In recent years, a new breed of investors has emerged on the scene, and they are changing the way the stock market works. These investors congregate on the popular subreddit – WallStreetBets, and they are known for their fearless approach to trading.

The members of WallStreetBets have become famous for their love of high-risk, high-reward stocks that have taken the market by storm. From GameStop to AMC Entertainment, these stocks have been the talk of the town, with investors raking in massive profits overnight. In this article, we’ll take a closer look at some of the best WallStreetBets stocks, their rise to fame, and what makes them so appealing to investors in 2025.

Here are the 10 best WallStreetBets stocks to consider investing in right now:The Top 10 WallStreetBets Stocks to Buy Today

A Closer Look at the Most Mentioned Stocks on WallStreetBets

The WallStreetBets subreddit has millions of members that seek stock investment tips. However, there are thousands of posts to cipher through, which makes it challenging to identify suitable portfolio picks.

Fortunately, we have done the hard work by searching for the most mentioned stocks on WallStreetBets in 2025. Below, we take a closer look at the top WallStreetBets trending stocks and analyze their growth potential.

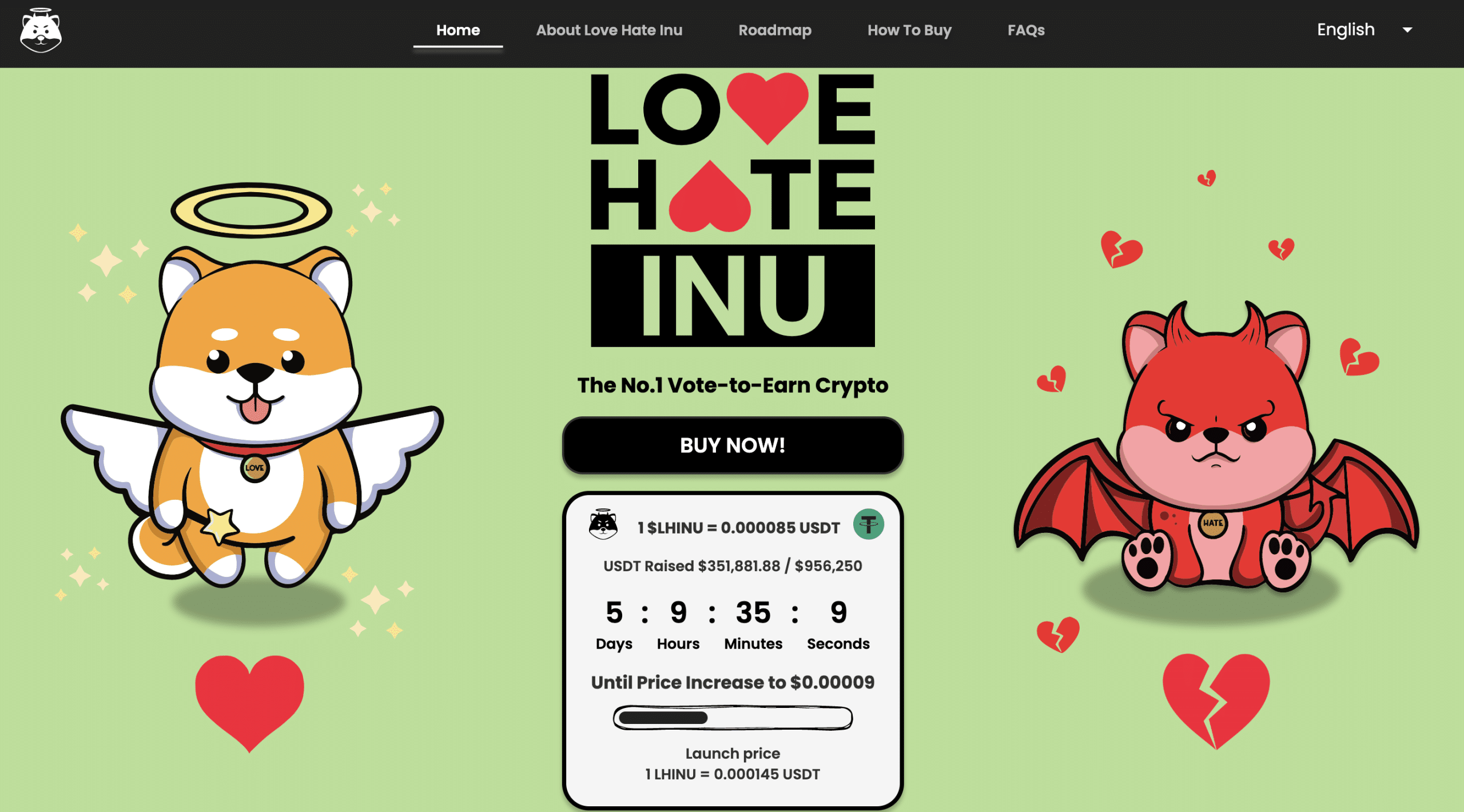

1. Love Hate Inu – Trending Vote-to-Earn Project With Ongoing Presale in 2025

Our first pick is not a stock but an upcoming cryptocurrency trending on WallStreetBets. Love Hate Inu is a brand new crypto project featuring a blockchain-powered voting platform. The project has developed a voting system secured by smart contracts and a staking mechanism.

This will prevent spam and manipulation while making the voting process verifiable and anonymous. According to the Love Hate Inu whitepaper, the global online survey software industry is expected to grow to $5.69 billion by 2027. This project aims to capitalize on this projected growth.

LHINU is a utility token developed by Love Hate Inu for transactions. Users first need to stake LHINU tokens to cast votes. Love Hate Inu will also reward users for their participation with LHINU tokens. Moreover, LHINU holders will also be able to create their own polls.

Love Hate Inu is also partnering with high-profile brands to run sponsored polls for its voting ecosystem. With sponsored polls, rewards are not only paid in LHINU tokens but also NFT discount codes and branded metaverse assets. By 2024, Love Hate Inu plans to integrate its voting system with the metaverse.

