Meme stocks are publicly traded companies that have gained a strong fan base online, mainly through social media. The term came about in 2021 when stocks such as GameStop, AMC, and BlackBerry became extremely popular on Reddit’s r/WallStreetBets forum. This resulted in significant profits for investors as the stock prices soared within weeks.

In this guide, we’ll take a look at some of the best meme stocks to buy in 2025.

The 10 Best Meme Stocks to Invest in 2025

Here are some of the top meme stocks to watch this year:

- Love Hate Inu – A vote-to-earn meme coin with real potential.

- Virgin Galactic – Space meme stock that fell back to earth in 2021, now up over 50% in 2023.

- Bed, Bath & Beyond – Ex-retail giant that became one of the biggest meme stocks of the last year.

- AMC Entertainment – One of the original meme stocks that was saved by retail investors.

- Nio – Chinese Tesla competitor popular on r/WallStreeBets.

- Tesla – Electric car giant run by Elon Musk.

- GameStop – The biggest 2021 meme stock still trading well above its pre-meme price.

- Nokia – Part of the original meme stock wave with real fundamental potential.

- Blackberry – Phone king turned cybersecurity company that rode the first meme stock wave.

- Palantir Technologies – Big Data Analytics meme stock up nearly 30% in 2023.

If you’re new to equity trading then you might be wondering how to buy stocks safely and efficiently. We’ll answer that question further down.

As you can see, we’ve included a range of different sectors and industries. Next, you will find our full evaluation of the popular meme stocks.

A Closer Look at the Best Meme Stocks to Buy

The way stock prices move isn’t always connected to business fundamentals. As such, finding meme stocks with potential may be done in a number of ways.

Below we offer more information on a dozen of the top meme stocks to invest in now:

1. Love Hate Inu – A Vote-to-Earn Meme Coin with Real Potential

While not a stock, Love Hate Inu is a new meme coin that shows strong potential for growth on this list, and its practical use gives it solid fundamentals. Additionally, meme coins and meme stocks share many similarities. They benefit from strong community support, and their success often depends on their popularity, so there is significant overlap with this coin.

What sets Love Hate Inu apart from other meme coins is its innovative vote-to-earn blockchain system. Users can stake LHINU tokens to participate in polls and will earn more tokens by doing so. This gives it an immediate use case as one of the first vote-to-earn cryptos, combining its meme status with a fundamental underpinning.

The success of Love Hate Inu was instantaneous, raising over $100k within hours of presale starting. 90% of the tokens being sold during the presale, which makes the coin immune from the infamous crypto rug-pull scams that less reputable actors have pulled off in recent years. The 10% of coins that are being held back are for liquidity, to cover listing fees, and for the community rewards mentioned above.

Currently in presale, Love Hate Inu started with a token price of $0.000085 for first adopters. That means a $1,000 investment gains first-week adopters over 11.7m coins. As the presale continues, the price will rise each week from the starting price of $0.000085 up to the final presale price of $0.000145. At the end of the two-month pre-sale period, 11.7m coins purchased during the first week will be worth around $1,700.

That’s potentially the tip of the iceberg for Love Hate Inu. Other meme coins like Dogecoin have had tremendous success since launching. A $1,000 purchase of Dogecoin in 2018 would have garnered investors around 370,000 coins. Today, that same number of coins is worth around $26,000. At its peak in 2021, 370,000 Dogecoin was worth an eye-watering $237,000.

Dogecoin hit those peaks and its current $0.07 valuation without any fundamentals backing it up. Love Hate Inu could be the meme coin with the popularity and fundamentals to make a real impact.

2. Virgin Galactic – Space Meme Stock That Fell Back to Earth in 2021, Now up Over 50% in 2023

Richard Branson’s space flight company Virgin Galactic was founded in 2004. The company’s rocket plane was the first commercial space-liner the world had ever seen. Virgin Galactic’s goal is to make space tourism a huge commercial industry. Whereby it will be as normal to buy tickets to go to space as it is to book a flight to a foreign country.

Virgin Galactic became one of the most popular meme stocks in early 2020. Hoards of Reddit retail traders caused shares to go from just under $12 at the start of January 2020 to almost $33 by the end of February. That year was full of ups and downs, thanks to some major setbacks for the company. Its flight test program was facing delays, there was a management shakeup, and the market value of the company remained volatile.

By early 2021, it was trading at around $25. However, after another rally, Virgin Galactic stock increased to over $54 per share. By mid-May 2021, shares had fallen to $16. However, by the end of June 2021, the stock had skyrocketed again to a new peak of around $56.

This came following the announcement that Virgin Galactic had been granted the much-needed regulatory approvals for commercial space travel and had completed a successful test flight. Virgin Galactic has already sold hundreds of seats for future space trips, with thousands more having paid advance deposits.

While the first space tourists are mostly scientists, celebrities, and other highly affluent people, the long-term aim is for the trips to be cheap enough for the average Joe to afford. According to Virgin Galactic, it plans to launch up to 400 flights each year, with tickets initially costing $450,000 per person, and each will carry six passengers and two pilots.

Virgin Galactic’s goal is to have three flights per month starting this year. If it achieves that lofty milestone, its 2023 YTD stock price increase of over 50% will probably seem small compared to its potential.

3. Bed, Bath & Beyond – Ex-Retail Giant That Became one of the Biggest Meme Stocks of the Last Year.

Another of the best meme stocks to invest in is US-based retail chain Bed Bath & Beyond, which was founded in 1971. The omnichannel retailer operates locations throughout the Americas and sells a diverse range of products in a number of consumer areas. In 2021, Bed Bath & Beyond pledged to launch eight new brands, and it has succeeded with this goal.

Bed Bath & Beyond is one of the popular meme stocks of the last year. Amateur investors gathered to identify highly shorted securities they could buy in bulk, and as a result, Bed, Bath & Beyond stock experienced a major boost in 2021. However, the meme stock picked up steam again in 2022 with a significant rally up to $27 in March and then again to $23 in August. In between the two peaks, the stock fell to as little as around $4.

As of March 2023, Bed Bath & Beyond is trading for around $1 and is on the verge of bankruptcy.

Despite this, Bed Bath & Beyond is still one of the most popular meme stocks. There are still retail investors either buying the stock or trading options

Due to the risk of volatility, Bed Bath & Beyond should only be purchased by experienced investors or those who are willing to lose the amount they invest. That’s doubly true for options trading. However, for the brave investor, there could be a lot of upside potential in Bed Bath & Beyond.

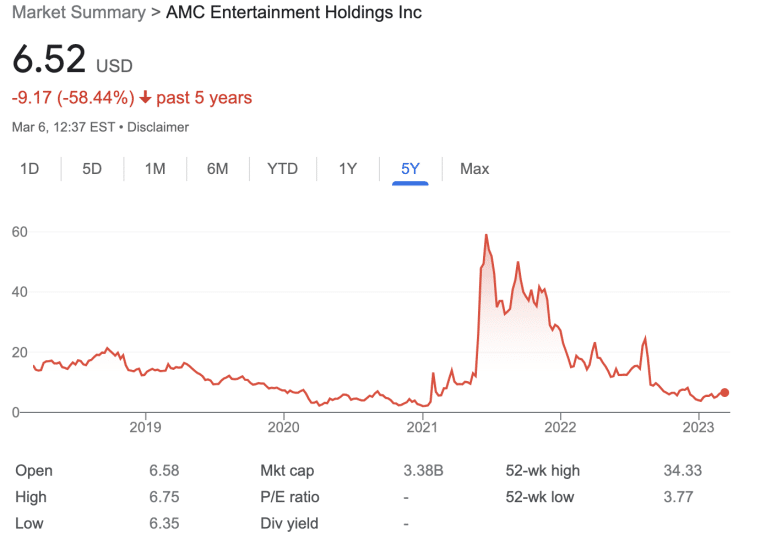

4. AMC Entertainment – One of the Original Meme Stocks That was Saved by Retail Investors.

AMC Entertainment was founded in 1920. This company is one of the world’s major movie theater companies. It has over 10,000 screens in 950 theaters throughout the world – which should give you an idea of its magnitude.

By offering loyalty and subscription programs and supplying its signature commercial-grade power-recliner chairs, the business has pushed the industry forward over the years. AMC Entertainment may not be a well-known name outside of the US, but its Odeon subsidiary is the European equivalent brand.

This hundred-year-old theatre company was forced to near bankruptcy in 2020. This came as a result of the COVID-19 pandemic, lockdowns, and the mass closure of movie theatres around the world. However, in early-2021, independent investors on the r/WallStreetBets group on Reddit rallied together to buy up AMC Entertainment stock in their droves.

As a result, the stock went from $2 at the beginning of 2021 to $62.55 by mid-June as it became one of the best meme stocks, which remains its all-time high price. The company has managed to raise over $2 billion as a result of people rallying to buy shares. This has enabled the company to take the 500 million share dilution it previously announced off the table and save it from certain bankruptcy.

As part of the effort to diversify the company, AMC announced that it would purchase 22% of Hycroft Mining Holding Corporation in 2022. In 2023, the company also released its own confectionary line of AMC Theatres branded popcorn for sale at Walmart. This is all part of AMC Entertainment’s strategy to maximize gains for shareholders by growing the business further.

The company’s plans also include reducing debt, investing in acquisitions and mergers, and upgrading its theatres. AMC Entertainment began accepting payments using cryptocurrencies to appeal to its retail investors. Additionally, the company also ventured into the world of NFTs and has perks such as free popcorn refills and discounts for its stockholders.

Of all the meme stocks from 2021 and more recently, AMC is the one to embrace its new shareholders the most.

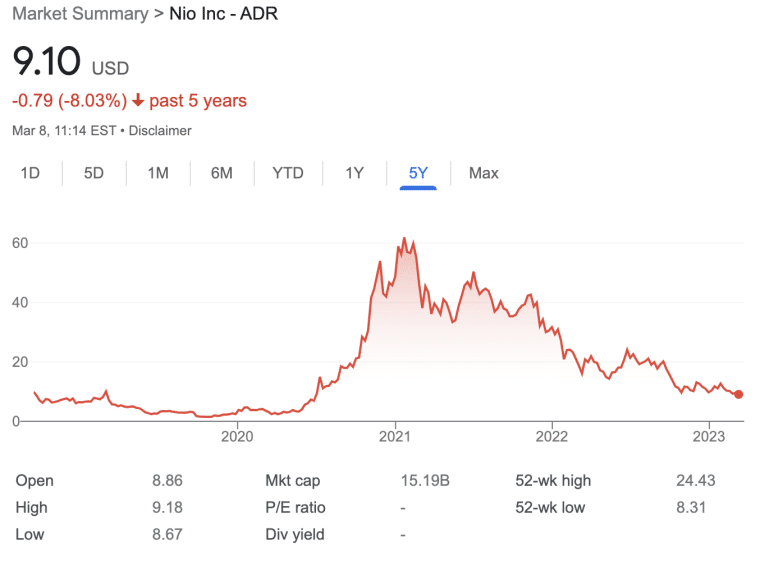

5. Nio – Chinese Tesla Competitor Popular on r/WallStreeBets.

Nio is a Chinese EV manufacturer founded in 2014 and is another top meme stock. Already, Nio is a market leader in China’s premium smart EV industry. It also creates next-generation batteries and digital technologies. The company also develops and markets industry-leading battery switching and battery-as-a-service technology.

Nio is also working on its own self-driving technologies for autonomous vehicles. In terms of stock performance, Nio entered 2020 at under $4 per share. However, following a rally prompted by Reddit stock traders, by November 2020, Nio stock had skyrocketed to around $54.

This illustrates a return of 1,250%. The rally in 2020 also made Nio the fifth largest car manufacturer by market cap, with a valuation of $75 billion. In January 2021, Nio stock experienced an all-time high of just under $62. However, following reports of semiconductor shortages, by the start of March 2021, Nio shares had pulled back to a little over $38.

Despite the lack of semiconductors, the company reported a healthy volume of deliveries and revenue growth. In total, Nio supplied 91,429 EVs in 2021, an increase of over 100% YoY. Moreover, in early 2022, there was a resurgence of interest in Nio stock on Reddit, making it once again one of the most popular meme stocks.

Nio shares continued to rally in 2022, with the company hitting highs and lows typical of a meme stock. That came to an from October 2022 when the stock price slid from $16 down to $9 by November. Since then, the Nio stock price has continued on a downward trajectory.

The stock looks to have found its resting place in the $9-$12 region in 2023 thus far. Despite this, Nio is still one of the most-watched and bought stocks on r/WallStreetBets suggesting it could have further potential as a meme stock.

6. Tesla – Electric Car Giant Run by Elon Musk.

Tesla was founded in 2003 and is often talked about as the original meme stock from before the term existed. The company designs, manufactures, leases, and sells electric vehicles. Tesla also makes energy generators, storage systems, and more. Tesla’s most popular products include well-received EVs like its Model S, X, 3, and Y.

Other products include Solar Roof Tesla Energy Software, Powerpack, Megapack Solar Panels, and the company’s integrated battery system – Powerwall. Moreover, in 2021, Tesla signed a supply agreement with Arevon, a leading renewable energy company.

The agreement was for Tesla to supply Arevon with a record quantity of Megapack batteries totaling 2 GW/6 GWh. These are to be used for multiple new energy storage projects. The most recent joint project between Tesla and Arevon is the Townsite Solar and Storage Facility.

This site is located in Nevada and includes over half a million solar panels. This will provide 360 MWh of Megapacks to help maximize the use of solar energy. The Megapack project will power 60,000 households.

As we touched on, a meme stock is a traded company that is highly influenced by online interest. To offer an example, between October and November 2021, Tesla made history by making the biggest 12-day gains the stock market had ever seen.

Online rumors about a transaction with rental vehicle firm Hertz appear to have been the key catalyst that propelled it above the $1 trillion market valuation. Immediately after, this resulted in a one-day increase of 13% to $1,025 per share. By 2030, Hertz intends to electrify its fleet in collaboration with the EV firm.

Although, as Elon Musk pointed out on Twitter, the acquisition will have little impact on Tesla’s economy because demand continues to outweigh supply.

7. GameStop – The Best Known Meme Stock Still Trading Well Above its Pre-Meme Price.

Ever wondered what the best WallStreetBets stocks are? Texas-born video game retailer GameStop was founded in 1984. GameStop is a one-stop shop for people looking to buy video games, accessories, consoles, and a range of other products. The company has over 4,500 brick-and-mortar stores and also an online presence.

GameStop stock was listed on the NYSE in 2002. During 2017, and a few years after, shares remained under $25. This is when everything changed for GameStop, as it gained a cult following online, and the meme effect shook the stock market. In a nutshell, if there’s one stock to point to as the start of the meme stock craze, it’s GameStop.

At the start of January 2021, GameStop was trading at just $4 and was in danger of bankruptcy. By the end of the month, following a short-squeeze kick-started by r/WallStreetBets members, the stock increased by over 1,500% to a peak of $347. By early February 2021, shares had plummeted back down to the $50 mark. However, this didn’t last long. In true meme-stock form, another rally began, which sent the share price to a high of almost $265 by mid-March.

Sharp price fluctuations like this continued throughout 2021, and the stock never dropped below $150. According to the company’s fourth quarter and fiscal year 2021 results, net sales were at $2.25 billion, up from $2.12 billion in 2020. At the end of March 2021, GameStop revealed its plans to undertake a stock split, in the shape of a stock dividend.

As of 2023, even when accounting for the stock split, Gamestop is still trading well above its pre-meme stock price.

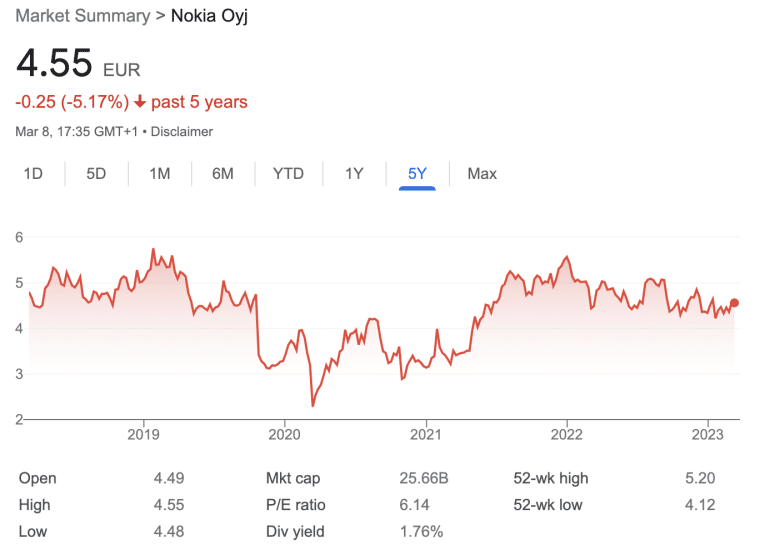

8. Nokia – Part of the Original Meme Stock Wave with Real Fundamental Potential.

If you’re looking for the most undervalued stocks and cheap meme stocks, Nokia is worth a look. The Finnish company was founded in 1865, and although it was a paper mill back then, over the decades, the company has shifted through many stages before focussing its attention on telecommunications as early as 1991.

Nokia is a well-known phone brand and hasn’t been without its struggles over the years. The company’s stock was flying high from the mid-1990s to the early 2000s. In June 2000, shares reached their highest value to date – around $58. By 2012, Nokia was engulfed in competition from the likes of Android and Apple, and the stock fell to an, at the time, all-time low of around $4.

Fast forward almost a decade to early 2021, and Nokia became one of the popular meme stocks when it experienced a resurgence in investor interest. Yet, after collapsing during the initial round of the meme craze, by August 2021, it had gradually risen to above $6 per share.

Nokia entered 2022 at around $6, but through peaks and troughs throughout the year, ended at around $4.5. Despite this, the company has made some good moves correlating with its meme stock interest.

In March 2022, Nokia and Chunghwa Telecom entered a two-year deal to work together to improve its 5G network in Taiwan’s central and southern regions. Nokia will deliver equipment from its latest energy-efficient AirScale portfolio to 4,000 additional locations as part of the arrangement, which will enhance capacity and performance.

Nokia is also collaborating with Google Cloud to create new 5G radio technologies. Nokia’s RAN edge cloud technology will combine with Google Cloud’s edge computing platform and applications ecosystem. Furthermore, Nokia provided the 5G infrastructure for UScellular’s new 5G network.

Looking ahead, Nokia could be one of the top meme stocks to invest in for its long-term fundamental potential.

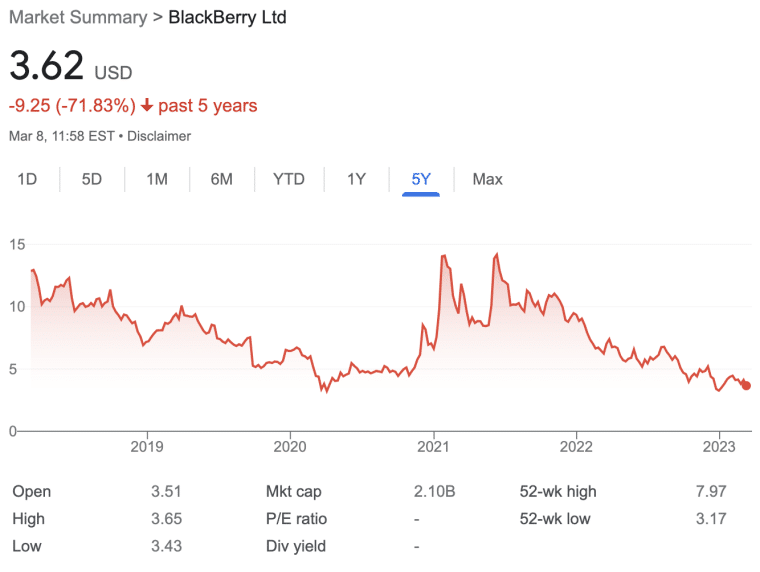

9. Blackberry – Phone King Turned Cybersecurity Company That Rode the First Meme Stock Wave.

Blackberry was founded in 1984. The company is known for its mobile devices, which were hugely popular in the 2000s. However, Blackberry now focuses on selling software systems and cyber security technology. Unlike some other of the best meme stocks, BlackBerry appears to have more solid business fundamentals.

The firm has evolved from a pioneering mobile device manufacturer to a significant cybersecurity player. Some of Blackberry’s biggest partnerships include IBM, Amazon Web Services, Qlik, and Intel. Despite this, Blackberry became a meme stock in early 2021, courtesy of Reddit.

Blackberry stock ended 2020 at a price of $6.60. After becoming one of the popular meme stocks on the aforementioned platform, Blackberry increased to $14 per share. This illustrates an increase of over 112% in less than a month.

Blackberry started 2022 at over $9 per share. However, after releasing its fourth-quarter results in March, some analysts lowered its price guidance, and shares fell. The company reported revenue of $185 million for Q4 2021, which was down 11.9% year-on-year. This was mostly due to supply chain issues.

Since then, the company’s stock price has continued in its downward trend. The company reached close to an all-time low price of $3.18 at the end of December but has since rallied slightly. The BlackBerry stock price is up by around 10% YTD in 2023.

BlackBerry is another of the meme stocks that has real fundamental potential outside of its meme stock status. The company has plenty of notable projects in the pipeline. This includes IVY tech software, which is a collaboration with Amazon’s AWS division and will be used in vehicle sensors. Automakers should be able to use the software to cut costs and enhance operations.

It’s this kind of broad background technology that BlackBerry is becoming known for that could lead to its long-term success. It’s not as exciting as having the most used smartphone, but it brings in revenue which makes BlackBerry one of the most interesting companies on this meme stock list.

10. Palantir Technologies – Big Data Analytics Meme Stock up Nearly 30% in 2023.

Palantir Technologies was founded in 2003, and the firm provides extremely secure data to a range of clients. Its three product divisions are Apollo, Foundry, and Gotham. In 2011 Palantir assisted in the capture of Osama bin Laden. This meme stock investigates criminal, communication, medical, secret service, and financial records.

One of the first outside investors in Palantir was the CIA, and the company is very selective about to who it sells its software. It began as a corporation dedicated solely to government clients. Therefore, its products were created with security as a foundation.

This company’s data mining software is also used by over a dozen countries to follow medical supply networks, anticipate breakouts in pandemic hot zones, and track COVID-19 infections. Palantir Technologies became a publically listed company in 2020, and its stock opened at $10.

In 2021, Palantir Technologies became one of the most talked-about meme stocks, and as a result, it enjoyed a sudden influx of support from retail investors. Palantir Technologies entered 2021 at $23.50, and the aforementioned meme rally saw shares increase by almost 50%, peaking at an all-time high of around $35.

During the first three months of 2022, Palantir Technologies floated between a high of around $16 and a low of $10. At the time of writing, the stock is down to less than $10. However, it has started to pick up momentum again and is currently up nearly 30% YTD in 2023.

For the full-year 2022, the company reported revenue growth of 23%, and its EPS increased by 33% to -0.18. Palantir Technologies expanded its contract with CDC for disease and monitoring response in April 2022. The company also partnered with Carahsoft to increase its reach in the US government market. It has also extended its partnership with Ferrari and won a $100m deal with the US State Department in March 2023 to modernize data management.

What are Meme Stocks?

Meme stocks are companies that experience sharp increases in their share price following online interest. Meme stocks can be those that are nostalgic brands, companies that have a large online following or a charismatic CEO, or businesses that are simply undervalued.

To further explain, let’s offer an example using GameStop, one of the popular meme stocks:

- In 2020, Wall Street veterans saw gaming company GameStop on its knees and began short-selling the stock.

- Meanwhile, thousands of individual investors gathered on the online Reddit forum r/WallStreetBets.

- These individual retail investors were eager to strike out at the financial markets and fight for the underdog.

- Instead of decreasing the price of GameStop stocks, r/WallStreetBets gathered together to acquire as many shares as they could.

- This caused the GameStop share price to rise and forced short-sellers to lose billions of dollars from covering their failed positions.

By January 29, 2021, GameStop stock had risen to $347. This beat the stock’s previous all-time high of around $60 years earlier in 2007.

Not only that, but over just ten days, the shares increased by more than 1,500% as a result of these small investors rallying to buy GameStop stock.

The impact was so great that it is responsible for the term “meme stock.”

Meme Stock News

- AMC, one of the original meme stocks, is on the verge of a reverse stock split which may impact its price.

- In 2023, meme stocks look to be making a comeback. In January, retail investors, the largest purchasers of meme stocks, represented up to a quarter of all stock trading.

- Meme stocks like Palantir, Virgin Galactic, and AMC have all made large 30%+ gains in 2023.

Conclusion

That’s everything you need to know about the most popular meme stocks right now and how to buy them. Make sure to conduct your own research on what a meme stock is before buying any assets. That can be done via social media platforms like Reddit.

For the biggest upside potential, we recommend Love Hate Inu as an exciting new meme coin with solid fundamentals. For traditional meme stocks, be sure to follow news on Virgin Galactic and Bed Bath & Beyond in 2023. Both companies have big years ahead of them.

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens