Ford Motor Company has cemented its legacy as one of the biggest automobile manufacturers in the world. With a growing revenue of $136 billion in 2021, Ford stock is among the most popular buys on the portfolios of stock market enthusiasts.

In this guide, we show you the process of buying stock in Ford and review the best platform to buy the company’s stock.

Buying Ford Stocks – An Overview

Trading and investing in the stock market has never been more accessible with online platforms. With a safe and reputable broker, you can buy stocks in minutes.

Below, we show you the steps to buy Ford and other stocks with a trusted broker.

- Open an account with a regulated broker – Head over to the broker’s website or mobile app and create an account. Provide your email address and create a username and password to complete this step.

- Upload ID – Verify your account by providing a valid photo identity. Either a passport or driving license can be used for the verification process.

- Deposit – Using any of the multiple payment methods that the broker provides, deposit the amount of fiat currency you wish to start trading with.

- Buy Ford Stock – Search for “Ford” using the navigation tools and enter your desired position size (minimum $10). Click “Open Trade” to confirm your purchase.

The steps above present an overview of buying Ford stock. If you are looking for an in-depth description of buying Ford stock, continue reading our guide.

Step 1: Choose a Stock Broker

Your first step is to find the place to buy Ford stock. The most popular stock trading platforms offer low fees on stock trades and provide a simple UI to accomplish this task. You should also look for brokers that provide fractional sharing – allowing you to buy just parts of a stock instead of purchasing an entire share.

Here is a full review of the best platform to invest in Ford stocks that meet those criteria:

Webull – Invest in Ford stocks using a Trading App

Founded in 2017, Webull provides users with the opportunity to purchase

Charging zero commissions on stock trades and boasting a low minimum deposit of $5, Webull’s low pricing structure is beneficial for beginners. From the 3,000 + stocks available on the platform, you can invest in a variety of assets through the fractional sharing feature Webull offers.

However, Webull’s only drawback is its limited payment options for depositing money – only offering bank transfers as a payment method. Despite this, Webull’s simple account opening process and simple mobile app make it a solid platform to buy Ford stock.

Catering primarily to the US markets, Webull is strictly regulated by the Securities & Exchange Commission (SEC), FINRA and SFC. A safe & secure platform, Webull provides over $500,000 worth of investor protection through the SIPC scheme.

| Number of Stocks | 3,000 + |

| Deposit Fee | No deposit fee |

| Cost of buying Ford Stock | 0% commission (Small spread fee) |

| Minimum Trade Size | $5 |

Your capital is at risk.

Step 2: Research Ford Stock

Now that you know where to buy Ford stock, it is important to complete a thorough assessment of the company before your investment. It is vital to analyse the company’s financials and business model to reach a conclusion on your investment decision.

We have completed a detailed study of the Ford Motor company below to save you time and research. Read on to learn about some key financial data relating to the Ford stock.

What is Ford

Founded by Henry Ford in 1919, Ford Motor Company is a leader in the global automotive industry and

Operating globally, Ford Motor CO. employs more than 186,000 people. After operating as a standard automotive maker for more than a century, Ford is currently focusing on electric car production and self-driving technology to compete with Toyota, Volkswagen and Tesla.

In 2021, Ford reported revenue of $136 billion, up from its 2020 earnings of $127 billion. The manufacturer also became the second-largest automotive maker of all-electric cars in the U.S, only behind Tesla. The company credits the desirable earnings due to an ease in the global computer chips shortage, which caused revenue to decline in 2020.

Ford has big plans for 2022, with the release of its F-150 lightning truck, which is the number one selling truck in the United States. The automotive maker expects to increase profits by 15% to 25% in 2022.

Ford Stock Price – How Much is Ford Stock Worth

Despite being formed in 1919, Ford Motor Company only went public in 1956. However, the Ford IPO (Initial Public Offering) turned out to be the largest in American history at the time.

The Ford stock sold in the initial offering totalled $643 million. Over 200 banks on Wall Street applied for the Class A shares (first round of shares). Eventually, the stock reached a total market cap of $3.2 billion on the first trading day.

Currently, Ford Motor Co. has a total market cap of $60.2 billion. This equates to an all-time increase of almost 18x. In the last decade alone, the price has increased by 140%, increasing 136% in 2021 alone.

While the overall price performance has been strong, Ford Motor Co. has proven to be a volatile stock at times. In the 1970s, the stock had witnessed a dip of more than 70%. Trading at $35 in 1999, the stock again plummeted to a value of just $8.1 in 2008, triggered by the stock market crash.

However, the Ford stock has historically recorded high earnings after dips in its stock price. After falling to a value of $1.5 in 1981, the stock soared to $15.7 by 1989. The same was witnessed after the 2008 stock market crash, as Ford rallied by 338% the following year.

Currently, the Ford stock price is at $14.59 as of May 2022, down nearly 33% YoY (Year on Year).

With a low P/E ratio of 5.10 and an EPS (Earnings per Share) of $4.5 in 2021, the Ford stock has just undergone a slight price correction.

Competition

Despite a market cap of $60.2 billion, Ford is behind some of its competitors in the EV industry. For example, Tesla leads the EV market with a market cap of $986.2 billion.

CNBC states that Ford still has a long road ahead, despite the highs of 2021. With some of the competitors in the EV industry being over-valued, Ford is still reasonably valued and has significant growth potential.

Analysts

A group of 20 analysts at CNN.com have predicted a median target of $18.50 for Ford in 2022. This is a 27.3% increase from current levels. It is worth noting that the highest target for Ford is $32, while the lowest is $11.

According to The Street, a group of Wall Street analysts, Ford is a moderate buy with a median price target of $23.13. The price prediction estimates a 70% increase in the Ford stock price.

Ford Stock Dividends

Since dividend payouts can be a way to earn passive income on stock investments; users have another reason to buy Ford stock.

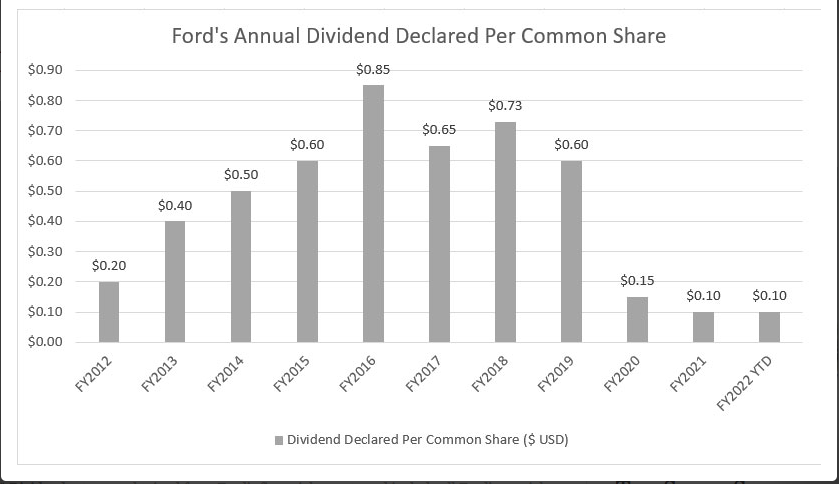

The Ford Motor Company is one of the most popular dividend stocks to purchase in the U.S markets, providing quarterly dividend payouts to all stockholders. On average, Ford provides an average dividend of 1% to 2% a quarter.

The company has a history of successfully paying out quarterly dividends – 2006 being the last time investors did not get a payout. However, Ford has been announcing reducing dividends since in the last decade.

In 2021, stockholders earned a dividend payout of $0.10 per share for the first three quarters. While the amount does not seem like much, dividend earnings are a massive boost for long-term investors and traders who have accumulated large amounts of the Ford stock.

The last time the company did not pay out a dividend was back in 2006, making Ford a safe bet for regular dividend payouts throughout the year.

Ford Stock Strengths 2025

Considering all the information we have covered above, Ford stock could be a worthy investment for the future. Let’s analyse this by taking a detailed look into some of the main factors and talking points.

EV industry

The Ford stock is also gearing up to become a leader in the EV industry, which is one of the fastest-growing industries in the automobile industry.

Ford USA posted the second-largest sales in the EV industry in 2021, behind Tesla. Ford’s Mustang Mach-E sold more than 27,000 units in the year, making it the nation’s second-favorite electric SUV behind Tesla’s Model Y.

After achieving new sales records in December 2021, Ford’s electrified vehicles sector grew 36% faster than the rest of the companies in the industry.

By maintaining chip supply issues and competing with Tesla and Lucid, Ford has the potential for more growth in the coming years.

Available at a Discounted Price

Currently, the Ford stock is trading at $14.59 as of May 2022. The stock is 22% below on a YoY basis. The company reported a 10.5% in vehicle sales and a further 17.8% decline in truck sales.

However, the SUV sales are up by 2.7% and their electrified sales are up by more than 50%. The EV sector represents 9.5% of its total sales and is the company’s main focus in the coming years. This is why many investors may favour entering Ford at the current price.

While this is not indicative of future profits, Ford Motor Company has a history of providing long-term investors with return.s

Earnings Increase

Despite a decline in the stock price since 2022, Ford Motor Company reported stellar earnings in 2021. With total revenue of $136 billion in 2021, the company earned $9 billion more than the preceding year.

The company made a profit of $17.9 billion in total. A big chunk of the gains came from Ford’s stake in Rivian, a maker of electric trucks. Another reason for the earnings increase was the company’s ability to adjust after a global computer chip shortage, severely delaying production throughout 2020.

While Ford released a quarterly loss of $3.1 billion in April 2022, the stock did not witness a further correction. Ford has pointed to its recent investment in Rivian stock as the main culprit behind the downward earnings report.

Ford Co. has also met Wall Street analysts earning predictions for Q1. The automotive maker made an EPS of 38 cents, higher than the predicted 37 cents coming from Wall Street.

Ford’s revenue of $32.1 billion for Q1 also surpassed Wall Street’s expected earnings by almost $1 billion.

Competitive Products entering the Market

2021 was a solid year for the company due to Ford’s drastic entry into the EV space. The majority of Ford’s focus in the EV sector in the coming years is surrounding their new electric truck – The F-150 Lightning. Ford Co. states that they have already taken in more than 200,000 reservations from customers for this new product.

While Tesla sold nearly twice as many EV products as their closest competitor in 2021, Ford expects to bridge the gap in the coming year. Based on pre-release sales, the F-150 Lightning has become the largest-selling electric truck in the United States.

With Tesla having no similar product in the U.S markets currently, Ford expects profit before certain expenses to increase by 15% to 25%. The company is preparing to produce 60,000 more F-150 Lightning models in 2022 and 150,000 by 2024.

Step 3: Open an Account & Buy Stock

Opening an account and with a regulated broker is straightforward. In under 5 minutes, start trading Ford with a trusted broker by following 4 simple steps.

Step 1: Open an account with a regulated broker

Visit the broker’s website and complete the account creation process. You will need to provide your email address and create a username and password to sign-up.

Complete this process by entering your full name and phone number.

Step 2: Upload ID

With regulated brokers, users need to verify their identity & residency before buying any stocks. Complete your verification by providing a photo ID.

- The photo ID can be either a passport or a valid driver’s license.

- Next, provide the site with your address proof. For example – a Bank statement that shows your name, address and date.

- The platform will verify your identity in under 5 minutes and send you a verification confirmation via email.

Step 3: Deposit Funds

Before you purchase Ford stock, you need to fund your account.

Supporting multiple payment methods, you can use credit/debit card options, bank transfers and e-wallets like PayPal, Neteller and Skrill to buy Ford and other dividend stocks.

Choose your preferred payment method and insert the deposit amount. Confirm this by clicking on “Deposit”.

Step 4: Search for Ford Stock

Once your funds have been deposited, you can proceed to search for Ford. Using the simple navigation bar, type “Ford” into the empty field on the search bar.

After having selected the stock, click the “Trade” option to continue.

Step 5: Buy Ford Stock

Once you click on trade, a pop-up appears on your screen with the buy/sell button.

Select “Buy” should you wish to trade on the price of Ford to rise and “sell” if you think the price will go down. You can choose to leverage your trade up to 5x – multiplying your chances of making profits or losses.

Enter your deposit position on the “Amount” section displayed on your screen.

Once you have inserted your desired amount, click on “Set Order” to confirm the purchase.

Factors Affecting Ford

After analysing everything from the company’s financials to their historical performance, we can understand the stocks strengths. According to us, the Ford stock is a solid investment opportunity for the long-term. Many could look to enter the stock at current levels if they wish to purchase Ford at a discounted rate.

Historically, the Ford stock price has been volatile at times but always bounced back. After the financial crash in 2008, the stock price of Ford increased by 338% the following year. Similarly, Ford experienced a significant rally in 2021, gaining almost 140% in the year.

Most price analysts are predicting the stock price of Ford to be a moderate buy for the rest of 2022. While this does not confirm a profit upon entry on current levels, the company is gearing towards a strong 2022 due to its electric vehicles sector.

Ford Co. is expecting to increase roughly 15% to 25% of its annual revenues due to an increase in computer chip units. Ford is also expected to boost their EV industry with its new electric truck, the F-150 Lightning. With 200,000 pieces already being accepted by the company, Ford expects to bridge the sales gap between themselves and Tesla in 2022.

Notably, the Ford stock has not faced a price correction despite slow earnings in Q1 of 2022. The earnings decrease is mainly due to their large stake in the electric truck company, Rivian – declining considerably after making Ford $9 billion in profit in 2022.

Overall, Ford is a solid stock that allows investors to earn quarterly dividends of 0.10 per share with an annual dividend yield of 2.67%. Given that the company is severely undervalued in the EV sector compared to its rivals, the Ford stock is a popular pick for many analysts and enthusiastic stock-market traders.

Conclusion

This guide has discussed investing in Ford stock in 2022. After an in-depth analysis of the Ford stock price and finances, the future of the automotive and EV manufacturer looks promising. The second-largest EV retailer in the U.S is currently worth $60.2 billion and posted $17.9 billion in earnings in 2020. If you want to purchase shares of this company, we advise using a regulated broker to buy Ford stock.

FAQs

How do I buy Ford Stock?

Can I buy one dollar of Ford Stock?

Read More:

- How to Invest in Stocks Online for Beginners

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks