Lucid is a luxury EV maker that also manufactures renewable energy storage systems. This US-listed stock is available to buy at most online brokers.

Today, we explain the process of buying Lucid Motor stock without paying any commission and talk about whether it makes a viable investment.

Buying Lucid Motors Stock – An Overview

This guide will detail investing in stocks online in the US. It is worth using an online broker that is regulated by the SEC and enables US investors to buy Lucid Motor stock without any commission fees.

Below, we’ve listed a four-step overview of buying Lucid stock.

- ✅ Step 1: Open an Account

It’s a standard requirement to register with a broker prior to placing an order to buy Lucid stock. Initiate the registration process. Next, enter basic information such as a name, username and password, email, and cell number. The broker will also need some ID and proof of residency. Plenty of options are available in this respect. - Step 2: Deposit Funds

Accepted payment include e-wallets such as PayPal, Skrill, and Neteller. Alternatives include credit/debit cards, ACH, and wire transfers. - Step 3: Search for Lucid Stock

Searching for Lucid stock is simple. Just type the name into the search bar. Lucid will appear in the list of markets, at which point, by clicking ‘Trade’ an order form will appear to complete the purchase. - Step 4: Buy Lucid Stock

Some brokers offer fractional investing, which allows traders to add just a portion of a stock to their portfolio with ease. Finally, enter the investment amount and confirm the order.

Following step four of this guide, Lucid stock will be added to the trading account. Any stock purchased will be accessible via ‘Portfolio’ on the main dashboard.

Beginners will probably prefer a more detailed account of buying stocks. With this in mind, later we offer a full and detailed guide with screenshots to buy Lucid Group stock with no commission.

Step 1: Choose a Stock Broker

Here is the review of the best online broker to buy Lucid stock today with low fees.

Webull

This broker will charge fees on stocks that are listed on international exchanges. As such, it’s important for investors to check what fees they might be liable for if they want to diversify in terms of location. All foreign stocks are offered as ADRs.

Webull offers thousands of stocks and the platform is simple enough to use for most traders. In terms of tools, there is no option to invest in Copy Trading.

That said, there is a range of technical indicators and also a fully customizable workspace with numerous price chart options. Those who decide that Webull is the place to buy Lucid Group stock can fund their account via ACH with no deposit fees payable. If opting for a bank wire instead, $8 per deposit will be taken, and on withdrawals, the fee is $25.

Webull also offers a paper trading account and traders who wish to check in on the performance of their stock investments on the go can download the free cell phone app. Webull also offers ETFs.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Lucid Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Lucid Stock

It’s crucial that traders perform research of their own when learning about buying Lucid stock. To help clear the mist, below we have detailed some information about Lucid as an investment product.

What is Lucid

Lucid Group is a company that is split into three divisions; technology, renewable energy, and EVs (electric vehicles). The firm was formerly known as Atieva and was formed in 2007 near Silicon Valley, California.

Lucid initially concentrated on creating batteries and electric powertrains for other automakers. It eventually secured over 50 patents in the US for its fundamental battery design.

In 2016, the company announced its intention to rebrand as Lucid Motors. In addition, the fledgling carmaker revealed that it was going to build an all-electric premium automobile of its own.

