Based in Turkey and looking to invest in the stock market but not sure where to begin? Buying and selling stocks starts with a regulated stock broker that offers security, low fees and access to the financial markets.

This handy guide reveals the best stock brokers in Turkey for 2025. We compare five leading brokers exploring a range of metrics, including fees, supported markets, deposit methods, and regulations.

List of the 5 Best Stock Brokers in Turkey

Below, investors will find a list of the best stock brokers in Turkey for 2025:

- Scope Markets – We discovered that Scope Markets is the top stock broker for Turkish investors. This well-known trading platform supports many of the most popular stocks worldwide, such as Amazon, Coca-Cola, Apple, AT&T, and Samsung. Scope Markets also provides access to major index funds like the Dow Jones and S&P 500. Turkish investors can trade stocks with no commission, and the minimum deposit is $50.

- XTB – XTB is an online trading platform that offers more than 2,000 stocks. This includes stocks from the US as well as those from the UK, Italy, France, Germany, and various other countries. There are no commissions for trading stocks, but the minimum trade sizes are quite high. For instance, you need to trade at least $50 when investing in US stocks.

- AvaTrade – Commission-free broker AvaTrade is an established platform with strong regulation. It supports plenty of stocks and other asset classes, including forex, commodities, and options. Deposits and withdrawals are processed fee-free and accepting payment types include debit/credit cards and bank wires.

- Libertex – Libertex is a CFD broker that supports over 50 stocks. It offers leverage on all markets and supports desktop and mobile trading. Third-party platforms like MT4 and MT5 are also supported. First-time traders will receive a 100% deposit bonus of up to $10,000.

- Capital.com – Nearly 3,000 stocks can be traded on Capital.com without paying any commissions. Minimum account requirements start at just $20, but this requires payments to be made with a debit/credit card or e-wallet. Capital.com has its own native trading platform, accessible via web browsers and an Android/iOS app.

Full Reviews of the Best Stock Brokers in Turkey

While Turkish investors have lots of options when choosing a broker, many factors need to be considered.

For example, what stocks does the broker support and how much does it charge in commissions? Additionally, what is the minimum deposit requirement, and is the broker regulated?

The reviews below cover these questions and more. Read on to choose the best stock broker in Turkey for 2025.

1. Scope Markets – Overall Best Stock Broker in Turkey for Beginners, Offering 0% Commission Trading

Scope Markets is the best stock broker in Turkey for beginners. First-time customers only need to deposit $50 to activate their accounts. What’s more, Scope Markets accepts many convenient payment methods. This includes Visa, MasterCard, Skrill, bank wires, and cryptocurrencies. The latter includes Bitcoin, Ethereum, USD Coin, and Tether.

The account opening process is fast and seamless. Simply provide some personal information to get started. We also like that Scope Markets offers Turkish investors a sign-up bonus. The first deposit is matched by 50%, up to $50,000. The bonus might not be suitable for all investors, as minimum volume requirements apply.

Nonetheless, Turkish investors will find a broad range of stocks on Scope Markets. This includes some of the most traded stocks globally. For instance, Apple, Tesla, Disney, Amazon, PayPal, Johnson & Johnson, and Nike. Scope Markets also lists stocks from other exchanges. This includes the UK, France, and several other European markets.

Scope Markets specializes in contracts-for-differences (CFDs), which offers Turkish investors many benefits. This includes the ability to trade stocks on margin. Scope Markets has a margin requirement of just 10%. So, trading $2,000 worth of Apple stock would require an account balance of just $200.

In addition, Turkish investors can go long (buy) or short (sell) when trading stocks. This offers trading opportunities regardless of whether the markets are bullish or bearish. That said, Scope Markets does not support fractional stocks. There is a minimum contract size of one stock, which can range from a few dollars to several hundred.

Turkish investors that are interested in other financial markets will also like Scope Markets. Not only does it support indices like the Dow Jones and S&P 500 but also forex. Scope Markets also supports commodities, including gold, silver, and oil. These assets come with higher leverage limits too. The main drawback is that cryptocurrencies are not supported.

Nevertheless, we like that Scope Market supports several trading platforms. This includes MT4, MT5, TradingView, and its own proprietary suite. All supported platforms are desktop and mobile-friendly. When it comes to fees, all supported markets – including stocks, can be traded at 0% commission.

There are no fees to deposit or withdraw funds either. In terms of safety, Scope Markets is an established broker that was first launched in 1997. It is authorized and regulated by the Financial Services Commission of Belize (FSC). All Scope Market traders have gone through a KYC process, ensuring that the platform complies with Turkish anti-money regulations.

| Number of Stocks | Pricing Structure | Fee to Trade Apple Stock | Minimum Deposit |

| Almost 400 | Commission-free on all markets | Spread-only | $50 |

Trading in financial instruments may result in losses as well as profits and your losses can be greater than your initial invested capital.

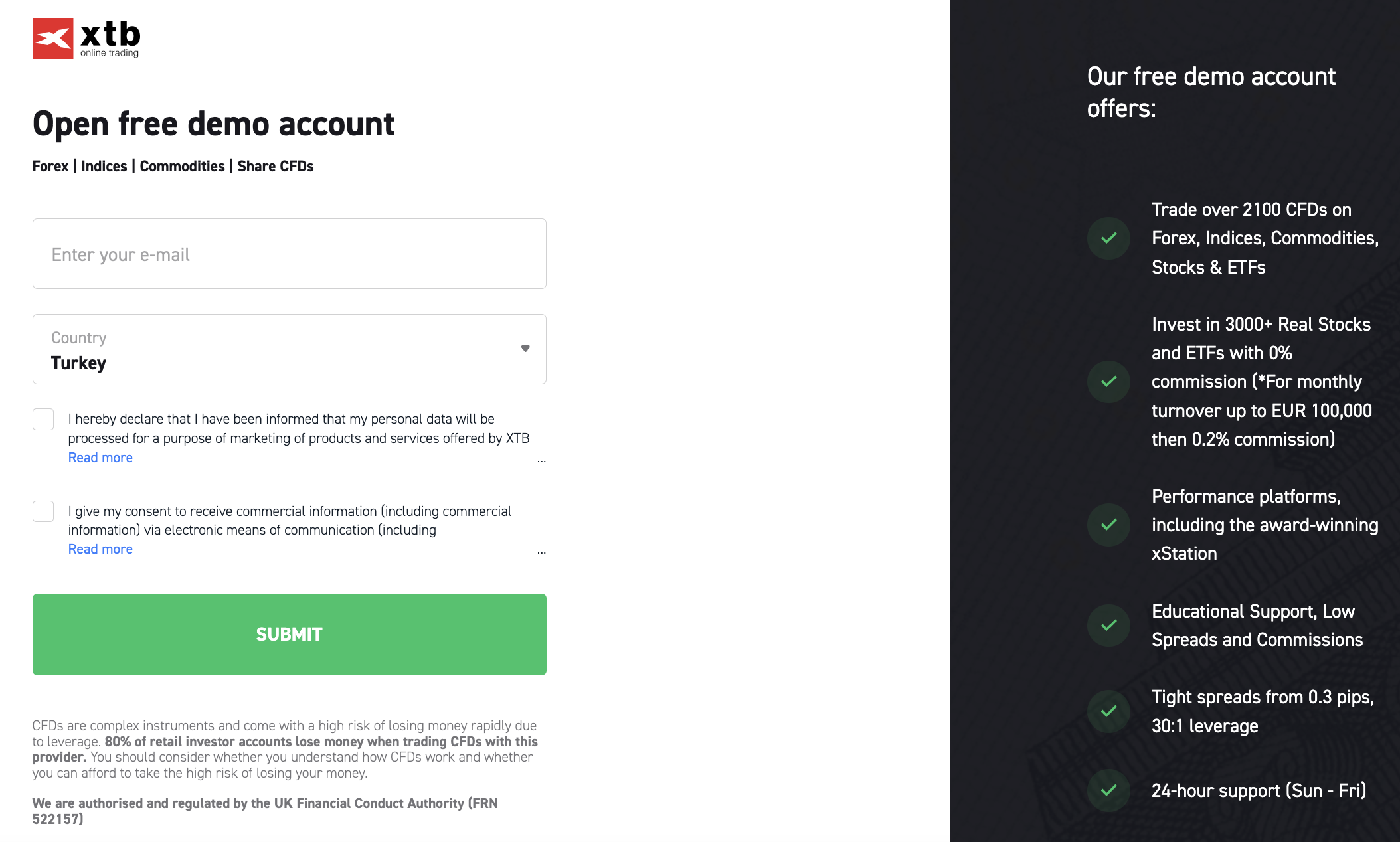

2. XTB – Trade Stocks From 16 Global Markets at 0% Commission

XTB is one of the best stock brokers for global diversification. It offers access to more than 2,000 stocks from 16 exchanges. This includes major markets in the US, the UK, and Germany. Other stock exchanges supported include Italy, Belgium, Sweden, Norway, and Portugal.

