Gamestop began life in the US as a brick-and-mortar retail store selling gaming consoles and accessories. The company is now directing much of its focus to e-commerce and the stock still has the support of investor communities like WallStreetBets.

In this guide, we show you how to buy Gamestop stock in 2025.

How to Buy Gamestop Stock in 2025

It’s a simple affair to invest in companies online these days. Once you’ve decided where to buy Gamestop stock, you can create a broker account.

Below, we show you how to buy Gamestop stock with the preferred broker of your choice.

- ✅Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process. Enter your personal details and create a username and password.

- Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license.

- Step 3 – Deposit Funds: Users can deposit funds by choosing a payment method which may include e-wallets, credit/debit cards, and ACH.

- Step 4 – Buy GameStop Stock: Users can search for the GameStop stock on the search bar of their platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Step 1: Decide Where to Buy Gamestop Stock

Making a decision on where to buy stocks is no easy feat with so many brokers offering access to the US markets. As such, we’ve reviewed the most popular platform that allows users to buy Gamestop stock.

This broker is regulated in the US and holds a FINRA membership.

Webull

Not only that but thanks to the broker’s acceptance of fractional trading, you can also allocate as little as $5 when making a purchase. There are more than 5,000 stocks available to trade at Webull. There are also non-US listed stocks, however, these are offered in the form of ADRs which often attract fees between $0.01 and $0.03 per share.

You can fund your Webull trading account with a wire transfer or ACH and there is no minimum deposit required to start investing. If you’re preferred payment type is a wire transfer, you will be charged $25 per withdrawal and $8 each time you make a deposit.

If you are based in the US and want to diversify, you can buy cryptocurrency by staking as little as $1.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Gamestop Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Gamestop Stock

It goes without saying that you need to research any potential investment. As such, prior to electing to buy Gamestop stocks, you will need to carry out a thorough investigation to reach your own conclusion on whether it makes a viable investment for you.

To save you a bit of online legwork, we’ve detailed further information below for you to study. This covers the Gamestop stock price and some key financial data, amongst other things.

What is Gamestop?

Gamestop had almost 5,000 brick-and-mortar shops at the height of its popularity. Whilst many shops have since been sold off, the company still operates over 3,000 outlets.

In addition to its traditional retail outlets, Gamestop is now concentrating on the e-commerce side of its business, to satisfy customers’ growing need for convenient online shopping and doorstep deliveries.

Not only that, but Gamestop, as we talk about shortly, is diving into the world of NTFs.

Gamestop Stocks Price – How Much is Gamestop Stocks Worth?

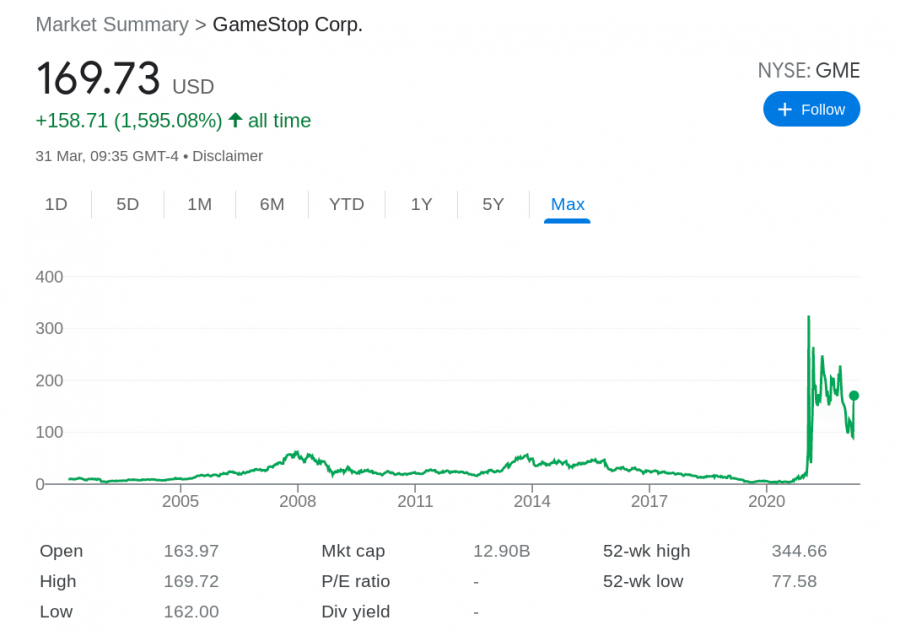

Gamestop was founded in 1984. In terms of Gamestop’s life as a publically listed stock, its initial IPO took place in February 2002, with a share price of $18. For many years the stock was stagnant and only saw two peaks over $50, with the most recent being just over $63 on December 24, 2007. Over five years of trading on the NYSE, Gamestop stocks have increased by 625%.

This all changed in 2021. Gamestop stock started in 2021 at a value of around $17 per share. However, as you likely know, in the same year Gamestop went on to become the poster child for a meme-stock craze that exposed weaknesses in the share market’s trading structure.

Following the hype surrounding casual and retail investors buying on mass, by January 27th Gamestop stock skyrocketed to almost $350. A day later, in an intra-day trading session stocks briefly increased to almost $500.

This illustrates a massive increase of almost 2,000% in less than a month. By February 2021, the stock had plummeted to around $40. Many online brokers halted trading of the stock or put restrictions in place in an attempt to stop investors from dumping their shares and making gains from the dramatic slide.

Gamestop stocks didn’t stay down for long, as its shares slowly climbed back up throughout March 2021. For the rest of 2021, Gamestop remained above the $100 mark.

Interest in Gamestop stocks has increased once again. In March 2022, the company’s chairman Ryan Cohen announced that he had acquired 100,000 more shares of Gamestop’s common stock. Moreover, as we talk about shortly, GameStop stock is once again at the top of the discussion boards on the same online forum that caused the stock to skyrocket in 2021 – WallStreetBets.

Gamestop Market Capitalization

As of writing, Gamestop has a market capitalization of nearly $13 billion – which makes it a large-cap stock. This is over 300% higher than its market capitalization a decade earlier.

Gamestop Index Funds

Gamestop stock is included in the S&P 400 Midcap index, S&P 600, and the NYSE Composite.

EPS and P/E Ratio

Let’s take a look at the financials of this company before you decide to buy Gamestop stocks.

- From January 2017 to January 2021, GameStop’s P/E ratio stood at an average of -14.0x

- During the same period, GameStop had a typical P/E ratio of -0.3x

- Over the past 12 months, GameStop’s P/E ratio stood at -33.3x and the P/S ratio at 2.1 x

- As of March 31st, 2022, GameStop’s stock has a P/E ratio of 0

- Gamestop is unprofitable, so it’s not possible to offer a comparison to the P/E ratio of the industry average in the same sector

According to its latest financial report, Gamestop’s EPS is -5.02. With its management changeup and plans to expand its business model, the company should start to generate a profit in the next few years.

Gamestop Stock Dividends

Between 2012 and 2019, Gamestop paid a consistent annual dividend. However, the corporation no longer distributes dividends owing to financial issues.

GameStop Features

Whether or not you decide to buy Gamestop stock will depend on multiple factors, largely, your own goals and appetite for risk.

Below we’ve listed some of the main features to look at when deciding to buy Gamestop stock in 2022.

Gamestop is Changing its Business Model

Gamestop is changing its business model, according to a report released in mid-2021. The company has a comeback strategy in mind that involves modernizing, leveraging digital assets, and diversifying.

See below:

- The announcement of Gamestop’s soon-to-be-launched NFT marketplace platform, as well as its ambitions for Web 3.0 and blockchain, appear to be the company’s first steps into the future

- Immutable X, which is a blockchain protocol designed to mint NFTs, will be in charge of supporting the marketplace

- Gamestop’s management has agreed to receive up to $150 million in IMX tokens, which is the protocol’s native crypto asset

- This will be distributed in stages depending on how the project progresses

- If Gamestop’s initiatives are successful, they might have a long-term impact on the company’s business model and future shareholder value

- Another major goal of the recovery is to move away from expensive mall storefronts and become an internet-based retailer

- On the surface, this appears to be a reasonable strategy, given that customer purchasing patterns have shifted to the digital realm and are continuing to do so

Gamestop’s forays into new and unproven areas, such as Metaverse prospects, NFTs, and cryptocurrencies have raised some eyebrows. However, the hope is these ventures create value for shareholders down the line.

Crucially, the company is still popular, and the hope is loyal customers follow Gamestop on its journey, as well as new ones. Gamestop’s CEO has said the company wants to become the Amazon of gaming.

Gamestop has a Strategic Multiyear Partnership With Microsoft

In order to provide rich new digital experiences to consumers, Gamestop will standardize its business operations on Microsoft’s hardware devices and cloud solutions.

This is all part of its mission to become the primary omnichannel customer access point for video game products.

- This also allows Gamestop to offer Xbox All Access, which is a no-cost package that includes the Xbox system and 24 months of Xbox Game Pass Ultimate

- Furthermore, GameStop and Microsoft are expected to collaborate on the release of one, or numerous, NFT titles

- In February 2022, multiple hints were made of a potential announcement on social media, mostly Twitter and Reddit

- This caused Gamestop stock to increase by almost 10%

Whilst rumors should be taken with a pinch of salt, if this comes to fruition, Microsoft would be able to use the collaboration to provide even better gaming experiences. This would apply to consoles such as Xbox as well as PCs.

The agreement would also enable Gamestop to develop new digital extensions of its brand, concentrating on membership-based services and digital currency as well as providing customers with the next generation of games.

A multi-year partnership with such a trusted technology company is another potential reason to buy Gamestop stock whilst priced at less than $200 per share.

Gamestop’s High-Profile Management Shakeup

When researching how to buy Gamestop stock, you will have noticed the boardroom and executive offices of the firm have been refurbished in the last year.

- The board has been completely reconstituted, with activist investor and Chewy CEO Ryan Cohen now serving as chairman

- Only three key officials at Gamestop have remained in place: Chief Information Officer Angela Venuk, General Counsel Dan Reed, and Human Resources Vice President Lisa Keglovitz

- From Brand Development Vice President Andrea Wolfe to CEO Matt Furlong, everyone else is a newcomer

- As news broke in 2021, premarket Gamestop stock rocketed 9%

Gamestop’s stock also soared after chairman Ryan Cohen invested an additional $10 million in the company in March 2022. Following the announcement, GameStop’s stock price soared to its highest level so far in 2022.

The new management team at Gamestop includes former Amazon executives. The hope for anyone looking to buy Gamestop stock is that this shakeup will bring stability to the company and allow it to grow exponentially.

If successful, this move could transform Gamestop from a brick-and-mortar retailer to an e-commerce powerhouse.

Gamestop Has a Refreshed Balance Sheet

GameStop has reported a net loss in three of the previous four quarters. With that said, it has around $570 million in cash and $552.2 million in debt, resulting in total net cash of $18.1 million.

Gamestop used the increasing stock prices of 2021 to improve its financial sheet, raising $1.7 billion in desperately needed capital.

- Gamestop’s short-term assets amount to $2.6 billion

- This is are more than its short-term liabilities of $1.4 billion and its long-term debt commitments of over $542 million

- Crucially, this means that Gamestop has more cash on hand than it has debt

- In fact, according to recent data, over the last five years, Gamestop’s debt to equity ratio has dropped from 36% to 2.8%

With a market valuation of nearly $13 billion as of writing – which is up from $670.2 million in 2021, and over 4,800 locations, GameStop is still a company of significant size and thus 0 is working hard on increasing value for shareholders.

Step 3: Open an Account and Buy Gamestop Stock

Opening an account to buy Gamestop stock only requires a few steps. Select the broker of your choice and follow this guide to buy GameStop stocks.

Step 1: Open a Stock Broker Account

Users can head over to the chosen broker they wish to begin trading with and download the stock app. Traders are required to enter their personal details and create their account by confirming their username and password.

Step 2: Upload ID

The next step is to verify your identity by uploading a valid photo ID. Users can do so by sending a copy of your passport/driver’s license and proof of address.

Step 3: Deposit Funds

The next step for users is to deposit funds into the account. Choose one of the available payment methods and then deposit money into the trading account.

Some of the available payment methods may include credit/debit card options, bank transfers or e-wallets like PayPal.

Step 4: Buy GameStop Stock

The final step is to begin purchasing the stocks. Users can type “GameStop” on the platform’s search bar and hit enter. Finally, enter the amount you wish to enter into the position and confirm the transaction.

Conclusion

Gamestop became the poster child for the meme stock frenzy that occurred in 2021. There is no saying for sure whether prices will reach those highs again.

Users can carefully analyze the stock and decide whether they wish to invest in GameStop. If traders want to buy this stock, they can pick a popular broker of their choosing and open a new position.

FAQs

How do I buy Gamestop stock?

Did Gamestop split their stock?

Can I buy one dollar of Gamestop stocks?

How much is Gamestop stock per share?

Read More:

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks

- Best Meme Stocks to Watch in 2025

- How to Invest in Stocks Online for Beginners

- Next GameStop Stocks to Buy in 2025