If you’re interested in learning how to invest in biotech stocks and what the popular biotech stocks to buy are then you are in the right place. Biotechnology is the place where biology and technology come together to create products that can improve the world and the lives of humans and animals.

In this ‘Popular Biotech Stocks to Watch’ guide we cover a list of biotech stocks to watch for this year and beyond.

Popular Biotech Stocks to Buy in 2025

Below is a list of biotech stocks to analyze for this year. These include a diverse range of biotech stocks in the sector that many investors are adding to their watchlist.

- Amgen

- Gilead Sciences

- Biogen

- Moderna

- Regeneron

- Vertex

- Illumina

- BioMarin

- Neurocrine Biosciences

- SPDR S&P Biotech ETF

A Closer Look at the Popular Biotech Stocks

The biotech sector has grown exponentially since the pandemic and is expected to be worth $2.4 trillion by 2028 – one reason investors are keen to know what the hottest biotech stocks are.

When choosing the popular biotech stock to invest in, it’s worthwhile building a portfolio of diversified companies that are focused on different areas in the biotech sector.

Each of these companies in the list of biotech stocks above has a certain specialism within the biotech sector. Some focus on developing drugs for certain conditions such as Alzheimer’s, others focus on producing vaccines for certain infectious diseases like Covid-19 to treat the coronavirus, while others focus on technology for genetics and DNA sequencing.

Read on to find out more about the popular biotech stocks to invest in for this year.

1. Amgen

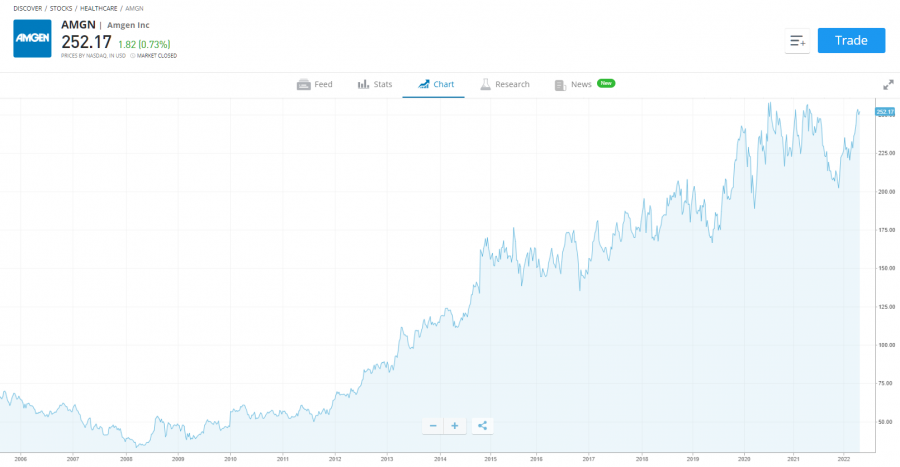

Amgen (AMGN) is the world’s largest biotech company by market cap. Listed on the NASDAQ Exchange, the company is worth more than $134 billion. The biotech company focuses on the discovery, development, manufacturing and marketing of human therapeutics.

Its products include brands such as Aranesp, Corlanor, Enbrel, Neulasta, Prolia and many others that are approved and on sale today. The company’s most successful product is Neulasta which is an immunostimulator that is used to prevent infections in chemotherapy patients.

Investors like Amgen stock due to its focus on recombinant DNA technology. The second-largest product sold by Amgen is Enbrel which is a tumour necrosis factor blocker that is used in the treatment of rheumatoid arthritis.

Amgen has revenues of more than $25 billion producing a net income of around $7 billion a year. The company’s stock price had a reversal of fortune in 2008 with the stock price rising more than 600% to a record high of $276.69 in January 2021.

2. Gilead Sciences

Gilead Sciences (GILD) is another leader in the biotech sector with a market cap of $78 billion. The American-based company focuses on the research and development of antiviral drugs that are used in the treatment of HIV/AIDS, hepatitis B, hepatitis C and influenza.

In March 2019, Daniel O’Day took over as CEO and turned the company around after a long period of falling sales. It evolved from a biotech company to a pharmaceutical company by acquiring several healthcare entities.

The company has had its fair share of criticisms as to its popular Truvada drug which costs more than $2,000 per month in the United States but only around $100 outside of the country. The fact Gilead makes $3 billion a year on the drug led to a Congressional hearing where the CEO had to defend its pricing.

Gilead Sciences has revenues of around $27 billion a year, producing a net income of around $6 billion a year. Gilead’s stock price also produces a current annual dividend yield of 4.66%.

The stock price performed well from 2010 to 2015 when it recorded an all-time at $123.37 in June 2015. Since then, the stock price has fallen around 50%.

3. Biogen

Biogen (BIIB) is an American multinational biotech company with a market cap of roughly $31 billion. The company focuses on the discovery, development and delivery of treatments for neurological and neurodegenerative diseases such as Alzheimer’s, Parkinson’s, multiple sclerosis and more.

In March 2019, Biogen had to halt phase 3 trials of its Alzheimer’s drug Aducanumab due to regulatory issues. However, the company reversed their plans the next year which led to the FDA (Food and Drug Administration) approving the drug in June 2021 using the accelerated approval pathway.

In the past, Biogen has also partnered with companies such as Samsung to build a foothold in the biosimilars sector through its expertise in protein engineering and cell line development.

Biogen has revenues of around $10 billion a year which provides a net income of roughly $1.7 billion a year. The company does not pay any dividends as most of the profits are reinvested in the research and development of new drugs.

From 2008 to 2017 Biogen’s stock price rocketed more than 1,100% higher to create an all-time of $442.29 in March 2015. Since then, the stock price has traded in a range between $442.29 and $215.53.

4. Moderna

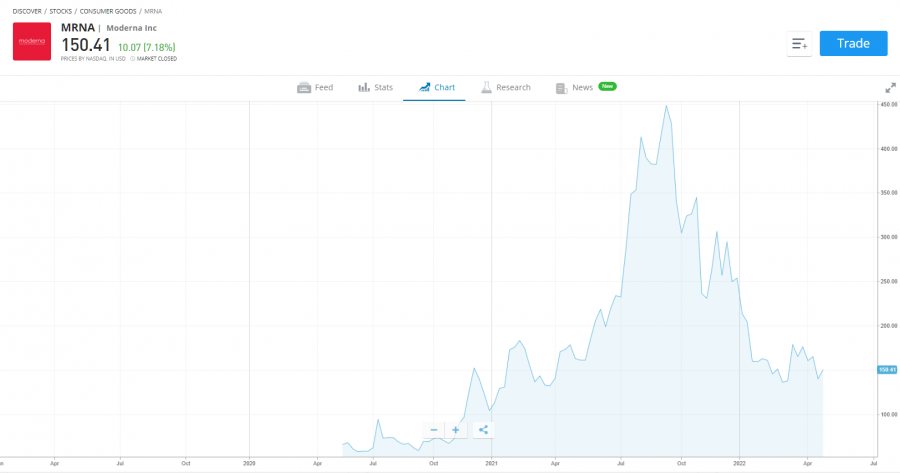

Moderna (MRNA), is a relatively new biotech company which went public in December 2018. Listed on the NASDAQ Exchange, the stock has a market cap of $60 billion. The company specialises in the development of medicines based on messenger ribonucleic acid (mRNA) technology.

Currently, Moderna has a strong pipeline of therapies using mRNA technology. This includes cancer vaccines, intratumoral immunology, regenerative therapeutics and antibody vaccines.

While Moderna has 44 treatment and vaccine candidates the only commercial product is the Moderna Covid-19 vaccine. The company’s Spikevax vaccine was approved in 70 countries and distributed in 807 million doses creating a revenue of $18.5 billion during the pandemic.

Last year, Moderna produced revenues of $18.5 billion, creating a net income of $12 billion. While most of this was from the Covid-19 vaccine, the biotech company has several vaccine candidates in the pipeline that could add to the bottom line as the need for the Covid-19 vaccine dissipates.

Since Moderna’s IPO in December 2018, the stock rocketed more than 3,200% higher to an all-time high of $497.49 in August 2021. The stock is now down nearly 70% from these levels.

5. Regeneron

Regeneron Pharmaceuticals (REGN) was founded in 1988 and has a market cap of around $74 billion. Regeneron focuses on the discovery, invention, development, manufacture and commercialisation of medicines.

The company’s products include brands such as VelocImmune, Dupixent, Praluent, Kevzara, ZALTRAP and many others. Regeneron partnered with pharmaceutical company Sanofi to develop a new drug that would help reduce cholesterol up to 72% more than its competitors.

In April 2022, Regeneron announced it would acquire Checkmate Pharmaceuticals for roughly $250 million to expand its product range of immuno-oncology drugs. The company also had its Covid-19 vaccine approved by the FDA.

Regeneron produces revenues of around $8.5 billion every year, creating a net income of roughly $3.5 billion. The stock price had its most notable period between 2008 and 2015, surging more than 2,500% higher.

However, the stock price languished between 2015 and 2020 before surging higher to create new all-time highs in early 2022.

6. Vertex

Vertex Pharmaceuticals (VRTX) is another American biotechnology company with a market cap of around $69 billion. The company specialises in the discovery, development, manufacturing and commercialisation of small molecule drugs for patients with serious diseases such as influenza, viral infections, autoimmune diseases, cancer, etc.

The company’s main products include Ivacaftor, Lumacaftor and Texacaftor. These drugs are used to treat more than half of cystic fibrosis patients in the United States, Canada, Europe and Australia.

Vertex is also involved in genetic therapies and has entered into collaborations with CRISPR Therapeutics, Moderna and Arbor Biotechnologies. The company’s pipeline looks strong with drugs targeting sickle cell disease, muscular dystrophy and kidney diseases.

Vertex has revenues of around $3 billion a year. The company has a notable earnings per stock growth rates in the biotech sector. This strength is shown in its stock price which has risen more than 2,200% since 2008.

The stock price created a record high at $306.08 in July 2020 before falling more than 40% lower. However, since October 2021, the Vertex stock price has risen 65% and is within reach of its all-time high price level.

7. Illumina

Illumina Inc (ILMN) is another biotech company with a market cap of around $50 billion and growing rapidly. The company develops, manufactures and markets life science tools and integrated systems for the analysis of genetic variation and function.

The company has a strong pipeline of products and services that are used for sequencing, genotyping and gene expression. In fact, the company managed to reduce the cost of sequencing a human genome to $1,000 from $1 million in 2007.

Illumina serves commercial clients such as pharmaceutical companies, other biotech companies, genomic research centres and academic institutions. This makes the company rather unique in its core offering which is why the likes of Bill Gates and Jeff Bezos invested $100 million in a Series A funding round in 2017.

Illumina makes around $4.5 billion in revenue each year which provides a net income of around $0.76 billion a year. The strength of the company has led other pharmaceutical companies such as Roche to lead unsuccessful buyout bids for Illumina.

From 2019 to 2021, Illumina’s stock price rose more than 360% to a record high of $555.77 in February 2021. Since then, the stock price has fallen around 40% lower as the biotech sector focused its efforts on creating a Covid-19 vaccine.

8. BioMarin

BioMarin (BMRN) is a smaller biotech company with a market cap of $15 billion. The company specialises in the business and research of enzyme replacement therapies (ERTs). The company was the first biotech company to provide therapies for mucopolysaccharidosis type I and phenylketonuria.

The company has grown over time through regular acquisitions of other biotech firms. So far, BioMarin has acquired Huxley Pharmaceuticals, LEAD Therapeutics, Zacaharon Pharmaceuticals, Prosensa and many others.

Currently, BioMarin has six products on the market which are considered orphan drugs. These are pharmaceutical agents that treat rare medical conditions and are not profitable to produce without government assistance.

BioMarin produces annual revenues of around $1.8 billion which creates a net income of $0.85 billion. As the company is small, there is the potential for long term growth in its stock price – especially because it focuses on orphan drugs which can help to build their pipeline and medical structures.

From 2009 to 2015, BioMarin’s stock price surged more than 1,300% higher to a record high of $151.75 in July 2015. Since then, the stock price dropped around 50% and has stayed around this price level for the past several years.

9. Neurocrine Biosciences

Neurocrine Biosciences (BINX) is another smaller American biotech company with revenues of around $780 million a year. The company focuses on the development of treatments for neurological and endocrine-related diseases and disorders.

The company regularly partners with larger pharmaceutical companies such as GlaxoSmithKline, Pfizer and Abbvie. In fact, in 2017 Neurocrine partnered with Abbvie by announcing an exclusive licencing agreement for the development and commercialisation of the Parkinson’s disease drug, opicapone.

Neurocrine has a pipeline of products which includes Elagolix which is used to treat endometriosis. Some of its other products in the pipeline are already at stage 3 clinical trials.

While Neurocrine may be a smaller biotech company, its annual revenues have grown consistently over the past several years.

From 2010 to 2020, Neurocrine’s stock price rocketed more than 4,600% higher to a record high of $136.26 in July 2020. Since then, the stock has fallen 30% lower.

10. SPDR S&P Biotech ETF

An alternative – yet common – play towards biotech stocks is to invest in stocks of a biotech ETF. The SPDR S&P Biotech ETF (XBI) is a fund that already invests in biotech stocks to track the S&P Biotechnology Select Industry Index.

The fund holds stocks in 163 biotechnology companies from large-cap to small-cap biotech stocks and many which have been discussed above. If you want to invest in a biotech ETF, then you are capitalising on the growth of the overall biotech sector rather than the individual performance of a stock.

The SPDR S&P Biotech ETF has experienced strong growth over the past decade. From 2010 to 2021, the ETF rose more than 880%. It is now down 50% from its record high.

What are Biotech Stocks?

Biotech stocks are companies that are publicly traded and listed on a stock exchange, whose focus is on creating and developing technology using biology. Biotechnology aims to conquer disease, provide a sustainable environment and advance health.

While most biotechnology companies will use living organisms and molecular biology to develop products, the science is also used in other industries such as goods production, biofuels and genomics.

Biotech companies differ from pharmaceutical companies because biotech companies use living organisms while pharmaceutical companies use chemicals to create their products. Most people will be familiar with vaccines that are produced by biotech companies, such as the Covid-19 vaccine.

However, biotechnology is used in a variety of different sectors. You will often see biotechnology used in genetics to reduce infectious diseases, as well as in biocatalysts to improve manufacturing processes.

As biotech companies can provide solutions in a wide range of sectors, they have seen significant growth over the past decade.

Biotech Penny Stocks

Biotech penny stocks are defined by the price a biotech company is trading at. For example, biotech stocks under $5 fit into the penny stock category. There are also biotech penny stocks under $1. These are not to be confused with cheap biotech stocks though.

Biotech penny stocks can be very volatile. This is because penny stocks are typically new companies that are very early on in their overall business cycle. While they can exhibit some outsized growth turning into a larger company, there will be some that never make it.

Here is a list of a few popular biotech penny stocks:

- BioNano Genomics (BNGO) – A Leader in Optical Genome Mapping Technology

- Vir Biotechnology (VIR) – An Immunology-Based Biotech Penny Stock for Growth

- Zynerba Pharmaceuticals (ZYNE) – Next Gen BioTech Cannabinoid Therapeutics Company

Conclusion

As biotechnology helps to solve world problems, the growth in the sector is forecasted to be exponential. Finding the popular biotech stocks could help to diversify your portfolio.