We like that XTB does not charge Turkish traders any commissions. But minimum trade requirements are in place. This amounts to $50 on US stocks. UK stocks require a minimum of £100. Other minimums apply depending on the exchange. XTB also offers leverage when trading stocks. A margin requirement of 20% is needed, so that’s just $200 for every $2,000 traded.

Much lower requirements are available on other asset classes. For instance, just 0.2% is needed when trading currencies. XTB also supports commodities, indices, and cryptocurrencies. The latter includes Bitcoin and some of the best altcoins. This includes BNB, XRP, Dogecoin, Ethereum, and Fantom.

As a CFD specialist, XTB supports long and short orders. This ensures traders can make gains in both rising and falling markets. We like that there is no minimum deposit requirement at XTB. Moreover, plenty of payment methods are supported. This includes debit and credit cards, which are processed instantly.

| Number of Stocks | Pricing Structure | Fee to Trade Apple Stock | Minimum Deposit |

| Over 2,000 | Commission-free on all markets | Spread-only | No minimum required |

Forex and CFDs are leveraged products and can result in losses that exceed your deposits. Please make sure you fully understand all risks.

3. AvaTrade – Established Stock Trading Platform That was Launched in 2006

AvaTrade is an online stock trading platform that also supports forex, commodities, and options. This is in addition to cryptocurrencies and indices. Launched in 2006, AvaTrade is regulated by nine financial bodies. It has a great reputation for fair trading conditions and fast payouts.

It processes payments without charging any fees. Accepted deposit and withdrawal methods include debit/credit cards and e-wallets. There is a minimum first-time deposit of $100 for Turkish investors. We like that AvaTrade is a 0% commission broker. This means investors only need to pay the spread when trading stocks.

AvaTrade supports over 600 stocks from the US and UK markets. It has a margin requirement of 20% on all supported stocks. AvaTrade supports many different trading platforms. This includes DupliTrade, MT4, and MT5. Many investors opt for AvaTrade’s proprietary platform, which supports desktop and mobile trading.

AvaTrade also offers educational materials. This enables first-time investors to get comfortable with CFDs, charts, and leverage. Beginners can also try AvaTrade out via its free demo account. This offers risk-free access to the financial markets, with traders buying and selling stocks with virtual capital.

| Number of Stocks | Pricing Structure | Fee to Trade Apple Stock | Minimum Deposit |

| Over 600 | Commission-free on all markets | Spread-only | $100 |

Trading CFDs and FX Options entail risk and could result in the loss of your capital.

4. Libertex – 100% Deposit Bonus of up to $10,000 for First-Time Traders

Libertex is a leading CFD broker that supports dozens of stocks. It does not charge any trading commissions (apart from Daimler and Total SA stock – 0.0003%). Rather, traders simply need to cover the market spread. Libertex has a minimum deposit requirement of just $10. That said, it also offers a welcome package; the first deposit is matched by 100% up to $10,000.

While tempting, terms and conditions apply. For example, the bonus funds are converted into cash when minimum trade requirements are met. A percentage of the spread is released to the client’s account, which can then be withdrawn. Nonetheless, there is no obligation to claim the bonus.

In terms of markets, Libertex supports over 50 stocks from the US, Canada, and Europe. This is much lower than other Turkish brokers. Libertex also supports currencies, cryptocurrencies, commodities, and indices. The latter includes markets in Europe, North America, the Middle East, Asia, and South America.

Libertex users can choose from three platforms when trading stocks. In addition to the Libertex platform, this also includes MT4 and MT5. We also like Libertext for its established reputation. It has over three million clients and has been operational for more than two decades.

| Number of Stocks | Pricing Structure | Fee to Trade Apple Stock | Minimum Deposit |

| Over 50 | Commission-free on all stock markets apart from Daimler and Total SA (0.0003%) | Spread-only | $10 |

77.77% of retail investors lose money when trading CFDs with this provider

5. Capital.com – Commission-Free Trading Platform With Almost 3,000 Stocks

Capital.com is one of the best stock trading platforms in Turkey for speculating on global markets. It supports nearly 3,000 stocks from multiple countries. This includes the US, Canada, Hong Kong, Singapore, and Japan. European markets include everything from the UK and France to Norway, Germany, and Sweden.

We like that all supported stocks on Capital.com can be traded at 0% commission. We also like that Capital.com has low margin requirements of just 5% when trading stocks. This provides trading capital of $10,000 for every $500 staked. Long and short positions are supported on all markets.

In addition to stocks, Capital.com covers other popular assets. This includes indices, commodities, forex, and cryptocurrencies. The minimum deposit is just $20 ($250 on bank wires). This will appeal to first-time stock traders. Additionally, Capital.com offers a demo account. This doesn’t require a deposit and comes with $100,000 in virtual money.

| Number of Stocks | Pricing Structure | Fee to Trade Apple Stock | Minimum Deposit |

| Nearly 3,000 | Commission-free on all markets | Spread-only | $20 ($250 on bank wires) |

The majority of retail investor accounts lose money when trading CFDs

How do Stock Brokers Work? Key Points

Stock brokers are third-party intermediaries that connect retail and institutional clients to the financial markets. In other words, stock brokers provide a bridge between publicly-listed companies and investors. Stock brokers make money in various ways, usually by charging investors a commission or spread.

Most stock brokers in Turkey offer a similar service. For example, first-time investors will initially need to open an account. Due to anti-money laundering regulations, the account opening process requires KYC documents. This is usually just a government-issued ID (e.g. driver’s license) and proof of address (e.g. bank statement).

Once the stock trading account is set up – Turkish investors can begin buying and selling shares. There are, however, some differences when comparing leading stock brokers in Turkey. For example, some offer a commission-free service, meaning investors only need to pay the spread.

How do Stock Broker Spreads Work?

- The spread is the difference between the buy and sell price offered by the broker.

- It ensures that irrespective of whether the stock price rises or falls, the broker always makes money from the trade.

- For instance, suppose Tesla stock has a buy and sell price of $269 and $271, respectively.

- In this instance, the spread amounts to $2.

- So, whenever a trader buys and sells Tesla stock, the broker will make $2 for every share traded.

While others will charge a flat commission on each stock trade. Additionally, stock brokers in Turkey will vary in which financial markets they support. The vast majority offer access to US stocks like Tesla, IBM, Johnson & Johnson, Amazon, and Apple. The best stock brokers in Turkey also support exchanges from other regions. For instance, the UK, Australia, Germany, and Canada.

Once a stock has been purchased, its value will rise and fall. Investors can sell their stocks during standard market hours. This can be achieved by logging into the brokerage account and placing a sell order. Some stocks also yield dividends. This means that the stockholder receives a small payment from the company – usually every three months.

What are the Different Types of Stock Brokers in Turkey?

There are many different types of stock brokers in the market. Turkish retail investors typically have access to two different options – traditional brokers and CFD trading platforms.

Each comes with its pros and cons, which we explain in the sections below:

Traditional Stock Brokers

Traditional stock brokers connect clients directly to their preferred exchange. This enables investors to buy ‘real’ shares in the company. By becoming a stockholder, investors are entitled to various perks.

For example, if the company pays dividends, all stockholders receive their share. The amount is proportionate to the number of shares held. Additionally, stockholders can vote when the company holds its annual general meeting.

Traditional stock brokers are more suited for long-term investors that do not require any additional features. For instance, short-selling is challenging when using a traditional broker, as this involves borrowing shares from other investors. Moreover, traditional brokers rarely enable retail clients to trade stocks on margin.

Another drawback is that traditional brokers have access to fewer exchanges. This is because the broker needs to be licensed in each and every market that it offers access to.

CFD Stock Brokers

The other option available to Turkish investors is CFD brokers. This type of trading platform operates slightly differently from traditional brokers – as investors do not buy ‘real’ shares. Instead, investors speculate on the future value of their chosen stock. This is because CFDs track the value of stocks in real-time.

So, if Nike stock is trading at $108.77 on the NYSE, the CFD should reflect the same price. And if Nike stock increases by 3%, so will the CFD. In this regard, CFDs still enable investors to profit from rising stock prices. But they also enable investors to short-sell stocks too. This offers a lot more flexibility for Turkish investors – especially during bearish cycles.

Another benefit of choosing a CFD broker is that investors can trade on margin. This means that investors only need to cover a small percentage of the overall trade size. For example, Scope Markets enables traders to buy and sell stocks with a 10% margin requirement. This means that a $1,000 stock trade would require an account balance of just $100.

How Does Margin Trading Work?

- Margin enables traders to buy and sell stocks with more money than they have in their brokerage account

- Each broker will have its own limitations, depending on their own risk controls, the market, and the type of account.

- Suppose the broker has a margin requirement of 10%

- The investor wants to trade Amazon stock – which is listed at $128

- In this instance, the trader only needs to put up $12.80 to execute the trader

- However, if the Amazon stock trade declines by 10%, the broker will automatically close the position

- This is known as ‘liquidation’ and it means the trader loses their entire margin ($12.80)

When researching the best stock brokers in Turkey, we also found that CFDs are a lot more cost-effective. In fact, most CFD brokers do not charge any trading commissions. This means only the market spread needs to be covered – which is usually a small fraction of a percentage.

This is especially handy for casual traders in Turkey. In contrast, traditional brokers usually charge a flat commission. For instance, suppose the broker charges $7 per stock trade. If the trader buys $100 worth of stock, they are effectively paying a commission of 7%. This will be in addition to the spread.

Tips on Selecting the Best Stock Trading Platform in 2025

First-time investors who are still not sure which broker to choose can read on. We explain the most important factors to consider when researching the best stock brokers in Turkey.

Reputation and Licensing

We would suggest checking the reputation and licensing status of a broker before opening an account. This is an important step to ensure Turkish investors can trade in a safe and regulated environment.

For example, Scope Markets has been offering brokerage services since 1997. It is also a regulated broker, licensed by the Financial Services Commission of Belize.

But not all brokers offer a safe trading space like Scope Markets. So be sure to evaluate the broker’s credentials as a priority.

Minimum Deposit Requirement and Payment Types

The best stock brokers in Turkey have reasonable deposit requirements. This typically averages $50 to $100 for first-time customers. But equally, it’s important to check the minimum trade size before making a deposit. For example, XTB does not have a minimum deposit requirement. But US stock trades need to meet a $50 minimum.

Additionally, Turkish investors should assess what payment types are supported. This can include Visa, MasterCard, bank wires, and e-wallets. If depositing in Turkish lira, check what FX rates are charged by the broker.

Supported Stock Trading Markets

Most countries have a domestic stock exchange. But investors in Turkey typically prioritize stocks from major markets. For instance, the NYSE and NASDAQ in the US and the UK’s London Stock Exchange. These exchanges attract the most liquidity and are less volatile than the emerging markets.

Nonetheless, investors should check what stock exchanges the broker supports before proceeding. At Scope Markets, investors can trade stocks from the US and several European exchanges.

Trading Commissions and Spreads

Online brokers charge fees, so it is important to understand how much it will cost to buy and sell stocks. The best stock brokers in Turkey offer commission-free trading. This includes Scope Markets, XTB, and AvaTrade.

But spreads will still apply. This is the difference between the buy and sell price of the stock being traded. So investors should assess average spreads when researching the broker.

User-Friendliness

Most stock brokers in Turkey offer a user-friendly platform that will appeal to beginners. The process of signing up will be seamless, as will making deposits and withdrawals.

Finding suitable stocks should also be simple. We prefer brokers that list stocks by recent performance, industry, and other filters. Not all stock brokers are aimed at beginners though.

On the contrary, some offer advanced trading tools that will only appeal to experienced investors.

Demo Account

The best stock brokers in Turkey enable new customers to create a free demo account. This will come pre-loaded with virtual funds. The demo account should replicate the main trading platform.

The key difference is that traders will buy and sell stocks with risk-free money. Not only are demo accounts ideal for novice traders but those wanting to try a broker out before making a deposit.

One of the best demo accounts for Turkish investors is offered by XTB. The demo account is free to open and can be used for 30 days.

Customer Support

Turkish investors should opt for an online stock broker that offers excellent customer support.

We found that Scope Markets offers the overall best customer experience. Not only can support be contacted via live chat but also by email and telephone.

Conclusion

Turkish investors have many options when buying and selling stocks online. But overall, Scope Markets is the best broker to consider.

Scope Markets doesn’t charge trading commissions and supports over 400 stocks from the US and Europe. The minimum deposit is just $50 and the platform is licensed by the Financial Services Commission of Belize.

Scope Markets is also offering a 50% bonus on first-time deposits, so follow the link below to discover everything there is to know about this leading stock broker in 2025.

Trading in financial instruments may result in losses as well as profits and your losses can be greater than your initial invested capital.

References:

https://www.swift.com/your-needs/financial-crime-cyber-security/know-your-customer-kyc/kyc-process

https://www.wsj.com/market-data/quotes/TSLA

https://fineksus.com/anti-money-laundering-regulations-in-turkiye/

https://markets.ft.com/data/equities/tearsheet/summary?s=AMZN:NSQ