Buying shares in Apple takes just five minutes from start to finish when using a regulated online broker. Not to mention that many FCA brokers in the UK now offer Apple shares on a commission-free basis.

In this beginner’s guide, we explain how to buy Apple shares in the UK in a safe, low-cost, and seamless way.

How to Buy Apple Shares UK in 4 Easy Steps

The four steps required when electing to buy Apple shares in the UK are listed below:

- ✅Step 1 – Open an account with a regulated broker: When buying Apple shares in the UK, it is important to ensure that the chosen stock broker is regulated by the FCA.

- Step 2 – Upload ID: Next, upload a copy of a passport or driver’s license. If the Apple stock investment is under €2,000 (about £1,750), this step can be completed at a later date.

- Step 3 – Deposit funds: The next step is to deposit some funds. This will need to be at least $10 (about £8) with many brokers.

- Step 4 – Buy Apple shares: Type in ‘Apple’ in the search box and click on ‘Trade’. In the ‘Amount’ button, type in the total investment size (minimum $10). Click on ‘Open Trade’ to buy Apple shares in the UK.

Read on for a detailed overview of what the future holds for the Apple share price, according to industry analysts.

FCA Regulated Stock Brokers with Apple Stock

As noted above, when electing to buy Apple shares in the UK, it is important to check whether or not the chosen stock broker is regulated by the Financial Conduct Authority (FCA).

Below, we discuss a popular broker to consider when exploring where to buy Apple shares in the UK, in a cost-effective and safe way.

XTB – Trade Apple Shares With Leverage

While XTB is one of the most popular forex brokers in the UK, this trading platform also supports a wide range of shares. This is inclusive of Apple alongside plenty of other popular US shares from the NASDAQ and NYSE.

XTB also supports shares from the London Stock Exchange, alongside markets in Germany, France, Switzerland, and more. We should, however, note that XTB is a CFD broker. This means that when gaining exposure to Apple shares in the UK, traders will not own the underlying stock.

Apple shares CFDs at XTB do come with various perks that traditional stocks cannot rival. For example, XTB enables users to trade Apple shares with leverage of up to 1:5. For instance, if the account balance is £100, XTB enables an Apple share position of up to £500.

Additionally, Apple shares can be traded both long and short at XTB. There are no commissions for trading Apple shares or any other supported stock CFDs. Currently, the spread for trading Apple shares is $0.48 per stock. The minimum trade size for US-listed shares like Apple is $50.

Along with shares, XTB provides CFD markets for ETFs, forex, indices, and commodities. Users in the UK can trade shares through the XTB web platform, which is built by the broker. There is also an XTB mobile app available for iOS and Android. XTB also offers a free demo account with $100k in virtual trading funds.

To get started with XTB, it takes around five minutes to open an account. There is no minimum deposit requirement at this broker. A wide variety of UK payment methods are accepted, including debit cards, Skrill, and bank transfers. Finally, XTB is authorized and regulated by the FCA.

- Read our comprehensive XTB review here.

| Trading Platform | No. Shares | Pricing System | Cost to Trade AAPL Shares |

| XTB | 1,850+ | No deposit fees with debit cards or bank transfers. 2% fee when depositing funds with Skrill. | 0% commission |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

Apple Stock Information

Although Apple is one of the top-performing shares of all time, this doesn’t necessarily mean that it represents a viable long-term investment. It is therefore wise to conduct plenty of independent research before buying Apple shares in the UK.

In the following sections, we unravel some of the key information surrounding the Apple stock price history and where this global tech giant could be headed in the coming months and years.

Basics of Buying Apple Shares

First and foremost, Apple is listed on the NASDAQ, which is one of the two primary stock exchanges in the US. This means that in order to buy Apple shares in the UK, investors will need to have an account with a stock broker that offers access to the NASDAQ.

Fortunately, this is the case with most FCA-regulated brokers, considering the ever-growing interest in US-based stocks such as Apple.

Historically, investors in the UK would need to meet a minimum lot size when buying Apple shares, but this is no longer the case. In fact, many UK brokers, support fractional shares.

As noted earlier, this means that investors can purchase a ‘fraction’ of one share, with a minimum investment of just $10.

For example:

- Let’s say that Apple is trading at $150 per share on the NASDAQ

- An investor in the UK wishes to risk $30 or about £25

- This means that the investor owns 20% of one Apple share ($30 into $150)

If the value of Apple shares were to rise by 10%, this would be reflected in the fractional stock purchase, irrespective of how much was invested.

Moreover, fractional shares are still entitled to dividends, which will be distributed at a proportionate rate. For instance, if Apple distributes a dividend of $1 and the investor owns 20% of one share, they will receive a payment of $0.20.

What is Apple?

Apple is one of the largest companies globally, with its suite of smartphones, tablets, laptops, and many other products in demand from all regions of the world.

Founded in 1976, Apple’s number-one selling product is the iPhone, albeit, the firm is also seeing rapid growth in the services department. This includes Apple TV, iTunes, and digital payment services.

Apple Share Price History – How Much is Apple Stock Worth?

After its creation in 1976, Apple went public just four years later. Opting for the NASDAQ exchange, Apple shares were priced at $22 during the IPO campaign. However, Apple shares have gone through five stock splits since the IPO, which means that its effective listing price was under $0.22.

Details of Apple’s five stock splits can be found below:

- 1987: 2-for-1 split

- 2000: 2-for-1 split

- 2005: 2-for-1 split

- 2014: 7-for-1 split

- 2020: 4-for-1 split

When Apple decides to split its stocks, otherwise called a AAPL stock split, this means that investors receive additional shares. However, the overall market capitalization remains the same, meaning that the AAPL share price will be reflective of the split.

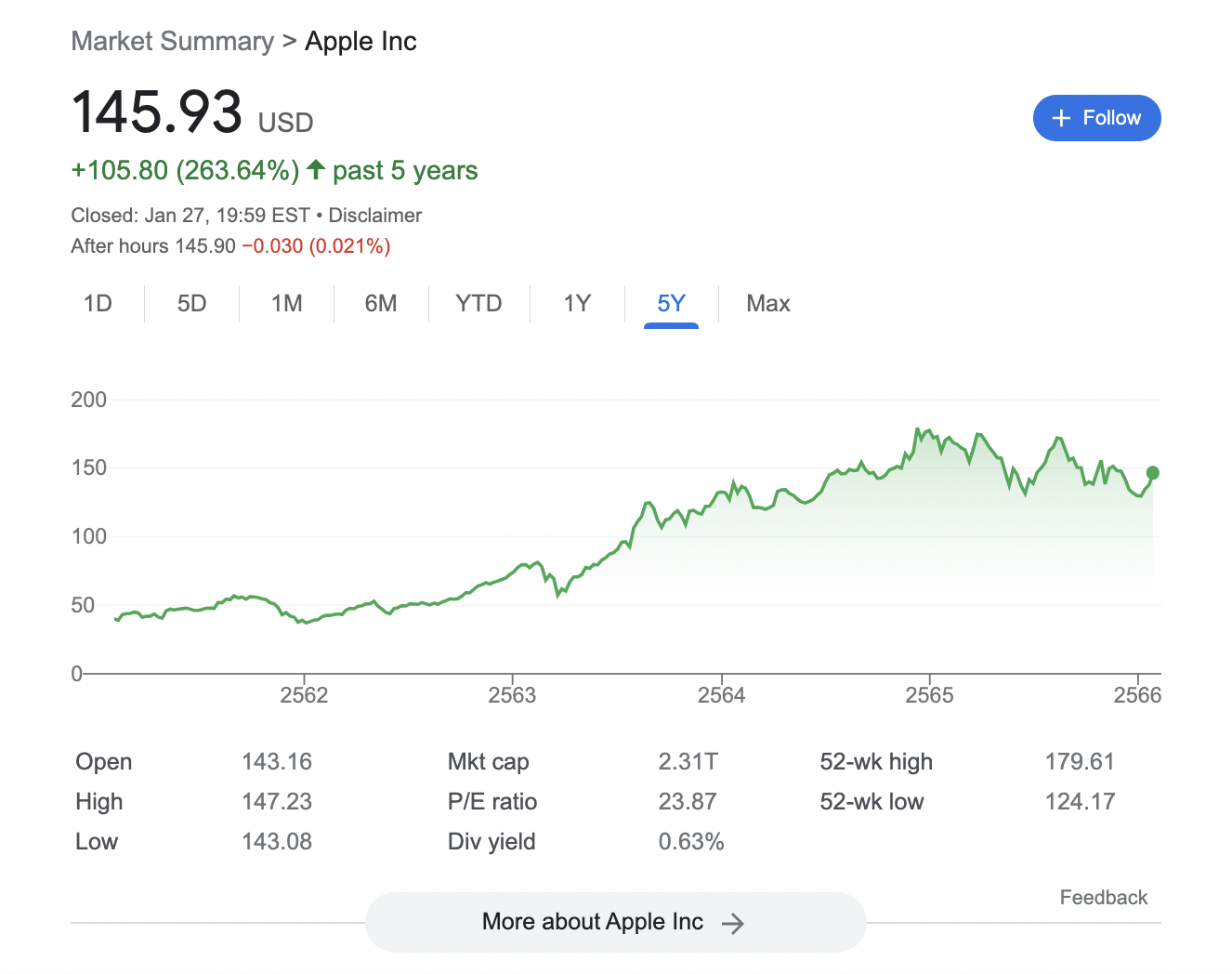

Since its IPO, Apple shares have generated unprecedented returns – with the stock growing by more than 78,000%. In more recent times, the Apple chart shows an increase in value by over 260% on a five-year basis. In comparison, the S&P 500 – which is the leading benchmark for US stocks, grew by 47% over the same period.

In particular, Apple was one of the high-performing shares during the COVID-19 pandemic. Like many other tech-heavy companies – such as Google, Netflix, and Amazon, Apple benefiting greatly from the so-called stay-at-home economy.

Based on the above Apple stock chart, over a 12-month period Apple shares are down 16%. During the same period, the S&P 500 declined by 10%. This means that when compared to the broader US stock market, Apple has declined at a faster rate. However, when compared to industry peers, Apple has performed better.

For instance, over the prior year of trading, Amazon, Google, and Microsoft have seen their share price decline by 31%, 25%, and 20% respectively. Crucially, the broader US stock markets were bearish throughout 2022, albeit, there has since been a slight recovery. With that said, tech-heavy shares like Apple generally fall at a faster pace when wider sentiment is weak.

Apple stock has a 52-week high of $179. As of writing, Apple is trading at 18% below this figure. The aforementioned 52-week high represents Apple’s highest-ever value, which was achieved in early 2022. With all that being said, Apple remains the largest US company in terms of market capitalization, with the firm worth over $2 trillion.

Apple Fundamentals

Seasoned investors will typically focus on the fundamentals when assessing the long-term potential of Apple shares. This means focusing on the broader performance of Apple to bypass short-term volatility and speculation.

Here’s what to consider when exploring how to invest in Apple shares in the UK:

Apple P/E Ratio

The price-to-earnings (P/E) ratio enables analysts to evaluate whether Apple shares are potentially over or undervalued.

As of writing, Apple shares are trading with a P/E ratio of just under 24 times. In comparison, competitors like Amazon and IBM are trading with a much higher P/E ratio of 94 and 66 times, respectively.

Samsung, on the other hand – which is Apple’s largest competitor in the iPhone market, carries a P/E ratio of just 10 times as of writing.

Apple EPS

Another metric to consider when exploring how to invest in Apple stock is the earnings-per-share (EPS).

The EPS is reported every three months, during the quarterly earnings call.

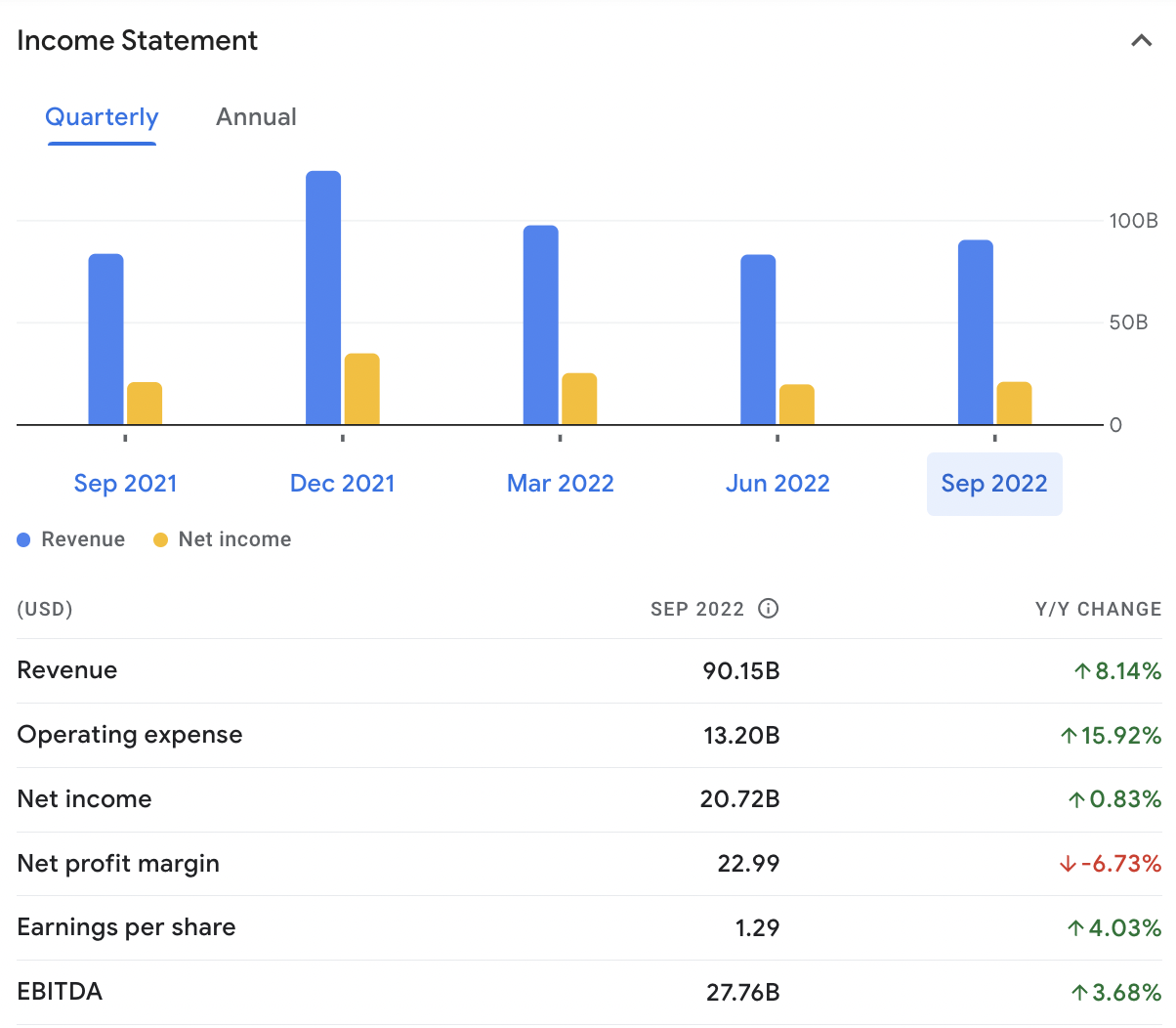

- In the most recent quarterly report that was released in September 2022, the EPS amounted to 1.29.

- This was a surprise of 1.44%, with the markets pricing in an EPS of 1.27.

- In the previous quarter, the markets expected an EPS of 1.16, while Apple reported 1.20 – a surprise of 3.86%.

The next quarterly report is scheduled for release in February 2023, with the markets expecting an EPS of 1.96. This represents a significant rise of over 50% from the most recent EPS of 1.29.

Apple Sell-Side Analysts

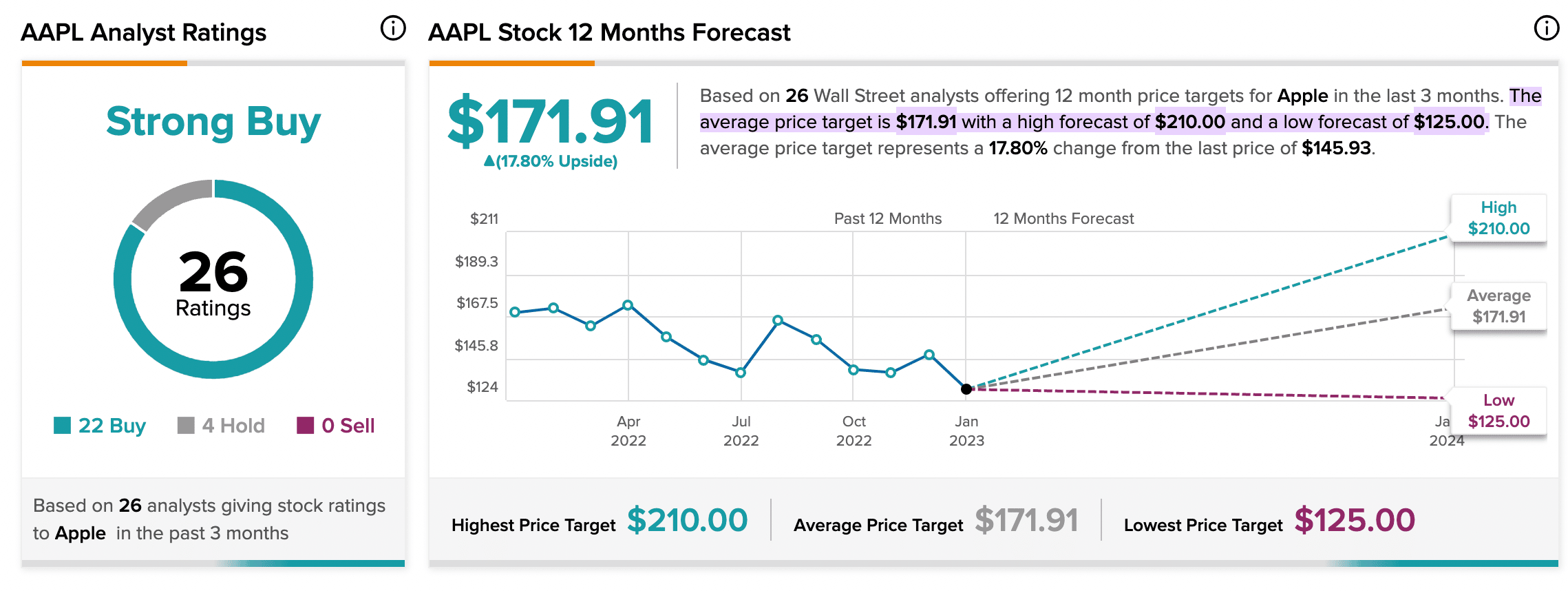

According to 26 Wall Street sell-side analysts, Apple is rated a strong buy. 22 of the 26 analysts have Apple as a buy, with just 4 opting for a hold.

According to the same sell-side analysts, the upper price estimate of Apple shares is $210. The lower price estimate is $125. This represents an average price target of $171. 91. Based on prices as of writing, the average target would require an upside of 17%.

Just remember that the aforementioned price targets are the subjective views of analysts, so should never be taken with any certainty.

Apple Earnings Call

The most recent quarterly report released by Apple was largely very positive.

- Revenues were up 8.14% to $90.1 billion. Net income grew by just 0.83% to $20.7 billion.

- Net profit margins, however, declined by 6.73% during the quarter.

- On the flip side, the earnings per share increased by 4% and the EBITDA grew by 3.6%.

As we cover in more detail later, Apple is a cash-transient business and as such, remains in possession of a robust balance sheet.

As per its most recent quarterly report, Apple was holding over $48 billion in cash and short-term investments.

Apple Shares Dividends

When buying Apple shares in the UK, investors will be gaining exposure to a consistent dividend payer. This has been the case since the late 1980s.

With that being said, the yield on Apple share dividends is notoriously low. As of writing, for example, the running dividend yield amounts to just 0.63%.

Apple dividends are distributed every three months. The most recent dividend – which was paid in November 2022, amounted to $0.23 per share.

Is Apple Stock a Good Investment for UK Traders?

In this section, we explore some of the core considerations to make before electing to buy Apple shares in the UK.

Robust Balance Sheet

The first point to note – which leads on from the above section, is that Apple has one of the most robust balance sheets globally.

At the forefront of this is the aforementioned cash and short-term investments of over $48 billion. This means that Apple has the financial stability to weather any economic storm that may arise in the future.

Not only that, but having access to such a strong cash position means that Apple can continue to innovate via its research and development objectives. This will also enable Apple to increase its portfolio of products and services via acquisitions.

Valuation

Some industry commentators argue that even with a market capitalization of over $2.3 trillion, Apple shares could be undervalued.

This is supported by its somewhat low P/E ratio of under 24, which is considerably lower than many of its competitors.

Not only that, but the average sell-side analyst price target for Apple shares is over $171, with the overarching consensus being that the firm is a strong buy.

Apple Buybacks

Although the typical dividend yield of Apple shares is modest, it is important to remember that the firm continues to facilitate its stock buyback program.

This means that Apple buys back a certain number of shares from the open market, which has the desired effect of reducing the overall supply.

And in turn, this can artificially increase the share price of Apple. Over the prior five years alone, Apple has bought back nearly 20% of outstanding shares.

Crucially, there is no reason to believe that this won’t be the case over the coming years, considering Apple’s robust balance sheet and huge cash hoard.

Metaverse, VR, AR, and Other Emerging Technologies

Apple’s solid cash position means that it is well-primed in the R&D department. The firm is looking to compete with many of the same technologies and concepts as Meta Platforms (formally Facebook), such as the metaverse.

This also includes virtual reality (VR) and augmented reality (AR). However, unlike Meta Platforms, Apple is not overexposed to these technologies, with the overarching focus remaining on core products like the iPhone.

Supply Chain Issues

Some industry analysts argue that the recent decline in Apple shares is largely due to its ongoing supply chain issues. This is because the vast majority of iPhones are manufactured in China, a country that for nearly three years remained in some form of lockdown.

China has, however, since loosened its COVID-related policies, which can only benefit Apple. Moreover, Apple has since increased its exposure to both India and Vietnam, so there will be less reliance on China moving forward.

Price Increase on Services

Services is one of the fastest-growing segments of the broader Apple portfolio. This includes the likes of Apple Pay, Apple TV, and Apple Music.

Although there was a slight slump in revenues from services in 2022, Apple increased its prices late in the year. Whether or not this pays off will be revealed in the firm’s next quarterly report – which is scheduled for February 2023.

Apple Stock Price Prediction

Apple posted a disappointing set of earnings results at the end of January, but AAPL has continued to enjoy a strong start to 2023 following a serious downturn in 2022.

Like many Big Tech firms and much of the investment world, Apple suffered through tough macroeconomic conditions last year and is currently down 12% at the time of writing year-on-year, with December seeing its lowest share price since June 2021.

As mentioned above, disruptions in the supply chain saw iPhone sales drop since 2019, while Mac sales have slowed significantly amid the rising cost of living, although iPad sales have increased as a knock-on effect.

Apple is attempting to move some of its supply chain out of China after the struggles in the last 12 months, with India a planned destination, but the fragility of its logistics remains an issue for many investors.

There are also expected regulatory battles with the App Store to come.

However, the last 30 days have been much more positive and the consensus among traders is that Apple remains a ‘buy’, despite the potential of short-term pain.

Apple is set to launch its VR headset this year – and will hope to outperform Meta’s disappointing sales – while the move to India will hopefully alleviate many concerns over supplies.

An Apple stock forecast sees an average high of $224.70 in February 2023, an average of $176.12 and a low of $123.22.

Latest Apple Shares News

When assessing how to buy Apple stock in the UK, it is crucial for investors to keep tabs on core news and developments surrounding the company.

Some of the latest developments to consider are discussed below:

- First flagship store in India: Apple recently announced that it is in the process of opening its first flagship store in India. Considering the sheer size of the Indian economy, this could have a major impact on the potential iPhone sales.

- Still no job cuts: Apple remains one of the only Big Tech firms in Silicon Valley to avoid mass job cuts. Competitors – including Meta Platforms, Amazon, and Google – have all made significant human capital layoffs in recent months.

- Crucial earnings report is looming: Things will become a lot clear for Apple shareholders in February, with the firm set to release its much-anticipated quarterly report. In particular, investors will be keen to evaluate iPhone sales, considering the slump in the prior quarter.

Conclusion

In summary, this guide has explained how to buy Apple shares in the UK without paying any commission. We have also explored some of the core fundamentals to consider before investing, with a strong focus on recent and upcoming earnings reports.

Just remember that many FCA-regulated brokers now support fractional shares, so there is no requirement to invest large sums of money when gaining exposure to Apple.

Independent research should always be conducted when electing to invest in Apple in the UK.