Alphabet is the parent company of Google and is one of the biggest technology conglomerates globally.

In this guide, we explain how to buy Alphabet shares in the UK without paying any commission. We also analyze the ins and outs of the Alphabet stock price, its earnings reports, future prospects, and more.

How to Buy Alphabet Shares UK in 4 Easy Steps

Those who just need a brief explanation of how to invest in Alphabet shares in the UK will find a step-by-step walkthrough below:

- Open an account with a regulated broker – To buy shares in Alphabet, sign up with an FCA-regulated broker. This will entail entering some basic personal information.

- Upload ID – Regulated stock brokers require investors to complete the Know-Your-Customer (KYC) process. Attach a photo ID like a passport or driver’s license, as well as a utility bill or bank statement. Do note that if the deposit is below €2,000 (approximately £1,700), you can come back to this step later.

- Deposit – Broker platforms require a minimum deposit, usually around of $10 (approximately £8). Choose from a bank transfer, debit card, or an e-wallet like Neteller or PayPal.

- Buy Alphabet Stock – Search for ‘Alphabet’ and buy GOOG shares by entering the monetary amount to allocate to the investment. This can be any amount from $10 upwards.

Note, most brokers will have a list of supported KYC documents and payment types on their platform. As such, investors can check this to see what’s available to them before investing in Alphabet stock.

Those wondering where to buy Alphabet shares in the UK should read on as we analyze some platforms next.

FCA Regulated Stock Brokers with Google Stock

The initial step to take when investing in Google shares in the UK is to pick one of the best stock brokers UK. That is to say, a regulated broker will be able to give UK traders and investors access to US-listed stocks.

As such, investors will first need to decide where to buy Alphabet shares in the UK.

Here is a review of a trading platform that may help with this process.

XTB – Top Rated Broker with 0% Commission to Trade Alphabet Stock

This is achieved by placing a buy or sell order, respectively. CFDs also enable traders to leverage their positions when placing an order to buy GOOG shares. XTB offers UK traders leverage up to 1:5 on share CFDs, which increases a £100 position to £500.

XTB is also among our 10 best UK CFD brokers and offers more than over 2,100 tradable instruments in total, with around 1,850 of them share CFDs.

Applying leverage when trading Alphabet share CFDs should be done with caution. Leverage is highly risky and also magnifies losses if the investor speculates incorrectly.

XTB also offers a range of ETF CFDs, in addition to commodities, indices, and forex. The minimum investment is $50 (around £40). Notably, XTB accepts debit/credit cards, as well as bank transfers and Skrill. E-wallets attract a 2% fee, and credit card issuers may also apply a charge.

- Read our full XTB review next.

| No. of stocks | 1,850+ stock CFDs |

| Deposit Fee | 2% for e-wallets. 0% for bank transfers and debit cards |

| Cost to trade Alphabet stock | Commission-free |

| Minimum trade size | $50 (around £40) |

Your capital is at risk. 82% of retail investor accounts lose money when trading CFDs with this provider.

Alphabet Stock Information

We have covered some reputable platforms to help investors in deciding where to buy Alphabet shares in the UK. It’s also crucial to research the model of the business, how it’s performed thus far in the stock market, and many other metrics.

To shorten the learning curve, we’ve included a range of information that it’s important to know before investing in Google shares in the UK.

Read on to discover the ins and outs of this company, including the Alphabet stock price history, and more

What is Alphabet?

Alphabet is a conglomerate comprising several companies. The primary focus is on the software and internet services sectors. Google was previously known as Backrub when it was first developed as a search engine project in the mid-90s. Google has now become the world’s most popular search engine.

Furthermore, Google’s parent firm, Alphabet, is now a global powerhouse that owns the following:

- Android

- Google Play Store

- Google Chrome

- Google Photos

- Google Search Engine

- Maps

- Waymo

- Google Ads

- YouTube

- Nest

- Gmail

- Fitbit

- and more

According to Alphabet, some segments of its business now have over a billion users. This company is also using AI to expand into industries such as electronics, semiconductors, healthcare, and autonomous EVs.

Alphabet Share Price – How Much is Google Stock Worth

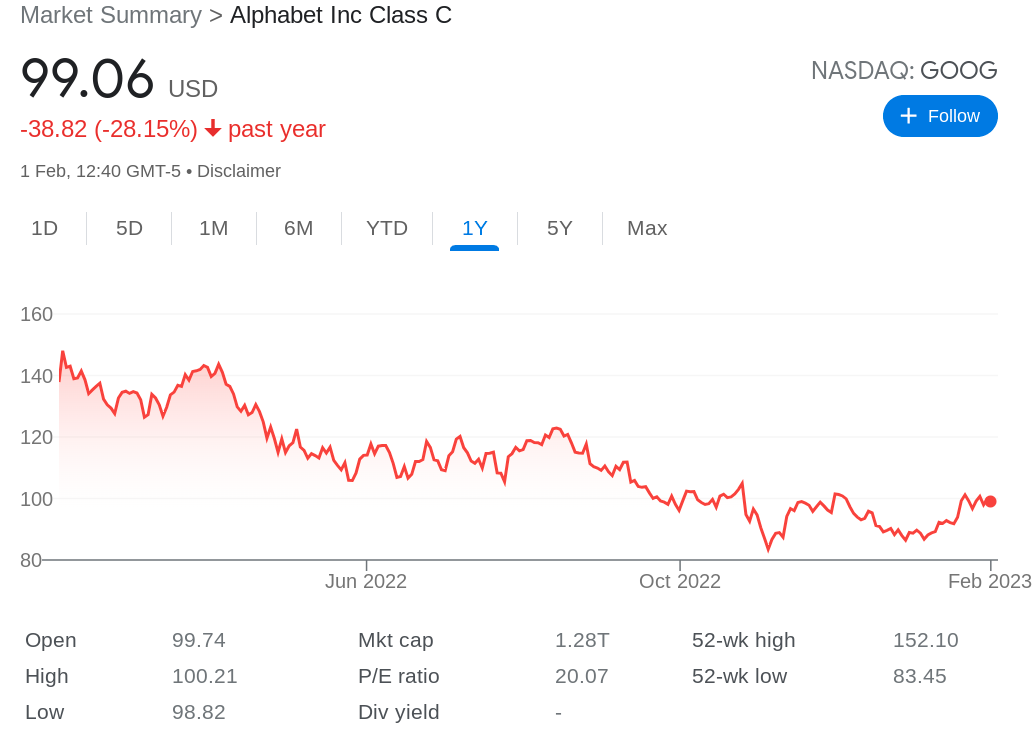

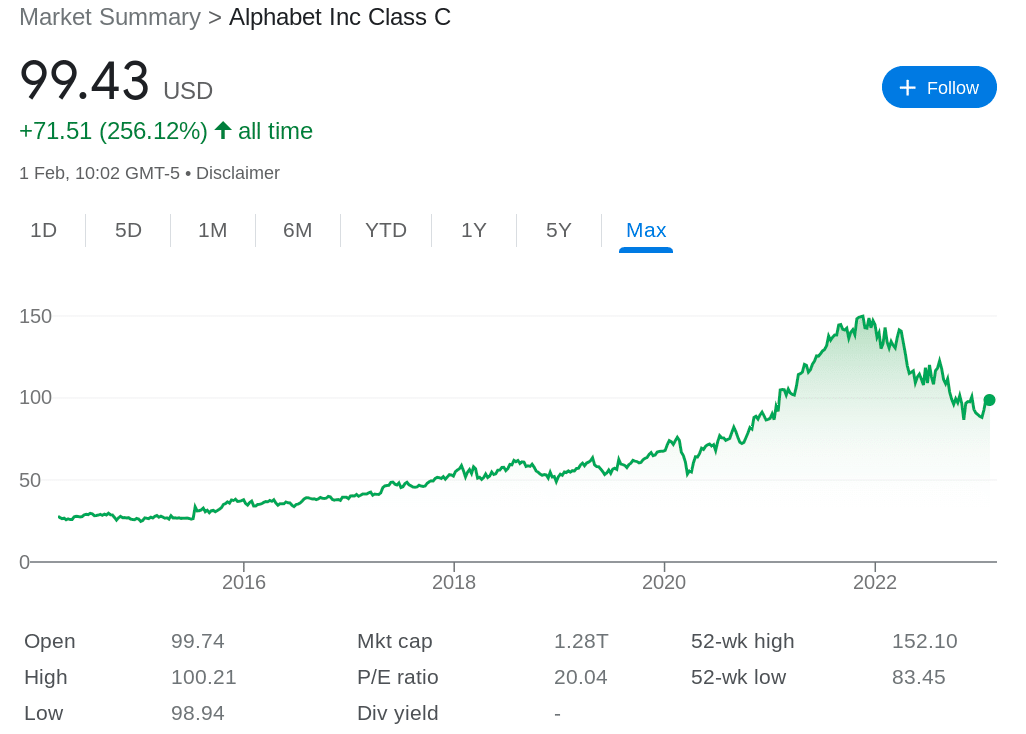

Alphabet was founded in 1996. Google stock was listed on the NASDAQ in 2004. As we said, it started off as Backrub, before changing to Google in 1998. When Google shares were first listed, the IPO price was set at $85. However, taking the firm’s various stock splits into account, the effective listing price was well below a dollar.

In 2015, Google’s CEO rebranded the parent firm to Alphabet, a holding company that includes a range of subsidiaries. According to the Alphabet stock chart, going back as far as March 2014, shares traded for under $65 until the end of 2019. In early 2020, many tech stocks struggled, along with the broader market.

The general health of the economy and Alphabet’s advertising business are closely intertwined. Considering the COVID-19 pandemic’s significant economic impact, it’s possible that investors believed Alphabet was experiencing revenue declines.

Alphabet shares were trading at around $68 at the start of 2020, by the end of March they had fallen to just under $54, a decline of almost 21%. However, at the end of April 2020, Alphabet went up to almost $64 following stronger-than-expected revenue.

Due to stronger-than-anticipated ad sales, Alphabet exceeded Wall Street’s profit projections for Q3 2021. By November 2021, Alphabet had reached its all-time high of around $150. As of writing, in the last year of trading, Google’s stock has lost over 38% of its worth, and some Alphabet bulls think it is potentially undervalued.

Alphabet Stock Dividends

Alphabet doesn’t distribute any dividends to its stockholders and this has been the case since the company was founded.

As such, all of the company’s earnings are reinvested in the various sectors of its business to help it expand.

Alphabet Stock Fundamentals

Next, having researched various aspects of the company and its performance, we’re going to talk about some of Alphabet stocks’ strengths.

Multiple Sources of Revenue

Those who buy Google shares in the UK are actually investing in a multifaceted company with numerous sources of revenue.

This includes products and services such as hardware, the Play Store, Search, Maps, YouTube, Android, Chrome, and ads. Google Services in particular generate revenue from numerous avenues, but primarily from advertising.

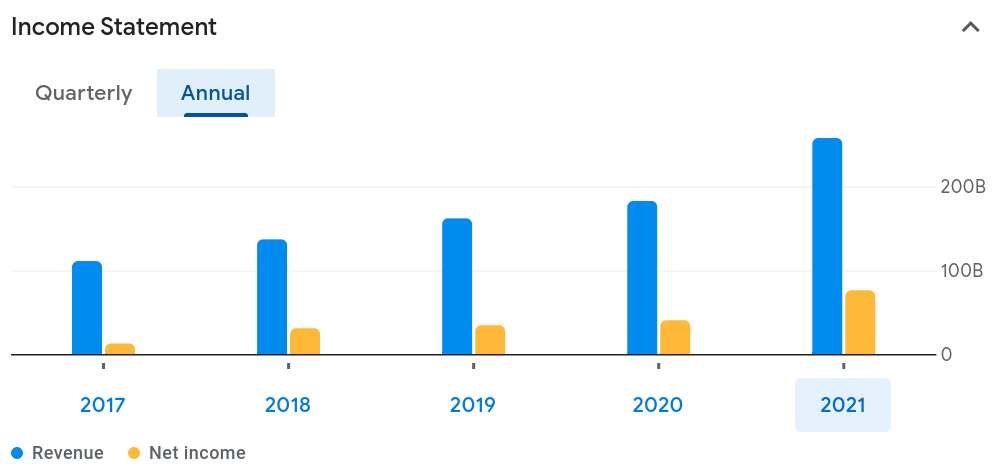

Here’s what we found out from the annual income report for the most recent fiscal year:

- Revenue was up 41.15% Y/Y to $257.64 billion

- Operating expenses increased by 20.17% to $67.98 billion

- Net income was up 88.81% to $76.03 billion

- Cash from operations went up by 40.73%

- Net profit margin increased by 33.77%

- EPS (earnings per share) was up 91.43%

- EBITDA increased by 66.01%

- Total assets were up 12.41%

- Free cash flow increased by 37.81%

Additionally, the selling of hardware, digital content, and apps all generate income. In-app purchases and fees collected for subscription-based services like YouTube Premium and YouTube TV are additional revenue sources for Alphabet.

