Leading online retailer and tech giant Amazon (NASDAQ:AMZN) is one of the world’s most well-known companies and has a market cap in of around $1 trillion at the time of writing.

The popularity of Amazon extends to its stock which is one of the most traded on the NASDAQ. So let’s take a look at everything potential investors should know about how to buy Amazon stock in 2025.

How to Buy Amazon Stock

You can buy Amazon stock from a regulated broker with 0% commission in just a few steps.

- Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process.

- Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license. Note: other platforms may have different requirements/waiting periods.

- Step 3 – Deposit Funds: Users can usually deposit as little as $10 from a variety of payment options, such as e-wallets, credit/debit cards, and ACH.

- Step 4 – Buy Amazon Stock: Users can search for Amazon stock via the search bar of the platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Step 1: Decide Where to Buy Amazon Stock

Publicly-traded stocks vary in price based on a multitude of factors, and Amazon’s shares are valued at around $96 at the time of writing. As such, when you’re deciding on where to buy Amazon stocks, you might elect to do so at a brokerage that supports fractional trading.

This allows you to allocate smaller amounts to gain exposure to the company. To help you decide where to buy stocks, we’ve reviewed one of the best brokers to buy Amazon stock from:

Webull – Commission-Free Trading From $5

You can allocate just $5 when partaking in fractional trading at Webull. There are thousands of stocks listed here. With that said, you won’t find many internationally-listed stocks at this brokerage, apart from a selection of ADRs.

Keep in mind that ADRs may come with depositary service or custody fees, which at Webull typically range from $0.01 to $0.03 per share. You can use ACH and bank wire transfers for payments, and Webull does not require a minimum deposit. However, bank wire transfers incur an $8 fee for each deposit and a $25 fee for each withdrawal.

This brokerage does not offer any copy trading features. However, we discovered some tools, including different order types, screeners, news and data, and customizable charts with multiple timeframes. Plus, US clients can buy cryptocurrency starting with just $1. There is also the option to invest in Amazon stock through an IRA.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Amazon Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

What is Amazon?

Amazon is now one of the world’s most recognized and valuable brands. The vast e-commerce enterprise sells everything from housewares, electronics, and furniture to toys, books, and stationery.

The company also offers cloud services – which include renting out computer resources and data storage on a large scale through Amazon Web Services (AWS).

- Amazon Web Services was created in 2002 and first provided data on website popularity, internet traffic patterns, and other information for marketers and developers.

- The Elastic Compute Cloud (EC2), which leases out computer processing capacity in tiny or large amounts, was added to AWS’s offering in 2006.

- Amazon’s Simple Storage Service (S3), which leases out data storage online, was launched the same year.

As of 2022, AWS has a 33% market share in the critical cloud services segment, meaning around one-third of the internet runs on Amazon’s platform. That’s more than any other single competitor and part of why the Amazon stock price has faired so well in recent years.

As of 2022, around 200 million individuals have signed up for Amazon Prime throughout the world. By 2026, Amazon Prime Video is predicted to have over 240 million members globally.

As other streaming services like Netflix struggle to increase revenue, Amazon is in a unique position with the Prime package it offers to retain and grow its subscriber base.

Step 2: Is Amazon Stock a Good Investment?

Amazon is one of the top-performing stocks of the 21st century. It’s so popular that in its relatively short history on the NASDAQ, there have been four stock splits. The last Amazon stock split in 2022 took the buy-in price from an eye-watering $2,933 per share to a more palatable $125 in the days following.

Despite the stock split making Amazon shares more attractive to investors, it couldn’t save the company from a 37.86% decline over the past 12 months to February 2023. The Amazon share price decline has been so bad that in December 2022, the stock hit a three-year low. That has many investors questioning, should I buy Amazon stock?

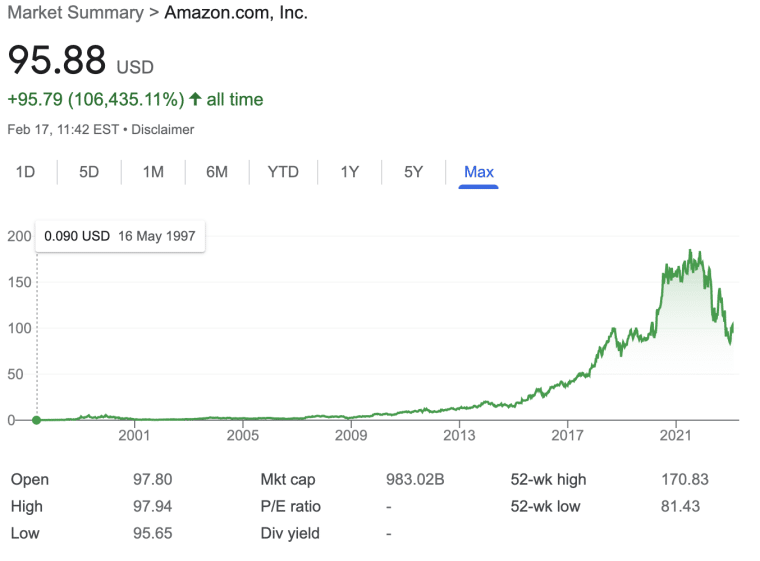

However, it isn’t all bad news for Amazon stockholders. If we look back at a longer time frame, Amazon shares have done very well for early investors. Those who invested in the company five years ago are still up around 28% despite the recent poor performance. Of course, anyone who bought Amazon stock before the millennium would be up around 128,000%. A $1000 share purchase in 1997, based on Amazon stock today, would be worth around $1.2 million in February 2023.