Love Hate Inu is developed on the Ethereum network. The team is selling 90% of LHINU tokens via presale. This ensures that the community has a majority stake in the project. Moreover, selling such a large percentage of the overall supply during the presale prevents the threat of a rug pull.

The Love Hate Inu presale is currently in stage one and has already raised over $410,000. At present, LHINU tokens are being sold for $0.000085.

By the last presale stage, LHINU tokens will be priced at $0.000145. In other words, stage 1 investors will secure an upside of 70% by the time the presale ends. As such, it is clear why Love Hate Inu is trending on WallStreetBets. Investors can stay updated about the Love Hate Inu presale via the project’s Telegram channel.

Presale Stage

Token Price

Amount of Tokens

Token Percent

Total Price

Stage End Date

1

$0.000085

11,250,000,000

12.5%

$956,250

(Soft launch) + 7.5 days

2

$0.000090

11,250,000,000

12.5%

$1,012,500

7.5 days

3

$0.000095

11,250,000,000

12.5%

$1,068,750

7.5 days

4

$0.000105

11,250,000,000

12.5%

$1,181,250

7.5 days

5

$0.000115

11,250,000,000

12.5%

$1,293,750

7.5 days

6

$0.000125

11,250,000,000

12.5%

$1,406,250

7.5 days

7

$0.000135

11,250,000,000

12.5%

$1,518,750

7.5 days

8

$0.000145

11,250,000,000

12.5%

$1,631,250

7.5 days

Total

90,000,000,000

100%

$10,068,750

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens

2. Tesla – Market Leader in the Electric Vehicle Industry

Tesla is one of the most widely discussed EV stocks on WallStreetBets. Due to environmental concerns and government regulations, the electric vehicle market is expected to grow rapidly in the coming years. As the EV market leader, Tesla continues to benefit from this growth.

Moreover, Tesla has developed a strong brand and loyal customer base – not to mention a first-mover advantage. According to many WallStreetBets members, the firm will continue to witness sizable sales and revenue growth. This is despite facing stiff competition from traditional car manufacturers and new entrants in the EV market.

For Q4 2022, Tesla posted record revenues of over $24 billion. This represents a year-over-year growth of more than 37%. Moreover, WallStreetBets investors are also attracted to Elon Musk’s leadership and vision for Tesla’s future. Over the past five years, the price of Tesla stock has increased by over 700%.

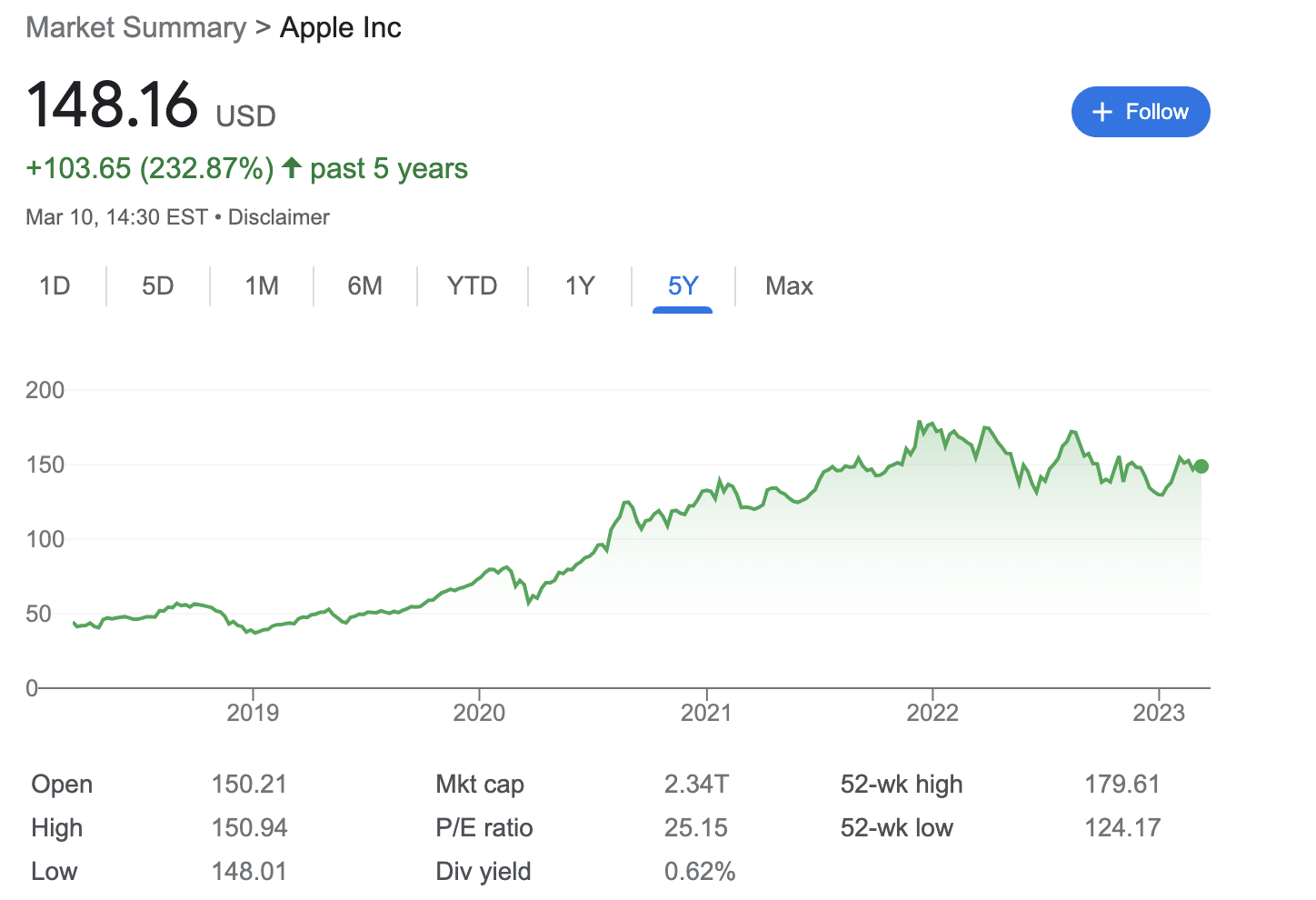

3. Apple – Innovative Tech Stock With a Strong Global Brand

Apple is one of the most recognized and trusted brands in the world. It has a wide range of products within the tech industry, catering to a large and diverse consumer base. Apple continues to demonstrate almost unwavering demand for its products. For instance, in 2022, Apple saw growth in its desktop computer segment while competitors like Microsoft saw declines.

In recent years, Apple has expanded into new markets, such as healthcare and streaming services. Apple is also set to announce an AR/VR headset in 2023. This signals its entry into yet another high-growth market. Additionally, Apple is also profiting from its service businesses.

For instance, revenue from the App Store, Apple Music, Apple Pay, and other services continues to grow. As such, its services division now accounts for a significant portion of the company’s overall revenue. In other words, when investors buy Apple stock, they get exposure to a wide range of markets.

Over the prior five years, the company’s stock has generally trended upwards, with occasional dips. During this time, the value of Apple stock has increased by over 230%. For this reason, Apple remains one of the best tech stocks on the WallStreetBets forums.

4. Coinbase – WallStreetBets Trending Stock Offering Exposure to the Crypto Market

Coinbase is the only publicly traded cryptocurrency exchange in the US. But, Coinbase is much more than just an exchange. After launching in 2012, Coinbase has built a full-fledged crypto ecosystem. For instance, the company facilitates crypto payments for merchants, issues new digital tokens, and even funds blockchain startups.

As of writing, Coinbase serves more than 110 million clients and has 245,000 ecosystem partners in over 100 countries. This makes it one of the best WallStreetBets stocks for those looking to invest in the ever-growing cryptocurrency industry. However, like Tesla, WallStreetBets members consider Coinbase a long-term investment option.

This is due to the rising mainstream adoption of cryptocurrencies and the potential for Coinbase to directly benefit from this. Additionally, Coinbase has a solid reputation for security and regulatory compliance. This is particularly important, considering the regulatory challenges faced by major crypto exchanges.

For instance, Coinbase reports its SEC filings to the public, which sets it apart from its biggest competitor, Binance. Moreover, as of Q4 2022, Coinbase has around $90 billion worth of assets, implying that it has a good financial standing. Since the beginning of 2023, the price of Coinbase stock has increased by about 60%.

5. Visteon – Pure-Play Supplier of Automotive Cockpit Electronics

Visteon is a global technology company operating in the automotive industry. It manufactures automotive cockpit electronics such as digital instrument clusters, infotainment systems, advanced driver assistance systems (ADAS), and more. These products cater to the growing demand for connected cars, electric vehicles, and autonomous driving technologies.

Visteon has contracts with major automakers worldwide, including Volkswagen, Mazda, Ford, General Motors, and Hyundai-Kia, among others. The company also has a global presence, with operations in Europe, Asia, and North America. Crucially, Visteon has invested heavily in research and development to stay ahead of emerging automotive technologies.

Since March 2022, the price of Visteon stock has increased by nearly 60%. To put this into perspective, the value of the S&P 500 fell by around 9% during the same time. Moreover, Visteon has strong finances. For instance, Visteon’s revenue for 2022 was $3.76 billion. This is a 35% increase from the previous year.

In simple terms, Visteon outperformed the broader market last year. The stock has also performed well since the turn of 2023, gaining 20% in value. As such, it is clear why Visteon is one of the best WallStreetBets stocks to buy right now.

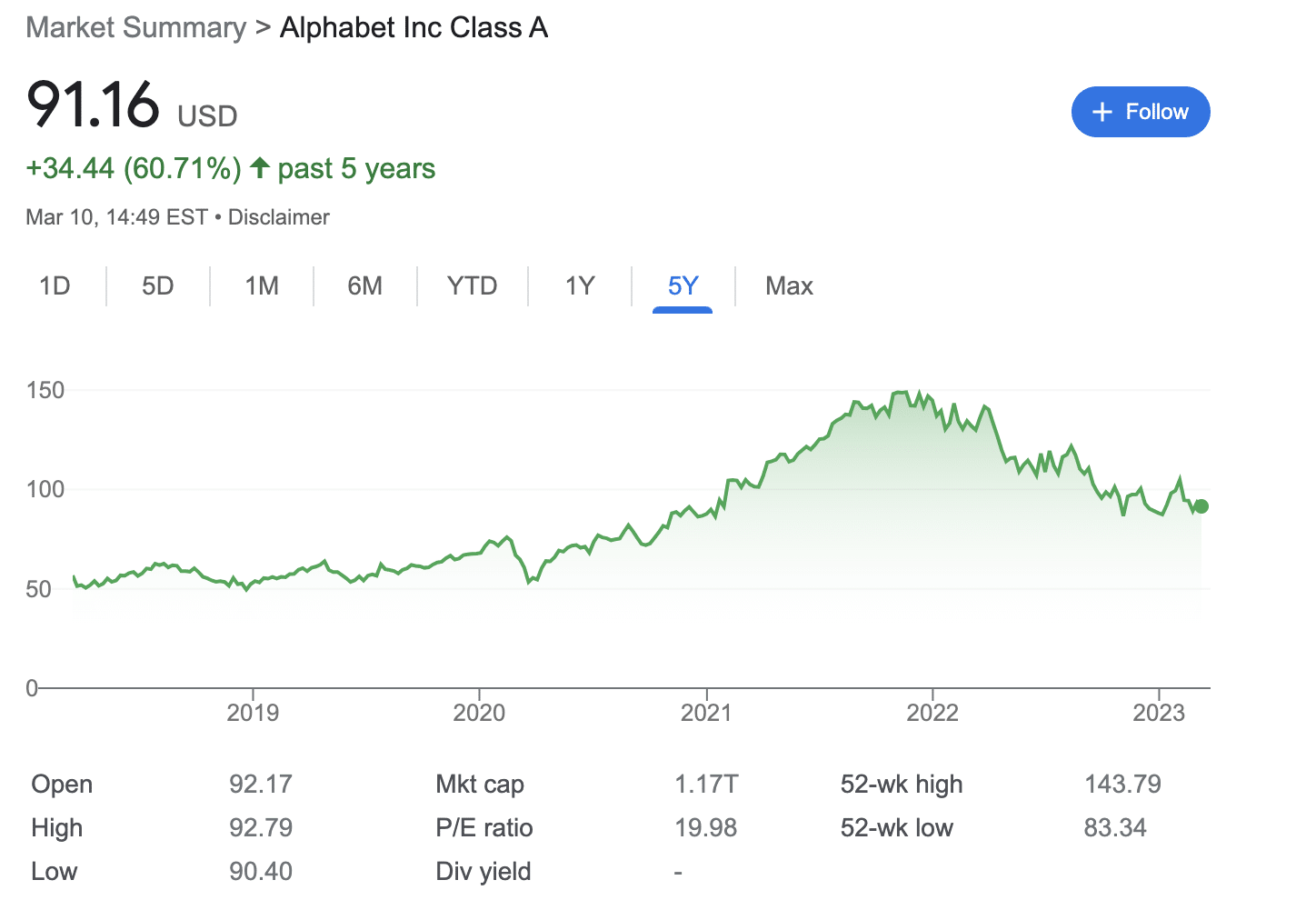

6. Alphabet – Popular Tech Stock With Long-Term Growth Potential

Alphabet is a multinational conglomerate and the parent company of Google. It has a highly robust balance sheet, diversified revenue streams, and a dominant market position in digital advertising. For instance, Google is the world’s largest online advertising company, with a market share of over 30%.

Similarly, Alphabet has a monopoly in the search engine industry. Therefore, the likelihood of a competitor unseating Google as the market leader is slim to none. In addition to advertising, Alphabet has a range of other products, including Google Cloud, Google Play, and YouTube. On top of this, Alphabet has many upcoming projects categorized as ‘Other Bets’.

This includes ‘Waymo’, an autonomous vehicle division. While ‘Other Bets’ has incurred losses, many WallStreetBets investors believe the potential payoff is significant. This innovation is one of the reasons why Alphabet is deemed one of the WallStreetBets top stocks.

Alphabet stock has shown strong performance over the past five years, in addition to a solid 52-week range of $83 to $144. Moreover, the company’s robust balance sheet currently holds over $113 billion in cash and equivalents. As of writing, investors can buy Alphabet stock at 40% less than its all-time high of $150.

7. Lucid Group – Electric Automaker Focusing on the Luxury Market

Lucid Group is perhaps one of the best WallStreetBets meme stocks of this year. This company is an American luxury electric vehicle maker, which gives it a solid niche in the competitive EV industry. Lucid Group also develops advanced electric drivetrains and battery systems for other industries, including commercial transportation and energy storage.

However, Lucid Group stock has lost over 65% of its value over the last 12 months. This is mainly due to growing competition in the EV market and its huge cash burn. Despite this, the company’s majority shareholder, Saudi Arabia’s sovereign wealth fund, has increased its stake by 9.2% to 1.11 billion shares.

Additionally, the Saudi Arabian government has committed to buying 100,000 Lucid Group vehicles in the next 10 years. Lucid also plans to step up its production in 2023. In light of these developments, Lucid Group is now one of the talked about stocks on WallStreetBets.

Due to the discounts currently on offer, it isn’t surprising why WallStreetBets members continue to discuss this stock. After all, the subreddit is known for buying stocks that are trending downward.

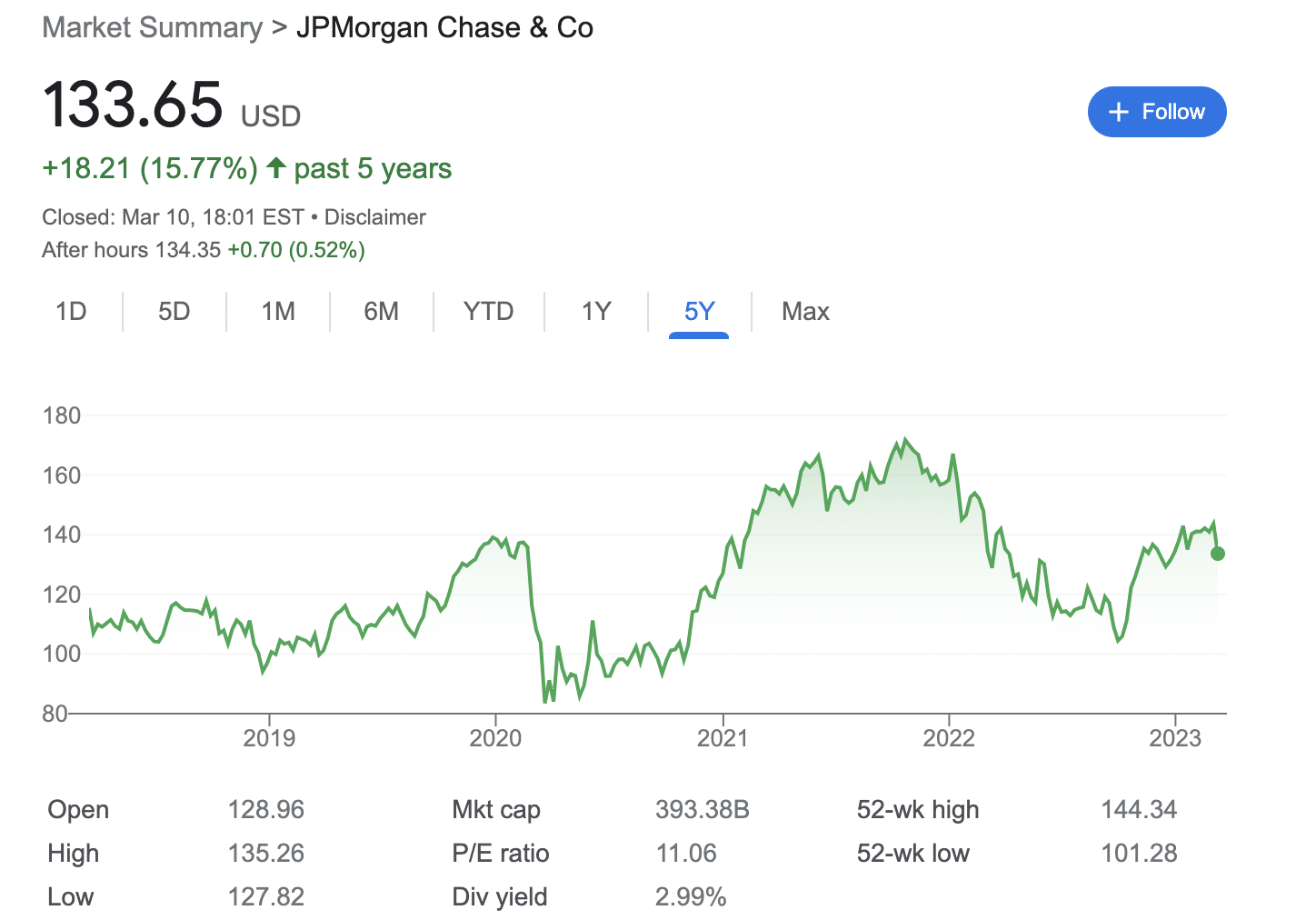

8. JPMorgan Chase – Well-Established Company in the Banking Sector

JPMorgan exceeded analyst expectations for Q4 2022 with $34.6 billion in revenues and $11 billion in net income. It is one of the largest and most profitable banks in the world and has consistently delivered strong financial results. The company has a diversified business model that includes investment and commercial banking as well as asset management.

This diversity helps to insulate JPMorgan from any one sector or market downturn. Moreover, JPMorgan is expected to benefit from a strong net interest rate margin in 2023. JPMorgan is also one of the best-managed banks in the industry under the leadership of CEO Jamie Dimon.

For example, since the start of the pandemic, JPMorgan Chase has maintained a prominent position in cash. This has proven to be a smart move – as the US banking system faces pressure on liquidity due to the Federal Reserve’s quantitative tightening. This leaves the company in a flexible position to cover deposit outflows without dipping into its securities book.

JP Morgan is also one of the best WallStreetBets stocks in terms of dividends. As of writing, the company offers a running dividend yield of about 3%. This can provide a steady stream of income for investors, and also demonstrate the bank’s commitment to shareholder value.

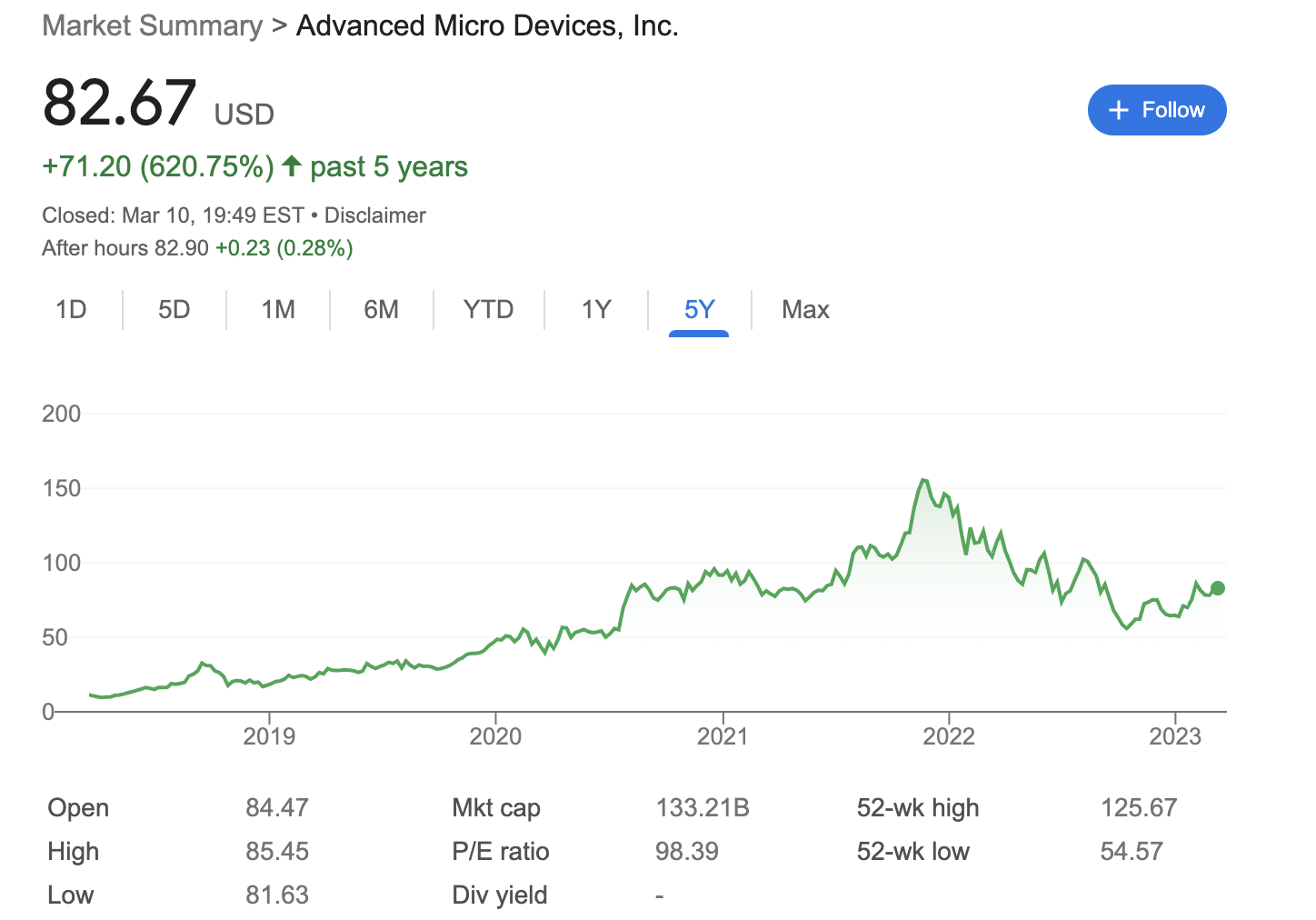

9. AMD – Leading Player in Semiconductor Sector

Advanced Micro Devices, or AMD, is a semiconductor company that produces microprocessors, graphics processors, and other computer-related components. The company has experienced significant growth in recent years. In fact, over the prior five years of trading, AMD stock has increased by over 620%.

In comparison, Intel, its biggest competitor, lost over 45% of its stock value during the same period. There are numerous reasons for this. For instance, AMD’s data center market share is growing. With customers such as Google, Oracle, and Microsoft, AMD is providing strong competition to Nvidia with its new Instinct MI250 GPU accelerators.

Consequently, AMD continues to witness substantial revenue growth. In 2022, AMD surpassed Wall Street’s expectations with total revenue of approximately $23.6 billion. This marked a 44% increase from the previous year’s revenue of $16.4 billion. With such strong numbers, it is evident why AMD is one of the best WallStreetBets stocks today.

10. C3.ai – Software Provider for Enterprise-Scale AI Applications

Artificial intelligence is a trending topic in 2025. As such, it isn’t surprising that WallStreetBets members continue to debate the best AI stocks to buy. At the forefront of this is C3.ai – a software firm providing AI and machine learning solutions for enterprise companies. It is also emerging as one of the top Reddit WallStreetBets stocks in this sector.

Its prebuilt and configurable AI tools can be deployed in various industries, including financial services, defense, and healthcare. The company only went public in 2020 and its IPO was one of the largest in the AI industry. However, the stock’s value has since plummeted.

One of the reasons for this is that C3.ai’s revenue growth has been stagnant – despite its superior products. Moreover, potential clients are hesitant to sign large deals due to economic uncertainty. With that said, C3.ai has since shifted its business model from subscription to consumption-based. This will link client usage with financial results.

This also means that the company will generate more revenue from product usage rather than sales. Many WallStreetBets investors believe that this transition can have a positive long-term effect. Moreover, C3.ai is still in its infancy as a business. In other words, there is still plenty of room for C3.ai to grow in the AI sector.

What is WallStreetBets?

WallStreetBets is a popular community on the social media platform Reddit. It is focused on discussions about stock trading and investing. This subreddit gained widespread attention in early 2021 after its members banded together to buy stocks like GameStop and AMC.

WallStreetBets has since grown to over 13 million members. Users in the subreddit post memes and discussions about investment strategies to provide insights and advice on the stock market. Investors also consult the subreddit to find potentially lucrative opportunities in the crypto market.

History of WallStreetBets Stocks

WallStreetBets was created in 2012 by Jaime Rogozinski. The subreddit was intended to promote discussions of high-risk, high-return investments. Over the proceeding few years, WallStreetBets remained a relatively small community. According to subreddit statistics, it did not surpass 100,000 subscribers until 2017. According to a recent Bloomberg article, Mr. Rogozinski has since sued the online forum (Reddit) for unjustly removing him as chat moderator.

Between 2017 and 2020, apps like Robinhood have made investing more accessible. By December 2020, the subreddit had expanded to 1.8 million subscribers.

However, it was the meme stock trend of 2021 that helped WallStreetBets make the headlines.

- In January 2021, members of WallStreetBets began buying up shares of GameStop.

- At that time, GametStop was trading at around $4 and was being heavily shorted by hedge funds.

- This led to a surge in GameStop’s share price, causing significant losses for the hedge funds that had shorted the stock.

- The phenomenon gained widespread media attention, with WallStreetBets members being hailed as “retail investors” taking on Wall Street’s ‘elite’.

- The stock price of GameStop reached an all-time high of about $347 on January 27, 2021. On January 28, GameStop’s intraday stock price hit an all-time high of $483.

- This represents an increase of over 10,000% in just four weeks.

GameStop’s stock price eventually returned to more typical levels. GameStop wasn’t the only stock boosted by the subreddit. Some of the other heavily promoted WallStreetBets stocks include AMC, BlackBerry, Nokia, and Bed Bath & Beyond. Since 2021, WallStreetBets has gained attention for its ability to influence the stock market.

Is WallStreetBets Good for Stock Investing Recommendations?

WallStreetBets has gained a lot of attention for its discussions on stocks, especially after the GameStop short squeeze. Therefore, some investors view WallStreetBets as a way to gauge market sentiment or identify potential investment opportunities. But how do you find the next GameStop stock in 2025?

However, ultimately, WallStreetBets is an online forum where users can post opinions, strategies, and trades. Hence, it’s important to note that the information and advice shared on WallStreetBets may not be reliable or accurate.

Moreover, this subreddit is also known for its high-risk and speculative takes. In other words, investors should do their own research before risking money on the most talked about stocks on WallStreetBets.

Conclusion

In summary, we have reviewed some of the best WallStreetBets stocks of 2025. While some of these stocks have a strong footing in the market, others tend to be high-risk investments with huge growth potential.

However, the most trending WallStreetBets asset is a crypto project called Love Hate Inu. This is a newly founded ecosystem that facilitates blockchain-based voting. Users can stake the project’s LHINU tokens to participate in polls and subsequently earn rewards.

Love Hate Inu is offering LHINU tokens right now via a presale campaign at discounted prices. Early investors can complete their presale purchase with ETH, USDT, or a credit card. Follow the link below to get involved with Love Hate Inu today!

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens