Alphabet (NASDAQ:GOOGL), the parent company of Google, is one of the most popular tech stocks in the sector. A market cap of around $1.2tn also makes it the fourth most valuable company in the world. That’s not a big surprise, the tech giant has woven its way into nearly every aspect of 21st-century life, from its titular search engine to nearly 72% of phones, and the world’s most popular video platform, YouTube.

The company’s reach is so vast that it’s difficult to find anyone who doesn’t use at least one of its products. As a result, Alphabet is one of the most closely watched stocks alongside the likes of Apple, Microsoft, and Amazon. So let’s take a look at everything potential investors should know about how to buy Alphabet stock in 2023.

Step 1: Decide Where to Buy Alphabet Stock

Choosing a broker can be a daunting task when you’re looking to buy Alphabet stock for the first time. That's why we've done the legwork and can recommend Webull as the best place to buy Alphabet stock because of its 0% commission fees and variety of top-quality tools.

We also have a more comprehensive list of our most popular trading platforms right here. Otherwise, check out our review of this top broker below:

Webull - Fractional Trading From $5

Webull is another popular broker for people looking to buy Alphabet stock. This platform will allow you to buy stocks in fractional quantities from as little as $5 for equity in the company. It's the best platform to invest in Alphabet stock for those who want to grow their portfolio in small increments.

Webull is another popular broker for people looking to buy Alphabet stock. This platform will allow you to buy stocks in fractional quantities from as little as $5 for equity in the company. It's the best platform to invest in Alphabet stock for those who want to grow their portfolio in small increments.

WeBull also doesn't charge any commission when you buy Alphabet stock because it is US-listed. Although, if you decide to trade foreign stocks later, they will be offered as ADRs, and you will need to check out what trading fees you will incur.

The platform is simple to use and comes with some useful trading tools. All users get access to fundamental company information and a stock screener. Webull also offers aggregate ratings, watchlists, price charts, and technical indicators.

If you decide this is the place to buy Alphabet stock now, you can download the Webull app to trade on the go. This platform also offers a free paper trading account that enables you to try out various strategies and hone your skills before using your own money.

Webull charges $8 on every bank wire deposit and $25 per withdrawal. You can, however, make a deposit via ACH for free.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH - free / Bank wire - $8 |

| Fee to Buy Alphabet Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Is Alphabet Stock a Good Investment?

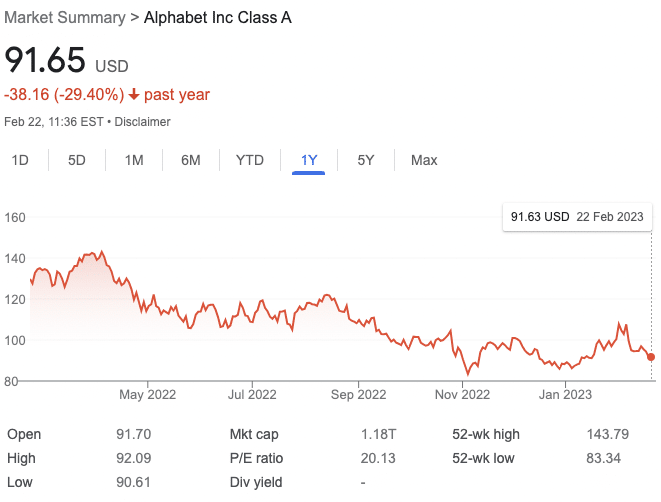

In the 12 months since February 2022, Alphabet stock is down 29.40%. The company suffered from the wider economic landscape in 2022, and, despite a brief rally, at the start of 2023, the stock hasn't really picked up.

Google Services make up around 92% of Alphabet's total revenue, of which the majority of that comes from advertising. For that reason, investors are spooked that Alphabet's main source of revenue could dry up should companies begin to tighten marketing budgets in the wake of a serious economic downturn.