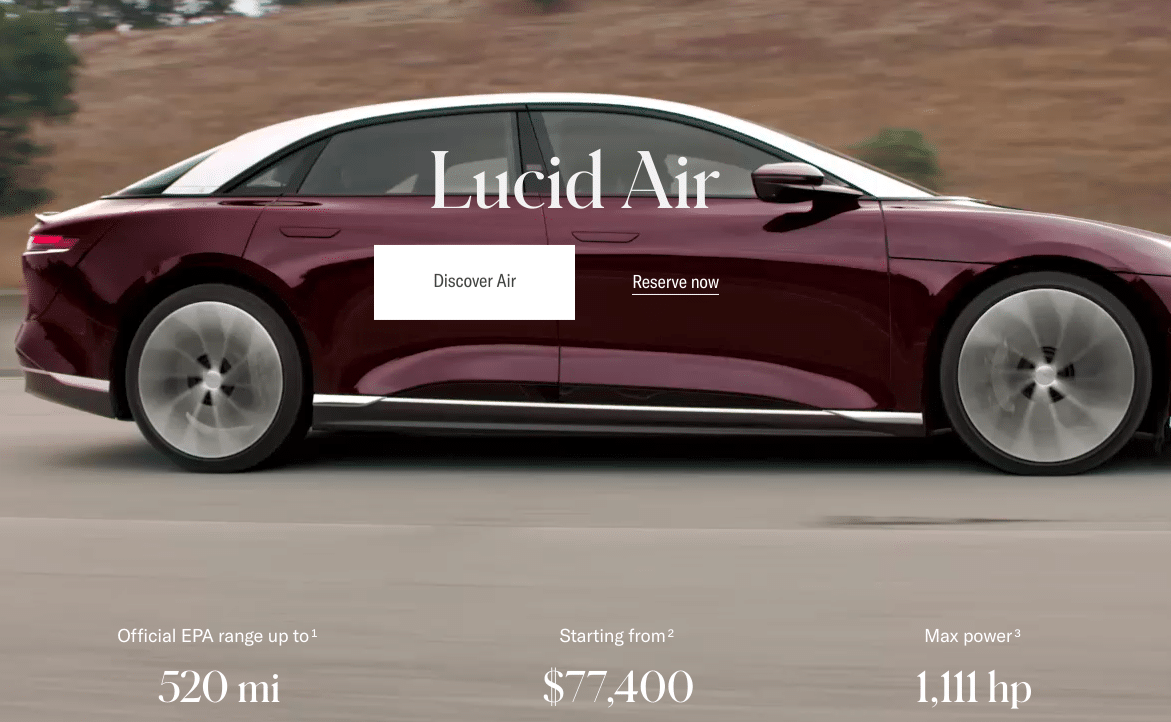

Shortly after, Lucid began construction on Casa Grande – a $700 million purpose-built facility with a 590-acre footprint. This was the first of its kind in North America. Lucid Air was the company’s first vehicle.

- The Lucid prototype made news in 2018 when it smashed lap times of production vehicles like the Jaguar I-Pace at the Laguna Seca track

- Moreover, in a quarter-mile race, the Air prototype clocked in at 9.9 seconds, beating a Tesla Model S

- Lucid’s tri-motor Air then broke the track record set by the Tesla Model S Plaid prototypes at Laguna Seca

- Lucid Air is a cutting-edge luxury sedan with a California-inspired style and a full-size interior in a mid-size external footprint

The company has other EVs in the pipeline, as well as variations on existing designs. Lucid also supplies batteries to the EVs used in Formula E, which is a race that features next-gen cars that run on electricity.

Not only that, but Lucid is keen to enter the home energy storage market in the coming years, like Telsa. For now though, as we explain later, this company has its eyes on the global EV market and has already begun its expansion beyond the US.

Notably, in 2021, a merger was completed that resulted in the company becoming Lucid Group.

Lucid Stock Price – How Much is Lucid Stock Worth

At the start of 2021, Lucid stock was trading at around $10. By February 19th, it had increased by around 430% to $53. This came about following an announcement that the Lucid Group was setting up a new manufacturing facility. However, the stock plummeted following news of the SPAC deal with Churchill Capital IV.

By the 5th of March in the same year, the stock had fallen to a little over $24, which illustrates a drop of almost 55% in less than two months. This company began trading as Lucid Group on the NASDAQ in July 2021. By the end of the year, Lucid stock began to recover from its March lull.

After trading at below $27 for months, Lucid Motors’ stock price went up by over 129% between late October and November 2021. This followed the company’s announcement that it received an increase in order reservations for its EVs for 2022. This meant that Lucid Group’s goal of making twenty thousand Air Sedans in 2022 was right on track to become a reality.

This went down well with investors. The stock started 2022 at around $38, before falling to $27 by the end of January. The same happened to many technology and growth stocks and the culprit was inflation fears and rising interest rates. Moreover, in March 2022, despite beating sales estimates in the first quarter of the year, Lucid lowered its production target.

This caused the Lucid Motors stock price to fall to its lowest value since early 2021 as people began selling off their holdings. At the time of writing, Lucid Group stock is trading around 48% lower than it was at the start of 2022. This could represent a bargain for traders who foresee an increase in value. We talk more about Lucid’s road map and potential later on.

EPS and P/E Ratio

Part of learning about buying Lucid stock is checking out the company’s financials.

As such, we analyzed the latest quarterly reports available and have noted down the EPS and P/E ratio to give traders a clearer idea of its valuation.

