Peloton sells exercise equipment alongside a successful interactive fitness platform. The firm formed part of a handful of stay-at-home stocks that benefited during the COVID-19 pandemic

In this guide, we explore the ins and outs of Peloton stock to understand if this company is a viable investment. We also explain how to buy Peloton stock via a regulated broker on a commission-free basis.

How to Buy Peloton Stock With a Regulated Broker

Peloton stock trades under the ticker symbol PTON on the NASDAQ exchange.

Here’s how to buy Peloton stock in four simple steps:

- ✅Step 1 – Open an Account With a Regulated Broker: Visit a suitable online broker and open a new trading account. Begin the registration process by providing a valid email address and setting a password.

- Step 2 – Upload ID: To comply with KYC standards, regulated brokers require their users to provide proof of identity – such as passport or national ID card. In addition to this, users will also need to submit proof of address – such as a bank statement.

- Step 3 – Deposit Funds: Some online brokers support a range of payment methods, including bank transfers, credit/debit cards, and e-wallets. To deposit funds, specify the amount and carry out the transaction using the preferred mode of payment.

- Step 4 – Research and Buy Peloton Stock: Before buying Peloton stock, investors should spend some time researching the company. After that, search for ‘Peloton’ on the brokerage platform. In the order box that appears, enter the position size and place the trade.

For complete beginners, we have included a more detailed step-by-step explanation of the Peloton stock investment process further down in this guide.

Step 1: Choose a Stock Broker

Peloton is a US-based, mid-cap stock trading on the NASDAQ. As such, finding an online broker that offers access to this stock is a relatively simple process.

However, when considering where to buy Peloton stock, investors should explore a few key factors before choosing a broker. This includes the regulatory standing of the broker, what fees are payable, supported payment methods, and the overall convenience of using the platform.

Below, we provide a brief overview of two popular stock trading platforms that list Peloton.

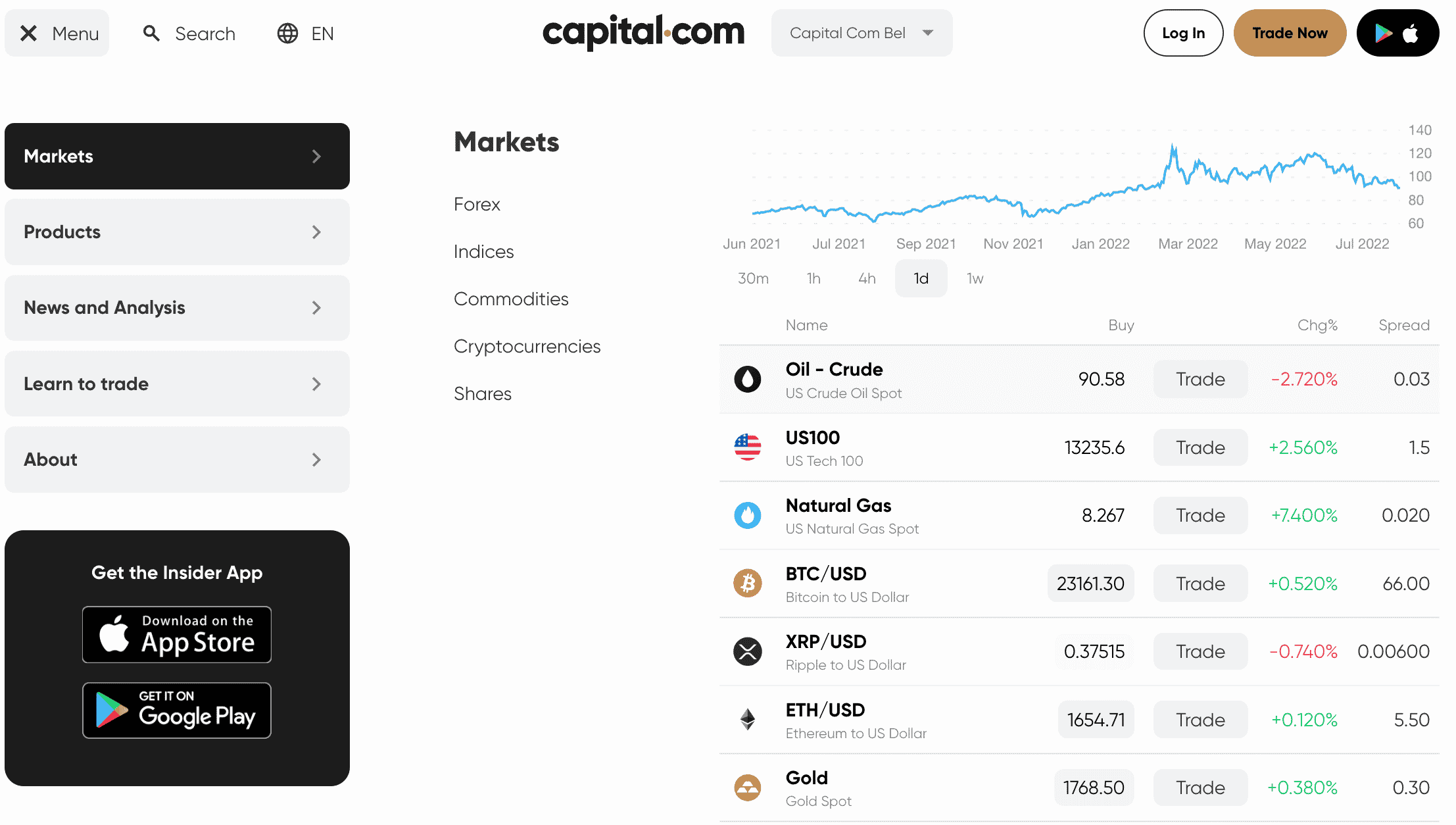

1. Capital.com

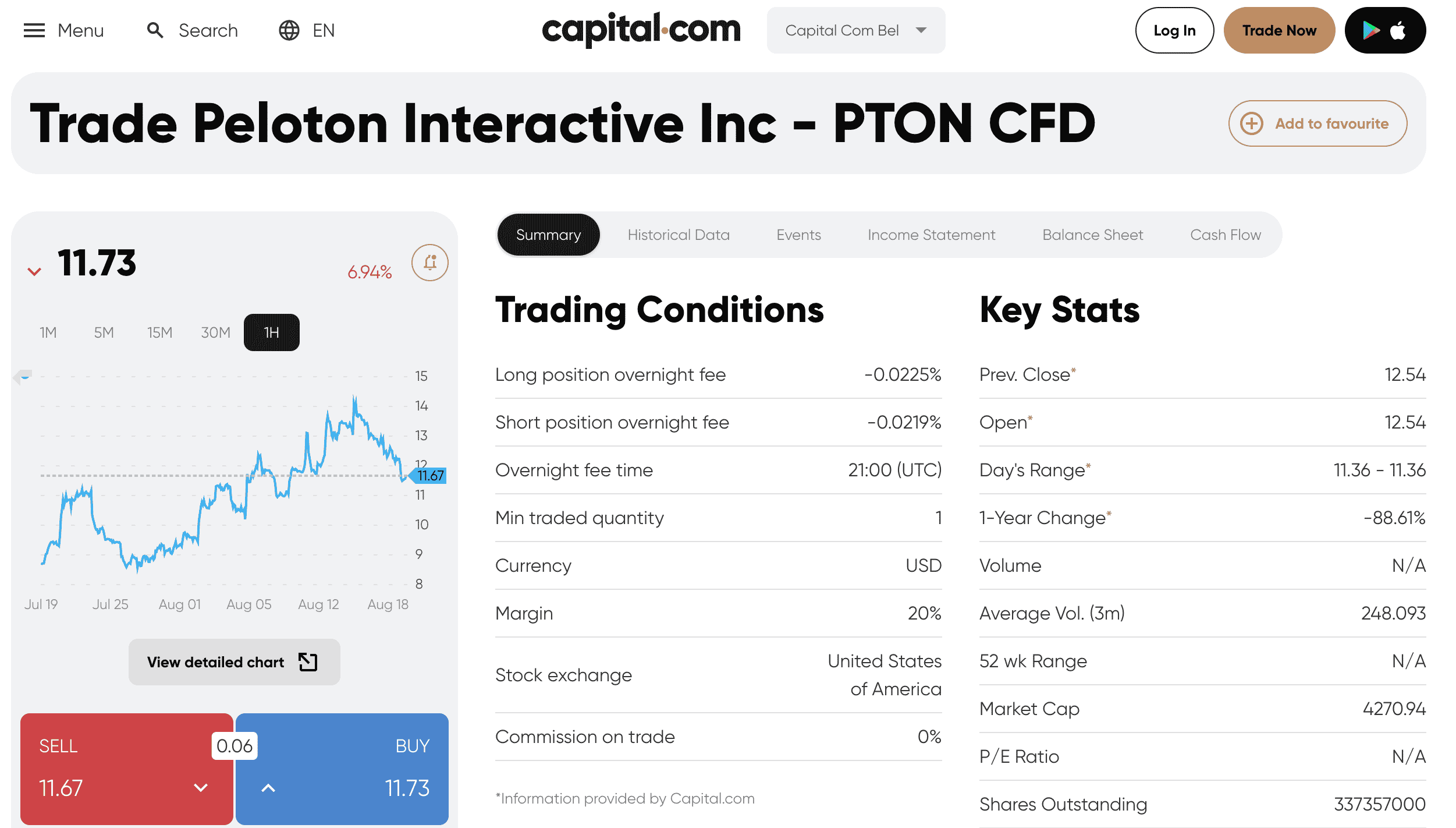

However, those looking to capitalize on the short-term volatility of Peloton stock might consider trading CFDs. And Capital.com is a popular platform that specializes in this financial derivative. It accepts customers from many countries around the world, except the US – where CFD trading is prohibited.

Non-US investors can get started with the platform in less than five minutes. Capital.com allows users to trade Peloton stock on a 0% commission basis, along with a competitive spread. Moreover, Capital.com supports fractional trading, with a minimum investment of just $1.

For funding, Capital.com accepts instant payments via debit/credit cards and e-wallets. For these payment options, the account minimum stands at $20. Bank wires are also supported, but investors will have to deposit at least $250 when using this method.

Since Capital.com deals with CFDs, users can also go long or short on Peloton stock. Moreover, the platform supports margin trading and offers retail clients leverage of up to 1:5. This means that investors can open a position worth $5,000 by risking only $1,000 from their trading capital.

