Oil is a popular performing asset classes in 2025. In fact, since hitting lows of under $20 per barrel in 2020, oil has increased in value by over 1,000%.

In this guide, we discuss the 10 popular oil stocks and how to complete your investment at a commission-free broker.

The 10 Popular Oil Stocks to Watch 2025

The 10 companies outlined below represent the popular oil stocks to invest in.

- ConocoPhillips

- Marathon Petroleum

- Antero Resources

- ExxonMobil

- BP

- Phillips 66

- Chevron

- Halliburton

- Shell

- China Petroleum

When it comes to buying stocks for the first time, you need to ensure that you’ve researched the markets and historical data thoroughly. Before making a decision on which oil stocks are right for your portfolio – be sure to read our in-depth analysis.

A Closer Look at the Popular Oil Stocks to Watch

Just because oil as a commodity has seen its value increase ten-fold since the pandemic began, this isn’t to say that all companies operating in this sector are worth looking at for your portfolio.

As such, researching the popular oil stocks for 2025 is crucial to ensure that you are making smart investment decisions. The sections below review the 10 popular oil stocks in 2025.

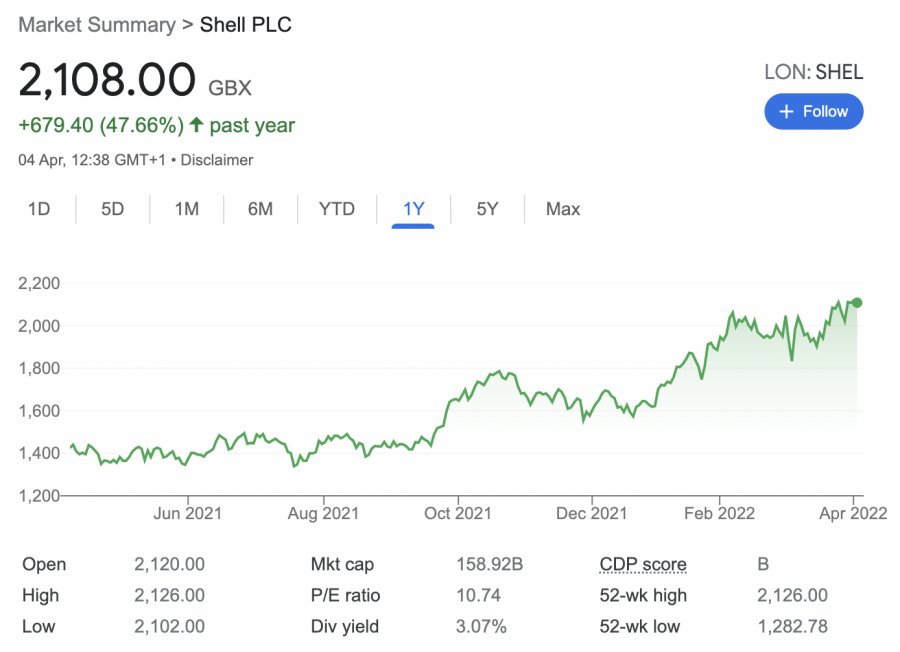

1. ConocoPhillips

One of the popular oil stocks is ConocoPhillips. Founded in 2002, ConocoPhillips is a major US-based oil company with its stock listing on the NYSE. The firm operates in over a dozen global regions – including but not limited to Norway, Malaysia, Australia, and Canada.

Domestically, Founded in 2002, ConocoPhillips is a major US-based oil company with its stock listing on the NYSE. Domestically, ConocoPhillips has a strong foothold in the Texas oil scene.

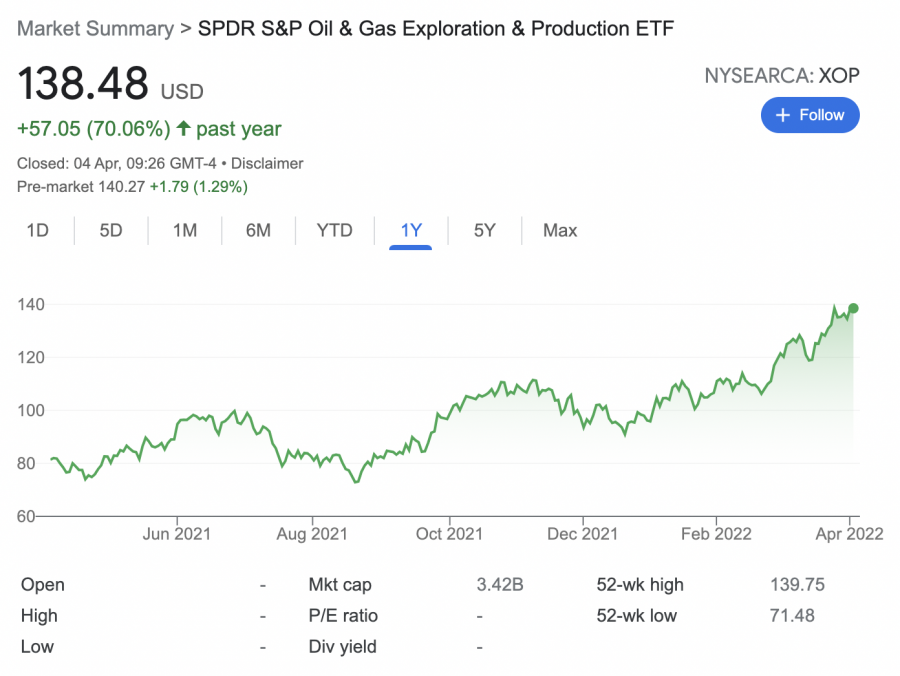

For example, over the prior five years, the SPDR S&P Oil & Gas Exploration & Production has declined in value by 7%. In comparison, and during the same period, ConocoPhillips stock has increased by 103%. Over the prior 12 months, ConocoPhillips stock has risen by 92% in comparison to the 70% gains generated by the SPDR S&P Oil & Gas ETF.

ConocoPhillips has a solid dividend program in place. As of writing, the firm is offering a running dividend yield of 2.33%. Moreover, the company has a P/E ratio of 16.5 times as of writing.

2. Marathon Petroleum

Founded in 2009, Marathon Petroleum is another US-based oil stock. Specializing in both crude oil and gasoline. Marathon Petroleum is one of the largest wholesale suppliers in this industry. As per its most recent earnings report, Marathon Petroleum now has the capacity for producing nearly 3 million barrels of crude oil per day.

This is especially crucial in the current economic climate, where demand for oil far outweighs supply. In terms of its stock price performance, Marathon Petroleum shares are up nearly 70% over the prior five years. Over a 12-month period, the stocks have increased by 57%. As such, this highlights that much of the firm’s recent growth has been achieved in the prior year.

Marathon Petroleum stock has a dividend yield of over 2.7%, as of writing. Perhaps the main drawback with this oil stock is that based on prices as of writing, Marathon Petroleum is carrying a huge P/E ratio of nearly 42 times.

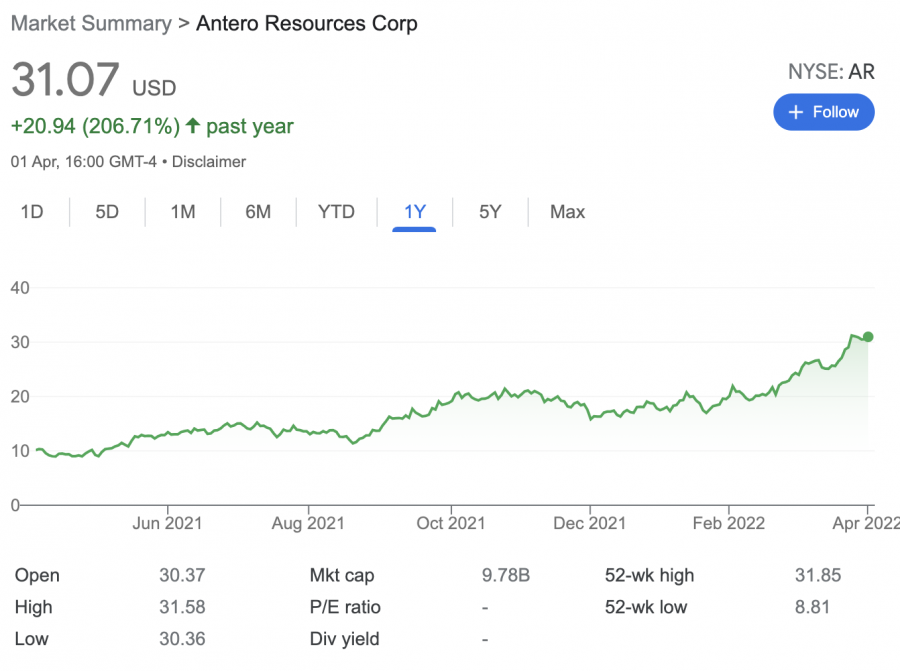

3. Antero Resources

Antero Resources has outperformed the broader market by a considerable amount in recent years. In fact, over the prior 12 months alone, Antero Resources stock has witnessed gains of over 200%.

Founded in 2002, Antero Resources specializes in the exploration of hydrocarbon via fracking technologies. Its suite of natural resources is vast – with Antero Resources involved in the extraction of natural gas, petroleum, ethane, and more.

Although Antero Resources is enjoying a strong upside momentum, it is important to note that the stock is over 40% down from when it first listed on the NYSE back in 2013.

Antero Resources do not pay a dividend. On the other hand, as of writing, the firm is still carrying a market capitalization of under $10 billion.

4. ExxonMobil

Founded in 1999 through the merger of Exxon and Mobil, this US-based stock is a major producer of oil and has. Listed on the NYSE with a huge market capitalization of over $350 billion, ExxonMobil is one of the largest oil stocks in this industry.

As of writing, the oil and gas giant is offering a running yield of over 4.2%. With that said, this is somewhat lower than the 7-8% that ExxonMobil was offering in 2021. Nonetheless, ExxonMobil has a P/E ratio – which stands at just over 15 times as of writing.

In terms of its stock market performance, ExxonMobil shares have increased by more than 47% over the prior 12 months. Over a 5-year period, the shares have remained virtually flat – with growth of just under 1%.

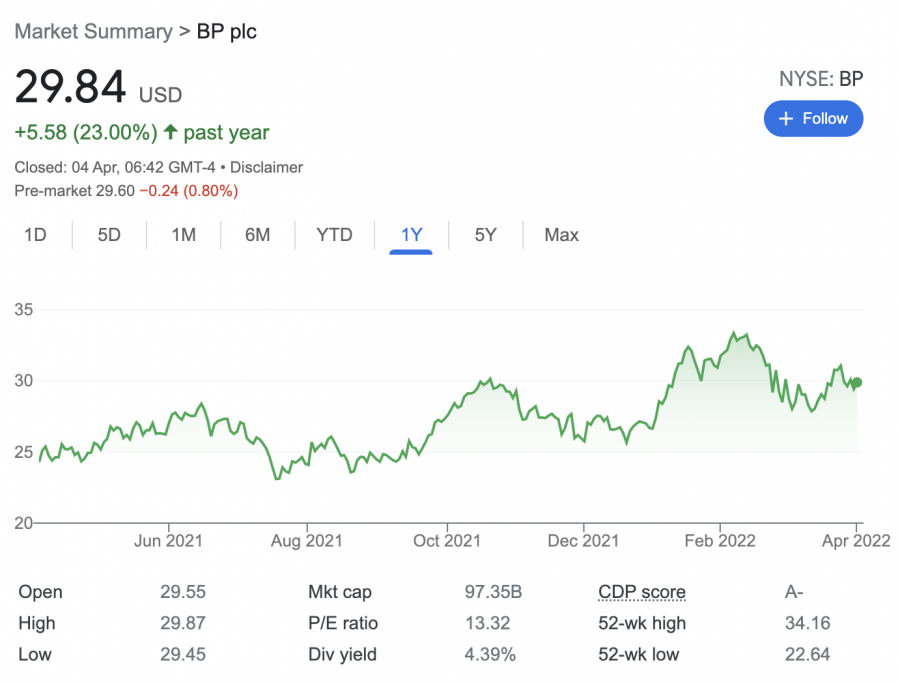

5. BP

BP is a UK-based oil and gas stock with its primary listing on the London Stock Exchange. The firm has had a rocky ride in the markets ever since its Deepwater Horizon scandal – which has resulted in BP paying fines worth over $70 billion since 2010.

First and foremost, BP is carrying a P/E ratio of just over 13 times. As such, this potentially indicates that the oil stock can be purchased at a favorable entry price. Second, As of writing, BP is paying a running dividend yield of nearly 4.4%. Over the prior 12 months of trading, BP stocks are up 23%.

In comparison to the broader oil and gas markets, this is below par. Moreover, BP shares are down nearly 15% over a 5-year period. However, BP is still a major player in the global oil sector.

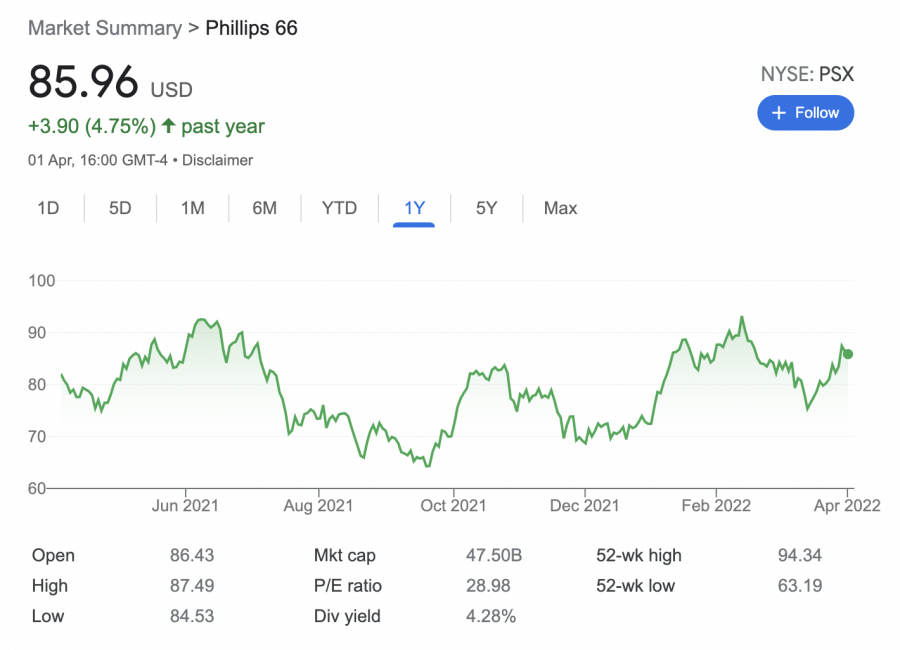

6. Phillips 66

On the one hand, it should be noted that Phillips 66 has, just like BP, underperformed the broader market in recent years. However, what Phillips 66 does offer for your portfolio is long-term stability.

As of writing, this oil stock will get you a running dividend yield of over 4.2%. Moreover, Phillips 66 has initiated various share buyback schemes over the past decade.

This firm has some of the lowest operating costs in the US refinery space. Moreover, when buying Phillips 66 stock, you will also be gaining exposure to the renewable energy industry. In terms of its performance, Phillips 66 stock is up just 5% and 11% over the prior one and five years, respectively.

7. Chevron

Founded in 1879, Chevron is one of the most established oil companies in the US. Fast forward to 2022 and the firm is now operational in more than 180 nations globally. In terms of its key markets, Founded in 1879, Chevron is one of the most established oil companies in the US.

Chevron has exposure to virtually every step of the global supply chain of oil. This includes everything from exploration and production to refining and logistics.

When it comes to recent performance, this oil stock has witnessed gains of over 57% in the prior 12 months. Over a 5-year period, however, Chevon stocks are up just 50% – which is far below the market average. On the other hand, Chevron is offering a 3.4% running dividend yield as of writing. Moreover, it has a P/E ratio of 20 times.

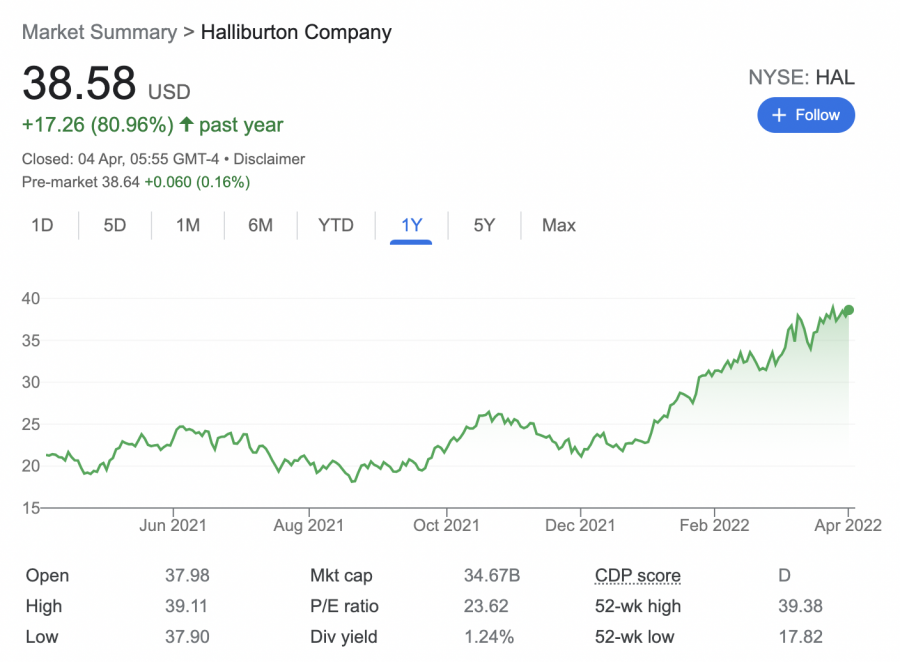

8. Halliburton

Next up on our list of the popular oil stocks for 2022 is Halliburton. This stock does not extract or produce oil itself. On the contrary, Halliburton is involved in providing products and services to the broader energy industry. In doing so, this ensures that conventional oil companies meet their exploration targets in a cost-efficient manner.

Founded in 1919, Halliburton stock is listed on the NYSE. As of writing, the firm is carrying a market capitalization of $34 billion, which, many market analysts argue is undervalued. Moreover, over the prior 12 months of trading, Halliburton stock has increased by more than 80%.

As noted earlier, the SPDR S&P Oil & Gas ETF has grown by 70% during the same period, which means that Halliburton continues to outperform the wider sector in the short term. With that said, Halliburton stock is down 22% when compared to five years prior. Finally, as of writing, Halliburton is offering a running dividend yield of over 1.2%.

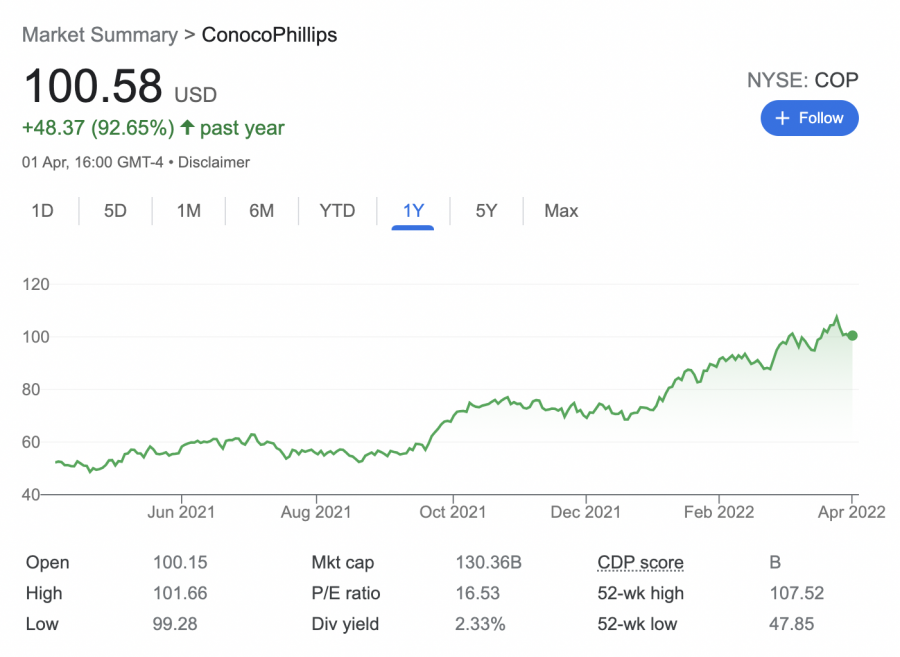

9. Shell

Shell is another popular oil stock which investors can research. In a nutshell, this oil and gas giant, based on prices as of writing, is carrying a P/E ratio of just over 10 times.

Furthermore, Shell has a running dividend yield of over 3%, as of writing. Looking at the recent performance of Shell, the oil stock has generated gains of more than 47% over the course of the past year. Over the prior five years, however, Shell stocks have decreased by a little under 2%.

If you want to gain exposure to this oil company – the shares have their primary listing on the London Stock Exchange.

10. China Petroleum

China Petroleum is the final oil stock we will be reviewing on this guide.

China Petroleum pays a running dividend yield of over 6.6% as of writing.

In addition to a dividend program, China Petroleum, based on prices as of writing, is carrying a small P/E ratio of just 7.4 times.

Alternatively, traders can research the best uranium stocks to watch in 2025 as the climate crisis continues to dominate the headlines especially with the recent COP27 climate change conference that held place in Sharm el-Sheikh.

Factors of Popular Oil Stocks

Now that we have analyzed the 10 popular oil stocks – we can take a closer look at what factors to evaluate when choosing popular oil stocks.

Performance vs Broader Oil Markets

Perhaps the first thing to assess when searching for the popular oil stocks 2022 is to look at how the company has performed against the broader market.

There are many ways in which you can do this. Albeit, a reference point is the previously discussed SPDR S&P Oil & Gas ETF. Put simply, this is one of the largest ETFs in the oil and gas industry – and it tracks a basket of leading companies that operate in this space.

Once again, over the prior 1-year, the SPDR S&P Oil & Gas ETF has increased by 70%. The firm has outperformed the ETF with gains of 92% over the same period.

This is also the case with Halliburton, which has increased by more than 80% in the past year.

Operating Costs and Break-Even Price

Companies that are involved in the exploration, production, and transportation of oil are prone to huge operating costs. \

- The general way that operating costs are calculated in this industry is on a per-barrel basis.

- As a prime example, it was recently reported that ExxonMobil has a break-even point of $41 per barrel.

- This means that when oil prices surpass $100 per barrel – as they are at the time of writing, ExxonMobil can generate much wider profit margins.

Dividend Program

Oil companies are some of the popular dividend payers in the stock market. In fact, other than Antero Resources, all of the companies from our list of the popular oil stocks have a solid dividend program in place.

As such, when you invest in oil companies, you can generate a consistent income stream in addition to capital gains.

Diversification Into Renewables

Another metric to look for when searching for the popular oil stocks for your portfolio is whether or not the firm in question is looking to diversify into renewable energy.

After all, by the year 2030, many governments around the world have committed to banning conventional petrol and diesel cars. Therefore, established oil companies will need to act fast to ensure they get a head start in the renewables industry.

Recovery Since COVID

In many cases, some of the popular oil stocks that we analyzed on this page have not only recovered their COVID-related share price losses – but have since gone on to achieve new heights.

However, some firms – such as BP, are still trading at a share price that is lower than pre-pandemic levels.

Oil Penny Stocks

The 10 oil stocks that we discussed earlier are also classified as large-cap companies. However, there is also an abundance of oil penny stocks that possess both a low share price and market capitalization.

According to the SEC, a penny stock is a publicly-traded company with a share price of below $5. The upside potential on oil penny stocks can be huge – albeit, so are the risks.

The sections below review some of the popular penny oil stocks in the market:

- Enquest – This oil penny stock is a UK-based exploration and production firm. As of writing, Enquest carries a market capitalization of under $600 million. Over the prior year of trading, Enquest stock is up 74%.

- Gran Tierra Energy – This penny stock specializes in the exploration and development of both oil and gas. The vast bulk of its operations are based in Ecuador and Colombia. Although several of the firm’s key operational hubs have faced ongoing protests recently, its stocks are up 127% over the prior 12 months.

- Tetra Technologies – This penny stock provides core services to companies operating in the oil and gas industries. Over the prior 12 months, Tetra Technologies’ stock is up 45%.

Don’t forget – penny stocks – especially those in the oil industry, are extremely volatile. As such, ensure that you do plenty of research into the company and if possible – avoid stocks that trade over-the-counter.

Conclusion

This guide has reviewed and talked about some of the popular oil stocks that are available in the market. Interested investors can conduct their own research and decide on whether or not to invest in oil stocks. Furthermore, users can begin trading in oil stocks after picking a suitable stock broker of their choice.