Searching for the best small-cap growth stocks by past performance and upside potential? Seasoned investors will often allocate a portion of their portfolio to small-cap stocks from a range of industries and markets, with the view of targeting extended long-term growth.

The risks, however, should be fully understood before proceeding – as small-cap stocks are often more volatile than their blue-chip counterparts. In this guide, we discuss some of the best small-cap stocks in the market right now according to industry commentators.

Best Small-Cap Stocks According to Performance 2025

Below is a list of the best small-cap stocks to watch according to market analysts:

- Rapid7 – Cybersecurity and Cloud Network Solutions

- Envestnet – Software Developer and Distributor for Financial Institutions

- ACI Worldwide – Real-Time Payment Systems for Banks

- Albany International – Industrial Textiles Serving Clients on a Global Basis

- Phunware – Mobile Solutions for Digital Marketing and Advertising

- ACM Research – Single Wafer-Wet Cleaning Technologies

- Aston Martin – UK-Based Manufacturer of Luxury Cars

- Novavax – Biotech Company Developing Vaccines for Infectious Diseases

- B&G Foods – Small-Cap Stocks With Dividends

- Hanesbrands – US-Based Holding Company for Clothing Brands

When searching for popular small market cap stocks, it is important to conduct independent research.

This should include a thorough analysis of the company’s financials – such as its balance sheet, free cash flow, and short-term debt. More on this later.

A Closer Look at the Best Performing Small-Cap Stocks

Small-cap stocks are suitable for investors that have a higher tolerance for risk and subsequently wish to target extended long-term growth. Due to their small market capitalization, stocks within this marketplace offer higher upside potential.

Equally, however, small-cap stocks often struggle to attract sufficient levels of liquidity, and thus – investors should expect a lot more volatility when compared to blue-chip companies.

In the sections below, we explore some of the best small-cap stocks according to market analysts.

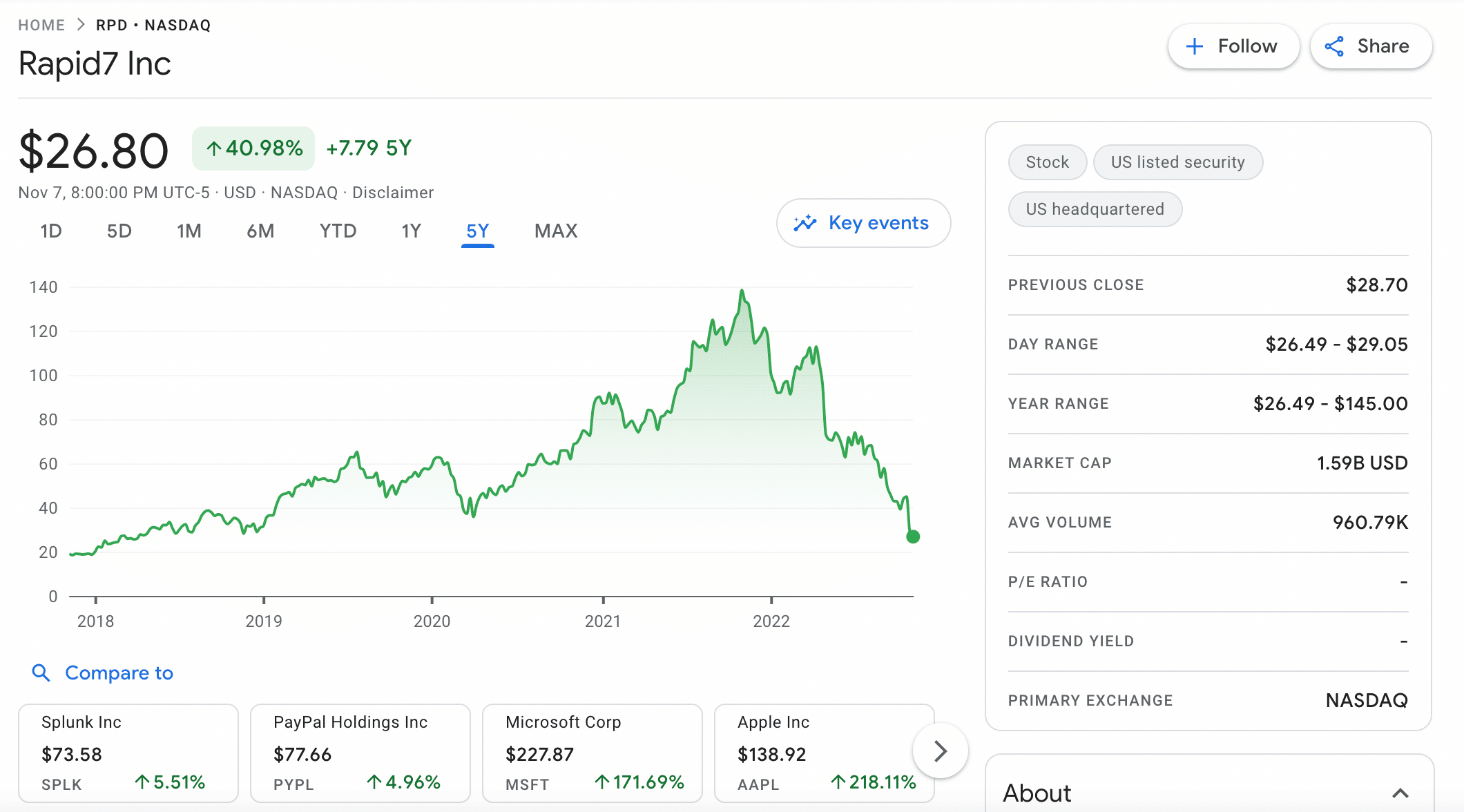

1. Rapid7 – Cybersecurity and Cloud Network Solutions

Rapid7 is a small-cap company that is listed on the NASDAQ. Founded in 2000 and headquartered in Boston, the firm specializes in cybersecurity and cloud network solutions. This is an industry that continues to witness exponential growth, considering the rising global threat of cyber attacks that are conducted remotely.

Some of the most prominent companies that Rapid7 currently serves include Autodesk, Hilton, Domino’s, and Univision. As of writing, Rapid7 stock carries a market capitalization of just under $1.6 billion. As is often the case with small-cap stocks, Rapid7 continues to experience high levels of volatility.

In the prior 52 weeks of writing, for example, Rapid7 stock has witnessed highs and lows of $145 and $26 respectively. Over the prior five years of trading, Rapid7 has generated gains of nearly 41%. In comparison, the Russell 2000 index – which tracks small-cap stocks that are listed in the US, has grown by just 23%.

On the flip side, Rapid7 stock has declined by 80% over the prior 12 months. This is the case with many small-cap stocks in the market, as institutional investors are packing capital into more stable asset classes. Nonetheless, in its most recent quarterly earnings call, Rapid7 reported a revenue increase of 32.46% – to $167.46 million.

Net profit margins also increase by 12.47%. However, do bear in mind that in the same quarter, net income stood at a $39.61 million loss.

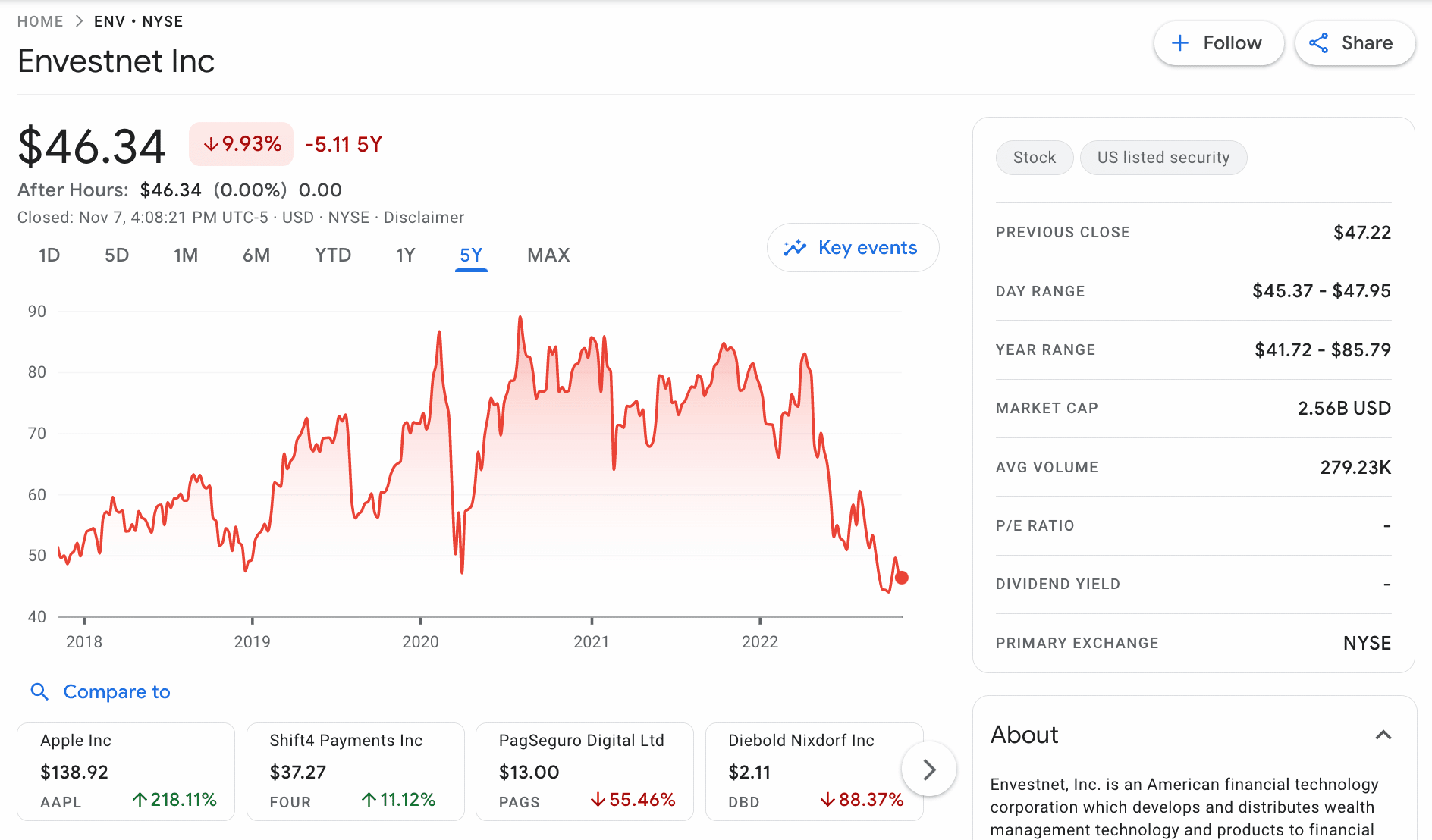

2. Envestnet – Software Developer and Distributor for Financial Institutions

When searching for the best small-cap stocks according to prominent analysts, Envestnet is often discussed. Founded in 1999 and based in Pennsylvania, Envestnet specializes in software and technological solutions for financial institutions. In addition to this, the firm is also involved in credit and annuity solutions, financial planning, and data aggregation.

This small-cap stock is yet another company within the market that has witnessed unprecedented volatility over the prior year. 52-week highs and lows of Envestnet stock stand at $41 and $85 respectively. In the past 12 months of trading, the stock is down 44%. In comparison, the Russell 200 is down 26% over the same period.

In terms of the financials, Envestnet reported a 10.43% revenue increase in its most recent quarterly earnings report – up to $318.85 million. However, the key concern is that the firm still reported a net income loss of $23.29 million. As such, its most recent earnings report is reflected in the current stock price.

3. ACI Worldwide – Real-Time Payment Systems for Banks

ACI Worldwide is an established software company that was founded in 1975. Based in Florida, the firm specializes in providing real-time payment systems for banks and financial institutions. ACI Worldwide currently serves 19 of the top 20 banks globally, which subsequently enables more than 80,000 merchants to directly accept Omni-commerce payments.

The software provided by ACI Worldwide also includes real-time solutions for enterprise and banking fraud. In terms of its stock performance, ACI Worldwide has witnessed 52-week highs and lows of $36 and $19 respectively. As of writing, this small-cap stock is trading at just under $21, which represents a 12-month decline of almost 34%.

Over a five-year period of trading, ACI Worldwide stock is down 10%. With all that being said, ACI Worldwide released a great set of results in its most recent earnings report. Revenue was up 12.85% for the quarter to $340.43 million and net income rose by 105.23% to $13.35 million. In turn, earnings per share increased by 26.09%. Free cash flow also increased by 59.43% to $32.77 million.

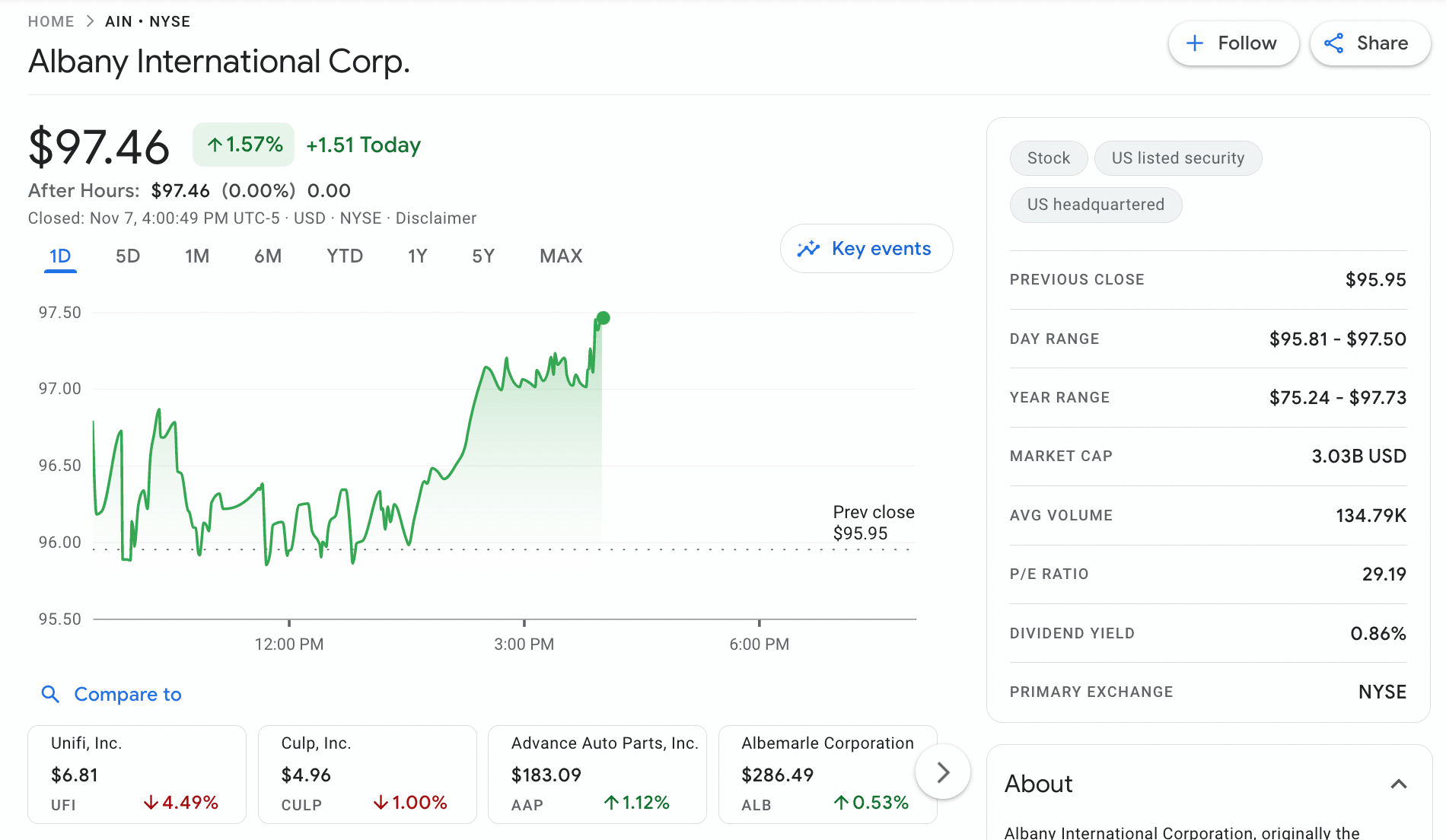

4. Albany International – Industrial Textiles Serving Clients on a Global Basis

In terms of the best small-cap stock for performance, Albany International has outperformed the Russell 2000 benchmark in recent years. Over the prior 12 months of trading, Albany Internationa stock has witnessed a 52-week high and low of $97 and $75 respectively.

This translates into 12-month growth of 10%. On a five-year basis, this small-cap stock has grown by 66%. This strong performance does, however, mean that Albany International stock is trading with a P/E ratio of over 29 times. Nonetheless, the stock is also a dividend payer, with a running yield of 0.86% as of writing.

Its most recent earnings report generated mixed results. On the one hand, revenue was up 12.10% to $260.56 million, resulting in a 38.55% increase in earnings per share. However, net income declined in the quarter by 65.35% – down to $10.69 million. Free cash flow declined considerably too – with a 61.61% drop to $15.10 million.

5. Phunware – Mobile Solutions for Digital Marketing and Advertising

Founded in 2009, Phunware is a US-based company that specializes in mobile solutions for digital marketing and personalized advertising campaigns. The firm also provides brand loyalty tools for companies operating in the cryptocurrency space. According to some market analysts, Phunware could be the best small-cap stock for long-term growth.

The reason for this is that as of writing, Phunware stock carries a market capitalization of just $166 million. Volatility is extremely high with this small-cap stock – especially over the prior year. 52-week highs and lows on this stock amount to $4.60 and $1 respectively. On the one hand, Phunware stock is down 61% over the past 12 months.

On a five-year basis, the stock is down 83%. However, in the one month prior to writing, this small-cap stock is up 45%. One of the motivating reasons for this sudden surge in value is due to the firm’s recent earnings report. Revenue was up over 281% to $5.4 million and net profit margins rose by 42.52%.

With that said, this small-cap company generated a loss of $17 million in the most recent quarter, so investors must be prepared for further volatility.

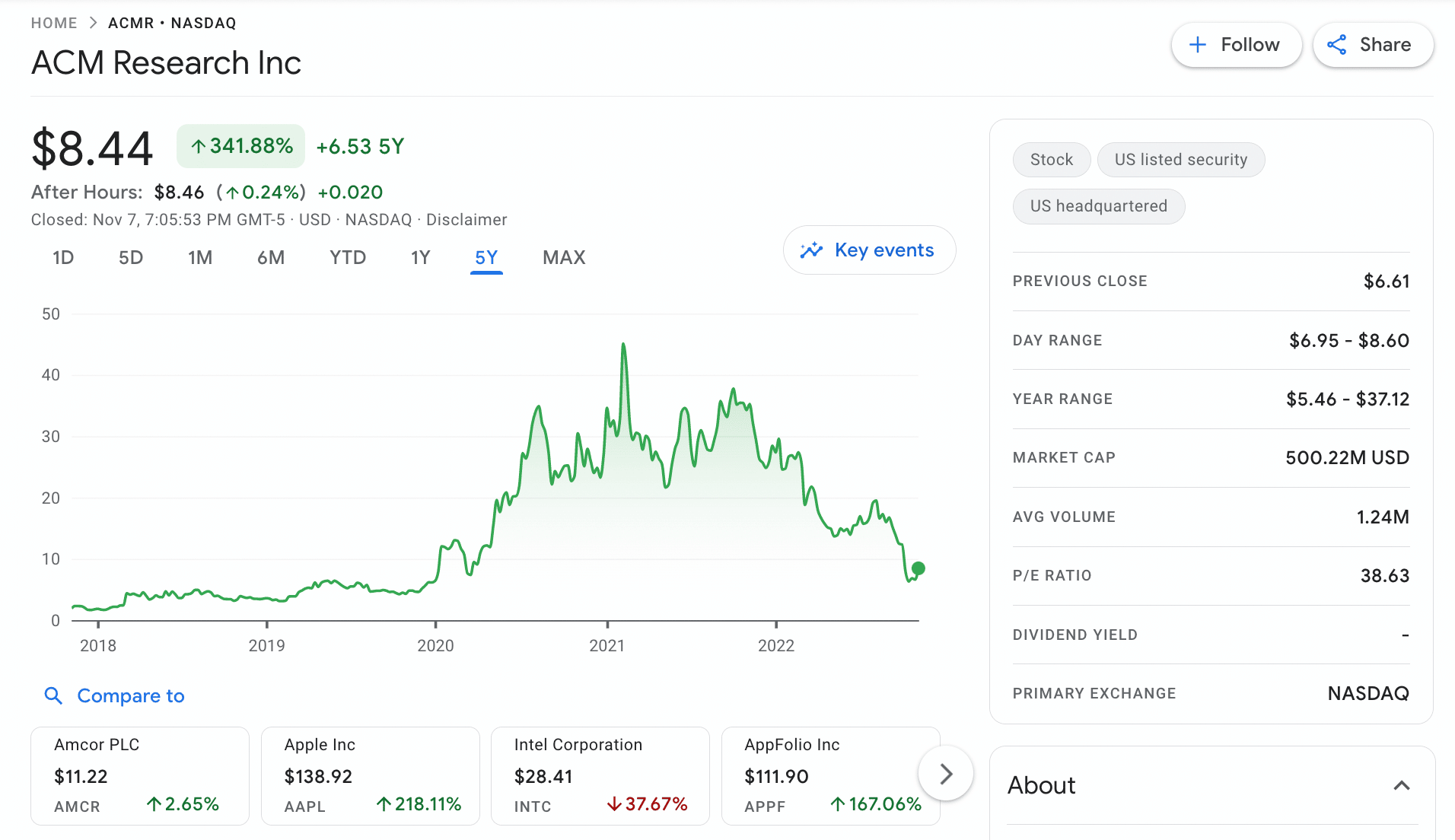

6. ACM Research – Single Wafer-Wet Cleaning Technologies

In terms of performance alone, ACM Research represents one of the best small-cap stocks – considering that it has increased its valuation by over 341% on a five-year basis. Once again, over the same period, the Russell 2000 benchmark has grown by just 22%. This small-cap firm specializes in technologies that serve single-wafer wet cleaning solutions.

In particular, the company is behind the Smart Megasonix™ cleaning technology, which is supplied to firms operating in the industrial sector. ACM Research stock is listed on the NASDAQ exchange and as of writing, carries a market capitalization of just $500 million.

Its P/E ratio is somewhat inflated at nearly 39 times and no dividend policy is in place. 52-week highs and lows stand at $37.12 and $5.46 respectively, which highlights extreme volatility. In the prior 24 hours of writing, this small-cap stock has increased by over 26% – largely due to being upgraded by Jefferies Group from ‘underperformed’ to ‘hold’.

7. Aston Martin – UK-Based Manufacturer of Luxury Cars

Founded way back in 1913, Aston Martin is a British luxury car manufacturer. With that said, the firm only went public in late 2018 – listing on the London Stock Exchange. The stock performance of Aston Martin has been nothing short of a disaster since its IPO – with the firm now trading nearly 97% lower than its original listing price.

This has resulted in Aston Martin becoming a small-cap stock – with a valuation of nearly £900 million as of writing. Nonetheless, those searching for small-cap value stocks might consider that Aston Martin recently reported a 12.61% revenue increase in its most recent earnings call, up to £309 million. Moreover, EBITDA increased by over 80% to £42.5 million.

8. Novavax – Biotech Company Developing Vaccines for Infectious Diseases

Novavax sits within the category of small-cap biotech stocks. The firm specializes in developing, manufacturing, and distributing vaccines for infectious diseases. This includes influenza, Ebola, and the coronavirus. Founded in 1987, Novavax stock is listed on the NASDAQ exchange and as of writing, carries a market capitalization of $1.5 billion.

This is perhaps one of the most volatile small-cap stocks that we will discuss today – considering its 52-week high and low of $236 and $16 respectively. This means that over the prior 12 months of trading, the stock is down nearly 89%. This rapid decline in value is largely down to its financials.

For example, its most recent quarterly earnings call reported a 37.61% decline in revenue – down to $185.93 million. Net income took a major hit too – declining by 44.89%. This means that the firm made a $510 million net income loss for the quarter.

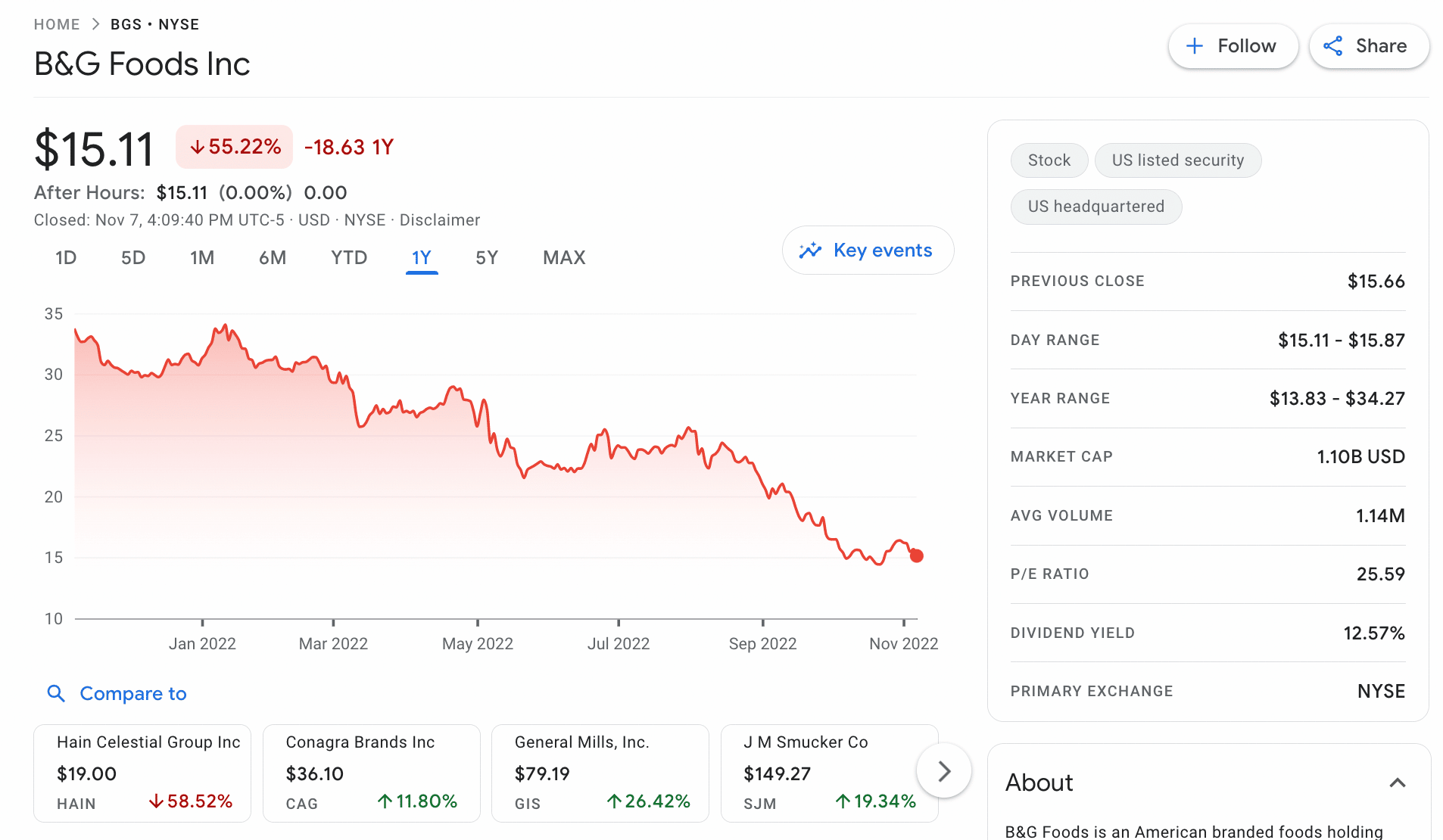

9. B&G Foods – Small-Cap Stocks With Dividends

Those in the market for small-cap stocks that pay dividends might consider researching the credentials of B&G Foods. Founded in 1996, this US-based company manufactures and distributes a range of condiments, relish, and pickles. Listed on the NYSE, B&G Foods stock carries a market capitalization of $1.1 billion.

Interestingly, this small-cap stock not only pays a dividend – but as of writing, this equates to a running yield of over 12.5%. Its stock price, however, has declined by 55% over the prior 12 months, so this should be taken into account rather than focusing exclusively on the dividend yield.

With that said, one of the main reasons for this rapid decline in valuation is due to rising inflation levels. This has had a direct impact on core ingredient costs for B&G Foods, in addition to packaging and transportation. Although its most recent earnings call reported a 3.14% rise in revenue to $478.97 million, net income and earnings per share declined by concerning levels.

10. Hanesbrands – US-Based Holding Company for Clothing Brands

Hanesbrands is one of the best small-cap stocks to buy and hold according to Susan Dziubinski from MorningStar. Founded in 1901, Hanesbrands is a US-based holding company for a variety of clothing brands. This includes everything from Just My Size, Hanes, and Champion to Bonds and Maidenform.

However, due to unfavorable currency exchange rates, inflation, and supply chain delays, Hanesbrands stock has been hammered this year. In fact, over the prior 12 months of trading, Hanesbrands stock is down 60%. On the flip side, Hanesbrands stock is offering a running dividend yield of nearly 8.5% as of writing. Moreover, its P/E ratio stands at just 5.88 times.

What are Small-Cap Stocks?

The universally accepted definition of a small-cap stock is a public company with a market capitalization of under $2 billion. However, small-cap stocks can refer to companies with a much larger market capitalization – especially when utilizing the Russell 2000 index as a solid benchmark figure.

After all, although the Russell 2000 index tracks small-cap companies listed in the US, some of its constituents carry a market capitalization of up to $15 billion. Nonetheless, small-cap stocks are those that have the potential to grow considerably from current valuations.

This is because many small-cap stocks are actually new companies, so they sit within the remit of growth stocks. On the one hand, small-cap stocks are appealing to investors that wish to generate higher-than-average market gains. Equally, however, the risks associated with small-cap stocks are much higher – especially when compared to blue-chip stocks.

For example, a company with a small market capitalization is prone to much wilder pricing swings. Investors that do not want to invest in highly-volatile companies should therefore avoid small-cap stocks. Moreover, depending on the underlying market capitalization, small-cap stocks can also struggle with liquidity.

This means that the process of cashing out a small-cap stock investment can be problematic, should there be a lack of buying interest in the market. Fortunately, when searching for the best small-cap stocks, investors might instead consider an index fund. For example, as noted above, the Russell 2000 tracks 2,000 small-cap stocks that are listed in the US.

Why do People Invest in Small Cap Stocks?

Due to the enhanced risks involved, it is important to conduct considerable levels of research when searching for the best small-cap stocks.

Before we take a much closer look at the risks, let’s explore some of the main reasons why investors often allocate a segment of their portfolio to the small-cap stock market.

Upside Potential

The overarching reason why investors explore small-cap stocks is that companies within this space offer a higher upside potential.

- For example, the likes of Apple and Microsoft already carry a market capitalization of over $1 trillion – so there is only so much growth that the companies can generate for shareholders.

- In other words, large-cap stocks have already consumed much of their growth – with the likes of Apple and Microsoft achieving this feat in the 1980s and 1990s.

- In stark contrast, small-cap stocks have the potential to grow by significant levels.

- For example, we mentioned earlier that small-cap stock Phunware carries a market capitalization of just $166 million as of writing.

- If Phunware was to generate growth of 1,000%, it would still be classed as a small-cap stock.

Crucially, the market depth – which highlights how much a stock will increase by based on a specific buy order amount, is extremely loose in the case of small caps.

More specially, due to lower levels of liquidity, small-cap stocks can grow a lot faster than their large-cap counterparts, even with a modest amount of buying pressure.

Cyclical Pricing

Many investors are attracted to small-cap stocks before of their cyclical nature. In many cases, small-cap stocks perform well when the economy is strong.

On the flip side, when the economy is sluggish, small-cap stocks typically decline at a faster rate than the market average. This means that small-cap stocks as a whole can be somewhat predictable.

New and Innovative Markets

Many small-cap stocks are new companies that specialize in innovative markets that are yet to take off. This means that investors can gain exposure to small-cap stocks while they are still in their infancy.

And in turn, if the respective business model is accepted by the broader economy, this can result in a prolonged upward trajectory.

Short-Term Speculation

Day and swing traders will often focus on small-cap stocks, considering the volatility on offer.

After all, it is not uncommon for a small-cap stock to rise or fall by 10-20% in a single day of trading. This represents highly conducive market conditions for short-term speculators.

For example, we mentioned earlier that ACM Research was recently upgraded from ‘underperformed’ to ‘hold’ by Jefferies Group. While this news might seem somewhat inconsequential, ACM Research stock increased by over 26% in just one day of trading.

Plethora of Index Funds

Buying and selling individual small-cap stocks can be a challenging endeavor. There are many thousands of companies that operate in this space, so being able to successfully hand-pick small-cap stocks is no easy feat.

With that being said, there are dozens of index funds that specialize exclusively in tracking small-cap stocks. The Russell 2000, for example, tracks 2,000 small-cap stocks that are listed in the US. This means that through a single trade, investors can gain exposure to 2,000 small-cap companies.

There are also actively managed ETFs and mutual funds that target small-cap stocks. Either way, taking the fund route not only offers instant diversification, but a passive way to access the small-cap markets.

Potential Risks of Small Cap Stocks

On the one hand, small-cap tech stocks enable investors to target higher investment returns. However, this marketplace is a lot risker when compared to large-cap, established companies with a blue-chip status.

As such, in the sections below, we discuss some of the main risks associated with the small-cap stock market.

Volatility

Perhaps the main risk of investing in small-cap stocks is the extreme volatility involved. Small-cap stocks can fall by double-digit percentages in a single day of trading, consequently leaving investors with sizable losses.

Moreover, when economic confidence is low – as it is right now, it is often small-cap stocks that generated more severe losses when compared to those with a large market capitalization. This is why many small-cap stocks lost considerable amounts of value in 2023.

OTC Markets

Many small-cap stocks are listed on the OTC (Over-the-Counter) markets. This means that access can be limited for the average trader, considering that OTC exchanges are typically suited for large-scale investors.

While some online brokers do provide a gateway to the OTC markets, exchanges in this space often struggle with liquidity issues. This means that attempting to sell a small-cap stock on an OTC exchange can result in a highly unfavorable exit price.

Cash Flow Issues

Small-cap companies often carry very low levels of cash. This can be highly dangerous during times of economic uncertainty, especially if the small-cap company has growing debt obligations.

This is why even the slightest of declines in a quarterly earnings report can result in a huge market sell-off – leaving inexperienced investors with unprecedented losses.

Lack of Income

Although some small-cap stocks have a dividend policy in place, most do not. And as such, this means that by investing in small-cap stocks, the likelihood is that potential returns will only come in the form of capital gains.

Where Can You Buy Small-Cap Stocks

In order to buy small-cap stocks, investors will need to have an account with a regulated brokerage. In the US, for example, the broker must be authorized and licensed by the Securities and Exchange Commission (SEC).

The top-10 list of small-cap stocks that we discussed on this page are available to buy at many of the best trading platforms.

Conclusion

In summary, this guide has provided a subjective overview of the best small-cap stocks according to market analysts. Although small-cap stocks are popular with investors that wish to target a higher upside on their investments, this market is often prone to huge volatility swings.

As such, some investors consider diversifying across small-cap index funds and ETFs, in addition to less risky asset classes. Most importantly, investors must ensure that they only buy small-cap stocks from an SEC-regulated broker.