights the comparative value of Wish stock which indicates it could be a cheap buy at current levels.

However, financial metrics must be taken with a pinch of salt as they don’t take into consideration some of the more fundamental factors about stocks. For example, Wish has a huge debt to equity ratio of 3.06 and is burning cash fast. It also has a negative profit margin which is a tough point to consider. Wish also has negative earnings per share which highlight the tough investment case for the company.

Overall, it seems the only real investment case for Wish is that the shares are very cheap. However, it seems that they are cheap for a reason, with the company operating with pretty bad fundamentals.

Wish Stock Dividends

Wish stock has never paid a dividend and has only been floated on the stock exchange since 2020. Considering the lack of cash generation and the high level of debt on its balance sheet, it is unlikely that Wish will start to pay a dividend any time soon.

Is Wish Stock Strong

We have taken a quick look at the direction of Wish stock. That being said, there are more factors we can look at to determine whether Wish stock is a buy. Let’s take a look.

Stock price history

Looking at Wish’s historic share price, it follows a definite downtrend since shares were floated for just over $20 in December 2020. Looking at the Wish share price chart, there is certainly a resistance line that shares are struggling to break above. Looking at a support line, it indicates that shares could plummet much lower before they reach support. Whilst this technical analysis is not full proof, it does indicate some of the basic levels that the shares might follow.

Wish (WISH) stock price chart

Competition

Looking at Wish’s competition, it’s a pretty bustling field. Market leader Amazon currently dominates, commanding over 37% of the market share. Perhaps a slightly more applicable comparison is Alibaba, which currently holds around 50% of the Chinese market and is growing at a rapid 40% year-on-year rate. In 2021, Alibaba delivered a whopping $109bn in revenues, which shows its dominance over Wish. Wish has to face these older, more established brands which are generating much more capital and are profitable.

There are also some up-and-comers in the e-commerce world, each of which is disrupting their markets. For example, OnBuy and Snackpass have seen their 5-year search growth multiply by 3150% and 3950% respectively.

Macroeconomic factors

As mentioned, inflation has been creeping up across the globe. In fact, last month in the UK it hit its highest level in 30 years. Both the UK and US central banks have started to raise interest rates as a consequence. In fact, the UK raised its rates to 0.75% in March 2022 and the US did the same, raising rates from 0% to 0.25%. Investment Bank Goldman Sachs has predicted that rates may rise a further six times throughout the course of this year. These rising rates reduce consumer spending which could hurt Wish’s customer volumes. In addition to this, as mentioned, it harms growth stocks, and people trend towards safer investments.

The tragic Russia Ukraine situation could also hurt Wish stock. With oil prices skyrocketing to well over $100 a barrel, many companies are facing rising costs. Wish could be in a similar position here, as costs of transport are likely to rise as a consequence. Rising costs put pressure on margins which is the last thing that Wish needs.

Finally, supply chain issues left over from the Covid-19 pandemic could have a lasting effect on the delivery of Wish products. With delivery already extremely slow, Wish doesn’t want any further delays on products. This could put more pressure on margins as consumers may switch to quicker alternatives.

Consumer trends

One positive that the pandemic has left which could benefit Wish, is how it has reshaped consumer trends. It is estimated that the pandemic added a whopping $219bn to US e-commerce sales from 2020 to 2021. Before the pandemic, this number was not expected to be reached until around 2024. With Wish being one of the leading retailers online, it will no doubt have benefited from the pandemic in this respect. In addition to this, consumers are much more likely to stay shopping online, which could continue to benefit Wish stock in the future.

Counterfeit products

In 2020, the consumer group Which called out Wish for selling counterfeit products which could be harmful to consumers. In a study carried out by Which, it purchased a series of goods, only to find the majority of them were either fake, illegal, dangerous, or never arrived. Consumer experience should be on any online retailer’s priority list, and hence this factor is extremely poor for Wish. Since the report was issued, Wish has announced it would be working with Which to try and identify these products. Due to this, Wish has been hit by a number of ‘lost profit’ lawsuits from companies like Off-White, Adidas, and Gucci. This isn’t beneficialfor the Wish brand and will likely hurt its cash flow if it has to reimburse these companies.

Step 3: Open an Account & Buy Wish Stock

You may have decided that you want to purchase some Wish stock. If this is the case, you will need to set up an account with a broker. We reviewed brokers earlier in this article, so hopefully, you have a better idea of which one suits your investment needs. Below we take an in-depth look at how you can set up an account with a regulated broker.

Step 1: Set up account

The first step is to set up your account. To do this, visit the broker’s website and sign up. Follow the onscreen instructions to set up a free account. You will have to enter some basic personal information at this stage including your email address.

Step 2: Verify your account

Now the account has been set up you must verify it before you can add funds. In order to do this, you must confirm your identity by providing the broker with two forms of valid government ID. These are a proof of identity and a proof of address. Examples of these include a driver’s licence or passport and a copy of a recent utility bill. Large brokers aim to have these documents verified within minutes.

Step 3: Add funds to your account

Now the account has been verified you can set up a payment option and add funds. Most brokers support a host of payment options including bank transfer, debit/credit card, and e-wallet payments such as PayPal and Skrill. Select your preferred option and fill out a deposit form to add your funds.

Step 4: Buy Wish stock

Now the account has been funded, you can open a Wish position in your portfolio. To do this, use the search bar and type in Wish. Once you see the stock, click on the Trade button. This will open up an order form which you can fill out to select the number of shares you wish to buy. Complete the order form to open your Wish position.

Factors affecting Wish

Now we have covered all of the necessary information, we can reach a rounded conclusion as to whether Wish stock is a buy or sell.

Buy case for Wish

As we saw above, Wish has been taking numerous steps in order to improve its services over the next couple of years. These have included cutting costs by stripping back the labour force, improving the app for consumers, and improving relationships with suppliers. In addition to this, the firm has been working closely with Which to help strip out counterfeit items from production.

In addition to this, as we saw above Wish stock seems very cheap compared to market leader Amazon. With a very low P/B and P/S ratio, Wish stock does look a value stock. In addition to this, it is down well over 100% from its all-time high. Considering those points, Wish stock could be a value buy at its current share price. However, that does not mean that the stock could not sink lower in the future.

Sell case for Wish

Whilst there are a number of positives for Wish stock, there are also multiple indications that the stock could be a sell if you are currently holding it in your portfolio.

As previously mentioned, the macro-outlook is currently being shaped by rising interest rates, the Russia Ukraine conflict, and the pandemic. All three of these points are factors that negatively affect Wish. Rising rates could hurt the company’s stock, and the current geopolitical situation in Europe could affect supply negatively. With these three factors being so prominent in the world today, it seems like Wish stock will have a bumpy road ahead of it.

Another sell indication would be the business’s brand name being tainted by counterfeit products. There is a large list of companies that have filed ‘lost profit’ suits against Wish, highlighting the problem. Wish has announced a series of steps to start cutting out these products, however, in terms of tainting the Wish name, the damage has already been done and is likely irreversible.

This is a twofold negative factor for Wish. Firstly it will turn consumers sour on Wish products and the brand name, which could lead to declining customer volume and revenues. Secondly, this factor could hurt Wish as if it loses these suits then it will likely have to pay out large sums to the plaintiffs. In addition to this, large sums will have to be used in order to pay for lawyers to defend the Wish brand. With Wish already having negative cash flow, these outgoings are the last thing that it needs.

Finally, a technical analysis of Wish stock, as outlined above, seems to confirm the bearish trajectory of the stock. There is a strong resistance line marked out above, with a number of inflection points that have been touched throughout the stock’s history. What’s more, it seems that at the $1.77 level, the stock could touch this line again soon. If it is able to break this resistance, then it may creep higher again, however, if it follows the historic trend then it could plummet even lower. This is yet another indication that Wish stock could be a sell.

Conclusion

Wish has grown to become one of the most popular e-commerce sites in the world. In fact, in 2018 it was the most downloaded mobile shopping app on the planet. Revenues and user traffic was steadily increasing, and things seemed to be going well for the company. However, since its IPO in 2020, Wish stock has lost over 100% of its value. This has been due to a number of reasons, including the macroeconomy, counterfeit products, and poor results.

We took a closer look at each of these factors in turn and weighed them up against some of the positives for the stock. These positives included a cheap-looking share price and a series of plans to streamline the business.