Web3 is a term used to define the next generation of the internet.

The main concept is that Web3 technologies will allow the internet to become decentralized, through the use of blockchain, smart contracts, NFTs, and the metaverse.

Those looking to gain early exposure to the growth and realization of the Web3 might consider doing so via the stock market. Therefore, in this guide, we explore the 10 best Web3 stocks to buy today for maximum upside potential.

Best Web3 Stocks to Buy in 2022

For a snapshot overview of the best Web3 stocks to buy in 2022 – check out the list of 10 companies outlined below.

- FightOut – Overall Best Web3 Stock Alternative

- Dash 2 Trade – New Crypto Intelligence Platform Offering a Web3 Stock Alternative

- Coinbase – Popular Web3 Stock Providing Exposure to the Crypto Market

- Meta Platforms – Top Web3 Stock to Buy for Exposure to the Metaverse

- Samsung – Global Electronics Brand Continues to Increase its Exposure to the Web3

- Apple – Provides the Underlying Devices to Make Web3 Possible

- Verizon Communications – Leading 5g Network for Facilitating Web3 Access

- NVIDIA – Market Leader in GPU Supplies for Blockchain Mining

- Cloudflare – Giant Data Centre Provider With Support for NFTs

- IBM – Technology Innovator With Growing Interest in Blockchain and AI

As is evident from the above list, Web3 stocks come from a variety of sectors.

This is good, as it allows investors to mitigate their exposure to this niche marketplace by purchasing a diversified basket of Web3 stocks.

A Closer Look at the Best Web3 Stocks to Invest in

Most Web3 stocks are actively involved in other markets. This means that there are not any pureplay Web3 stocks, which is great for diversification purposes.

Therefore, to gain exposure to the growth of Web3, it is wise to build a portfolio of stocks from multiple industries.

With this in mind, below we offer a much closer look at the best Web3 stocks to buy right now.

1. FightOut – Overall Best Web3 Stock Alternative

Put simply, FightOut is a ‘Move-to-Earn’ (M2E) project that incentivizes users to work out consistently and build their fitness. FightOut does this by rewarding users with REPS tokens whenever they complete workouts. Tokens are awarded based on movements recorded via FightOut’s smart technology – meaning the more users work out, the more tokens they’ll earn.

Once enough REPS tokens are accrued, users can spend them in the FightOut Store to buy apparel, supplements, merchandise, and more. If users require more REPS tokens, they can buy FightOut tokens (FGHT) and use them to purchase REPS. FGHT is FightOut’s native ERC-20 token and will act as the cornerstone of the project.

Each user will also have a ‘soulbound’ NFT avatar that evolves as the user increases their health and fitness. Users can even buy cosmetics and accessories for this avatar, thereby ‘gamifying’ the process of building fitness.

In the future, FightOut’s roadmap details plans for 20 real-life ‘FightOut Gyms’, each decked out with cutting-edge equipment designed to track users’ movements and award REPS. These gyms will also have a health bar, content studio, and co-working space – making them a community hub for FightOut users.

Although the FightOut project is still in development, early investors can buy FGHT through the presale phase for just $0.0166. The eventual listing price of FGHT has already been announced as $0.0333 – meaning tokens are available at a 50% discount.

Given FightOut’s close link to the crypto sector, FGHT has emerged as a viable alternative to the best Web3 stocks on the market. Those looking to learn more about the project can join the official Telegram channel.