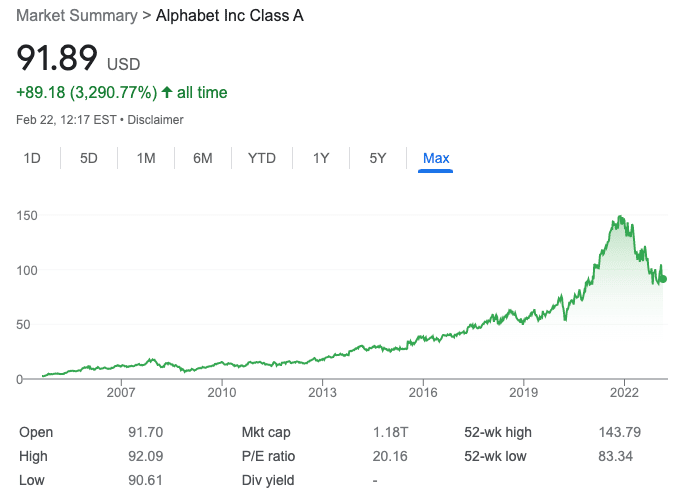

That makes a prediction for how Alphabet stock will perform in the coming years more difficult than it has been in the past. Since its initial listing in 2004, then as Google, Alphabet stock is up around 3,478%. Those who invested in the stock back then have done very well for themselves. Even over the last five years, the Alphabet share price is up 62.26%. However, past performance isn't indicative of future returns, and the next couple of years could be quite rocky for the company.

Determining whether Alphabet stock is a good buy right now should depend on whether it's a long-term or short-term investment. For those who want to buy and hold onto Alphabet for many years, the company is likely a good investment as the current price is at a two-year low. That's not to say it won't go lower, but the best way to invest long-term is to buy more shares regularly to offset price changes.

As a short-term investment, there's too much volatility within the market to recommend buying Alphabet stock with the goal of selling it in less than a year.

Remember, prior to investing your hard-earned capital, it's vital to conduct thorough research. As such, part of learning if Alphabet stock is a good stock to invest in is researching the ins and outs of the company and also its recent financial performance. This is the same whether you want to buy Snap stock, Alphabet, or something else entirely.

What is Alphabet?

Alphabet is the parent company of Google, which was created in 1998. Google is the world's largest search engine.

Alphabet was created as the parent company of Google in 2015 to reflect its expanding areas of interest. The following fall under the Alphabet umbrella:

- Alphabet owns Google Chrome, Maps, Drive, Play, Pixel, and Fiber.

- Alphabet also owns Android, YouTube, Fitbit, DoubleClick, Nest, Adsense, and many more.

- The Google Cloud Platform has an 11% market share in the growing $500 billion cloud computing sector.

- Google invests heavily in analytics, data management, security, and artificial intelligence (AI).

As you can see, Alphabet's business model is far-reaching and includes everything from cloud computing, search, and web browsing to the most widely used mobile operating system Android, and physical products such as Fitbit and Nest.

Alphabet Stock Price History - How Much is Alphabet Stock Worth?

Google, then Alphabet, was publically listed in August 2004 at $85 per share, valuing the company at $23bn. By today's standards, that might sound low, but there was some skepticism at the time around the viability of the internet start-up. The company put any doubt to rest over the next two decades, as Alphabet has become one of the most prominent technology companies in the world. Now with a market cap of around $1.2tn, that makes the initial $23bn valuation look paltry.

Google, and then Alphabet, had a stock split in 2014, and then a second in 2022. The 2014 stock split was notable as the company didn't only split its shares, it also created two classes of stock going forward. These became known as Alphabet class A (NASDAQ:GOOGL) stock and class C (NASDAQ:GOOG) stock, complete with a new symbol each. The difference is that Alphabet class A stock has voting rights, while class C stock does not. Despite this difference, the price of Alphabet class A stock and class C stock tends to rise and fall in tandem.

Alphabet price history stock chart:

The most recent stock split in 2022 took Alphabet stock from a price of over $2,000 per share to around $110, making the company much more accessible to smaller investors. Since then, the price has fallen further, but so has the price-to-earnings (P/E) ratio. Alphabet is now sitting at a rather attractive 20 P/E. Compared to competitors like Apple (25.17) and Microsoft (28.09), the current Alphabet share price is looking quite attractive.

EPS and P/E Ratio

When buying any stock, it's important to track the financial health of the company to evaluate whether it is a sound investment, and the same is true for Alphabet. Two ways to do that are by looking at the earning per share (EPS) and price-to-earnings (P/E) ratio. EPS and P/E are quick ways of telling how well a company is doing.

Currently, Alphabet has an EPS of 4.48 for the last 12 months, which is down 18.76% on 2021, but still much higher than 2020 (2.93) and 2019 (2.46). So although Alphabet's profits dropped last year, the company is still well up on its pre-pandemic earnings.

The P/E ratio, tells us how cheap a company's stock is relative to its earnings. A lower P/E could be an indicator that a stock is essentially on sale.

As of February 2023, Alphabet has a relatively low P/E of 20. The P/E ratio for Alphabet dropped considerably with the stock price hit it took in 2020. The last time the company had a P/E ratio this low prior to 2022 was all the way back in 2022. So based on the Alphabet stock price today, this could be the best time to buy the company in over a decade.

Market Capitalization

Alphabet is a large-cap stock. At the time of writing, Alphabet has a market capitalization of nearly $1.2 trillion. This makes it one of the largest companies in the world by market cap, alongside the likes of Apple, Microsoft, and Saudi Aramco.

Index Funds

This company is a member of 'FAANG', which refers to the best-performing tech stocks in the US. This is an acronym for Facebook (Meta), Amazon, Apple, Netflix, and Google (Alphabet).

These stocks make up a large portion of the S&P 500 index.

Some of the funds that hold Alphabet stock include:

- SPDR S&P 500 ETF Trust

- Communication Services Select Sector SPDR Fund

- Vanguard Communication Services ETF

- Invesco QQQ Trust

- iShares Core S&P 500 ETF

- Vanguard Total Stock Market ETF

At the time of writing, there are over 250 ETFs that hold Alphabet stock. As such, you could learn to invest in Alphabet stock via a fund, which in turn will simultaneously add a diverse selection of other companies to your portfolio.

Read More: You can read about learning to trade ETFs here.

Alphabet Stock Dividends

Alphabet is not a dividend-paying company and has stated on more than one occasion that it has no intention of doing so for the foreseeable future. This might be disheartening for those looking to buy Alphabet stock for a steady cash flow.

However, the reason Alphabet stock doesn't offer dividend payments to investors is that future earnings are retained to grow the business. The idea is that this should, in turn, increase the value of the company, which is beneficial for investors.

If you are keen on receiving dividends, we've covered some of the most popular dividend stocks to add to your portfolio.

Alphabet Stock Price Forecast - Factors Affecting Alphabet Stock

Prior to deciding whether to buy Alphabet stock, make sure you check out the many variables that will influence the value of your investment.

Alphabet is one of the most successful tech stocks in the world. Moreover, it has experienced consistent growth over the last two decades. The company continues to innovate and makes smart tech-based acquisitions to expand its business.

See some of the reasons you might decide to buy Alphabet stock below:

Alphabet has Made Hundreds of Smart Acquisitions Over the Years

As we mentioned earlier, Google was founded in 1998, although it did not go public until 2004. At the time of writing, the company has made over 230 acquisitions in a little more than two decades.

As such, the corporation is much more than an online search engine. Alphabet has entered industries such as advertising, hardware, and many more as a result of its purchases. One of its most consequential purchases was Android in 2005 for $50 million. The mobile operating system now runs on nearly 72% of phones worldwide.

As such, when you buy Alphabet stock, you're not investing in a one-trick pony.

Some of the company's other most important acquisitions are listed below:

- Online video platform YouTube

- Mobile advertising firm AdMob

- Online advertising corporation DoubleClick

- Consumer electronics company and wearable activity tracker Fitbit

- GPS navigation software firm Waze

- Software and travel company, ITA Software

- Home automation firm Nest

- Telecommunications specialist HTC

- Data analytics company Looker

As you can see, these are all strategic acquisitions by Alphabet, and this is only a select handful. The company tends to focus on technology firms that can grow its business in a variety of directions.

Moreover, in March 2022, Alphabet announced its pending acquisition of cybersecurity firm Mandiant. The acquisition is estimated to be worth around $5.4 billion. The purchase will enhance the security of Google Cloud and also allow it to offer more services in the growing market.

Alphabet is a Technological Innovator

In 2022, Alphabet launched a multi-search feature on Google. It's a new approach for individuals to locate what they're looking for by combining visuals and text. For example, people can take a snapshot of a shirt design and then search for one with the same pattern.

The business also announced new search capabilities to assist users in identifying and making appointments with healthcare providers that accept their insurance. Moreover, with ad automation, AI-powered search advertisements let Google's clients respond rapidly to the market circumstances that matter most to them.

YouTube has witnessed considerable growth in recent years. The video platform now boasts over two billion monthly signed-in users and has become a primary destination for learning, instructional videos, and entertainment.

As the world returned to face-to-face activities following the easing of Covid-19 lockdowns. YouTube was able to hold onto the gains it made as a result of the pandemic keeping people at home.

That hasn't stopped the company from innovating. In 2021, YouTube launched its "YouTube Shorts" section to directly compete with the likes of TikTok and Instagram.

It has been an instant success, YouTube Shorts has more than 30 billion daily views at the time of writing, which is four times more than a year earlier. Alphabet also launched additional video editing tools in the first quarter of 2022, and it is continuing to invest in making Shorts an even better experience for artists and viewers alike.

Has Plenty of Room to Grow in the Long-Term

Another potential way Alphabet is looking to grow revenue and increase its users is to hit people's living rooms. Every day, nearly 700 million hours of YouTube material are watched on a television.

As such:

- Alphabet plans to provide new smartphone control navigation and engagement tools for YouTube's linked TV users. This will allow them to comment on and share content they're viewing on TV straight from their smartphones.

- Alphabet will continue to invest in innovative form factors, seamless multi-device experiences, and user privacy.

- The company will also continue to provide developers with the tools they need to flourish on mobile applications in the coming years.

- Google Play pricing has changed to assist all developers to flourish in the marketplace. 99% of developers qualify for a service charge of 15% or less at the time of writing. This had an immediate impact on the firm's earnings but should help growth.

- Alphabet believes it is a long-term strategy for supporting the ecosystem and becoming the most developer-focused app store and gaming platform.

- To attract more business, Alphabet is also looking into other billing solutions.

- Moreover, Alphabet released the Data Safety area on Google Play in early 2022, in response to privacy concerns.

- Here, users can learn more about how apps gather, distribute, and safeguard their data.

Furthermore, in terms of hardware, the Pixel 7 smartphone is a major step forward for the line. It's one of the most successful Pixel models ever, giving Alphabet its highest-selling week ever for the Pixel series shortly after release. The rumored Pixel folding phone could further grow its hardware segment which has lagged behind other Android manufacturers in the past.

Google Cloud Revenue is Growing

Google Cloud revenue increased around 44% year over year in the first quarter of 2022, with sustained strong success across its platform and workspace. That's great news in a nearly $500bn industry that is expected to grow by an average of 14.1% each year to 2030.

In cybersecurity, the company has introduced new offerings, such as assured workloads, to address digital sovereignty in the European Union.

Additional products include virtual machine threat detection, first-to-market, and agentless malware detection capabilities. Not to mention an advanced intrusion detection system for crypto-mining.

Alphabet Stock Split and Potential Dow Jones Listing

When it comes to growing its business model, Alphabet has another advantage. As well as being one of the popular tech stocks, the majority of the world's population uses Google's services on a daily basis.

The Alphabet stock split in 2022 has opened up share buying to a much wider range of investors. The stock split was approved by Alphabet shareholders for the date of July 15, 2022. After the split, the price of Alphabet shares went from over $2000 to just over $100, making it much more palatable for regular investors to buy into the company.

Furthermore, the split may increase the chances of Alphabet stock being added to the Dow Jones Industrial Average, potentially bringing in a lot more interest and capital.

Is Alphabet Stock a Buy?

Opinions differ, but Alphabet stock is generally considered a long-term buy. Alphabet is one of the biggest tech conglomerates in the world and continues to grow.

See a brief recap below to help you decide whether or not you should buy Alphabet stock:

- Over five years, Alphabet stock has increased by around 69%.

- A 20-for-1 stock split took place in 2022, bringing down the individual share price.

- Market commentators think this makes Alphabet the ideal candidate for the Dow Jones Industrial Average.

- Alphabet owns companies like YouTube, Android, AdClick, Fitbit, Mandiant, Nest, and more.

- The company's Google Cloud business is growing, and revenue was up 44% year on year in Q1 2022.

- The Pixel line of phones is finally gaining mainstream traction.

The above makes Alphabet a good buy for those who are not concerned about the short-term struggles the company may face in a weakened global economy.

Conclusion

When considering whether or not to buy Alphabet stock, be sure to consider what we have covered in this article. The key points to consider are "How much is Alphabet stock?" does the P/E and EPS represent good value based on the current price? Also, be sure to follow news about Alphabet stock to ensure you're up to date on any potential changes in the markets the company operates in.

Considering the current price, EPS, and P/E, investors who are considering holding Alphabet stock for a long time could be looking at the best entry point into the company in over a decade.

If you've decided to purchase Alphabet stock, make sure to use our recommended broker Webull for commission-free trading and the best app to keep track of your portfolio on the go.