AMC is a movie theatre company that narrowly avoided bankruptcy in 2021 after finding itself front and center of the meme stock craze. Two years on from the Reddit meme stock frenzy, AMC still has a large following of investors that believe in it.

The AMC stock price is up over 61% in 2o23, so is this the start of a rebound?

In this guide, we will walk you through how to buy AMC stock, covering everything you need to know.

Step 1: Decide Where to Buy AMC Stock

The first step to buying AMC stock is to choose a broker to purchase shares. The most important aspects to consider when choosing a trading platform are the fees to buy stocks and the safety protections of the platform.

We think Webull is the best place to buy AMC stock and other assets. It's a commission-free platform, meaning all stock trades are purchased without a fee that on other platforms can be quite hefty. Especially when buying a low-priced stock like AMC. Furthermore, funds in Webull are protected under CySEC and the FCA in Europe and the UK and buy the SEC and FINRA in the US.

Webull - Buy AMC Stock From $5

Webull is a good option for those who are looking for a low-cost method of investing when deciding where to buy AMC stock. This brokerage offers commission-free trading on US-listed stocks, which of course, includes AMC.

Webull is a good option for those who are looking for a low-cost method of investing when deciding where to buy AMC stock. This brokerage offers commission-free trading on US-listed stocks, which of course, includes AMC.

There are over 5,000 stocks listed on WeBull, making it a solid option for diversifying. Check what fees you will be liable for if you think you may wish to access internationally listed stocks, though. Webull charges fees on non-US stocks via ADRs.

This US broker offers a safe trading space as it is registered with the SEC, among other regulatory bodies. Whilst there isn't an overly extensive set of tools, you will find a dozen or more charts, 50 technical indicators, and some educational content aimed at newbie investors.

The minimum stake is just $5 at Webull, which allows you to add a fraction of a share in AMC stock to your portfolio without risking too much. To begin trading stocks, you will need to fund your account with either ACH or a bank transfer.

If you fund your Webull trading account with ACH, you will not be required to pay a fee. If, however, you pick a bank transfer, you will be charged a flat fee of $8 per transaction on deposits and $25 on withdrawals. Webull also offers an excellent stock app, allowing you to buy AMC stock on the go.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH - free / Bank wire - $8 |

| Fee to Buy AMC Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

For more on brokers, check out our article on the best stock trading platforms.

What is AMC?

AMC is one of the best-known names in cinema, the company is the largest movie theatre chain in the world and has the biggest slice of market share in the US. Outside of the US, the AMC name is less well known, but the company owns the massive Odeon Cinemas Group, which is popular in Europe.

- AMC was founded in 1920.

- As of 2022, the company operates 10,500 screens around the world.

- There are 950 AMC-owned theatres across the globe.

- AMC pioneered many of the cinema staples that are common today, such as cup holders in armrests and raised stadium-style seats.

- AMC is an industry leader in premium theatre formats and services, such as IMAX screens, power recliners, and reserved luxury seating.

- Along with its subsidiaries, such as Odeon, and Movietickets.com, it also offers food distribution, theatre exhibitions, online ticket booking, and other services.

- This year, AMC branched out into the confectionary market by selling its AMC Theatres branded popcorn at Walmart.

Step 2: Is AMC Stock a Good Investment?

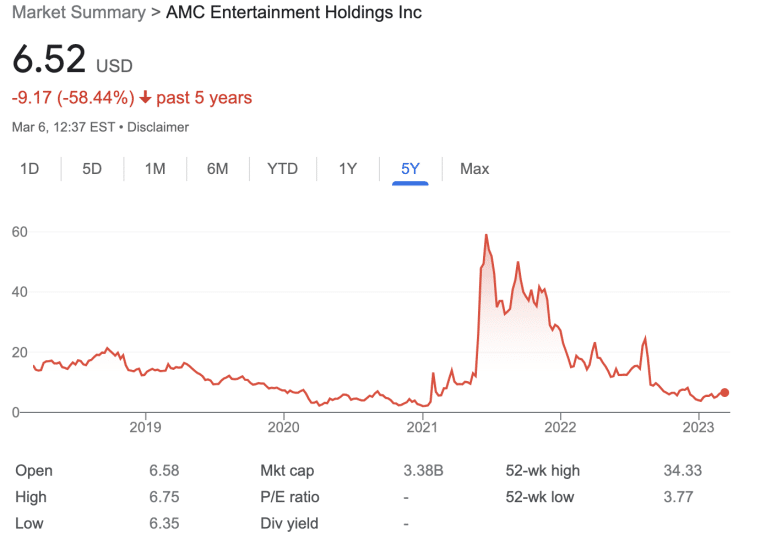

The value of AMC stock is currently tied up in the wave of retail investors who have bought shares since the beginning of 2021. The massive retail trading investments pushed the AMC stock price up to an all-time high of $59.26 by June 2021.

Retail investors saved the company by purchasing shares in late 2020 and early 2021, allowing it to manage debts and recover from the effects of the COVID-19 pandemic.

There's no doubt that AMC is in a stronger position today than it was back then. However, many potential investors in its stock are interested in the possibility of a short squeeze. That's when market forces push a stock up stratospherically high as short sellers try to purchase shares to close out their positions. The more short sellers that try to buy the stock, the higher the price goes, creating a cascading effect.

When looking at an AMC stock chart for the last three years, it certainly seems like the short squeeze came and went.

Many retail investors aren't convinced that the $62.55 high for AMC stock was the real short squeeze, and there are over 500k members of the r/AMCstock (not r/AMC) Reddit message board that would argue that point.

It's easy to say that AMC stock is a good investment if you vehemently believe that a short squeeze is on the horizon. Yet, it might not be the only factor when deciding whether to purchase shares.

Fundamentally, AMC is in a far better position than it was mid-pandemic. Revenue is approaching 2019 levels, and the company has cut expenses and reduced its debt load. When considering if AMC stock will rebound, short squeeze or not, the company seems to be on the right trajectory.

AMC Stock Price History - How Much is AMC Stock Worth?

AMC was acquired by Chinese conglomerate Wanda Group in 2012 for $2.6bn. In 2013, AMC stock was once again listed publically on the NYSE at $18 per share. Wanda Group retained a stake in the company up until 2021 when it cashed out its shares.

- The AMC stock price suffered greatly in 2020, dropping to an all-time low of $2.12 in December.

- At this time, the company was in hot water financially and facing bankruptcy.

- This was largely down to the global disruption caused by the COVID-19 pandemic.

- Many entertainment stocks suffered because of global lockdowns and restrictions, forcing the closure of theatres and other such venues.

At the start of the global pandemic, the company already had an estimated $5 billion in debt, which was due to mass refurbishments following its 2016 Odeon takeover.

In fact, things were so bad that AMC announced a new stock offering in December 2020. At this point, hedge funds took advantage of the chance to increase their short positions in the company. This was the catalyst for AMC's role in the 2021 meme stock craze as retail investors bought shares to help the company raise funds and beat the hedge funds shorting the company.

For anyone who missed it, retail investors from online forum groups like Reddit's WallStreetBets took a strong interest in AMC stock. This was of a very similar nature to what happened with the most well-known meme stock, GameStop. As such, large numbers of independent retail investors bought AMC stock en masse.

In doing so, the AMC stock price went from around $2 at the start of January 2021 to over $13 by the end of the month, showing an increase of around 550%. AMC stock fell again and was trading at $10 per share at the start of May 2021.

However, following another meme rally and the announcement of shareholder perks such as free popcorn, AMC stock experienced an all-time high of around $62.55 per share. The peak was achieved on June 2, 2021, before falling back down for the rest of the year. However, AMC stock remained at a highly inflated value with more mini peaks until around October 2022.

The stock price appears to have settled, at least momentarily, in the $5-$8 region. Though that's quite a large range for such a low-priced stock, which shows it is still relatively volatile.

AMC stock began 2023 at just under $4 but has rallied to between $6-$7 in the first three months of the year.

EPS and P/E Ratio

When considering the fundamentals of AMC stock, it's crucial to explore the earnings-per-share (EPS) and price-to-earnings (P/E) ratio. Financial reports of listed companies are released on a quarterly basis, although not all at the same time. To find out when AMC releases its reports, be sure to look for news of the stock during earnings seasons.

AMC had a net loss of $973.6m in 2022 which means it has a P/E ratio of not applicable (N/A). This is the case when a company has lost money and has a negative EPS. AMC's most recent EPS, based on its 2022 earnings, is -0.93.

Anyone can calculate the P/E ratio themselves by dividing the stock price by the EPS, though it is simple to find online.

Potential or current investors in AMC stock will want to pay attention to the EPS and P/E going forward. If the company is able to bring itself to profitability over the coming years, it could dramatically alter the stock price.

Market Capitalization

The market cap valuation of AMC is in a greater state of flux than more stable stocks. As of March 2023, AMC has a market cap of around $3.2bn. Over the last three years, the AMC market cap has swung from as low as half a billion dollars to as high as $53bn.

Index Funds

AMC is included in the Russell 2000 and 3000. As such, it is held by multiple ETFs, such as the iShares Russell 2000, Vanguard Mid Cap Index, and around 70 others. If you like the sound of diversifying, you can trade ETFs.

AMC Stock Dividends

AMC does not pay dividends.

However, if you decide to invest, you could also invest in other dividend stocks. This will allow you to diversify your exposure to AMC.

Increase in Liquidity Following Come Back

As mentioned above, the meme stock rally in 2021 helped AMC to get back on track financially. This undoubtedly makes it a better investment than it was in 2020.

In addition to this, theatres were allowed to open their doors once more in late 2021, which resulted in an increase in revenue for AMC. In 2023, cinemas are beginning to get back to a semblance of pre-pandemic normality.

- AMC's revenue in 2022 reached $3.91bn, up from $1.24bn in 2020 but still below the 2019 level of $5.46bn.

- Avatar: The Way of the Water has massively increased theatre-going numbers. The movie is now the third highest-grossing of all time.

- AMC has been trying to find new sources of revenue. The company bought a 22% stake in Hycroft Mining in 2022 and began selling its popcorn at Walmart this year.

AMC no longer has to worry about playing defense now that it has nearly $2 billion in liquidity and cash streaming. Instead, it has been looking at ways to sure up its business and expand.

AMC Stock Forecast - AMC's Plan to Grow Value for Shareholders

AMC management was able to generate $587bn in cash because of the company's stock sales during the meme rally. The company sold 11.55 million shares when the price was close to its peak in June 2021. That was an increase on the $917m the company was able to raise between December 2020 and January 2021.

AMC has pledged that the money raised from the aforementioned meme rally has been and will continue to be used for major projects that stabilize the company.

As previously mentioned, this has entailed investing in its main business, movie theaters, and infrastructure, as well as debt reduction for the company and pursuing other revenue streams like confectionary products.

AMC's long-term growth plan includes the following targets:

- AMC has kick-started plans to upgrade all of its Dolby Cinema and IMAX premium screens.

- To grow the company, AMC has begun diversifying by taking over leases from struggling cinema chains.

- In addition to acquiring smaller exhibitor chains, the company also launched its AMC Theatres branded popcorn with Walmart in March 2023.

- In April 2022, the company announced that it had purchased multiple theaters in Connecticut, Maryland, Annapolis, and upstate New York.

- This gave AMC 66 extra cinema screens, with the possibility of more from the same owners.

- The company bought its 22% stake in gold and silver mining company Hycroft Mining in 2022.

AMC's decision to expand its screen count and make acquisitions to grow the business means it is well-positioned to generate free cash flow and maintain its place as the world's biggest theatre chain.

Moreover, the aforementioned investment creates a transformational opportunity for AMC, as it is now an entertainment company with diverse holdings and a better chance at stability and growth.

That makes the forecast for AMC stock much better than it was during the pandemic. Rather than facing bankruptcy, the company has been given the rare opportunity to turn itself around without intervention from a restructuring entity. This makes the AMC stock forecast for the next few years and the longer term into 2025, 2030, and further much brighter.

Predictions for the AMC stock price in the short term may be difficult because of the lingering effects of the meme rally, but there's no doubt the company is getting its house in order.

AMC Could Still Benefit from the Meme-Stock Effect

Some market commentators thought interest in meme stocks would have died down by now.

However, this speculative tendency has continued, wreaking havoc on hedge funds that bet against AMC stock.

Furthermore:

- The CEO of the company has done well with its social media activities and has maintained an optimistic attitude toward AMC.

- As a result of this, the CEO is now well-liked by retail investors who own stocks and will look to support AMC.

- Moreover, AMC has retained popularity on Reddit's trading threads as one of the main meme stocks.

- At the time of writing, short interest in AMC is at approximately 20%.

- As such, short interest levels are still deemed high, thus indicating the possibility of another squeeze.

Even if there is another rally, which many analysts believe is possible, there is no guarantee that AMC will breach the all-time high of $62.55 it reached in June 2021.

However, if you believe in the future of the company, you could buy AMC stock and hold on to it with the hope your investment appreciates naturally.

Alternatively, see it as a short-term opportunity, where you might buy AMC stock at a low price and sell if it skyrockets again, following strong financials or a meme rally.

For instance, if you bought AMC stock in January 2021 at $2 each and sold them in June of the same year, you would have been looking at gains of around 3,400%.

AMC is Offering Perks to Shareholders

AMC shareholders can engage with the company via the Investors Connect platform. This is where you'll find the latest updates, offers, and promotions.

Some of the perks offered to shareholders include:

- Free large popcorn refills and discount Tuesdays.

- AMC Stubs Insiders are awarded 20 points for each $1 spent and a $5 reward every time they hit 5,000 points.

- 'I Own AMC' NFTs have been dished out to shareholders.

- The company has also teamed up with Orange Comet to mint thousands of themed NFTs.

- These include collections of NFTs for big movie releases like Lightyear and Jurassic World Dominion.

Around 580k shareholders signed up to the Investors Connect portal and were each given the aforementioned AMC NFTs for free. The adoption of NFTs and the acceptance of crypto payments are two of the ways the company is looking ahead to the future.

Is AMC Stock a Buy?

Despite AMC stock losing value since its meme rally, many retail investors still believe in the stock. Regardless of what happens or doesn't happen, with a short squeeze, AMC has put the money it gained from its meme rally of 2021 to good use.

First of all, AMC chose to wipe out half a billion dollars worth of debt. Secondly, the company is investing in refurbishing its theatres to entice moviegoers and expanding its revenue potential.

AMC has done this by making investments away from theatres, such as the gold and silver mining company Hycroft and its line of popcorn products. This all bodes well for future growth.

- Revenue is recovering to pre-pandemic levels.

- The smash-hit movie Avatar: The Way of Water is now the third highest-grossing movie of all time which has helped ticket sales.

- AMC has been making acquisitions to grow its theatre business.

- AMC is also leaning into its internet fame by producing NFTs and allowing cinema-goers to use cryptocurrencies to buy tickets at its US theatres.

- This includes options such as Bitcoin, Ethereum, Litecoin, Shiba Inu, and Dogecoin.

The latter was accepted following a social media poll held by AMC's CEO. Two-thirds of people voted in favor of Dogecoin tokens being added to the list of accepted cryptocurrencies on the AMC app.

If there was any uncertainty surrounding the hundred-year-old cinema chain's ability to stay relevant - this should offer further insight into its progressive plans to grow.

Moreover, as the world bounces back from the worst of the COVID-19 pandemic, there is no doubt that theatres will see an increase in revenue. The company hasn't quite reached pre-pandemic revenue figures yet, but it is on track to potentially do so in 2023.

Conclusion

The decision over whether or not to purchase AMC stock can fall into two camps. The beliefs are that purchasing the stock could lead to short-term gains from a short squeeze or faith in the company that it is on the road to becoming a stable long-term business after utilizing the money it gained in 2021 from selling shares.

Many Wall Street analysts believe that AMC already had a short squeeze when it hit $62.55. However, the short percentage is still high, and many retail investors believe that there's more to come.

Regardless of what the AMC stock price is today, the decision of whether or not to buy shares should be based on thorough research. As a volatile stock, AMC is potentially riskier than other stock assets. Those who don't have the stomach for risky investments may want to look at buying Amazon stock or a similarly sized company.

Whichever route you decide to take, we can recommend Webull as the best place to invest in AMC stock and a variety of other options