See below some key data from Lucid’s financial reports:

- Q4 2021 expected EPS was -0.30.

- Expected revenue for Q4 2021 was $59.87 million. $26.39 million was reported. This was a surprise of 0.42%

- Q1 2022 expected EPS was -0.29. -0.37 was reported. This was a surprise of -27.17%

- Expected revenue for Q1 2022 was $55.56 million. $57.68 million was reported. This was a surprise of 3.81%

- Based on the most recent EPS and the currency price, the P/E ratio at the time of writing is 0

Traders can work out the P/E ratio by dividing the latest EPS by the market value of the stock. However, in this case, the P/E ratio is 0. This is because the EPS is negative.

As we mentioned, revenue increased for Lucid, however, the start-up company still isn’t profitable. That is to say, after the deduction of expenses from its revenue, earnings were still in the red.

Market Capitalization

The market capitalization at the time of writing is over $33 billion. At the start of 2021, the company had a valuation of around $300 million.

Index Funds

Investors can also add Lucid Group stock to their portfolio via a fund, such as an index or an ETF. At the time of writing, there are over 74 ETFs that feature Lucid stock.

See some of the ETFs that hold this stock listed below:

- Invesco QQQ Trust

- Vanguard Total Stock Market ETF

- Global X NASDAQ 100 Risk Managed Income ETF

- Vanguard Mid-Cap Value ETF

- ProShares UltraPro QQQ

- Vanguard Value ETF

For anyone unsure of where to begin, there is a full guide on trading ETFs here.

Lucid Stock Dividends

Traders or investors who buy Lucid Group stock will not receive dividends. Lucid is still very much a start-up company when compared with legacy car makers such as Ford.

If a passive income is important, traders could always add Lucid to their portfolio, in addition to familiarizing themselves with buying dividend stocks.

Factors Affecting Lucid

Before deciding whether Lucid Group stock is worthy addition to an investment portfolio, traders will need to delve a little deeper.

Below we talk about everything from Lucid Group’s road map in 2022 and beyond, to partnerships and purchase commitment deals.

Lucid Motors is Preparing to Challenge Existing Luxury EV Makers

When researching about purchasing Lucid Motors stock, many traders will notice that the company is fast becoming a Tesla challenger.

That is to say, Lucid Motors is hoping to challenge existing luxury EV makers like Tesla by delivering a range of innovative electric Sedans and SUVs over the coming years.

- The Lucid Air Dream Edition, the company’s first offering, has a 0 to 100 km acceleration time of 2.7 seconds

- The vehicle delivers a horsepower of 1,111 (or a range of 900 km) on a full charge

- Its 924 V electrical architecture allows for fast charging of around 15 minutes per 400 kilometers

- The company says these factors make it ideal for a vast expansion in the European market and beyond

- Lucid Air was named ‘Car of the Year 2022’ by Motortrends.This beat the likes of Mercedes Benz S-Class, Porsche, and Honda Civic amongst others

- Lucid also began delivery of its Air Grand Touring EV in early 2022. This EV accelerates from 0 to 60 mph in 3 seconds and has a horsepower of 819

When researching Lucid stock, traders can also check out upcoming models or projects. As an investor, being aware of products or services which may bring in additional revenue is important.

Not only that, but having a basic understanding of how well-received new products are is helpful.

People tend to buy more stock in anticipation of an increase in revenue.

- In June 2022, Lucid begins delivery of its Grand Touring Performance EV

- Grand Touring Performance accelerates from 0 to 60mph in 2.6 seconds and delivers 1,050 horsepower

- On average, Lucid’s EVs perform well in terms of efficiency

- For instance, the Lucid Air Dream Edition range has been accredited with an estimated range of up to 516 miles

- In 2024, Lucid aims to take SUVs to new heights with Project Gravity

- The company hopes Project Gravity will create a new benchmark for electric SUVs

According to the company’s first-quarter 2022 financial report in March of the same year, Lucid has taken over 30,000 orders. The company states it already has 24 service centers and also has potential sales totaling around $2.9 billion.

Lucid Group Plans to Enter the Home Energy Storage Market

Lucid Group, like Tesla, is looking at Energy Storage Systems (ESS) for residential, utility-scale, and commercial applications.

- The firm is currently putting their ESS to the test with a modest solar farm at the Lucid Group’s headquarters

- EV sales are expected to bring in $22.8 billion by 2026, according to the company

- In addition, the corporation has said that the energy storage side of the business might be larger than its automobile division in five years

- If this is right, the ESS division’s revenue would need to exceed $22.8 billion

This remains to be seen, and the company is concentrating most of its energy on being a market leader in EVs. That said, it shows the company is forward-thinking and could offer a lot more to shareholders later down the line.

Lucid Has a Purchase Commitment of Up To 100,000 EVs

When people are looking to invest in a company, it’s also wise to check out its strategic acquisitions and partnerships.

For this guide on buying Lucid Motors stock, we did just that.

This company has agreed on a partnership to be part of the social and transformative economic reform called Saudi Vision 2030:

- The Saudi Arabian Ministry of Finance signed an agreement with Lucid in April 2022

- The deal states that the Ministry will purchase at least 50,000 EVs

- However, this could be up to 100,000 Lucid vehicles over the space of a decade

- The committed volume order number is estimated to range from 1,000 to 2,000 vehicles per year

- This is likely to increase to between 4,000 and 7,000 vehicles per year by 2025

In keeping with Saudi Vision 2030, this commitment supports the government’s efforts to diversify the economy.

This is hoped to create thousands of local high-skilled job opportunities, and offer economic benefits to Saudi Arabia.

Lucid Signed a Multi-Year Deal with Wolfspeed

Lucid will also work with a global leader in silicon carbide technology, Wolfspeed.

- Wolfspeed’s sophisticated Silicon Carbide semiconductors from its state-of-the-art Mohawk Valley factory in New York will be used in the award-winning Lucid Air EVs

- The facility is the world’s biggest 200-millimeter silicon carbide fabrication plant

- Lucid will benefit from increased capacity as a result of this partnership, as it should help them better support their long-term EV production goals

- Wolfspeed’s XM3 Silicon Carbide power modules are used in Lucid Air’s inverters

- Specifically, the XM3 power modules contribute to the efficiency and power density of Lucid’s 163-lb, 670-hp motor

- This is achieved by increasing power density whilst reducing switching losses and resistance

This partnership with Wolfspeed will see Lucid using cutting-edge chips as part of a multi-year agreement.

These silicon carbide chips are more efficient than standard ones. This deal will allow Lucid’s EVs to charge at a faster rate, have a longer range, and be even more efficient.

Will Build a New Operating Facility in Saudi Arabia

As we touched on, Lucid is expanding its manufacturing capabilities beyond the US.

One of the ways the company will do this is to build an operating facility in Saudi Arabia. This facility is set to be completed in 2025.

Lucid looked at a number of options before deciding on King Abdullah Economic City (KAEC) in Saudi Arabia, which is noted for its livability and sustainability.

As such, in early 2022, Lucid confirmed its decision that this is the next location for the second of its worldwide network of EV manufacturing plants.

- The new Saudi Arabian plant will be called the Advanced Manufacturing Plant #2 (AMP-2)

- The project is capable of producing around 150,000 electric vehicles per year

- This will create employment for over 4,500 people once completed and is set to provide significant long-term advantages to KAEC

- The plant’s sustainable-mobility alternatives, as well as a significant increase in job possibilities, will further cement KAEC’s position as the area’s premier automotive center

- Again, this demonstrates Lucid Motors’ dedication not only to global expansion but also to being a part of the Saudi’s Vision 2030

- The aim of which is to achieve the development of promising new industries and economic diversification

The factory will be located in KAEC’s ‘Industrial Valley’ near King Abdullah Port on the main Red Sea commerce route. This route handles almost a third of Saudi Arabia’s Western Region container traffic.

Furthermore, since 2021, Lucid’s Middle East regional headquarters in Riyadh has been active. As such, in addition to this new operating facility, the company will be in a position to continue to grow on a global scale.

Lucid is Expanding into Europe

This company is working hard to expand its brand, which is a positive for those looking to buy Lucid Group stock.

In May 2022, Lucid opened its first luxury research studio in Europe, specifically in Munich, Germany.

Moreover:

- EV customers located in the UK, Italy, France, Denmark, Finland, Austria, Belgium, Spain, and Sweden will be able to place orders on EVs throughout 2022 and beyond

- By the end of 2022, right-hand drive orders will be available for UK customers, with deliveries expected to start in 2023

- The company also stated that it would deliver a very limited number of Lucid Air Dream Edition P and R to reservation holders to celebrate the introduction of Lucid Air

- Reservation holders in the Netherlands, Germany, Switzerland, and Norway will be able to choose between two versions

- This includes Dream Edition R, which embodies Lucid’s meticulous focus on optimizing the range

- Additionally, Lucid offers Dream Edition P, which has a performance-oriented engine

- Lucid’s end goal is to launch additional service centers and luxury retail studios in Germany, as well as the Netherlands, Switzerland, and Norway

- The company says this expansion of retail and service centers will continue throughout 2022

Moreover, in the years that follow, Lucid will expand further into Europe, with the aim of strengthening its position in the global market.

Step 3: Open an Account & Buy Stock

It couldn’t be more simple to buy Lucid stock. After all, it’s listed in the US and there are heaps of brokers that list it. As we touched on, trading platforms in this market will offer low trading fees and a solid customer experience.

This is precisely why we think the question of where to buy Lucid Motors stock is a no-brainer – a regulated brokerage is a must.

Follow the sign-up instructions below to buy Lucid Group stock.

Step 1: Open a Broker Account

To get the ball rolling, visit a brokers website and complete the sign up process.

Most brokers will need the following information to allow traders to buy Lucid stock:

- First and last name

- Chosen username and password

- Place of residency

- Date of birth

- Nationality

All new customer will be asked a few simple questions to finish setting up the account to buy Lucid stock.

This entails filling in a brief questionnaire regarding trading history so the broker knows how experienced the person is. Confirm all to continue to the next step.

Step 2: Upload ID

Next, traders are required to upload some ID to complete the KYC process.

This is required by all regulated brokers and, once complete, allows people to buy Lucid as and when they like in a few clicks.

- Traders need to attach a clear photo or scan of their passport, state ID, or a driver’s license that shows a valid date

- The broker will also need proof of the residency details given in step one of this guide, which must also show the name and date of issue

- Again, this is simple. People can upload a copy of a recent bill such as one from an electricity or water company. Bank statements are also accepted

There will be a full list of supported KYC documents on the platform. Regulated brokers are efficient with the KYC procedure and can usually validate documents within minutes.

Step 3: Deposit Funds

Traders will need to choose a payment method to add funds to their account and buy Lucid Group stock.

For US traders, options include ACH, wire transfer, credit/debit card, or an e-wallet. Some brokers also support PayPal, Neteller, and also Skrill in the US.

Step 4: Search for Lucid Stock

Using the search bar, type ‘Lucid’ in and wait for the results to load.

To place an order to buy Lucid stock right now, click ‘Trade’ to confirm the selection.

Step 5: Buy Lucid Stock

That’s it, in four steps a fully functional account has been created at a broker. Traders can now place an order to buy Lucid Group stock.

Enter an amount of $10 or more and confirm the order to add this stock to the newly created portfolio.

Factors Affecting Lucid

Even those who now feel knowledgeable on buying Lucid stock may still wonder whether it’s a buy or sell. Many market analysts think now is the time to buy Lucid stock.

This is with the view of holding onto it until later down the line as the company grows. That is to say, the company is still a startup compared with other vehicle makers, but has some smart partnership deals in place and many more EV’s in the pipeline.

To name just one partnership, the company has signed a multi-year agreement with Wolfspeed.

- Wolfspeed’s silicon carbide chips will offer significant performance advantages in Lucid’s EVs.

- Moreover, Lucid’s initial EV offering, the Air Sedan, has won various awards.

- Lucid’s EV was awarded Car of the Year by MotorTrend magazine in 2022 and has beat the likes of Mercedes EQS and Porsche Taycan, amongst others.

Lucid has also been praised for its energy-efficient vehicles and its Air models have a longer range than Tesla’s EVs. The company also has a clear roadmap.

This includes penetrating the European market and building various new facilities such as factories, as well as luxury retail studios and service centers.

Not only that, but the company has openly stated that it will enter the renewable energy home storage market at some point in the future. In 2021, the worldwide energy storage systems market was estimated to be worth nearly $211 billion.

Conclusion

That brings us to the end of this guide on buying Lucid stock. We’ve explained the ins and outs of the company and also the stock’s performance in recent years.

We’ve also provided a guide covering the process of purchasing Lucid stock from a regulated broker.