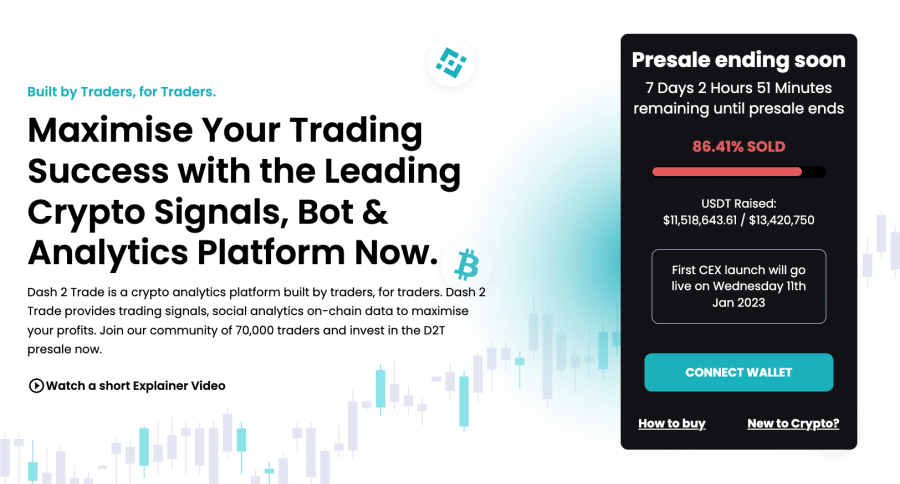

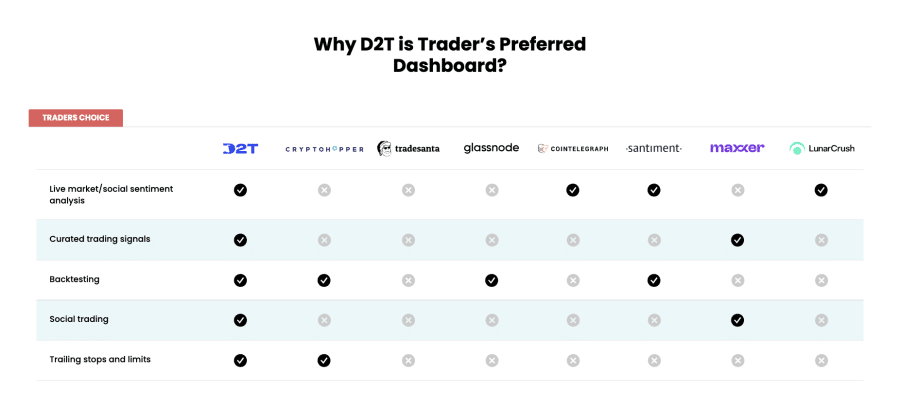

2. Dash 2 Trade – New Crypto Intelligence Platform Offering a Web3 Stock Alternative

As one of the most promising cryptocurrencies on the market, Dash 2 Trade has been attracting significant attention from the investment community. The reason for this is Dash 2 Trade’s pioneering tools and services, which help streamline the crypto research and analysis process.

Crypto analysis is relatively challenging at the time of writing, as most platforms focus on just one or two areas. Dash 2 Trade looks to change this by offering a comprehensive crypto analytics ecosystem that contains trading signals, a presale scoreboard, social sentiment indicators, ‘whale watch’ tools, and more.

In addition, Dash 2 Trade’s roadmap notes plans for trading competitions, a ‘Learn to Earn’ trading academy, and even an auto-trader feature. This last feature is exciting, as it will plug directly into the trader’s brokerage account and fully automate the buying/selling process.

At the heart of the project is D2T – Dash 2 Trade’s native ERC-20 token. Users must pay a monthly subscription in D2T to access the higher membership tiers, which contain the most valuable features.

Early investors can still buy Dash 2 Trade tokens (D2T) through the presale, with tokens priced at just $0.0533. However, the presale is scheduled to end on January 5th – and with over 86% of the presale allocation already sold, there’s a high likelihood the remaining D2T could be snagged in the coming days.

Those looking to become part of the rapidly-growing Dash 2 Trade community can join the official Telegram channel.

3. Coinbase – Popular Web3 Stock Providing Exposure to the Crypto Market

Considering where this niche market is in 2022, Coinbase is another option for those seeking the best Web3 stock to buy right now. Although not a pure-play stock, Coinbase is as close to a Web3 specialist as we have right now. After all, Coinbase is not only one of the largest crypto exchanges globally, but it offers a variety of other services, some of which are linked to the Web3.

For example, Coinbase is home to a newly launched NFT marketplace. Bearing in mind that NFTs are expected to play a major role in the future of decentralization and private ownership, this is a great benefit for Coinbase’s aim to operate at the forefront of the Web3. Furthermore, Coinbase also offers prepaid crypto-backed Visa cards, as well as staking services.

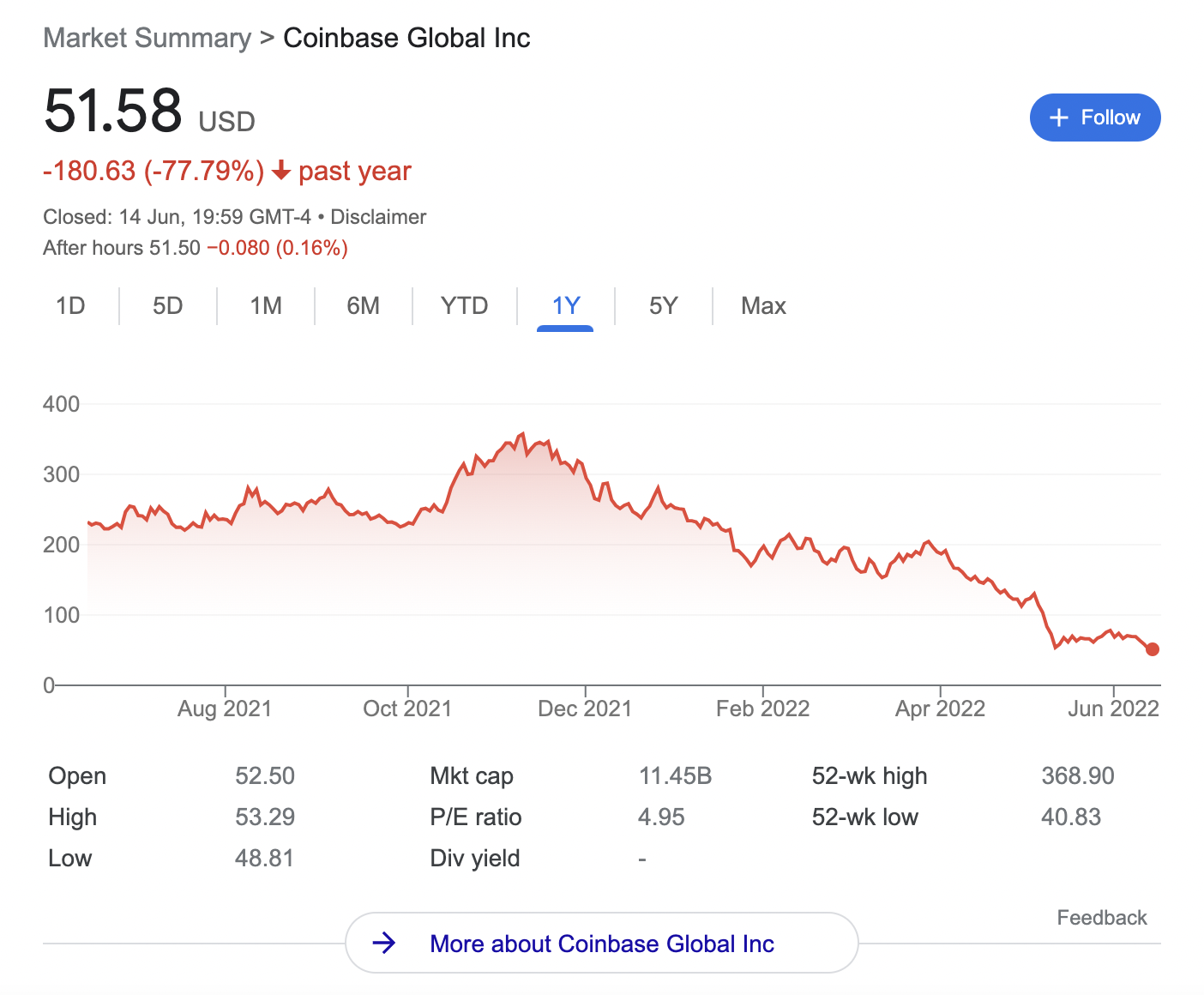

Coinbase is the only pure crypto exchange that operates as a public company in the US – with its shares listed on the NASDAQ. The firm first went public in April 2021, so this may appeal to investors that are in the market for growth stocks. With that said, the value of Coinbase stock since going public has declined by a considerable amount.

For instance, after its first day of trading on the NASDAQ, Coinbase stock was changing hands at $342, The stocks have since hit all-time lows of $40.This represents an end-to-end decline of over 88% from its original IPO price. While at first glance this should be a cause of concern, it is important to remember that 2022 has been an awful year for cryptocurrencies.

And therefore, this has had a direct impact on the value of Coinbase stock. On the other hand, many would argue that at any pricing level below $100 per stock, Coinbase is trading at a bargain. With nearly 100 million verified users on its books, Coinbase has all of the required tools needed to succeed. As such, it makes the number three spot on our list of the best Web3 stocks to buy.

4. Meta Platforms – Top Web3 Stock to Buy for Exposure to the Metaverse

When researching the top Web3 stocks to buy, the metaverse is a term that is sure to appear frequently. For those unaware, the metaverse is a collective term that refers to the virtual world. The idea is that once the technology gets to where it needs to be, people will be able to live, work, communicate, socialize, and more in the metaverse – all from the comfort of home.

And at the forefront of this growing concept – which many argue will sit at the core of the Web3, is Meta Platforms. In fact – CEO Mark Zuckerberg is so confident about the future of the metaverse that the name of the company he founded – Facebook, was rebranded.

Another area of Meta Platforms that could have an impact on the Web3 is digital currency. And, considering that a couple of years ago Facebook planned to launch its own digital token – Libra, this could further enhance its ability to have a major say in the Web3.

