Surgical robot technology has advanced steadily since the 1970s – when NASA first began to develop it. Although robotic medical systems are still in their infancy, advancements are occurring swiftly.

One of the leaders in this space is Intuitive Surgical, a company whose stock trades on NASDAQ. This guide will explain the ins and outs of how to buy ISRG stock in 2025.

How to Buy ISRG Stock

As well as researching the company and its performance, one of the first steps for investors is to consider where to buy stocks.

By adhering to the four steps outlined below, investors can buy ISRG stock on a commission-free basis with a regulated brokerage.

- ✅Step 1 – Open a Trading Account: Begin the sign-up process by heading over to a trading platform that holds a regulatory license. Enter some basic information – such as a name and contact details, and then add the desired username and password.

- Step 2 – Upload ID: Brokers that follow the KYC process can verify an investor’s identity with an uploaded photo ID and proof of address. For example, a passport or driving license. This is in addition to a letter or bill with a full name and address, such as a bank statement.

- Step 3 – Deposit Funds: Many brokers allow investors to choose between an array of deposit methods. This typically includes options such as credit/debit cards, bank wire transfers, ACH, and in some cases e-wallets.

- Step 4 – Buy ISRG Stock: The most efficient way to locate ISRG stock is to type its full name or ticker into the search bar. Enter Intuitive Surgical or ISRG, and then place a buy order by entering the monetary amount to invest. Confirm the order to complete the transaction and add ISRG stock to the portfolio.

Step 1: Decide Where to Buy ISRG Stock

There are tons of trading platforms to sieve through when deciding where to invest in ISRG stock.

In this regard, we’ve reviewed some reputable US-friendly brokers in the sections below.

2. Webull

Notably, Webull states that international ADRs attract other fees such as custody or depositary service charges of $0.01-$0.03 per share. Webull facilitates fractional investing. As such, although at the time of writing, the Intuitive Surgical stock price is over $200, investors can allocate $5 or more to add it to their portfolio of assets.

As well as familiarising themselves with how to buy ISRG stock, it’s also important for investors to check deposit methods, minimums, and fees. Webull accepts ACH and wire transfers, with no minimum deposit expected. Notably, the platform may charge a deposit fee, depending on the payment method used.

ACH is free, while each wire transfer deposit costs $8. Withdrawals using this payment type are charged $25. Features include customizable price charts, news, and other basic trading tools. That said, Webull does not offer any passive Copy Trader tools. Nonetheless, the broker offers IRAs, options, cryptocurrencies, forex, and ETFs.

At the time of writing, Webull is offering up to 12 free stocks to a new account with a maximum value of $30,600.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy ISRG Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research ISRG Stock

Prior to placing an order to buy Intuitive Surgical stock, it’s important to research the company in full.

To give investors an informed start, we’ve analyzed a range of metrics, such as its stock price and performance, revenue model, dividend policy, and more.

What is ISRG?

The company is primarily known for medical technology, most notably robotic surgical systems, of which this company was the pioneer.

- With the use of cutting-edge robotic technologies, end-to-end learning, and value-added services, Intuitive Surgical has advanced minimally invasive care for the masses

- Da Vinci Surgical Systems are stand-out products for the company, along with accompanying tools, services, and equipment

- The company’s Da Vinci Surgical System is one of the forerunners of robotic-assisted medical procedures

- It is used to perform a variety of surgeries with less risk

Here is some more information about Intuitive Surgical:

- Around 6,730 Da Vinci Surgical Systems are used in almost 70 countries worldwide

- The company has provided training on this technology to over 60,000 surgeons globally

- Thus far, there have been over 10 million medical procedures performed using this particular surgical system

- Another product by Intuitive Surgical is the Ion endoluminal system

- This is a robotic-assisted bronchoscopy platform for minimally invasive lung biopsies

The Royal College of Surgeons of England (RCS) is a pioneer in surgical education and ensures the standard of all training programs offered in the UK and around the world. In October 2022, Intuitive Surgical became the largest robotic surgical provider to receive accreditation from the RCS.

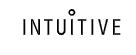

ISRG Stock Price – How Much is ISRG Stock Worth?

ISRG was listed on the NASDAQ in 2000. Taking the two previous 3-for-1 ISRG stock splits into account, the IPO price was just over $2. Based on its value at the time of writing, ISRG stock has increased by over 10,000% since its IPO listing.

Over a shorter period of five years, the ISRG stock price has increased by over 75%. The all-time high of ISRG stock was in November 2021, at which time the price was almost $365. By January 2022, the stock had fallen to just over $271. This occurred following the company’s Q4 2021 earnings call.

Whilst earnings and sales were slightly higher than what had been previously expected, the Intuitive Surgical stock price fell as the company noted the impact of COVID-19 on Da Vinci procedure volumes. As such, the stock price declined by almost 26%, compared with its all-time high just months earlier.