Naturally, past performance isn’t an indicator of future returns. Yet, as Amazon has diversified its revenue streams in recent years, it has arguably become a better investment based on fundamentals than it was ten or more years ago.

Amazon Stock Price History

Amazon investors have been on a rollercoaster ride in recent years, with its stock skyrocketing throughout 2020 and 2021 as the pandemic sent home-bound consumers to its e-commerce site in droves. Then last year, macroeconomic headwinds slowed spending, dragging Amazon’s stock down by almost 50% throughout 2022.

However, if Amazon’s share price history is anything to go by, the company’s stock won’t be down forever. Despite the sell-off in 2022, its stock has retained growth of 35% over the last five years and 640% over the last decade.

Moreover, Wall Street has rallied in 2023, with Amazon shares up almost 17% since Jan. 1. As the home of a solid cloud computing business in Amazon Web Services (AWS), leading market share in e-commerce, and a consistent stock price history, Amazon is a reliable growth stock.

As of February 2023, Amazon’s stock price of around $96 is still 38% down year over year, suggesting it is nowhere near hitting its ceiling.

Check out the Amazon stock price history chart below:

Amazon Stock Price Forecast

After a challenging 2022, when Amazon’s e-commerce segments reported combined operating losses of $10.59 billion, the company has a mountain to climb to return that part of its business to profitability. However, AP News recently reported that inflation in the U.S. had eased for the seventh month in a row, with the metric at its peak of 9.1% in June 2022 and 6.4% in January 2023. The improvement is a positive sign for Amazon’s e-commerce business. With consumers able to spend more, the Amazon stock price forecast is brighter than it was at the end of 2022.

Additionally, despite declines in digital sales, Amazon’s cloud computing business more than pulled its weight last year and will likely continue to do so for the long term. AWS made up 100% of Amazon’s $12.2 billion in operating income in 2022, proving the strength of the platform’s leading 34% market share in the booming industry. That’s good news for a longer-term Amazon stock forecast of 2025 or 2030 too.

The cloud market was valued at $368.97 billion in 2021 and is projected to expand at a compound annual growth rate of 15.7% through 2030. When Amazon’s e-commerce business is back to form, the company could see significant gains from boosted sales and cloud growth.

Amazon’s average 12-month price target is currently 39% above its stock price. Alongside solid positions in two lucrative markets, Amazon’s stock price prediction makes its shares a compelling buy. If the company continues on its current trajectory, it would mean Amazon is a good stock to invest in.

Amazon Stock Price – How Much is Amazon Stock Worth?

Amazon has maintained a market capitalization of around $1 trillion, despite the stock price falling nearly 38% between February 2022 and 2023. Amazon became a publically listed company on the NASDAQ in 1997, with an initial IPO price of $18. This would be the equivalent of $0.09 per share today when taking the company’s four stock splits into account.

Amazon’s share price took a tumble in 2022 as negative macroeconomic factors hampered growth. The Fed’s decision to raise interest rates has made equities much ‘riskier’ in general, leading to a broad sell-off of Amazon shares. However, Amazon still dominates the e-commerce space – even if it isn’t as dominant as it was in 2021.

Amazon stock split

- The latest split was approved by shareholders in May 2022, with the Amazon stock split date on June 6th.

- Last year’s stock split was the first for Amazon since the late 90s. The first stock split occurred in 1998, with two more splits in 1999.

- In March 2022, before the stock split, one share of Amazon was worth $2,933.

- After the 20-for-1 stock split in June, one share was about $125.

- The Amazon stock price today, as of February 2023, is at $96 per share.

Amazon Market Capitalization

At the time of writing, Amazon is the fifth-largest company in the world as measured by market cap, behind the likes of Microsoft, Saudi Aramco, Google, and Apple. As of February 2023, Amazon carries a market capitalization of around $1 trillion.

Amazon Index Funds

Amazon is a member of multiple indices. This includes the NASDAQ Composite and NASDAQ 100, the S&P 100 and 500/Consumer Discretionary, and the Russel 1000 and 3000.

EPS and P/E Ratio

Amazon’s latest earnings report in Q2 2022 saw the company’s EPS come in negative at -$0.20. The reason given for this poor performance was supply chain constraints and rising interest rates, creating a challenging business environment.

In terms of its price-to-earnings (P/E) ratio – the relative value of a stock against the company’s earnings – Amazon stock sits at 97 at the time of writing in February 2023.

The stock’s highest P/E ratio without NRI was around 3,732 times for the last 13 years, while 44 times was the lowest.

Amazon Stock Dividends

Since its founding, Amazon has never paid dividends to its investors.

Instead, gains are used by the company to develop and expand into other areas in an attempt to boost revenue (and profits).

Amazon Stock Features

You can look at a range of different metrics and features when analyzing Amazon stock. We have discussed a few below:

Network Effect

The network effect is a phenomenon that occurs when the estimated value of a service (or product) improves as more people use it.

As such, when researching how to invest in Amazon stock, you will probably see this term used to describe the company. The firm’s brand has grown tremendously powerful as a result of the network effect, amongst other things.

For instance:

- When customers flock to Amazon’s website, the platform becomes more appealing to businesses looking for new customers

- As more vendors join the Amazon marketplace and eventually provide a larger quantity and diversity of products, a higher number of online shoppers will use the website

- In 2021, Amazon’s third-party merchants topped 6 million, with the business adding 2,000 new vendors every day

- Meanwhile, the number of Prime members is increasing at a rate of 30 million people each year, according to estimates

The network effect has allowed Amazon’s e-commerce operation to continue to grow at speed and is showing no signs of slowing down.

Amazon is consistently ranked among the world’s most valuable brands. For instance, Amazon came in fourth place in Forbes’ most recent ranking of global companies.

Amazon Dominates Online Retailing

Amazon is one of the most popular shopping sites in the world.

The company is able to provide a variety of benefits to customers, such as:

- People all over the world are attracted to Amazon’s low cost and diversity of products. This has led to Amazon’s dominance in the e-commerce market.

- The company holds a 37.8% market share in the US e-commerce business, 12% more than the closest ten competitors combined.

- As of late 2021, Amazon Prime is offered in 23 countries. In the US alone, nearly 1 in every 3 people pay for an Amazon Prime membership.

- Amazon ships an estimated 1.6 million packages each day. This equates to a daily revenue of almost $610 million.

- Prime subscription fees alone brought in $31.77bn for Amazon in 2021.

This positions the company well for future success, which should benefit shareholders looking to invest in Amazon stock for years to come.

Amazon is a Cloud Computing Pioneer

As you may have discovered when researching how to buy Amazon stock, the company is a pioneer in cloud computing.

This is a sector that analysts expect to develop at a compound annual growth rate of 15.7% through 2030.

- Amazon Web Services (AWS) has risen to the top of the cloud market

- Specifically, as of the end of 2022, AWS had a share of over 34% of the $368.97 billion market

- Microsoft Azure, Amazon’s closest competition, came in second with a market share of 21%

- Interestingly, Amazon’s cloud computing division now has far higher profit margins than its traditional e-commerce division

- AWS made up 100% of Amazon’s $12.2 billion in operating income in 2022

Cloud computing solutions are the backbone of the web. Amazon’s lead in this sector makes it one of the most important companies in the world.

As such, the company’s bottom line should benefit as AWS grows to account for a bigger share of Amazon’s sales.

Step 3: Open an Account and Buy Amazon Stock

Once you have decided to invest in Amazon stock, you need to create an account to execute the trade. Head over to the Webull site, follow the account creation and ID verification steps, and you will be ready to deposit fund and open a trade to hold Amazon stock.

Is Amazon Stock a Buy?

In the past year, Amazon’s stock has lagged behind the broader market. The stock price has lost the majority of the gains it had made up to the beginning of 2022. However, the price is still up nearly 30% over the last five years.

- The recent downturn for Amazon means now could be a good time to purchase the stock.

- When you are researching the ins and outs of how to buy Amazon stock, you can look at the company’s recent difficulties, as well as focus on the firm’s long-term strategy.

Conclusion

Amazon is one of the most valuable companies in the world, with a market cap of around $1 trillion. Its recent struggles due to the wider economic climate means that the stock price is now trading at levels not seen since early 2020.

For investors willing to ride out the economic uncertainties, Amazon could prove to be a fruitful investment. It has a diversified business in cloud computing, a massive lead in e-commerce, and it’s one of the most recognized companies on Earth. The recent Amazon stock split in 2022 also means that the company is much more accessible to smaller investors who want a piece of the online behemoth.

FAQs

How do I buy Amazon stock?

Did Amazon split their stock?

Can I buy one dollar of Amazon stock?

How much is Amazon stock per stock?

Is Amazon a buy, hold, or sell?

What is the Amazon stock prediction

Why did Amazon stock sink?

Is Amazon losing money?

When was the Amazon stock split?

When is the best time to buy Amazon stock?

Read More:

- How to Invest in Stocks Online for Beginners

- Best Penny Stocks to Watch for 2023

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks