Over the past few years, cannabis-related businesses have attracted a lot of investor attention. Sundial Growers is one such company that has grown in popularity, particularly as a meme stock.

In this guide, we show you the process of how to buy Sundial Growers stock with a regulated broker. We’ll also discuss whether Sundial Growers has the potential to become a solid investment based on its current performance and future prospects.

Buying Sundial Growers Stock – An Overview

When considering where to buy Sundial Growers stock, we suggest partnering with an SEC-regulated broker. With that in mind, the following steps will discuss investing in Sundial Growers stock in less than five minutes:

- ✅ Step 1: Open an Account

Get started by visiting a regulated broker and creating an account. This entails providing an email address and a username. New users will also be required to create a password. - Step 2: Upload ID

Next, provide some basic personal information in order to complete the KYC process. This includes submitting details such as a full name, date of birth, and contact number – along documents that verify the personal details provided. - Step 3: Deposit

Fund the newly-created account through an accepted payment method, such as a credit/debit card, bank transfer, or e-wallet. - Step 4: Buy Sundial Growers Stock

To buy Sundial Growers stock, type the company name, or ‘SNDL’ into the search bar. Then, click on the ‘Trade’ button to load an order box. Here, specify the amount to be invested in Sundial Growers stock and use ‘Open Trade’ to place the order.

For those who need a more comprehensive explanation of buying stocks, we have included a detailed guide at the end of the guide.

Step 1: Choose a Stock Broker

The most simple way to buy Sundial Growers stock is via an online broker. However, there are many platforms that claim competitive fees and features – and as such, it is not an simple undertaking to find a suitable provider.

To help make the decision more simple, below we’ll look at a popular online broker that provide access to Sundial Growers shares:

Webull

However, the o% commission structure is applicable only for US stocks. This means that while users can buy Sundial Growers stock with no fees, those wishing to diversify into non-US markets will have to consider extra charges. In addition to equities, Webull also supports options trading, ETFs, and cryptocurrencies.

In terms of deposit methods, Webull accepts payments via ACH and bank wire transfer. However, credit/debit card transactions are not yet supported, nor are e-wallets. It is also important to note that Webull charges a flat fee of $8 for bank wire transfers.

More importantly, Webull does not impose a minimum account balance requirement. With the broker’s fractional trading feature, users can start investing in stocks from just $5. Webull also comes with a convenient app, making it simple for users to buy Sundial Growers stock and cash out their investments on the go.

| Number of stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to buy Sundial Growers stock | 0% commission + spread |

| Minimum deposit | $0 |

Your capital is at risk.

Step 2: Research Sundial Growers Stock

One of the most crucial steps when learning to invest in stocks is to understand the different ways to research a company. It is never a sound idea to make investment decisions based on stock market movements alone.

Rather, one should look into Sundial Grower’s annual reports and business model to arrive at an informed decision. Investors will be able to gather information about the company from SEC filings, earnings reports, and recent news.

In this section of our guide, we provide an overview of what users need to know before setting out to buy Sundial Growers stock.

What is Sundial Growers

Sundial Growers is a company engaged in the production, distribution, and sale of cannabis derivative products.

The firm was established in 2006 and is a licensed producer of small-batch cannabis in Canada. Its business is analyzed under four segments – cannabis production and cultivation, cannabis retail, liquor retail, and investments.

It is important to note that Sundial Growers has come a long way since its initial days:

- At the time of its launch, Sundial derived its revenue solely from the cultivation and sale of cannabis.

- Then, in 2021, the company caught the attention of Reddit and soon emerged as one of the most popular meme stocks of the year.

- This popularity enabled Sundial to raise cash several times over, which it might not have been able to do otherwise.

- Sundial has since started investing in retail shops and diversifying its operations into the liquor sector.

In a nutshell, Sundial Growers is working toward strengthening its portfolio for generating long-term profits. That being said, the company also faces challenges in the cannabis market. This is mainly due to the fact that cannabis is not legalized in the US on the federal level – which has made expansion relatively difficult for Sundial Growers.

As we move forward with the guide, we will discuss the factors that are in favor of Sundial Growers and the risks that need to be considered before parting with any capital.

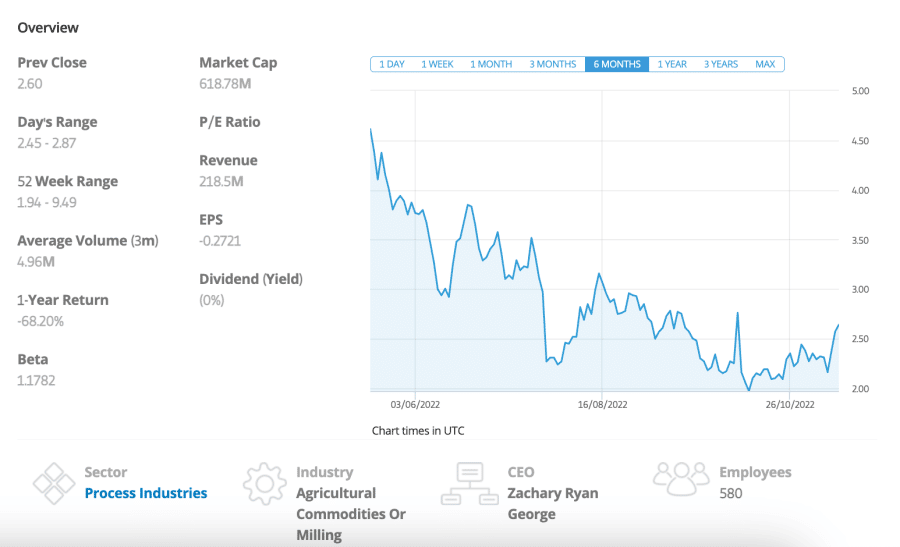

Sundial Growers Stock Price – How Much is Sundial Growers Stock Worth

However, this was primarily due to the general market sentiment towards cannabis companies at the time. For instance, some Canadian cannabis businesses had previously faced regulatory issues, which reflected badly on this segment of the stock market.

Post the IPO, Sundial Grower remained a small-time player. By September 2020, SNDL stock was trading at around $0.25, generating significant operating losses. According to analysts, the company was about to face bankruptcy alongside the added risk of being delisted from the NASDAQ.

However, in 2021, traders on Reddit took a liking to the company. Sundial Growers gained in popularity as a meme stock and even hit the $4 mark in February 2021. That being said, this frenzy did not last long. Since early 2021, Sundial Growers stock price has plummeted. In March 2022, Sundial witnessed a short period of bullishness again – gaining by about 25%.

However, since March 2022, the SNDL share price has been on a consistent downtrend. There have been small bullish spikes, but on the whole, it’s been a challenging period for investors. In October 2022, the company’s shares bottomed-out at $1.99 – a price that hadn’t been seen since November 2020.

At the time of writing, Sundial Growers stock is valued at $2.67. To put this into perspective, this is over 97% below July 2019’s all-time highs.

EPS

The EPS is a metric commonly used by investors when deciding whether a stock is worth their attention. The EPS indicates how much money a firm makes for its stockholders.

Here is an overview of how Sundial Growers have performed in terms of EPS estimates (figures are noted in CAD):

- Q3 2021 = $0.06

- Q4 2021 = N/A

- Q1 2022 = -$0.20

- Q2 2022 = -$0.31

- Q3 2022 = -$0.03

As highlighted above, the company has been consistently unprofitable over the past year. However, Q3 2022 saw losses shrink quite substantially – hinting that Sundial Growers may be back on the right track.

P/E Ratio

The P/E ratio measures the value of a stock relative to its earnings. Typically, a high P/E ratio suggests that the stock is ‘overvalued’ relative to its earnings, whilst the opposite holds true for low P/E ratios.

In the case of Sundial Growers:

- Sundial Growers’ current P/E ratio is below 0. This is because the company is unprofitable, so therefore this metric doesn’t apply.

- According to Yahoo Finance, Sundial’s forward P/E ratio is 50.76.

The P/E ratio of a company is often analyzed by comparing it to that of its peers. So, when considering other cannabis stocks such as Tilray, which also has a negative P/E ratio, it’s clear that the major industry players are all in the same boat in regards to profitability.

Capital Raise

Another factor to consider about Sundial Grower is the company’s penchant for diluting stockholders. It’s no surprise that firms that go public issue more stock to raise cash. However, Sundial has done it several times, which has increased the stock count by over 2,000%.

This is also one of the reasons why Sundial continues to be among the most popular penny stocks in the market. That being said, in an effort to bring up the SNDL stock price to $1, the company has announced that it will buy back equities worth CAD $100 million.

The stock repurchase program started on November 19, 2021, and as of November 2022, the company still has 101 million shares left on its repurchase program. This means that Sundial can continue to buy shares at opportunistic times to return value to shareholders.

Sundial Growers Stock Dividends

If looking for dividend stocks, Sundial Growers will not be of interest. Crucially, this company does not pay any dividends and has not indicated that it plans to do so in the future.

As we noted earlier, Sundial Growers is focusing on investing in retail stores and making other acquisitions. Moreover, the company is still unprofitable – so there is no money leftover to distribute to shareholders.

Factors Affecting Sundial Growers

There is a certain level of risk tied with all investments, and nothing is ever guaranteed in the stock market.

Nevertheless, those who are interested in Sundial Growers stock might want to consider the following benefits of owning this stock:

Diversified Portfolio

As we noted earlier, Sundial Growers has crafted a strategy to take advantage of its sudden popularity to branch out. While it continues to focus on the cannabis market, the company is also investing heavily in the liquor sector.

Its brand portfolio includes Sundial Cannabis, Palmetto, Grasslands, and Top Leaf. In the final quarter of 2021, Sundial Growers also announced the acquisition of Alcanna – one of the largest retailers of alcohol in North America.

This deal gives Sundial Growers a much better retail footprint that spans the cannabis and liquor markets. In fact, this makes Sundial the largest private-sector liquor retailer in Canada, with over 170 locations. Moreover, this deal also gives Sundial the opportunity to expand its retail cannabis operation by 78 stores through Alcanna’s majority-owned subsidiary, Nova Cannabis.

Sundial has also announced that it will be purchasing Zenabis – a cannabis company that has an indoor growing facility in New Brunswick. This will help Sundial increase its output and also allow the company to ship cannabis to Europe – opening up another revenue stream.

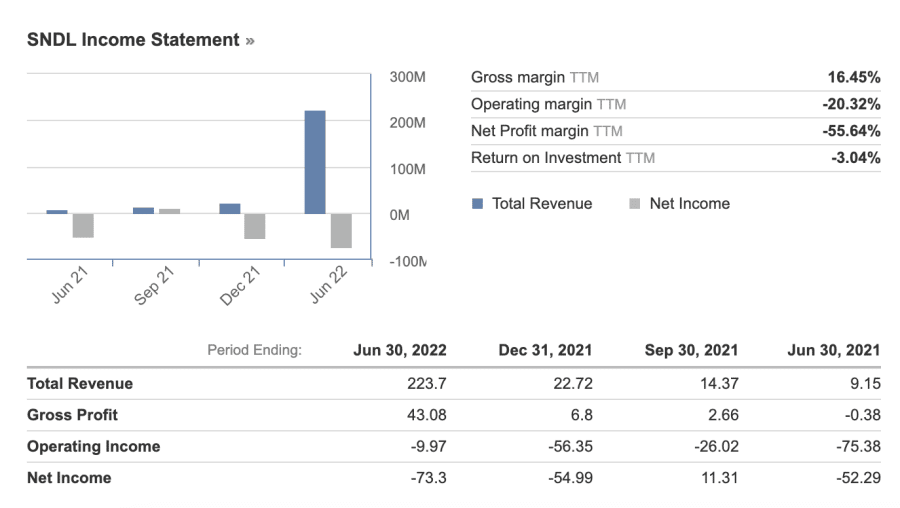

Increasing Revenues

In November 2022, Sundial Growers released its Q3 2022 earnings report, showing revenues of $173.6m. This was an incredible 1,500% increase from Q3 2021’s revenue figure.

Gross margin also increase by 2,723% on a year-over-year (YoY) basis. However, the company is still unprofitable and made a net loss of $74.4m. Although this looks bad, the figures do show that Sundial is moving in the right direction – which has helped create positive sentiment towards the company.

Cannabis Industry Has Room to Grow

At its core, Sundial Growers still fits into the category of a cannabis stock. And it is important for investors to keep in mind that this sector still has a high growth trajectory.

- While Sundial Growers operate primarily in Canada, with its acquisition of Alcanna, it also has the opportunity to venture into the American market in the future.

- With more US states legalizing Cannabis, Sundial’s targetable market is growing.

- Moreover, consumers within the existing marketplace are also becoming more interested in cannabis and related products.

- Finally, Sundial is now actively shipping cannabis to Europe. This has added another significant revenue generator for the company – and one that could expand rapidly in the years ahead.

This can work out well for Sundial Growers, given that the company is able to beat its competitors.

Sundial Grower Risks

Sundial Growers has improved significantly over the years. However, none of the positive factors are sufficient to outweigh the fact that there are many other candidates in this market – most of which have better prospects.

If considering cannabis stocks in the US, you might want to look past Sundial Growers. Some of the prominent players, such as Tilray, CuraLead, and Green Thumb, already have a larger market share in the cannabis sector.

Secondly, as long as the recreational cannabis market remains illegal at the federal level in the US, Sundial will not be able to compete with other big players in the space. Moreover, this also limits the amount that Sundial can expand by – which is why the company has begun to look overseas for revenue-generation opportunities.

In other words, before setting out to buy Sundial Growers stock, investors should consider how much risk they can handle.

Step 3: Open an Account & Buy Stock

Finally, when ready to buy Sundial Growers stock, investors can visit their chosen brokerage site to purchase the equity.

For beginners, we have created a step-by-step breakdown of buying Sundial Growers stock at a regulated broker.

Step 1: Open a Broker Account

Head over to broker’s website to create a free account. Users can get started by clicking ‘Join’ and filling in the required details.

This includes an email address, as well as a username and password.

Next, click on the ‘Create Account’ button. Users will have to confirm their email addresses before proceeding.

Step 2: Upload ID

When using an SEC-regulated broker, it is mandatory for all users to complete a KYC verification process.

To complete this step, users will need to provide some personal information – such as a full name, date of birth, home address, and phone number.

In addition to this, the broker will have to verify the information provided,

This requires the submission of two documents:

- Proof of ID – such as a copy of a driver’s license or passport

- Proof of Address – such as a copy of a bank statement or utility bill issued within the last three months

The broker will then check these documents and notify users when the verification is completed. The entire process is automated and takes only a couple of minutes – given that everything is in order.

Step 3: Make a Deposit

Users will then be able to make a deposit. The supported payments methods will vary depending on the broker, although common ones include credit/debit card, bank transfer, and e-wallet (e.g. PayPal).

Step 4: Search for Sundial Growers Stock

Most brokers have thousands of stocks. As such, the simplest way to locate Sundial Growers is to search for the stock.

Users can usually find the search bar on the homepage. Simply enter ‘SNDL’, or ‘Sundial Growers’ here to find the stock. When the result appears, click on ‘Trade’.

Step 5: Buy Sundial Growers Stock

Upon clicking the ‘Trade’ button, the broker will load up the order box for this particular stock. Here, users can specify the investment amount.

The minimum stake amount required will depend on the specific broker. To finalize the investment, use the ‘Open Trade’ button at the bottom of the order box.

The broker will then execute the order and users can find the stock added to the portfolio section of their account.

Sundial Growers Strengths and Weaknesses

Sundial Growers is not a business with wide profit margins. However, the stock presents a renewed investment opportunity, after its recent acquisitions of Alcanna and Zenabis.

Furthermore, revenues have increased over the prior year and from the looks of it, the company could continue to generate more income in the coming quarters – mainly driven by expansion into Europe.

Moreover, at less than $3, many might find Sundial Growers stock to be low-cost. As we noted above, the firm is looking to branch out into the retail market and would be in prime position to benefit if the US legalized cannabis at the federal level.

Many Sundial Growers stock forecasts suggest that it will breach the $5 mark soon. And with abundant cash flow, the company could manage to pull off a transformation – assuming that management delivers on its roadmap targets.

Having said all that, Sundial Growers stock presents a number of risks. The main risk is that the company is still unprofitable and doesn’t have the market share that its competitors do. Moreover, Sundial has had to branch into other sectors just to maintain a steady income stream. Finally, the consistent stock dilution has begun to take its toll on the share price – putting off a large percentage of investors.

Buy Sundial Growers Stock – Conclusion

This guide has discussed buying Sundial Growers in detail – covering some basic information about the company and its future prospects. We’ve also taken a closer look at the company’s financials and highlighted the pros and cons associated with owning shares.

Finally, we urge all investors to perform independent research to determine whether SNDL stock is a match for their portfolio – and to never invest more than they’re comfortable losing.