Artificial intelligence (AI) is one of the hottest stock investment trends of 2025. Therefore, many investors are looking to gain exposure to the growth of this industry by purchasing a broad portfolio of AI stocks.

In this guide, we discuss the 10 best AI stocks to buy now for maximum upside.

Looking for a list of the best AI stocks to buy in 2025? Check out the 10 companies below, all of which are looking to capitalize on the growth of AI. Best AI Stocks to Invest in 2025

A Closer Look at the Top Performing AI Stocks to Buy

The vast majority of top AI stocks are not exclusively involved in artificial intelligence. On the contrary, AI and other emerging technologies – such as machine learning, are still a work in progress.

Nonetheless, from an upside perspective, this enables investors to benefit from the growth of AI while this niche is still developing.

Below, investors will find an evaluation of the 10 best AI stocks to buy right now.

1. Amazon – Overall Best AI Stock to Invest in

We would argue that the overall best AI stock to invest in, from a risk-management and long-term upside perspective, is Amazon. On the one hand, Amazon is not a pureplay AI stock, as it is largely involved in other business areas. In addition to its core e-commerce division, Amazon is also involved in cloud computing, drone deliveries, on-demand video, and much more.

Amazon has actually been utilizing AI for many years, most notably to help suggest suitable products and services for its e-commerce customers. With that said, Amazon has since expanded its AI capabilities into other product areas. For instance, Alexa is built around AI, which is why its responses continue to increase in accuracy and personalization.

Furthermore, Amazon warehouses and distribution centers utilize AI with the view of achieving ultra-efficiency. Not only is Amazon one of the best AI stocks to buy, but in 2025, investors have the opportunity to invest at a major discount. For instance, based on prices as of writing, Amazon stock is trading at a 35% discount when compared to the previous 12 months.

This is largely due to broader market conditions – especially in the case of tech-heavy stocks. Crucially, however, Amazon has a solid business model that is diversified across a huge number of markets, not to mention one of the most robust balance sheets on Wall Street. Therefore, Amazon is our top pick as one of the best AI stocks to watch.

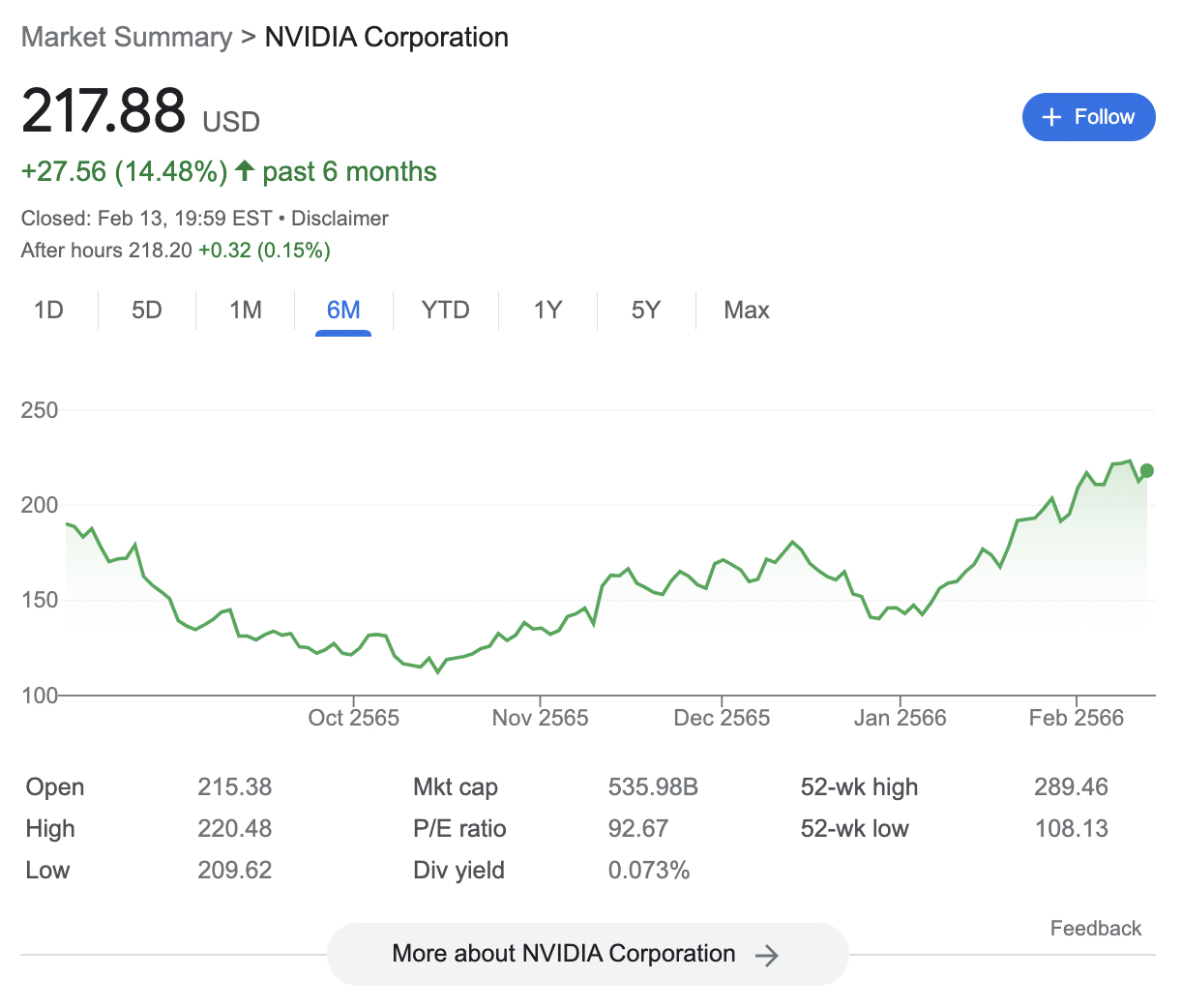

2. NVIDIA – De-Facto Chip Provider for AI and Machine Learning Data Centers

NVIDIA, with a market capitalization of over $500 billion as of writing, is one of the largest stocks on the NASDAQ. NVIDIA is active in a plethora of markets, many of which it dominates on a global stage. This is inclusive of GPUs (Graphics Processing Units) and high-performance chips. Both of which will play a major role in the future of AI and machine learning.

The reason for this is that AI consumes an unprecedented amount of data. After all, the main concept with AI is that it continues to learn and improve over the course of time, which is facilitated through historical and real-time data. Crucially, data centers that store AI-centric data utilize NVIDIA-backed chips and graphics cards.

In theory, this means that as the growth of AI continues to rise, so will demand for NVIDIA products. Therefore, this is one of the best AI stocks for 2025. Moreover, NVIDIA is also working on both hardware and software products that will facilitate self-driving cars, which in turn, are fueled by AI.

3. C3.ai – Artificial Intelligence Pureplay With a Small Market Capitalization

Those in the market for a pureplay AI stock might consider C3.ai. In a nutshell, C3.ai is a software-centric firm that enables businesses and government agencies to implement AI into their everyday processes.

New AI stocks like C3.ai offer an attractive upside potential in the long run, considering that the firm carries a market capitalization of under $2.5 billion as of writing. Moreover, C3.ai was only listed on the NASDAQ in late 2020, so it has plenty of time to grow.

With that being said, the C3.ai stock price is trading at over 80% below its initial IPO value, but this is largely due to broader market conditions. As such, this offers a great entry price to gain exposure to this AI pureplay.

4. IBM – Proven Leader in Bringing Emerging Technologies to the Mass Markets

IBM has been at the forefront of technological innovation for many decades. In fact, IBM was behind one of the first use cases for AI, when its Deep Blue supercomputer beat chess Grandmaster Garry Kasparov in 1997.

Since then, IBM has continued to invest significant amounts of capital and human resources into the research and development of AI. In today’s market, IBM serves a range of industries with its AI-centric products, including the banking world for the purpose of AML regulatory compliance.

Moreover, IBM also serves AI healthcare stocks and companies with the view of developing new treatments for age-old medical issues. Over the prior year of trading, IBM stock has seen a modest increase of 5%.

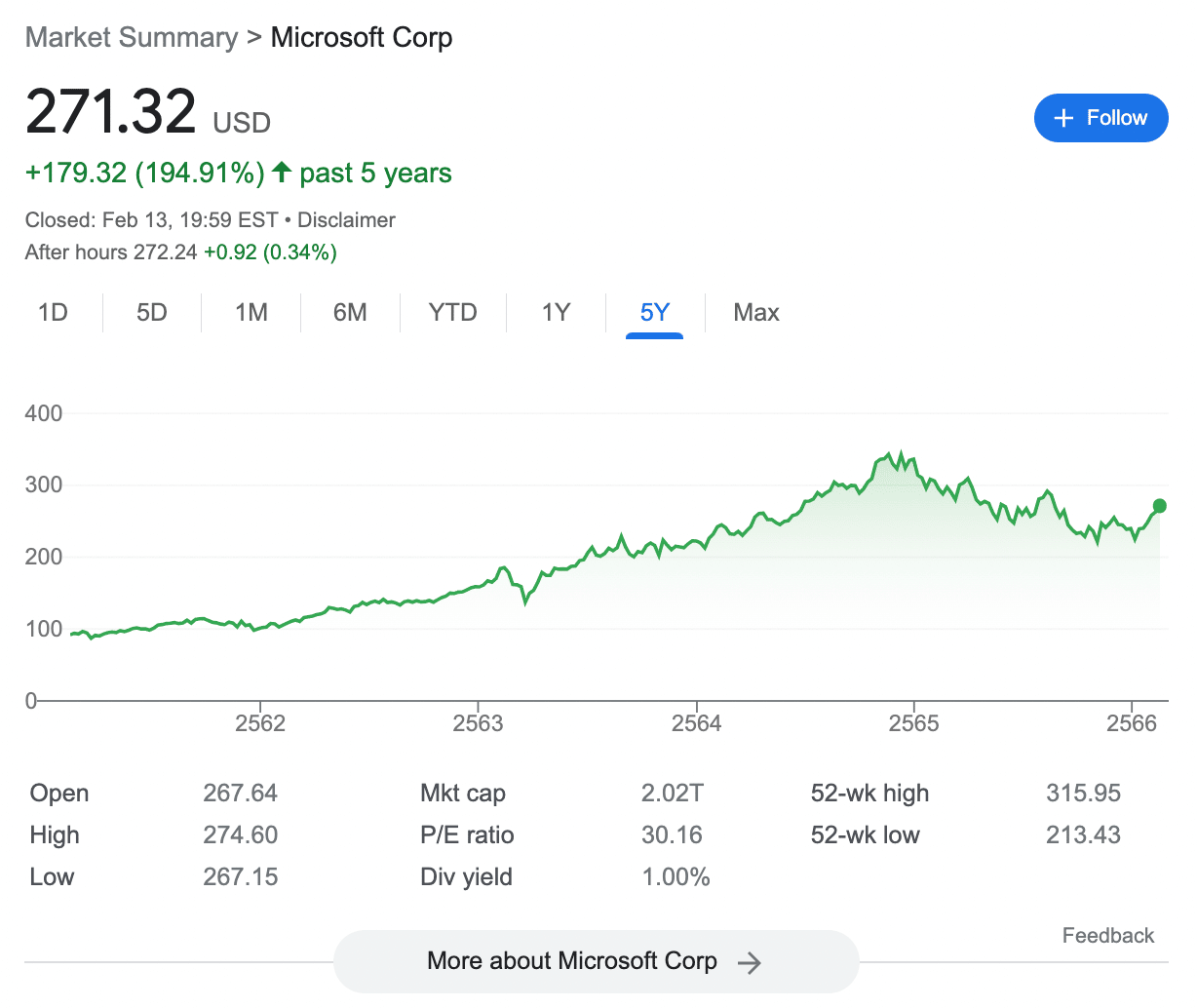

5. Microsoft – Multi-Billion Dollar Investments and Acquisitions in AI

Microsoft is another large-cap tech stock that has made its AI intentions clear. Just last year, the firm completed its much-anticipated acquisition of Nuance Communications for a reported $19.7 billion.

Nuance Communications is involved in AI-driven solutions for both consumers and businesses through human language development. Previous to this, Microsoft invested $1 billion in OpenAI, a US-based research company exclusively focused on the growth and development of AI.

Therefore, Microsoft is tipped as one of the best AI software stocks to keep an eye on in the coming years. Although Microsoft stock is down 8% over the prior 12 months, the shares are up over 190% on a five-year basis. Interested in buying Microsoft stocks? Read our useful tutorial today.

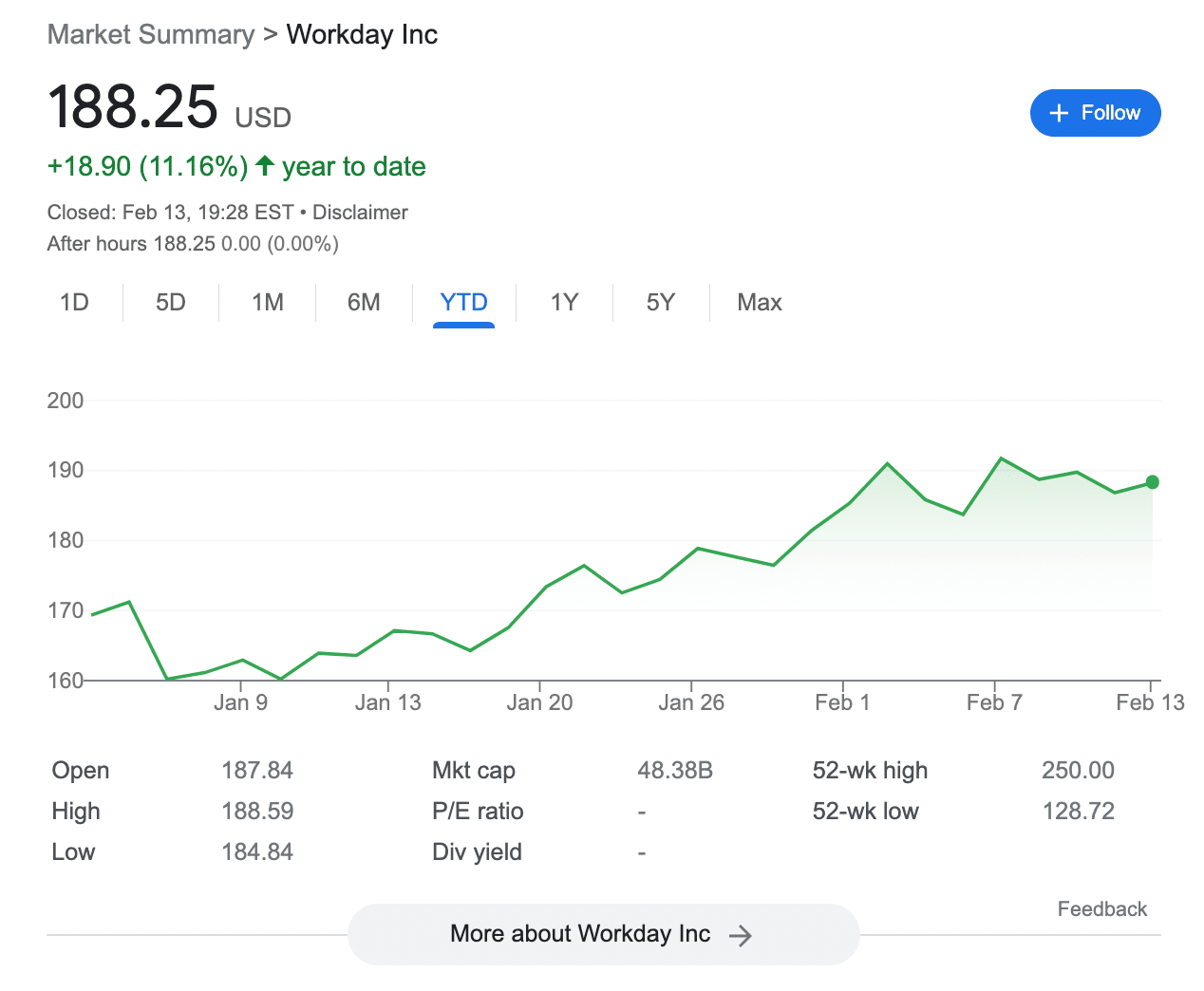

6. Workday – Cloud-Based Software Company With AI Technologies

Workday is a software company that specializes in providing business solutions for medium-to-large entities. More specifically, Workday streamlines the processes required in HR and payroll departments, alongside broader employee information.

In conjunction with the cloud, Workday utilizes AI-centric technologies to improve efficiency and reduce costs. Although many investors have not previously been exposed to the Workday model, the firm is a large-cap stock with plenty of upside in the making.

As of writing, Workday is valued at just under $50 billion. Over the prior 12 months of trading, this AI stock has declined in value by 20%, representing a notable entry for first-time buyers.

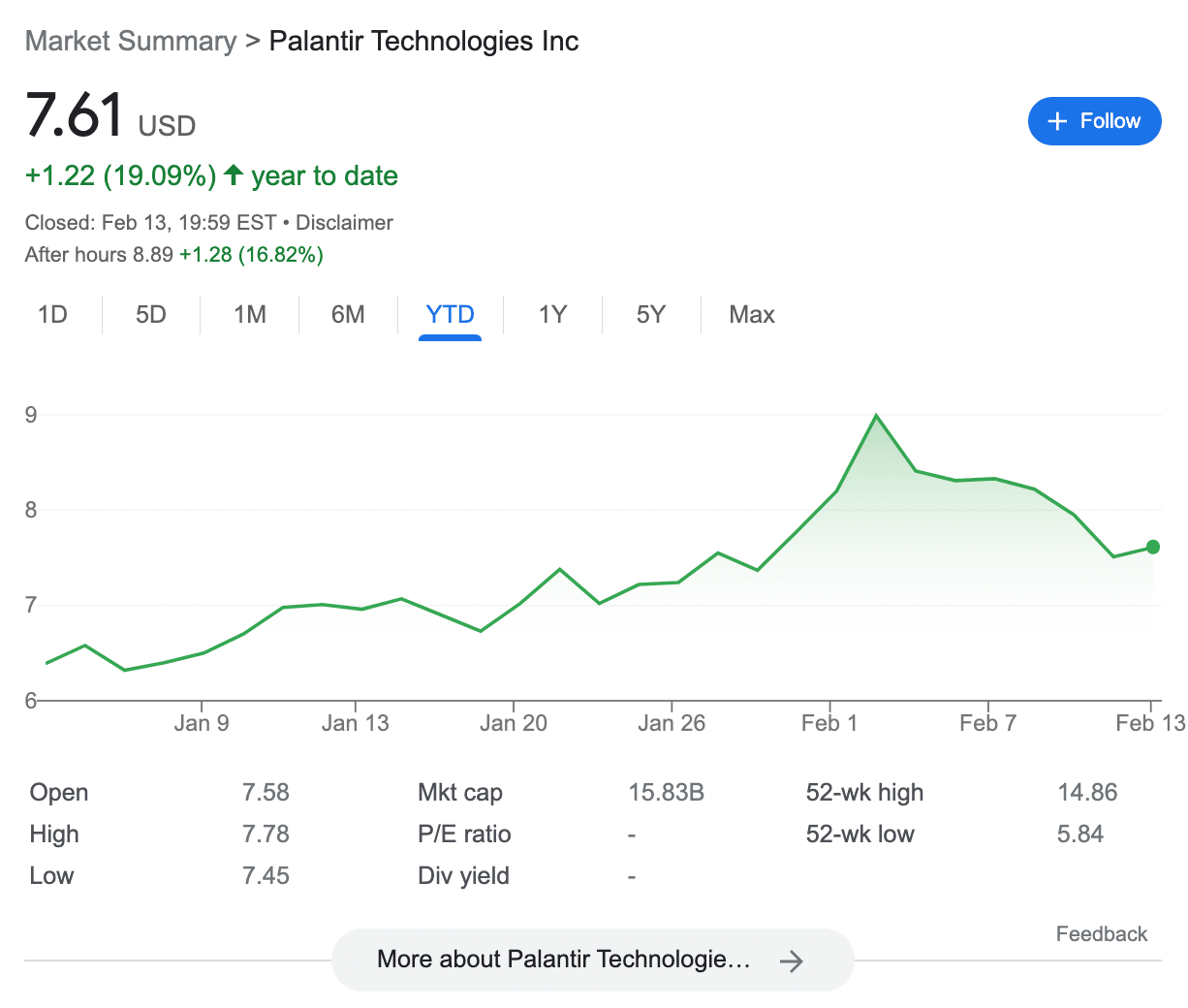

7. Palantir – AI-Centric Data Analytics for Intelligence and Insights

Palantir is a growth stock that largely serves the US defense sector for the purpose of intelligence and streamlining big data. The firm is also increasing its exposure to the corporate sector with a strong focus on improving operational efficiencies in the supply chain space.

Most importantly, the underlying technology supporting Palantir is backed by AI. This AI stock has had a volatile journey since it went public in late 2020.

Over the prior 12 months of trading, Palantir is down over 40% – which far exceeds the broader tech-heavy decline. Nonetheless, with a market capitalization of just $15 billion as of writing, this could one of the most undervalued AI stocks in the market for 2025.

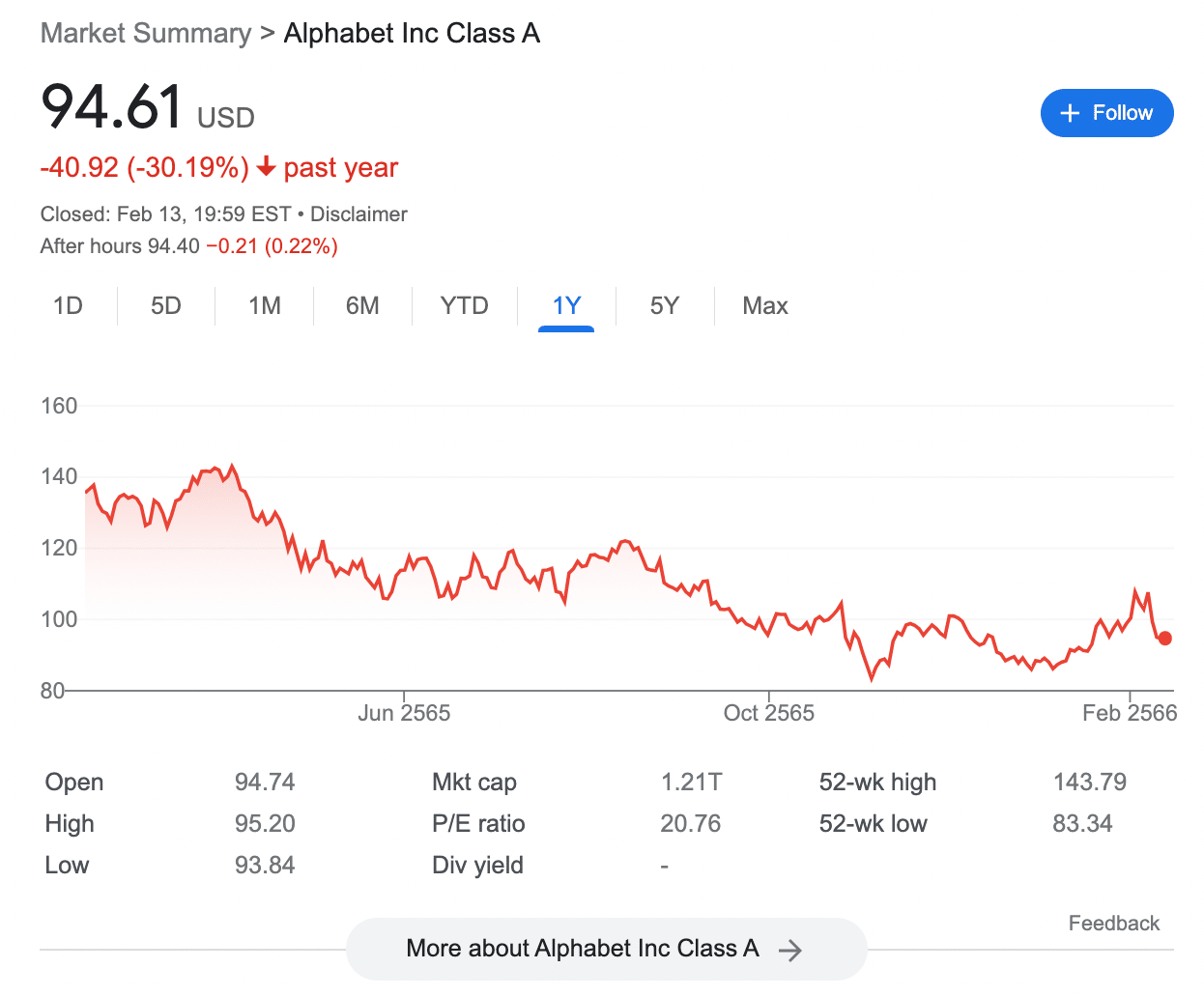

8. Alphabet – Major-Tech Giant Working on its Version of ChatGPT

There has been much discussion about Alphabet’s (Google) interest in artificial intelligence in recent months, especially with the tech giant releasing details of its AI-backed chat box that aims to compete with ChatGPT.

However, Alphabet has been actively increasing its exposure to the AI space for more than a decade. After all, Alphabet purchased the UK-based AI research laboratory DeepMind more than 10 years prior. But is this enough to convince eager investors to buy Alphabet stock in 2025?

Although Bard – Alphabet’s version of ChatGPT, is still a major work in progress, the firm has all of the required resources to bring a working product to the market in the coming years.

And when it does, Alphabet can integrate Bard into its portfolio of products – at least one of which is used by over 4 billion people globally.

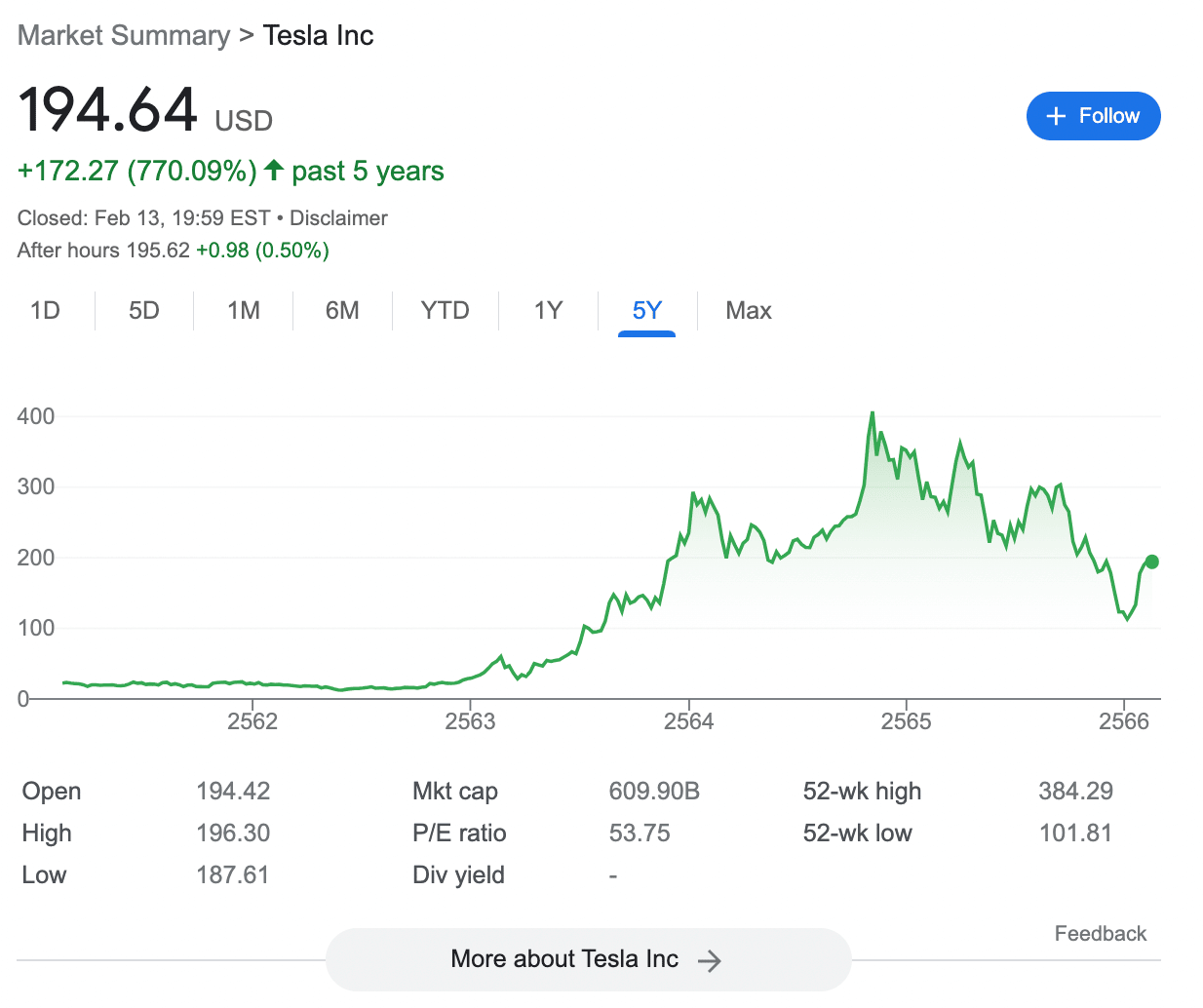

9. Tesla – AI Solutions for Driverless Cars and More

Tesla is primarily known for its electric vehicles (EVs) and is now the largest car company globally by market capitalization. With that said, Tesla continues to pump vast resources into the growth of its driverless cars.

And most importantly, this segment of the business is fully focused on AI and robotics. Some of the core niches within its AI division include dojo systems and chips, functional code foundations, and autonomous algorithms.

Tesla is also reportedly working on developing an in-house insurance division that will quote Tesla owners based on their historical driving data, which again, is backed by AI. With this in mind, many investors looking for the best sustainable investments are looking to buy Tesla stock in 2025.

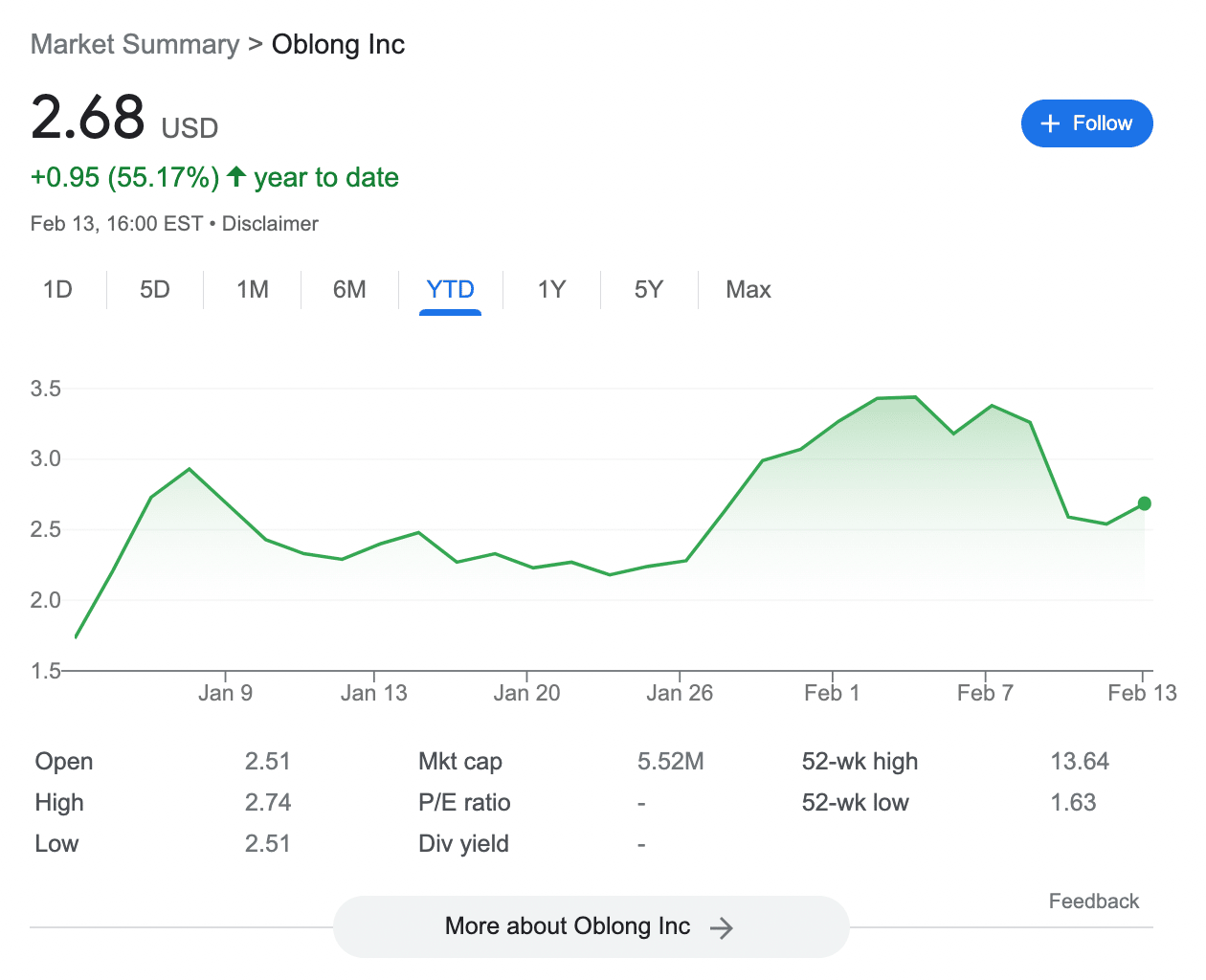

10. Oblong – Micro-Cap AI Penny Stock

Those in the market for AI penny stocks under $1 will likely be interested in Oblong. Although this penny stock is priced at just over $2 per share, this AI firm carries a minute market capitalization of just $5 million as of writing.

Oblong is currently working in collaboration with IBM to research and develop AI-centric products that can shape the computing technology space.

Year-to-date, Oblong stock has increased by more than 5.69%.

Are AI Stocks a Good Investment?

Although AI has loosely been a technological innovation since the 1950s, it is still an emerging niche. Sure, there are many online platforms that utilize AI effectively today, such as Amazon and Google, but this represents just a small fraction of the technology’s true potential.

Therefore, much in the same way as other emerging technologies, such as blockchain, machine learning, and robotics, investors still have the opportunity to gain exposure to AI while the broader industry is young. In particular, this will appeal to investors that have a preference for high-growth markets.

After all, even conservative estimates argue that the AI space will be worth more than a trillion dollars by 2030. Another factor to bear in mind is that the wider stock market – especially companies involved in AI and other tech-related areas, is currently trading at a discount when compared to prior highs.

This offers an opportunity to buy a range of the best AI stocks at an attractive entry price. Another benefit of investing in AI stocks is that, as highlighted by the 10 companies we discussed earlier, is that most participants in this market are not pure-plays. Instead, AI stocks operate in an entirely different market.

This reduces the overall risk, as investors can avoid being overexposed to AI. Ultimately, AI, alongside side other growth industries, represents the chance to catch a fast-growing trend before it truly takes off. Some would argue that this is much the same as investing in social media in the 2000s or EVs in the 2010s.

AI Stock Price Forecast – What Does the Future Hold

Predicting the future of individual AI companies’ stock is no easy feat. Once again, this is because the key players in this industry are not purely involved in AI. In fact, AI represents a small segment of the respective company’s overall business model.

- With that being said, many analysts in this space agree that the broader AI stock forecast will be worth well over a trillion dollars by 2030.

- Based on the current state of the AI market, this means that upside potential could be huge within the coming years.

- Predicted compound annual growth rates vary depending on the estimates.

- But, the general consensus is that AI will achieve double-digit percentage growth at least within the coming decade.

To determine the AI stock price prediction of each company, it is worth exploring sell-side analyst ratings, each of which will have a lower, average, and upper-end target.

How to Pick the Best AI Stocks to Buy

There is a significant number of both new and established companies that are looking to spearhead the growth of AI. This ranges from trillion-dollar companies like Amazon to brand-new AI startup stocks with a small-cap valuation.

Either way, knowing which companies represent the best AI stocks to buy can be challenging for beginners.

Below, we help clear the mist by explaining the most effective way to choose AI technology stocks.

Balance the Risk Exposure

In order to select the best AI stocks for an investment portfolio, it is first important to know which types of companies to target. For example, major players in this space already possess multi-billion dollar market capitalizations.

This somewhat reduced the exposure risk, as AI is likely being used to improve or build new products that are already in demand.

- For example, Amazon continues to invest in its AI and machine learning capabilities to continue offering products and services that are directly targeted to consumer needs.

- As such, by electing to buy Amazon stock, the investment isn’t exposed to AI alone.

From a risk perspective, it might be worth allocating the majority of the AI portfolio to established companies like this.

In turn, a much smaller segment of the portfolio can be allocated to high-growth, high-risk AI companies, many of which are complete startups.

Look for Acquisitions

Another notable way to find the best AI stocks is to search for companies that are making relevant acquisitions.

For example, Alphabet recently completed the $100 million purchase of Alter, an AI-based avatar creation startup. This highlights that Alphabet is serious about becoming a dominant force in the future of AI.

Similarly, Microsoft recently purchased Nuance Communications, which bridges the gap between AI and healthcare services.

There are many other examples of big tech companies acquiring small AI startups and crucially, this is a great way to assess which companies are likely to be at the forefront of the industry’s growth.

Diversify Across Multiple AI Niches

It is also wise to ensure that a diversification strategy is utilized when searching for the best AI stocks. Perhaps the best way to do this is to allocate funds to a variety of niches from within the AI industry.

For example, AI deep learning stocks like Nvidia are a leading force in the chip manufacturing space. Considering that Nvidia has invented and/or developed many emerging technologies – inclusive of GPUs, its proven track record of innovation means that it could be a great starting point for AI investors.

Other notable areas of AI to focus on include software. There is every belief that AI-driven software packages will streamline many of the tasks we perform today, so keep an eye on companies active in this space.

Additionally, not only is Palantir considered one of the best cybersecurity stocks, but it also making waves in AI. In particular, Palantir is looking to expand its AI capabilities to service the corporate sector, thus reducing its reliance on governmental contracts.

Look for Small-Cap Gems

So-called small-cap gems refer to AI stocks that carry an ultra-small market capitalization. In turn, the risks are super-high, considering that small-cap AI stocks are usually startups that have recently been listed on an exchange.

With that said, an appropriate risk-management strategy alongside diversification can yield attractive returns in the long run. As such, there is no harm in allocating funds to AI companies at the very start of their journey.

Just ensure that this is countered with some solid alternatives that are established in their primary marketplace.

Balance Sheet and Broader Fundamentals

It goes without saying that investing in AI research and development is an expensive practice, considering that results will likely not be financially realized for many years.

As such, when picking a portfolio of the best AI stocks to invest in, it is wise to consider the broader fundamentals of each company.

For example, big tech firms like Amazon, Apple, and Alphabet have highly robust balance sheets with many tens of billions of dollars in free cash flow. As such, they have the financial means to invest in the progression of their AI products and services.

In comparison, smaller-cap companies involved in AI will likely not have anywhere near the same resources, so this prevents a considerable risk from the perspective of an investment portfolio.

Look for Managed AI-Centric Portfolios

Rather than attempting to pick the best AI stocks on a DIY basis, it could make more sense to opt for a relevant ETF or managed portfolio. This presents a wide range of benefits, such as:

- Not needing to extensively research AI stocks

- Instantly diversifying across a range of AI investments

- Having the AI stock portfolio rebalanced and maintained passively

The Global X Robotics and Artificial Intelligence ETF is a great example of this.

As the name suggests, this ETF offers exposure to both AI and robotics – which are two emerging technologies that work hand-in-hand. Some of the AI stocks held by the ETF include Nvidia, Keyence, ABB, and Cognex.

Conclusion

The artificial intelligence industry is growing year-on-year, so now could be a great time to build a portfolio of AI stocks. We have discussed the 10 best AI stocks to invest in for 2025, including Amazon, NVIDIA, and C3.ai.