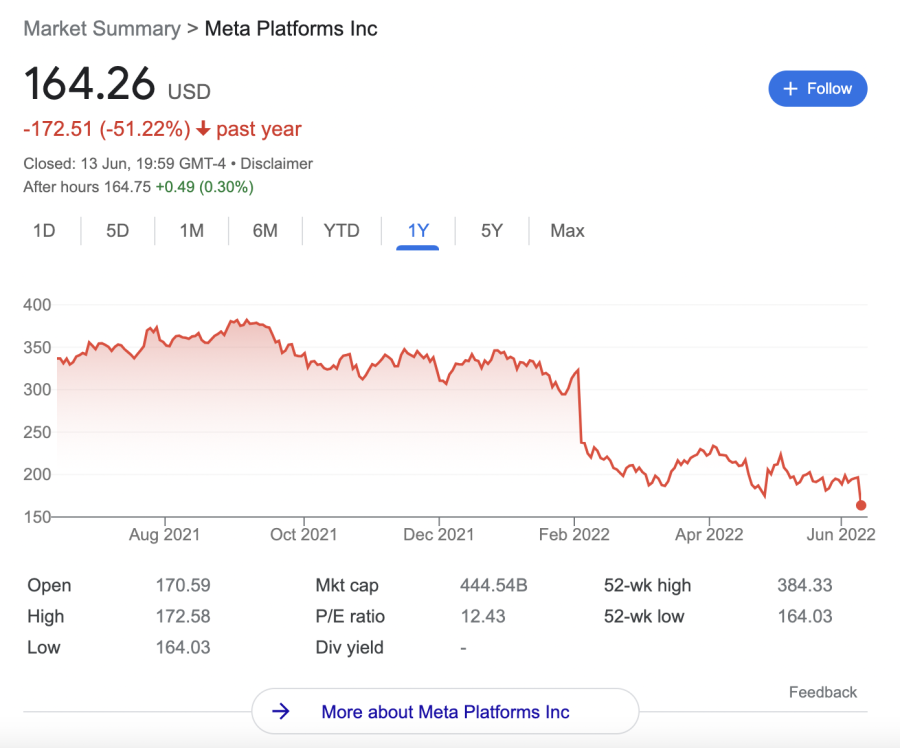

In terms of the specifics – and just like Coinbase, Meta Platforms has seen its stock price suffer in recent times. In fact, the stocks are down over 50% in the first six months of 2022. On the flip side, this means that Meta Platforms is perhaps the best Web3 stock to buy on the cheap.

After all, Meta Platforms owns some of the largest social media companies globally. In addition to Facebook, this also includes WhatsApp and Instagram. Meta Platforms also controls leading virtual reality maker Oculus, which is itself working towards making the metaverse a reality. Across its ensure social media portfolio, Meta Platforms is closing in on 4 billion active users.

5. Samsung – Global Electronics Brand Continues to Increase its Exposure to the Web3

Samsung has made its intentions clear on the Web3. In a nutshell, the global electronics brand has already made strides into this space with a variety of partnerships and integrations. First and foremost, Samsung recently launched its own network on Discord. This is with the view of offering a more immersive experience for its customers that wish to engage with the community.

This is in addition to the firm’s involvement with Decentraland – which is one of the leading crypto-centric projects working on the metaverse concept. Moreover, Samsung also formed a partnership with crypto project TRON, by adding support for several decentralized apps – or DApps, onto its smartphones.

DApps are expected to play a major role in the future of the Web3, not least because they operate without a centralized point of control. We should also mention that Samsung is behind the Blockchain Keystore. This is a concept that allows users of its smartphones to retain control over their private data.

All in all, Samsung is one of the best Web3 stocks to buy for those looking to invest in a firm that has already proven that it strives to have a solid impact on this market. In terms of its performance, Samsung stock is up just 35% over the prior year, which translates into slower growth when compared to the broader market. Nonetheless, the firm pays a healthy running dividend of over 2.3% as of writing.

6. Apple – Provides the Underlying Devices to Make Web3 Possible

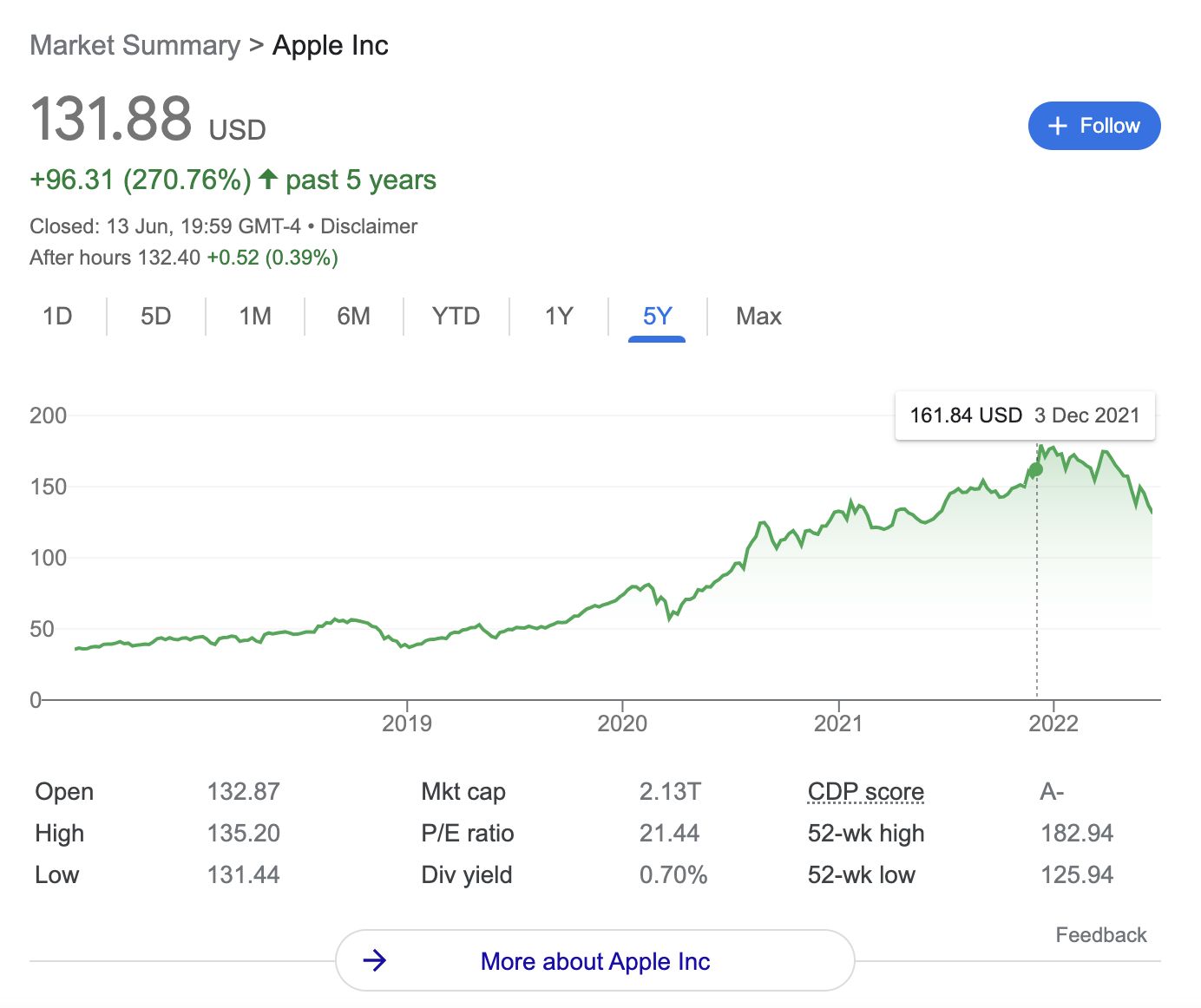

Some of the best Web3 stocks to buy are not actually involved in this marketplace at all. This is because they provide products or services that will be required for the Web3 concept to flourish. One such example is Apple, not least because users will need to have access to both a smartphone and a connection to be able to engage with many of the solutions that the Web3 aims to solve.

For example, those wishing to engage in decentralized transactions over the Web3 network will likely do so with cryptocurrencies. Therefore, to store and access said cryptocurrencies, a mobile wallet will be required.

Moreover, Mac laptops are often the preferred choice for developers building DApps and coding smart contract data. As such, this is another area that Apple can support the Web3 ecosystem. While Apple is yet to highlight any direct involvement in the growth of Web3, the firm is a clear innovator.

Therefore, there is every chance that management will eventually change its stance on this emerging technology. If it does, Apple continues to horde nearly $200 billion in cash reserves, so it has ample resources to explore the Web3. Also see our full beginner’s guide to buying Apple Stocks.

7. Verizon Communications – Leading 5g Network for Facilitating Web3 Access

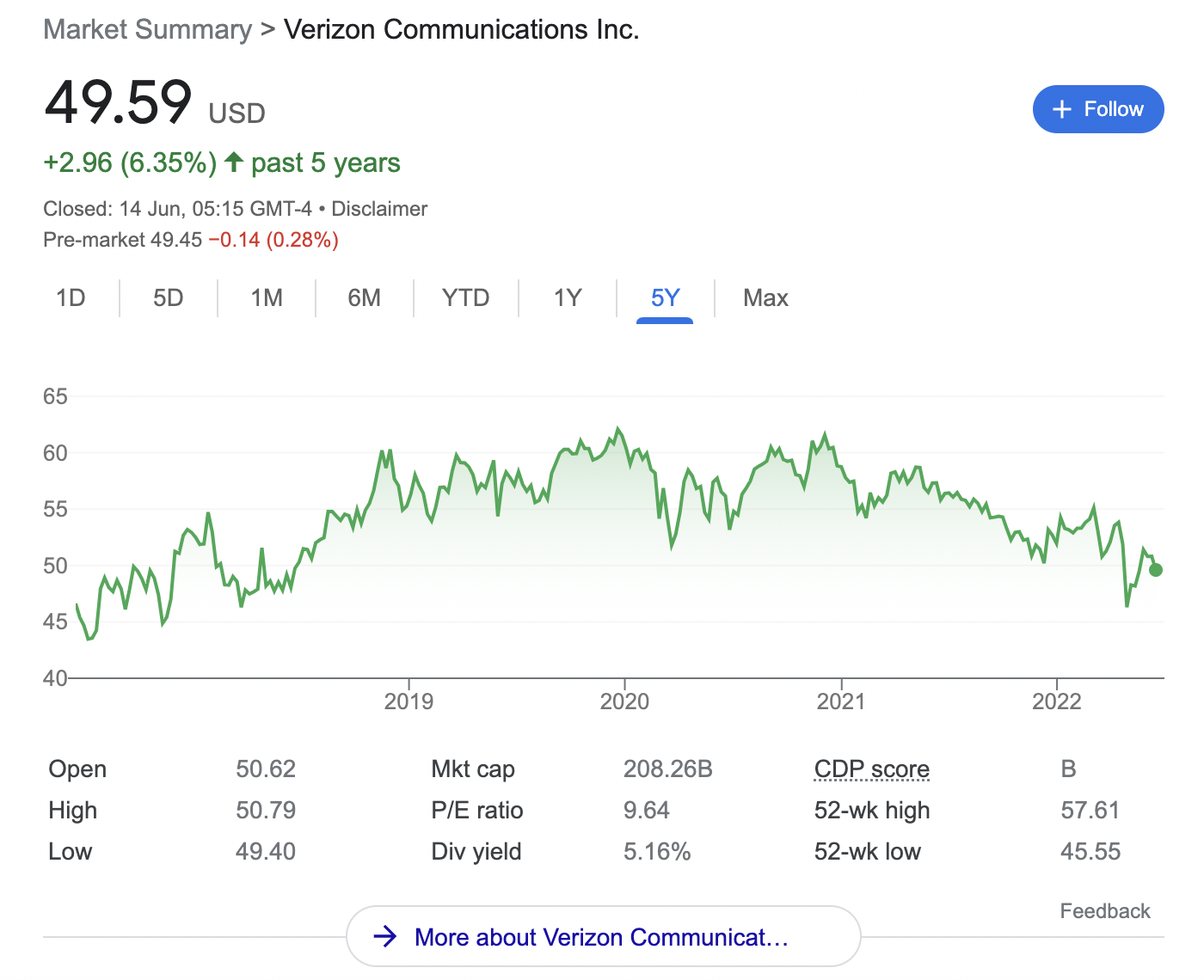

It goes without saying that in order to access the many benefits that the Web3 hopes to offer, an internet connection will be required. Not only that but considering how much data the Web3 is likely to need to offer a solid user experience, there is likely to be a strong reliance on 5G.

Therefore, Verizon Communications is perhaps one of the top Web3 stocks to buy for this purpose. After all, Verizon has a major foothold in the 5g space as one of the biggest telecommunication companies globally. Interestingly, Verizon has already stated its intentions to provide the required 5G network to the metaverse.

Moreover, the firm’s 5G Ultra Wideband network is already supplying 100 million people, with further expansions in the pipeline. In terms of investing in this Web3 stock, Verizon has been sluggish in recent years. Over the prior 12 months, the stocks are down over 13%.

Across a five-year period, growth of just 6% has been achieved. With that said, Verizon is well primed to benefit significantly from its ever-growing 5G rollout. In the meantime, the firm is offering a running dividend yield of over 5%. We also like that Verizon is carrying a P/E ratio of just over 9.6 times as of writing, which illustrates that investors can buy this Web3 stock at a bargain.

8. NVIDIA – Market Leader in GPU Supplies for Blockchain Mining

Another area to consider when searching for the best Web3 stocks to invest in is blockchain mining. Put simply, for blockchain networks to remain decentralized – there is a requirement for miners to confirm and validate transactions. In turn, for this to be achieved, miners require specialist hardware devices – many of which come in the share of graphics processing units (GPUs).

The market leader in the global GPU industry by a considerable margin is NVIDIA. This firm is listed on the NASDAQ exchange and it has rewarded investors with some impressive returns in recent years. For instance, NVIDIA stock has made gains of over 310% in the prior five years.

In comparison, the NASDAQ Composite has grown by 75% over the same prior. We like that NVIDIA has a robust balance sheet with plenty of free cash flow. Moreover, as per its most recent quarterly earnings report, the firm generated $8.29 billion in revenue. This is up 46% year-over-year.

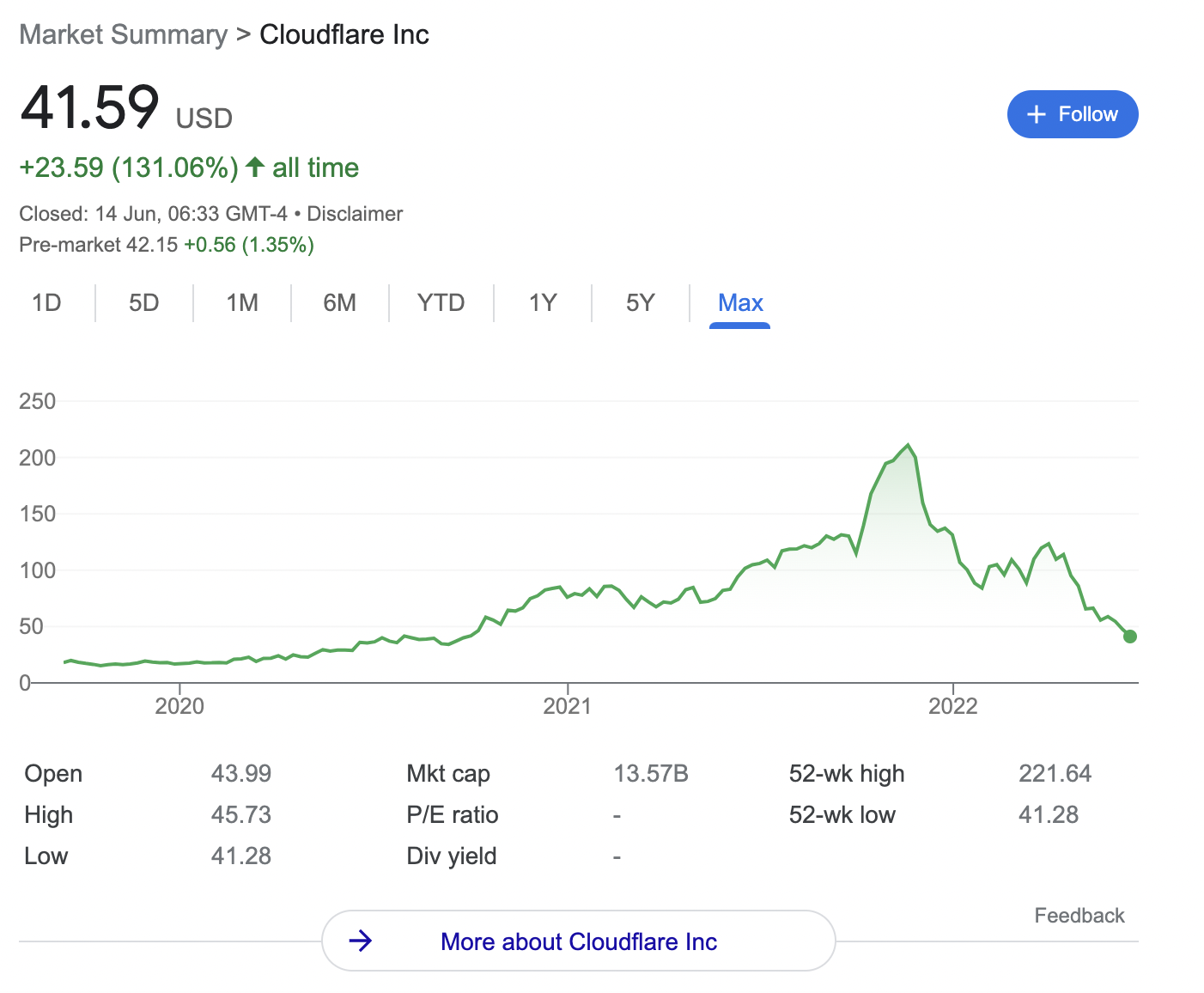

9. Cloudflare – Giant Data Centre Provider With Support for NFTs

Cloudflare is a growing company that was first launched in 2009. The firm specializes in cloud services and DDoS mitigation through giant data centers. In terms of its involvement in the Web3, we mentioned early that NFTs are likely to play a major role in this marketplace.

And, with this in mind, the Cloudflare network now supports the safekeeping of NFT collections. More specifically, the technology allows video content creators to provide ownership via a unique ERC-271 token ID and contract address. This will allow people to transfer and display their content while at the same time, being sure that copyright ownership is well documented.

Cloudflare first went public in 2019 – 10 years after the firm was founded. Opting for the NASDAQ exchange, the stocks have grown in value by over 130% since the IPO. As of writing, Cloudflare carries a market capitalization which is under $15 billion, so the upside potential on this Web3 stock could be huge.

10. IBM – Technology Innovator With Growing Interest in Blockchain and AI

IBM has solidified itself as a global technology innovator. In terms of its exposure to the Web3, IBM has been involved in the growth of blockchain networks for several years. In fact, IBM has already partnered with leading network Stellar to facilitate its inter-firm cross-border payments.

IBM is also investing heavily in several emerging technologies that are sure to have a major impact on the growth of the Web3. This is inclusive of both artificial intelligence and machine learning.

IBM is a solid Web3 stock to consider buying today, both in terms of its strong financial position and loyal client base. We also like that as of writing, IBM is offering an attractive running dividend yield of nearly 5%. Like many tech stocks, IBM has suffered in 2022, so this once again offers a great chance to buy the dip.

What are Web3 Stocks? Overview of Web3

In a nutshell, Web3 stocks are public companies that have an interest in the future of the internet. The Web1 refers to the original version of the internet that began in the 1990s. Think along the lines of 56k modems and super-slow loading times. Next, we had the Web2, which specifically refers to the age of mobile data and social media.

The Web3 will aim to take things to the very next level. One of the main characteristics of Web3 is to decentralize the internet. This means taking power away from Big Tech firms like Google and Facebook – and back into the hands of internet users. At the forefront of this is being able to access internet services in a private and secure manner.

In order to achieve this goal, several emerging technologies will play a major role. This includes the blockchain protocol, which allows data to be shared without requiring a third-party entity or single point of control. Moreover, the Web3 is expected to extend to cryptocurrencies for the purpose of transacting online.

Another area of the Web3 that is sure to grow in the coming years is the metaverse. Then there are NFTs, which allow users to prove and retain ownership of both tangible and intangible items. It is, however, important to note that there are no pureplay Web3 stocks. This means that there are no publicly traded companies that are devoted exclusively to this marketplace.

Instead, the best Web3 stocks discussed on this page have displayed an interest in helping the future of the internet grow. Whether that’s Coinbase for its NFT marketplace, Verizon for providing the required 5G network, or Apple for its smartphones – many industries and sectors will likely be involved in the Web3 in one way, shape, or form.

Are Web3 Stocks a Good Investment?

Before risking money on an unproven and emerging marketplace like the Web3, investors need to assess whether or not this scene is a good fit for their portfolio.

With this in mind, below we discuss the core benefits of electing to invest in Web3 stocks today.

Invest in a Concept Before it Goes Mainstream

It could be argued that buying Web3 stocks right now is perhaps similar to investing in social media before it becomes mainstream. After all, billions of people around the world use at least one social media platform.

The same could be said for investing in the internet in the early 1990s. Either way, the key point here is that the Web3 is still just a concept. There is no surefire definition of this term, which highlights just how much of an early stage the Web 3 is.

Nonetheless, as this guide discussed earlier, some of the best Web3 stocks to buy are established companies that have already expressed their interest in this marketplace.

And, by adding a selection of Web3 stocks to a portfolio in 2022, this will allow investors to gain exposure to the industry at a highly favorable entry point.

No Pureplays – So Risk is Reduced

We mentioned earlier that there are no pureplay Web3 stocks in the market. Instead, the best Web3 stocks to invest in discussed on this page are companies operating in other industries and sectors.

Whether that’s IBM, Meta Platforms, NVIDIA, or Samsung, the Web3 only makes up a very minute division of these firms. As such, this will ensure that investors do not become overexposed to an idea that is yet to come to fruition.

Many Ways to Gain Exposure to the Web3

Another thing to keep in mind when searching for the best Web3 stocks is that there are many ways to gain exposure to this niche marketplace. Sure, this page has discussed 10 companies that have a foothold in the future of the Web3.

However, investors might also consider gaining exposure to the Web3 via cryptocurrencies like Bitcoin and Ethereum. The latter, in particular, provides the underlying blockchain framework for many metaverse platforms.

Another option is to invest in the ever-growing NFT space, which, again, is expected to complement the broader Web3 ecosystem.

Buy the Tech Dip

Many of the best Web3 stocks to buy right now operate in the technology sector. This means that – as per a much broader market sell-off, many tech stocks have suffered in 2022.

For example, Coinbase – which came out as the overall best Web3 stock to buy, is down nearly 80% in the first six months of 2022 alone.

Then there is Meta Platforms – which is looking to build the future of the metaverse, which is down 50% during the same period.

Crucially, this means that now could be the best time to invest in Web3 stocks, as many leaders in this space are trading at a major discount.

Web3 Penny Stocks

As of writing, there are no Web3 penny stocks operating in this space. This means that investors will need to opt for established companies with a proven interest in the Web3, rather than risking capital on a pureplay.

With that being said, it is still possible to invest in Web3 stocks with just a few dollars. Many trading platforms offer all of the Web3 stocks discussed today at a minimum trade requirement of just $10.

This means that with a modest deposit of $100, investors can buy 10 of the best Web3 stocks currently in this market.

Conclusion

This guide has analyzed and ranked the 10 best Web3 stocks to buy today. While this industry is still very much in its infancy, there are plenty of ways to gain exposure to the next generation of the internet.

Leading the way in this regard is FightOut – a brand-new M2E project with an exciting roadmap. Although FightOut isn’t directly a Web3 stock, this project is inextricably tied to the future of Web3. Moreover, since investors can buy FGHT tokens through the presale at a discount, there’s already huge industry buzz around the project – hinting at long-term value potential.

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain