Taiwan Semiconductor Manufacturing (TSM) is one of the biggest producers of microchips globally. Semiconductors are used in everything from cell phones, televisions, and radios to medical equipment and ATMs.

In this beginner’s guide, we explain how to buy Taiwan Semiconductor Manufacturing stock. We also explore whether or not TSM stock represents a viable portfolio consideration through an in-depth analysis of the firm.

How to Buy Taiwan Semiconductor Manufacturing Stock With a Regulated Broker

To start this guide off, we are going to shed some light on how to buy Taiwan Semiconductor Manufacturing stock with a regulated brokerage.

Depending on the brokerage chosen, US-based investors can access domestic and international stocks without paying commissions or deposit fees.

See below for a simple guide on how to invest in Taiwan Semiconductor Manufacturing stock:

- ✅Step 1 – Open an Account With a Regulated Broker: Select a broker that holds a license from the SEC and provides access to Taiwan Semiconductor Manufacturing stock. Next, complete the registration form. This will include information surrounding the identity of the investor, such as a name and address, as well as an email and other basic details.

- Step 2 – Upload ID: All regulated brokers require the investor to provide ID and proof of residency. This is so that the investor’s identity can be validated and the broker is able to adhere to AML guidelines.

- Step 3 – Deposit Funds: Select a payment method from which to make a deposit into the stock broker account. At many trading platforms, this will be inclusive of ACH, and bank wire transfers. In some cases, investors can also select e-wallets like PayPal and Skrill, and/or credit and debit cards.

- Step 4 – Research and Buy TSM Stock: Many modern stock broker platforms have a search facility to save investors time when looking for their chosen asset. As such, type ‘Taiwan Semiconductor Manufacturing” into the search bar. Alternatively, look for its stock ticker – which is TSM. Once found, the investor can select it and place an order to buy TSM stock at their chosen stake.

The TSM stock order will be executed straight away – on the proviso that the NYSE is open.

Step 1: Choose a Stock Broker

Those wondering where to buy Taiwan Semiconductor Manufacturing stock can read the following reviews to help them decide on the most suitable fit.

When researching trading platforms from which to buy TSM stock, we look at a range of metrics. This includes trading fees, asset availability, platform navigation, and much more.

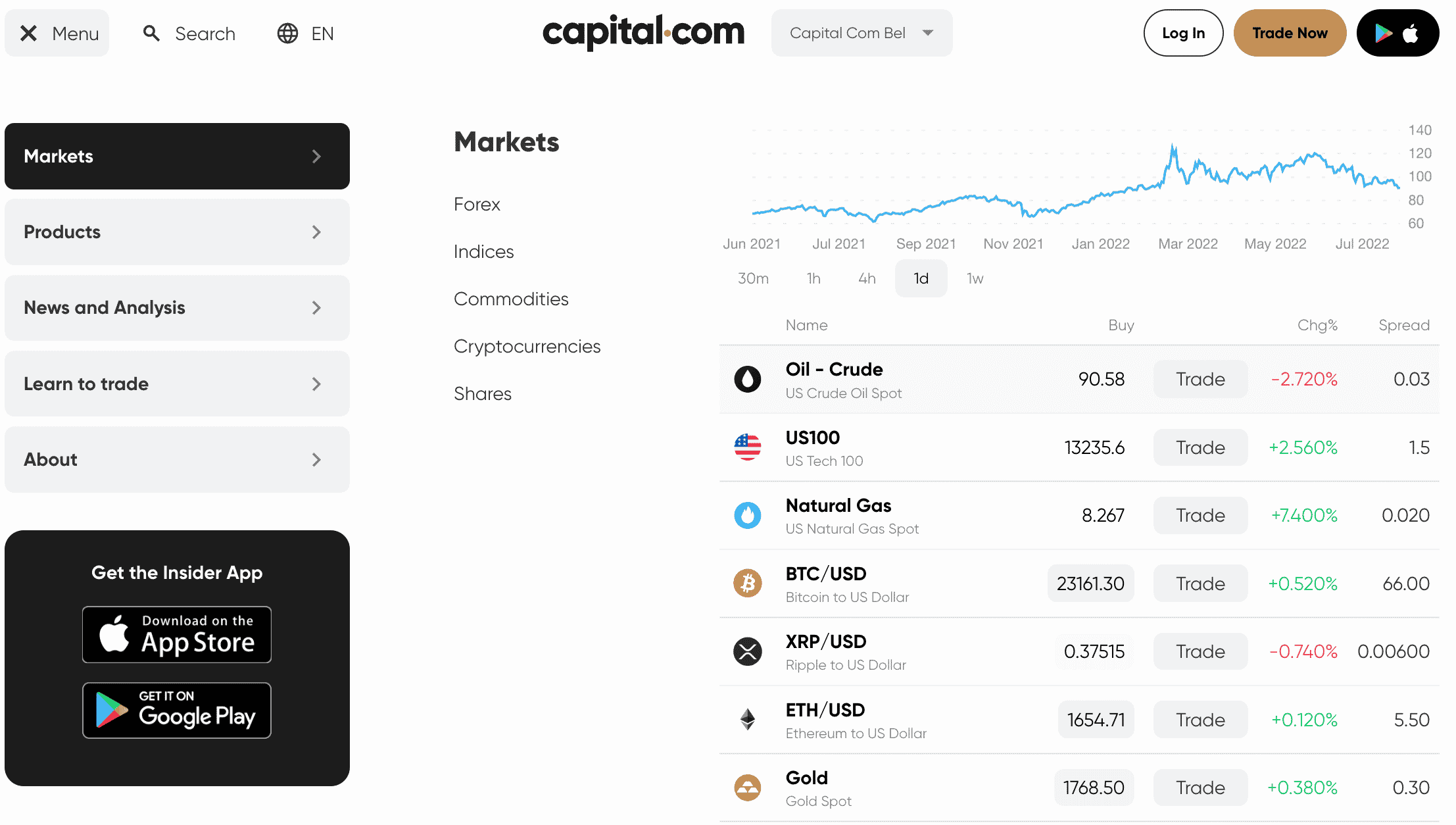

1. Capital.com

Notably, investors will not take ownership of any stock. CFDs are financial instruments that track the price fluctuations of an underlying stock. If, after carrying out some research and analysis, an investor thinks the underlying stock is likely to go down in price, they can open a short position by placing a sell order.

If, on the other hand, the investor believes the stock will go up in price, they can open a long position by placing a buy order. Capital.com does not charge commission. However, traders will need to pay the difference between the buy and sell price of the stock CFD – the spread.

In addition to the platform’s 5,400+ stock CFDs, Capital.com also provides access to cryptocurrencies, forex, and commodities. The minimum amount required on e-wallets and credit/debit card deposits is $20. Importantly, if the investor wishes to fund their account using a wire transfer, the minimum deposit increases to $250.

Capital.com does not charge deposit or withdrawal fees. However, one charge to be aware of is overnight financing, also referred to as swap fees. This is charged for each day a position remains open after that particular stock market has finished trading for the day.

It is for this reason that Capital.com is better suited to day traders, rather than those looking to hold positions in the long term. In terms of trading tools, Capital.com has a range of technical indicators, price charts, and other features that aid technical analysis for stock investors.

This platform supports MT4 integration. For those unaware, MT4 is a popular platform used by technically minded stock traders for its advanced tools. Capital.com is regulated by multiple bodies, which include the FCA, CySEC, ASIC, and NBRB.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. However, international stocks are offered as ADRs and Webull states that these positions will have additional fees attached. As such, investors should bear this in mind when deciding where to buy TSM stock. That being said, there isn’t a huge variation of internationally listed stocks at Webull. As such, this platform is likely better suited to investors looking to create a portfolio of stocks based in the US. In terms of usability, Webull is suitable for beginners as well as more advanced investors. This is because the platform is uncomplicated, but there are trading tools available for performing technical analysis. Webull also provides access to a range of IRAs which covers Rollover, Roth, and Traditional. This brokerage is regulated by the SEC which should give investors peace of mind. When it comes to funding a Webull account, there is no minimum deposit in place. Moreover, deposits via ACH are free of charge. Importantly, those that opt for bank wires when funding their account will need to pay an $8 fee on each transaction and a further $25 for each withdrawal by the same method.

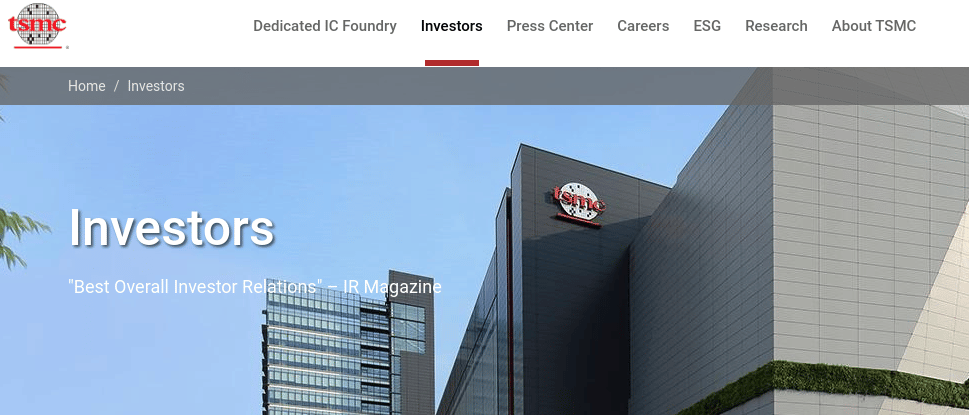

Your capital is at risk. When researching how to invest in stocks online, investors need to study a wide range of information. This can include things like how the company makes money, its performance on the stock market, financial reports, and more. With this in mind, investors can take a closer look at the ins and outs of Taiwan Semiconductor Manufacturing below. This should help investors of all skill sets to make an informed choice when deciding whether or not to buy TSM stock. Taiwan Semiconductor Manufacturing was founded in 1987 and has its headquarters in Taiwan’s Hsinchu Science Park. Interestingly, the company makes sure that it never competes with its clients by deciding not to create, produce, or market any semiconductor goods under its own brand name. With around 53% of the global semiconductor market share, Taiwan Semiconductor Manufacturing is the biggest specialized maker of this product worldwide. As per the most recent figures available, the business employs over 65,000 people. The primary objective of Taiwan Semiconductor Manufacturing is to produce integrated circuits and semiconductors. According to TSM itself, it produces over 1,230 niche products, including almost 300 diverse technologies, for over 500 different clients. Taiwan Semiconductor Manufacturing products are used in everything from radios, digital cameras, TVs, game consoles, and cell phones, to electric automobiles and medical equipment. This company’s goods are mainly sold in Asia, the US, and Europe. Another important part of learning how to buy Taiwan Semiconductor Manufacturing stock is to look at its past performance. One way to do this is to look at the Taiwan Semiconductor Manufacturing stock chart. In 1993, TSM stock became available to the public when it was listed on the Taiwan Stock Exchange (TWSE). In 1997, Taiwan Semiconductor Manufacturing made history by becoming the first Taiwanese firm to be publically listed on the New York Stock Exchange (NYSE). Taiwan Semiconductor Manufacturing stock traded at less than $30 until 2016. However, 2017 was the year that the global semiconductor market grew across the board. Throughout the year, TSM traded between $30 and $45. This is mostly attributable to increased unit manufacturing for a number of application sectors. For instance, higher-end cellphones, graphics cards, gaming consoles, and an increase in the manufacturing of electric automobiles. Another aspect was the widespread usage of DRAM and NAND flash by solid-state drives, servers, and PCs. 2019 saw a slowdown in Taiwan Semiconductor Manufacturing’s growth as fewer smartphones and consumer goods were purchased Nonetheless, by the end of January 2020, Taiwan Semiconductor Manufacturing stock was trading nearer to $60. Strong PC sales during the pandemic, a growing need for more sophisticated data center CPUs, and advanced 5G devices led to a rush of new orders. According to historical Taiwan Semiconductor Manufacturing stock news, this caused the company’s growth to accelerate. Taiwan Semiconductor Manufacturing began to produce a bigger share of income from its 5-nanometer node as a result of this momentum. This persisted throughout 2021 and the first half of 2022. By January 2022, TSM stock had reached its all-time high of over $140. Since 2018, Taiwan Semiconductor Manufacturing’s market capitalization has increased by over 130%. At the time of writing, TSM stock is trading at a discount of almost 36% compared with its aforementioned all-time high. One way to measure the value of a company’s common stock is by looking at its EPS. Here’s what we found out from the previous four earning calls released by Taiwan Semiconductor Manufacturing: It’s important for investors to remember that Taiwan Semiconductor Manufacturing stock’s growth is cyclical. This means that macroeconomic or systematic changes in the wider economy will have an impact on the price of TSM stock. As central banks rushed to boost interest rates to stop runaway inflation in 2022, the semiconductor market started to cool down. Then there are the protracted Covid lockdowns in China, in addition to Russia’s war on Ukraine. Both of which precipitated a swift change in the outlook of the Taiwan Semiconductor Manufacturing stock forecast, and many others in this industry. The value of a stock may be calculated using a wide range of measures. The price-to-earnings (P/E) ratio is one of the first things investors look for in quarterly financial reports. For those unaware, this compares the price of a stock to its earnings per share. Taiwan Semiconductor Manufacturing has a P/E ratio of 18.35 at the time of writing. Fellow US-listed semiconductor stock ON Semiconductor Corp has a P/E ratio of 18.97. As such this is almost like-for-like with TSM. Some investors look to dividend-paying stocks as part of a passive investment strategy. However, it’s important to check that the company offers dividends as many don’t. At the time of writing, Taiwan Semiconductor Manufacturing offers a running dividend yield of 2.1%. The latest quarterly dividend amount paid to Taiwan Semiconductor Manufacturing investors was $0.47 per stock. Any possible investment needs thorough research prior to allocating any funds to it. As such, we’ve included some useful information surrounding Taiwan Semiconductor Manufacturing stock below. This includes everything from the companies manufacturing capabilities, to how it makes its revenue, key clients, growth, and more. It’s important for investors to understand how a potential stock investment generates its revenue. In the case of Taiwan Semiconductor Manufacturing, the company is engaged in research and development in a number of different fields and territories. See below: The business strategy of Taiwan Semiconductor Manufacturing is that of a specialized ‘pure play’ foundry. That is to say, integrated device makers like Samsung and Intel develop and then produce the chips used in their own products. In contrast, Taiwan Semiconductor Manufacturing exclusively works on a contract basis and doesn’t market devices of its own design. As we’ve said, Taiwan Semiconductor Manufacturing is the industry leader in this space. Regardless, those researching how to buy TSM stock will want a clear picture of what this company is capable of, in terms of output. It’s clear that a crucial component of Taiwan Semiconductor Manufacturing’s production strategy is maintaining a reliable capacity. Prior to investing in a company, it makes sense to check out its financial health. Although to reiterate, TSM stock is cyclical. Therefore, a bad quarter or year is sometimes due to external influences that are completely outside of Taiwan Semiconductor Manufacturing’s control – rather than bad management. Nonetheless, Taiwan Semiconductor Manufacturing has grown year on year in terms of revenue. See some information below that spans five years: In its Q2 2022 financial report, Taiwan Semiconductor Manufacturing posted positive earnings. On a consolidated basis, revenue for July 2022 increased by almost 50% when compared with the same month in 2021. Moreover, revenue was more than 6% up from June 2022. It’s clear that Taiwan Semiconductor Manufacturing is still producing impressive results. All that said, it’s important for all investors to conduct their own thorough research to try and gauge whether this is a worthy addition to their portfolio. Stocks that are index constituents are desirable to some investors. This is because a lot of big institutional investors follow indices like the FTSE and Dow Jones. Therefore, as institutional investors adjust their portfolios, it is asserted that once a company is added to the index, demand could soar, and with it the stock price. It’s also possible to buy Taiwan Semiconductor Manufacturing stock via an ETF, such as: Investing in a company via a fund is also a strategy to diversify and expose a portfolio to many different stocks. The manufacturing of semiconductors is a very competitive sector, with the leading companies influencing a substantial portion of global technological advancement. Although Taiwan Semiconductor Manufacturing is a global leader in its industry, it’s still wise to be aware of the company’s competitors. Similar stocks sometimes move sympathetically with each other. This is especially the case when there is an outside force affecting the industry that the companies cater to. Investors looking to buy stocks with a regulated broker can follow the steps listed below. This is the safest way to buy Taiwan Semiconductor Manufacturing stock – as regulated brokers have to follow strict guidelines to protect investors. This, in turn, means investors are more likely to have a positive experience in terms of professionalism and fair conduct. In order to open an account and buy stock in Taiwan Semiconductor Manufacturing, the investor will be required to tell the brokerage a bit about themselves. This invariably includes the following information: That’s the basics covered. It’s likely that the brokerage will also need to know some information surrounding prior trading experience. The purpose of this is to gain an understanding of what financial services to offer to the investor. Another industry standard when signing up with a broker to buy TSM stock is to complete the KYC process. This is a simple case of uploading an official and government-recognized form of photo ID such as a passport or driver’s license. This can also include a state ID in most cases. Additionally, the trading platform will need to validate an investor’s place of residency. Many brokers will accept an official bill or letter in the name of the investor. This must show a recent date of issue, as well as the address that was given by the investor in step 1. Examples include bank statements, tax letters, and utility bills. It goes without saying that in order to buy TSM stock, an investor will need to have funds in their brokerage account. The investor will also need to meet the minimum deposit requirement expected by the platform and select a payment method from what is supported. Many trading platforms will facilitate ACH and wire transfer deposits. Some platforms – such as Capital.com, will enable investors to pay by credit/debit card, or buy stocks with PayPal, Neteller, Skrill, and other e-wallets. At this point, the investor has had their identity verified, funded their account, and will be able to place an order to buy Taiwan Semiconductor Manufacturing stock. First, TSM stock needs to be located. The easy way of doing this is via the search bar found on the majority of online trading sites. This can be done by typing the Taiwan Semiconductor Manufacturing stock ticker into the search bar -TSM. Once found, select the stock by clicking it, and this will reveal an order form. To buy TSM stock, enter the monetary amount to invest and confirm to add it to the portfolio. Prior to placing an order to buy Taiwan Semiconductor Manufacturing stock, investors need to carry out plenty of thorough research. This guide has covered multiple important aspects of the company, including Taiwan Semiconductor Manufacturing’s stock history, and its financial situation. This should aid investors in answering the question ‘is Taiwan Semiconductor Manufacturing a good stock to buy?’.

Approx No. Stocks

5,400

Min Deposit

$20

Cost to Trade TSM Stock

0% commission + spread

2. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy TSM Stock

0% commission + spread

Step 2: Research Taiwan Semiconductor Manufacturing Stock

What is Taiwan Semiconductor Manufacturing?

Taiwan Semiconductor Manufacturing Stock Price – How Much is TSM Stock Worth?

Taiwan Semiconductor Manufacturing Stock – EPS

Taiwan Semiconductor Manufacturing Stock – P/E Ratio

Taiwan Semiconductor Manufacturing Stock Dividends

Taiwan Semiconductor Manufacturing Stock: Fundamental Research

Business Model

Production Output Capabilities

Financial Health and Growth

Index Inclusion

Key Competitors

Step 3: Open a Trading Account & Buy Taiwan Semiconductor Manufacturing Stock

Open a Brokerage Account

Upload ID

Deposit Money

Buy Taiwan Semiconductor Manufacturing Stock

Conclusion

FAQs

Can you buy Taiwan Semiconductor Manufacturing stocks?

How much does it cost to buy Taiwan Semiconductor Manufacturing stock?

How much is Taiwan Semiconductor Manufacturing worth in 2022?

Is Taiwan Semiconductor Manufacturing a public company?

Is Taiwan Semiconductor Manufacturing a good stock to buy?

Should I buy Taiwan Semiconductor Manufacturing stock?

When should I buy Taiwan Semiconductor Manufacturing stock?