NRG Energy is a mid-cap US utilities company ranked #333 in the Fortune 500. With good financials in general and a notably low P/E ratio, the Texas-based firm could be a strong value stock according to some market analysts.

Below we delve into NRG financials to find out. We also look at where to buy NRG stock by reviewing two regulated brokers which offer competitive fees on share transactions.

How to Buy NRG Stock with a Regulated Broker

- ✅Step 1: Open a trading account with a regulated broker - Head over to your chosen stock trading platform and enter a few personal details to get started.

- Step 2: Verification - Regulations state that all investors must supply proof of ID and proof of address.

- Step 3: Deposit - Using credit/debit card, bank transfer and a range of e-wallets, deposit funds into your trading account.

- Step 4: Search for and research NRG Stock - The most experienced traders conduct extensive market research before investing any capital.

Step 1: Choose a Stock Broker

Want to know where to buy stocks in 2025? In this guide we present the most popular broker: Webull. We explore how to buy and sell stocks safely to build a diversified portfolio.

Webull

Although it has only been in business since 2017, broker Webull has attracted upwards of 10m users. Headquartered in New York, Webull is a leading stock trading platform.

Although it has only been in business since 2017, broker Webull has attracted upwards of 10m users. Headquartered in New York, Webull is a leading stock trading platform.

Webull offers an impressive range of 5,000 stocks, and the vast majority are US-based. Foreign shares are available via ADRs (American Depositary Receipts). Options trading is also provided — which is useful for more advanced traders.

For retirement planners, Webull offers the advantage of IRA (Individual Retirement Accounts). If users want to trade on margin, a special account is available.

Other Webull highlights include:

- Extended hours trading (pre-market and after-hours).

- Top charting tools: Level 2 Advance (Nasdaq TotalView).

- 24/7 customer service.

Perhaps most impressive of all are customer ratings of Webull's cellphone trading app. Android users give the Webull app an average review score of 4.4/5 on Google Play. Apple users rate it on average as 4.7/5 on the App Store.

Webull users wanting to buy NRG stock may do so at 0% commission. A minimum trade of just $5 applies. A $25 fee applies to bank wire withdrawals.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying NRG: | Spread fee: not available |

Your capital is at risk.

Step 2: Research NRG Stock

What is NRG Energy?

- 6m customers across 24 US states served by NRG.

- 6,635 staff members work for NRG with ex-COO Mauricio Gutierrez taking up the role of CEO in 2015.

- Investors wanting to invest in NRG can find it on the US New York Stock Exchange.

- The NRG stock symbol is 'NRG'.

NRG Business Organization

- NRG has operational headquarters in Houston, Texas and financial headquarters in Princeton, New Jersey.

- The firm has acquired 11 other energy companies including Green Mountain Energy, Reliant Energy, Stream Energy and, most recently, Direct Energy in January 2021.

NRG splits its operations into three segments:

- Generation: NRG has a diverse generation base featuring coal, oil, gas, solar and nuclear. The firm currently owns or leases 25 power plants with 18,000 megawatts of capacity.

- Retail: NRG delivers power via customer and business solutions.

- Corporate: NRG trades in commodities and financial products, as well as providing specialist advisory services.

NRG Stock Price — How Much is NRG Stock Worth?

From the NRG stock chart below we can see that the NRG stock price today is hovering around the $38 mark.

Post-pandemic NRG Stock History

Since the pandemic, the stock has recovered from a low of $21.41 on March 18th, 2021. Despite frequent corrections, its direction of travel has been upwards ever since. It hit a 2021 high of $43.03 on December 31st.

During May 2022, NRG — like many energy stocks — rocketed in value owing to rising wholesale electricity and gas prices worldwide. On May 26th, 2022, it hit a 2022 high of $46.81. Over the next 3 weeks, the price corrected sharply to below $36 and has since rebounded to over $38.

Buy NRG Stock: Three Key Financial Metrics

The big question: is NRG one of the most undervalued stocks?

We can begin to answer this question by picking out a few key metrics. Particularly useful in this respect is the P/E Ratio. This gives some indication of how much a company is valued by the market in relation to its earnings. NRG has a notably low P/E ratio, which suggests that it is, indeed, undervalued.

We can also browse an NRG income statement, balance sheet and cashflow statement.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Ratio | Assets (that can be liquidated in 90 days) plus cash divided by liabilities | The ability of the company to pay off all its debts in 90 days from now |

NRG EPS (Earnings Per Share): $7.17

NRG's EPS has rocketed year-on-year.

This is a green flag for investors considering whether to buy NRG stock. An increase in EPS means that the company is becoming more profitable.

- In Q1 2021, the EPS figure for NRG was just -$0.33.

- In Q1 2022, NRG earned net income of $1,736m. Divided by shareholder equity, this results in a figure for diluted Earnings per Share of $7.17 for Q1 2022.

- This equates to a trailing 12-month EPS of 16.4.

By comparison, fellow mid-cap utility firm OGE's EPS figure for Q1 2022 was $4.8 and UGI's was $7.0.

Mauricio Gutierrez, NRG President and Chief Executive Officer remarks: 'I am pleased by the strong performance of our platform during the first quarter of 2022.'

NRG P/E Ratio: 2.33

NRG's Price/Earnings Ratio of 2.33 is very low.

This too is a green flag for investors considering whether to buy NRG stock. A low P/E ratio means that the investor is paying relatively less for profits generated. Unless there is something fundamentally wrong with the company or its market, this indicates a fair deal; a 'value stock', in other words.

By comparison:

- Fellow mid-cap utilities firm OGE has a P/E ratio of 7.7.

- UGI (similar size) has a P/E ratio of 5.6.

- The giant US utility company NextEra Energy has a P/E ratio of 105.92.

NRG Ratio: 1.35

Quick Ratio is regarded as the acid test of a company's finances. It shows the proportion of assets to liabilities over the short-term. If the company had to pay off all its liabilities in 90 days, could it do it? NRG's Quick Ratio of over 1.00 shows that it could do so, with some breathing room.

NRG Stock Dividends

NRG is set to pay dividends totaling $334m in 2022. This is on top of $1bn in share buybacks.

NRG's current dividend yield is 3.63%. This ratio measures the dividend payment vs. the stock price. This dividend yield is respectable, but not exceptional. Dividends in the utility sector tend to be higher than in other sectors.

However, as we outline below, NRG is planning to increase its return to shareholders on an ongoing basis.

Investors looking to buy NRG stock, or any other stock, should note that companies must strike a balance between rewarding stockholders with profits whilst retaining enough earnings to fund expansion. So a high dividend yield — whilst rewarding investors — may act as a brake on future share price performance.

Market Analysis of NRG Stock

Before we being this section it's important to note that all market analysis featured in this article is based on third-party speculations.

1: Strong Q1 Gains

Q1 net income was $1.7bn — up $1.8bn year-on-year, thanks to losses in 2021 due to Winter storm Uri and huge gains this year as a result of rocketing natural gas and power prices as well as a resumption of service in the key Limestone power plant.

EPS was up too year-on-year impressively from -$0.33 to $7.71.

Despite the fact that energy producers are well-placed to benefit from rising power prices, they are subject to inflationary pressures too. NRG has therefore done well to achieve roughly the same EBITDA (earnings before interest, taxes, depreciation and amortization) in Q1 2022 as it did in Q1 2021 (adjusted for asset sale in 2021).

NRG has issued guidance saying that it aims to hit a level of $1,950m - $2,250m adjusted EBITDA for 2022.

Investors considering whether to buy NRG stock should watch out for the firm's next quarterly results which come out on August 4th, 2022.

2: Improving Debt Profile

Whereas private consumers might consider debt to be out-and-out dangerous, companies take a different view.

Particularly in the utilities sector, taking on debt is actually considered to be a vital part of business planning. This debt is necessary so that companies like NRG can acquire new companies to increase revenues, as well as invest in new technologies.

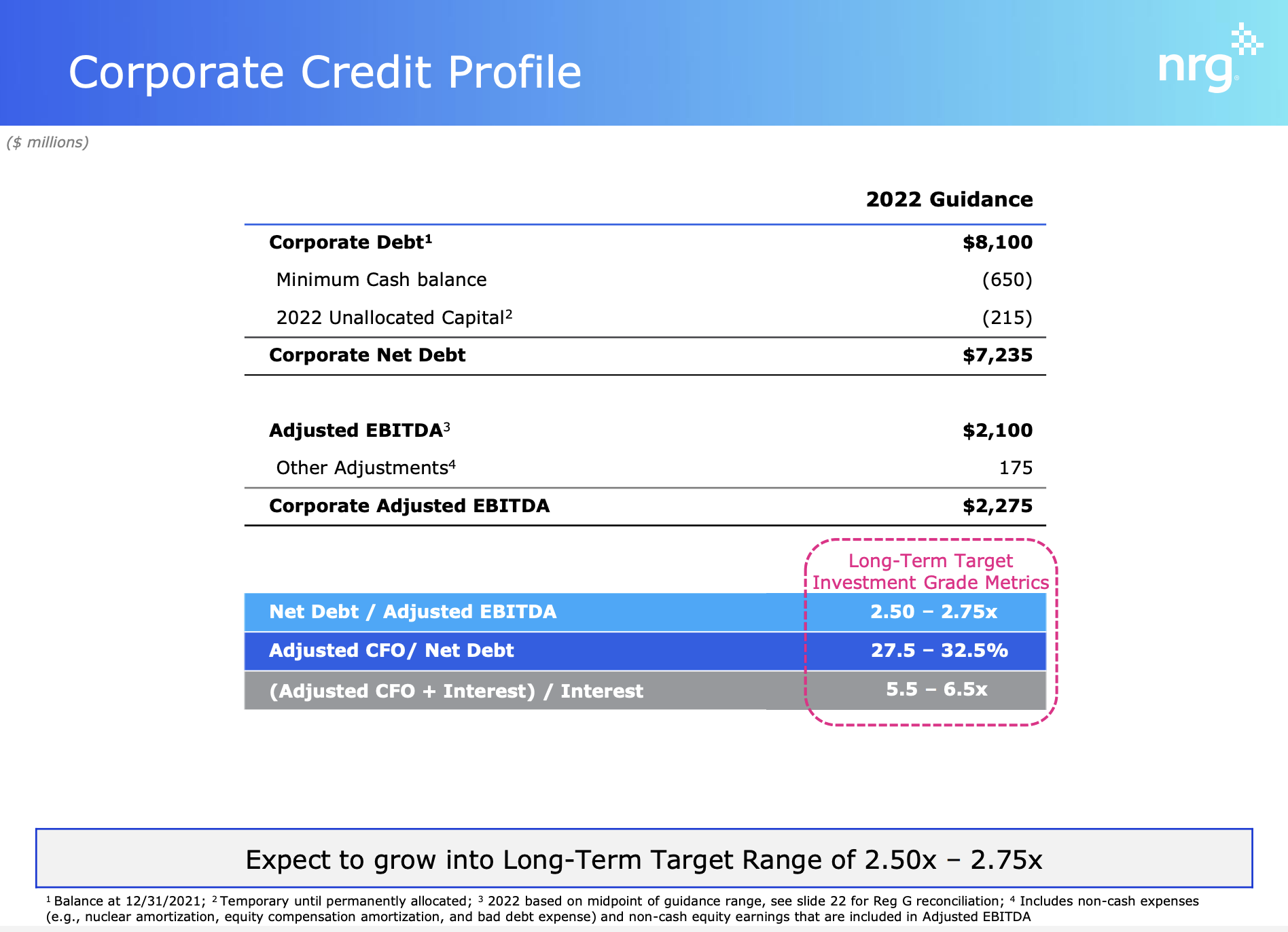

A key statistic here is debt vs. adjusted EBITDA. This shows how much debt the company has in comparison to its yearly earnings.

- In the utility sector a ratio of less than 4.5 is considered, as a rule of thumb, to be okay.

- NRG expects its debt/EBITDA ratio for 2022 to be 3.18. This means that the firm is not in too much debt already to stifle further growth.

- NRG is aiming for a lower ratio of 2.5-2.75 over the longer-term.

2: Hedge Funds Buy Stock in NRG

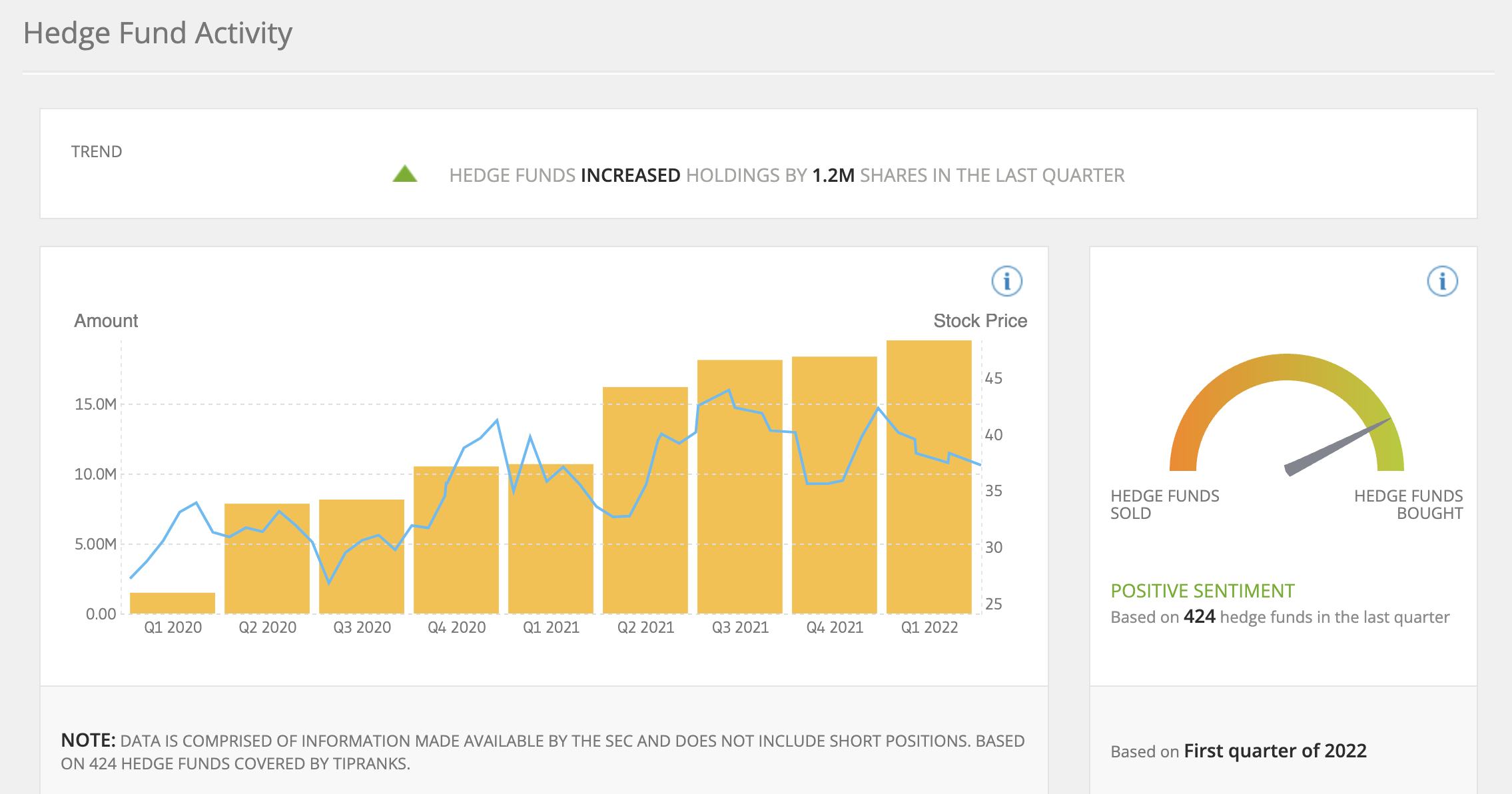

One of the perks for investors is the data available on hedge funds.

Hedge funds are professional investment companies. Although they make mistakes like all investors, it is always useful to be aware of their stance on a particular stock.

In Q1 2022, hedge funds increased their holdings in NRG by 1.2m shares. As we can see from the graph below, hedge funds have been steadily increasing their support for NRG since Q1 2020.

Hedge fund manager Richard Pzena of Pzena Investment Management is the biggest hedge funder holder of NRG stock by some distance. Pzena holds $715m of NRG stock.

No less than 5 hedge fund managers have decided that Q1 2022 was the right time to buy NRG stock:

Table: New Hedge Fund Holdings in NRG Stock, Q1 2022

| Hedge Fund | Manager | New NRG Holding |

|---|---|---|

| Cunning Capital Partners | E. Foreman | $1.46m |

| Echo Street Capital Management | G. Poole | $1.03m |

| Bridgewater Associates | R. Dalio | $0.53m |

| Saba Capital Management | B. Weinstein | $0.32m |

| SCP Investment | S. Colen | $0.26m |

3: High Institutional Ownership of NRG Shares

97.4% of NRG Energy shares are owned by institutional investors. And 0.8% of NRG Energy shares are owned by insiders (totalling $64m).

Utility stocks tend to be popular with the large money managers because they are low-risk. Such a high proportion of institutional ownership indicates that the experts think that NRG is in for a long-term period of growth.

4: Positive Dividend Prospects

What puts NRG in the top ranks of the dividend stocks is its commitment to a rise in dividends of 7-9% every year. NRG's 5-year annual dividend growth rate is a healthy 40.79%.

On April 20, 2022, NRG declared a quarterly dividend of $0.35 per share. This was payable on May 16, 2022 to stockholders owning stock as of May 2, 2022. The firm has yet to announce the next dividend payment.

5: NRG Addressing Unmet Customer Needs

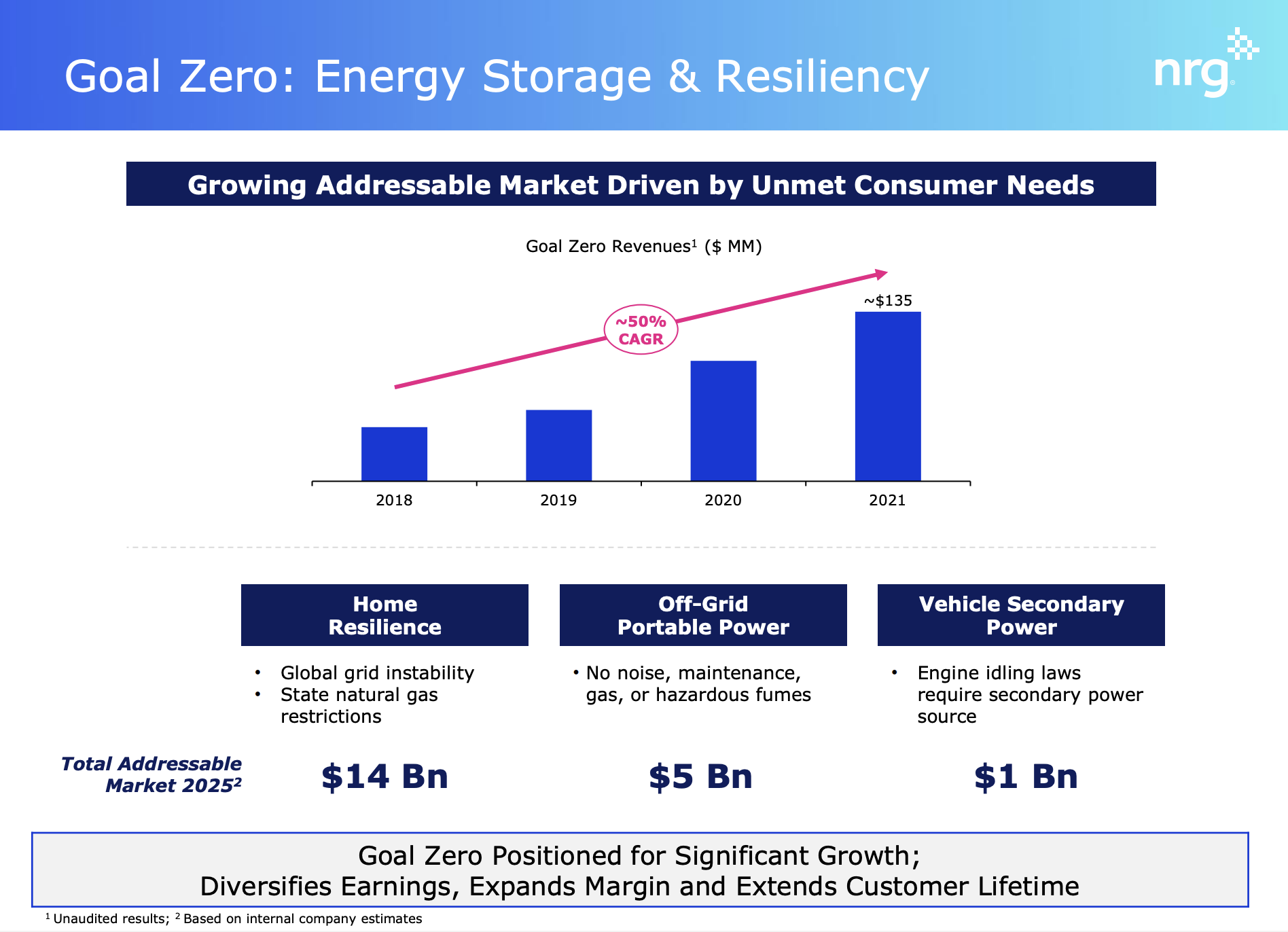

Between 2018 and 2021, NRG has achieved a 50% CAGR (Compound Annual Growth Rate) in revenues deriving from the energy storage and resiliency market.

This is a growing sector that NRG aims to continue to service in order to diversify its earnings and extend its interaction with each of its customers. It is split into 3 areas:

Table: NRG's Goal Zero

| Market | Description | Addressable Market Size 2025 |

|---|---|---|

| Home Resilience | Measures and products to guard against global grid instability, and natural gas restrictions in some states. | $14bn |

| Off-grid Portable Power | Providing products to allow customers to store power off-grid with no danger or maintenance issues. | $5bn |

| Vehicle Secondary Power | Engine idling laws state that vehicles will require a secondary power source. NRG aims to exploit this requirement commercially. | $1bn |

6: Strong ESG Emphasis

'ESG' is a relatively-new company metric which measures a company's commitment to Environmental, Social and Governance factors.

- NRG is listed #14 on Forbes Green Growth List.

- NRG is aiming for a 50% carbon reduction target in 2025 and net-zero by 2050.

- The Board of NRG has achieved 64% board diversity. Out of 11 members, 4 are women and three are described as 'ethnically diverse.'

Investor Sentiment

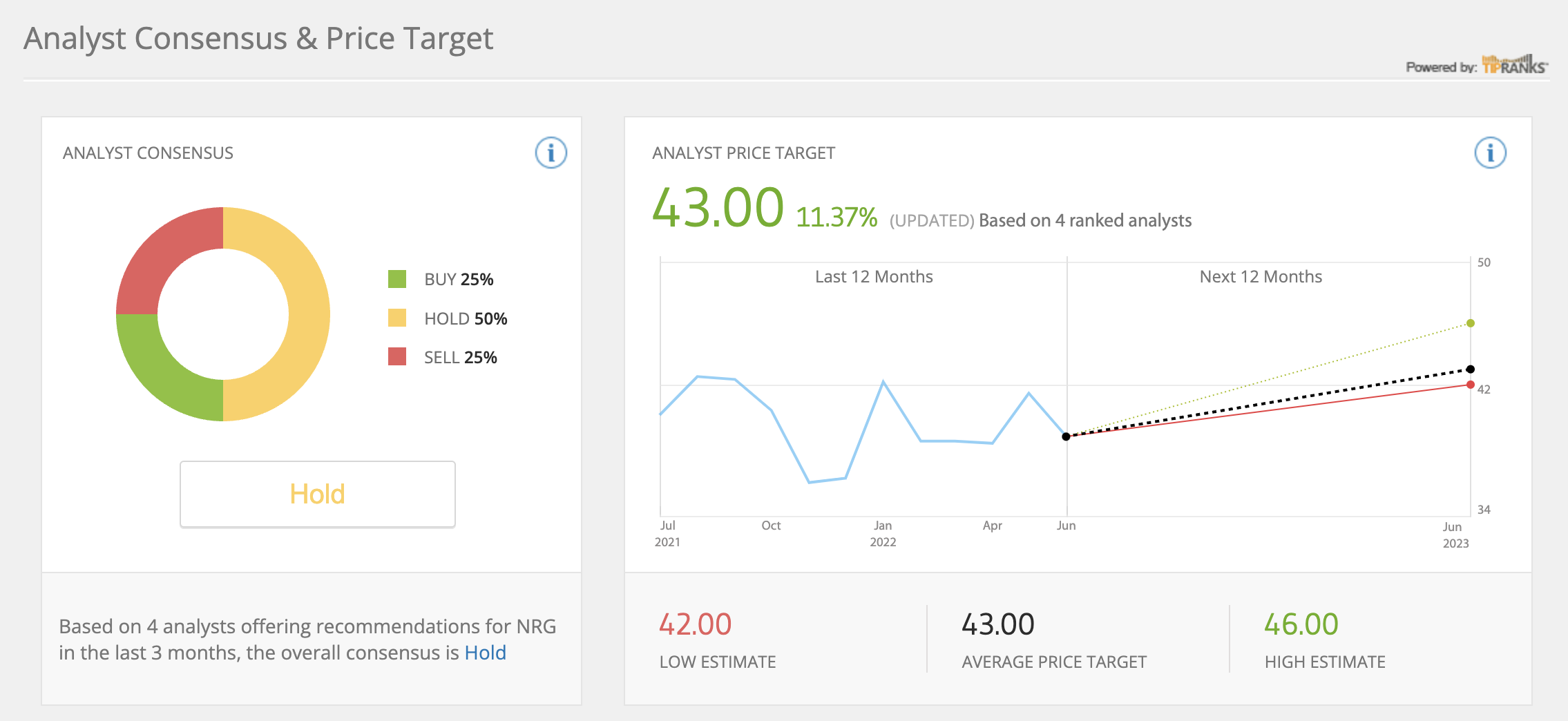

BUY: Analysts Predict 11% Upswing in Price

The NRG stock price today is $38.61.

Of four analysts who issued investor notes over the last 3 months, 2 advised to hold the stock, 1 advised to buy and 1 advised to sell. With a mixed bag of opinion, where does that leave the ordinary investor considering whether to buy NRG stock?

We note that the average target price for NRG in 12 months of these four recommendations is $43. This is 11% higher than its current price of $38.61. So we can assess that the general opinion of the experts is generally bullish (if restrained).

We may further note that Analyst Stephen Byrd of Morgan Stanley, who issued the Buy recommendation, posits a target price of $46. That is a rise of just over 20% on today's price.

SELL: Utilities Stocks Vulnerable to Reversal in Market

The current escalation of power prices globally typically put energy stocks like NRG in a better position according to some market analysts.

But investors should note that, over the course of 2022, the global energy market may stabilise, and prices for oil and gas will fall. Utility stocks will then possibly take a tumble in value.

As both a producer and retailer of energy, NRG has some insulation here, particularly as it has such a diversified basis of power generation. But it is not invulnerable to sudden charges in the macro picture for its sector.

Conclusion

In outlining its operations as well as picking out a few NRG key financials, we have aimed above to give the investor the basis to make their own minds up.

When it comes to how to invest in NRG stock, there is nowadays only one option. And that is to go online and sign up with a broker.