Snap Inc. is the parent company of Snapchat, a leading social media platform among teens and young adults across the world.

In this guide, we explain how to buy SNAP stock through a regulated broker.

We also review a list of popular brokers that might be considered when searching for the ideal place to buy SNAP stock.

How to Buy SNAP Stock With a Regulated Broker

Let us start with a step-by-step breakdown of how to invest in SNAP stock with a regulated broker:

- ✅Step 1 – Create an Account With a Registered Broker: The first step is to find a broker that is registered with the SEC and allows you to trade SNAP stock. Then, go to the broker’s website and set up an account. You will need to provide some personal details like your full name, date of birth, and home address.

- Step 2 – Upload ID: Regulated brokers comply with KYC guidelines and as such, require users to verify their identity by uploading a proof of ID and home address.

- Step 3 – Deposit Funds: Next, investors should fund their brokerage account. The majority of brokers accept payment via a bank wire and ACH. A smaller number of providers also support credit/debit cards and e-wallets such as PayPal.

- Step 4 – Research and Buy SNAP Stock: Investors should always conduct thorough and independent research before risking money on a stock. When ready, type in the SNAP stock ticker in the search bar of the brokerage platform, and enter the amount to invest in the company.

After finalizing the order, the broker will execute it instantly – assuming that the NYSE is open. Then, the purchased stock will be added to the investor’s portfolio on the respective platform.

Step 1: Choose a Stock Broker

Wondering where to buy SNAP stock? The first port of call is to have a clear idea of what to look for in a stock broker. Needless to say, it is important to choose a broker that is regulated and convenient to use.

Moreover, investors should also find out whether the chosen broker provides access to trading tools and offers support for multiple payment methods.

Based on these considerations, we have created a list of two popular brokers that offer SNAP stock – which we review below.

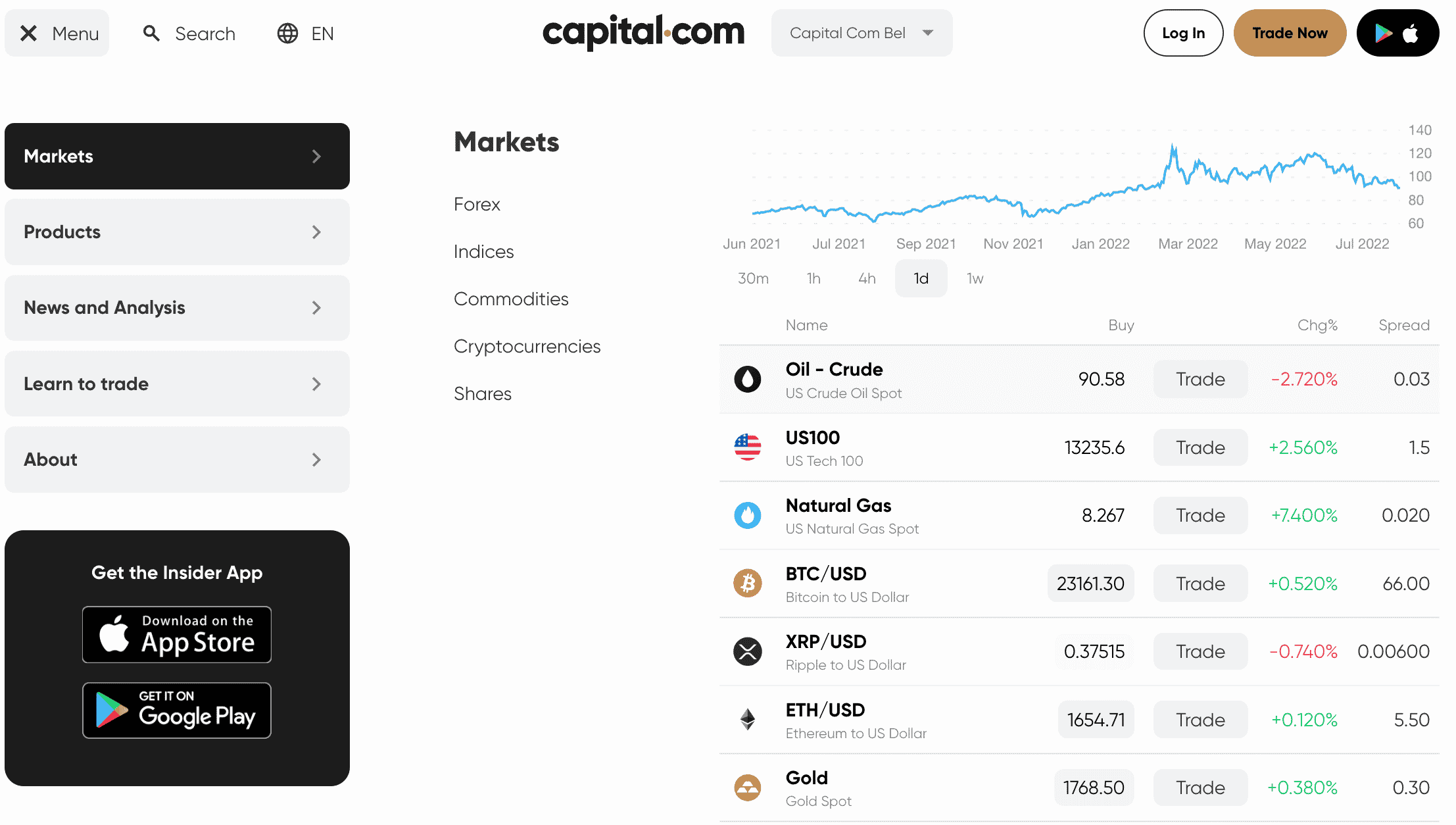

1. Capital.com

Instead, Capital.com lets its users speculate on SNAP’s future price through CFDs, which are financial tools that follow the live value of this stock. Additionally, when trading CFDs, investors can take advantage of both rising and falling markets. For example, if an investor thinks SNAP’s stock price will increase, they can open a long position.

On the other hand, if the speculation is that the price of SNAP will go down, an investor can set up a short position instead. To get started, investors can make a deposit into Capital.com using a credit/debit card, e-wallet, or through a bank wire transfer. The minimum deposit is $20, except when making a bank wire – for which users will have to meet a minimum of $250.

In terms of trading fees, Capital.com charges no commission at all. Moreover, there are no deposit or withdrawal fees either. However, investors will have to pay swap fees if they keep a position open overnight.

For this reason, CFD trading is the forte of short-term traders rather than long-term investors. The platform has many technical indicators that help its users arrive at their trading decisions. Advanced users will also appreciate that Capital.com supports MT4 – a superior third-party trading platform that comes with state-of-the-art tools.

The Capital.com platform is regulated by CySEC, FCA, ASIC, as well as NBRB. Apart from stocks, Capital.com can also be used to trade CFDs in the markets of cryptocurrencies, commodities, and forex.

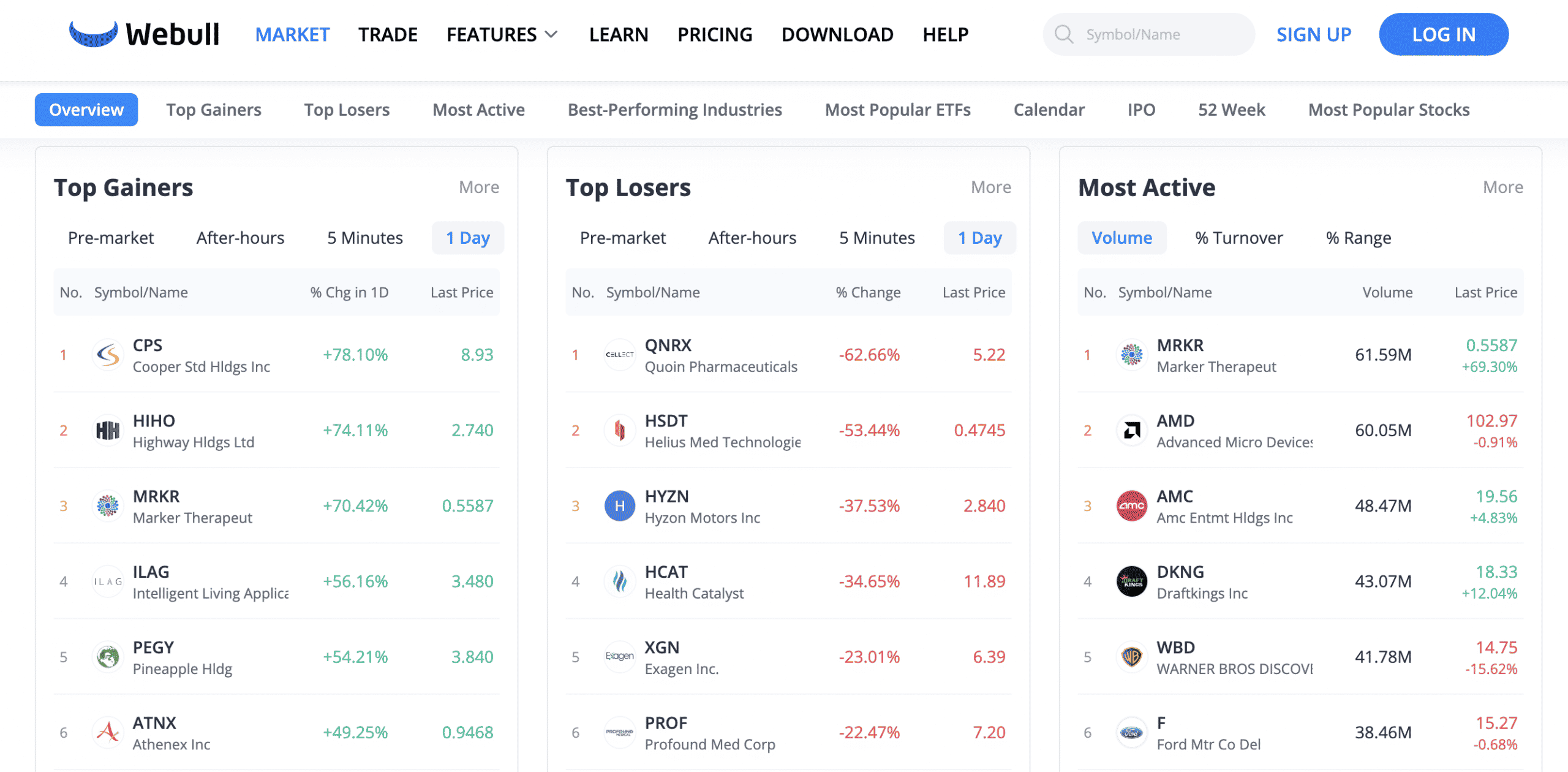

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Webull supports fractional investments into stocks. And with this broker, users only need to invest a minimum of $5 to purchase SNAP stock. Moreover, SNAP and most undervalued stocks can be purchased on a commission-free basis. Investors are offered access to foreign stocks via ADRs – which come with additional fees. Investors might also like the fact that Webull does not stipulate a minimum deposit amount. Users of this platform can deposit funds via ACH for free. Bank wires are also supported, but this comes with an additional fee of $8 when making deposits. Similarly, withdrawals made via bank wire are charged a $25 fee. Webull also offers demo trading accounts for its users. On top of this, this broker extends support for retirement accounts – including Roth, traditional, and rollover IRAs. When utilized, US-based investors can invest in the stock markets in a tax-efficient manner. Webull is regulated by the SEC, making it a secure broker to use for investment purposes.

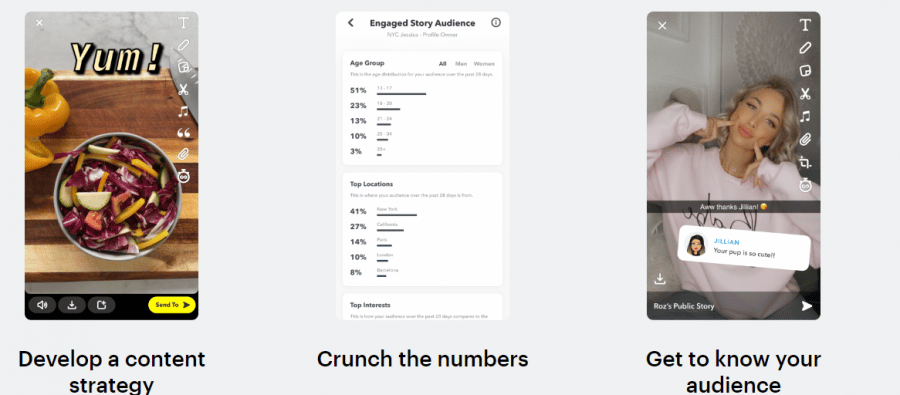

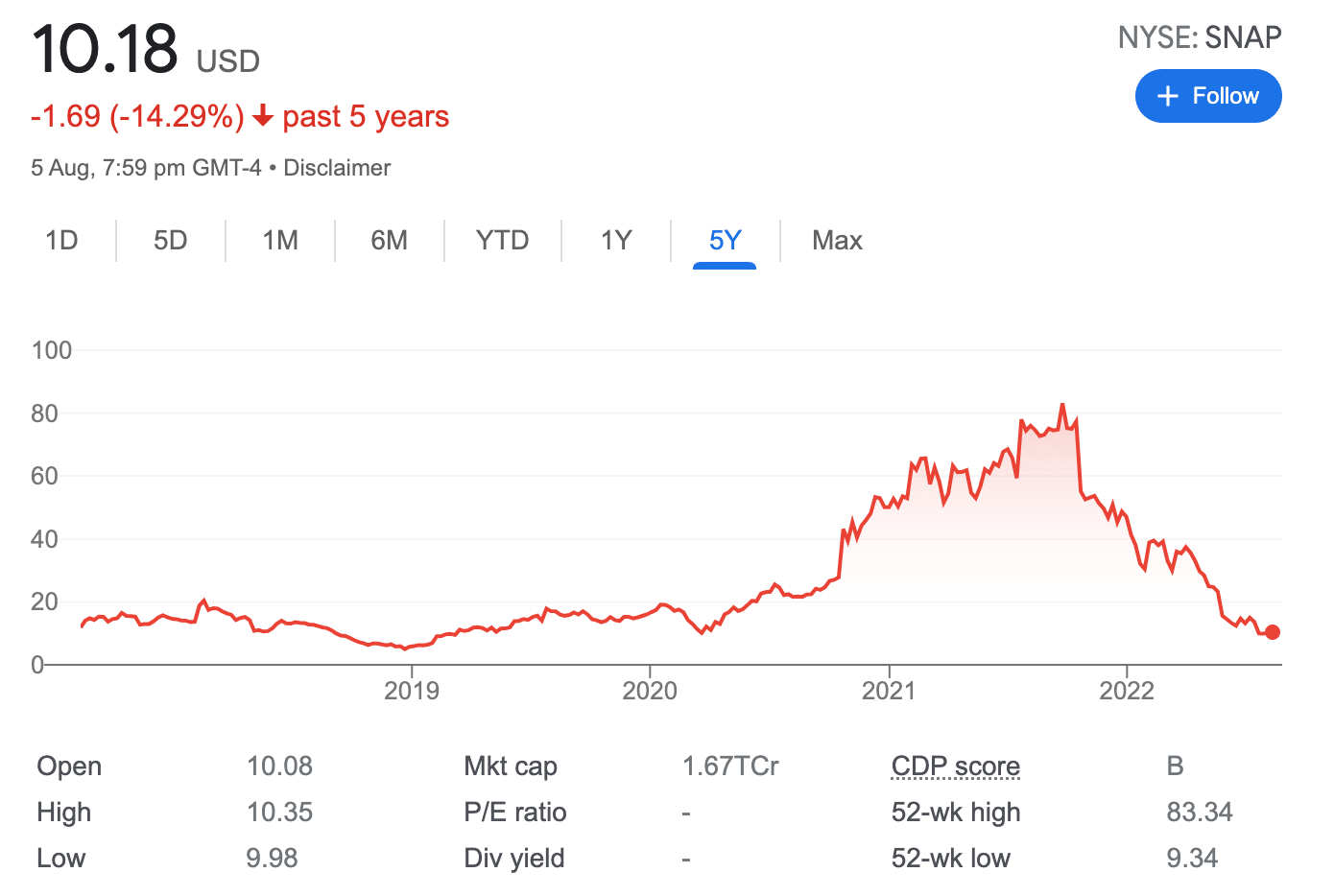

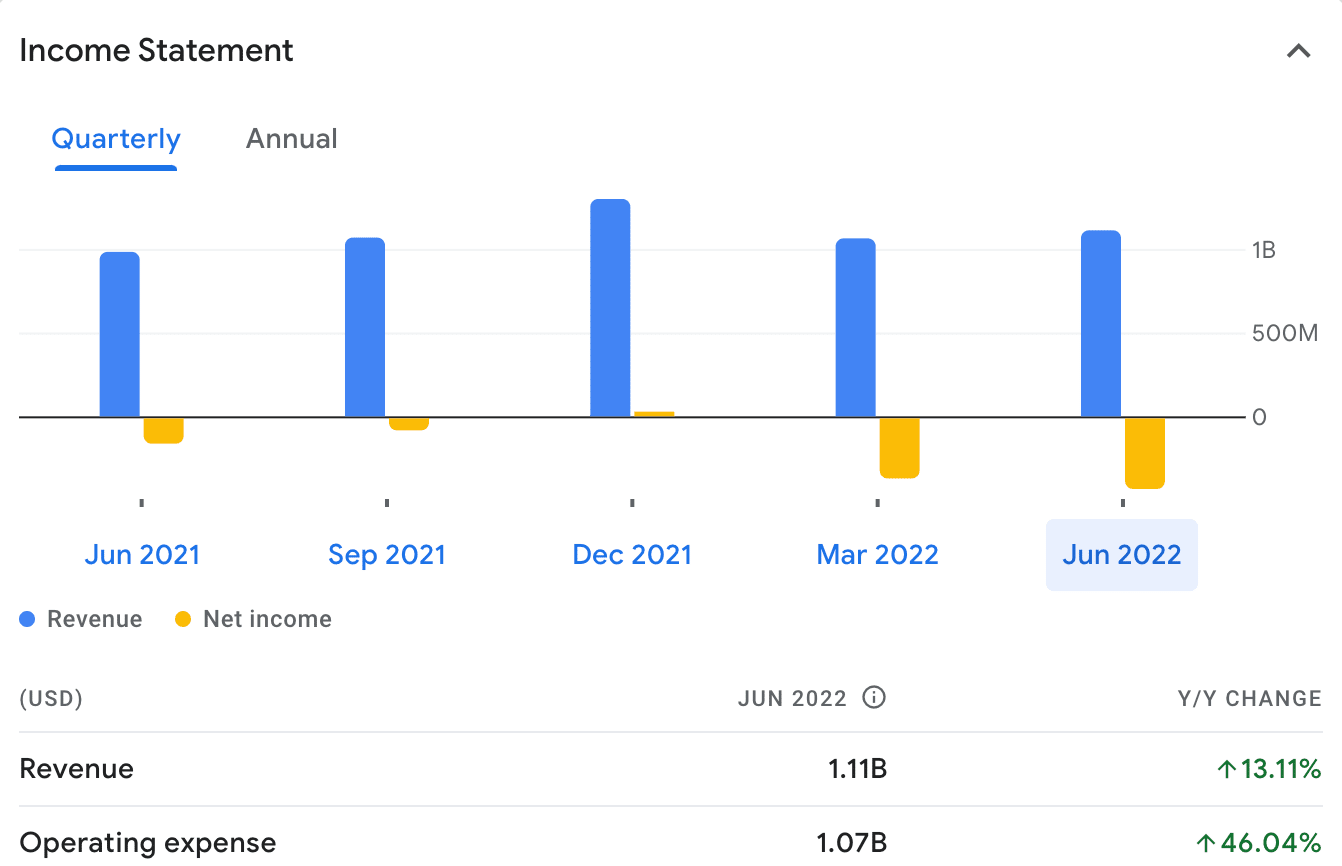

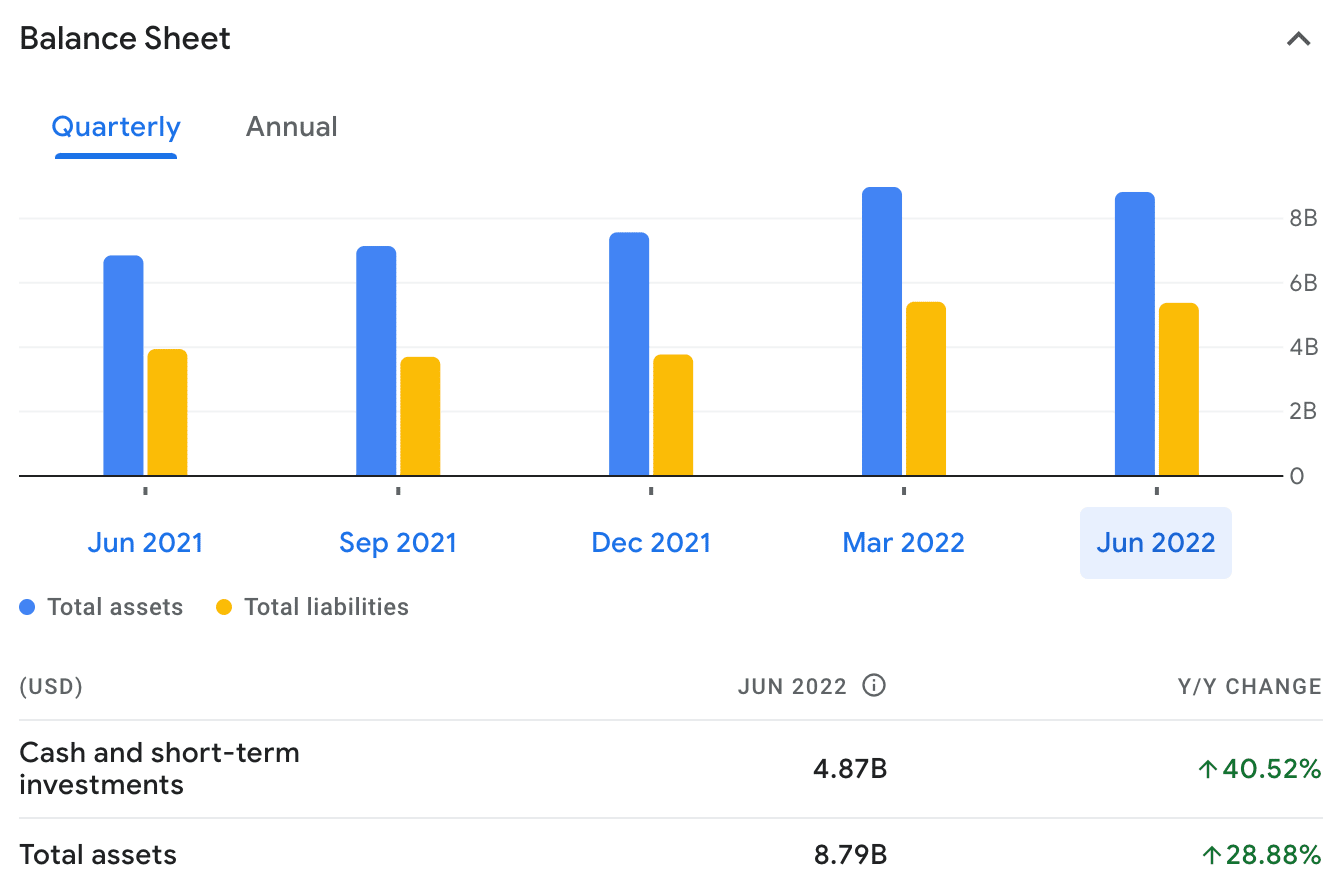

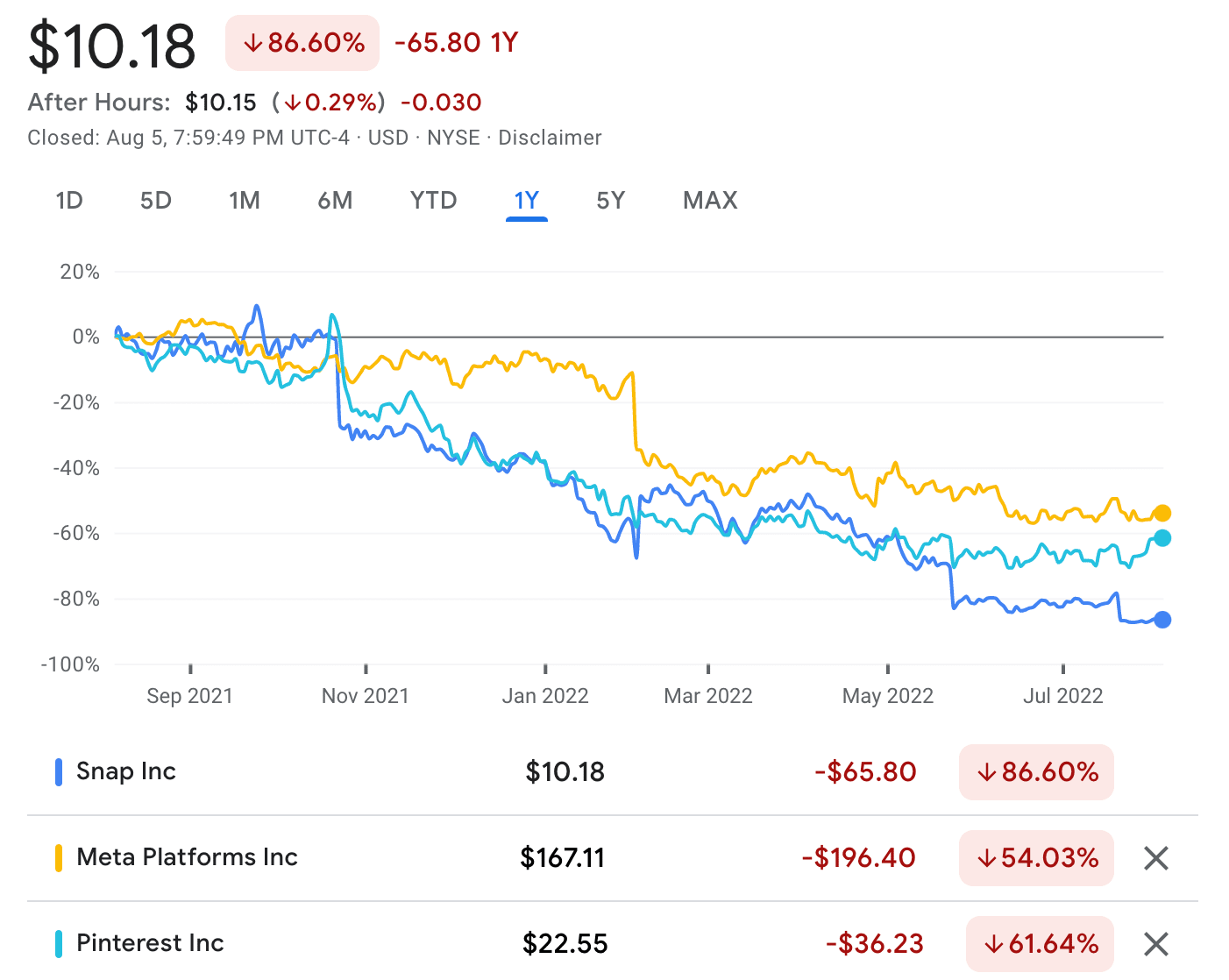

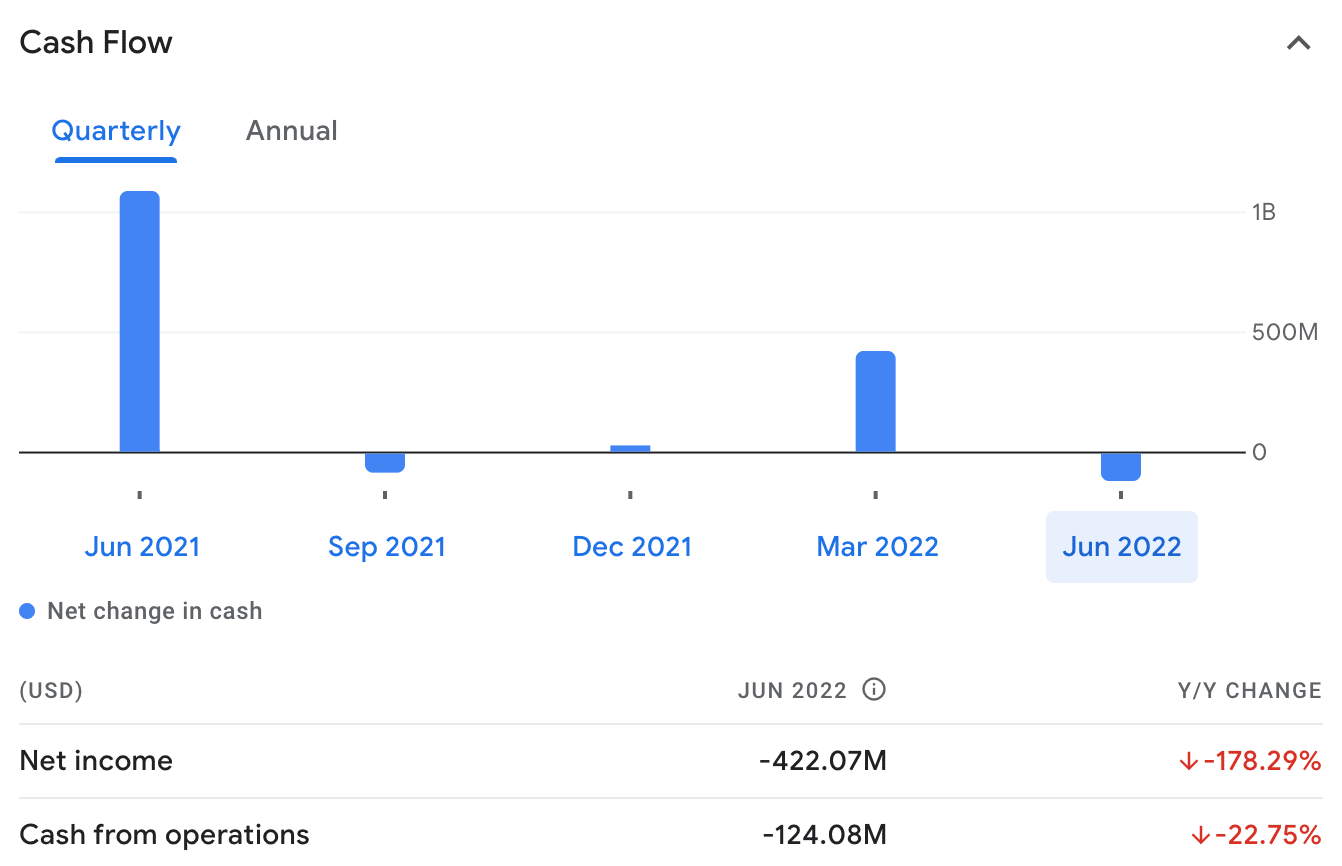

Your capital is at risk. No matter how experienced an investor is, it is necessary to do due diligence before putting money into a stock. This is particularly crucial for beginners who might not have a full understanding of how to invest in stocks online. So, in order to answer the question, ‘is SNAP a good stock to buy’, investors need to conduct independent research and figure out whether this company is a good fit for their portfolio. With this in mind, let us take a closer look at SNAP stock by analyzing its fundamentals. In simple terms, ‘SNAP’ is the ticker of the publically-traded company Snap Inc. Headquartered in California, Snap Inc is a camera company that was established in 2011. With that said, this firm is better known for its social media app, Snapchat. At the time of its release in 2011, Snapchat had several unique elements, and it wasn’t long before the app became hugely successful. By 2014, Snapchat was being used by nearly 50% of the 18-year-old demographic in the US on a daily basis. Soon enough, the platform started expanding, adding more features to its app. As of writing, Snapchat is now used by more than 300 million people. The two other notable products of this company are Spectacles and Bitmoji. Is Snapchat stock a buy or sell? To help answer this question, we have included a brief overview of the SNAP stock history. The company went public and started trading on the NYSE in March 2017. At the time of its IPO, a single SNAP share was priced at $17. By the end of the same trading day, SNAP stock had increased by over 40% – at around $24 per share. For the next three years, until 2020, the price of this stock did not witness any significant change. Towards the end of 2020, the value of SNAP entered an upward trend, profiting from the broad rise in stock prices across the market. In addition to this, the stock continued to gain value as a result of its positive earnings reports in Q1 and Q2 2021. Notably, between March and September 2021, the price of this stock increased by over 600%. However, by the beginning of October 2021, the SNAP stock price entered a downward trend. From the SNAP stock chart above, it is evident that the company is facing some serious challenges. SNAP stock price today, at the time of writing, stands at around $10. This is nearly 88% less than its all-time high in September 2021. EPS, or earnings per share, is a metric that is widely used by investors to determine a company’s profitability. Typically, when attempting to target above-average capital gains, investors tend to prefer stocks with a high EPS – which indicates that the company is earning more than what it’s spending. That said, growth stocks such as SNAP with a low EPS can still beat the odds. After all, it wasn’t until 2021 that Tesla reported its first full-year profit – 18 years after its inception. The price to earnings (P/E) ratio is another factor that can help evaluate if SNAP stock is a good buy. To arrive at a conclusion, investors should compare the P/E ratio of SNAP to the wider market. For instance, the average P/E ratio of North American software companies is 51. In comparison, SNAP has a P/E ratio of about 20. However, it is also necessary to evaluate the P/E ratios of SNAP’s direct competitors. That being said, one cannot rely on just the EPS or the P/E ratio to determine whether SNAP is worth investing in. Moreover, metrics such as the EPS and P/E ratio can vary dramatically if the company manages to amplify profits in the near future. This is why investors shouldn’t rely entirely on the past performance of a company. Rather, such metrics should be analyzed in conjunction with the firm’s scope of growth. Investors looking to generate a regular income might be in search of the best dividend stocks. If so, investing in SNAP will not be the ideal move to make. At the time of writing, SNAP does not pay any dividends. The main reason for this is that the company does not generate sufficient profits to be distributed cash to shareholders. This is in line with the majority of tech stocks that are in the early stages of growth. These companies tend to reinvest any profit made for research and development to drive the development of the firm. Every investor should first gain an understanding of the financial standing of Snap before risking any money. This is, perhaps, the most crucial step to deciding whether or not it is worth investing in Snap stock. In this section, we offer an in-depth analysis of the company, considering the various factors that might affect its stock market performance. Like other social media platforms, Snapchat is free to join and use. The company primarily makes its revenue from advertisements. In fact, only 1% of its earnings come from other product divisions. Crucially, in the last few quarters, SNAP has faced challenges in growing its revenue. On top of this, SNAP also decided to avoid providing financial guidance for the next quarter. In response to this uncertainty, the company’s stock took a hit on the market. So, when trying to figure out the answer to the question, ‘is Snapchat stock a buy’ – investors should also think of the drawbacks of this company and the challenges it faces. Needless to say, SNAP’s lack of profitability continues to be a cause of concern among investors. Another aspect that investors should look into is the debt of the company. As of Q2 2022, SNAP carries a financial debt of $3.74 billion – however, this is convertible. The company had previously managed to settle some of its 2025 and 2026 notes when the stock price of SNAP was high. However, at the time of writing, the price of SNAP stock is down 88% from its prior peak. Unless it recovers soon, the company could struggle to repay its debt. That being said, as per its Q2 2022 earnings report, SNAP has about $4.9 billion in cash and other marketable securities on its balance sheet. But the firm will need this cash to fund its operations. In other words, there is a chance that SNAP might be forced to repay the current debt by taking another loan – which will lead to unfavorable financing terms. With interest rates growing, this is less than ideal. So, while SNAP has enough cash to survive the current bear market, the company needs to get to a breakeven point. There is widespread speculation that the US economy is due to enter a recession. If and when this happens, the advertising industry will take a huge hit – which has been the case in recessions gone by. Companies are likely to cut their advertising and marketing costs to focus on other key aspects of their business. This can have a direct impact on the revenue of social media platforms like Snapchat – as the majority of its income comes from advertisements. If its advertisement revenues do drop, so will its ability to raise cash. Perhaps the most prominent challenge faced by Snapchat is the changing dynamics of the social media sector. Platforms such as Instagram and TikTok are growing rapidly and are the biggest rivals of Snapchat. As the audience flock toward other social media networks, Snapchat stands the risk of losing relevance in the industry. One key point that puts SNAP at a greater risk than other popular social media networks is that this company caters to a narrow audience – primarily young users. In comparison, the likes of YouTube and Instagram have universal appeal. which makes it easier for these social platforms to monetize their userbase – which isn’t the case with Snapchat. While it is clear that SNAP is in the midst of challenging times, it still has the potential to grow in the future. At the beginning of 2022, SNAP announced that it was breaking new ground in the field of augmented reality and is looking to capitalize on the growth of the metaverse. The company’s augmented reality smart glasses, Spectacles, can help achieve this goal. The technology used by Spectacles smart glasses overlays digital images and other information into a person’s field of view. This includes applications of AR technology, such as navigation, games, commerce, and more. Although Spectacles does not bring in much profit to SNAP at this moment, the technology has plenty of room to grow. In the meanwhile, the company is also looking for ways to generate revenue from AR on the Snapchat app. For example: The company is working to add more augmented-reality features to the Snapchat platform. If SNAP manages to profit from its AR initiatives, it has the potential to become one of the popular metaverse stocks in the coming years. Despite the fact that SNAP has strong competitors, the company has managed to sustain its user growth. As of Q2 2022, the photo and video sharing app has around 347 million daily active users from across the world. Therefore, when wondering ‘Is SNAP stock a buy’ investors should take time to understand the challenges faced by the company. Once the investor is armed with sufficient knowledge about SNAP, the final step is to buy stocks with a regulated broker. Although we offered a brief overview earlier, here – we have included a more detailed explanation of how to buy SNAP stock via a regulated online broker. Opening an account with an online trading platform often takes only a few minutes. First, investors will have to provide their email address and a suitable password and username they wish to use for the account. Next, proceed to verify the email address. In the next stage, investors will also have to provide some personal information, such as: After providing this information, online brokers will often require their users to answer a few questions related to their prior investment experience. This is to determine the trading knowledge and risk tolerance of the user so that the broker can suggest products accordingly. All regulated brokers require new users to verify their identities. As part of this process, investors will have to submit a valid government-issued ID – such as a passport or driver’s license. In addition to this, new users will also have to provide proof of address, like a utility bill. Identity verification can take anywhere from a few minutes to a couple of days. But if all the documentation provided is valid, investors will be able to buy SNAP stock. After getting verified, investors can proceed to fund their brokerage account. Most platforms support ACH and bank wires. Some brokers also enable investors to buy stocks with PayPal or other e-wallets. Nonetheless, when making a deposit, make sure to enter the minimum amount required to invest in SNAP. Next, use the search bar of the brokerage platform and enter the SNAP stock symbol. When the correct result appears, click on the stock to proceed. On the order page, enter the amount of capital to use to buy SNAP stock and confirm the order. The broker will execute the order and will add the stock to the investor’s portfolio. To summarize, this guide has covered the important aspects investors need to know before they buy SNAP stock. We have discussed the fundamentals of this company, as well as its prospects. SNAP faces intense competition in the market and is yet to achieve profitability. Nonetheless, SNAP is still a growth stock in its early stages of development, so a lack of profitability at this moment in time is not a major surprise. Crucially, by following this guide, investors will be able to choose the right broker to buy SNAP stocks as safely and cost-effectively as possible.

Approx No. Stocks

5,400

Min Deposit

$20

Cost to Trade SNAP Stock

0% commission + spread

2. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy SNAP Stock

0% commission + spread

Step 2: Research SNAP Stock

What is SNAP?

SNAP Stock Price – How Much is SNAP Stock Worth?

SNAP Stock – EPS

SNAP Stock – P/E Ratio

SNAP Stock Dividends

SNAP Stock: Fundamental Research

Revenue Model

Long Term Debt

A Potential Decline in Advertising Spending

Fierce Competiton

Expansion into AR

Increasing User Base

Step 3: Open a Trading Account & Buy Snap Stock

Open a Brokerage Account

Upload ID

Deposit Money

Buy SNAP Stock

Conclusion

FAQs

Can you buy Snapchat stocks?

How much does it cost to buy Snapchat stock?

How much is Snapchat worth in 2022?

Is Snapchat a public company?

Is SNAP a good stock to buy?

Should I buy SNAP stock?

When can I buy Snapchat stock?