From originally selling books online, Amazon has since developed into an international IT corporation with expertise in everything from cloud computing and artificial intelligence (AI) to digital streaming and e-commerce.

In this guide, we explain the ins and outs of how to buy Amazon shares in the UK. We also discuss the share price history of Amazon alongside key investment considerations such as market caps and stock splits.

Below, investors can see a simple explanation of how to sign up with a regulated brokerage. Follow these steps to buy Amazon shares in the UK today.How to Buy Amazon Shares UK in 4 Easy Steps

Following the final step, the brokerage will add Amazon shares to the portfolio of the investor.

The quantity will be based on the share price at the time of investing in Amazon stock. Read on for a more detailed account of how to invest in Amazon shares in the UK.

FCA Regulated Stock Brokers with Amazon Stock

To buy shares in Amazon from the UK, investors will need to gain access to the US stock exchange – the NASDAQ.

This is where a leading stock broker in the UK comes in.

Below, we’ve reviewed an FCA-regulated platforms for those still deciding where to buy Amazon shares in the UK.

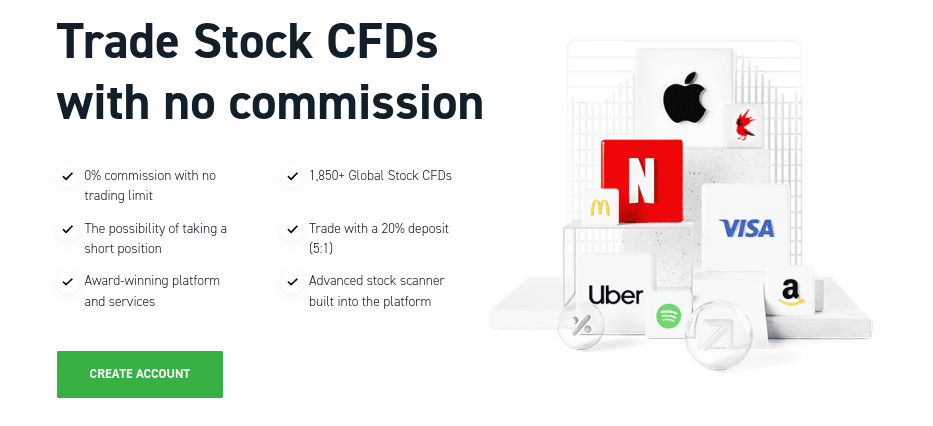

XTB – Top Broker to Buy Amazon Shares UK with 0% Commission Fees

XTB lists over 2,100 financial instruments as of writing. This brokerage offers a wide range of global markets which includes stock and ETF, in addition to commodities, indices, and forex. As such, to buy Amazon stock in the UK, investors will do so via share CFDs at this brokerage.

This has its advantages. For any investors who are unfamiliar with this type of instrument, CFDs allow traders to place both long and short orders, as well as being able to leverage their positions. XTB offers 0% commission fees on share CFDs and there are no trading limits in place.

The minimum stock trade size is $50 (around £40) at XTB. In terms of tools, investors will find Amazon stock charts, price tables, and market calendars. XTB allows investors to trade with a 20% deposit, specifically, the platform offers leverage up to 1:5. Investors should tread with caution if opting to use leverage when trading Amazon stock.

Applying leverage entails opening positions that are larger than the account balance would normally allow. As such, this is comparable to a loan. In addition to Amazon, we found over 1,850 alternative stock CFDs. The complete spectrum of stock CFDs includes, among other industries, IT, healthcare, medical, food, industrial, automotive, and entertainment.

To trade Amazon shares at XTB today, investors can fund their accounts without needing to meet a minimum deposit. Supported payment methods include credit/debit cards, bank transfers, and e-wallets such as Paysafe (formerly Skrill). Note that the latter attracts a 2% fee. Some credit card providers may charge a fee too, however, the XTB platform itself does not.

- Read our full XTB review here.

| Approx No. of Shares | Over 1,850+ |

| Pricing System | 0% commission on all shares, including Amazon |

| Cost of Trading Amazon | Minimum trading size for Amazon shares is $50 |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

Amazon Stock Information

A large part of learning how to invest in Amazon shares in the UK is gaining a clear understanding of the business model.

This is in addition to the Amazon stock price history, and fundamentals surrounding the financial health of the company.

Investors can read on for further information before choosing to buy Amazon stock in the UK.

What is Amazon?

Amazon offers a wide range of products, including housewares, movies, music, toys, books, electronics, and much more. These products are sold directly to millions of consumers. Amazon also acts as a middleman between them and a wide range of third-party sellers from around the world.

Meanwhile, Amazon’s web services division offers computer and data storage resource rentals. This part of the business is called AWS (Amazon Web Services). SaaS (Software as a Service), PaaS (Platform as a Service), and IaaS (Infrastructure as a Service) are just a few of the cloud computing services offered by AWS.

Additionally, this company is well-known for manufacturing the popular Kindle e-book reader devices. Amazon has become a significant disruptive force in the book publishing sector as a result of its marketing of these devices. Amazon also has its own music subscription service called Prime Video.

This is in addition to electronics such as Alexa smart speakers, Fire TV devices, tablets, and more. According to recent leaks, Amazon is now interested in creating games and entering the NFT (non-fungible tokens) market. It seems that Amazon wants to let users play games on the blockchain and win NFTs.

The company will likely administer the infrastructure directly, bypassing Amazon Web Services (AWS).

Amazon Share Price History – How Much is Amazon Stock Worth?

Amazon was founded by Jeff Bezos in 1994 as an online retailer, initially focussing primarily on selling new and second-hand books. Amazon began selling CDs in 1998, subsequently expanding its product portfolio. The next year, it introduced more product categories, including children’s toys, a range of electronic items, and DIY tools.

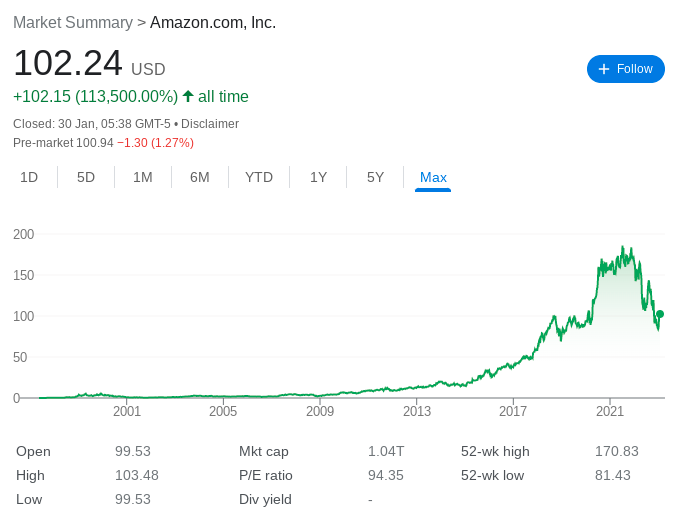

Let’s take a look at the price history of Amazon stock . By 1997, Amazon stock was listed on the NASDAQ and shares were available to the public for $18 each. By 1999, Amazon was voted the most overvalued stock and it continued to struggle into the 2000s as the Dot.com bubble burst.

Between 1999 and 2002, Amazon shares had fallen by almost 90%. By 2009, things started to pick up for Amazon stock. The company reported huge profits despite the recession, which went down well with investors and shares increased almost 27% that day.

From October 2009 and the same month in 2019, Amazon’s stock increased by over 1,740%. By this point, the online retailer was getting its revenue from multiple avenues, including its own products and services. As we mentioned, this includes everything from the popular echo dot speakers with the assistant Alexa, to the streaming service Prime Video.

All prices take Amazon’s numerous stock splits into account. According to the Amazon stock chart, its all-time highest price was achieved in July 2021, when shares were almost $190. Some Amazon bulls argue that the company’s shares are cheap at the time of writing. This is because they are now trading about 47% below the previous record high and could be undervalued.

Amazon Fundamentals

Before buying shares in Amazon, investors will need to study some information surrounding the fundamentals of the company’s financial health.

P/E Ratio

The most recent closing price of Amazon stock is multiplied by the latest EPS (earnings per share) figure to determine the P/E ratio (price to earnings).

This is one of the most commonly used valuation metrics. The P/E ratio offers a straightforward approach to determining whether a company is fairly valued or not.

As of writing, Amazon’s P/E ratio is 94.48 times. To offer some comparison, Apple’s P/E ratio is 23.76, and Microsoft’s is 27.62.

Compared to Amazon, Apple’s P/E ratio is far lower. However, due to its significant investments in growth, Amazon’s profitability might be misleading.

PEG Ratio

Amazon’s TTM (trailing twelve-month) PEG ratio is calculated by dividing the company’s current P/E ratio by its 12-month growth rate. This, in comparison to the P/E ratio alone, may provide a more complete picture for some stock investors.

This is most likely due to the comparison between the P/E and growth rate.

According to Zacks Investment Research, at the time of writing – Amazon has a PEG ratio of 3.04. A PEG ratio that is higher than 1 can be indicative of overvalued shares, or potential growth.

As we touched on, according to some Amazon bulls, it’s more likely that the shares are underpriced.

EPS Ratio

The EPS ratio (earnings per share) is revealed in each quarterly report.

Here is the EPS of Amazon stock according to the last four earnings calls:

- Q4 2021 – EPS beat expectations by 657.1%

- Q1 2022 – EPS expectations missed by -190.58%

- Q2 2022 – EPS missed expectations by -270.7%

- Q3 2022 – EPS expectations were beaten by 35.53%

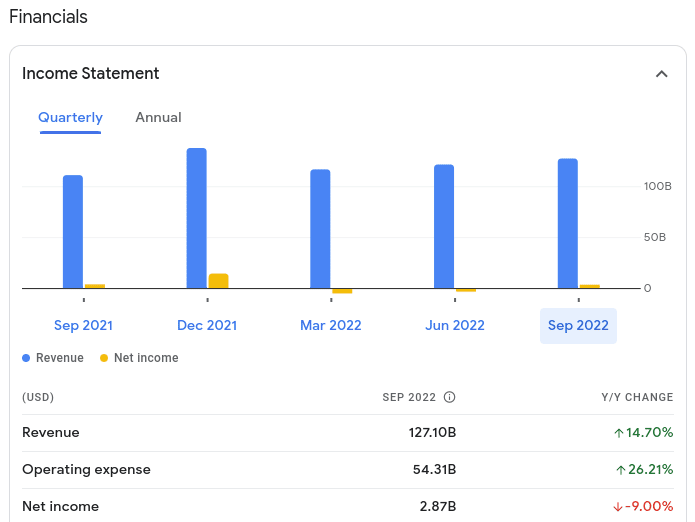

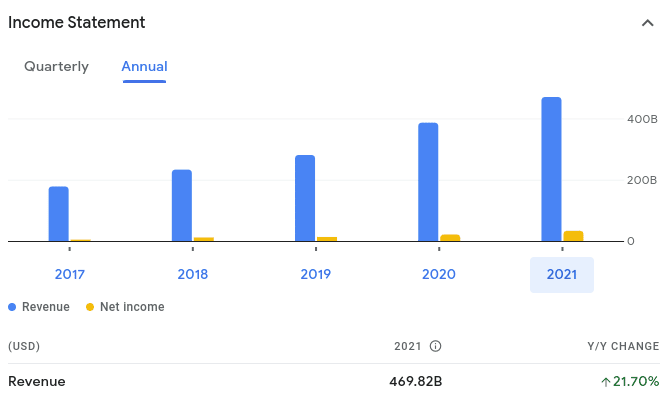

According to the quarterly financials as of September 2022, revenue was up by nearly 15% Y/Y (year-over-year). and the company’s net change in cash increased by almost 76%.

Meanwhile, operating income fell by almost 48%, and diluted EPS was down 9.68% Y/Y.

EBITDA

EBITDA stands for earnings (net income) prior to interest, taxes, depreciation, and amortization. As such, it’s often used to illustrate the profitability of a company.

According to Wall Street Journal, a Dow Jones company, the annual EBITDA for Amazon in 2021 was over $48.36 billion. According to Amazon’s earnings call, as of September 2022, the quarterly EBITDA was $12.73 billion.

ESG Rating

A company’s resistance to long-term environmental, social, and governance risks is measured by an ESG grade.

Thousands of publicly traded companies like Amazon are evaluated and verified by the independent platform MSCI, which is often used as a rule of thumb.

As of writing, Amazon has been given an average MSCI ESG score of A, among almost 80 other retail-consumer discretionary companies. The company had an ESG score of BB in late 2019, so has improved greatly over the last five years.

Amazon Shares Dividends

Amazon, like many other technology stocks, does not pay dividends to investors.

Amazon puts these funds back into growing the company instead of paying shareholders. This, in turn, should benefit long-term Amazon investors as growth is key.

Is Amazon a Good Investment for UK Traders?

When deciding whether or not to buy amazon shares in the UK, investors can explore the key considerations discussed below:

Amazon is Sensitive to Inflationary Pressures

The cost of living in the future is likely to affect consumer spending, both in regard to retail goods and also subscription-based streaming services like Amazon Prime.

- Amazon’s video streaming service’s yearly membership fee increased in 2022

- This has already affected the number of subscribers, which fell in the hundreds of thousands

- In Q3 2022, Amazon’s net income was down 9% compared with the same quarter the year earlier

That said, the company’s dominant position in the cloud services market could continue to fuel sales and profitability growth for many years to come.

Amazon Has Multiple Sources of Revenue

As we touched on, Amazon stock is sensitive to inflation. However, it’s also worth bearing in mind that the company does benefit from multiple sources of income.

Here is an overview of how each section of Amazon’s business is performing, as of Q3 2022:

- According to Amazon’s business metrics, online store sales’ Y/Y growth was 13%

- Y/Y for the same quarter, third-party seller services grew by 23%

- Subscription services increased by 14%

- Advertising went up by 30%

- AWS grew by 28%

The company launched ‘Amazon Fresh’ food outlets throughout the UK and the US in 2022. As of late 2022, the corporation also began making deliveries via drone to Prime users in the US. By 2030, the cloud infrastructure industry is anticipated to more than triple in size on the AWS side of things.

Therefore, this could provide Amazon with significant growth, even if Amazon can only retain its worldwide market share (which is the majority as of writing). Moreover, many investors are probably watching this space to see how successful the company’s entry into the NFT space will be.

Amazon Stock Price is Trading at a Low Price

An Amazon stock investment costs almost 50% less than it would have done during the prior all-time high. But is this enough for retail investors to invest in Amazon in the UK?

The value decline is partially related to the blow the stock market experienced in 2022. This was largely a result of the Federal Reserve increasing interest rate rises in an effort to curb inflation.

At the time of writing, Amazon’s market capitalization has just about halved since the aforementioned high and now sits at just over $1 trillion.

Amazon stock is trading over 40% lower than it was at its 52-week high. As such, some Amazon bulls believe this stock is undervalued and therefore represents a bargain.

Amazon Stock Price Prediction

Amazon (AMZN) is down by 35% in the last 12 months but has seen a decent recovery since the start of 2023, where it is up 22.4% from yearly lows of around $85.

The stock dipped to the 2018 price and having been a Wall Street darling for many years, is now suffering long-term headaches caused by the coronavirus pandemic.

There was a boom in online shopping during the lockdown that has since fallen away and the pandemic also had other repercussions such as logistical backlogs around the world, increased costs and, of course, inflation.

However, a strong Q4 2022 – where the company saw sales of $149.2 billion, up 9% year-on-year – has led to the price of AMZN bouncing back, despite news of a larger-than-expected wave of layoffs in early January, with nearly 20,000 jobs cut.

The Amazon stock forecast is wildly different depending on whether you are investing for the short or long term and also depends on whether the US Federal Reserve will continue to commit to its program of interest rate hikes.

There are continued rumours that multi-billionaire founder Jeff Bezos could return to his former role as CEO.

For now, however, many analysts have placed Amazon on their ‘buy’ list as it trades at around $100 at the time of writing.

The average 12-month Amazon stock price forecast sees it at $139.54, which would be an increase of around 40%, with a high of $244.39 and a low of $80.8.

Latest Amazon Shares News

When researching how to buy Amazon stock in the UK, it’s also a sensible idea to look at the latest news.

Here is the latest Amazon share news:

- Buy With Prime – As of January 31st, all qualified US merchants will be able to participate in Buy with Prime. This will allow Prime members to take advantage of perks like free shipping and returns on websites other than Amazon. When the initiative was first introduced in April 2022, it was exclusively accessible to online merchants that already had a connection with Amazon and used its fulfillment services. Some Amazon bulls believe Buy with Prime can help the firm displace companies like Shopify and greatly increase its addressable market.

- NFT Market Ambitions – According to a report by Blockworks, Amazon intends to launch a number of blockchain-based products. The online retailer could begin digital collectibles as early as April 2023. At this time, it’s thought that Amazon will also provide its users with access to crypto games with the chance to win free NFTs as rewards.

- Amazon is Entering the Healthcare Space – In January 2023, Amazon revealed its new ‘RxPass’ service. For $5 per month, users of Amazon Prime may access a variety of prescription drugs, with free delivery included. Traditionally, patients in the US needed to set up their insurance, submit claims, and visit a real pharmacy to pick up their prescriptions when it has been prepared. By doing away with the insurance component, RxPass is attempting to remove a lot of these obstacles and Amazon investors are watching this space.

The company is also working on opening brick-and-mortar stores to boost its presence in the UK. Amazon regularly updates its investors’ site with news that may affect shares.

Conclusion

The market capitalization of Amazon as of writing is over $1 trillion, and many bulls consider the stock to be highly undervalued. When investors buy Amazon shares in the UK at this time, they are able to do so at a discount of almost 50% when compared to the stock’s all-time high.

Amazon has a successful streaming platform, an online marketplace, cloud computing services, and its own range of electronics. The company has now set its sights on the NFT market. Prior to deciding whether or not to invest in Amazon stock, investors will need to carry out thorough research of their own.