Interested in learning how to buy SAVA stock with a regulated broker? Many investors noticed the record 2,300% move higher last year. The key question now is whether or not the Cassava Sciences (SAVA) share price will repeat the same growth again.

In this article we research the fundamentals of the SAVA stock price, analyse all the recent SAVA news and go through how to buy SAVA stock with a fully-licensed stock trading platform in 2025.

How to Buy SAVA Stocks 2025

Below is a four-step guide on how to invest in SAVA stock with a regulated broker.

- Open a stock trading account – You can open an account with a FCA-regulated broker in just a few clicks by visiting the official website.

- Upload ID – To comply with regulations and keep your capital safe, simply upload a proof of address and ID to verify yourself.

- Deposit – Traders can deposit funds using a variety of methods such as credit/debit card, bank wire transfer, PayPal and more.

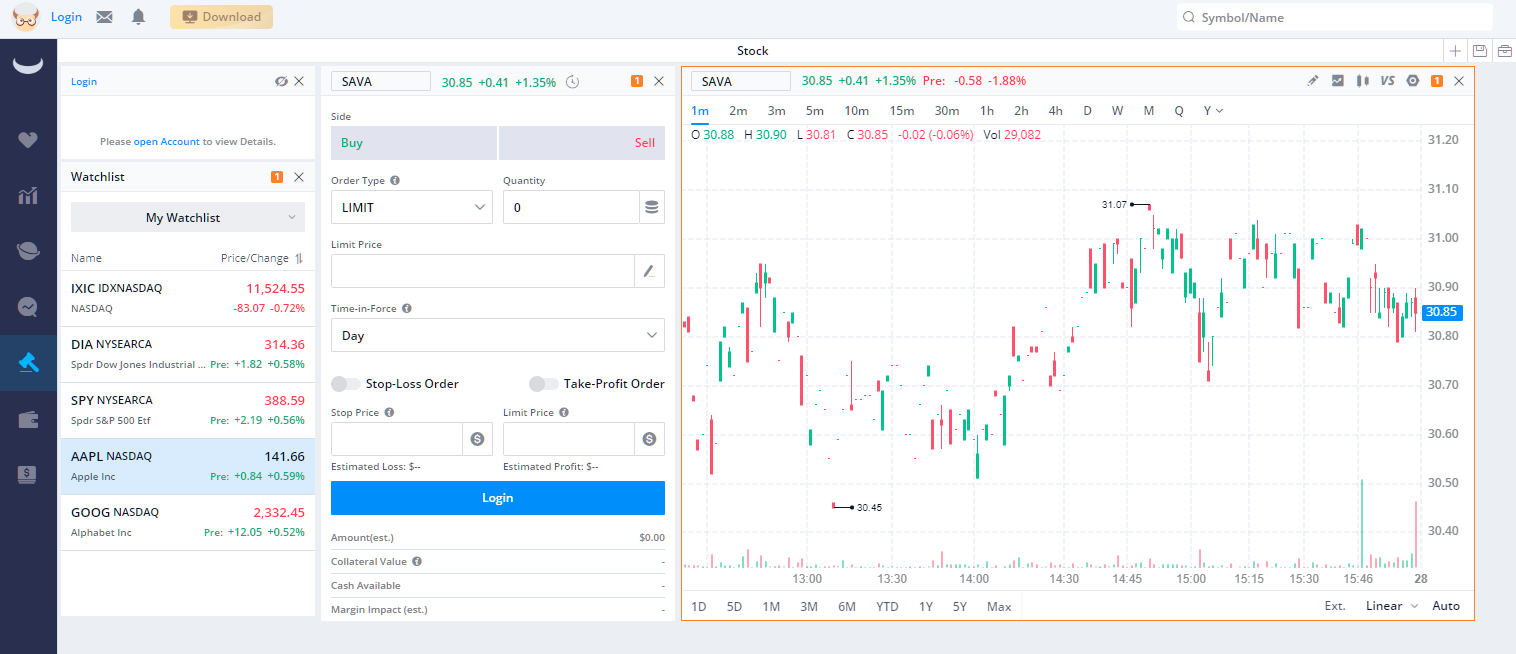

- Buy SAVA Stock – You can invest in SAVA stock after you’ve conducted your own market research. It’s important to remember that stocks are volatile assets and you should only invest capital that you can afford to lose.

Step 1: Choose a Stock Broker

The most important step before you buy SAVA stock is to make sure you are using a fully regulated stock trading platform.

Webull

Webull is another stockbroker that was formed in 2017. Webull provides the ability to invest in stocks with thousands from the US with 0% commission. However, the offering of stocks outside of the United States is limited.

The broker’s web platform is packed full of different features. With Webull, investors can also access other markets such as cryptocurrencies and products such as options trading and fractional investing.

Regulated by the Securities & Exchange Commission (SEC) and FINRA, Webull does provide a high level of safety and security for your funds. Webull’s offering is mainly catered to US clients with accounts such as Individual Retirement Accounts (IRAs) only available to US clients.

Active stock market investors will also be limited to the regulator’s pattern day trading stocks rules which only allows for 3 day trading, or short term positions every 5 business days and a requirement to maintain a minimum $25,000 account size.

Webull is also a member of the SIPC which protects clients up to $500,000. The broker does provide a wide range of extra research tools and a feature-rich trading platform and mobile trading app.

| Number of Stocks: | 5,000+ |

| Pricing System: | 0% commission + Spread |

| Cost of Buying SAVA: | Only spread fee from $0.14 cents |

Your capital is at risk.

Step 2: Research SAVA Stock

It’s important to analyze what Cassava Sciences (SAVA) does, the Cassava Sciences stock news that can impact its future price direction and understand some of the core fundamentals of the SAVA stock price.

What is Cassava Sciences?

The SAVA stock ticker refers to the symbol for biotechnology company Cassava Sciences Inc. While established in 1998 under the name Pan Therapeutics in Austin Texas, the company changed its name as it shifted its focus to the development of novel drugs for neurodegenerative diseases.

Cassava Sciences have a core focus on detecting and treating Alzheimer’s disease. Some of the company’s most well known products include Simufilam and SavaDx. The biotech company also has a range of clinical trials underway called rethinkALZ and refocusALZ.

SAVA Stock Price – How Much is SAVA Stock Worth?

Understanding the Cassava Sciences stock price financial metrics can help to understand the health of the company and the trend for the future.

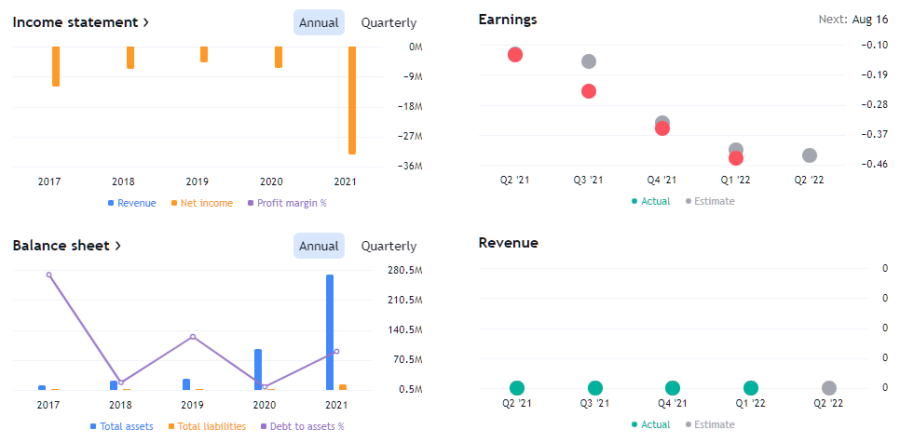

The SAVA stock history and financial metrics shows that the company has a market cap of around $1.22 billion. The current price-to-earnings (P/E) ratio is -26.24. The reason the P/E ratio is negative is that its operations are still in the clinical stage with the firm not generating any revenue or cash flow yet.

In the latest quarterly earnings report on 5 May, Cassava Sciences reported $0.44 earnings per share (EPS) for the quarter which missed analysts’ estimates of $0.42 EPS. However, most analysts are forecasting the next EPS to be negative at -$1.75.

SAVA Stock Dividends

Want to learn how to buy SAVA dividend stock? Unfortunately, investors cannot as Cassava Sciences stock does not pay out a dividend to shareholders and therefore has no dividend yield. This is common for biotechnology companies as instead of paying any profits to shareholders, the money gets reinvested for more growth.

Dividends are rewards paid out to shareholders for the investment in the company. The dividend stocks are more common among mature and stable companies that are already established and less likely to grow as fast as a technology company.

The new stocks for dividends tend not to be new technology companies as investors would want the company to invest profits back into the business to grow and increase the share price to then pay dividends in the future.

Cassava Sciences Has Money in the Bank

Research and development and running clinical studies can be an expensive business. More importantly, for clinical trial companies such as Cassava Sciences, it is important to have enough money in the bank to fund its studies.

This is because clinical trial companies aim to profit from the commercialization of a drug that has worked well in clinical studies. Investors are more likely to invest in the rollout of the drug or a bigger pharmaceutical company will pay billions for the formula and the license of the product.

Currently, Cassava Sciences has more than $230 million in the bank. With only around $230,000 in debt and last year’s total expenses of just $32.8 million, there seems to be enough money in the bank to invest in research and development and clinical trials.

SAVA’s Leading Simufilam Drug is in Phase 3 Clinical Trials

Cassava Sciences’ leading drug is Simufilam. It is a proprietary name for a small oral drug that aims to restore the normal shape and function of the filamin scaffolding protein within the brain which is typically altered in neurodegenerative diseases such as Alzheimer’s.

So far, the drug has been reported to restore impaired neuron and cognitive functions in mice. The drug is now undergoing Phase III clinical trials which are expected to finish in 2023 or 2024.

The first human trials in 2020 showed promising results in a non-placebo controlled study across 13 Alzheimer’s patients. Later on, a study across 50 patients showed that over 9 – 12 months the treatment improved cognition through analysis of biomarkers from the cerebrospinal fluid.

The prospects for the drug are very high. However, a petition to the US Food and Drug Administration (FDA) may cause a pause in Phase III clinical trials for the drug as scientists questioned certain anomalies in Cassava’s findings.

But, the lead petitioner was also the biggest short seller in the stock which led to a substantial gain in financial profit, questioning the original petition to the FDA.

Only 1 Other Product in the Pipeline SavaDX

SavaDX is Cassava Sciences’ blood-based diagnostic test to detect Alzheimer’s disease. The aim is to try and identify the diseases years before any overt symptoms. In early studies, SavaDX detected 10 times the differences between patients with Alzheimer’s and healthy individuals.

Currently, the clinical program is funded by research grants from the National Institute of Health (NIH). However, the issue is that it is a long way off Phase III clinical trials and commercialization. The latest earnings report also stated that the company’s core focus is on the development of their lead candidate Simufilam.

SAVA Stock – Fundamentals

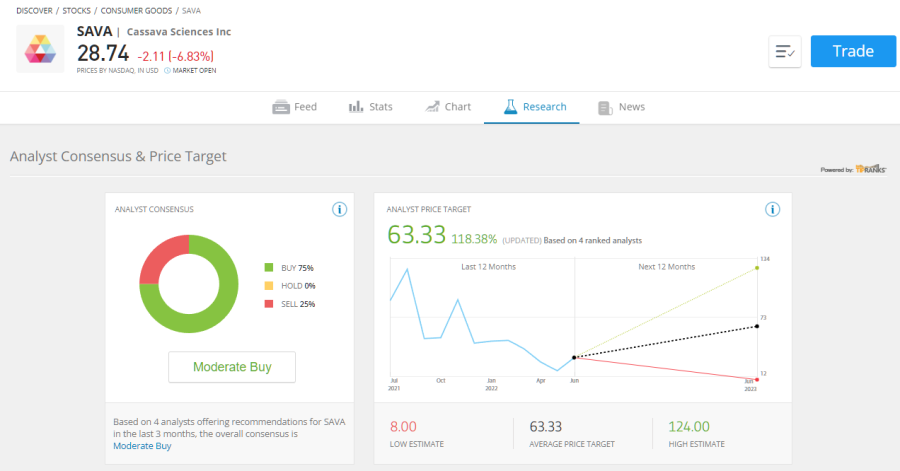

While investors can buy SAVA stock with a regulated trading platform, it’s worthwhile doing some extra research on how the analysts view a Cassava Sciences forecast.

Investors can access research from the platforms which offer data from a range of sources. Currently, of the 4 analysts surveyed by a major broker for a Cassava Sciences stock forecast, 3 suggest buying SAVA stock while 1 suggests selling the stock.

The highest price target from the bullish analysts is $124.00 while the lowest price target from the bearish analyst is just $8.00. This is a big difference of opinion and one which only paints a small part of the overall picture.

The bullish case for SAVA stock is clear according to market analysts. If Phase III clinical trials of their lead drug candidate Simufilam presents promising results, some market experts have suggested that the stock price could surge higher and revisit record highs once again.

Both Phase I and Phase II trials offered encouraging results which led to the more than 5,000% return in the SAVA stock history over the past few years.

However, recent events have caused the stock price to decline nearly 80% from its record high. This was largely due to a highly publicized report from a group of short-sellers picking apart Cassava’s findings from its clinical trials that request the FDA to halt the trial.

While Cassava provided an extensive rebuttal and was found to have no evidence of impropriety from a scientific journal review – as claimed by the short-selling group – the stock has not yet recovered.

Conclusion

The most important question is where to buy SAVA stock? When dealing with high volatility biotech stocks it’s important to keep the risk low. This is where fully regulated brokers such as Webull come in as you can invest in SAVA stock starting with 0% commission and low spread fees.