5G will be the broader successor to 4G in the future, so more people are looking to invest in this technology.

As such, today we reveal the most popular 5G stocks to watch in 2022. We also explain how you can add 5G stocks to your investment portfolio.

The Most Popular 5G Stocks to Watch in 2025

Below we have listed the most popular 5G stocks to watch.

- Broadcom – Overall Most Popular 5G Stock to Watch Right Now

- Advanced Micro Devices – Large-Cap Semiconductor Company With 5G Acquisitions

- Skyworks Solutions – Connection Chip Designer With a Strong Growth Outlook

- Qualcomm – Global 5G IP Network Leader With Hundreds of Contracts

- Nvidia – Invest in a Pioneer Company Playing a Huge Role in Driving 5G Technologies

- Verizon Communications – US Multinational Communications 5G Stock With High Dividends

- Ericsson – Innovative Leader in the 5G Network Infrastructure Market

- Equinix – Global Data Centre Operator and REIT With Well-Known Tech-Giants as Clients

- Marvell Technology – Chip Design Company Focussing on Storage and Networking

- Arista Networks – Data Centre Switching Stock on the Edge of Networking Technologies

The 5G stocks we’ve chosen cover various stages of internet innovation. Next, we take a closer look at each to help you find 5G stocks.

A Closer Look at the Most Popular 5G Stocks to Watch

Wireless technology of the fifth generation, or 5G, is proving to be one of the fastest-growing fields of technology. As such, more and more investors are looking to invest in 5G.

You are probably keen to take a look at the most popular 5G stocks we listed above in more detail, so you can understand a little more about why each company should be on your investment radar.

See more information on each 5G stock below to help you decide which might be for your portfolio.

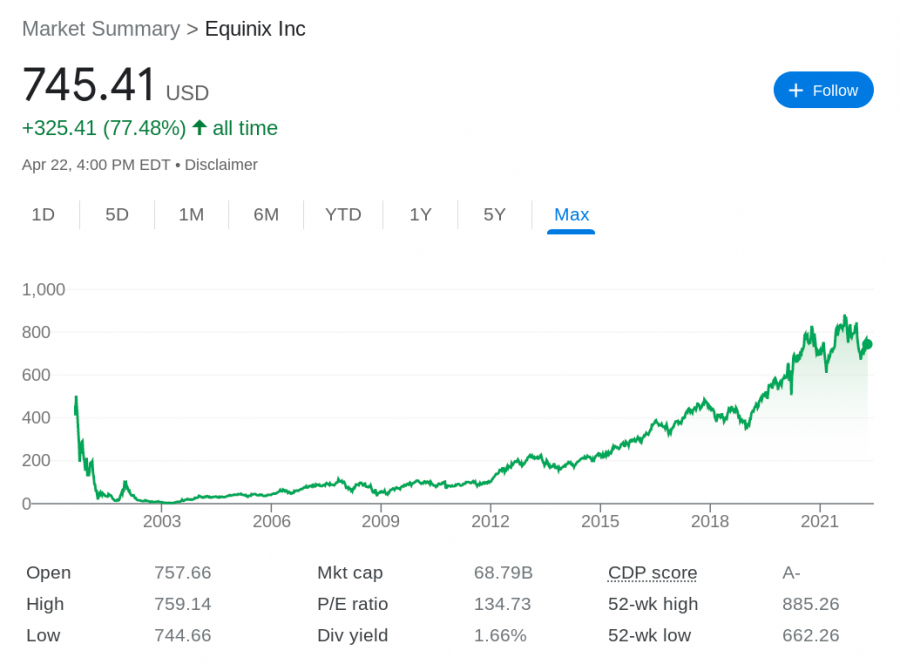

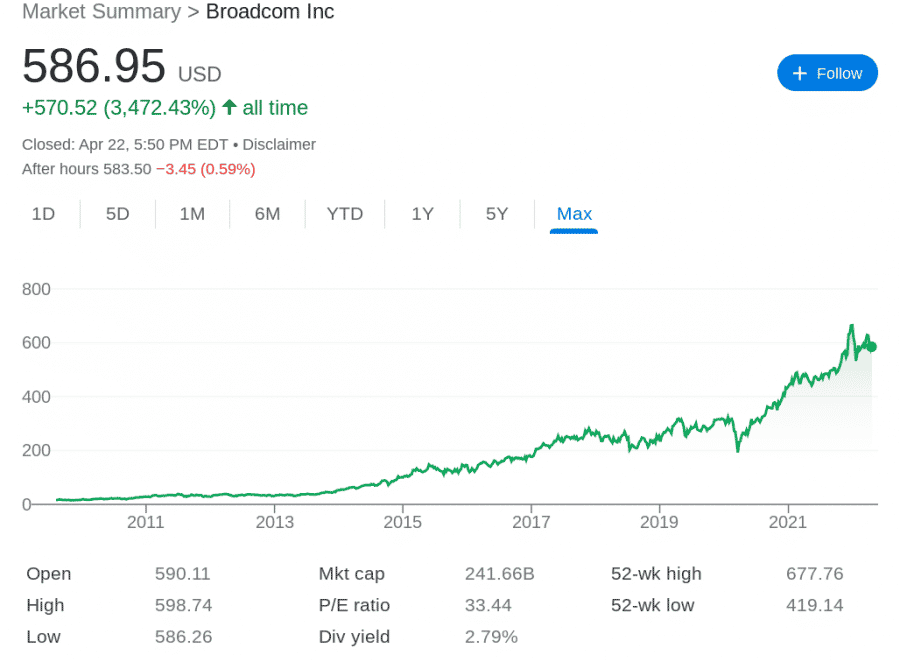

1. Broadcom – Overall Most Popular 5G Stock to Watch Right Now

Broadcom was founded in 1961. The company began life in the semiconductor division of Hewlett Packard before separating in 1999. Broadcom was bought by Avago Technologies in 2016. It was valued at just under $30 billion at that time, and six years later had a market cap of over $240 billion.

This company creates, develops, and makes various infrastructure software products and semiconductors. Broadcom is well-known in the 5G space. The company’s designs appear in base stations that generate wireless signals and in network infrastructure. These serve as the backbone of the internet within the mobile network ecosystem.

Broadcom also creates components that enable smartphones and other devices to connect to wireless networks. Some of this company’s biggest clients include Motorola, Apple, Asus, Hewlett-Packard, Logitech, Cisco Systems, IBM, Nintendo, Dell, and Nokia.

This diverse company is currently the top 5G stock to keep an eye on and is always striving to expand. For instance, Broadcom has completed several acquisitions lately aimed at integrating infrastructure management tools into its business. Since Broadcom’s software can work with network equipment, the 5G sector has improved the company’s profit margins.

The company assists clients with safeguarding and monitoring their cloud computing assets and networks. Recent reports suggest that Broadcom’s free cash flow profit margin was almost 50%. Broadcom went public in 1998 with its listing on the NASDAQ, stocks finished the trading day with gains of over 120%.

Since this time, stocks have increased by almost 3,500%. As well as supply chain shortages, the semiconductor industry took a hit in early 2021 after unconfirmed reports of China potentially invading Taiwan. The US is the world leader in semiconductor design, however only around 12% of chip production capacity is based there, and the rest is in Asia.

As such, this caused several semiconductor stocks to fall. However, Broadcom’s all-time high was just over $674 in December 2021. The increase followed the company’s announcement that 2022 would result in a higher dividend payout for investors.

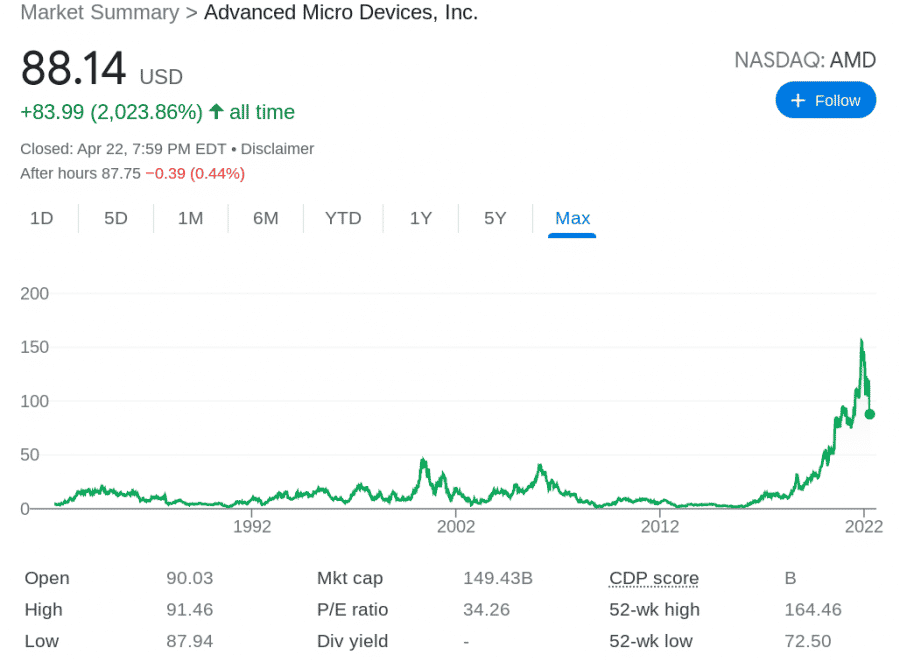

2. Advanced Micro Devices – Large-Cap Semiconductor Company With 5G Acquisitions

Advanced Micro Devices was founded in 1969. This is a multinational corporation specializing in the production of semiconductor devices for computer processing. In addition, the firm makes flash memory, graphics processors, motherboard chipsets, and a number of other components for consumer electronics.

One of the reasons Advanced Micro Devices made this list of the most popular 5G stocks is its acquisition of Xilinx, the market leader in field-programmable gate array (FPGA) processors. FPGA chips may be reprogrammed and modified at the hardware level. The versatility of these processors makes them suitable for developing the fundamental equipment needed to deploy 5G technology.

The deal, which was finalized in 2022, is set to provide Advanced Micro Devices with access to a world-class research and development department as well as increased profitability. In terms of proprietary technology, EPYC is a brand of multi-core x86-64 microprocessors. This is one of Advanced Micro Devices’ most important 5G products.

Advanced Micro Devices products and technologies are used by Google Cloud, Microsoft, Lenovo, Cisco, Atos, Netflix, Gigabyte, Dell Technologies, Supermicro, HPE, and others. Furthermore, future Samsung phones might use this company’s graphics capabilities to create specialized gaming phones.

In terms of Advanced Micro Devices stock, this company made its debut on the NYSE in 1979, before moving over to the NASDAQ in 2015. In late November 2021, Advanced Micro Devices reached an all-time high of around $162. This happened following the news that Meta Platforms had selected the company’s EPYC processors to power Facebook.

Moving forward to early 2022, stocks have fallen by almost 46% since the aforementioned all-time high. This was largely down to an analyst firm slashing Advanced Micro Devices’ stock price target price from $148 to $115, based on concerns about its performance in 2023.

Other market commentators disagree. Advanced Micro Devices reported record revenue in 2021, up 68% year-on-year. Moreover, by anticipating demand years in advance, Advanced Micro Devices has been able to avoid most of the challenges associated with the worldwide chip supply deficit we mentioned earlier. As such, this is one of the most popular semiconductor stocks for 5G.

3. Skyworks Solutions – Connection Chip Designer With a Strong Growth Outlook

Skyworks Solutions was founded in 2002 and is a wireless semiconductor company. Skyworks Solutions’ semiconductors are used for mobile communication systems and in radiofrequency. Power amplifiers, front-end modules, and RF devices for phones and wireless infrastructure equipment are among the company’s offerings.

This company is participating in 5G launches with various smartphone makers. Some of Skyworks Solutions’ key customers include Bose, Samsung, Google, Huawei, Cisco, Amazon, LG, Microsoft, Xiaomi, and Honeywell. Furthermore, Apple accounts for nearly half of the income of the connection chip designer.

This Skyworks Solutions also has a growing portfolio of solutions for additional 5G devices including modems and linked equipment, which includes anything from healthcare gadgets to connected automobiles. In early 2022, Skyworks Solutions announced that it will collaborate with Silicon Laboratories.

The aforementioned infrastructure and automotive business will be purchased for $2.7 billion. Following the acquisition of Silicon Labs, Skyworks Solutions will have a portfolio of carmakers. As such, Skyworks will be well-positioned to serve automakers by building the high-end processors required for such technologies.

The aforementioned acquisition will allow the company to diversify its income stream. The company has been publicly listed since 1968. 2021 was a volatile year for this 5G stock. The year started out well with strong earning reports (revenue increased by over 60%) and Skyworks Solutions reached its all-time high of $193 in July.

However, the supply issues faced by many semiconductor companies weighed heavy. By the end of the year, the stock was around 21% lower than its previous high. That said, with drivers like IoT, connected vehicle proliferation, and 5G adoption, Skyworks is in an excellent position to grow.

4. Qualcomm – Global 5G IP Network Leader With Hundreds of Contracts

Qualcomm is a global leader in services related to wireless technology, software, cellular connectivity, and semiconductors. Just about every device uses this company’s technology, making it one of the most popular 5G stocks to invest in. Some of its products include optimized software, modems, RF systems, processors, 4G and legacy connectivity solutions, and of course 5G.

Essentially, everything a business would need to design and build sophisticated wireless applications and products. Qualcomm’s biggest customers include Samsung, Apple, Huawei, Nokia, Microsoft, Lenovo, Sony, and Vivo, but there are many more high-profile clients using its technology.

Moreover, the company has a background in sophisticated driver-assistance systems in the automotive industry. This multinational corporation has partnered with BMW to provide a self-driving chip, as well as Ferrari, Nio, Tesla, Mercedes, and over 30 others. As such, the company is in high demand.

In terms of its stock, Qualcomm became publically listed in 1991 at $16 per share. Since then, the stock has increased in value by over 24,000%. Qualcomm’s revenues are rising again thanks to the 5G device upgrade boom, and the company’s total potential phone markets (excluding other mobile devices and automobiles) are expected to rise at an annual rate of over 10% through 2024.

Finally, for the past two decades, this corporation has paid dividends to shareholders and the running yield at the time of writing is 2.26%. In 2022, Qualcomm will complete and begin projects such as Release 17 and 18, respectively.

The company has already unveiled several 5G advancements such as the new Snapdragon Digital Chassis-connected EV platforms, Open Ran solution with Fujitsu, new end-to-end private network solutions with Microsoft, and many other exciting new 5G processes.

5. Nvidia – Invest in a Pioneer Company Playing a Huge Role in Driving 5G Technologies

Nvidia was founded in 1993 and develops wireless technology-related semiconductors, software, and services. This is one of the most popular 5G stocks to watch as it possesses patents that are fundamental to mobile communication. This includes protocols such as 5G, 4G, CDMA2000, TD-SCDMA, and WCDMA.

This company is quite the pioneer in technological advances. The graphics processing unit (GPU), which is most widely utilized in high-end video games, was invented by Nvidia. GPUs are also being employed in a variety of other applications, including AI, self-driving vehicle research, and of course 5G.

On the infrastructure equipment front, the company is expanding its footprint in the mobility sector. The company’s chip designs are assisting telecoms firms in deploying updated networks, allowing machine-to-machine communication via 5G, and supporting novel use cases such as vehicle autonomy and high-end gaming.

Well-known companies that use Nvidia technology include Microsoft, Ericsson, Softbank, and Google. Moreover, Verizon embeds the GPUs designed by this company throughout its network which includes hundreds of small cell sites, as well as its data metacenters. Nvidia has plenty of innovative products that can be used across a range of sectors.

For instance, ‘GeForce NOW’, which allows for 5G gaming, and ‘CloudXR’ which offers VR/AR experiences. The company’s technology can also be used to deliver photorealistic images over 5G via raytracing on cell phones. Put simply, raytracing is a sophisticated graphics technique that allows for realistic lighting. This makes for high-quality gameplay, which is big business.

This stock became available to the public in 1999 and has since increased in value by almost 48,500%. By 2021, stock had reached around $130. There were some dips that occurred around the time widespread supply issues affected the industry. However, by November 2021, Nvidia stock was trading at $330, which remains at its all-time high at the time of writing.

This came after the company announced its progress on its Omniverse software platform as well as strong earnings reports. In addition to 5G, use cases expand to applications such as self-driving cars and artificial intelligence, so Nvidia will continue to grow over the course of time.

6. Verizon Communications – US Multinational Communications 5G Stock With High Dividends

Verizon Communications was founded in 1983. The company focuses on integrated telecommunications. This entails providing wireless data, and internet services. Verizon’s 5G and 4G networks are utilized for netbooks, smartphones, automobiles, tablets, fixed modems, smartwatches, mobile hotspots, and other wireless devices.

Moreover, the Federal Government uses Verizon Communications for its data services, payphones, telecommunications systems, and business phone lines. Verizon Communications has been partnering with companies in different industries in a bid to bring its 5G technology to multiple markets, in particular the metaverse.

As such, this is one of the most popular 5G stocks to watch right now. Using 5G in virtual and augmented reality applications allows people to experience the virtual world and have immersive experiences in the metaverse. Following a merger with GTE and Bell Atlantic in 1998, Verizon Communications stock went public as the company we know now.

The official IPO took place in 2000. The company is listed on the NYSE, as well as the NASDAQ Global Select Market. Verizon Communications’ all-time high since the aforementioned IPO was around $62 in late 2019. Verizon Communications is also one of the most popular dividend stocks on this list. The running dividend yield at the time of writing is 4.9%.

Verizon Communications, the US’ largest mobile network, has big ambitions for 5G, including enhanced customer service and new applications like industries with robots, wirelessly linked equipment, and smart cities. The company has committed to bringing 5G to more than 100 million people.

7. Ericsson – Innovative Leader in the 5G Network Infrastructure Market

Ericsson was founded in 1876 in Stockholm and is known for its telecommunications services. The company, once known for its cell phones, is now a leader in 5G, edge computing, cloud infrastructure, and the Internet of Things. In fact, this telecommunications conglomerate was the first to deploy 5G to all four continents.

Some of the products offered by this company include mobile switching centers, radio network controllers and base stations, and service application nodes. Ericsson collaborates with service providers all over the world. The company has over 120 live 5G networks, has announced more than 170 commercial 5G agreements, and has 89 contracts in place.

This is one of the most popular 5G stocks to invest in because these figures should continue to rise in the near future. The company’s roadmap involves rapidly expanding its 5G networks across the globe. Moreover, Ericsson won an $8.3 billion 5G deal with Verizon Communications in July 2021, focusing mostly on radio access network (RAN) equipment.

Ericsson’s five-year contract with Verizon Communications is the company’s largest to date. Ericsson has been trading on the NASDAQ since the 1980s. The all-time highest price per share last happened in March 2000, when it hit $130. To date, Ericsson stock has failed to get anywhere near this all-time high.

In February 2022, the stock plummeted once again following a report that revealed in 2019 that it may have accidentally facilitated terrorist activity in Iraq. That said, Ericsson has been forthcoming with information to help the investigation and many market analysts think that this volatility will be short-lived.

Looking at the bigger picture, investors should have plenty of growth to look forward to following the aforementioned multi-year agreement, plus, as we mentioned, the company has lots of 5G contracts in place and is a leader in this field.

8. Equinix – Global Data Centre Operator and REIT With Large-Cap Clients

Equinix was founded in 1998. This is one of the most popular 5G stocks since it is the world’s largest data center operator. The company’s connectivity skills enable 5G technology to run smoothly, and it has proof in the form of many partnerships. Moreover, this company’s data centers offer lots of network providers and carriers.

The company has an alliance with a string of well-known tech giants including Nokia, Apple, Amazon, and Facebook, to name just a handful. In June 2020, Equinix launched a new Edge Proof of Concept and 5G Centre in Dallas. Its 5G facility was designed to aid cloud platforms, enterprises, mobile network operators, and vendors in connecting with Equinix’s data center.

The goal is to allow them to trial, demonstrate, and speed up complicated 5G and edge deployments – as well as interoperability scenarios. Moreover, Equinix is expanding into India. This was kick-started by Equinix’s purchase of GPX India in September 2021.

The acquisition should help the business connect to the rapidly developing South Asian market. Equinix’s unique market positioning will help it develop through network-neutral co-location. Another 5G partnership that should grow the business is its contract with Dish Network.

The companies established a partnership in November 2021. Equinix will supply connection infrastructure for Dish’s 5G network. In order to test and evaluate 5G services, the company has also partnered with Nokia. Put simply, this brings together technology suppliers, mobile network operators, and cloud platforms to test and advance 5G technologies.

Equinix was listed on the NASDAQ in 2000 and in 2015 it became a REIT (Real Estate Investment Trust). This was possible due to the company’s income-producing data centers. Trading as a REIT allows Equinix to generate substantial tax savings. This is for investors as more can be reinvested back into growing the company.

The all-time high of Equinix was $882 in early September 2021, following the aforementioned acquisition. This could be a 5G stock to watch as it is well-positioned to benefit from increased demand for interconnected data-center space, which is being driven by the adoption of enterprise cloud computing. Customers’ needs for cloud or internet services are also expanding.

9. Marvell Technology – Chip Design Company Focussing on Storage and Networking

Marvell Technology was founded in 1995 and is one of the most popular 5G stocks that is involved with semiconductor technology. The company’s primary activities are in the storage and networking space whereby it aims to design and develop industry-leading technology that can be used to move, process, secure, and store data.

The company has over 10,000 patents and its products include semiconductor devices, data, and central processing units, as well as integrated and application-specific circuits. Furthermore, Marvell Technologies has made some savvy acquisitions and collaborations in recent years.

For instance, in March 2020, Marvel Technology announced a collaboration with Nokia to design and develop 5G multi-RAT silicone innovations. In another collaboration, in August 2020, Marvell Technology announced its long-term partnership with TSMC would be extended.

For those who are unfamiliar, TSMC is the world’s biggest specialized semiconductor foundry. This enables Marvell Technology to supply a comprehensive silicon portfolio for the data infrastructure sector using the industry’s most advanced 5 nanometer (nm) manufacturing technology.

In another smart move, in April 2021, the company finished its acquisition of Inphi. This is a company that manufactures high-speed analog semiconductors for communications and computer businesses in the US. In October 2021, Innovium, a premier developer of high-performance novel switching silicon solutions for Cloud and Edge data centers, was also acquired by Marvell.

The aforementioned acquisitions will expand Marvell’s reach in 5G infrastructure and data centers. In terms of its stock, Marvell was listed on the NASDAQ in July 2000. Since then, stocks have increased by over 310%. Its all-time high stands at over $91 dollars. This came after the company announced better than expected results for the third quarter of fiscal 2021.

Specifically, the company’s net sales increased by over 60% to $1.2 billion from the previous year. All five of the company’s key business segments saw significant growth. Datacenter and industrial/automotive revenue more than quadrupled, while consumer sales, carrier infrastructure, and business networking, grew 20%, 28%, and 56% respectively.

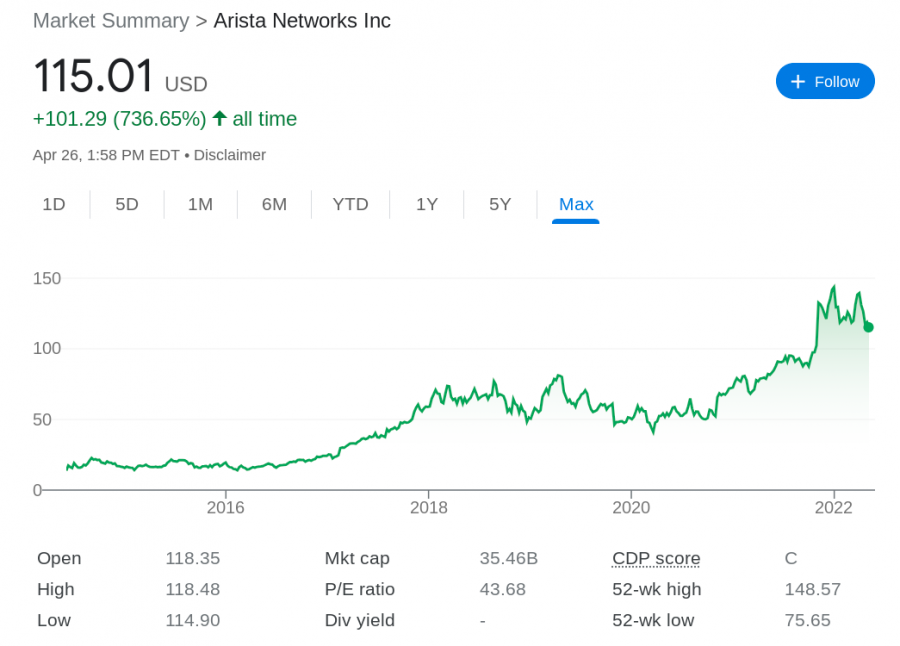

10. Arista Networks – Data Centre Switching Stock on the Edge of Networking Technologies

Arista Networks was founded in 2004 and is a US-based computer networking company with multiple awards under its belt. The firm’s hardware tends to run on cheaper third-party chips than some of its competitors. This gives the company the advantage of offering super flexible networking solutions.

In a nutshell, Arista Networks is a leading data center equipment vendor, offering open-source hardware, administration, and cybersecurity technologies. As technology expands the capabilities of mobile devices, Arista is well-positioned to gain from the associated surge in cloud computing services – making it one of the top 5G stocks.

Some of the company’s best-known clients include Microsoft, Apple, and Facebook, which speaks volumes. Moreover, data center companies like Arista Networks will play an increasingly essential role in mobile network management. This is because 5G transmits huge quantities of data, allowing ultra-high-definition video streaming or even communications for network-connected vehicles.

Arista Networks stock was listed on the NYSE in June 2014 at $43 and has since increased by almost 737%. By the end of October 2021, Arista Networks stock was a little over $100 per share, within a week it was trading at almost $133. This illustrates an increase of over 30%. This happened after the company reported a 24% increase in revenue year on year.

Specifically, revenue grew to over $749 million, which was $11 million more than expected. At the end of December 2021, Arista Networks reached an all-time high of over $148. This was largely thought to be down to an increase in data orders from Facebook and a potential increase in corporate campus sales which could be to the tune of $400 million.

Over a year of trading, Arista Networks stock has increased by over 43%, whereas one of its main competitors, Cisco, has fallen by 1%. This top 5G stock leads the market for 100 and 400-gigabit ports, which is a crucial measure for the fastest networks.

How to Find the Most Popular 5G Stocks to Watch Now

The high internet speeds and efficiency we’ve grown to expect can only become better with a 5G network infrastructure. Of course, you can try to capitalize on this by finding the most popular stocks 5G to watch.

See some key considerations below when selecting 5G stocks for your portfolio.

How Does the Company Fit Into the 5G Sector?

When looking for the most popular 5G stocks for your portfolio, see what kind of company it is and how it fits into the sector.

See some of the most common 5G focussed company types you can watch:

- Semiconductor Manufacturers – The electronics that process data and execute orders in a computing system are the basic building blocks for 5G. These businesses produce the semiconductors that make 5G possible. Among the top chip manufacturers in this space are Broadcom, Advanced Micro Devices, Skyworks Solutions, Qualcomm, and Nvidia.

- Wireless Network Carriers – This refers to companies that operate and sell network capacity or provide other communication services. As a result, carriers are responsible for ensuring that data traffic exists and functions properly. An example of a wireless 5G network carrier would be Verizon Communications.

- Real Estate Asset Holders – A 5G REIT refers to a company that owns property that makes income from this technology. A prime example of this is Equinix, a company that owns data centers used by the likes of Apple and Facebook amongst others.

- Infrastructure and Equipment Companies – This type of 5G stock is a provider of management and network software, data center equipment, and radio transmitters. The most popular 5G stocks that fall into this category include Ericsson and Arista Networks.

As you can see, there is some variation with 5G stocks. If you can’t decide on the most popular 5G stocks to watch, you could consider buying a fractional share of each company.

Acquisitions and Partnerships

Another thing to look out for when researching the most popular 5G stocks is to see what acquisitions the company has made. This is because, if the company makes smart acquisitions, this can greatly benefit its stock, as well as growth.

For example:

- Broadcom bought MagnaCom, a developer of 5G wireless communications technology. MagnaCom was purchased for $60 million and the acquisition allowed Broadcom to gain access to a patented modulation method known as WAM.

- One of Advanced Micro Devices’ major acquisitions was Xilinx, a semiconductor and technology business that made programmable devices and software tools. The deal cost Advanced Micro Devices $35 billion.

- For Advanced Micro Devices, the transaction was game-changing, as it adds Xilinx’s adaptive computing technology and programmable processors to the company’s product lineup.

- Furthermore, Advanced Micro Devices’ research and development skills were greatly extended.

Acquisitions and mergers can create stronger profit margins, as well as increase the product or client portfolio of a company. Also, check existing and pending partnerships.

As we touched on, thanks to the ongoing strength of its relationship with TSMC, Marvell Technology has access to a full silicon portfolio for the data infrastructure sector.

In the case of Skyworks Solutions, following its purchase of Silicon Labs, it now has carmaker clients on its books so it can penetrate the autonomous driving market.

Financial Health of Company

As is the case with any stock investment, it’s important to look at the financial health of a 5G company.

Importantly, bear in mind that some firms might be on the cusp of improving their financial health by means of the aforementioned acquisitions and partnerships. Each quarter, 5G stocks must release financial statements.

This will invariably include information such as cash flow, net profit, sales, debt, turnover, and more. You can also compare data to the quarter or year before, and with competitors in the same sector.

This should give you an idea of how the company has performed over a longer period.

Are 5G Stocks a Sound Investment?

If you are still familiarizing yourself with how to invest in 5G stocks and are wondering whether this sector is right for your portfolio – read on.

5G is the Future of Fast and Efficient Internet Services

The advantages of 5G technology over the present 4G standard are plentiful. This includes speeds that are up to 100 times faster than 4G networks. Not to mention lower latencies, with data requests and responses taking as little as a few milliseconds.

It is inevitable that 5G will take over 4G, in the same way, 3G will cease to exist. As such, by learning how to buy 5G stocks now, you might find yourself making gains on your investments as demand for the technology increases.

The 5G Wireless Network Supply Chain is Vast

You can create a diverse portfolio of stocks when investing in 5G because there is a wide range of businesses making this technology a reality.

For instance, as we said, 5G stocks can be anything from chipmakers and cloud computing firms to network carriers and real estate holders. Some companies stretch across a range of areas so have a diversified revenue stream.

As we also touched on, Qualcomm’s product range includes semiconductors that allow 5G technology in anything from IoT devices and industrial equipment to smartphones, vehicles, and even network modems.

Long-Term Growth Opportunities

Although 5G technology is already available, it will take several years for companies to implement next-generation mobility services to completion.

As such, the most popular 5G stocks, such as infrastructure equipment and software companies will have plenty of opportunities to grow. This allows you to capitalize on this by investing in them.

5G stock prices will undoubtedly fluctuate over the next decade. However, they are expected to rise overall as this technology takes over the current 3G and 4G networks used around the world.

5G Penny Stocks

A 5G penny stock is a company that is trading at $5 or less. Any business with access to super-fast 5G communication technology has an opportunity to benefit from the expansion of this sector.

See a few of the top 5G penny stocks listed below:

- UTStarcom Holdings – This company develops technologies for bandwidth from mobile, streaming, and other applications. It provides services to cable and telecommunications companies all around the world including Taiwan and Japan.

- Borqs Technologies – This company is a global provider of 5G wireless technologies, IoT solutions, and innovative clean energy solutions. Borqs Technology has agreed to modify its licensing arrangements with Qualcomm in order to design and produce 5G products based on Qualcomm’s most recent technologies.

- Wireless Telecom Group – This 5G penny stock is a leading global designer and manufacturer of RF and microwave-based devices for the advanced communications and wireless sectors. It caters to cellular carriers, satellite communication firms, network equipment companies, semiconductor providers, and more. The company also offers specialized 5G radio access network solutions.

The cheap pricing of penny stocks makes them more accessible.

Where to Invest in 5G Stocks

Having researched the ins and outs of the most popular 5G stocks to invest in, consider your options when it comes to trading platforms. Ideally, you will be looking out for a convenient and cost economical online brokerage with tons of stocks.

How to Buy 5G Stocks

By now, you have more than likely decided on which is the most popular 5G stock for your portfolio, and where you want to invest.

The following guide will detail how to buy stocks.

Step 1: Open an Account

Before you can buy 5G stocks we’ve talked about today, you will need to complete a sign-up form.

- Click ‘Join Now’

- Enter a username and password

- Add your email address

Next, you will need to add your address, cell number, nationality, and date of birth.

This brokerage is regulated in multiple jurisdictions. As such, you will need to answer some simple questions about your investing experience and give your social security number. This is standard practice and takes no time at all.

Step 2: Upload ID

To complete the next step and access 5G stocks, attach your photo ID so the platform can validate the information you’ve given.

Step 3: Deposit Funds

You must now put some money into your account.

Payment method choices include credit/debit cards, Neteller, PayPal, Skrill, online banking, and wire transfers.

Step 4: Search for 5G Stocks

At this stage, you can look for your chosen 5G stock investment. Here, we are using the search bar to type in 5G stock to watch right now, which is Broadcom.

Enter the name of your top 5G stock and click ‘Trade’ when you see it.

Step 5: Buy 5G Stock

All that you need to do now is enter the amount you wish to allocate to the 5G stock.

Conclusion

Investing in a company that is involved in, or focuses on, 5G technology is simple. There are many options covering various different products, and services.

Some 5G stocks include Broadcom, Advanced Micro Devices, Skyworks, and Qualcomm.