Penny stocks are an attractive, albeit risky, trading option for investors who hope to make huge returns. Originally classified as stocks that traded for less than $1, hence the name “penny,” this type of stock is now considered to be any share that trades for less than $5.

While penny stocks have had a controversial history, the modern under $5 definition means some surprisingly respected and notable companies are, by definition, penny stocks. In the past, penny stocks could typically only be traded via OTC transactions, and the companies weren’t listed on traditional exchanges. However, all of the penny stocks we have featured on this list trade on a major exchange.

So let’s take a look at some of the most popular penny stocks in 2025.

Top Penny Stocks to Watch in 2025

- Blackberry – The former smartphone king is making interesting moves in cybersecurity.

- Oatly – The biggest brand in non-dairy milk.

- Grab Holdings – The Uber of Southeast Asia.

- GrafTech International – Industrial materials manufacturer in the electric vehicle supply chain.

- Genworth Financial – S&P 400 insurance company.

- Nano Dimension Ltd – 3D printing specialist for electronics manufacturing.

- Sunworks Inc. – A small solar power company providing panels and batteries.

- Globalstar – Satellite phone and data communication provider.

- Zynerba Pharmaceuticals Inc. – Cannabinoid-based pharmaceutical company targeting rare disorders.

- Tilray Brands Inc. – Cannabis brand with a wide array of products.

A Closer Look at the Popular Penny Stocks

Those looking for the most popular penny stocks can analyze the different options and make a decision on their investment opportunities. It’s always wise to do research when buying any stock, but that is doubly true for penny stocks.

Let’s get started with our picks of the popular penny stocks to buy as we move further into 2025.

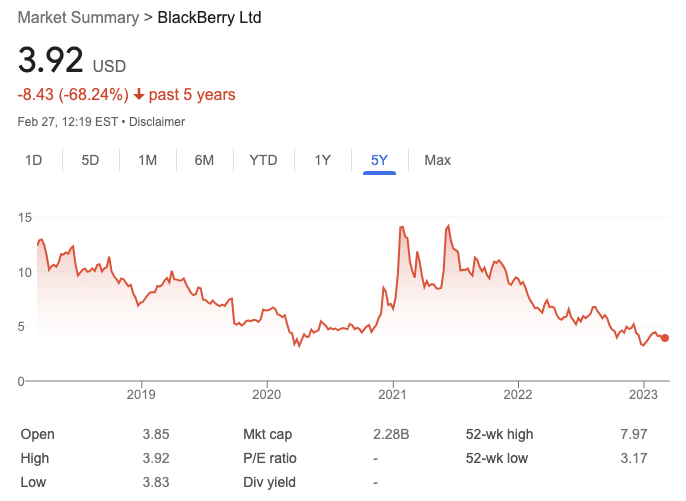

1. BlackBerry (BB) – Best Big Name Penny Stock

Blackberry has fallen a long way from its heyday in the early 2000s. Far from its one-time valuation of $137 per share in 2008, the company’s stock now dips in and out of penny stock territory on a regular basis. As of February 2023, the BlackBerry stock price sits at just under $4, up from a three-month low of $3.18 at the end of December.

BlackBerry stock hit a three-year high of $14.10 in January 2021, on the back of the Reddit meme stock craze that engulfed stocks like GameStop, and AMC.

It’s well known that Blackberry fumbled the transition to touchscreen smartphones after the introduction of the iPhone. What isn’t quite so well known is what the company has been doing since then.

The company has pivoted away from its once sector-defining phone business and is now focused on enterprise cybersecurity. This less flashy area of business isn’t making the company as much money as it used to, but financially Blackberry is working its way back to profitability.

In 2022, Blackberry had a net profit of $12 million which doesn’t sound like a whole lot, but that was a massive turnaround for the company. It had losses of $1.1bn in 2021 and $152m in 2020.

If Blackberry’s pivot is successful, it could be the best penny stock of 2023.

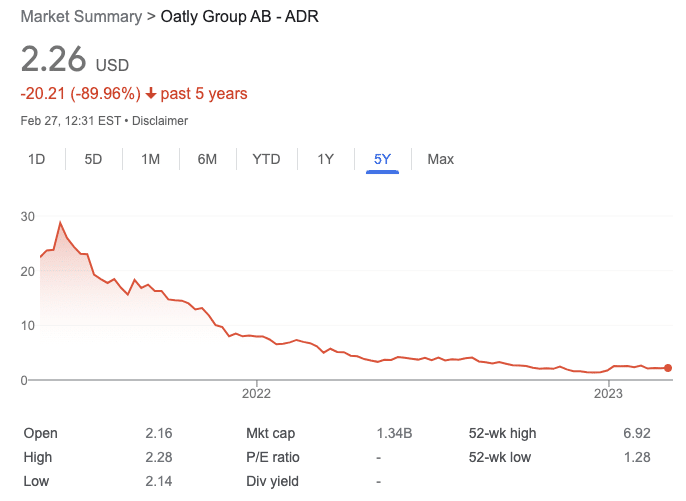

2. Oatly (OTLY) – The Biggest Name in Oat Milk

The premiere oat milk company Oatly is arguably the biggest name in non-dairy milk. The Swedish company was one of the first oat milk companies to make an impact when it launched in the US in 2016. However, since then, competitors have risen up, and Oatly has struggled to ramp up its production.

The Oatly stock price peaked at $28.73 just weeks after its IPO in 2021. Unfortunately for investors who bought into the company back then, the stock price has fallen by over 90% in the last two years.

At a price of $2.14 in February 2023, it seems like the only way Oatly can go at this point is up. As of 2022, the company still retained around 22% of the oat milk market in the US. It’s projected that the non-dairy milk industry will increase from $25bn in 2022 to $61bn in 2029. The question is, can Oatly grow its business sustainably, increasing profits during that time?

If Oatly can get a handle on its production woes, reduce its expenses, and make it to profitability, the company could be a very good stock to buy right now.

3. Grab Holdings (GRAB) – Southeast Asia’s King of Ride Sharing and Delivery

Grab is virtually unheard of in the US and Europe, but visit Southeast Asia, and you’ll see the green bags, stickers, and signs representing the company nearly everywhere you look. Grab operates in much the same way Uber does in the US. The company’s app provides ride-sharing, food delivery, and payment services.

As the biggest start-up in Southeast Asia, it might be somewhat surprising to see that Grab is a penny stock. After all, US equivalents like Uber and Lyft trade for around $33 and $10, respectively. Grab stock, on the other hand, can currently be purchased for just $3.

Don’t let the stock prices alone fool you, though. While Lyft is a $10 stock, its market cap is just $3.75bn compared to Grab’s $11.77bn.

The main reason for the low Grab stock price is that despite the company’s size and prevalence throughout Southeast Asia, it has been hemorrhaging money. Grab lost $3.45bn in 2021, $2.61bn in 2020, and $3.75bn in 2019.

Despite its losses, analysts are cautiously optimistic about the forecast for Grab stock. Grab currently has a 12-month price target of $4.24 and analyst recommendations of Buy or Strong Buy. If Grab can grow its way into profitability, it could be the best penny stock to buy right now.

4. GrafTech International (EAF) – Industrial Manufacturer in the Electric Vehicle Supply Chain

Another popular penny stock to consider is GrafTech International. GrafTech International is a US-based manufacturer of graphite electrodes and petroleum coke – both of which are critical components of the steel-producing process. Excitingly, Graftech is also one of the largest producers of key components used in electric vehicle batteries. Although GrafTech is headquartered in Ohio, the company operates throughout Europe, South America, and Canada.

Many analysts consider GrafTech one of the most popular cheap stocks to buy since it is directly involved in the rapidly-growing process of electric-arc steelmaking. This process is considered much more eco-friendly than ‘traditional’ processes – all whilst being even more cost-effective.

At the time of writing, the GrafTech share price is hovering around the $5.65 level – an 18.70% increase from the beginning of the year. The company is still growing financially. Graftech went from nearly $8m net profit in 2017 to $854m in 2018, although it hasn’t been able to match that level since. The company has posted decreasing but still healthy net profits since then, with 2022’s net profit the smallest decrease yet, from $388m in 2021 to $382m in 2022. Suggesting that the company is finding its footing.

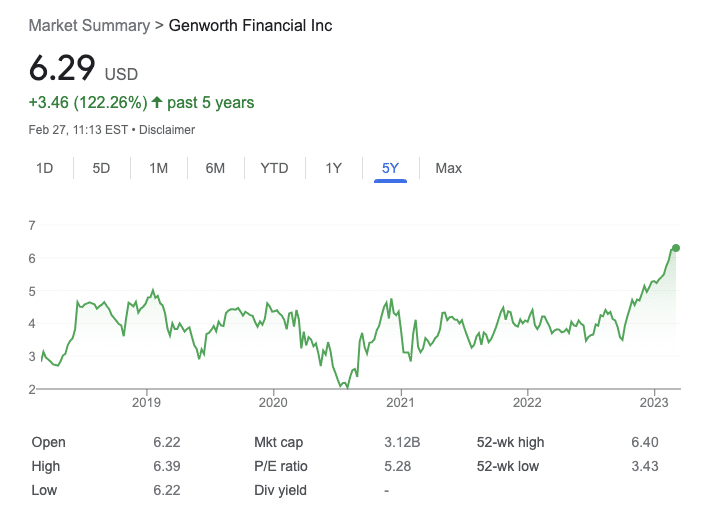

5. Genworth Financial (GNW) – S&P 400 Insurance Company Growing Away From Penny Stock

Genworth Financial is a US-based insurance company that is a constituent of the S&P 400 index. The company offers a wide array of services, including long-term care insurance, mortgage insurance, and annuities. According to Google Finance, Genworth Financial has a market cap of $3.12bn at the time of writing, with shares hovering around the $6.29 level.

Genworth Financial makes our list because the company has become much leaner in recent years. After the deal between Genworth and China Oceanwide Holdings fell through, the company decided to offload several of its businesses, drastically cutting costs. In turn, this has helped Genworth reduce its debt burden substantially.

From a financial perspective, Genworth brought in over $7.5bn in revenue in 2021 and 2022. Moreover, the company is consistently profitable and currently has a net profit margin of just under 10%. Given that Genworth is one of the few providers of long-term care insurance, the company is in a prime position to benefit from the ‘aging’ of the US population.

6. Nano Dimension Ltd (NNDM) – 3D Printing Specialist for Electronics Manufacturing

Based in Israel, Nano Dimensions is a 3D printing specialist that provides software and hardware to speed up electronics manufacturing. The company specifically targets the prototyping phase of traditional production timelines using Deep Learning AI.

A single Nano Dimension share is currently priced at $2.92. Since its meteoric rise in early 2021, when it hit $15.54, the share price has fallen considerably. This is a common issue with hi-tech companies coming to market. What has not helped the price are the acquisitions of Global Inkjet Systems and Essemtec in the last 12 months.

On 24th January 2022 and again on 14th March 2022, the price dipped to just under $3 and then rocketed upwards to exceed $3.90. The stock looks to be on its way back up, though, since the start of 2023, the Nano Dimension share price has risen by over 26%.

7. Sunworks Inc. (SUNW) – A Small Solar Company with Big Potential

Based out of Roseville, California, Sunworks is involved in the booming solar power sector. The firm sells photovoltaic systems to local companies in the industrial and agricultural sectors.

Sunworks employs over 500 staff and has a market capitalization of $65.45m. This is a high ratio of staff-to-market cap, and suggests that restructuring might be one of many ways to improve profitability.

Sunworks’ revenues increased by over 150% between 2020 and 2021, from $37.9m to $101m. However, this had no impact on the stock price, which has endured a steady decline since its January 2021 high of over $25. At the time of writing, each SUNW share is valued at just $1.85.

Ultimately, investing in Sunwork represents a bet on a small solar energy company that may not boast the highest management or financial performance. However, like many growth stocks, momentum slowed in 2022 due to the high-inflation environment. As a result, easing inflation in 2023 could see the company return to a trajectory of growth.

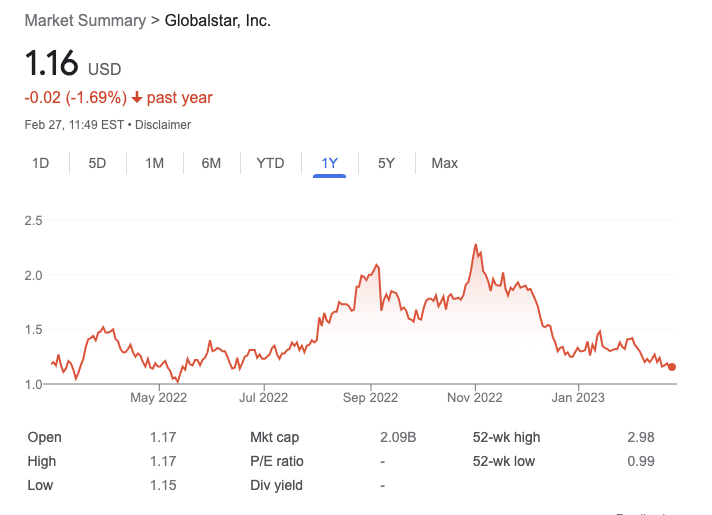

8. Globalstar (GSAT) – Satellite Communication Company with a Huge Market Cap

Founded in 2003 and based out of Covington, Louisiana, Globalstar is a US satellite communications company. The firm has a network of satellites and ground stations that serves roughly 775,000 subscribers across a range of sectors, including energy, forestry, and public safety.

Unusually for a penny stock, Globalstar has a significant market capitalization of $2.09bn. It has a reasonable price/sales ratio of 14.79. Meanwhile, quarterly revenues increased by 15.3%% in Q3 2022 to $37.63m, although gross profit decreased by 24%

Moreover, after recording net income deficits of over $100m in 2020 and 2021, Globalstar is clearly in some trouble. The GSAT price hit a 2022 low of $0.92 on 24th February. Since then, the share price soared to $1.80 in October 2022 and sits at $1.16 as of 27th February 2023.

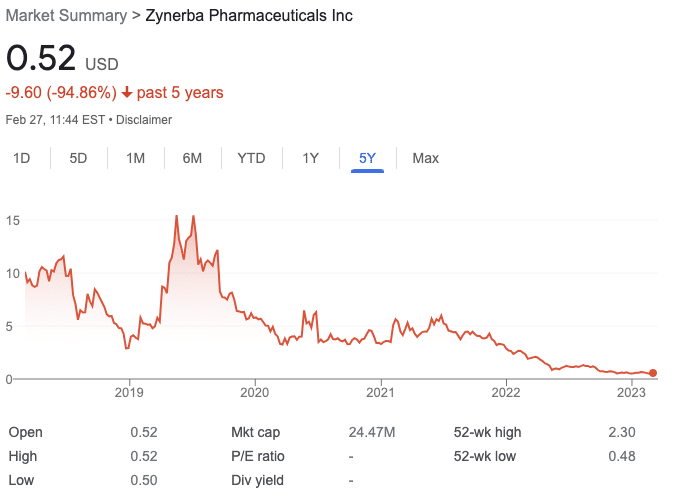

9. Zynerba Pharmaceuticals Inc. (ZYNE) – Cannabis Pharmaceutical Company with Promise

Headquartered in Pennsylvania, US, Zynerba is a specialist cannabis-related company. The firm exclusively serves the US healthcare sector. Zynerba tackles rare diseases by developing formulations that are applied to a patient’s skin and provides pain relief. For example, Zynerba has developed an experimental treatment called Zygel which is a patent-protected gel containing pain-relieving cannabinoids.

Despite massive initial interest in cannabis stocks from the markets, the enduring problem for all cannabis-related companies in the US is that cannabis remains illegal at the federal level. Since 2018, Zynerba has been in a research and development phase. It thus recorded no revenue and significant net income deficits for 2018-2021. This is usual for a company engaged in product development in a new sector.

Zynerba stock is currently priced at just $0.52 per share, with a market cap of just over $24.47m – making it the smallest company on our list.

10. Tilray Brands Inc. (TLRY) – Cannabis Brand with Excellent Diversity of Products

Founded in 2013, Tilray Brands is headquartered in Nanaimo, Canada. Unlike fellow cannabinoid provider Zynerba, the firm produces and exports medical cannabis as well as cannabis foods and beverages for general consumption. Tilray Brands was the first licensed producer of medical cannabis in the world to gain certification in line with European Medicine Agency standards. The firm has operations in Canada, the US, Europe, Australia, and Latin America.

A Tilray share hit an all-time high of $214.06 on 19th September 2018, but has remained under $29 since February 2021 and sits at $2.80 as of February 2023.

Tilray is an established firm with firmly-rooted international operations. However, its prospects rely on the federal legalization of marijuana in the US – something that is still hotly debated in congress.

What are Penny Stocks?

The old-fashioned definition of a penny stock is a share in a company that is valued at less than one dollar. In the past, these types of stocks could typically only be purchased outside of the big exchanges. This was known as buying over-the-counter (OTC).

These types of penny stocks were incredibly risky and are what most people think of when they hear the term. However, the definition has changed in recent years.

What is a Penny Stock Today?

The modern definition of a penny stock is a share in a company that is priced at less than $5 — or features on the NASDAQ Capital Markets tier as a small-cap company. There are far more companies that fit this broader definition, and there are many, including all of the ones mentioned in this article, that do feature on major exchanges like the NASDAQ and NYSE.

Why Invest in Penny Stocks?

Penny stocks offer some of the biggest potential growth of any asset class. However, with that potential comes a lot of risks. Penny stocks are much more prone to volatility than regular blue chip stocks.

It’s not just volatility to watch out for either, the possibility of a penny stock dropping quickly, and even dropping to zero is quite real.

One of the Best Penny Stocks of all Time

So why would anyone invest in penny stocks? Some of the biggest stocks today were, at one time or another, penny stocks. As recently as 2015, AMD was a penny stock. The company was on the brink of financial disaster, but that all turned around with the wildly successful release of its 2017 Ryzen CPUs. The processors set the company on a path to where it is today, as a major global chip designer once again.

A $10,000 investment in AMD in February 2015 would be worth a whopping $251,000 today. That’s an incredible rate of return and a good example of why people invest in penny stocks. The risks are big, but so are the potential rewards.

Things to Keep in Mind When Investing in Penny Stocks

As mentioned, the risks to penny stock trading are higher than in other kinds of stock. Not every penny stock is going to turn into an AMD. In fact, the majority are, statistically speaking, likely to lose money.

That’s why it is incredibly important to research a penny stock thoroughly before investing. Research is important when buying any stock, but as the risk with penny stocks is higher, it’s best to be even better prepared than normal.

Check the financials of a company before investing. Many penny stocks are cheap because the company has gone through some kind of financial turmoil. Questions to ask yourself are: Is the company on a path to profitability? Why is the stock cheap in the first place? What are the risks to this company specifically?

The Financial Health of a Penny Stock

Some stocks may be cheap because of financial woes that happened in the past, but that’s not necessarily the future. A company with a history of financial issues increasing revenue, growing profit margins, or reducing costs could be back on its way to growth.

If the company you’re looking at is financially stable, it could be a good investment.

Why is a Company a Penny Stock?

The next thing to consider is why is this company a penny stock. It could be that the company has a low share valuation but a huge market cap. In that case, it being a penny stock is less of a warning sign.

Another reason is investor sentiment. Some of the stocks featured in this article had huge valuations as recently as one or two years ago. If that’s the case, research what spooked investors and caused the downward spiral.

If you’re confident that the reason the company you’re looking at is a penny stock is something other than serious financial difficulties, it could be a good penny stock to buy.

Is This Penny Stock Company at Risk?

The final key point to consider before investing in a penny stock is whether the company in question is at risk. This could be from any number of factors. One of the key reasons why Cannabis stocks tumbled in price was because of their over-saturation. That means the market is incredibly competitive, and picking a winner becomes more difficult.

In that case, it’s important to identify why the company you are looking at will beat the competition. What edge does it have? What does it have that no other company does?

Investing in any penny stock can be risky but it’s possible to minimize that risk by considering all of the above carefully.

Where to Buy Penny Stocks

If you’re wondering where to buy stocks priced at around $5 and below, there are several popular stock brokers that support this asset class.

XTB – A Great Platform for an Introduction to Penny Stocks

XTB is one of the best trading platforms for beginners, which makes it a great place to experience trading penny stocks with no risk. The XTB demo account gives users £100k of virtual money to practice buying and selling stocks without risking actual money.

