Stock prediction services have historically relied on human research methods. Fast forward to 2025 and artificial intelligence (AI) is now proving it can consistently make accurate stock recommendations.

This guide analyzes the 8 best stock predictors that leverage AI and other innovative technologies. We also explain how AI stock predictors work and what you need to consider when choosing a provider.

List of the Most Accurate Stock Predictor Services

Here’s a list of the 8 best stock predictor services utilizing AI in 2025:

- AltIndex: Our best choice for accuracy and overall value is AltIndex. Stock recommendations are sent through email, and trades usually stay open for several months. AltIndex uses AI, machine learning, and natural language processing. It gathers alternative data from social media and other sites to assess consumer insights. AltIndex stock selections have a 75% accuracy rate, resulting in average gains of 22% over six months.

- Stocklytics: A new data analytics platform featuring an AI-driven scoring system. It rates thousands of stocks and ETFs on a scale from 1 to 100 using six data points: ownership, efficiency, performance, debt, dividends, and valuation. Stocklytics also provides price forecasts for the next 7 and 30 days. There are no fees, allowing you to use Stocklytics freely.

- Candlestick.ai: Relatively new in the market, Candlestick.ai offers a fully-fledged AI picking service for just $9.99 per month. Members receive 3 predictions every week via push notifications.Candlestick.ai is available as an Android and iOS app. Candlestick.ai provides information on each stock pick, ensuring users understand its methodology. 23% returns have been made since 2022.

- FinBrain: Specializes in deep learning algorithms, which use AI and machine learning to predict future stock prices. FinBrain is suitable for all trading strategies; it offers predictions from 10 days up to 12 months. Algorithms analyze technical and fundamental data, including indicators, earnings, and financial news. Prices start from $70 for 30 days, going up to $900 for an annual subscription.

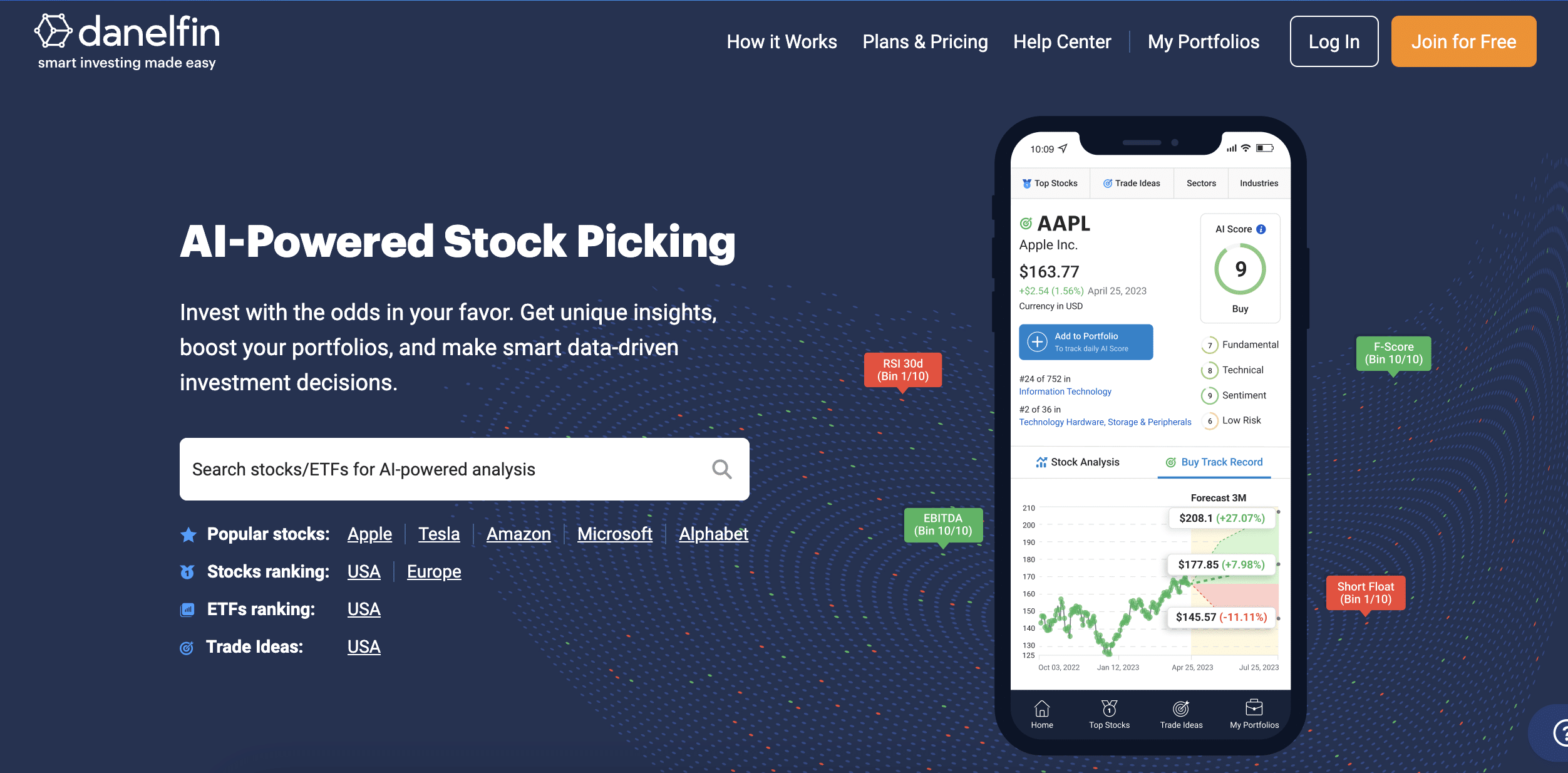

- Danelfin: Through explainable AI, Danelfin analyzes fundamental, technical, and sentiment data points to generate an AI score. Stocks with a 10/10 score are considered a ‘Strong Buy’. Since it was launched in 2017, Danelfin has returned over 191%. Freemium members have access to the top 10 ranked stocks, alongside a daily newsletter. Premium plans cost $12 or $35 per month, depending on what features you seek.

- Tickeron: Established marketplace for AI-backed investment tools, including pattern trend predictors and stock screeners. Tickeron also offers AI robots that buy and sell stocks autonomously. Over 60 different strategies are available, some operating for over 4 years. Tickeron charges $90 per month, which includes 1 AI robot. Increasing the plan to $145 per month gets you an unlimited number of robots.

- Kavout: AI and machine learning methods are used by Kavout to manage client capital. This option will only suit investors with at least $100,000, which is the minimum requirement. Kavout offers a completely passive experience and performance has been exceptional since inception in 2020. Its Kai Equity portfolio has produced average annualized returns of 20.8%. In comparison, the S&P 500 returned 9.1% annually.

- AIStockFinder: Extracts Big Data sets from millions of data points, with AI deployed to discover trends. AIStockFinder then suggests which stocks to buy based on its findings. Its prediction service was launched in 2017. Since then, AIStockFinder claims to have a 70.2% accuracy rate. Free plans target growth of 10% per stock recommendation. This is extended to 40% on premium plans, which cost $1,990 per month.

A Closer Look at the Best Stock Predictors With AI Integration

This section leaves no stone unturned – we review the best AI stock prediction software in the market today. In addition to accuracy and historical returns, we also explore methodology, pricing, supported markets, and overall reliability.

1. AltIndex – Alternative Data Specialist Leveraging AI and Machine Learning to Pick Winning Stocks [75% Accuracy Rate]

Let’s get straight into it – AltIndex is our top pick for AI stock predictions. In a nutshell, AltIndex recommendations have a historical accuracy rate of 75%. Since inception, investors have made average 6-month gains of 22%. This translates to 44% on an annualized basis, which is considerably more than the S&P 500 has produced in recent years.

Before we dive into its AI stock picking service, let’s explore how AltIndex works. It specializes in ‘alternative data‘, which focuses on information outside of traditional sources. It uses machine learning to analyze comments, likes, and overall sentiment on social media sites. It also tracks app store downloads, employee satisfaction, SEC filings, website visits, and much more.

The idea is to assess how the markets view individual stocks. This information is yielded long before earnings calls and financial news reports – giving AltIndex users a time advantage. AltIndex also leverages AI to measure how investible each stock is, based on its alternative data insights. Ranked from 1 to 100, stocks with a high score are ‘Strong Buys’.

Some investors like to use AltIndex manually. But the most effective way is to sign up for its AI stock predictor service. This sends stock recommendations directly to your email inbox. Prices are competitive, starting from $29 per month for 10 monthly stock picks. Upgrade to a $99 per month plan to increase this to 25 monthly picks.

| Stock Predictor Overview | Historical Returns | Pricing |

| Analyzes alternative data from social media, app downloads, website analytics, and more to discover consumer insights. AI is leveraged to generate stock recommendations, which are distributed via email | 75% accuracy rate, translating to average 6-month returns of 22% | Pricing depends on the number of monthly picks: $0 (1 pick), $29 (10 picks), $99 (25 picks) |

Pros

- AI stock prediction service with a 75% accuracy rate

- Average 6-month returns of 22% – far outperforming the S&P 500

- Covers thousands of stocks and some of the best cryptocurrencies

- Competitive pricing – get 25 monthly stock picks for $99 per month

- Also offers portfolio tracking tools and stock alerts

Cons

- Freemium members only receive 1 stock pick per month

- Might not be suitable for casual investors on a budget

2. Stocklytics – AI-Generated Price Forecasts and Technical Ratings on Thousands of Global Stocks

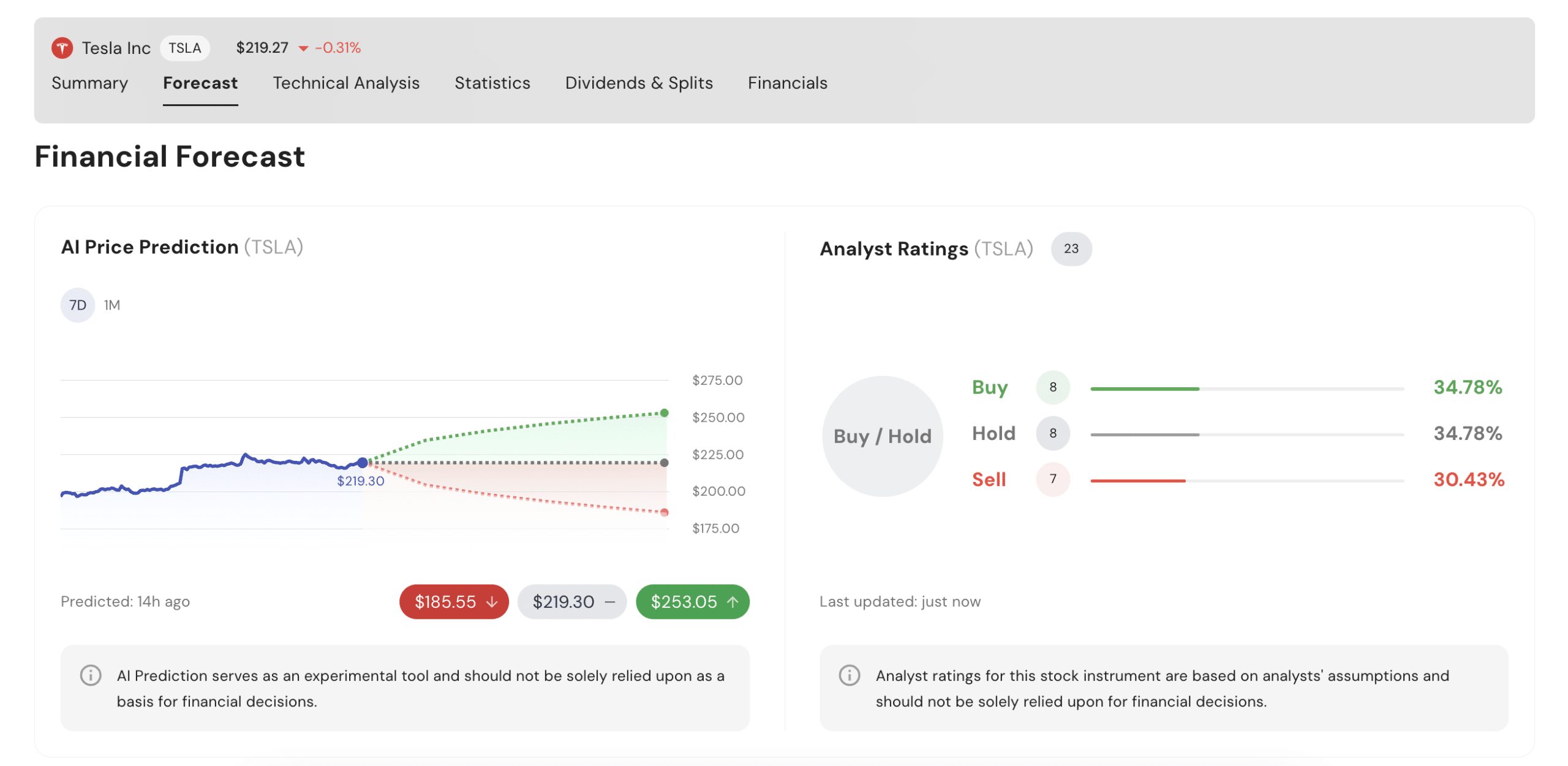

Stocklytics is a data analytics platform backed by AI. It offers many analysis and prediction tools on thousands of global stocks and ETFs. In particular, we like its AI-backed price forecasts. This predicts how much the stock will be worth in the next 7 and 30 days. It offers a low, average, and high estimate – which is similar to sell-side analyst ratings.

However, predictions are leveraged through AI insights, rather than human analysis. What’s more, Stocklytics also uses AI to generate a proprietary rating score. This runs from 1 to 100 and is based on six essential data points; efficiency, ownership, debt, dividends, performance, and valuation.

Right now, there are 7 stocks with a score above 90 – including AutoZone, BellRing Brands, and Horizon Therapeutics. Investors in a budget catered for – as Stocklytics is free to use. Simply register an account to remove limitations. The main drawback is that Stocklytics doesn’t distribute its AI predictions – users need to manually see which stocks have a high rating.

| Stock Predictor Overview | Historical Returns | Pricing |

| Data analytics platform that has built a proprietary rating system from 1 to 100 on thousands of stocks. Through AI, stocks are rated based on efficiency, ownership, debt, dividends, performance, and valuation. AI-backed price forecasts are also provided | N/A: Users need to manually choose stocks based on AI rating scores and price forecasts | Free – simply open an account to remove limitations |

Pros

- Proprietary algorithm gives thousands of stocks an AI rating

- Utilizes the most important metrics – including valuation and efficiency

- Offers price forecasts for the next 7 and 30 days

- No paid plans – the platform is free to use

Cons

- Does not distribute AI picks – so users need to manually check which stocks are hot

- Doesn’t track cryptocurrencies or commodities

3. Candlestick.ai – App-Based Stock Prediction Service Costing Just $9.99 per Month

Candlestick.ai will appeal to users who want AI stock predictions delivered to their smartphones. It offers a user-friendly app for iOS and Android. Costing just $9.99 per month, Candlestick.ai offers great value for money. Members receive 3 AI stock recommendations per week, delivered via push notifications.

Users can customize the type of recommendations they receive based on their own strategy and financial goals. For example, whether you’re building a long-term portfolio and looking to make short-term plays. Either way, Candlestick.ai removes the guesswork – you’ll be told exactly which stocks to buy and sell.

We also like that Candlestick.ai provides its methodology for each stock pick. This explains the reasons behind the recommendation, such as a technical reading or financial ratio. That said, Candlestick.ai provides limited data on its historical performance. It claims to have made 23% returns since 2022, but no specific dates are available.

| Stock Predictor Overview | Historical Returns | Pricing |

| New market entrant that was launched in 2022. Sends 3 AI stock recommendations per week via its Android and iOS app. | 23% returns since inception | $9.99 per month |

Pros

- Budget-friendly AI stock predictor costing just $9.99 per month

- Receive 3 stock recommendations per week

- Available as a user-friendly app for iOS and Android

- Covers more than 6,000 stocks

Cons

- Limited data on its historical performance – other than 23% returns since 2022

- Rated 3.7/5 on Google Play

4. FinBrain – AI-Backed Deep Learning Algorithm to Predict Future Stock Price Movements

FinBrain is a FinTech startup that specializes in deep learning algorithms. It leverages AI and machine learning to predict future stock price movements. It covers four key data categories. First, it explores historical price action, such as 52-week highs and lows, and average volume.

Second, FinBrain analyzes technical indicator readings, including moving averages and the RSI. FinBrain also assesses important events, such as dividend announcements and earnings reports. Finally, FinBrain also evaluates qualitative data, such as financial news reports and social sentiment analysis. These data points are analyzed to generate real-time insights.

There isn’t a stock recommendation service per se; FinBrain requires a manual approach. For example, you can search for a stock to see its 10-day forecast, as per FinBrain’s deep learning prediction. Long-term traders are also catered for, as FinBrain offers 12-month price forecasts. Prices start from $70 for a 30-day plan, up to $900 for 1 year.

| Stock Predictor Overview | Historical Returns | Pricing |

| Has developed a unique deep learning algorithm that’s backed by AI and machine learning. Analyzing more than 10,000 stocks, covering qualitative, technical, pricing, and event-based metrics. Predicts future stock price movements from 10 days to 1 year | N/A: Users need to manually review its price forecast predictions | Prices range from $70 (30 days) to $900 (1 year) |

Pros

- Leverages deep learning algorithms to predict future stock prices

- Suitable for short and long-term traders – forecasts range from 10 days to 1 year

- Covers more than 10,000 stocks from multiple international exchanges

- Also predicts stock indices movements

Cons

- Expensive – charges $900 for a 1-year package

- Doesn’t offer any results-based metrics on its price forecasts

5. Danelfin – Explainable AI Ranking System to Identify Strong Buys [191% Returns Since 2017]

Danelfin is a popular AI-backed stock predictor platform that specializes in explainable artificial intelligence. Its proprietary tool not only discovers the best and worst stocks to buy, but the reasons behind each evaluation. Danelfin analyzes three core data categories; fundamental, technical, and sentiment indicators.

This covers over 900 different indicators, ranging from EPS growth and 52-week highs to insider transactions, gross margin, and hedge fund trades. Danelfin tracks thousands of stocks from the US and European markets. It extracts data from the prior 252 (US) and 500 (EU) trading days to generate an AI stock rating.

Ratings run from 1 to 10; stocks with a 10/10 score are considered a ‘Strong Buy’. According to Danelfin, its AI prediction tool has returned over 191% since 2017. However, Danelfin doesn’t offer a conventional stock predictor service. Users need to choose which stocks to buy based on its AI scoring system. Danelfin plans range from $0 to $35 per month.

| Stock Predictor Overview | Historical Returns | Pricing |

| Explainable AI analyzes over 900 data points, covering technical, fundamental, and sentiment research. Thousands of US and European stocks are tracked and given an AI score of 1-10 | N/A: Users need to manually review its AI scoring system to decide which stocks to buy or sell | The free plan comes with the 10 highest-rated stocks. The $12 and $35 per month plans come with unlimited access |

Pros

- Explainable artificial intelligence assigns stocks with an AI stock of 1-10

- 10/10 stocks are ‘Strong Buys’

- 191% returns since 2017

- Covers thousands of US and European stocks and ETFs

Cons

- Users need to choose which stocks to buy based on AI scores

- Pricing plans increase after 3 months

6. Tickeron – AI Trading Robots That Automatically Buy and Sell Stocks

Tickeron is an established marketplace for AI-backed trading tools and strategies. This includes a pattern search tool that analyzes stock breakouts, target prices, and confidence levels. It also has an AI stock screener that evaluates the ideal entry and exit prices. This is in addition to its AI trend prediction engine, which is ideal for day and swing traders.

But where Tickeron really excels is with its AI trading robots. These enable you to buy and sell stocks autonomously, as the AI robot trades on your behalf. There are more than 60 trading robots to choose from, each with its own strategy. For example, its Swing Trader robot buys stocks it perceives to be undervalued and trending upward.

Active for over 4 years, this AI robot has produced average annualized gains of 15%. Another popular AI robot is the Bearish S&P 500 Swing Traders. This short-sells the S&P 500 when the AI robot discovers bearish signals. Since its inception over 4 years ago, it’s generated average annualized gains of 25%. Monthly plans cost $90, which gives you access to 1 AI robot.

| Stock Predictor Overview | Historical Returns | Pricing |

| Offers many AI-backed tools, including stock screeners and pattern trend predictors. Popular for its AI robots, which trade stocks autonomously. More than 60 strategies are available, some have been operational for over 4 years | Depends on the chosen AI robot | $90 per month, which gives you access to 1 AI robot. $145 per month gets you unlimited robots |

Pros

- Buy and sell stocks autonomously through AI trading robots

- More than 60 robot strategies to choose from

- Some robots have a track record of over 4 years

- Also offers other AI-backed tools – including pattern trend predictors

Cons

- $90 per month only gets you 1 AI robot

- Allowing an AI robot to trade on your behalf can be risky

7. Kavout – Investment Portfolios Managed by AI and Machine Learning

Kavout is one of the best stock predictors for passive investors. Unlike the other providers discussed so far, Kavout operates more like a conventional fund manager. It collects capital from clients and makes investment decisions accordingly. However, all investment-related plays are decided by AI and machine learning.

The only issue is that Kavout has a minimum investment requirement of $100,000. If this is within reach, you’ll have access to its top-performing portfolio – the Kai Equity fund. This invests in large-cap US stocks that have the potential to outgrow the S&P 500. The portfolio was launched in January 2020 and has produced average annualized returns of 20.8%.

Over the same period, the S&P 500 averaged 9.1%. Kavout also offers a secondary portfolio – the Kai Dynamic Asset Allocation fund. This also invests in US large-cap stocks, but adopts a lower-risk strategy. It has produced average annualized returns of 11.6% since January 2020, which still outperforms the S&P 500 benchmark.

| Stock Predictor Overview | Historical Returns | Pricing |

| Specialist fund manager that allows AI and machine learning to guide investment decisions. Minimum investment requirement of $100,000 | Average annualized returns since inception in January 2020: Kai Equity (20.8%) and Kai Dynamic Asset Allocation (11.6%) | Management fees are not published |

Pros

- Investment fund managed backed by AI and machine learning

- No input required from investors – 100% passive

- Kai Equity fund has made average annualized returns of 20.8% since January 2020

- Returns have more than doubled the S&P 500 performance since inception

Cons

- Does not accept investments of under $100,000

- Past performance time frame is still relatively short when compared to established funds

8. AIStockFinder – AI Stock Predictions With Target Gains of up to 40%

Last on this list of the best stock predictors is AIStockFinder. This provider leverages Big Data and artificial intelligence to generate stock recommendations. It scrapes millions of data points from various sources, covering both technical and fundamental research.

It claims that since 2017, it has generated 1,830 stock picks, of which 1,285 were profitable. This translates to an average return of 5.6% per recommendation. However, specific returns depend on the chosen plan. For example, the platinum plan targets average returns of 40%. This comes with a huge price tag of $1,990 per month.

At the other end of the scale, AIStockFinder also offers a free plan. Each prediction comes with a target growth of 10%. According to AIStockFinder, free users have outperformed the market by 7% annually since 2017. AIStockFinder offers a 30-day free trial on its premium plans, so it’s worth trying to assess profitability.

| Stock Predictor Overview | Historical Returns | Pricing |

| Combines Big Data and AI to generate stock market predictions. Users are told which stocks to buy and sell, ensuring full guidance is provided. It targets gains of 10-40% per trade. | Since inception, 1,285/1,830 stock picks have returned a profit | Annual pricing plans depend on prediction targets: $0 (up to 10%), $490 (up to 20%), $1,990 (up to 40%) |

Pros

- Leverages Big Data and AI to predict future stock price movements

- 70.2% accuracy rate since its inception in 2017

- Average returns of 5.6% per stock recommendation

- Free plan offers prediction targets of up to 10%

Cons

- Ambiguity on historical returns – with several different performance metrics provided

- Platinum plans cost $1,990 per month

Rating the Best Stock Predictors: Our Methodology

When reading reviews of the best stock predictors, it’s important to understand how providers are ranked. Here’s an overview of our research methods:

- Accuracy and Past Performance: It goes without saying that you’ll want to choose the most accurate stock predictor. Therefore, we prioritized services with the best track record since they were incepted. We prefer providers that are transparent about their average annualized returns. This enables us to compare returns with the S&P 500 benchmark. That said, some stock predictors provide an accuracy rate, which is the percentage of predictions yielding a profit.

- Prediction Time Frames: We covered a wide range of prediction services to ensure that all trading strategies are catered for. AltIndex, for instance, has an average investment outlook of at least 6 months. Some providers target much shorter gains, which will appeal to day and swing traders.

- AI Methodology: We explored the AI methodology of each stock predictor service to understand its reasoning models. For instance, Danelfin leverages explainable AI to generate stock picks, which looks at the prior 252 days for US stocks, and 500 days for European stocks. Kavout leverages AI and machine learning to pick undervalued large caps. FinBrain uses deep learning algorithms to predict stock prices from 10 days to 1 year.

- Pricing and Value for Money: Pricing is also an important research method to consider. You’ll need to ensure the monthly subscription fee aligns with your proposed investment strategy. Not only do you need to cover the monthly fee but also outperform the S&P 500 benchmark. Otherwise, there’s no point paying for AI predictions. We also gave preference to AI stock predictors offering free trials or a money-back guarantee.

- Reputation in the Public Domain: One of the best ways to evaluate stock predictor services is from existing customer experiences. We researched online forums, rating platforms, and app stores to assess broader sentiment. We also read through comments to assess potential benefits and pitfalls.

The Basics of AI Stock Predictors

AI stock predictors leverage artificial intelligence to predict future stock price movements. The underlying process is data-driven, meaning AI needs access to historical and current market data. Depending on the provider, this usually includes fundamental data like earnings reports, financial news, and financial ratios.

How to Interpret Stock Predictor Historical Performance?

- There’s often ambiguity when stock predictors display their historical performance. Different metrics are used depending on the provider.

- If the service provides average annualized returns, this is the best metric to use. This is the average annual percentage gain since the service launched. For example, suppose the stock predictor makes 200% over 4 years. That’s an average annualized gain of 50%.

- AltIndex – which is one of the best alternative data providers, reports results as an average 6-month gain. This is because its service is still relatively young.

- Other providers publish the accuracy rate. This doesn’t highlight returns per se, but the percentage of profitable trades.

Technical data is also important. This might cover indicators like moving averages and the RSI, 52-week highs and lows, trading volume, and market capitalization. Some stock predictors also build social indicators into their models. This looks at broader consumer sentiment. In other words, whether society views a stock positively or negatively.

In most cases, stock predictors use machine learning to extract and analyze data, while AI makes predictions based on the findings. AltIndex also utilizes natural language processing during its analysis process. This enables it to extract text-based data from social media networks and other popular websites.

Irrespective of the underlying model, AI stock predictors have one goal – to outperform market benchmarks like the S&P 500. If they don’t, then investors won’t pay their monthly subscription fees. Prediction services will vary from one provider to the next. For instance, AltIndex and Candlestick.ai are aimed at stock investors seeking a passive experience.

These services distribute stock recommendations to paying members, meaning they’re told exactly what companies to buy and sell. Stocklytics and Danelfin do things differently. While they still leverage AI to predict future stock prices, members are required to choose which investments to make. This is based on the AI stock ratings made by each provider.

Ultimately, the capabilities of AI stock predictors are far greater than what human analysts can achieve. Consider that AI has no limitations in terms of how much data it can analyze and process. This means it can track thousands of stocks and markets at any given time. Conversely, humans can only analyze one stock at a time.

Should I Use an AI Stock Predictor? Benefits and Drawbacks Explored

Using an AI stock predictor doesn’t guarantee results. Moreover, even if you make money, higher returns could be available elsewhere. At a minimum, your chosen predictor service should outperform the S&P 500. For example, over the prior five years, the S&P 500 has returned just over 56%.

This means that your chosen AI stock predictor should exceed these returns. You also need to factor in subscription costs. These need to be covered to make the process viable. Nonetheless, we found that the best stock picking services have generated notable returns in recent years – proving that AI has what it takes.

For example, AltIndex’s AI prediction service has made average bi-annual gains of 22%. This is significantly more than the S&P 500 over the same period. AltIndex users need to pay $99 per month for up to 25 monthly recommendations. Therefore, you’ll need to assess whether you can still make money based on your average investment amounts.

However, it’s important to remember that many AI stock predictors are new market entrants. While they might have generated huge returns, historical data often only goes back a couple of years. In contrast, some traditional stock tipping services have been operational for several decades. This offers more credibility to their published returns.

Nonetheless, AI predictors can also be used as investment assistants. For example, some investors use Stocklytics for its free AI-driven price forecasts. Investors can then use other research methods to validate the findings. AI can also be used when performing technical research. It can highlight key trends and indicator readings considerably faster than a human analyst.

Conclusion

The capabilities of AI extend to the stock market, with many prediction services outperforming traditional benchmark indexes. This includes AltIndex, which combines AI, machine learning, and alternative data.

Its stock predictor service has performed well since inception; AltIndex has returned average 6-month gains of 22%. Check out AltIndex’s freemium plan to start receiving AI stock recommendations today.

References

- https://www.ibm.com/topics/explainable-ai

- https://online.maryville.edu/blog/big-data-is-too-big-without-ai/

- https://www.bloomberg.com/quote/SPX:IND

- https://mitsloan.mit.edu/ideas-made-to-matter/machine-learning-explained

- https://hbr.org/2022/04/the-power-of-natural-language-processing

- https://www.pimco.com/gbl/en/resources/education/understanding-benchmarks

- https://www.reuters.com/markets/quote/.SPX/