In addition to charging 0% commission, Capital.com processes deposits and withdrawals for free. However, when keeping CFD positions open overnight, users will be liable to pay ‘swap’ fees. Therefore, bear in mind that fees can add up when a position remains open for multiple days.

This is why CFD trading is a strategy used mostly by day and swing traders. When compiling this Capital.com review, we also found out that the platform enables users to trade via MT4 and offers access to more than 70 technical indicators. There are thousands of charts available at the users’ disposal, along with the option to set price alerts for specific stocks.

Capital.com also has a dedicated section for educating beginner traders. In addition to stocks, the broker supports commodities, cryptocurrencies, and forex markets. Finally, Capital.com holds licenses from the FCA, CySEC, NBRB, and ASIC.

Finally, Capital.com is

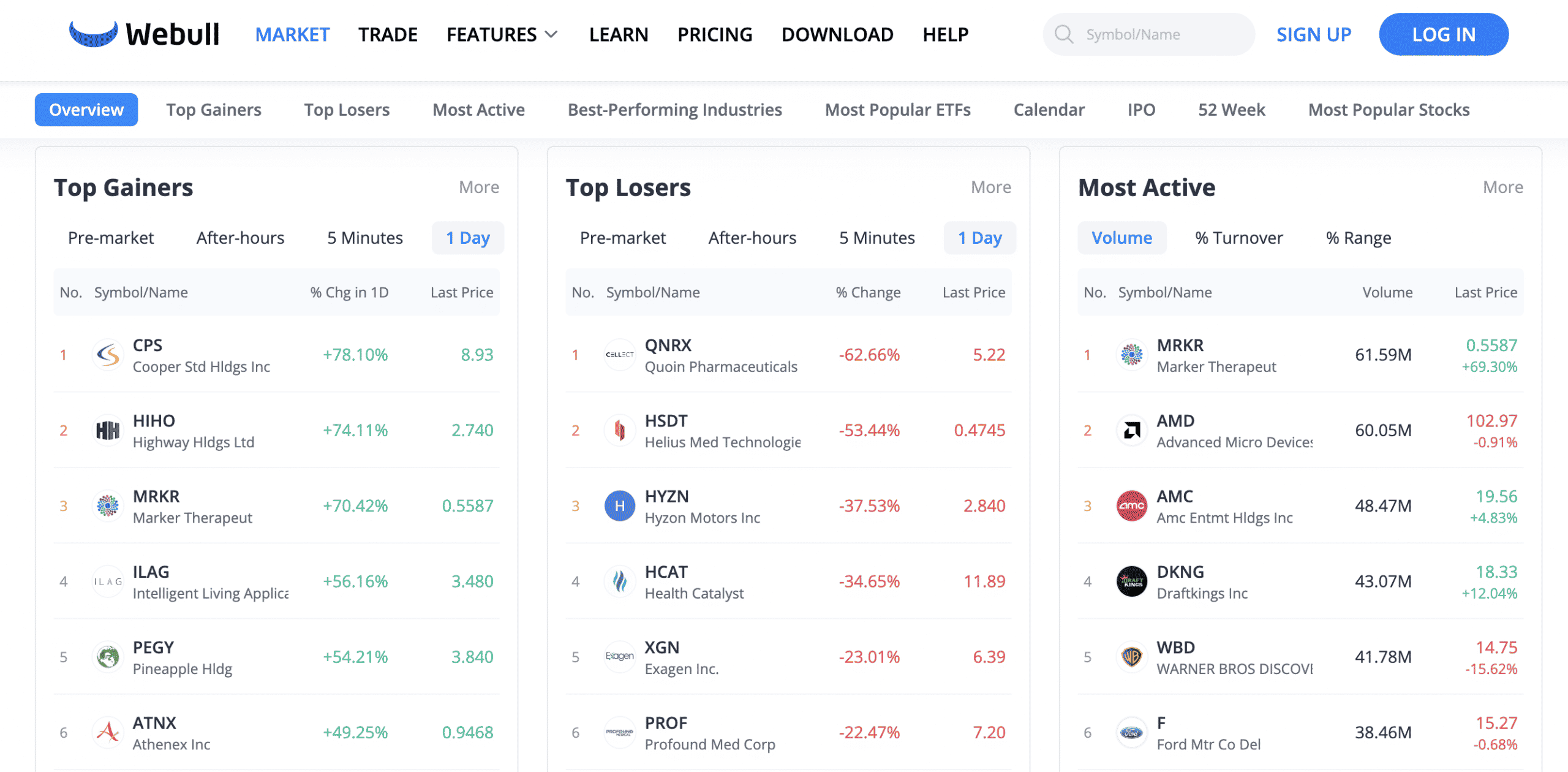

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Nevertheless, investors can open a brokerage account with Webull without having to meet any minimum deposit requirement. Moreover, Webull supports fractional investments. Here, users can buy Peloton stock from just $5. Webull has also implemented a no-commission pricing plan for US-based stocks such as Peloton. However, when trading international stocks, Webull users will need to keep an eye out for additional charges. The platform comes with over 50 technical indicators and other charting tools that help investors with the decision-making process. In terms of funding, investors can make deposits via ACH and wire transfer. The latter will cost an additional $8 when adding funds and $25 when making a withdrawal. Out of the three platforms we listed here, Webull is the only broker that supports retirement accounts. This includes Roth, traditional, and rollover IRAs. And moreover, all these retirement accounts can be opened and maintained without paying any additional fees. Webull also provides a safe trading space for its users, as it is regulated by the SEC. This broker also supports demo accounts for stocks – enabling users to test their strategies in real-time market conditions.

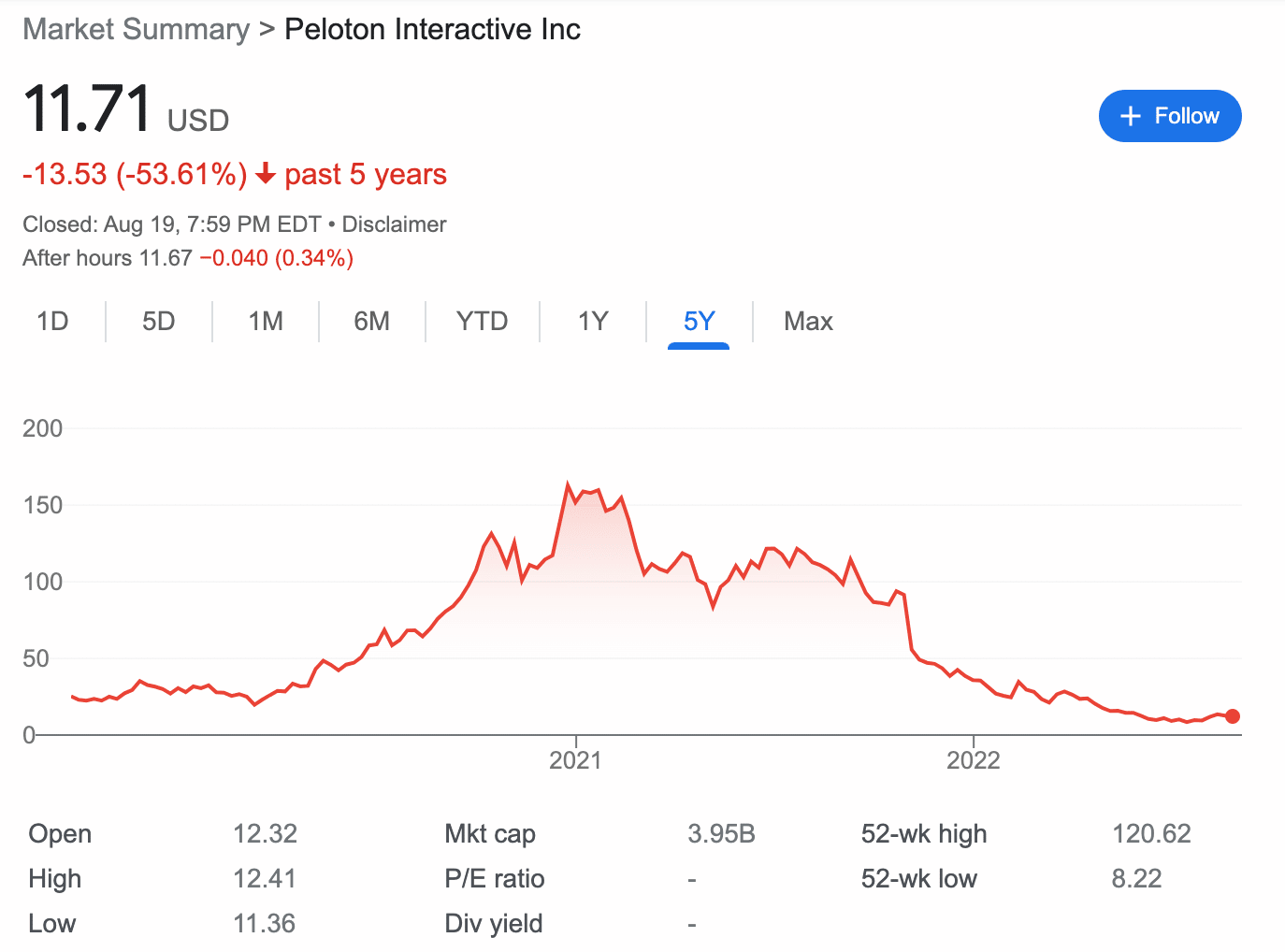

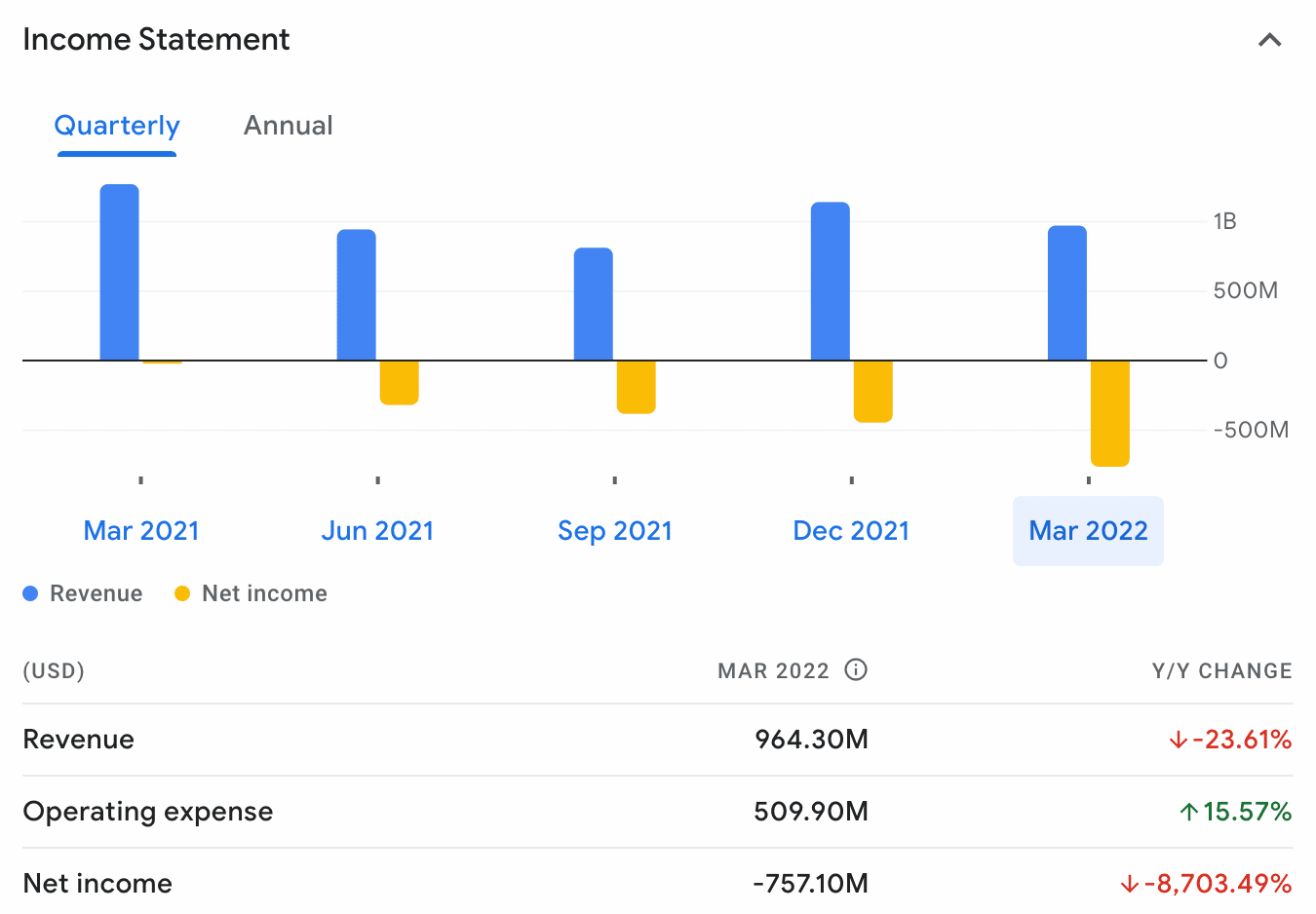

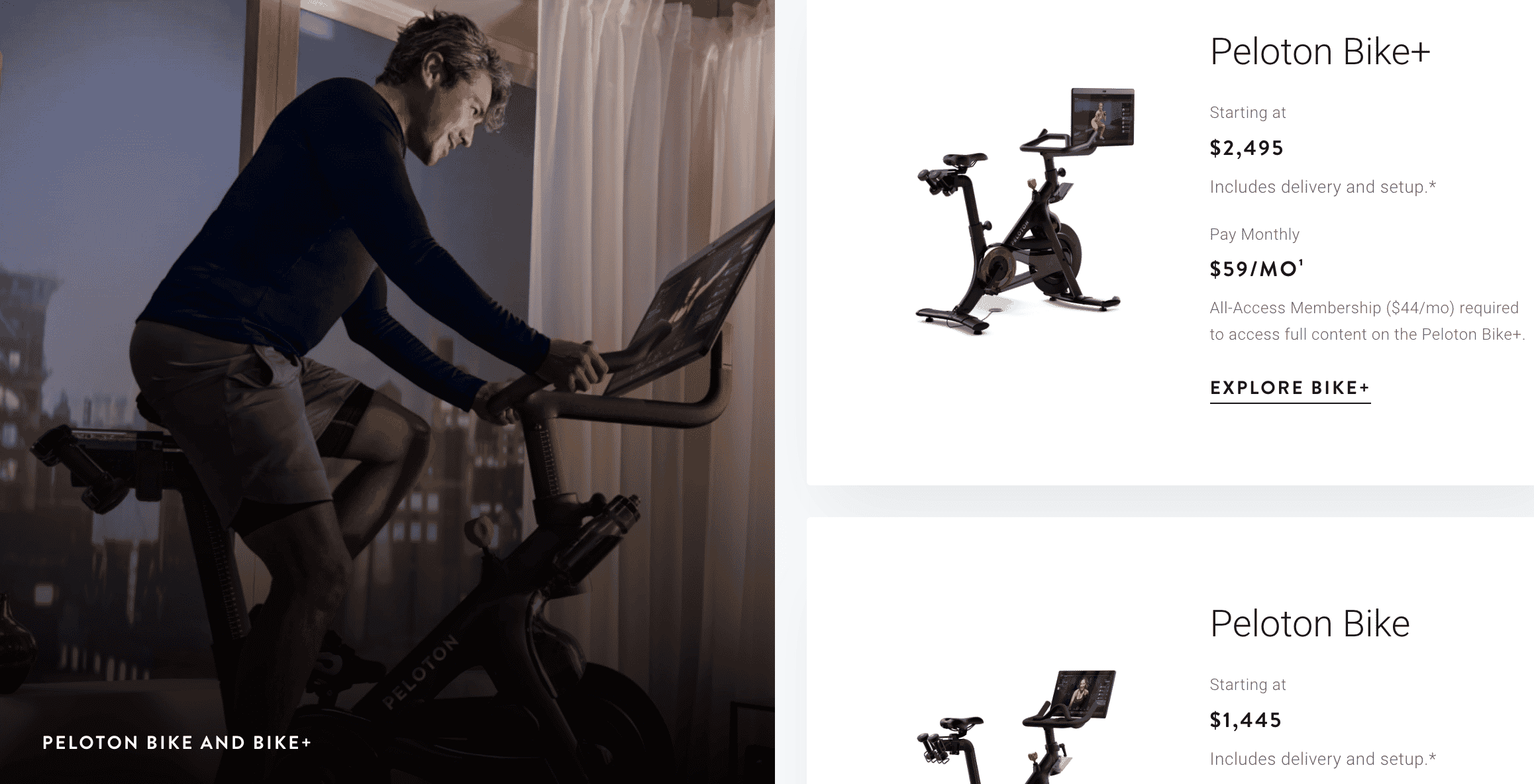

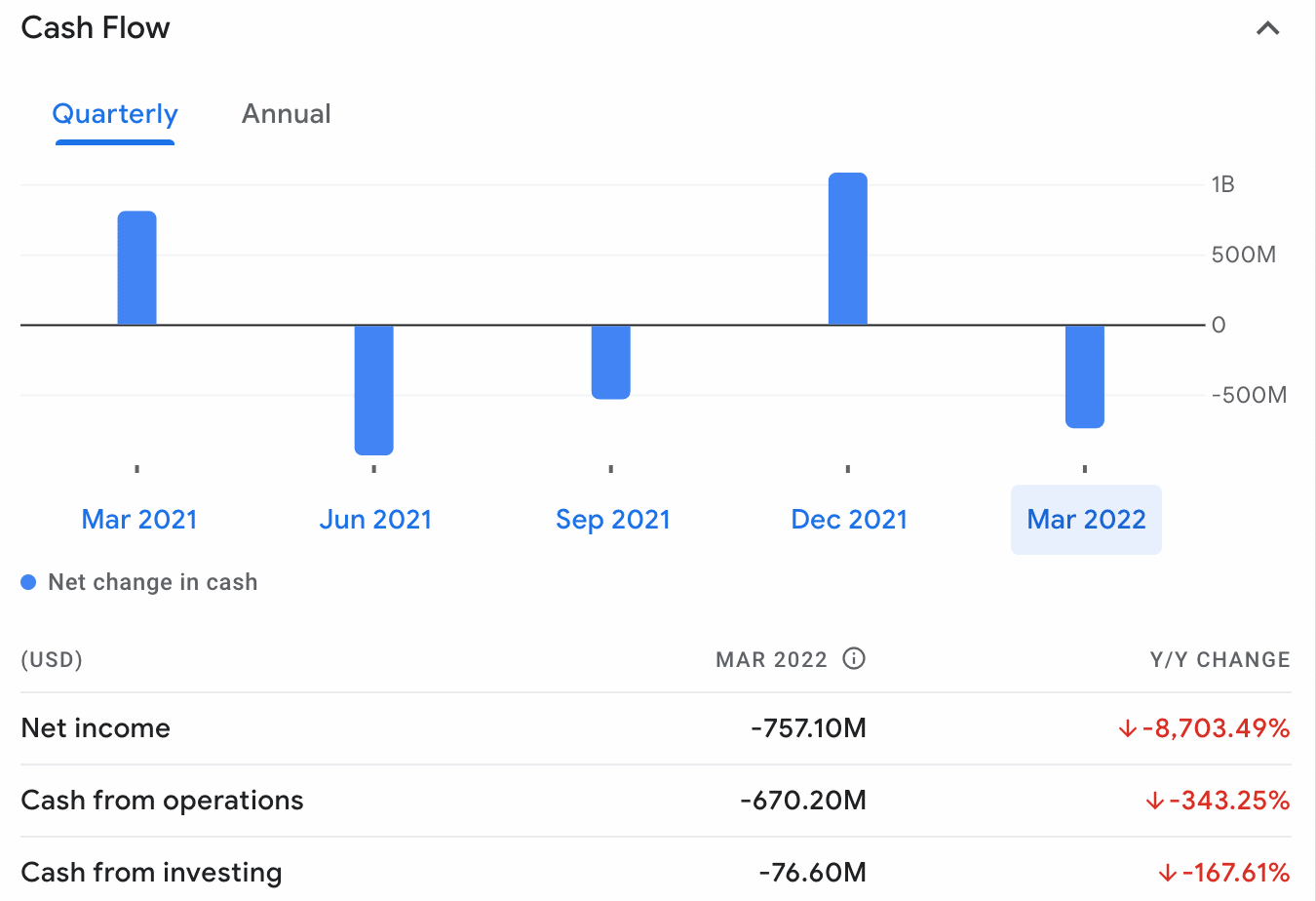

Your capital is at risk. Peloton has established itself as one of the most popular fitness brands of the digital world. Given this, investors might naturally be curious to know the answer to the question – ‘is PTON stock a buy?’. However, the popularity of a brand does not necessarily make it a good investment choice. Instead, investors are advised to study the company to ensure that Peloton stock aligns with their long-term goals. In the following sections, we provide our readers with an overview of what Peloton is, its stock price history, and the company’s business model. We will also consider what risks investors need to be aware of before adding Peloton stock to their portfolio. Peloton was launched in 2012 with the aim of providing at-home boutique fitness services. It launched its first exercise bike in 2014, which became a huge success in the fitness market. In 2018, the company released its second product, the Peloton treadmill. During its first few years of operation, Peloton stood out in the market with its interactive fitness platform. Its equipment connects to an exclusive digital ecosystem, enabling users to engage in on-demand or live fitness classes. Additionally, its equipment also helps track fitness metrics. As the company evolved, Peloton started adding more services to its platform, such as fitness accessories and branded apparel. Today, the brand has become a household name. It has a growing base of connected fitness subscribers, who pay around $45 a month for an all-access membership. Over the last decade, Peloton has built over 70 studio retail shops across the US, UK, and Canada. It also has three studios in Manhattan that provide live-streamed and on-demand classes. The company’s growth was further fueled by the demand for stay-at-home fitness equipment during the pandemic. However, things have taken a turn since then. The company’s revenue has fallen dramatically since the stay-at-home era, which has naturally created concern among investors. Needless to say, this has affected the Pelaton stock price considerably when compared to the highs it experienced during the pandemic. Analyzing the Peloton stock history can help investors understand how this equity has reacted to different market trends. This can be useful in figuring out the future direction of Peloton stock. Peloton held its IPO in 2019 at a price of $27. Leading up to 2020, the stock did not go through any significant volatility. However, in the midst of the pandemic and subsequent lockdown measures, Peloton began to see a rise in demand for its products. Consequently, the Peloton stock price began moving in a rapid upward trend. Peloton’s stock value reached its peak of $167 in January 2021 – translating to an increase of over 500% when compared to its IPO price. However, after the economy reopened, there was a shift in the market – with investors reducing their exposure to growth stocks like Peloton. This led to Peloton stock gradually losing its value in the market. In addition to this, the company also issued surprisingly large financial guidance cuts, which drove the stock price further down. It is evident from the Peloton stock chart that the firm is now firmly in a bearish market. At the time of writing, Peloton is trading just below $12 – 50% below its IPO price. When considering the downward trajectory of Peloton stock, it is crucial to analyze the financial position of the company. As we noted above, Peloton stock was enjoying great success in 2020. The management team expected this increased demand to continue well into the future and overinvested in expanding its production facilities. However, with the pandemic subsiding, consumers returned to traditional fitness options, such as gyms and cycling studios. In other words, Peloton is now dealing with an excess supply and little demand to back this up. Not so surprisingly, the company’s last profitable quarter was during the middle of the pandemic, in Q2 2022. According to its latest earnings report, Peloton reported a net loss of $757 million in Q3 2022. Let us consider some key metrics of Peloton’s financials. A negative EPS and P/E ratio does not necessarily make Peloton a bad investment. But Peloton has been burning cash at a rapid rate nonetheless. The fitness platform lost $2.27 per share in Q3 2022, which was much worse than what Wall Street analysts had predicted. So, when faced with the question ‘is PTON stock buy or sell’ – investors need to take a step back and consider whether they believe that Peloton stock will bounce back, or drop further. The only way to assess this is through additional research. As we have established, Peloton has not made any profit across the prior few fiscal quarters. And unsurprisingly, this means that the company does not pay any dividends to shareholders. Furthermore, it is common for tech companies and growth stocks to reinvest their profits into the business In the case that Peloton manages to generate profit in the coming years, there is every chance that it will focus on expansion rather than offer dividends to stockholders. Those looking for a passive income might consider reading our guide on dividend stocks. Is Peloton stock a buy or sell? To answer this, it’s important to know exactly what type of company Peloton is. This is where fundamental research comes in. In this part of our guide, we will cover some crucial points that investors should assess before electing to buy stock in Peloton. Peloton’s primary revenue comes from two segments – connected fitness products and subscription fees. The first segment generates revenue from the sale of fitness equipment such as stationary bikes, treadmills, and free weights. It also derives money from related services, which include delivery, installation, and extended warranty agreements. In Q3 2022, this segment’s revenue fell by 42% year over year. According to Peloton, the decline was fueled by a drop in consumer demand. The connected fitness segment was also negatively impacted by the product recall of Tread+, which accounted for $18 million worth of sales. On the other hand, revenue from subscription services has increased 19% year over year. Peloton has increased its monthly fees and has taken steps to accelerate its fitness-as-a-service strategy. Nevertheless, losses from the connected fitness products segment have overshadowed its earnings from subscription services. And consequently, Peloton has been burning through its cash flow to cover its opening expenses. Needless to say, the COVID-19 pandemic was a success story for Peloton. As per broader lockdown measures, consumers relied on Peloton’s line of stationary fitness equipment in order to work out from home. This resulted in a ‘pull-forward’ of demand. In fact, Peloton is not the only company that saw a sudden surge in demand during the early days of the pandemic. Several other tech stocks, such as Netflix, PayPal, and Shopify, went through the same cycle. And most of these stay-at-home stocks saw their growth slow down more than a year later – just like Peloton. In the case of Peloton – when demand exploded during the beginning of the pandemic, the company struggled to deliver bikes and treadmills. To keep up, it bought Precor, an exercise equipment manufacturer. Peloton even made plans to build a new factory in Ohio. However, as the pandemic waned, meaning that the firm had too much supply alongside little demand – which led to rising expenses and falling profit. Hence, the company was forced to seek refinancing. Earlier in 2022, Peloton succeeded in securing $750 million via a five-year debt term from JPMorgan and Goldman Sachs. In February 2022, Peloton announced leadership transitions in order to drive sustainable growth and profitability. John Foley, Peloton’s co-founder who led the company for almost a decade, stepped down to become the executive chair. The new CEO, Barry McCarthy, has held senior roles at Spotify and Netflix. Under McCarthy’s leadership, Peloton is going through some notable changes – such as: All these measures will lead to the layoffs of hundreds of Peloton employees. However, the stock market responded to these cost-cutting measures somewhat positively. After the announcement was made on August 12, 2022, Peloton stock saw its value go up by around 12%. However, concerns over falling revenues still loom among investors. Over the years, the fitness sector has grown at an exponential rate. At the time of its launch, Peloton had a highly appealing value proposition. But today, that is no longer the case. Not only are there several other companies offering similar products and stay-at-home fitness services, but at a much lower cost. Some of its main competitors in the high-end fitness equipment sector include NordicTrack and Life Fitness. Moreover, investors should remember that Peloton is not only competing with stay-at-home equipment providers. Rather, the company is facing competition from gyms, health and wellness apps, and even social media fitness influencers. For instance, SoulCycle, a company that offers studio cycling classes, is also competing with Peloton. They both target similar clientele – but, Peloton appeals to those who wish to train in their home, whereas SoulCycle is for those who prefer gyms. And with pandemic restrictions easing, an increasing number of consumers have started to opt for gyms rather than working out at home. Meanwhile, there are also at-home fitness videos available via YouTube, which allows consumers to stream workouts for free. Altogether, Peloton is facing fierce competition from all sides – and it is in urgent need of a new strategy if it wants to stay relevant. When faced with the question ‘should I buy Peloton stock’, investors should consider the future prospects of the company. As we have noted above, Peloton is making some notable changes in its business strategy. However, Peloton’s management team has indicated that the company will not be profitable anytime soon. Given this, investors will need to do independent research to decide if Peloton is worth the risk. To conclude our guide, let us revisit the process of how to buy Peloton stock. Visit the website of a regulated broker that supports Peloton stock and sign up as a new user. To create an account, investors will have to provide a valid email address and a chosen password. The platform will also ask users to fill in some personal details – such as a first and last name, contact details, and date of birth. Next, users will have to get verified on the platform. This step involves submitting proof of identity documents – such as a copy of a passport or driver’s license. Some brokers also require their users to upload proof of address. This can be in the form of a recently issued utility bill or a bank statement. In order to buy Peloton stock from an online broker, investors will need to ensure that there are sufficient funds in their trading accounts. When making a deposit, investors should also meet the minimum amount stipulated by the broker. This, once again, varies depending on the chosen platform. To start the investment process, type in the Peloton stock ticker ‘PTON’ in the search bar of the broker’s website. Then, place a buy order by specifying the amount to be invested into Peloton stock. While brokers typically stipulate a minimum investment amount, the requirement varies from one platform to the next. Regardless, many popular online brokers support fractional investing – which allows investors to buy fractions of Peloton stock. After placing the order, the broker will execute it, and the Peloton stock will be added to the investor’s account portfolio. Investors can then track the performance of the stock in real-time. This beginner’s guide has discussed the various aspects investors should know before electing to buy Peloton stock. To summarize – while Peloton has established itself as a leading provider of stay-at-home fitness equipment, the company is struggling to move in the right direction. So, is Peloton stock a buy? – To find the right answer, investors should take a long-term view of the stock and the company’s growth potential by conducting research. Nonetheless, in order to buy Peloton stock, investors will need to create an account with a regulated broker, deposit funds, and place an order.

Approx No. Stocks

5,400

Min Deposit

$20, $250 via bank transfer

Cost to Buy Peloton Stock

0% commission + spread

2. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy Peloton Stock

0% commission + spread

Step 2: Research Peloton Stock

What is Peloton?

Peloton Stock Price – How Much is Peloton Stock Worth?

Peloton Stock – EPS and P/E Ratios

Peloton Stock Dividends

Peloton Stock: Fundamental Research

Peloton Business Model

Pull-Forward Demand

New Management and Business Strategies

Peloton vs Competition

Potential for Growth

Step 3: Open a Trading Account & Buy Peloton Stock

Open a Brokerage Account

Upload ID

Deposit Money

Buy Peloton Stock

Conclusion

FAQs

Why is Peloton stock so low?

Can I buy stock in Peloton?

How much does it cost to buy a PTON stock?

Does Peloton stock pay dividends?

Is Peloton a good stock to buy?

When can I buy Peloton stock?

Is Peloton listed on NASDAQ or NYSE?