That makes it an excellent resource for anyone who wants to practice buying penny stocks before risking any real money. Since penny stocks are higher risk than bigger, more well-established shares, it’s a wise move to practice with fake money first.

XTB also offers beginner articles and eBooks on a wide variety of trading and investing information. That means you can read up on anything you’re unsure about and put that new knowledge into practice on either the live platform or through a demo account.

XTB also offers a wide range of stocks, including small-cap companies, like the ones we’ve mentioned in this article.

Setting up an account on XTB is easy, and deposits in Euros, Dollars, and British Pounds are all free of charge with a debit/credit card or bank transfer.

Your capital is at risk.

How to Buy Penny Stocks

Now that we’ve covered some of the best penny stocks to buy today let’s take a closer look at how to buy shares in any of these companies. All of the shares mentioned in this article can be purchased on XTB. We think it’s the best place to buy penny stocks because of the low spread and ease of use.

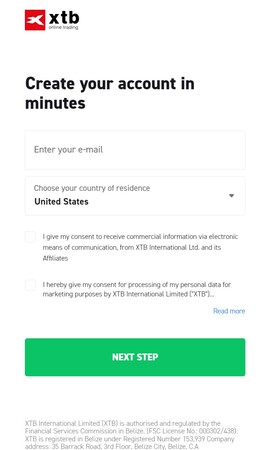

Step 1: Open an XTB Account

To begin, head to the XTB site. Fill out the sign up form with personal information, including income and finances and your phone number for verification purposes.

Your capital is at risk.

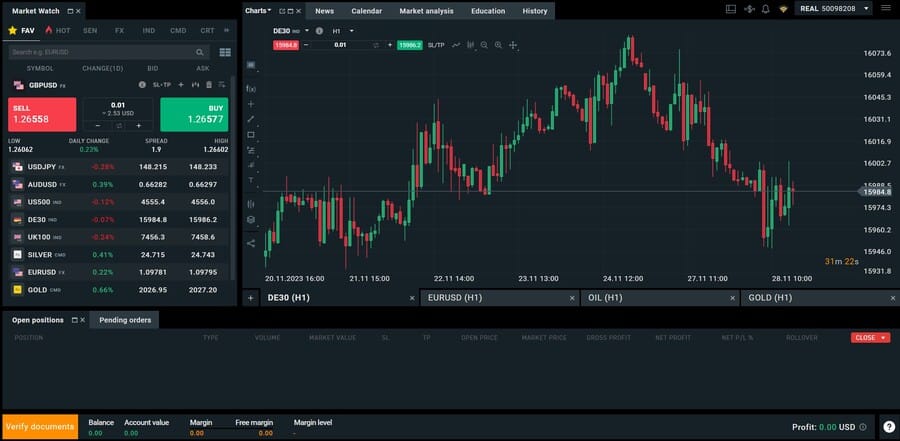

Step 2: Verify your ID and Deposit Funds

You’ll be instantly greeted with XTB’s trading platform. Verify your ID after you open your account. You can upload your passport or ID card. Deposit funds from your account dashboard when ready.

Step 3: Buy Penny Stocks

After depositing funds, all that remains is to purchase your chosen penny stock. Search for your chosen penny stock, and the dedicated page for the company will appear.

Conclusion

Penny stocks can be an effective way for users to diversify their portfolios. That’s especially true when using a low-cost trading platform such as XTB.

Our top three penny stocks are BlackBerry, Oatly, and Grab. All three companies face uphill battles towards profitability, but when considering penny stocks, we’re not necessarily looking for which is safest. We’re looking at which has the biggest potential upside.

All three of these companies have the potential for massive growth in the coming years as they each mature within their respective industries. That’s why those three top our penny stock list.

FAQs on the Popular Penny Stocks

What are Penny Stocks?

Which stocks are penny stocks?

How do penny stocks work?

How can I buy penny stocks?

What is the cheapest penny stock?

What are popular Penny Stocks?

Which penny stock is best?

Can penny stocks be profitable?

Is it a good idea to invest in penny stocks?

Do penny stocks ever succeed?

Read More:

- How to Invest in Stocks Online for Beginners

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks