Initial public offerings (IPOs) enable investors to buy a newly listed stock before the shares are listed on a public exchange.

This is very similar to how initial coin offerings (ICOs) work, albeit, investors will be buying a newly launched crypto token as opposed to stocks.

Nonetheless, in this guide, we explore the best IPOs to watch alongside some notable ICOs that are also due to hit the market this year.

The 9 Best Upcoming IPOs to Watch in 2025 – Upcoming IPO List

Below, we list some of the best IPOs to watch in 2023. We also list a duo of ICOs, for those that are considering gaining exposure to the crypto market.

- Sponge V2 – Promising ICO With High Staking Rewards And A P2E Game

- Tamadoge – Mint Pet NFTs for Breeding and Battling Other Players

- Battle Infinity – Play-to-Earn Fantasy Sports Game Built via a Metaverse and NFT Ecosystem

- Reddit – Social Media Forum Expected to go Public Later in 2023

- Discord – Instant Messaging Platform That is Hugely Popular With Gamers

- Stripe – Global Payments Processor for E-Commerce Companies

- Instacart – Personal Grocery Shopping Delivery Service

- Mobileye – Innovator of Autonomous Driving Technologies

- Chime – Largest Online Bank in the US

Readers are reminded to always perform in-depth research prior to investing in an IPO or ICO.

Note: Many of the best IPOs to watch listed above are, at this stage, yet to confirm a specific date. As a result, readers will need to keep track of the progress of each respective IPO campaign.

A Closer Look at the Best Upcoming IPOs and ICOs

When choosing a new project to invest in – whether that’s a stock IPO or a crypto ICO, plenty of independent research is required. After all, it is likely that the investor is injecting capital into a project and business model that is still unproven.

In the sections below, we analyze some of the best IPOs to watch alongside some up-and-coming ICOs.

1. Sponge V2 – Promising ICO With High Staking Rewards And A P2E Game

Sponge V2 is currently the best alternative to Upcoming IPOs. It is an upgrade of the original Sponge meme coin, which gained significant traction in 2023. Transitioning to a more utility-focused project, it offers new features with even higher rewards.

A key feature is its high 40% Annual Percentage Yield (APY) for staking, given out over four years. The project introduces a Stake-to-Bridge model, enabling a smooth transition from SPONGEV1 to SPONGEV2 tokens.

It also includes a Play-to-Earn (P2E) game ‘Sponge Racer,’ which combines gaming with token utility, offering entertainment and additional earning avenues.

The total supply of Sponge V2 tokens is limited to 150 billion, with 43.09% reserved for staking rewards and 8% allocated to the P2E platform.

Building on the original community of 30,000 members, Sponge V2 aims to achieve more growth and list on major exchanges such as Binance and OKX.

It also maintains active engagement through social media channels like Twitter and Telegram for investors to stay updated on the latest developments.

| Hard Cap | N/A |

| Total Tokens | 150 Billion |

| Tokens available in presale | N/A |

| Blockchain | Ethereum Network |

| Token type | ERC-20 |

| Minimum Purchase | None |

| Purchase with | USDT, ETH, Card |

2. Tamadoge – Mint Pet NFTs for Breeding and Battling Other Players

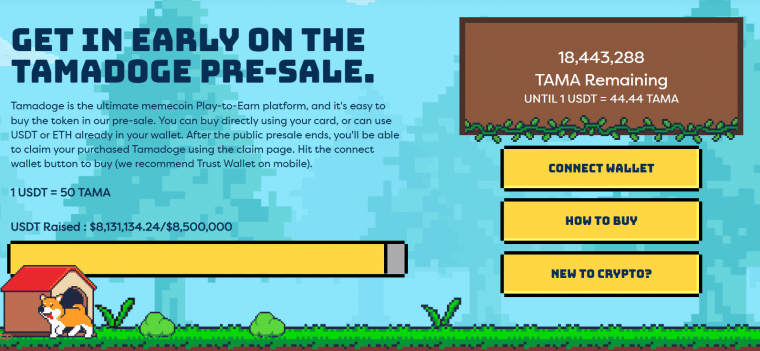

Our top choice for thrilling new projects set to launch soon is Tamadoge. While it’s not exactly an IPO, this recently started crypto project is in its presale ICO stage, having already raised $8 million in seed funding. Half of its presale token allocation is already sold, and the rest is likely to be purchased before October begins.

Unlike other meme coins, such as top dog Dogecoin which has an unlimited supply at 130,000,000,000 already in circulation, the native TAMA token is capped at just 2 billion coins and has a deflationary mechanism that sees 5% of tokens burned with every transaction.

Although proudly calling itself a meme coin, Tamadoge has also created a play-to-earn crypto game, centered on pet dogs, that promises long-term utility for holders. When starting the game, the player will be able to mint their own pet via an NFT. This means that each pet is unique to the next, and ownership of the NFT is verifiable on the blockchain.

Opting for the Ethereum blockchain, Tamadoge enables pets to engage in battle with each other. This offers an enjoyable user experience for players, as the winner of each battle will be determined by the individual traits and characteristics of each pet NFT. This means that when the pet NFT is initially minted, its rarity is completely randomized by a smart contract.

Another interesting aspect of this project is that Tamadoge pets can breed. In other words, two individual NFTs can breed a completely new pet with its own traits and characteristics. In terms of how players earn rewards, this will be determined by the battles that pet NFTs engage in.

In other words, when winning a battle, the player will earn rewards in the form of TAMA. Looking at the project’s roadmap, Tamadoge aims to launch its NFT game by Q4 2022, alongside a beta version of its battle app. There will also be a Tamadoge leaderboard, which offers monthly competitions and prizes to the most successful pet NFTs.

Further down the line, developers at Tamadoge are looking to incorporate its NFT gaming model into the metaverse. This will be in conjunction with augmented reality, which aims to offer players the most immersive experience possible. Those in the market for the best NFT games should know that Tamadoge is currently engaged in its presale campaign and can keep up to date with all the latest from the project in the Tamadoge Telegram channel.

We explain how to buy Tamadoge later in this guide.

Read More: Check out our market analysis on the best emerging cryptocurrencies for 2023. Readers might also be interested in our guide on the best crypto to buy in the crash.

3. Battle Infinity – Play-to-Earn Fantasy Sports Game Built via a Metaverse and NFT Ecosystem

Another crypto project to highlight is Battle Infinity, which has just given early investors peak returns of 700% from its presale price after a listing on decentralized crypto exchange PancakeSwap, with a market cap of $60 million.

Its native IBAT token will next be list on centralized exchange LBank on August 26, with forecasters predicting another pump ahead of more listings in the near future.

Battle Infinity is building a metaverse ecosystem that combines a variety of decentralized products and services. For instance, there will be a decentralized exchange (DEX) that enables investors to swap digital tokens without a third party.

There will also be a crypto staking tool, which enables users to earn interest on IBAT. But perhaps, most importantly, Battle Infinity will be home to a wide variety of immersive games that can be accessed via its metaverse world. One such example is its fantasy sports game – the IBAT Premier League.

This is a multiplayer play-to-earn crypto game that can be enjoyed by users from all over the world. The main concept is similar to a conventional fantasy sports game, whereby users will need to build a custom team of athletes from a specific sporting franchise – such as the IPL (cricket) or NBA (basketball).

The user will accumulate points after each real-world game, based on how each player within their team performed. For example, if opting for a cricket team, the more runs that the individual player scores in the match, the more points the Battle Infinity user will earn. Crucially, unlike a conventional fantasy sports game, the IBAT Premier League pays rewards in crypto tokens.

When earning IBAT through the Battle Infinity platform, this can be traded against other digital assets – such as BNB.

Read More: Join the Battle Infinity Telegram to find out more about the project and visit the Battle Infinity website to download and read the whitepaper.

4. Reddit – Social Media Forum Expected to go Public Later in 2022

Founded in 2005, Reddit is a hugely popular social media forum that enables users from all over the world to discuss everything from politics and crypto to technology and travel. The forum is also known for its role in the meme stock saga of 2021, whereby companies like Gamestop and AMC were pumped via a specific sub-Reddit – WallStreetBets.

Nonetheless, Reddit wishes to be viewed as a serious company, and thus – in late 2021, the firm filed for its IPO listing. This was touted to commence in March 2022, however, this has since been delayed.

In terms of the specifics, it is expected that Reddit will list on the tech-heavy exchange NASDAQ with an estimated valuation of between $10 and $15 billion. All in all, this is one of the best IPO stocks to watch now. Alternatively, we’ve covered the best stocks on Reddit in another article that you can read by clicking here.

5. Discord – Instant Messaging Platform That is Hugely Popular With Gamers

Next up on our list of the best IPOs to watch is Discord. This company offers instant messaging and streaming services to millions of users globally. Crucially, the Discord platform is particularly favored by gamers that wish to play and communicate within a predefined community.

Although figures vary, it is estimated that Discord is now home to over 150 million monthly active users. This is an impressive feat considering that the platform launched as recently as 2013. Although Discord is primarily a free-to-use service, it does have a number of revenue streams that it relies on. This includes premium subscription packages and game distribution fees.

According to UK-based CFD and spread betting platform City Index, the Discord IPO is expected to happen in either the second half of 2022 or at the latest, early 2023. Therefore, this is one of the best new IPOs to keep an eye on. Either way, the same firm notes that Discord will likely list with a valuation of approximately $15 billion.

6. Stripe – Global Payments Processor for E-Commerce Companies

Of all the companies discussed on our list of the best IPOs to watch, Stripe has the largest valuation. As per its most recent series H funding round – in which it raised $600 million, valued the firm at $95 billion.

This means that Stripe is expected to become one of the biggest upcoming IPOs in 2022. Stripe is a global payments processor that provides services for e-commerce companies that operate exclusively online.

This enables merchants of all shapes and sizes to collect payments from customers. Stripe has since ventured into other products and services, which include tax management and small business loans. In its IPO, at this stage, Stripe is not giving too much away. As such, this is an IPO listing to keep an eye on in the coming months.

7. Instacart – Personal Grocery Shopping Delivery Service

Instacart operates somewhat of a unique business model insofar as it offers customers a personal grocery shopping service. In a nutshell, Instacart customers will choose the grocery store that they wish to buy products from and an Instacart driver will collect and pay for the items, before delivering the goods on a same-day basis.

This offers a more efficient and speedy delivery service when compared to ordering directly from the supermarket website itself – if one exists at all.

According to Forbes, InstaCart filled for its IPO listing with the SEC in Q1 2022. In terms of its valuation, its most recent funding round suggests that InstaCard will list at just under $40 billion.

InstaCart is yet to announce its listing date yet, so again, this is one of the best upcoming IPO to watch throughout 2022.

8. Mobileye – Innovator of Auton0mous Driving Technologies

Mobileye is an autonomous driving technologies innovator that is also involved in the development of software and computer chips. Founded in 1999, Mobileye was previously a public company before it was acquired by Intel. However, due to the rapid growth that the firm has generated in recent years, Intel has confirmed that it will re-list Mobileye as an individual entity.

Goldman Sachs and Morgan Stanley will prepare the IPO listing, which is expected to take place later in 2022. It remains to be seen what valuation the IPO will opt for, albeit, what we do know is that Intel originally purchased Mobileye for $15.3 billion in 2017.

9. Chime – Largest Online Bank in the US

Chime could be viewed as a challenger bank, insofar that it aims to revolutionize the way that everyday Americans access daily financial services. This Chime app offers checking accounts without monthly fees, alongside fee-free overdrafts up to $200.

Chime also enables customers to build their FICO Score through a secured credit card. Although it was reported by Forbes in Q1 2022 that Chimes was in the process of going public, this has since been delayed due to broader economic conditions.

What is an IPO?

An initial public offering – or IPO, is a process that enables private companies to go public and thus – trade on a public exchange like the NYSE or NASDAQ. In turn, this allows both retail clients and institutional investors to buy shares in the company.

Certain conditions need to be met when going public, such as predictable and consistent earnings. When going through the IPO process, the company will need to determine a variety of factors, such as its market valuation and how many shares to issue. This is where investment banks such as Goldman Sachs and Morgan Stanley come in.

The respective institution will guide the company through the entire IPO supply chain, to ensure that it prices its shares at the right valuation.

Once the IPO has begun, the shares will trade on the chosen exchange – just like any other public stock. This means that the value of the company will now be determined by the market forces of supply and demand. Historically, many newly listed IPOs have performed well in the early stages of trading.

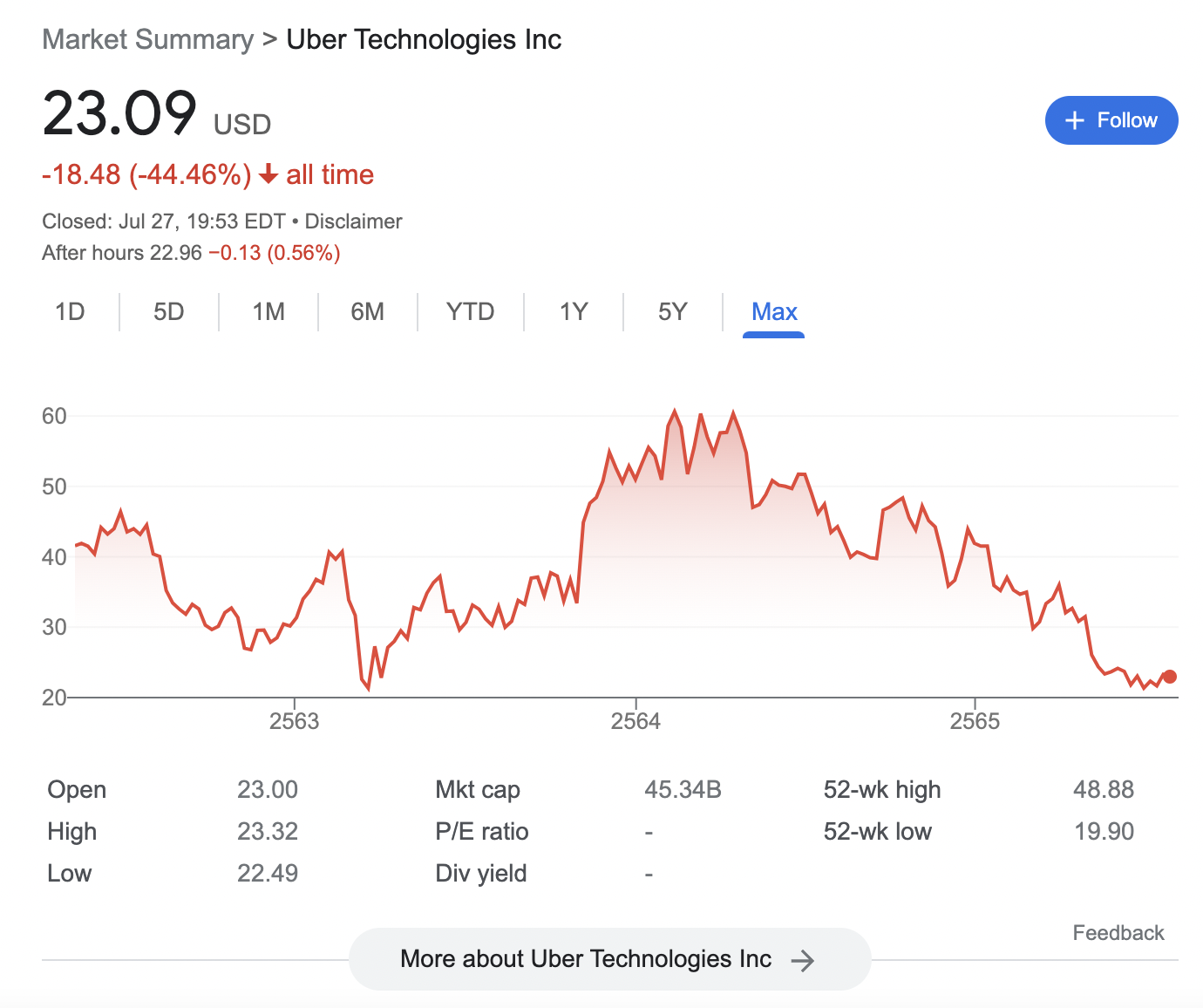

This is because there is often a lot of hype surrounding IPOs – as investors view this as the best opportunity to buy the respective shares at a favorable price. However, in recent years, there have been a number of cases where much anticipated IPOs have failed to live up to the expectations of the market.

For example, when Uber went public in 2019, the firm listed its shares at $45. This valued the company at just over $75 billion. However, more than three years later, Uber stocks have since hit 52-week lows of $19.

How do Initial Public Offerings Work?

Those in the market for the best IPOs to watch should first learn how the investment process works. This will ensure that readers have a firm grasp of IPOs before risking any capital.

Pre-IPO Stage

Before a company decides to go public, it is considered a private firm. This means that there is no means for individual retail clients to invest in the company. Rather, investments typically come via a series of funding rounds that are exclusive to venture capital firms and banks.

Moreover, when it comes to valuation, this is often determined by its most recent funding round.

- For instance, let’s suppose that a venture capital firm invests $400 million into the company for a 5% stake

- This would value the company at $8 billion

Once the company determines that it meets the required framework to go public, it will need to file an IPO application with the SEC.

In terms of why a company goes public, this could be for a variety of reasons. First, going public allows the firm the raise significant amounts of capital – far more than would be possible through private funding rounds. Second, IPOs are often seen as an exit strategy for founders of the company, as well as early angel investors.

The Role of Investment Banks

As noted earlier, the company that wishes to go public will typically hire the services of an investment bank – such as Goldman Sachs. The role of the investment bank is to determine:

- The most suitable date for the IPO – based on both micro and macroeconomic conditions

- The valuation of the company

- The number of shares that should be issued

- The price of each share

The investment bank will also advise the company on which exchange the shares should be listed, which is usually the NYSE or NASDAQ.

Share Allocation

It is important to note that when a company goes through the IPO process, it will never issue 100% of its shares to the public. On the contrary, the founders of the company, alongside early angel investors, will often take a percentage for themselves.

For example:

- Let’s say that the firm is valued at $10 billion at the pre-IPO stage

- The firm will issue 100 million shares

- This prices the shares at $100 each

- The founders of the company will get 20% or 20 million shares

- The remaining 80% or 80 million shares will be made available to the public via the IPO

In the above example, this means that in order to invest in the IPO, each share will need to be purchased in multiples of $100.

Exchange Listing

Once the fundamentals of an IPO have been decided, the exchange listing will take place on a specific date. As soon as the market opens on this date, the value of the shares will be determined by market forces.

This means that if the IPO is well received, the value of the shares could show an immediate upside. On the other hand, if market sentiment on the IPO is weak, then the opposite can and will happen.

Where to Buy IPO Stocks

When searching for hot upcoming IPOs, one of the most important aspects is learning how to initiate an investment.

In the vast majority of cases, stock brokers will have access to the IPO, with a limited number of shares being made available to their customers. This means that in order to invest in an IPO, retail clients will need to go through a regulated broker.

With that being said, investors will be able to buy shares in the newly listed company as soon as trading begins on the respective exchange.

While there might be a slight variation between the IPO and exchange price, this should be minute if the investor gets in early.

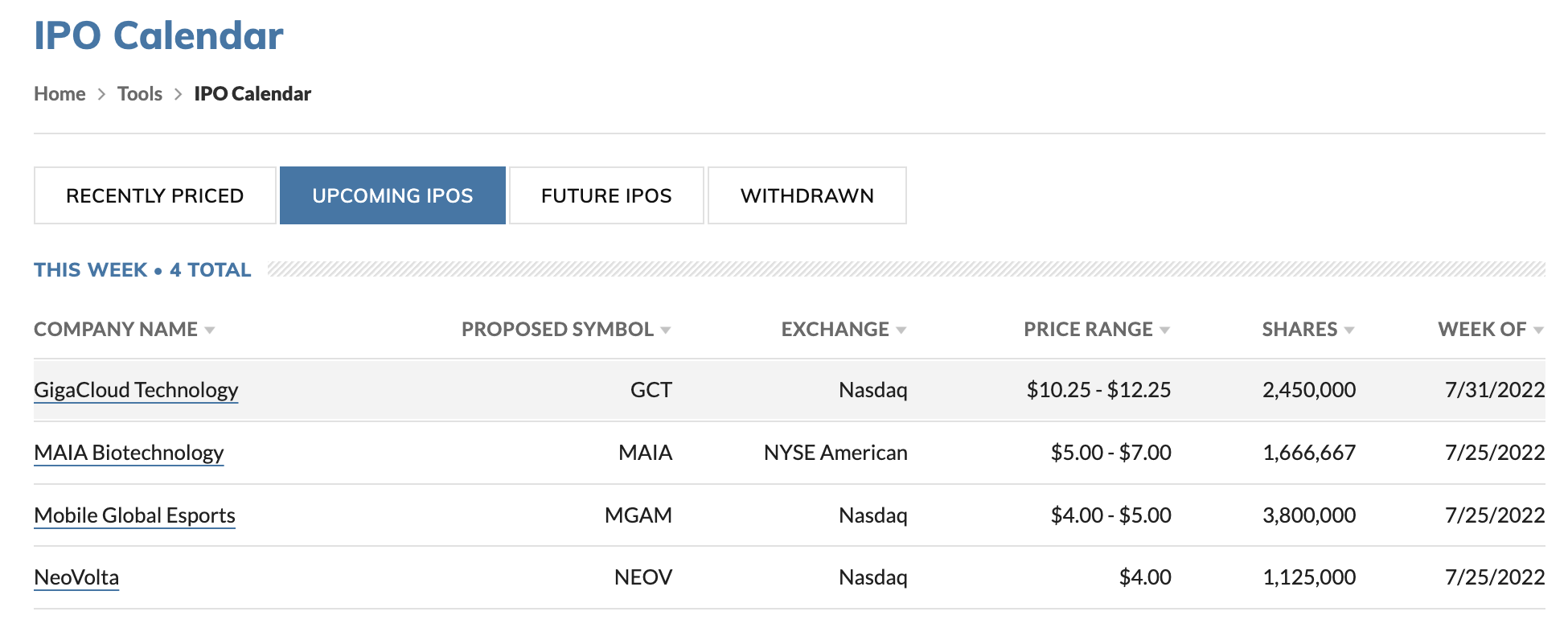

How to Find the Top New IPOs – Upcoming IPO Calendar

In terms of how to find new upcoming IPOs, this usually starts off with rumors that are discussed within the mainstream financial media.

Then, if the company proceeds with its plan to go public, it will file an application with the SEC. If the application is approved, the next step is for the company to choose an IPO listing date.

The key point here is that in order to stay abreast of upcoming IPO stocks, investors will need to research the internet regularly. For example, terms like ‘new IPOs this week’, ‘best IPOs this week’, or even ‘new IPOs this month’ can yield suitable results.

Another way to stay updated with new IPOs coming out is to sign up with a regulated brokerage that offers a notification service. This will inform the user when big upcoming IPOs have been confirmed, alongside information on how to proceed with an investment.

Are IPOs a Good Investment? Pros and Cons of Investing in an IPO

It is important to assess whether IPOs coming up represent a suitable investment, as per the trader’s personal financial goals and tolerance for risk.

Before learning how to invest in upcoming IPOs, traders should consider the following:

Often Allows Investors to get the Best Share Price Possible

Perhaps the most obvious reason why retail clients search for small-cap stocks and upcoming IPOs in 2025 is that in theory at least, this often offers the best share price possible.

After all, there should be an expectation that the newly listed company will perform well over the course of time. If there wasn’t this expectation, then the IPO would struggle to attract sufficient levels of interest.

As a prime example, when Tesla went public in 2010, its IPO offered shares at $17 each. However, Tesla has since split its stocks, so its adjust IPO price is approximately $3.84.

Since going public back in 2010, Tesla stock has hit all-time highs of over $1,200. This amounts to growth of over 30,000%. Ultimately, success stories like Tesla is a motivating reason for investors to search for the best IPOs to watch.

Invest in a Company While it is Still Young

By investing in a company during its IPO, this enables the retail client to gain exposure to a firm while it is still in its infancy. Once again using Tesla as an example, back in 2010, there was still a lot of uncertainty surrounding the future of electric vehicles.

As such, those that invested in Tesla when it first listed on the NASDAQ were effectively taking an enhanced risk, not least because its business model was unproven at that time. Furthermore, Tesla was a loss-making company – like many new public companies are.

Therefore, the additional risk associated with new IPOs to watch allow believers of the respective company to get in on the action before the firm becomes mainstream.

High Brokerage Minimums

As noted earlier, in order to invest in an upcoming IPO, retail clients will usually need to go through a regulated broker. However, oftentimes, the broker will require a large minimum lot size to be met.

This means that casual investors might not have the financial resources to access the IPO. Although investors can access the newly listed stock once it begins trading on an exchange, there might already be a huge disparity in pricing.

Many IPOs Fail to Live up to the Hype

Over the course of the past few years, there have been many hugely anticipated IPOs across both the NYSE and NASDAQ. However, we are now seeing more and more IPO listings that fail to live up to the hype.

- As a prime example, when the crypto exchange Coinbase went public in April 2021, the stock opened on the NASDAQ at $381 per share.

- By the end of the trading day, Coinbase stock closed at $328 – a loss of 14%.

- Since the IPO, the downfall has only continued, with Coinbase stock hitting lows of $40.

- This represents a decline of nearly 90% when compared to the IPO listing price.

As per the above example, this should highlight that even the most anticipated IPOs can very quickly turn sour. Therefore, investors should never make the assumption that a newly listed stock is sure to increase in value.

IPOs are Often Overvalued

Another drawback to consider when learning how to invest in IPO stocks is that oftentimes, the initial valuation appears to be overpriced. When this is the case, this makes the IPO listing unattractive.

While valuations are, of course, subjective, there have many many instances in recent years where the general consensus was that the IPO was priced too high.

- For example, when South-East Asian super app Grab went public on the NASDAQ in late 2021, the shares were priced at just over $13 – which translates into a valuation of $40 billion.

- Many market commentators argued that this was hugely overvalued considering that Grab lost an estimated $2.75 billion and $3.5 billion in 2020 and 2021 respectively.

Ultimately, when researching an IPO investment, it is important to take an in-depth look at the listing price to determine whether or not this represents a viable valuation.

Likely no Dividend Income for Several Years

When a firm goes public for the first time, it is likely a young company still in its growth stage. This means that oftentimes, the company will not be making sizable operating profits – if at all.

Therefore, another consideration to make before investing in an IPO is that there will likely not be any dividend income for some time.

For example, although Tesla was founded in 2003 and went public in 2010, the firm is only now considering implementing a dividend policy.

Conclusion

In conclusion, IPOs allow investors to buy stock in a company while it is still at the very early stages of its development. Therefore, this can result in a low entry price for the investor.

In addition to the best IPOs to watch, crypto ICOs are becoming more popular. Although fraught with risk, this enables an investor to gain exposure to a brand new token.

An exciting ICO, which is soon to be offered is Sponge V2. While building on the original Sponge’s success, it integrates a gaming platform with its Stake-to-Bridge model and has a high minimum staking APY of 40%.