This global brand has cornered the market in creative software. But, thanks to the general bear market, Adobe stock price is down 35% in the last 12 months. We delve into Adobe’s financials to find out how the company is performing.

Below we show the process of investing in Adobe stock without paying any commission. We review two brokers which offer full transparency around fees, as well as a range of financial assets to trade. Let us begin by reviewing the process of getting started buying stocks online.

Buying Adobe Stock — An Overivew

- ✅Step 1: Open an account with a regulated Broker – Sign up with a regulated broker for free. Supply a few personal details to get started.

- Step 2: Verification – Supply proof of ID and proof of address. All regulated brokers need to check ID so they stay in line with international ‘Know Your Customer’ regulations.

- Step 3: Deposit – Users are spoilt for choice when it comes to ways to deposit funds: credit/debit card, bank transfer and e-wallets are all commonly accepted. No deposit fee applies.

- Step 4: Search for Adobe Stock – Find Adobe stock by entering the Adobe stock symbol ADBE in the broker’s search toolbar.

- Step 5: Buy Adobe Stock – With some brokers fractional share trading is possible, meaning investors can buy less than one share.

Step 1: Choose a Stock Broker

For anyone wanting to buy Adobe stock they need to sign up with an online broker.

Where to buy stocks is effectively the first decision we need to make.

Investors looking to invest in any stock — from penny stocks to tech stocks like Adobe — should consider brokers which offer:

Extensive Regulation

- In the US, brokers are regulated by the Securities and Exchange Commission (SEC). Other regulatory bodies include FINRA and FinCEN.

- Investors wanting to buy shares UK should look out for regulation by the Financial Conduct Authority (FCA).

- In Europe, many brokers are registered in Cyprus and regulated by CySEC.

No Commission on Stock Transactions

As realists, we do not expect brokers to handle our investments for free. But nowadays we do expect a broker to charge zero commission on stock transactions.

Investors should watch out, though, for non-trading fees like deposit fees and withdrawal fees, as well as fees on specialist trading arrangements like Contracts-For-Difference (CFDs). Capital.com offers CFDs.

Tight Spread Fees

Spread fees are a way that all brokers make money. There is no getting away from them if the aim is to invest in stocks.

- The spread is the difference, at any point, between the price an investor can buy at and the price he/she can sell at.

- To make a profit, the broker will offer a slightly-higher buy price and a slightly-lower sell price. The tighter this spread, the less the investor must sacrifice on a ’round-trip’ trade of buying and selling an asset with a broker.

- The buy price is $389.73.

- The sell price offered is $388.44.

- The spread therefore is $389.73 minus $388.44 = $0.89.

As a percentage of the buy price, the spread is 0.23%. This percentage is often called the spread fee.

Investors wanting to buy Apple stock, for example, or other NASDAQ stocks should use a regulated broker.

Capital.com

With 5,600 financial markets on offer, Capital.com offers stocks, ETFs, commodities, indices and forex.

Capital.com has a reputation for bringing new stocks to market as soon as they are available. The broker was one of the first off the market bringing Electronic Vehicle stock Rivian to market, for example, after its record-breaking IPO in November, 2021. (Investor can buy Rivian stock with Capital.com)

With Capital.com, all business is done with CFDs, which allow investors to go short on trades (ie. bet that the price will fall rather than rise) as well as leverage their trade for extra sensitivity to price movements.

CFDs are for ‘scalping’ small movements in price. But overnight fees are charged, which makes them unsuitable for investors wanting to buy cheap stocks, for example, and hold for the long-term.

Capital.com charges no commission on stock trades. A spread fee of 0.77% applies on ADBE stock.

Leverage of 5:1 is applied automatically, and an overnight fee of 0.023% is levied on the borrowed funds.

| Number of Stocks: | 5,000+ |

|---|---|

| Pricing System: | Spread fee + Overnight fees for CFDs |

| Cost of Buying Adobe: | 0.77% Spread + 0.023% overnight fee |

| Deposit Fees: | NA |

| Withdrawal Fees: | NA |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research Adobe Stock

Investors researching where to buy Adobe stock also need to research the stock itself.

With plenty of information available from brokers like Capital.com, there is no need to follow the headlines or focus on Reddit stocks.

Instead, let us get an overview of what Adobe does, how it generates revenue and what its balance sheet looks like.

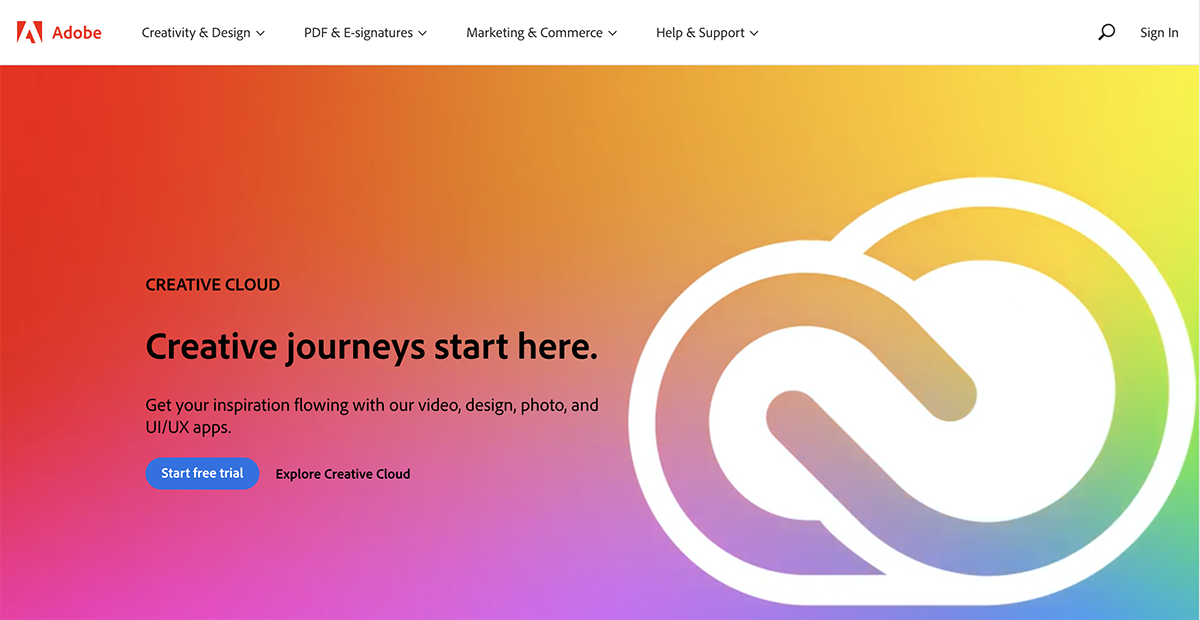

What is Adobe Systems Inc

US-based software firm Adobe provides creative software for image editing, desktop publishing, graphic design, 3D graphics, document management and film production.

Adobe’s flagship Photoshop product is the unquestioned industry standard in image editing software.

Adobe offers a range of other products, notably:

- Illustrator, which faces competition in the field of vector graphic production from Sketch, CorelDraw and Affinity Paint amongst others.

- InDesign, which took over from Quark as the world’s leading desktop publishing programme.

- Dreamweaver, which is a web development app.

Adobe products are offered via monthly subscription on Adobe’s Creative Cloud.

Adobe Operational Overview

- Adobe is headquartered in San Jose, California, US.

- The firm has offices in America, Asia, Australasia, Europe and South America.

- Adobe has almost 26,000 employees, and for 21 years has featured on Fortune’s ‘1oo Best Companies to Work For’.

Adobe Trading Overview

- Adobe came to market with an IPO in 1986.

- The Adobe stock symbol is ADBE.

- ADBE is traded on the US Nasdaq Exchange.

- Adobe’s fiscal year begins and ends during late November each year.

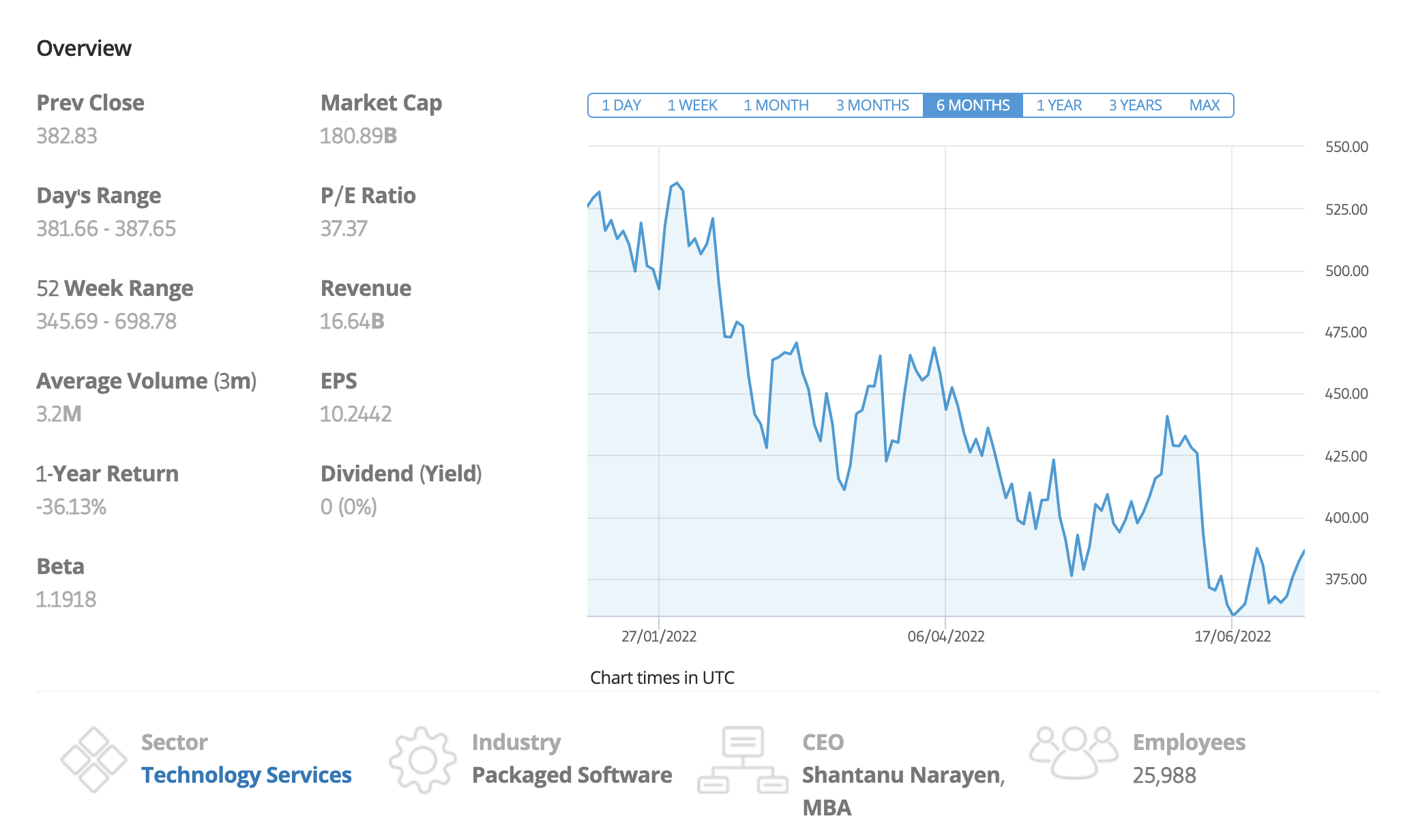

- Currently the market capitalisation of ADBE is $184bn.

- The stock has a beta of 1.19, which means it is marginally more volatile than the market.

- The stock price is down almost 36% over the last 52 weeks.

Adobe Stock Price — How Much is Adobe Stock Worth

The Adobe stock price today is $389.44. As we can confirm from the Adobe stock chart below, that is the closing price on July 8th, 2022.

Adobe Stock History

Adobe’s monopoly on creative software has seen its stock price accelerate in growth for the last decade. Then it has fallen foul of the current bear market based on fears over inflation, interest rates and the Ukraine crisis.

- For the first decade of its listing, Adobe’s price remained under the $50 mark.

- In 2013, the price began a steady rise to over $100 at the beginning of 2017.

- Just three years later, by the beginning of 2020, the price had almost quadrupled to hit an intra-day all-time high of $386.06 on 16th February, 2020.

- The onset of the Pandemic triggered a brief correction during Q1 2020. The price fell to a 2020 low of $255.03 on 15th March, 2020.

- The price then bounced to oscillate in a channel between $450 and $500 until Q2 2021.

- In early June 2021, the price rocketed again. It hit an all-time-high (ATH) of $698.78 on November 22nd, 2021.

- Since then, Adobe has been a major casualty of the bear market affecting even tech stocks. Its value has plummeted to a 2022 low of $345.69 on 17th June 2022.

- The ADBE price has since recovered by 10% to hit its current level of $389.44.

Adobe Stock Three Key Financial Metrics

Unlike professional analysts, regular investors may not have the time to delve into the financials of a stock.

From this overview of the previous financial year, we can isolate three metrics — covering profitability, valuation and debt — to assess the general health of Adobe stock.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Quick Ratio | Current assets divided by current liabilities | The ability of a company to pay off its short-term debts within 90 days |

Adobe EPS (Earnings Per Share): $10.24

EPS is one measure of a company’s profitability.

For the financial year ending November 2021, an EPS for Adobe was reported of $10.24.

This means that for every share outstanding in the company, Adobe earned $10.24 in net profit.

This is a green flag of sorts to investors wondering whether to buy Adobe stock. By comparison, some other tech companies have higher valuations than Adobe but negative EPS figures. Adobe has continued to be profitable.

Adobe’s EPS figure for Q2 2022 (announced June 16th, 2022) was $2.49.

The firm’s projected EPS for Q3 2022 is down on this figure by $0.13, at $2.35.

