In today’s highly-volatile investment environment, finding the best shares to buy is more challenging than ever. Rampant inflation and rising interest rates have prompted mass fear in the markets, leading to a broad sell-off of many asset classes. However, even amidst all this, the stock market still offers enticing opportunities for investors capable of dealing with the risk.

With that in mind, this guide presents 11 of the best shares to buy in the UK, according to several top equity analysts. We’ll discuss each of these shares individually, covering their financials and price history, before presenting a detailed breakdown of the critical factors to consider when looking for companies to invest in.

The 11 Best Shares to Buy Now in the UK According to Analysts

Finding the best investments to add to a portfolio can be challenging, especially given the overwhelmingly negative sentiment toward many asset classes. However, listed below are 11 of the best shares to buy in the UK according to analysts and leading media outlets – each offering the potential for positive returns:

- Love Hate Inu (LHINU) – Overall Best Shares Alternative in 2025

- Advanced Micro Devices (AMD) – Popular Share to Buy in 2025

- Persimmon (PSN) – A High Paying FTSE 100 Dividend Stock

- Apple (AAPL) – One of the Most Bought and Sold Shares Globally

- Berkshire Hathaway (BRK.B) – Vast Holding Company Owned by Warren Buffett

- Johnson & Johnson (JNJ) – Pharmaceutical Giant that’s Resilient in Tough Economic Times

- Enphase Energy (ENPH) – Rapidly-Expanding Solar Energy Company

- Rio Tinto (RIO) – Huge Mining Company with International Operations

- BAE Systems (BA.) – Popular Defense Contractor with Regular Dividends

- British American Tobacco (BATS) – Well-Known Tobacco Company with Solid Branding

- Glencore (GLEN) – Enormous Commodities Firm with Strong Financials

Reviewing the Best Shares to Invest in UK

The decision to buy shares shouldn’t be taken lightly, as this asset class tends to be more volatile than other asset classes like bonds and ETFs. Nevertheless, stock trading is perhaps the most popular avenue for investors to generate returns – and with so many companies to choose from, there’s always opportunity in the market.

So, without further ado, let’s take a closer look at analysts’ picks for the best shares to buy now:

1. Love Hate Inu (LHINU) – Overall Best Shares Alternative in 2025

According to the Love Hate Inu whitepaper, this platform will allow users to stake $LHINU tokens to earn voting opportunities on the available meme polls on the ecosystem. The meme polls range from a variety of topics, such as entertainment, politics, and social issues.

Depending on how many polls a user participates in, the earnings increase. This is because Love Hate Inu will reward users with $LHINU every time they vote through the user interface. According to the platform roadmap, Love Hate Inu will also launch a vote submission platform through which members can create their own polls.

While Love Hate Inu is advertized as a meme token, it benefits from a low token supply of just 100 billion coins. This is far lesser than other popular shitcoins including Dogecoin. From the available supply, 900 million tokens have been allocated for an eight-round presale. Currently, $LHINU is on stage two of the presale, priced at $0.00009 per token.

The price will increase per round, eventually increasing to $0.000145 per token by the final round. This equates to a 61% price jump from current levels. Since the start of the presale, Love Hate Inu has raised over $1.2 million in just a few weeks. The total presale hard cap is set at more than $10 million.

With an upcoming exchange listing planned for Q2 2023, and Love Hate Inu’s plans of integrating metaverse experiences in the future, $LHINU can be one of the best tokens to hold in 2025.

Join the Love Hate Inu Telegram channel to stay updated with all this project’s developments and updates.

Presale Started

8 March 2023

Purchase Methods

ETH, USDT, Credit Card

Chain

Ethereum

Hard Cap

$10,068,750

Min Investment

None

Max Investment

None

2. Advanced Micro Devices (AMD) – Popular Share to Buy in 2025

Advanced Micro Devices is one of the fastest-growing technology stocks of the last few years. After verging on the point of ruin during the first half of the last decade, the company turned things around with the wildly successful release of its Ryzen desktop/laptop processor platform in 2017.

Since the start of 2018, AMD’s share price is up by around 620%, making it not only a business success story but one of the best long-term stocks of the last five years.

The good news for those who weren’t lucky enough to invest in AMD in 2017 is that the company shows no sign of slowing down. In 2022, AMD had revenue growth of 43%, on top of a 68% increase the year before. In the last five years, AMD has gone from a revenue of 6.48bn in 2018 to 23.6bn in 2022. If it continues that progress, that could make AMD a top contender for the best share to buy in 2023.

At the same time, AMD’s biggest competitor in the processor market, Intel, has experienced seemingly neverending difficulties with its own lineup of consumer and data center products. In Q3 2016, Intel and AMD had a consumer CPU market share of 82.5% and 17.5%, respectively. By Q1 2022, that market share had changed to 63.5% for Intel and 36.4% for AMD.

AMD has a strong product line and avenues of potential future revenue. If it continues on the path it has been on, it could be one of the best long-term stocks in the technology sector.

| 12 Month Performance | -19.15% |

| Five Year Performance | 620.75% |

| Price-to-Earnings (P/E) Ratio | 98.3 |

| Dividend Yield | 0% |

3. Persimmon (PSN) – A High Paying FTSE 100 Dividend Stock

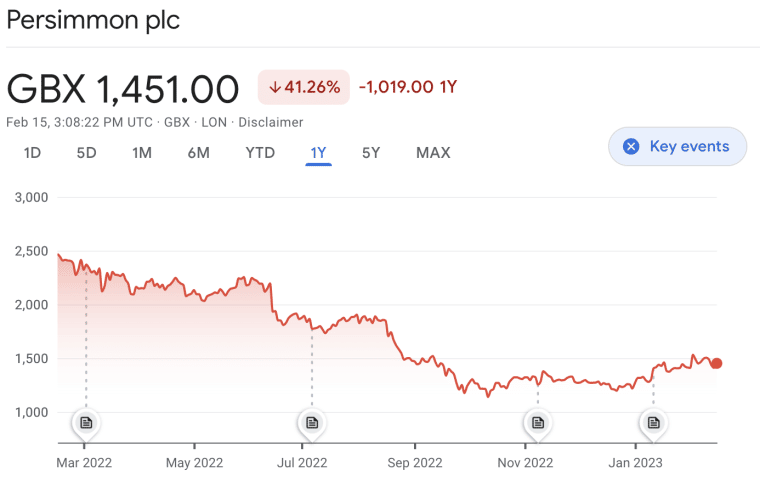

The British housebuilding company Persimmon has made a name for itself in the UK stock market by paying huge dividends. The dividend payouts in 2022 totalled 16.21%, which is a long way ahead of second place Rio Tinto at 9.43%. In its latest earnings report, the company announced a lower dividend yield for 2023, but at 60p per share, it’s still one of the highest-paying FTSE 100 dividends.

The Persimmon share price suffered throughout 2022 due to the wider economic outlook, with the price down by around 41% from February 2022 to 2023. However, the current price could represent an opportunity for new investors to get in while the shares are cheap, potentially making it one of the best shares to buy today.

Those who want the best stocks to invest in for the dividend payout are likely to hold onto their shares for a long time. As the housing market in the UK stabilizes, Persimmon could be one of the best long-term investments for shareholders who reinvest their dividend payouts.

| 12 Month Performance | -47.38% |

| Five Year Performance | -52.23% |

| Price-to-Earnings (P/E) Ratio | 6.93 |

| Dividend Yield | TBD in 2023 |

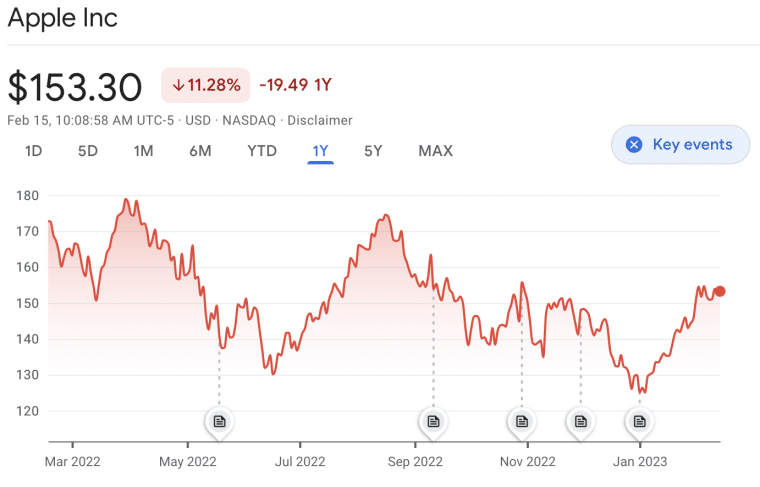

4. Apple (AAPL) – One of the Most Bought and Sold Shares Globally

According to several leading media outlets, Apple is one of the best shares to buy in the UK at the time of writing. Apple needs no introduction, as the tech behemoth has made a name for itself over the past two decades thanks to groundbreaking products like the iPhone, iPad, and MacBook. Looking ahead, Apple is set to add to its best-selling lineup with its upcoming AR/VR glasses as early as this year.

AAPL shares can be purchased using most day trading platforms and investment apps that offer access to NASDAQ-listed shares. The reason Apple makes our list is that the company’s shares are actually performing better than the S&P 500 index at present. So, although they’re still in the red, Apple’s shares have proven to be relatively resilient.

Apple shares look appealing from a long-term perspective, as the company’s share of the smartphone market is as high as ever. Moreover, Apple is placing greater emphasis on service revenue, with AppleTV+, iCloud, and AppleCare growing rapidly. Finally, the company is also resistant to the adverse effects of inflation due to its exceptional brand power, which means it can continue to offer products at a premium price point.

As one of the FAANG stocks, many investors are looking to buy Apple shares in the UK as part of building a diversified portfolio for both long and short-term investments.

| 12 Month Performance | -1.41% |

| Five Year Performance | 233.63% |

| Price-to-Earnings (P/E) Ratio | 25.23 |

| Dividend Yield | 0.62% |

5. Berkshire Hathaway (BRK.B) – Vast Holding Company Owned by Warren Buffett

Berkshire Hathaway has long been touted as one of the best shares to buy, and that’s still true in 2025 – yet the share price struggled for much of 2022. The company is best known because of its leadership by Warren Buffett and Charlie Munger, who are two of the most successful investors of the past century.

Those who typically invest in cryptocurrency may find BRK.B shares unsuitable since they are low-volatility and do not provide any crazy returns. This is because Berkshire Hathaway owns around 60 businesses, many of which are involved in the consumer goods market. On top of this, the company also has a vast stock portfolio valued at around $300bn.

Investing in Berkshire Hathaway stock is similar to investing in a fund because its performance is based largely on the portfolio of stocks it owns. That makes Berkshire Hathaway one of the best shares to buy for beginners.

As noted by Bloomberg, Berkshire Hathaway engages in regular share buybacks and repurchased $1bn worth of shares in Q2 2022. This tends to help prop up the price and, combined with the company’s defensive properties, makes Berkshire Hathaway a suitable option for today’s volatile investing environment.

| 12 Month Performance | -6.99% |

| Five Year Performance | 46.71% |

| Price-to-Earnings (P/E) Ratio | 58.4 |

| Dividend Yield | 0% |

6. Johnson & Johnson (JNJ) – Pharmaceutical Giant that’s Resilient in Tough Economic Times

Johnson & Johnson is one of the best-known pharmaceutical companies in the world. Its products are used across the globe, and, most importantly, for company stability, its items are always in need.

That has historically made Johnson & Johnson one of the most stable companies to invest in. Even during times of economic crisis like the 2008 recession, Johnson & Johnson’s share price and revenue haven’t been as exposed to market forces as other well-known companies.

While other companies’ share prices tumbled in 2022, Johnson & Johnson’s price went down by under 4%. That’s significant when many companies have measured their drops in double-digit percentages.

The pharmaceutical company has also offered a reasonable dividend of between 2.5-3% over the last five years. Considering the current economic climate, that potentially makes Johnson & Johnson one of the best stocks to buy now.

| 12 Month Performance | -10.48% |

| Five Year Performance | 13.41% |

| Price-to-Earnings (P/E) Ratio | 22.5 |

| Dividend Yield | 2.98% |

7. Enphase Energy (ENPH) – Rapidly-Expanding Solar Energy Company

Enphase Energy is one of the most popular new stocks to emerge in the past few years, generating returns of over 22% in the 12 months since March 2022. Most of Enphase Energy’s focus is on developing and manufacturing solar inverters and battery energy storage, which will play a crucial role in the global decarbonization effort.

The company is performing admirably from a financial perspective, increasing revenue by over 68% in 2022. Remarkably, during the same period, Enphase Energy’s net profit rose by 173%, which suggests the company has a solid outlook.

Notably, Enphase generated a free cash flow (FCF) of $237 million in Q4 2022, which has provided the resources needed to acquire smaller companies operating in the industry. Due to this aggressive strategy, many analysts are touting Enphase Energy as one of the top solar energy stocks on the market right now.

As the world moves towards greener forms of energy, Enphase could be one of the best shares to buy today.

| 12 Month Performance | 22.89% |

| Five Year Performance | 4,353% |

| Price-to-Earnings (P/E) Ratio | 76.78 |

| Dividend Yield | 0% |

8. Rio Tinto (RIO) – Huge Mining Company with International Operations

Rio Tinto is a metals and mining company founded in 1873 that has grown exponentially over the past 149 years. RIO shares are listed on the LSE and the ASX, whilst the NYSE offers an ADR linked to the company. At the time of writing, Rio Tinto is one of the largest mining companies globally, just behind Glencore and BHP Group.

One of the main reasons that RIO shares are so popular is that many of the company’s commodities, such as lithium and copper, are critical inputs for making batteries for electric vehicles (EVs). Considering the electric vehicle market is projected to value around $823bn by 2030, these commodities could play a key role in Rio Tinto’s revenue generation.

Although the company’s free cash flow and revenue dropped in the first half of 2022, it still maintains nearly $300m in cash reserves. Rio Tinto did reduce its interim dividend by more than 50% on the back of these figures, although the new yield is still higher than the FTSE 100 average at 6%. That means it still ranks as one of the best UK shares for dividends.

| 12 Month Performance | 6.61% |

| Five Year Performance | 54.61% |

| Price-to-Earnings (P/E) Ratio | 10.24 |

| Dividend Yield | 6% |

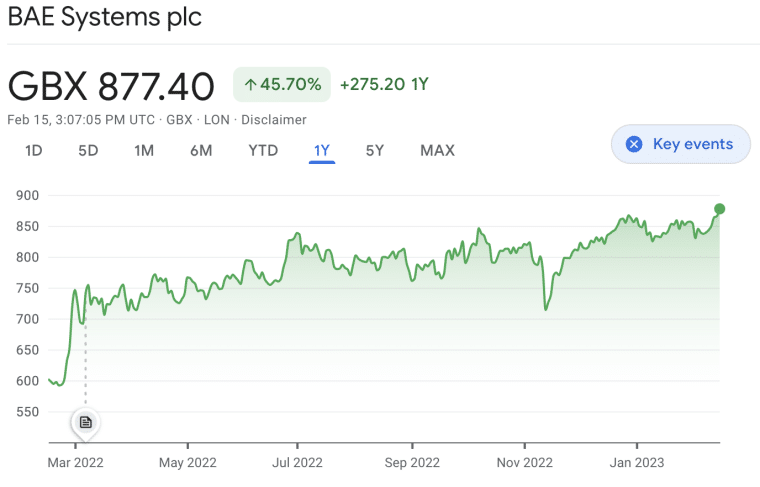

9. BAE Systems (BA) – Popular Defense Contractor with Regular Dividend

According to some analysts, BAE Systems is one of the best shares to invest in in the UK. That analysis is backed up by the growth the share price has had over the last 12 months, with a 26.98% increase from March 2022 to 2023.

BAE Systems is a UK-based defense contractor and one of the world’s largest suppliers of arms. Most of BAE System’s operations are based in the UK and the US, although the company also has a foothold in Australia, Canada, and the Middle East.

BAE shares have been attracting attention recently due to the ongoing war between Russia and Ukraine. This has led to increased defense spending by many Western nations – which is excellent news for BAE Systems’ revenues.

For example, The Guardian notes that UK defense spending could reach £100bn by 2030, which would likely see huge numbers of drones and jets purchased from BAE Systems. That could potentially make BAE Systems one of the best FTSE 100 shares to buy now. Finally, the company even provides a solid dividend yield of 2.94%, which will appeal to passive income investors. Since BA. shares are listed on the London Stock Exchange (LSE), they can be easily bought using most stock trading apps.

| 12 Month Performance | 26.98% |

| Five Year Performance | 57.04% |

| Price-to-Earnings (P/E) Ratio | 18.21 |

| Dividend Yield | 2.94% |

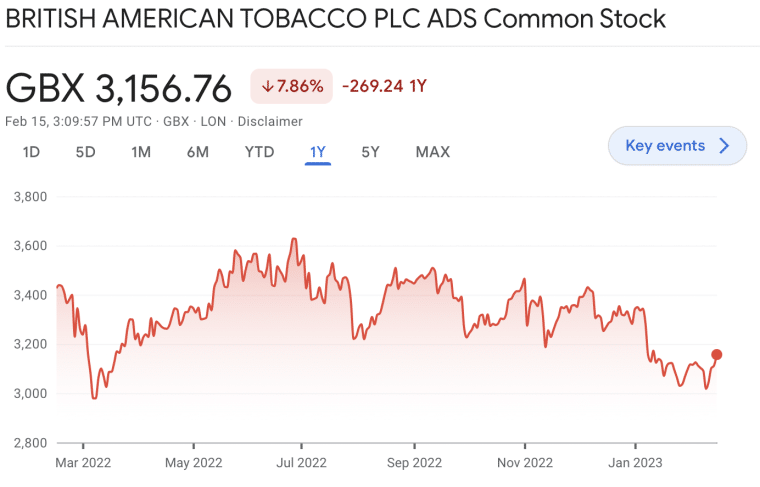

10. British American Tobacco (BATS) – Well-Known Tobacco Company with Solid Branding

As its name suggests, British American Tobacco is a UK-based tobacco company that manufactures cigarettes and other nicotine-based products. According to Statista, British American Tobacco is the third-largest tobacco company in the world and boasts a market cap of around £70bn.

British American Tobacco has exceptional staying power, evidenced by its products being available in 180 countries worldwide. The main reason for the company’s success is its brand strength since it owns numerous leading cigarette brands, including Lucky Strike, Pall Mall, and Dunhill.

The company has also expanded into the vaping market and owns Vuse, one of the world’s most popular e-cigarettes. Finally, BATS shares also offer an impressive dividend yield of 7.30% – one of the top 10 highest yields on the FTSE 100.

| 12 Month Performance | 0.12% |

| Five Year Performance | -27.61% |

| Price-to-Earnings (P/E) Ratio | 10.30 |

| Dividend Yield | 7.30% |

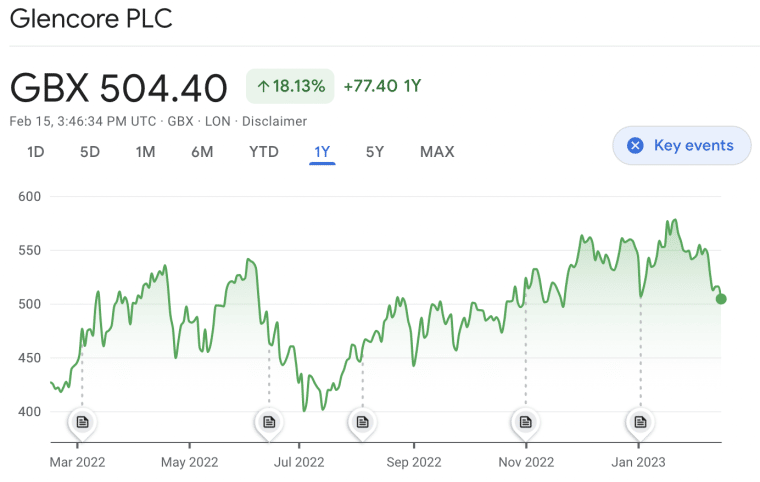

11. Glencore (GLEN) – Enormous Commodities Firm with Strong Financials

Concluding our list of the best shares to buy in the UK, as noted by equity analysts, is Glencore. Glencore is a multinational company involved in the metals and mining industry and has solidified itself as the world’s largest commodity trader.

Glencore is also extremely strong from a financial perspective, with the company announcing a massive $7.1bn payout to shareholders on the back of a strong Q4 2022. The company was also able to cut its debt down from $6 billion to just $75 million in a year.

Many of the commodities Glencore produces are involved in the production of ‘green’ energy, like wind and solar power. As such, demand for these commodities will increase over the coming decade as countries worldwide look to become more sustainable – which is excellent news for Glencore’s future revenue and could make it one of the best shares to buy in 2023.

| 12 Month Performance | -3.76% |

| Five Year Performance | 20.18% |

| Price-to-Earnings (P/E) Ratio | 4.23 |

| Dividend Yield | 10.23% |

How to Find the Best Shares to Buy

Whether you’re looking for the best ways to invest £75k in the UK or are just interested in diversifying your portfolio, picking the right shares of stock to match your risk tolerance and budget is important. Even though more people than ever are opting to invest in Bitcoin and other alternative assets, shares still represent an excellent way for investors to generate a return over the long term.

Finding the best shares to buy in the UK will undoubtedly start with the best stock brokers UK. With that in mind, detailed below are some of the most effective strategies that investors can deploy when researching which shares to buy:

Understand the Macroeconomic Situation

When looking for the best shares to buy right now in the UK, the most important thing investors must do is understand the macroeconomic situation. By doing this, investors can identify which sectors are likely to be hampered by the prevailing conditions – and which may be resistant.

For example, rising interest rates mean that companies with substantial debt burdens are now in a precarious position since these debts will become more expensive to service. On the other hand, banking stocks may benefit from rising interest rates, as their lending margins will increase – leading to greater interest income.

Use Reputable Financial Media Outlets

Investors can also find shares to buy by conducting analysis using leading financial media outlets. Outlets like the Financial Times and Bloomberg are great tools for investors, as they showcase accurate data which can inform investing decisions.

Moreover, these outlets also provide objective market updates, which enable investors to keep tabs on current trends. Combining this information with other forms of analysis can help illuminate assets with high value potential.

Review the Company’s Financials

The best shares to invest in in the UK can also be found by conducting an in-depth analysis of the financials of different companies. Although a company’s stock price is typically shaped by supply and demand forces, it can also be affected by metrics like net income, earnings per share (EPS), and net debt. For an example of how to examine a company’s financials, you can read our article on how to buy Amazon shares in the UK.

The most effective way to gain insight into a company’s financial position is to review its earnings reports. These are released either quarterly or bi-annually and reveal critical information like revenue, profits, and margins. By comparing the data in one quarter with the data that was released in the same quarter a year previous, investors can determine whether a company is growing or not.

Seek Out High-Growth Industries

According to analysts, many of the best UK shares to buy now are in high-growth industries. As the name implies, these are industries that are growing at a faster-than-average pace, meaning that companies involved in these industries tend to be performing well.

Some examples of high-growth industries at the time of writing include electric vehicles, casinos, and commercial aircraft manufacturing. Although not all companies operating in these industries will be successful, it’s often a good idea to analyze the top performers and determine whether they represent an effective investment opportunity.

Utilize Social Media

Finally, investors can also uncover shares with high price potential by using social media. Platforms like Reddit and Twitter have become meeting places for retail traders to discuss trending stocks – which tends to create a snowball effect of momentum.

However, it’s important to note that the information presented on these platforms is subjective, so it may be biased. Thus, investors would be wise to combine the insights they receive on social media with other forms of analysis to ensure potential trade ideas have a high chance of success.

Another trending stock on the market is GOOGL. The company has faced scrutiny over the growth of AI tech and how that may or may not impact its core search business over the next few years. For further details on Alphabet, read our article on how to buy Alphabet shares in the UK.

Latest UK Stock News

- March 10 – Silicon Valley Bank, which serves mainly businesses in the US, is taken over by regulators in the US after a bank run. Fears mount of a wider banking system collapse.

- March 12 – US regulators announce that all funds held in SVB will be secured by the government via a new Bank Term Funding Program.

- March 13 – HSBC and the UK government announce that HSBC will purchase SVB UK for £1 in a bid to secure UK tech companies.

- March 13 – Government intervention over the weekend looks to have staved off a larger bank run, and banking stock prices recover after huge losses.

Best Shares to Buy in the UK – Conclusion

To conclude, this article has presented a selection of the best shares to buy in the UK, as reported by various leading analysts. Although none of these shares can guarantee a positive return, they may offer investors a ray of hope in today’s testing market conditions.

One of the best recommended alternatives to shares in 2025 is Love Hate Inu – a new cryptocurrency currently on presale. Love Hate Inu is a vote-to-earn cryptocurrency platform that allows users to earn free tokens by staking $LHINU, the native token, and participating on meme polls.

$LHINU is currently priced at $0.00009, during its second presale round. In just a few weeks of the presale launch, Love Hate Inu has raised more than $1.2 million.

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens