During the Q1 2022 earnings call, Netflix (NYSE: NFLX) talked about an ad-supported tier. Disney too announced an ad-supported tier amid the streaming war.

To be sure, the ad-supported tier is quite an about turn for Netflix as the company has always supported ad-free streaming. However, the changing market dynamics and loss of subscribers in the first quarter of 2022 made Netflix rethink its strategy.

Internal documents reviewed by the Wall Street Journal show that Netflix expects to have 4.4 million subscribers for the ad-supported tier by the end of this year of which 1.1 million are expected in the US.

By the end of 2023, the company projects the subscribers to rise to 40 million with a third of these in the US. Netflix made these projections to advertisers. It partnered with Microsoft for the ad-supported tier.

Netflix Expects to Add 40 million subscribers to the Ad-Supported Tier

Reportedly, Netflix is looking to price the ad-supported tier between $7-$9 per month. The pricing looks quite aggressive looking at what other streaming companies are offering their services for. Disney, for instance, would offer the ad-supported tier at $7.99 per month. It would increase the price of the ad-free tie by $3 to $10.99.

In the most recent quarter, Disney reported streaming subscribers of 222 million which also includes the subscribers for Hulu and ESPN+. The total number of Disney+ subscribers, which includes Hotstar and core Disney+ subscribers has surpassed 150 million, which is no mean achievement considering the company launched Disney+ only in the back half of 2019.

While Disney stock has crashed this year, most analysts remain bullish and it has a consensus buy rating from analysts.

Meanwhile, in response to the WSJ report, Netflix said, “We are still in the early days of deciding how to launch a lower priced, ad supported tier and no decisions have been made.”

Amazon is Another Key Streaming Player

The streaming war is heating up. Along with Disney and Netflix, Amazon is another key player in the market and its total subscribers have also surpassed 200 million. Amazon has increased Prime prices in key markets including the UK. However, the company faces an antitrust probe over the policies related to third-party sellers on the e-commerce platform.

California’s attorney general, Rob Bonta has filed a suit in San Francisco Superior Court alleging that Amazon prohibits third-party sellers from offering lower prices on other platforms including through their own websites.

Streaming War is Heating Up: Will Netflix be the Winner?

Netflix lost 1.2 million streaming subscribers in the first half of 2022. The company is looking to win over more subscribers with its ad-supported tier. However, Wall Street has a mixed view on whether it can win the streaming war with the ad-supported tier.

Needham is among those who doubt that Netflix can win the streaming war with its ad-supporter tier. Benchmark analyst Matthew Harrigan believes that Netflix is pricing its ad-tiers quite higher which would be prohibitive for potential buyers.

Notably, there is a slowdown in digital ad spending and social media companies like Meta Platforms and Snap are among the worst affected. Meta Platforms stock hit a new 52-week low earlier this week.

However, after the over 50% fall in 2022, some analysts see Meta stock as undervalued and last month JMP advised investors to buy Meta Platforms stock.

JP Morgan and Evercore ISI Advise Buying Netflix Stock

Meanwhile, some analysts are bullish on Netflix. Today, Evercore ISI analyst Mark Mahaney upgraded NFLX stock from inline to outperform and assigned a target price of $300 on the company.

Mahaney said, “We believe these opportunities, especially the ad-supported service, constitute Growth Curve Initiatives (GCIs)—catalysts that can drive a material reacceleration in revenue growth.” He added, “We don’t believe these opportunities are factored into current Street estimates or into NFLX’s current valuation. Hence the upgrade.”

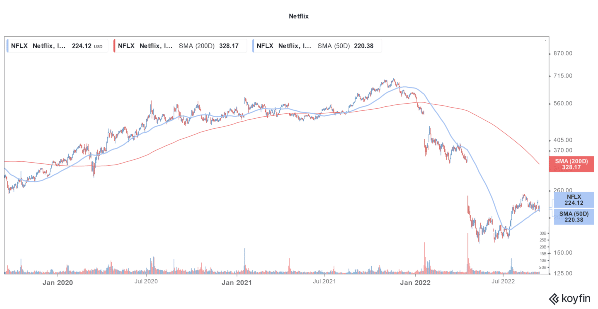

JPMorgan analyst Doug Anmuth also advises investors to buy Netflix stock and is bullish on the company’s ad-supported tier. Meanwhile, Netflix stock is down over 60% for the year. While it has recovered from its 52-week lows, it is still the worst performing FAANG as well as S&P 500 stock this year.

Tech Stocks Are Under Pressure due to Fed’s Rate Hikes

Federal Reserve’s rate hikes are also making investors apprehensive about stocks. The August CPI came in worse than expected and led to a crash in US stocks. While a 75-basis point rate hike at the Fed meeting later this month looks like a done deal, some analysts are now calling for a 100-basis point rate hike.

Cathie Wood of ARK Invest has taken a contrarian view and is instead predicting a deflation. Elon Musk and Jeffrey Gundlach have also supported Wood’s views on inflation. Wood is known to back her favorite companies and bought the dip in companies like DocuSign and Zoom Video Communications. Tesla meanwhile remains the top holding for her flagship ARK Innovation ETF.

Related stock news and analysis

- How to Invest in ETFs – With Low Fees in 2022

- After ECB, the Fed Also Looks on Track for a 75-Basis Point Rate Hike

- Best Tech Stocks to Buy in 2022 – How to Buy Tech Stocks

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption