Walmart is the largest grocery retailer in the US.

This stock is often preferred by investors that seek solid returns alongside stable dividends – not least because Walmart offers products and services that are in demand regardless of how the economy is performing.

In this guide, we explain the process of buying Walmart stock from an SEC-regulated broker.

Buying Walmart Stock – An Overview

The step-by-step process of investing in Walmart is very simple when using a regulated brokerage site.

For a guide of buying Walmart stock from a regulated broker – follow the guide below:

- ✅ Step 1: Open an Account

As is the case with all online stock brokers, users will first need to register an account. After clicking on ‘Join’ – fill out the registration form by entering some personal information. Users will also need to enter some contact details and a chosen username. - Step 2: Deposit Funds

Commonly supported payment types are inclusive of e-wallets like Paypal, debit/credit cards, ACH, and bank wires. - Step 3: Search for Walmart Stock

Next, type in ‘Walmart’ into the search bar. When Walmart (WMT) appears – click ‘Trade’. - Step 4: Buy Walmart Stock

After clicking on the ‘Trade’ button an order box will appear. In the ‘Amount’ field, users will need to enter the USD amount that they want to invest in Walmart stock. Click ‘Open Trade’ to complete the order.

Step 1: Choose a Stock Broker

When deciding on where to buy Walmart stock, choosing a brokerage site that offers low fees alongside support for small minimum investments can be beneficial.

In addition to this, some investors will look for trading tools such as real-time pricing charts and stock screeners.

Below, we have reviewed the best trading platform to consider when learning about investing in Walmart stock.

Webull

Those on a tight budget will also appreciate that Webull permits fractional stock investments from just $5. In effect, this means that a deposit of just $100 would permit diversification into Walmart and 19 other stocks. In total, Webull offers over 5,000 stocks from the NYSE and NASDAQ.

Other than a limited number of ADRs, international stocks are virtually non-existent here. With that said, Webull does list a wide range of ETFs – many of which offer access to foreign markets and assets. Webull also allows users to invest in cryptocurrency from just $1. This covers dozens of major tokens – with more projects added regularly to meet customer demand.

For those that are opening an account with Webull for the very first time, the broker offers a promotional bonus. By simply registering a verified account, users will be given two free stocks valued at up to $300. After adding some funds, an additional four stocks will be awarded for free.

On the other hand, those that are looking to build a long-term investment portfolio might consider opening a retirement account at Webull. This consists of Traditional, Roth, and Rollover IRAs. Finally, Webull might also appeal to those that wish to buy Walmart stock and other equities on margin. This will require a minimum account balance of $2,000 as per SEC rules.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Walmart Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Walmart Stock

Researching Walmart stock from will ensure that potential investors enter the market with their eyes wide open.

In the sections below, we examine some key information surrounding this company from an investment perspective.

What is Walmart

Founded in 1962, Walmart is the largest grocery retailer in the US. The firm has over 4,700 stores in the US alone, and thousands more overseas. This includes locations in Canada, India, South Africa, Mexico, and more.

Due to its significant market share in the US, Walmart is able to purchase goods and services at competitive prices. This is subsequently passed on to the consumer – which is why Walmart continues to remain the go-to retailer for those on a budget.

Walmart Stock Price – How Much is Walmart Stock Worth

Walmart is not only the largest grocery retailer in the US – it is of the largest companies globally. As an organization that offers products and services that remain in demand regardless of how the US economy is performing, Walmart is viewed as a staple stock. This means that investors will often flock to Walmart during times of uncertainty for its strong and stable status.

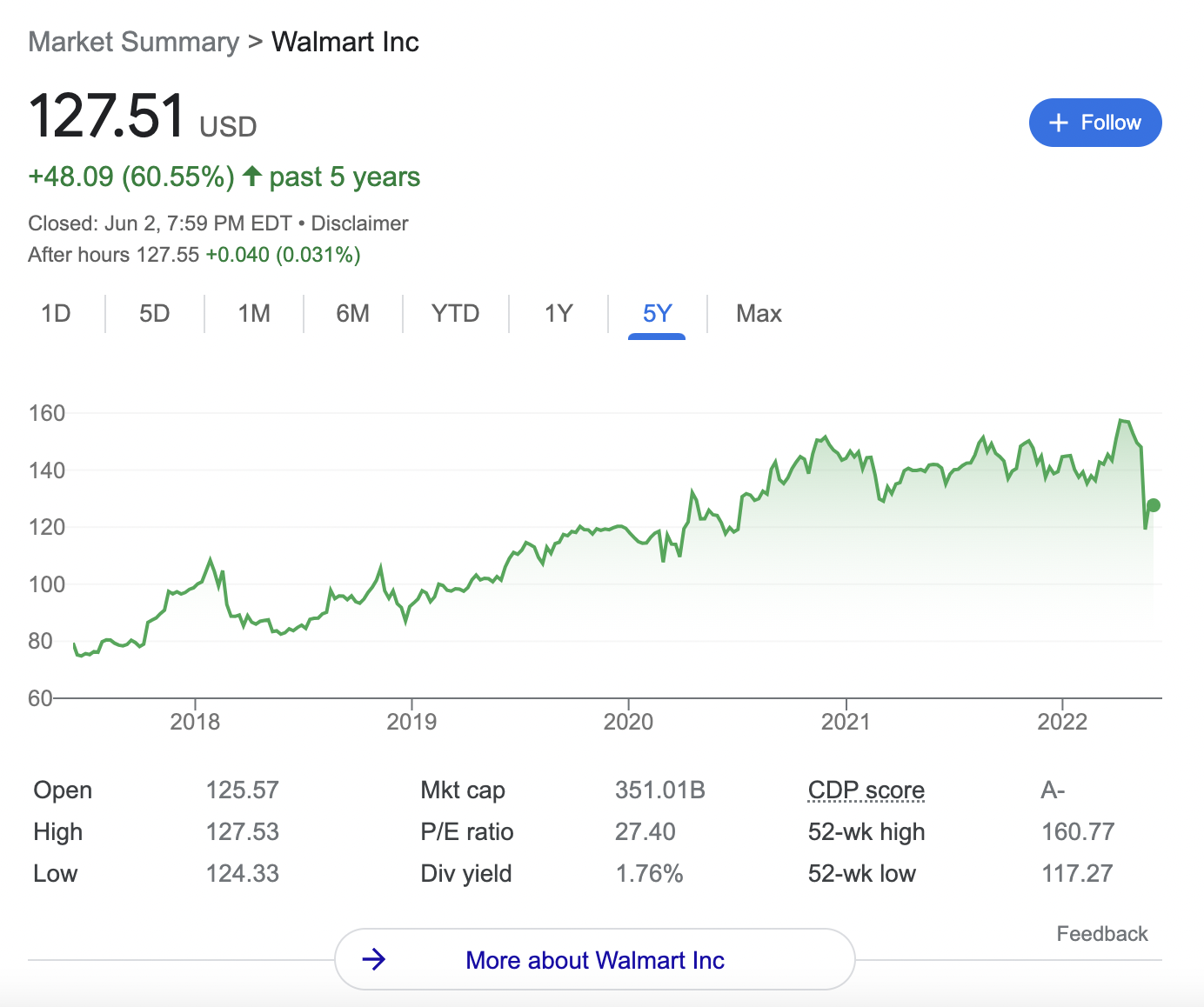

In terms of its stock price performance, Walmart has increased in value by 60% over the prior five years. While this might seem modest at first glance, it is important to note that, over the same period, the NYSE Composite has grown by just 35%.

As such, this highlights that although Walmart typically generates slow and steady returns, in recent years it has outperformed the broader markets. As of writing, Walmart is carrying a market capitalization of over $350 billion. This makes it one of the largest entrants of the S&P 500 index.

EPS and P/E Ratio

Walmart, as of writing, is carrying a P/E ratio of just over 27 times. .

For instance, fellow low-cost retailer Costco is carrying a P/E ratio of over 38 times. Amazon is perhaps even more expensive at over 60 times.

In terms of its EPS, this stood at $4.87 and $4.75 in 2021 and 2020 respectively – which represents an increase of over 2.5%.

Walmart Stock Dividends

Although Walmart doesn’t offer the most yield in the market, it is still one popular dividend stock to add to your portfolio.

The reason for this is simple – Walmart is just one year away from becoming a dividend king. This means that the firm has increased the size of its annual dividend payment for nearly 50 consecutive years.

Therefore, for those looking for a solid dividend stock that can be relied on – even during bearish economic conditions – Walmart is worth considering.

Factors Affecting Walmart

Deciding on whether or not Walmart stock is a worthy buy will require some additional in-depth research.

It’s worth focusing on the fundamentals in this respect – such as how the firm is performing against the broader market and how its most recent earnings report stacks up against Wall Street expectations.

Consider the following when deciding on whether to buy Walmart stock:

Solid Stable Stock With Consistent Dividend Policy

The first thing to note when deciding on whether or not to invest in Walmart is that the firm is a solid stable stock.

And as we mentioned earlier, this means that the firm will likely continue to perform well and meet its forecast targets even when the broader economy is bearish.

- In addition to this, Walmart is one year away from becoming a dividend king.

- This is especially impressive considering the global uncertainties that Walmart has gone through over the prior five decades – including the COVID pandemic and 2008 financial crisis.

All in all, while Walmart likely won’t provide the same sort of returns as tech stocks like Amazon or Apple, at the same time, the firm will appeal to those that seek solid and stable returns alongside a consistent dividend policy.

Opportunity to Buy the Dip

Walmart – like most retailers in the US, is suffering the effects of rising inflation and supply chain issues. This has resulted in tighter profit margins, which in turn, has impacted its stock price.

After all, Walmart margins are already wafer-thin, as the grocery retailer operates on a high-volume, low-mark-up business model.

For instance, in April 2022, Walmart stock hit an all-time high of $160. Just one month later, the stock hit lows of $117. This translates into a decline of 25% in just four weeks of trading.

However, many would argue that the current issues facing inflation and higher costs of goods are temporary. And therefore, it is possible to take advantage of this temporary market dip by purchasing Walmart stock. With that said, it’s impossible to predict the future so its key to always do your own reesarch.

Walmart Outperforms the Broader Markets

While Walmart is known for its slow and steady returns, the firm has still outperformed major indices over the prior few years. As we mentioned earlier, over a 5-year period, Walmart stock is up 60%.

In comparison, the NYSE Composite has grown by just 35%. This highlights that Walmart has what it takes to generate returns – even when it is operating on ever-tightening margins.

Step 3: Open an Account & Buy Stock

For those wishing to learn about buying Walmart stock today with low fees and small account minimums, a regulated broker is the platform for the job.

To invest in Walmart in under five minutes – follow the steps below.

Step 1: Open an Account

The first step is to open an account with a regulated broker. The broker will need to collect some personal information – such as name, home address, and social security number.

It will also require a cell phone number and email address.

Finally, the broker will collect some information regarding any prior trading experience. This ensures that the platform offers suitable products and services for its clients.

Step 2: Upload ID

As a regulated broker by the SEC and FINRA, so it must also collect some ID documents.

This includes a government-issued ID – such as a driver’s license or passport. A broker also asks for proof of address. Examples of supporting documents include a recent bank statement or internet bill.

The broker will verify the documents near-instantly. Wait for a confirmation email to advise when the account has been verified.

Step 3: Deposit Funds

Most brokers support a range of payment methods including a debit/credit card to deposit funds as this payment method is both instant and convenient.

Other options here include ACH, domestic bank wires, Paypal, and Neteller.

Step 4: Search for Walmart Stock

The next step is to find Walmart on the platform. Many brokers offer a convenient search bar.

Therefore, it’s just a case of typing in ‘Walmart’ and clicking on the ‘Trade’ button to proceed to the next step.

Step 5: Buy Walmart Stock

The broker will require an order form to be completed. This simply requires the amount of money that will be invested into Walmart stock.

Finally, to buy Walmart stock for your portfolio instantly, click on ‘Open Trade’.

Walmart Stock Strength

For those seeking above-average market returns – Walmart will likely not be of interest. However, for investors that favor slow and steady growth from a company that has a significant market share and a robust balance sheet, Walmart is well worth considering.

After all, the low-cost products and services that Walmart sells are in demand during all economic cycles. Furthermore, Walmart has increased the size of its dividends for no less than 49 consecutive years.

This has been the case even during major bear markets – such as the 2008 financial crisis and the COVID pandemic. This sentiment on Walmart is largely shared by the broader markets – with 81% of sell-side analysts concluding that Walmart is a buy.

Finally, and perhaps most pertinently, Walmart stock has suffered the impact of rising inflation levels and supply chain disruptions – through no fault of its own. In turn, this has impacted its stock price.

Conclusion

Walmart is a solid staple stock with a robust balance sheet. In addition to steady returns, investors can rely on the firm’s 49-year consecutive dividend payout history.

To buy Walmart stock, the process is very straightforward when using a regulated broker. From start to finish, it doesn’t take more than five minutes to open an account and place a market order.

FAQs

How do I buy Walmart stock?

Where can I buy Walmart stock?