Intuitive Surgical’s Q2 2022 results fell short of expectations, as the company missed expected revenue by 2.46% and EPS by 4.84%. This led to a further decline of almost 6% in a single trading day in July 2022. In October 2022, things began to look up for ISRG stock. Following its Q3 2022 report, the stock increased by almost 9% in a trading day.

This report showed procedure growth for its robotic surgical system, as well as beating revenue estimates by 2.63% for the quarter. At the time of writing, this ISRG stock is trading at a discount of around 40% compared with its all-time high in 2021.

ISRG Market Capitalization

The market capitalization of ISRG stock is over $78 billion at the time of writing. As such, Intuitive Surgical is classed as a large-cap stock.

ISRG Index Funds

Intuitive Surgical is a constituent in multiple funds.

Here are some funds that hold ISRG stock:

- Global X Robotics & Artificial Intelligence ETF

- iShares Core S&P 500 ETF

- Vanguard Growth Index Fund

- iShares U.S. Medical Devices ETF

- Health Care Select Sector SPDR Fund

- Franklin Intelligent Machines ETF

This means it’s possible to buy Intuitive Surgical stock, whilst simultaneously gaining exposure to a basket of other equities.

EPS and P/E Ratio

Some key metrics investors can check prior to allocating funds to Intuitive Surgical stock are the EPS and P/E ratio. This is because they offer a clearer indication of the market value of a company compared to its earnings.

Here is some more information, according to the last four earning reports:

- Q4 2021 report showed an EPS of $1.30, which was a 1.56% surprise

- Q1 2022 report showed an EPS of $1.13, which was a 5.10% surprise

- Q2 2022 report showed an EPS of $1.14, which was a negative surprise of -4.84%

- Q3 2022 report showed an EPS of $1.19 which was a surprise of 6.30%

- Based on its price at the time of writing, the P/E ratio of ISRG stock is 57.86 times

As we touched on in the stock price analysis section of this guide, Q2 2022 was a disappointment for shareholders. The negative report reflected fundamental headwinds specific to fewer trade-ins and supply chain timing.

According to the company, unlike Q4 2021, there was a more substantial influence on its capital placements than the total pressure from COVID lockdowns. The latter had a minor impact on procedures in the quarter.

ISRG Stock Dividends

As is clear from the previous financial reports, this medical device maker is still growing. As with many growth stocks, Intuitive Surgical does not pay dividends.

This is largely because the company uses profits to continue to grow and advance. This could work out well for long-term investors in the long run.

ISRG Stock Features

When researching how to buy ISRG stock, investors can also analyze the key features of Intuitive Surgical to ensure it aligns with their goals.

See some key features of this company below:

The Da Vinci SP System has Been Approved by Japanese Regulators

The robot-based Da Vinci system from Intuitive Surgical offers minimally invasive surgery. This technology continues to benefit the business, which improves overall performance.

- The Da Vinci SP system has already received approval and is readily available in the US for transoral urology and otolaryngology procedures

- In December 2021, the company announced that it has reached a milestone

- This company’s technologies have been used by surgeons to perform more than 10 million robotic-assisted surgical procedures globally

- Intuitive Surgical’s fourth generation of products also includes the Da Vinci X and Xi multiport systems

- The Da Vinci SP surgical system has now been approved by Japan’s Ministry of Health, Labour and Welfare (MHLW) for use in a variety of procedures

- This includes thoracic, urologic, gynecological, and general surgery, in addition to transoral head and neck procedures

- Since receiving its first approval for its multi-port system in 2009, the firm has expanded coverage by public insurance to include 29 different types of robotically assisted procedures in Japan

- The company’s top line could increase in the future thanks to the widespread approval of the Da Vinci SP system

As such, Intuitive Surgical is getting ready to introduce its brand-new single-port robotic surgical system to the Japanese market.

According to the manufacturer, Da Vinci SP can also be utilized in Korea for operations such as oral otolaryngologic, general, and gynecologic laparoscopic procedures, as well as urologic, and thoracoscopic surgery.

Expected Growth

It is anticipated that Intuitive Surgical will resume healthy levels of top-line growth over the coming years. This is in part because hospitals are no longer required to set aside such a sizable portion of their resources for treating COVID-19 patients.

It’s also worth bearing in mind that people are less concerned about the possibility of contracting the coronavirus while being admitted to a hospital. As such, a 12.4% growth in annual revenue is anticipated for the robotic surgery specialist in 2023.

In addition to reporting positive results and expectations for 2023, Intuitive Surgical boosted its projection for 2022. Procedure growth is now anticipated to be between 17% and 18%. This is 3% and 1.5% up from the previous guidance of 14% to 16.5%.

Furthermore, in addition to the top and bottom line figures, which showed a clean bill of health, management announced that the company had made a significant investment in itself. Intuitive Surgical revealed that under an existing repurchase authorization, it spent more than roughly $1 billion buying back its common stock in Q3 2022.

This is a potential positive for investors since share repurchases can signal management’s confidence that the stock is undervalued. Furthermore, as the share count declines, investors own a larger portion of the business.

Demand for Robot-Assisted Surgery is Likely to Increase

Thanks to companies like Intuitive Surgical, many common heart treatments can now be carried out using very tiny incisions.

This is because of the aforementioned advancements in robotic-assisted surgical technology, of which Intuitive Surgical is a market leader.

- When there are more procedures, Intuitive Surgical makes more money

- Due to overcrowded hospitals delaying many non-emergency surgeries, COVID-19 slowed the growth of many medical-tech stocks

- As such, it’s plausible that demand for robot-assisted surgery, tools, and services could grow as hospitals return to normal following the pandemic and previous supply issues

- The three sources of income for Intuitive Surgical are the sale of machines, instruments, accessories, and services

- Selling machinery generates a one-time income, whereas the other two revenue streams are recurrent

- The company receives about 70% of its revenues from repeat customers

Patient advantages of Da Vinci Robotic Surgery include a decreased risk of infection. Moreover, smaller incisions and fewer stitches greatly increase the likelihood of reduced scarring. Other advantages include shorter hospital stays and quicker healing.

Bearing all of these factors in mind, it’s no surprise that according to some analyses, the surgical robotic systems market was valued at $3.6 billion in 2021, and is expected to continue expanding.

As noted, Da Vinci Surgical Systems are already utilized in 70 countries.

Step 3: Open an Account and Buy ISRG Stock

Earlier in this guide, we evaluated some regulated brokers that accept US traders and facilitate fractional investing.

It’s also possible to invest in ISRG stock on a commission-free basis.

Below, we’ve detailed the steps needed to open an account and buy Intuitive Surgical stock:

Step 1: Open a Stock Broker Account

To invest in ISRG stock, head over to a regulated trading platform and look for the link to sign up.

Next, enter some personal information such as a name, address, email, and cell phone number.

The brokerage may also ask for a username and password personal to the investor.

Step 2: Upload ID

Regulated brokers require investors to provide ID and proof of address.

The former can be a passport, state-issued ID, or a driving license.

Many trading platforms can validate an address using a recent bank statement or utility bill.

Step 3: Deposit Funds

Next, fund the account by selecting a payment method and meeting the minimum deposit as stipulated by the broker.

Supported deposit methods can include credit/debit cards, e-wallets, and banking options such as wire transfers or ACH.

Step 4: Buy ISRG Stock

Most trading platforms include a search bar to make finding the desired asset easier. Type ISRG or Intuitive Surgical into the search bar and hit enter.

When it appears, click buy or trade and then enter the size of the position, meaning the amount to invest. Next, confirm and if the market is open, the stock should appear in the brokerage portfolio site right away.

ISRG Stock – Summary

So far, we’ve talked about the ins and outs of Intuitive Surgical, including the ISRG stock forecast, performance, and more.

Below is a recap of what we’ve covered today:

- The robotic surgery technology from Intuitive Surgical has been accessible in Japan for more than ten years

- Since receiving its initial approval for its multi-port system in 2009, the company has expanded coverage to include 29 different types of robotic-assisted procedures

- In 2022, the Da Vinci SP (single-port) surgical system received approval from the main Japanese regulatory body to be used in a variety of procedures

- With the clearance of a single-port robotic surgical system, Japanese surgeons will be able to perform complicated procedures faster and with the least amount of trauma

- The Da Vinci SP system has already received approval and is readily available in the US

- As of 2022, more than 10 million procedures have been carried out using Intuitive Surgical’s products

- Based on its price at this time, ISRG stock has increased by more than 75% over the last five years of trading

- In its Q3 2022 earnings call, the company beat its expected EPS by 6.30%

- In 2022, the company announced that it has invested $1 billion in share buybacks

Investors should carry out their own research prior to investing in ISRG stock. This should include looking at past performance on the stock market and the company’s financials.

The investor should also carefully consider how much they can afford to allocate to the stock in question. Some online brokers allow traders to buy ISRG stock in fractional amounts from just $5-10.

Conclusion

Investors that think there’s a future in robot-assisted surgery are researching companies like Intuitive Surgical, a leader in this technology.

The company enables medical professionals to perform minimally invasive surgeries that reduce risks, infections, and scarring for patients.

Intuitive Surgical recently reached a new milestone when it announced that over 10 million procedures have been carried out using its systems.

This guide has talked about how to buy ISRG stock. We’ve also delved into the financial reports, stock performance, key features, and more. Over the last five years, the price of Intuitive Surgical stock has increased by more than 75%.

FAQs

How do I buy ISRG stock?

Did ISRG split their stock?

Can I buy one dollar of ISRG stock?

How much is ISRG stock per stock?