Google’s revenue saw an increase in Q3 2022, which includes income from YouTube, as well as Network, and Cloud segments. It was, however, only 6%, the company’s most lackluster increase in years.

That said, low expectations for Alphabet’s Q4 2022 earnings call will have been affected by the slowdown in revenue growth. As such, the business might surpass expectations when the next quarterly report is released. The P/E ratio of Alphabet is 20.04 as of writing.

Alphabet Stock is Rated a Strong Buy

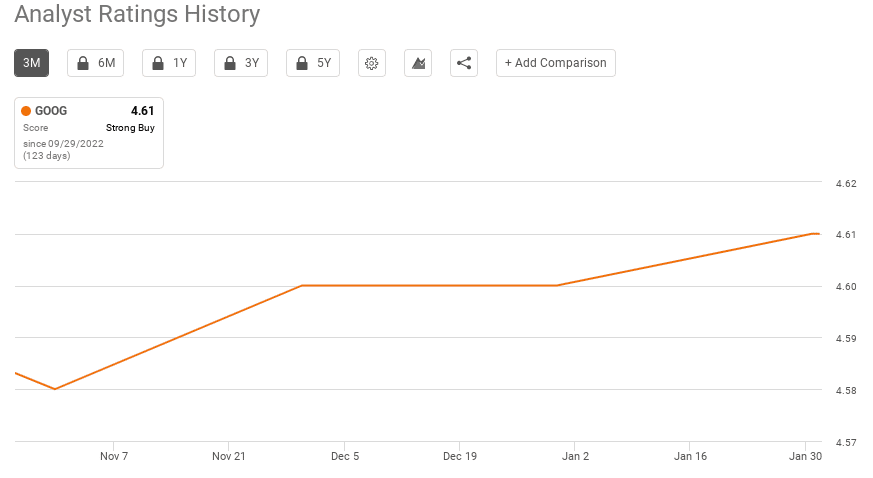

Those researching how to invest in Alphabet stock might also be interested to know what market commentators believe.

According to Seeking Alpha, the majority of the 51 Wall Street sell-side analysts in the last 90 days have rated Alphabet stock a strong buy.

Here’s the breakdown:

- 35 ranked Alphabet stock a strong buy

- 12 rated it a buy

- 4 advised to hold

- 0 said sell.

At the time of writing, out of an overall score of five, Wall Street sell-side analysts ranked Alphabet 4.6.

The average price target is $123.64. This is almost 24% higher than the Alphabet share price at the time of writing.

The low price target is $103, and the high is $160, which illustrates a potential upside of over 60%.

Google is focused on ESG & Sustainability

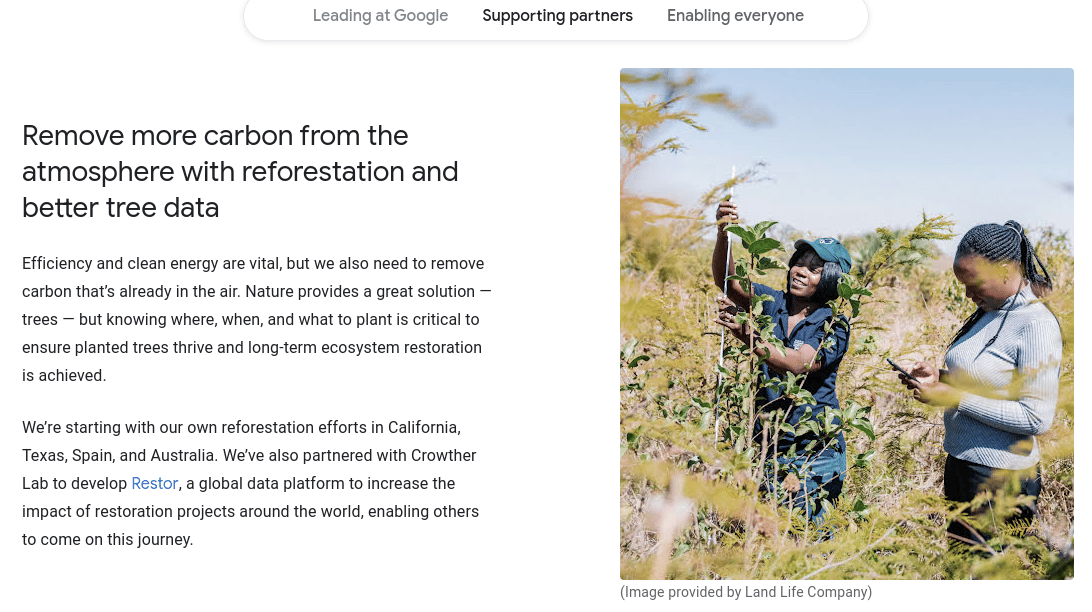

Google became the first business to achieve carbon neutrality across all of its activities in 2007. Ten years later, it became the first significant business to match 100% of its yearly electricity needs with renewable energy.

In its 2020 Sustainability Impact Report, Alphabet announced its plans to invest heavily in ESG (environmental, social, and governance) efforts across its numerous business segments and platforms.

Google issued sustainability bonds worth $5.75 billion in August 2020. As such, those who buy Google shares in the UK join the business in addressing pressing challenges thanks to the net revenues.

By 2030, Google wants all of its activities to have net zero emissions. Specifically, the business expects to allow 5 GW of new carbon-free energy throughout its core industrial zones by 2030. Alphabet’s investment in sustainability bonds significantly advanced this goal.

By educating them about their solar potential, more than 3,000 communities can measure and lower their carbon emissions from buildings and transportation while maximizing their usage of renewable energy. This will be a major positive for those who want to buy Alphabet shares but aren’t sure where the company fits into a low-carbon future.

Autonomous Driving Technology

The performance of the Google Services division, which provides the most to the top line of its parent company, Alphabet, could be positively influenced by its many partnerships. Alphabet has also created a company that focuses on the manufacture of autonomous driving technology.

This was initially called Google Self-Driving Car Project but was rebranded as Waymo in 2016.

- As of writing, Waymo’s robot-taxi services are offered in Arizona and California

- The Alphabet-owned company also creates driving technologies for other vehicles

- This includes delivery vehicles and Class 8 tractor-trailers for logistics and distribution

- Waymo and Uber made a collaboration announcement in 2022

- The partnership allows Uber to incorporate Waymo’s autonomous technology into its freight truck service

- In late 2022, Waymo submitted its application for the last license required to run fully autonomous taxis

- This applies to the state of California and means the service can run without a backup driver

In other automobile news, in January 2023, a new alliance named VP3 was established by Google, Ford, General Motors, and the renewable energy non-profit RMI. Increasing the number of virtual power plants (VPPs) online is the main objective.

Furthermore, Renault is now able to give over-the-air software upgrades to its vehicles thanks to Google’s expansion of its partnership with the automaker.

Google’s Initiatives and Alliances

In addition to the aforementioned green investments, Google has created a partnership with Pivot Energy. This is a top US developer of small utility-scale and onsite solar systems. The goal of the partnership is to make community solar initiatives available to users who have a Nest or Home device.

The initiative, Nest Renew, requires users to join up for a monthly membership in order to create a nearby renewable energy farm. To take part, they must also have a Google account. Once the renewable energy panels are operational, customers will be able to use solar credits each month on their power costs.

This will be is available for continental US customers to start. In the first year, the company hopes to save members living in these states at least $60 on their power costs thanks to the recent partnership.

In addition, the first 2,000 solar program registrants will get a $125 Google gift card. As a result, Alphabet anticipates that the company will gain traction with residents of these states. That is to say, it could also increase the pace at which Google accounts and Nest devices are adopted.

In another deal, Google Meet, with video-conferencing device interoperability, is being launched in partnership with Zoom Video Communications. Users will be able to attend Zoom Meetings from hardware that supports Google, as per the rules of the agreement.

Some of Google Cloud’s well-known customers include Goldman Sachs, Spotify, Ikea, PayPal, Unilever, Subaru, Twitter, P&G, and many more. It’s clear that the Google division of Alphabet regularly enters into strategic alliances to strengthen its potential for growth and market dominance in various areas.

Is Alphabet (Google) a Good Investment for UK Traders?

According to the Q3 2022 earnings call, Alphabet missed EPS, net income, and profit margin estimates for the quarter. The fact that search, advertising, and YouTube all performed worse than anticipated, together with its cloud segment, led Google to declare an overall loss in advertising in Q3 2022.

Demand for tech-related services and digital advertising may continue to decline through the majority of 2023. Even if things start to improve in the second part of next year, significant growth is not certain. As of writing, many are still fearing a recession is around the corner.

This, in part, comes as a result of the Federal Reserve’s increasing interest rates. As a result, marketing spending could be among the first to be reduced. Given that advertising accounted for the majority of total income in the most recent quarter, this could directly affect Alphabet stock.

As such, the rate at which Alphabet’s earnings increase in the following quarters could be constrained. Market analysts will no doubt be tracking Alphabet’s cloud expansion in addition to overall top and bottom-line growth.

Alphabet (Google) Stock Price Prediction

Alphabet (GOOG) stock, like much of the rest of the stock market, suffered through a brutal 2022 – dropping to some of its lowest prices in years – but has enjoyed a good bounceback to start 2023.

At the time of writing, the price is down by 22% year-on-year but in the last month has seen 25% gains to reach its highest price since mid-October.

However, as with its previous three quarters, Google’s parent company posted more disappointing results for Q4 2022 – there were declines across the board with analyst estimates missed with profits down again and a total revenue gain of just 1%

That mostly came from support for Google Cloud, but YouTube Shorts continued to eat into its long-form content, with advertisers pulling back and revenue in that section dropping by 8%.

The short-term outlook also remains dim, with advertising and spending forecast to move slowly across the board amid more global financial turmoil and the US Federal Reserve’s continued rate-hike policy.

Google also continues to lose grip on its market share after years of being the dominant search engine.

However, despite some short-term doom and gloom, when making an Alphabet stock forecast, most analysts agree that GOOG is a long-term buy.

YouTube may continue to struggle in 2023, but Alphabet has ambitious plans to introduce e-commerce and also turn it into a streaming service, while Shorts has nearly doubled its number of views in 12 months.

Alphabet has also announced plans to launch its own AI content generator – Bard – to challenge ChatGPT.

The 12-month Alphabet (Google) stock forecast sees an avearage high of $179.29 in February 2024, an average of $127.75 and a low of $94.62.

Latest Alphabet Shares News

Below is a rundown of the latest news surrounding Google stock:

- Alphabets Q4 2022 financial report was worse than expected – Overall revenue grew by just 1% with YouTube ad revenue dropping by a massive 8%.

- Google set to launch ChatGPT rival – Following the $10 billion investment from Microsoft into ChatGPT’s parent company OpenAI, Google is set to launch its own AI content generator, named Bard.

- Google has signed a deal with Pivot Energy – Eligible customers who use Google Nest or Home devices will be able to join a community solar energy program. The company promises to save customers money on their energy bills. It’s hoped this will boost sales for Google products and services

- Google Cloud accelerated – Throughout 2023, Alphabet is anticipated to gradually increase revenue growth, especially in the cloud services area. The company’s effort to grow globally includes a campaign in the Middle East. It presently has 106 data centers and 35 active cloud regions. Alphabet recently declared it will create additional cloud zones worldwide. With the help of BigQuery, Looker, and other tools, Revionics and Google Cloud have also developed a data-driven platform focused on pricing. The goal is to improve efficiency, scalability, and automation

Prior to opting to invest in Alphabet in the UK, it’s always worth researching news surrounding the company as oftentimes this can affect the share price.

Conclusion

The majority of Wall Street sell-side analysts over 90 days considered Alphabet stock to be a strong buy. That said, prior to placing an order, it’s important to conduct plenty of research when exploring how to invest in Alphabet shares in the UK.

This should be inclusive of studying the stock price history, and various elements of the business.

We looked at the historical performance of Google on the stock market, as well as the company’s sources of revenue, financial health, strategic partnerships, and much more.