This is something of a red flag for investors. Also worrying is that Adobe’s EPS figure for the whole of 2021 was down slightly on the previous year’s figure of $10.02. This was a reflection of difficult market conditions, with potential clients tightening their purse-strings over uncertainties about the post-pandemic economy.

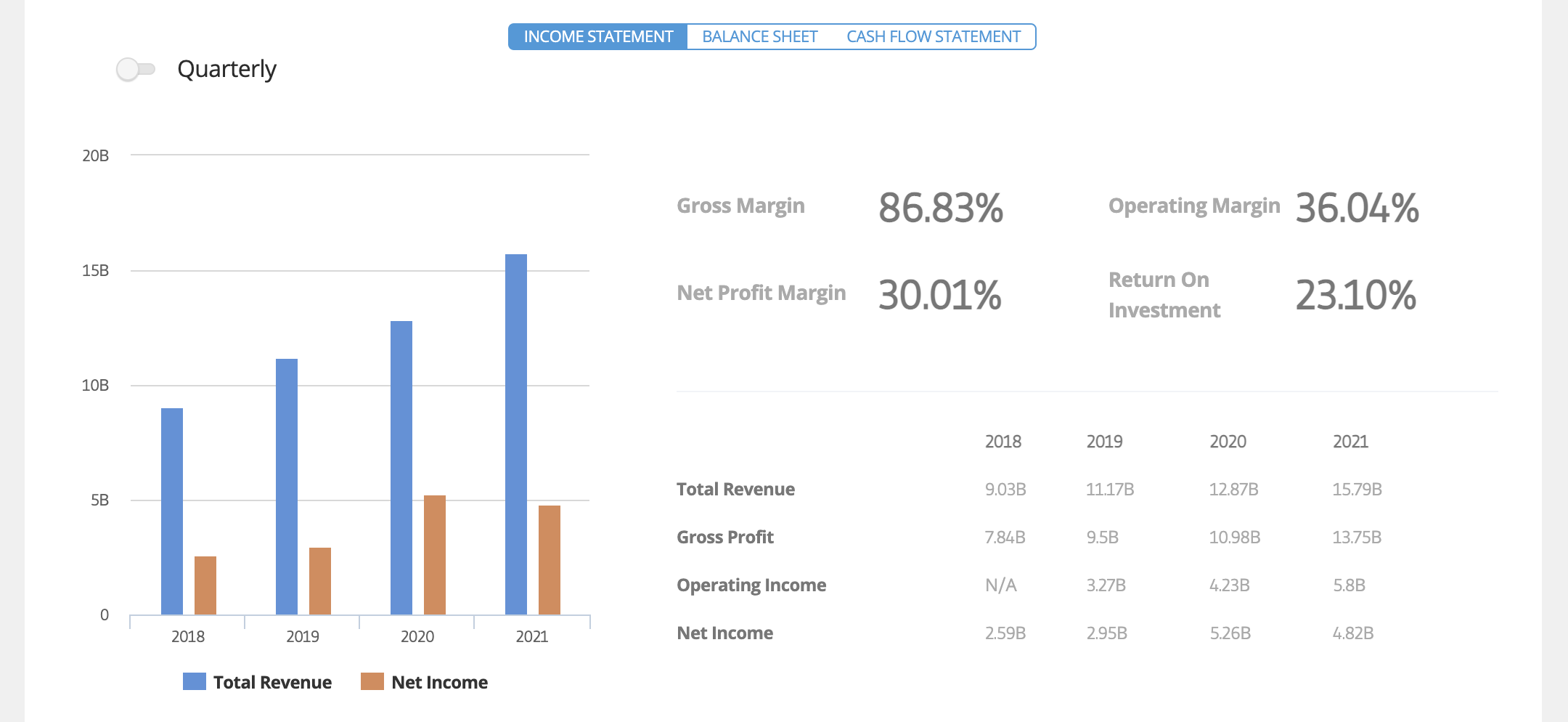

We can see below from the income statement summary that Adobe net income was down in 2021, from $5.26bn in 2020 to $4.82bn. This explains why the EPS figure was lower too.

Adobe P/E Ratio: 38.02x

P/E ratio shows how expensive a company is.

- P/E ratios differ widely from sector to sector. According to macrotrends.net, the average P/E ratio in the US software sector is 46.19x.

- With a P/E ratio of 38.02, the market therefore views Adobe as slightly cheaper than the norm for software companies.

On 31st January, 2022, the average sector figure had been 109.52x. From this, investors looking to buy Adobe stock can see that ADBE was not alone in taking a big hit to its stock price this year as a result of the bear market. The entire US software sector was hit hard.

Adobe Quick Ratio: 1.07

- DBE had a quick ratio of 1.07.

- This is a green flag for investors.

- Approximately, this quick ratio means that Adobe could pay off its liabilities at short notice if required to.

Another key ratio related to debt is the long-term debt to equity ratio. Adobe’s figure of 29.10% is, again, a green flag. It indicates that Adobe is not leveraged with debt.

Adobe Stock Dividends

Dividend stocks pay out a percentage of profits to investors on a quarterly basis.

Adobe does not pay a dividend.

Factors Affecting Adobe Stock

Below we consider some positive factors supporting the decision to buy Adobe stock.

75% Revenue Growth Since 2018

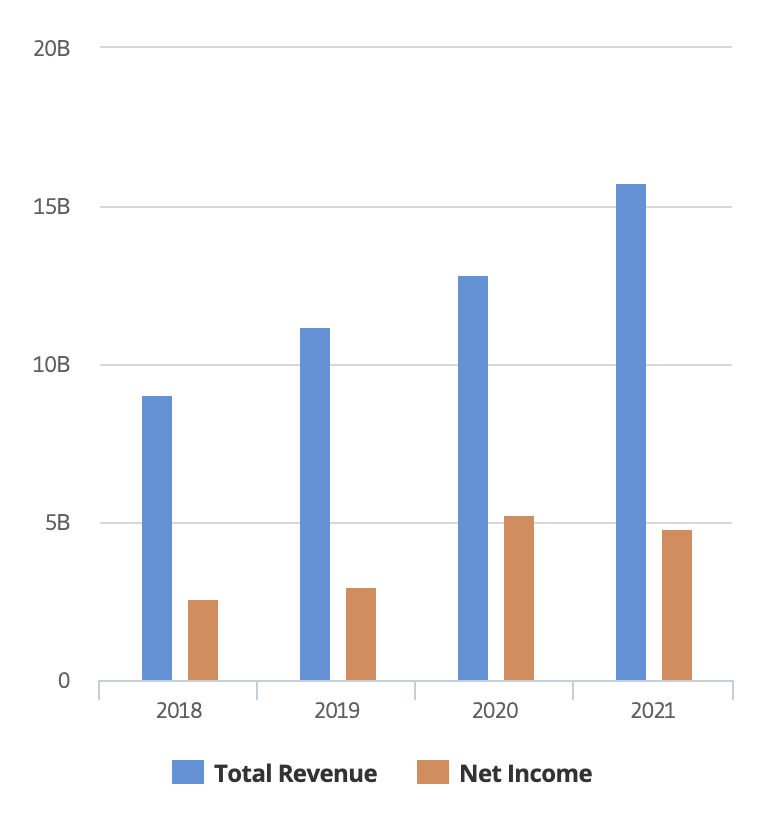

- Adobe’s revenues have increased steadily since 2018.

- In just 4 years, revenues increased by 75% from $9.03bn to $15.79bn.

Table: Adobe Revenues and Net Income, 2018-2021

| Financial Year | Revenue ($bn) | Net Income ($bn) |

|---|---|---|

| 2021 | 15.79 | 4.82 |

| 2020 | 12.87 | 5.26 |

| 2019 | 11.1 | 2.95 |

| 2018 | 9.03 | 2.59 |

Eagle-eyed investors might spot a slight snag, though. Net income was down last financial year from $5.26bn in 2020 to $4.82bn last year. This means that Adobe became less profitable.

EPS Projected to Be Down 2.8% in 2022

The company has not provided a projection of net income for FY 2022. But it has projected that EPS will be $9.95.

- EPS, we might remember, is (like net income) an indication of profitability.

Adobe EPS for 2021 was $10.24. So Adobe expects to be less profitable this year by 2.8%.

The market rewards increasing profits by a rising share price. Decreasing profitability is not a green flag for investors. However, Adobe explains that it must take into account:

- An effective increase in tax rates.

- Adobe’s decision to cease all sales in Russia and Belarus as a result of the Ukraine crisis.

- Expected losses due to unfavourable financial exchange (FX) rates of $175m.

Revenues Projected to Be Up 11.7% in 2022

The company expects revenues for 2022 to be $17.65bn.

- This is a rise of 11.7% on 2021.

This is positive news for investors who want to buy Adobe stock.

Also positive is Adobe’s revenue figure for Q2 2022.

- The firm achieved a record revenue of $4.39bn in Q2 2022.

- This was 14% up year-on-year.

- Adobe predicts that revenue for Q3 2022 will be up 0.9% at $4.43bn.

Step 3: Open an Account and Buy Adobe Stock

Brokers tend to offer similar onboarding processes. Investors looking to buy Adobe stock, for example, will need to:

- Sign up.

- Verify ID.

- Deposit funds.

- Find the particular stock (ADBE) they are looking for.

- Buy the stock.

We look at these five steps in detail with a regulated broker, which tend to have a reputation for a slick and simple sign-up process.

1: Sign up

- Get online and go to a broker’s website.

- Fill in name and address.

- Set a username or password.

- Press the ‘Create Account’ button to proceed.

2: Verify ID

Applicants will need to upload scans of:

- Personal ID: passport of ID card. (Broker’s tend to verifies passports faster.)

- Address ID: many options here including rent letter, utility bill and other official paperwork.

Note that many brokers do not accept scans, but rather expect the applicant to use their webcam or smartphone to photograph ID instead. Applicants just need to follow the onscreen instructions nonetheless.

3: Deposit Funds

- Most brokers will send the applicant an email to confirm that ID is verified. The applicant can then access their new account.

- Log on and press the ‘Deposit ‘ button at the bottom-left of the interface. This brings up the box shown below:

What deposit means are available depends on the country of residence of the user. Most brokers support deposits with credit/debit card, bank transfer and with a range of e-wallets. Investors wanting to buy stocks with PayPal may do so from European countries.

4: Search for Adobe Stock

- To access Adobe’s homepage, press the Adobe logo on your broker page.

- No need to figure out whether to buy Adobe stock — just press the ‘Trade’ button.

5: Buy Adobe Stock

With fractional trading, investors can buy less than one share in a company. The minimum investment is just a few dollars. And, the broker does the math.

The user need only enter how they want to spend in the ‘Amount’ box.

- Levels for Stop Loss and Take Profit can be set now, or left till later.

- Investors wanting to gear their trade to amplify the potential gains (or losses) may do so here by adjusting the leverage. This will mean, though, that the transaction becomes a CFD rather than a straight stock purchase, and overnight fees may apply. Beginners should leave the leverage at X1.

- Press ‘Open Trade’ to execute the trade.

Adobe Stock Strengths & Weaknesses

Investors asking themselves this question could usefully consider what the professionals think. Of course, we must allow that even professional investors get it wrong sometimes. But it is invaluable for the retail investor to have an overview of expert opinion nonetheless:

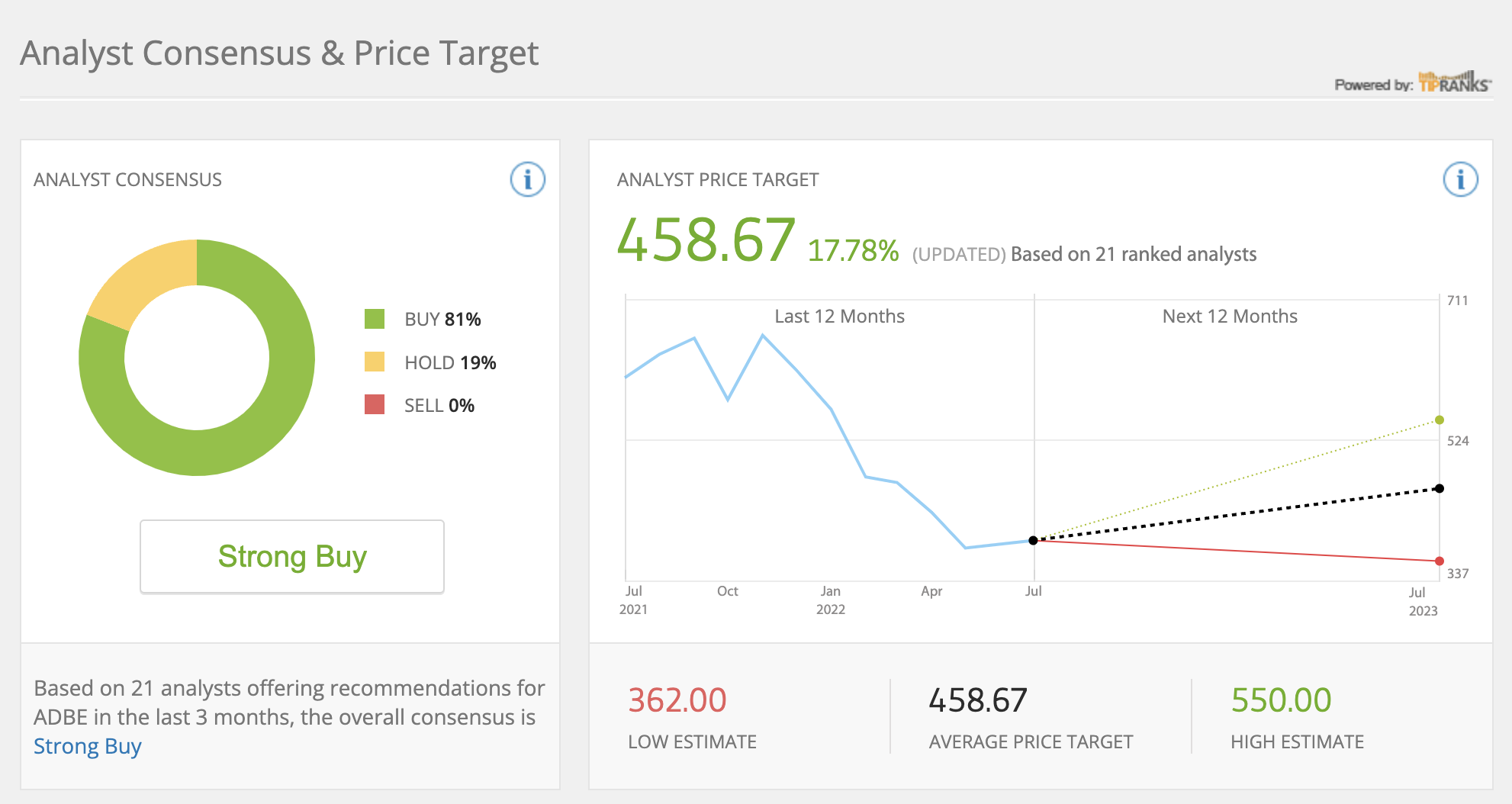

BUY: Pro Analysts State ‘Strong Buy’

Of 21 investor notes produced by analysts in the last 3 months:

- 81% said Buy.

- 19% said Hold.

- 0% said Sell.

- The average target price was $458, which is 17.78% up on the Adobe stock price today.

- The lowest price estimate was $362, which is $27 down on the current price.

- The highest price estimate was $550, which is $161 up on the current price.

BUY: Only 1.32% of Adobe Stock Currently Shorted

From marketbeat.com figures, we learn that – as of the last record date on June 15th, 2022 – $2.34bn of Adobe stock is shorted.

‘Shorted’ means that investors are betting that the price will fall. Apart from revealing a lack of confidence in the company’s share prospects, this shorting can have a negative impact on the price.

With a total floating (ie available) stock size of 470m shares, only 6.2m Adobe shares are currently being shorted.

This is a green flag for investors, as it shows 98+% of the market does not believe that the Adobe stock price is likely to fall.

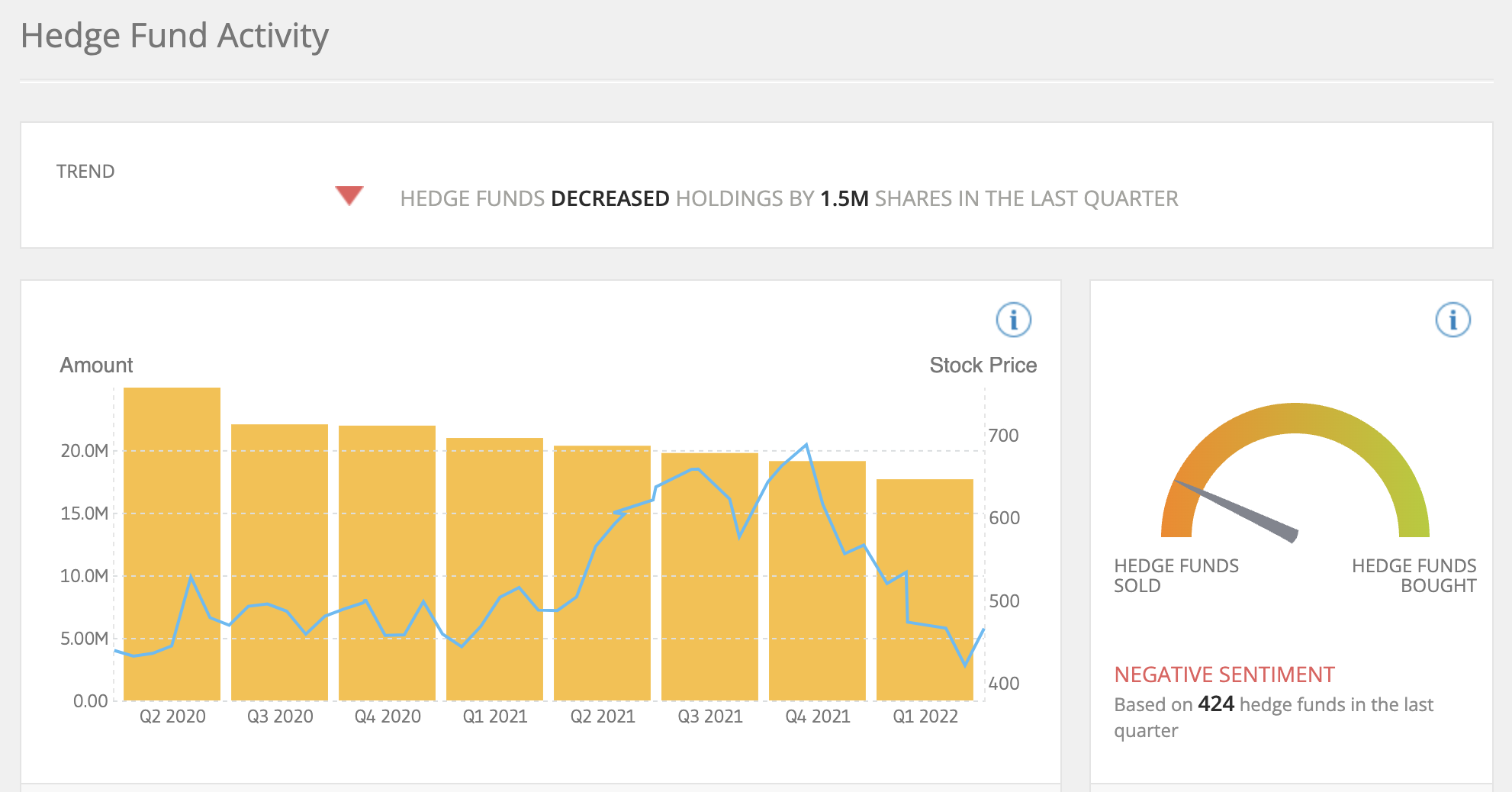

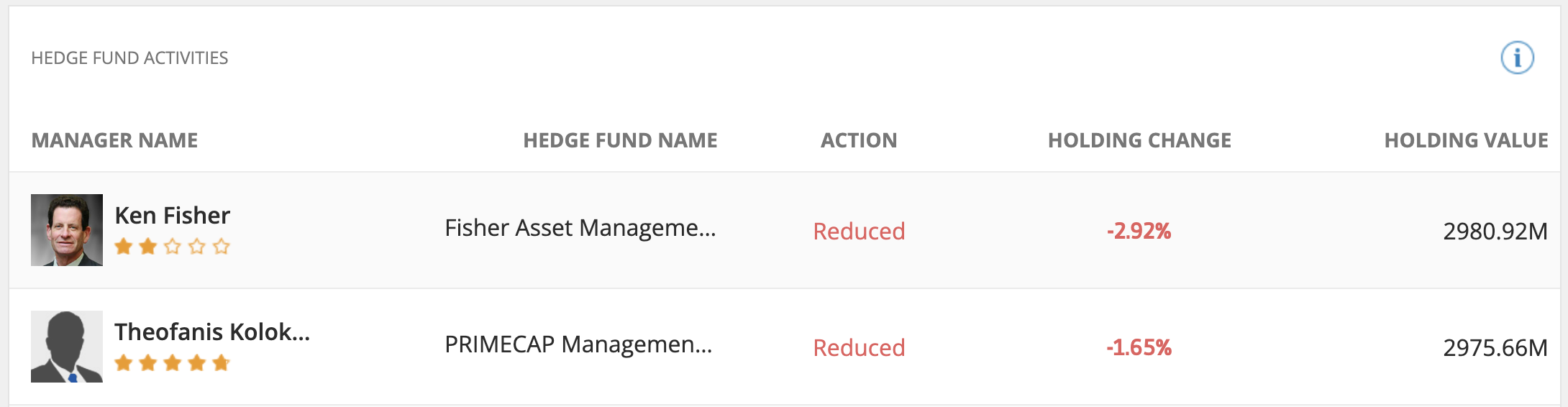

SELL: Hedge Funds Have Been Reducing their ADBE Holdings Since 2020

As we can see below from the overview of hedge fund holdings in Adobe, net holdings in Adobe by hedge funds have been gradually declining since Q1 2020.

However, users musing whether to buy Adobe stock will also note that three hedge funds holding ADBE have significant investments:

- Fisher Asset Management: $2.98bn.

- PRIMECAP Management: $2.97bn.

- Akre Capital Management: $714m.

What’s more, despite the general reduction of hedge fund holdings by 1.5m shares, several funds actually increased their investment in ADBE:

- Farallon Capital Management increased its holding by 88% to $322m.

- Mirova US LLC upped its stake by 26% to $276m.

- Intermede Investment raised its investment by 37% to $194m.

Conclusion

On the one hand, the analyst consensus is a Strong Buy. On the other hand, hedge funds have been reducing their holdings. Otherwise, we have observed that there is nothing fundamentally wrong with Adobe, and a lot that is fundamentally right. In particular, its lack of significant debt compared to assets as well as its global brand recognition should stand its share price in reasonable stead when the Nasdaq correction ends.

It’s up to the individual investor to decide how they feel about Adobe stock. But, if an investor feels that a correction is on its way, they can go short on Adobe stock using either of the two brokers we have reviewed or attentively they can register with a different regulate broker entirely.