Cheap stocks allow you to invest in equities without breaking the bank. We define a stock as cheap when it trades for less than $20 per share.

In this guide, we explore the 15 popular cheap stocks to watch.

Popular Cheap Stocks to Watch in 2024

Political unrest in Europe, growing crude oil prices, and inflation fears has resulted in enhanced volatility in the US stock market.

Having said that, this can sometimes result in companies or opportunities to buy stocks on the cheap.

As such, below we’ve listed the 15 popular cheap stocks:

- FightOut – Overall Best Investment in 2024 with Fitness App and Real-World Gyms

- Dash 2 Trade – Crypto Intelligence Platform to Maximize Earning Potential

- IMPT – Exciting Carbon Offsetting Protocol to Help Fight Climate Change

- Tamadoge – High-Potential Meme Coin and P2E Project set for Huge 2023

- Battle Infinity

- Lucky Block

- Ford

- Vodaphone

- Amcor

- American Airlines

- SoFi Technologies

- Viatris

- Hewlett Packard Enterprise

- Under Armour

- Carnival

You will be wise to research in full before investing funds in cheap stocks. Next, we help clear the mist by taking a closer look at the 10 companies listed above. You can also take a look at our guide on how to buy Medifast stock if you’re looking to gain exposure to a US-based nutrition and weight-loss business.

A Closer Look at the Popular Cheapest Stocks

Some market commentators expect the aforementioned global macroeconomic and geopolitical risks to continue to impact many sectors in the coming months.

See our pick of the cheapest stocks below:

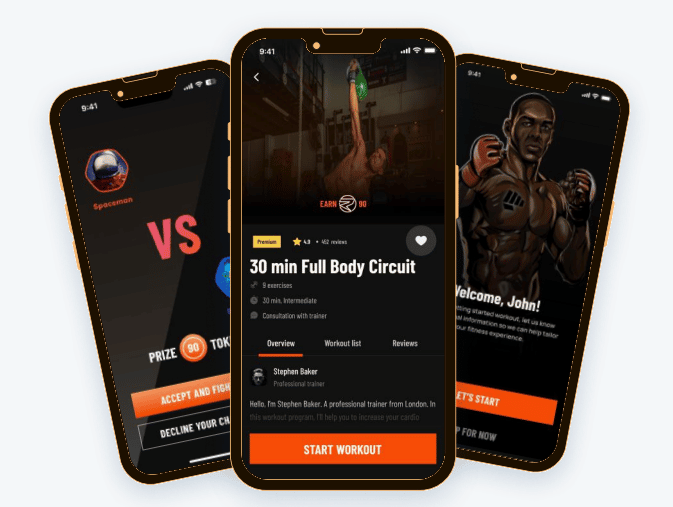

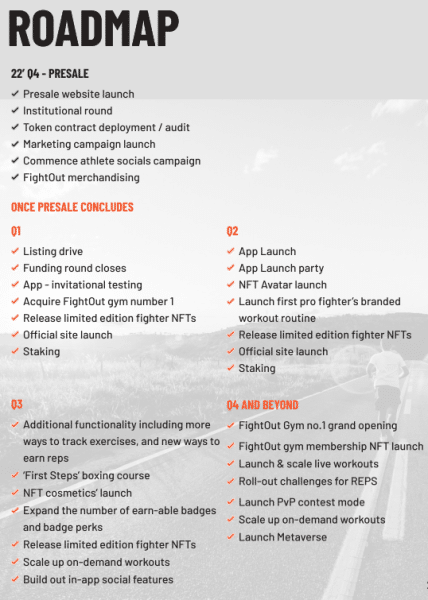

1. FightOut – Overall Best Investment in 2024 with Fitness App and Real-World Gyms

Having only just launched its presale, more than $2 million has already been invested into the move-to-earn crypto project in less than a week, with FGHT tokens on sale for just $0.016 each.

Investors are flocking to the project because of its ambitious plans which include developing a market-leading fitness app and building real-world gyms in key locations around the world that are integrated with Web3 technology and features.

FightOut, which is also our overall best crypto to invest in, is set to revolutionize the move-to-earn space that saw high levels of investment in 2021 and 2022 but ultimately struggled to retain users because of expensive start-up costs and flawed reward systems.

While the likes of STEPN required users to purchase expensive NFTs to get going and only measured steps – FightOut’s fitness app uses smart technology and key effort indicators, as well as measures sleep and nutrition, to build a digital profile of its user.

There are no NFTs needed to get started, with FightOut operating on a much cheaper subscription model, with users earning rewards for completing workouts at home or in the gym.

The app will not just cater to strength and conditioning training, but take a holistic approach that also covers wellness and mental health, with each user getting a tailored workout program based on their own needs and fitness.

The digital profile is a soulbound NFT, meaning it cannot be sold or traded, is fully customizable and is used to represent a user’s fitness profile, which can then be pitted against others in daily, weekly and monthly competitions for more rewards.

The FightOut team, which comes with a background in combat sports and fitness app development, has already started scouting locations for its first gym and is also in early contact with world-class athletes from the worlds of boxing, MMA and pro wrestling to join the project as ambassadors.

The ambassadors will not just help market the project but also provide exclusive content such as masterclass-style workout routines and behind-the-scenes training camp access.

FightOut is planning to raise $100 million during its presale, with 70% of that total to be spent on gym acquisition and development (70%), marketing and partnerships (18%) and product development (12%). Of the total 10 billion FGHT token supply, 60% will be allocated to the presale, another 30% for the rewards pool and 10% for exchange liquidity.

For more information, read the FightOut whitepaper and join the Telegram group or read our full how-to-buy FGHT token guide.

| Presale Started | December 14 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | N/A |

| Max Investment | N/A |

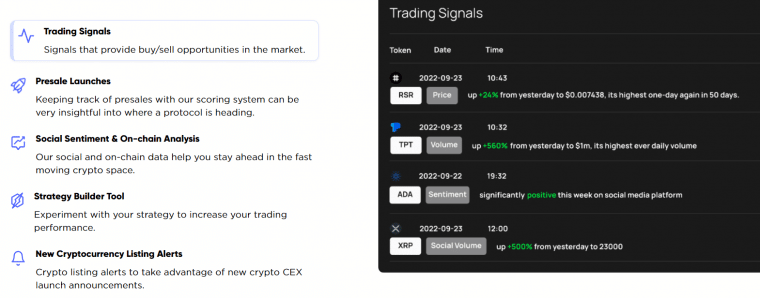

2. Dash 2 Trade – Crypto Intelligence Platform to Maximize Earning Potential

The intelligence and analytics platform is already in the final stage of its presale and is closing in on $10 million of funding – with investors excited by the range of tools, metrics and insights it will provide to users.

Dash 2 Trade secured more than $500,000 in investment in its first 24 hours of trading and experts expect it will pump after its IEO, with major exchanges LBank, BitMart and Changelly Pro already confirming listings.

Traditional investors will find the project appealing because it will offer its users a range of insights, data, analysis, and tools for traders and investors to maximize their profits.

Dash 2 Trade will offer trading signals to provide users with buy and sell opportunities in the market, as well as track social sentiment and on-chain analysis to spot developing trends ahead of the curve.

For traders, there will also be strategy-building and social trading tools, as well as backtesting platform to test and optimize trading strategies in real-time without risking capital.

For non-traders, Dash 2 Trade is developing a bespoke system that will find and rank the best new crypto presale projects, giving them a score out of 100 from a range of metrics to ensure the legitimacy of new projects.

They will also send out alerts and reminders on new coin listings so investors can maximize their earning potential.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| TOTAL | $13,420,000 | 262,500,000 |

The native D2T token, which is built on the Ethereum blockchain, is central to the ecosystem and grants holders access to various tools and insights.

Dash 2 Trade has a three-tiered monthly subscription – Free, Starter, and Premium – that grants different levels of access to the platform.

As the table above shows, a total of 262.5 million tokens are available in the presale across four phases.

However, only around 60 million tokens remain available to investors such is the huge interest in the project.

D2T tokens are currently on sale for $0.0533 – read our guide on how-to-buy Dash 2 Trade tokens during the presale.

Dash 2 Trade is being developed by the fully doxxed and KYC-verified team behind Learn2Trade, a beginners’ forex and crypto trading platform that has 70,000 global users and a four-star rating on TrustPilot.

For more information on the project, which we’ve already named among the best crypto presale of the year, read through the whitepaper and join the Telegram group.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

3. IMPT – Exciting Carbon Offsetting Protocol to Help Fight Climate Change

The project recently finished a highly successful presale where it raised more than $20 million and is now listed on Uniswap and LBank.

Users of IMPT will be able to earn IMPT tokens while shopping, with the tokens then converted into carbon credits to offset the carbon footprint of both individuals and retailers.

Carbon credits are effectively a permit to allow businesses to emit a certain amount of carbon into the atmosphere.

IMPT wants to make carbon credits open to everyone while also increasing transparency and reducing fraudulent activity around them.

The project will make carbon credits fully tradeable and will also develop a scoreboard to encourage more carbon offsetting efforts – more than 10,000 retailers and globally recognizable brands have partnered with IMPT.

Those who retire carbon credits, by sending them to a burn address and taking them out of circulation, will also receive unique NFTs.

IMPT is currently in phase 1 of its token presale and has already raised more than $1 million in just three days.

Tokens are currently on sale for $0.018 but will go up to $0.023 and then $0.028 in phase 2 and 3.

Read through the IMPT whitepaper for more information on the project and join the Telegram group for the latest news.

4. Tamadoge – High-Potential Meme Coin and P2E Project set for Huge 2023

Billing itself as a meme coin with a difference, Tamadoge enjoyed one of the best initial exchange offerings (IEOs) of the year at the end of September, with the native TAMA token pumping almost 2,000% from its presale price.

Unlike crypto’s biggest meme coin, Dogecoin, which has an unlimited supply and 130,000,000,000 tokens already in circulation, Tamadoge’s native TAMA token has a max supply of just 2 billion coins as well as a deflationary mechanism – 5% of tokens will be burned with every transaction in its pet store, increasing scarcity.

The project is also offering long-term utility to holders that DOGE cannot, through NFT ownership – in the style of 90s craze Tamagotchi – and a play-to-earn game that will see 3D and augmented reality featured.

Holders of the NFTs can spend TAMA on toys, treats and food in the pet store to grow their pets and can then use them to battle against other holders.

Since going live on exchanges, TAMA has not left the top 10 meme coins by volume and looks primed for a pump when crypto market conditions improve in 2023. With listings on more exchanges in the near future – including a possible listing on Binance – analysts are forecasting more gains for the new meme coin.

The ecosystem is also continuing in its development with the main game arcade-style mini games and the AR app all expected in 2023.

Keep up to date with the latest news from the project by joining the Tamadoge Telegram group.

5. Battle Infinity – Exciting New Project for Potential Investors

Battle Infinity is another non-traditional asset with high growth potential. It’s a gaming platform based in the Metaverse and is designed as a play-to-earn platform combining he virtual world with gaming elements.

Players compete in the Battle Arena and can access six platforms, including an innovative fantasy sports league and a DeFi exchange. Besides battling it out, players can immerse themselves in the Metaverse by watching and interacting in the Battle Arena. Participants get the best of both worlds. The developers integrated gaming with the Metaverse to design a temper-proof ecosystem by incorporating the platform’s native token, IBAT.

The BEP-20 protocol IBAT coin was developed on the Binance Smart Chain and used across different platforms such as the Premier League, Battle Swap and Battle Stake. With Battle Stake, players compete against stakers to get higher annual percentage yields (APY). The IBAT Premier League is an NFT-based fantasy sports game, enabling players to build a strategic team to battle and earn.

In this play-to-earn game, players earn IBAT tokens, which can be converted into another currency using the Battle Swap DEX integrated into the game and all its battle arenas. Other uses for IBAT are for advertising boards within the Battle Infinity program and transaction fees to be added to the staking pool.

Battle Infinity raised $5 million during its presale round before successful listings on numerous exchanges. The token is set for more listings in the near future, while the flagship IBAT Premier League remains in development.

Holders of the coin are kept in the loop with the latest happening via the platform’s Telegram group. Considering this concept’s innovation and potential, Battle Infinity remains an ideal project for investors looking not to miss the next big thing.

Cryptoassets are a highly volatile unregulated investment product.

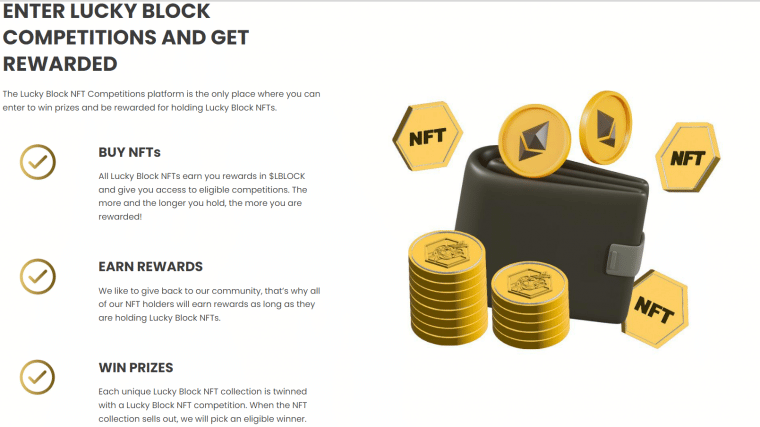

6. Lucky Block – Global NFT Competition Platform

Although LBLOCK V1 is down from February’s all-time highs, the development team recently launched LBLOCK V2, an ERC-20 token that is compatible with centralized exchanges and offers 0% fees, unlike 12% needed for trading the V1 coin.

Now could be the ideal time to buy Lucky Block, with the platform’s NFT prize draws also ongoing. Unrivalled prizes are up for grabs on the site with $300,000 Lamborghini, $1million house and $1 million of Bitcoin are all ready to be won.

The market leading competitions platform has also recently announced its burn of tokens, with 1% of the 3.65 billion supply being erased on a rolling monthly basis.

LBLOCK is currently undervalued and could break out when better conditions return to the crypto market.

Cryptoassets are a highly volatile unregulated investment product.

7. Ford

Ford is a US-based legacy carmaker that’s been around since 1903. Ford is one of the popular cheap long-term stocks to buy as the company is fully embracing the future of electric vehicles. The ability of conventional automakers like Ford to adapt and compete with Tesla could decide the EV industry’s new leader.

Ford has taken the electric vehicle transition very seriously. Some of the firm’s EV models include the Ford Mustang Mach-E, F-150 Lightning, and the E-Transit-350 Cargo. In a consumer report released in February 2022, Ford’s Mustang Mach-E beat Tesla’s popular Model 3 for the spot of the popular electric vehicle.

As such, although Ford is still in the early phases of its EV transition, it appears to be moving in the right direction. In 2021, it delivered 27,140 Mustang Mach-E cars. Various versions of the Ford E-transit van are also available. In March 2022, the company launched the Pro AC Charging Station to power it. In April 2022, the F-150 Lightning will be launched.

Moreover, Ford will boost its investment in electric vehicles to $50 billion by 2026, up from $30 billion by 2025. Ford confirmed that it will handle its EV business apart from its combustion engine division. The company expects to create more than 2 million electric vehicles through its new dedicated division, Ford Model e, by 2026.

This will make up a third of its annual worldwide output, with electric vehicles expected to account for 50% of total volume by 2030. Investors will be watching how well Ford’s electric vehicles sell in the coming quarters and years, but the company’s aggressive drive to compete with Tesla is encouraging.

Ford received 72,000 car orders in February 2022 alone, up from 54,000 the previous month. While trucks and SUVs account for the majority of those sales, Ford EV sales rose by over 55% in the same month. The P/E ratio is over 8 times as of writing. At the time of writing the running dividend yield is at almost 2.5%.

8. Vodafone

Vodafone is a telecom company with more than 300 million mobile customers and it is the largest 5G network in Europe. The company was founded in the UK in 1984 and now operates on a global scale. The firm also owns the money transfer cell phone app, M-PESA.

This is the largest money service platform of its kind in Kenya. Moreover, Vodafone has expanded its operations in South Africa, Tanzania, Ghana, Mozambique, Egypt, Lesotho, and more. The performance of Vodafone stock has been dismal for investors, especially when you notice that over five years of trading, its shares have fallen by over 34%.

Investors were no doubt turned off by the company’s dwindling sales and high levels of debt. Not only that, but the firm suffered from a reduction in revenue as the COVID-19 took hold. That said, during the last few months of 2021, Vodafone announced better-than-expected revenue results.

Globally, Vodafone reported an increase in revenue of over 4% to €11.7 billion (around $12.7 billion) during this period. The company cited strong growth in Africa, where it has almost 190 million users spanning eight countries. The company will also make money from roaming fees following the UK’s exit from the EU.

Vodafone’s profit forecast for the year 2022 has been revised, from €15 billion to €15.2 billion (around $16.3 billion to $16.5 billion). It has also raised its objective for free cash flow by €100 million (approximately $108.6 million).

Vodafone is another one of the popular cheap stocks that pay dividends. The running dividend yield is 6% at the time of writing.

9. Amcor

Amcor is a packaging firm that operates all over the world. The company creates closures, rigid containers, flexible packaging, customized cartons, and other services. Amcor’s products are used for home and personal care, beverages, food, medical devices, and pharmaceutical items.

This well-established packaging company is based in Zurich, Switzerland. Amcor has developed dramatically in recent years. This is especially the case since completing the purchase of the Bemis Company in June 2019. The acquisition increased the company’s global reach.

As such, it has opened up and created new consumers for its goods. This results in better economies of scale and increased efficiency and profits. Amcor now has operations in North and Latin America, Asia, Africa, and Europe. The company anticipates overall cost savings to be at least 10% higher than its initial objective of $180 million in fiscal 2022.

The global packaging market is expected to be worth around $400 billion by the year 2027. The COVID-19 pandemic’s impact on Amcor’s sales has been positive. The company has shown growth across a wide range of industries, including high-value end markets like cheese, protein, pet food, and coffee.

Moreover, consumer demand for rigid packaging is increasing. The company has noted a rise in its hot-fill container and beverage volumes. Growth is also aided by brand expansions. This includes the launch of new health and wellness goods in PET containers.

As noted, Amcor was able to benefit from the global pandemic. The stock has increased by 9% since the aforementioned acquisition in 2019. The all-time high of the stock was in August 2021 when shares reached over $12.90. The P/E ratio as of writing is at approximately 19 times and its running dividend yield is at just over 4%.

10. American Airlines

American Airlines was founded in 1930 and is one of the biggest air carriers globally. During the COVID-19 pandemic, American Airlines, like most aviation companies, had a hard time in the stock market. After all, air travel demand was all but wiped out by the pandemic.

With that said, the industry is on the road to recovery, largely because of the broad availability of vaccinations. American Airlines is still a work in progress. This is understandable since it is currently dealing with the financial consequences of COVID-19 restrictions and the damage this caused to the aviation industry as a whole.

At the time of writing, the P/E ratio of American Airlines is at -6.2 times. As we touched on, leisure travel is right on track to recover to pre-pandemic levels.

The company also reported lower capital expenditure requirements in 2021, which should help with debt reduction in the coming years. In early 2022, American Airlines got the go-ahead from regulators to partner up with a previous competitor, JetBlue.

The former rivals began proceedings with 33 new routes and almost 80 codeshares. In other news surrounding airline stocks, in early 2022 a Florida federal judge found that the Biden administration’s masking regulations on public transportation were illegal.

As a result, aviation stocks increased as major airlines cancelled their mask obligations. In terms of its competitors in the industry, American Airlines has outperformed competitor Spirit Airlines over the last year of trading. American Airlines fell by over 3.8% in 12 months of trading, and Spirit Airlines saw its shares decline in value by a whopping 26%.

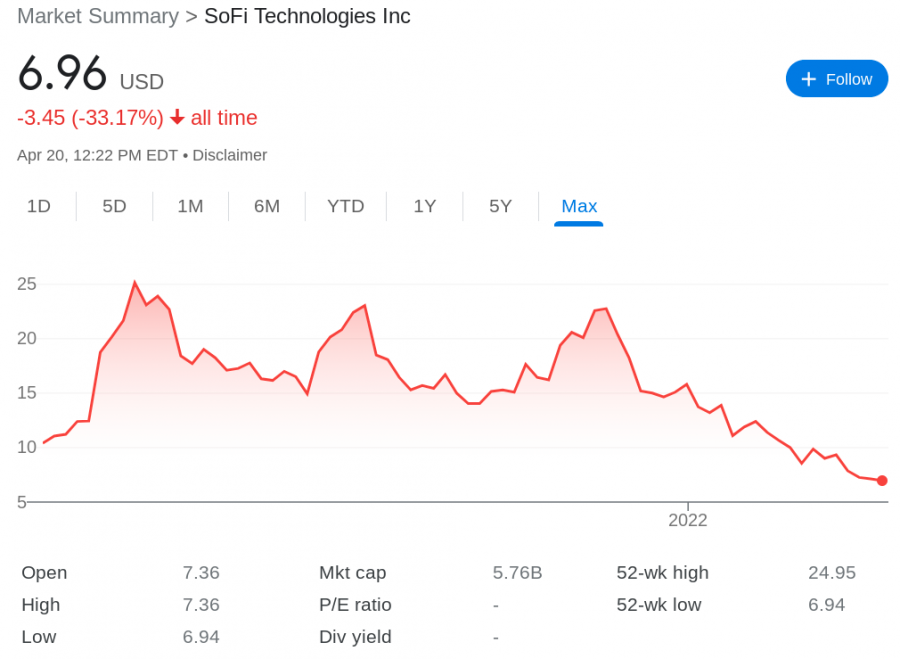

11. SoFi Technologies

SoFi Technologies is a fintech disruptor that was founded in 2011 with the goal of assisting Americans with achieving financial independence. Essentially, this company offers a next-generation platform with financial, banking, and investment services. In just over a year, the platform has nearly quadrupled its membership and continues to perform well.

SoFi paid $1.2 billion in 2020 to acquire Galileo Financial Technologies. This is a digital payment technology firm that allows SoFi to provide its own checking and savings accounts.

SoFi is also one of the cheapest stocks on the NASDAQ. Shares were first listed in June 2021, following a merger with Social Capital Holdings. On its first day of trading, shares were up by over 12% at around $22. The all-time high of SoFi stock is $23 – which was hit in the same month.

During the last three months of 2021, SoFi attracted an impressive 523,000 new subscribers to its financial app.

12. Viatris

Viatris is a pharmaceutical company that was created when Pfizer’s off-patent medicine division, Upjohn, and Mylan merged. Integrating these companies resulted in a high quality yet affordable back catalog of medicines for Viatris. In November 2020, Viatris began trading on the NASDAQ.

Viatris has an excellent portfolio of products, which includes numerous well-known brands including Viagra, Lyrica, Lipitor, and Xanax. These medications are also protected by patents, so Viatris has the advantage of owning products with some brand recognition. This should bode well for future sales volumes.

In addition to its authorized portfolio of more than 1,400 pharmaceuticals spanning numerous therapeutic categories, Viatris is focused on developing innovative treatments. In terms of its stock price action, its all-time high stands at over $18 – which was achieved in December 2020.

After a rocky year in 2021, Viatris stock had risen and was trading at around $14 per share by the end of February 2022. Within a month, Viatris stock had dropped to new lows of $10. This crash came after the company released its latest quarterly results in March 2022.

In the same month, the firm also revealed that it will sell its biosimilars business, one of its most innovative and exciting divisions, for $3.3 billion. Some investors weren’t happy with the news. Whilst others seemed to agree that the true worth of the company lies in the aforementioned portfolio of well-known brands.

Either way, Viatris expects $17 billion in sales in the fiscal year 2022.

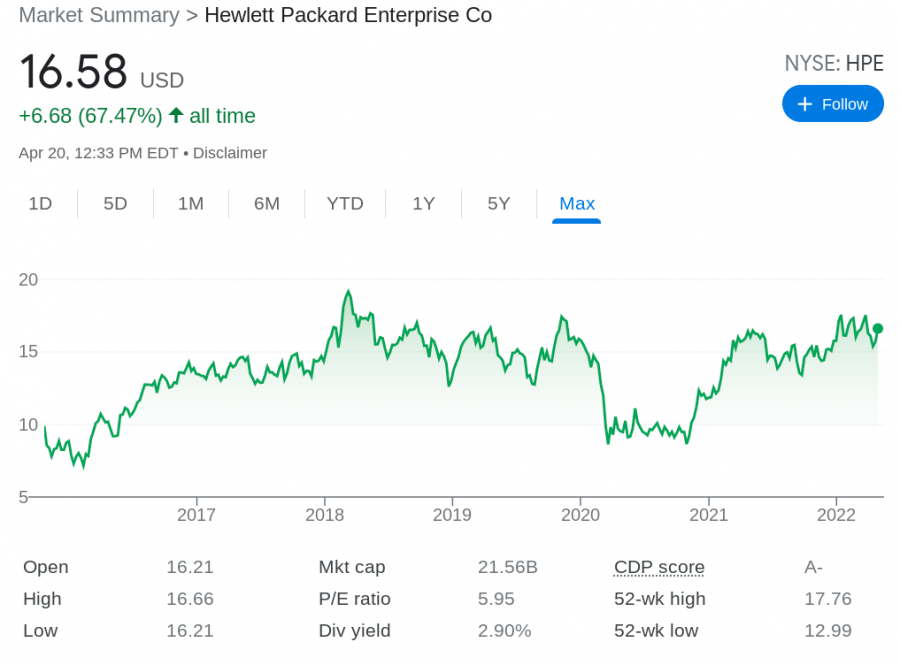

13. Hewlett Packard Enterprise

In 2015, the original Hewlett Packard Enterprise split into two companies. This resulted in HP and Hewlett Packard Enterprise, which become its own publically traded company. This firm is known for computers, smartwatches, printers, laptops, and accessories.

Hewlett Packard Enterprise still sells networking equipment and servers but is also heavily focused on the cloud IT infrastructure market. For instance, the company’s Greenlake project is an edge-to-cloud platform that offers flexibility and operational time savings of a reported 98%. This is largely used by remote and satellite offices, as well as data centers.

In the most recent quarter, Hewlett Packard Enterprise gained more than 100 new GreenLake customers, totaling over $500 million in contract value. Despite supply challenges, the company’s annualized recurring revenue grew 23% to $798 million during the same quarter.

The company’s goal is to save at least $800 million per year by the end of fiscal 2022. Moreover, Hewlett Packard Enterprise has been on the lookout for acquisitions to help it focus on high-margin hybrid IT models that combine on-premises and cloud computing capabilities.

Hewlett Packard Enterprise bought four companies in 2021, Zerto, Ampool, CloudPhysics, and Determined AI. These acquisitions have boosted the firm’s product portfolios and capabilities in the fast-growing cloud arena.

Year to date, Hewlett Packard Enterprise shares have outperformed the S&P 500. This stock increased by almost 2.4%, whereas the S&P 500 fell by 7%. Moreover, Hewlett Packard Enterprise was expected to earn $0.46 per share on sales of $7 billion in its fiscal first quarter of 2022. However, this was 15% higher than market analysts expected.

14. Under Armour

Under Armour was founded in 1996 and produces and markets branded performance and athletic footwear, clothes, and accessories for women, men, and minors in North and Latin America, the Middle East, Europe, Asia, and Africa via its subsidiaries. The company owns 165 stores in the US alone as of writing.

As well as various items of clothing and accessories, Under Armour has a digital fitness platform and shopping app. Over the years the company has introduced high-profile products including professional sportsman Jordan Spieth’s golf shoes and apparel. Not to mention actor Dwayne Johnson’s Project Rock line of training equipment and accessories.

Under Armour stock has had some challenging years, and this wasn’t helped by supply chain issues in both 2020 and 2021. However, the company’s marketing efforts, as well as cutting ties with some of its problematic wholesale retailers seems to have made a difference.

In its most recent quarter, e-commerce sales increased 4% year over year, accounting for 42% of Under Armour’s direct-to-consumer sales. The balance came from the retailer’s physical locations. Apparel revenue increased by 18%. Meanwhile, footwear revenue increased by 17%.

According to Under Armour’s annual report, revenue increased to $5.7 billion for 2021, up 27% compared with 2020.

15. Carnival

Carnival was founded in 1972 and is the largest cruise company of its kind. The firm became publically listed on the NYSE in July 1987 at just short of $3.90. This is taking into account the company’s two stock splits. The all-time high of this stock was around $70 in January 2018 and during the following two years of trading, shares fell to lows of $41.

By the end of January 2020, Carnival shares were selling at a market value of $52. Then COVID-19 took hold of the world and within three months the stock had fallen to $8.50, its lowest value since April 1993. This represents a decrease in value of almost 84% between January and April.

Throughout the COVID-19 pandemic, the cruise industry was among the most impacted, essentially closing down to avoid passengers from spreading the virus. The firm did everything it could to decrease costs, but ultimately, it needed to raise a lot of capital to survive, alongside a new share issue.

Carnival’s debt has increased from roughly $12 billion prior to the outbreak to almost $35 billion in the first quarter of 2022, which is an obvious turnoff for potential investors. Carnival was able to transport 850,000 people in the fourth quarter of 2021, which is more than twice as many as it was in the previous three months.

There seems to be a substantial latent demand for cruises, which will continue to expand as time passes. By spring 2022, the company’s whole cruise liner fleet is expected to be operational again.

Bookings for future itineraries in 2022 and 2023 are flying in at a rate that rivals what Carnival experienced in 2019 before the COVID-19 pandemic. Carnival’s revenue for the final quarter of 2021 was $1.29 billion, an increase of over 3,574% year over year.

Cheap Penny Stocks Definition

Whether a stock is cheap is subjective but usually refers to those priced at $20 or less per share. With that said, if you’re in the market for penny stocks, the SEC defines these as companies with a share price of $5 or less.

Conclusion

Today we’ve taken a closer look at some popular cheap stocks in 2022. Whichever constitutes the popular cheap stock for you will depend on your tolerance for risk, interests, and goals. Users can invest in their preferred cheap stocks by choosing a preferred stock platform of their choice.

Our top pick is FightOut an ambitious new crypto project that has already raised $2 million of funding in less than a week with investors excited by its revolutionary move-to-earn fitness app and plans to build Web3-integrated gyms in locations around the world.

FightOut has only just launched with tokens on sale for $0.016 each.

Another top pick is crypto intelligence and analytics platform Dash 2 Trade, which is now in the final stage of its presale.

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain