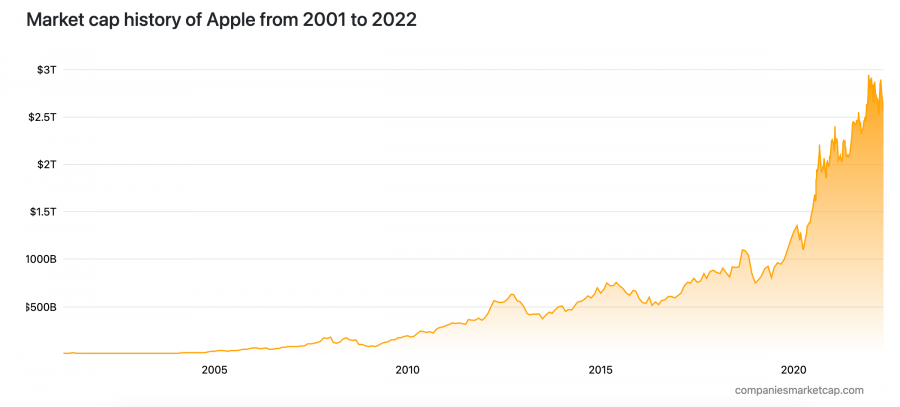

Apple (NASDAQ:AAPL) needs no introduction. The company has been at the forefront of technology and consumer products since it released the iPhone in 2007. Since then, Apple stock has grown by nearly 5000%, making it the most valuable company in the world with a market cap of over $2.4tn.

This guide discusses how to buy Apple stock in detail by reviewing the best place to buy Apple stock, what to look for when investing, and what we think the future looks like for the popular stock.

Step 1: Decide Where to Buy Apple Stock

The first thing you need to do when researching investing in Apple stock is to find a respected and cost-effective broker to trade with. The most popular stock trading platforms tend to offer a wide selection of companies to invest in with low fees. In addition, many platforms also allow fractional investing – which means you don’t have to purchase a full share if you don’t want to.

With that in mind, reviewed below is the most popular trading platform if you’re wondering where to buy Apple stock today:

Webull - Buy Apple Stock with as Little as $5

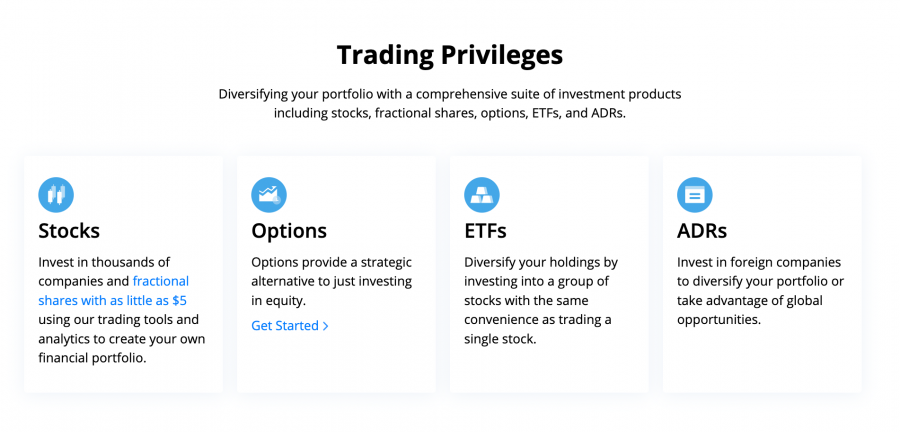

A solid option if you’re looking for a broker to buy Apple stock is Webull. Founded in 2017, Webull is one of the most popular trading platforms in the US and is regulated by the SEC, FINRA, and the SFC. Aside from being regulated by these entities, Webull also provides up to $500,000 worth of investor protection through the SIPC scheme.

A solid option if you’re looking for a broker to buy Apple stock is Webull. Founded in 2017, Webull is one of the most popular trading platforms in the US and is regulated by the SEC, FINRA, and the SFC. Aside from being regulated by these entities, Webull also provides up to $500,000 worth of investor protection through the SIPC scheme.

Webull users can trade a selection of stocks, ETFs, options, and cryptos – although the equities offered by the platform are all from US-based stock exchanges. There are no commissions to contend with when opening a stock trade, and Webull users can trade from as little as $5 per position. The annual margin rate is 6.99% for equity trading, which remains competitive with other brokers.

The account opening process with Webull is fully digital, and there is no minimum deposit threshold to be aware of. Notably, Webull only allows bank transfers as a funding method, with no support for credit/debit card deposits at present. However, deposits (and withdrawals) are entirely free to make.

Webull’s web trading platform is incredibly simple, allowing you to customize certain areas and employ various technical indicators. The mobile app is also intuitive and features extensive price alerts and two-step authentication. Finally, Webull also offers the ability to buy cryptocurrency commission-free, which is ideal if you're looking to create a diversified portfolio.

| Number of stocks | 3,000+ |

| Deposit Fee | Free |

| Cost to buy Apple stock | 0% commissions (plus small spread) |

| Minimum trade size | $5 |

Your capital is at risk.

If you're looking for more trading platform options, check out our in-depth article on where to buy stocks.

Step 2: Is Apple Stock a Good Investment?

We've discussed where to buy Apple stock. Now let’s turn our attention to the company itself. Much like when you buy Amazon stock, it's vital to analyze the company's financials and business model to ensure that any investment you make is suited for the longer term.

Apple is one of the most popular companies for investors to add to their portfolios. The stock has experienced nearly unparalleled growth since 2007, which is why the company is considered by many to be one of the safer stocks to hold. There's a reason why Apple makes up nearly 40% of Warren Buffett's Berkshire Hathaway portfolio.

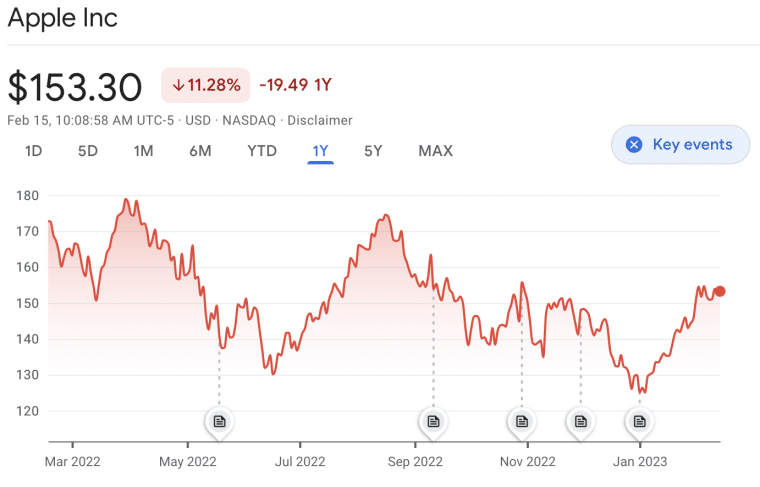

Is now the right time to buy Apple stock? Many Wall Street analysts think so. According to our data, 25 analysts give Apple a Strong Buy rating as of February 2023. Overall, around 95% of the analysts rate apple as either Strong Buy, Buy or Hold. Apple stock also has a reasonable 12-month average price target of $168 vs the current price of around $150.

Of course, current economic conditions may have some people wary of investing in Apple Stock. However, Apple stock has fared better than most of its peers over the last year. In the 12 months to February 2023, Apple stock fell by around -8.82%. Compared to competitors Alphabet (-27.65%), Meta (-16.14%), and Amazon (-36.30%), Apple wasn't a bad place to park money in 2022.

Past performance isn't a guarantee of future results, but we feel comfortable with the 12-month price prediction for Apple stock. Investors looking to hold onto their shares for a longer period of time may also benefit from a better valuation for Apple stock over a 5, 10, or 20-year-plus period.

What is Apple?

According to Statista, Apple is the largest company globally, boasting a market cap of around $2.4 trillion. It is also the largest technology company in the world (ahead of Samsung) and is consistently one of the three largest phone manufacturers globally.

As many people will already know, Apple was founded back in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, with the 'Apple I' being the company's first product. After expanding throughout the late 1970s, Apple went public in 1980 and then developed the ‘Apple Macintosh’, which was the original iMac.

Although Apple began to struggle in the late 1980s and early 1990s, thanks to Steve Jobs leaving the company and intense competition from Microsoft, the company bounced back in the early 2000s. Jobs was enticed back and led the company to incredible success by creating the iPod, iPad, iPhone, and iMac. Jobs was seen as a visionary within the field, and his impact on the company remains to this day.

After Tim Cook took over as CEO in 2011, Apple has gone from strength to strength, thanks to its incredible brand power. Anything that bears an Apple logo will generate colossal demand, allowing Apple to charge higher prices for its products relative to its competitors. According to Forbes, Apple remains the world’s most valuable brand, ahead of Google, Microsoft, and Amazon.

Over the past few years, Apple has continued innovating and adding new products, with the AppleTV+ streaming service receiving much acclaim. The Apple Watch is another product that has generated vast revenue streams for the company, with AirPods also bolstering the bottom line. In recent years, Apple has grown its long line of services that provide recurring revenue, including the App Store, Apple Music, iCloud, and AppleCare+. This segment has been making up a larger part of Apple's total revenue every year and is its fastest area of growth

Apple Share Price History - How Much is Apple Stock Worth?

We've explored what Apple is and the type of products the company offers, let’s turn our attention to the Apple stock price. As touched on above, Apple initially went public on December 12th, 1980, under the ticker symbol 'AAPL'. Stocks were initially priced at $22, although this equates to around $0.39 after accounting for subsequent stock splits.

Apple's IPO was an instant success, with the company selling 4.6 million stocks and producing over $100 million in capital. This made it the most successful IPO in decades, which also benefitted investors since stocks immediately rocketed on the same day, pushing Apple's market cap to over $1.7 billion.

Although Apple's stock has had its ups and downs over the following years, its fortunes began to look more optimistic after the introduction of the iPod and, later, the iPhone. This was a crucial period in Apple's history, as it was when the company began a string of successes that continue to this day. The company also launched its first-ever Apple Stores during this period, something that would become an iconic part of the brand as people queued for the latest Apple gadgets every year.

Between 2003 and 2008, the Apple stock price skyrocketed by over 2,500%, fuelled by the release of the iPod and the iTunes Store. Apple also announced the first MacBook during this period, which has become one of the most widely-used laptops in the world. Apple's stock continued to surge throughout the years that followed, thanks to the launch and subsequent success of the iPhone.

The iPhone continues to drive Apple's stock higher to this day due to its massive impact on its revenues. As of Q3 2022, the iPhone makes up 47.29% of Apple's total revenue. Further, its wearables and services segments which largely sell to iPhone users, make up another 30.98% of the company's revenue.

The impact of the iPhone on Apple as a company cannot be understated. In 2007, Apple sold 1.39 million iPhones, by 2018, this figure had skyrocketed to over 217 million. In total, the company had sold over 2.2 billion iPhones by 2018. During that timeframe, Apple’s share price rose another 798%, hitting a peak of $58.

Check out the Apple stock price history chart below:

After a few minor dips along the way, Apple’s stock continued to exhibit relentless growth and surged by 409% between 2018 and late 2021. According to data gathered from MacroTrends, Apple’s shares hit an all-time high of $182.01 on January 3rd, 2022. This gave Apple a market cap of $3 trillion – the first company ever to hit this level.

At the time of writing, Apple’s stock has pulled back from these highs and is trading around the $150 region. Various macroeconomic factors, such as rising inflation, continued interest rate increases, and supply chain difficulties, are harming tech stocks – and Apple is not immune to these issues.

Apple Stock Dividends

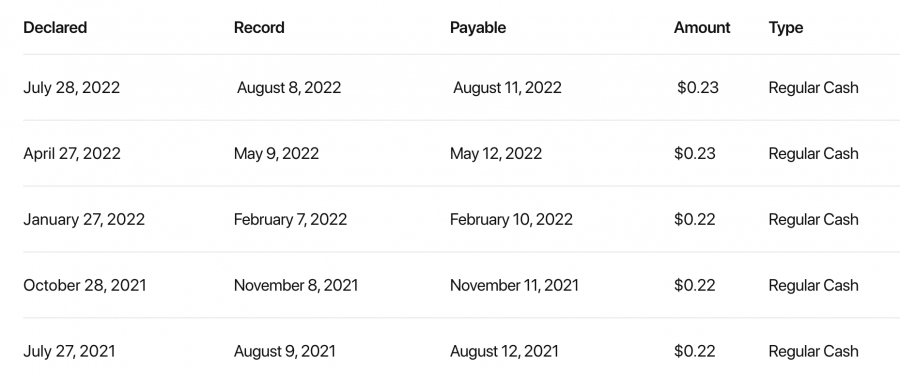

The Apple stock price has a storied history when it comes to growth, but it can also be considered one of the most popular dividend stocks on the market. The first thing to note is that Apple stock does indeed pay a cash dividend and has done so since 1987. These dividends have been paid quarterly and were only disrupted in the years that Apple performed a stock split.

Fast forward to the present day, and Apple pays a dividend yield of 0.60%. It isn't one of the highest paying dividends on the market, but other tech companies like Alphabet, Meta, and Amazon don't pay a dividend at all. Meanwhile, Apple is well known for increasing its dividend amounts nearly every year.

Apple's dividend payout ratio is only 14.31%, highlighting that less than a fifth of the company's profits is distributed to shareholders. Although this seems low, Apple has a reputation for reinvesting profits to create exciting new products – and this trend doesn't look likely to change anytime soon. That helps the company to fuel its massive growth, which is where investors have made most of their profits over the last several years.

Apple Stock Strengths

Considering all of the information we have presented thus far, it's natural to wonder whether Apple stock is regarded as a solid investment given the price today. To gain further clarity on this question, let's dive in and explore some of the main factors that make Apple such an intriguing investment opportunity:

Stellar Financial Results

The first thing to note when discussing Apple as an investment opportunity is the incredible financial position that the company is in. Apple’s net profit grew by 5.41% in 2022 to $99.8bn. Apple generated just shy of $30bn of net profit in the last quarter of 2022 alone.

According to that Q4 2022 earnings report, the company had over $475bn in assets, providing the foundation for future innovation. From a valuation perspective, Apple's price-to-earnings (P/E) ratio currently stands at 25.86, which is lower than competitors Microsoft (28.69), Amazon (97), and AMD (88.7). That means the value of Apple today, based on its stock price per share, is better than the aforementioned competitors.

Consistent Product Innovation

One of the reasons Apple has managed to stay ahead of its competitors is its innovation strategy. Apple has not rested on its laurels and provides consistent upgrades to its products that appeal to consumers.

In 2020, Apple made the biggest change to its Mac lineup in years by dropping Intel from its computers. Intel processors had been the backbone of both desktop and portable Macs since 2006. However, after years of Intel failing to provide the types of chips that Apple wanted, the iPhone company decided to go it alone.

Using its experience designing chips for the iPhone and iPad, Apple decided to upscale what it had done so far and begin using its own custom chips for all of its products. This began in 2020 with the MacBook Air, MacBook Pro, and Mac Mini. The result was an instantaneous hit, with many regarding the MacBook Air, in particular, as the best overall laptop on the market.

Apple had been able to get significantly more power out of the same form factor while also achieving massive battery life gains that no other CPU designer has come close to matching. The switch to Apple Silicon revitalized the Mac segment for Apple, with it selling a staggering 28% more Macs in 2021 than it did the year before.

The Mac revolution shows no sign of slowing down as Apple continues to release significant physical redesigns to its lineup that are proving incredibly popular.

Resistant to Market Effects

Another reason to consider adding Apple to your portfolio is that the company tends to be resistant to external factors. Investors who buy GameStop stock will realize the importance of this, as the company could not maintain its lofty status once the initial hype died down. This isn’t the case with Apple, as the company’s products remain in demand regardless of market conditions.

Apple was also one of the most resilient stocks during the market downturn of 2022. While competitors, like Alphabet and Amazon, suffered drops of 28.57% and 37.53%, respectively, over the 12 months to February 2023, the AAPL share price is down just 11.28%.

Huge Brand Appeal

Another feather in Apple's stability cap is the brand's appeal, the popularity of Apple products makes the company stand out from the crowd. Although Amazon and Google are huge names within the space, they don't have the same type of 'fans' that Apple has. This is evidenced by the enormous queues outside Apple Stores whenever the company launches a new iPhone.

This brand appeal has been built up over decades of providing visually appealing products that are simple to use. Many popular coffee shops or university lecture halls will undoubtedly show several people using MacBooks or iPhones, which have become a sort of 'status symbol' due to what they represent. Ultimately, this means that Apple can launch products in various industries and still receive demand – even if they don't have much market share.

That puts Apple in a unique position to launch products that other companies haven't been able to make a success. The iPhone, iPad, and Apple Watch weren't the first devices of their kind, but the Apple effect made them bestsellers.

Apple Stock Forecast

Apple's business model is excellent and ensures that the company will remain a growth machine for years. Although Apple initially started as a computing company, it has evolved into a sort-of ‘lifestyle brand’ that offers products in various niches. These include laptops, mobile phones, watches, earphones, headphones, accessories, and more.

This approach means that Apple does not rely on one product's revenue, ensuring that any supply chain issues or legal ramifications can be navigated seamlessly.

A recent example of this is Apple's growth of its services segment. Apple Music, Apple TV+, iCloud services, and of course, the App Store juggernaut have created a segment for Apple that is growing, even as iPhone hardware sales begin to plateau.

The idea is that even as people need to upgrade their phones less, if Apple can keep them in the ecosystem, they can still generate revenue. Looking ahead, Apple doesn't need its customers to purchase an iPhone every year or even every two or three. Instead, it will happily get subscription fees and sell AirPods, Apple Watches, and other complimentary devices to them instead. That model means the forecast for Apple stock is bright for 2025, 2030, and beyond.

Is Apple Stock a Buy?

Putting everything together, you might be wondering whether Apple is a strong stock. Things look bright for the company, especially since Apple is currently trading at discount relative to 2021's all-time highs. Given that Apple stock is known for its consistent growth, being able to invest at a lower price is a rare opportunity. That makes it an easier decision to buy Apple stock today.

As most market analysts will testify, Apple's brand power is one of the main reasons that the company looks set to continue growing in the years ahead. The price points that Apple can charge for its products are much higher than most of its rivals, meaning Apple's profit margins are enormous. This means the company generates tens of billions of dollars in profit every quarter, providing the fuel needed for further innovation. The financials are solid for anyone questioning if Apple is a good stock to invest in.

Although Apple does pay a dividend, its yield and payout ratio is low compared to other industries. This may put off investors looking to generate passive income, although tech companies are not well known for providing high dividend yields. Instead, these companies opt to reinvest profits back into the business – which is also the strategy that Apple employs.

There's no telling what Apple's next 'big product' will be. According to Statista, Apple spent an incredible $21.91 billion on R&D in 2021 – the most significant annual outlay in the company's history. There are rumors that 2023 will see the release of Apple's hotly anticipated AR/VR headset. Potential Apple investors will want to pay attention to news regarding this upcoming product when deciding whether to buy the stock.

Overall, we see no reason to consider Apple a selling opportunity, with the company seemingly going from strength to strength. Although iPhone sales have slowed slightly, there's no cause for alarm. The current iPhone models have underwhelmed and are not different enough for many users to upgrade. However, this is standard practice for Apple, where the big releases happen every 2-3 years. Expect iPhone sales to pick back up again when the next big redesign is announced.

Buying Apple Stock - Conclusion

Apple is one of the most sought-after stocks in the world, and for good reason. The growth of Apple over the past 20 years has been unbelievable.

The go-to US stock to own in the 20th century was Coca-Cola. Everyone wanted to buy it, and those who bought it early were often set for life from dividends and growth. The last decade has shown Apple to be the Coca-Cola of our time. It's the stock to own whether you're a retail investor or Warren Buffett. For most investors, the question usually isn't "Should I buy Apple stock?" it's "When should I buy Apple stock."

We think Webull is the best place to buy Apple stock with 0% commission, a simple investing process, and a great app to track all of your holdings.

FAQs

How do I buy Apple stock?

Where can I buy Apple stock?

Can I buy one dollar of Apple stock?

Will Apple stock split in 2023

Is Apple a buy or sell right now?

Is AAPL still a good buy

What is the forecast for Apple stock

Can you buy Apple stock directly

Read More:

- How to Invest in Stocks Online for Beginners

- Best Penny Stocks to Watch

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks