ContextLogic (NYSE: WISH) stock is up sharply in US premarkets today after the company announced a $50 million share repurchase program shortly after completing its reverse stock split.

Based on yesterday’s closing prices, WISH has a market cap of just above $167 million so the buyback would mean it repurchasing just about a third of its shares.

The stock has had a dismal run in 2023 and fell to its all-time lows. With a YTD loss of over 51%, it is among the worst-performing stocks of this year.

WISH’s underperformance is not limited to 2023 alone though. Notably, WISH went public in late 2020 and priced the IPO at $24. It had a tepid listing but rose above $31 in February 2021. The stock was once quite popular among meme stock traders.

It has since continued to tumble and had to announce a 1-for-30 reverse stock split in order to meet the minimum exchange listing requirements.

Meanwhile, commenting on the share repurchase, Vivian Liu, WISH CFO said, “We believe that the current macroeconomic environment and the strength of our balance sheet presents an attractive buying opportunity for our stock.”

Liu added that the buyback demonstrates the company’s “confidence in the future of our business.”

WISH Stock Surges after Announcing Buyback

WISH said that the stock buyback would remain in place until the end of the year and the timing would be based on market conditions and other considerations.

Liu said, “We believe the current market does not reflect the long-term value of our shares of common stock and we believe this share repurchase program will support our efforts to unlock the long-term value and opportunity we see ahead.”

To be sure, WISH stock might seem undervalued in a sense as it had $506 million worth of cash on its balance sheet at the end of 2022 – which is over thrice its current market cap.

- Read our guide on buying undervalued stocks

Notably, last year, Citron Research termed WISH the “most asymmetrical opportunity in the market” pointing to its negative enterprise value.

That said, WISH’s cash pile has gradually come down and between 2020 and 2022 it has burnt $1.5 billion worth of cash.

Also, its financial performance has deteriorated and from a near cash flow break even in 2020 it burnt $109 million in cash in the fourth quarter of 2022.

WISH Is Posting Massive Losses

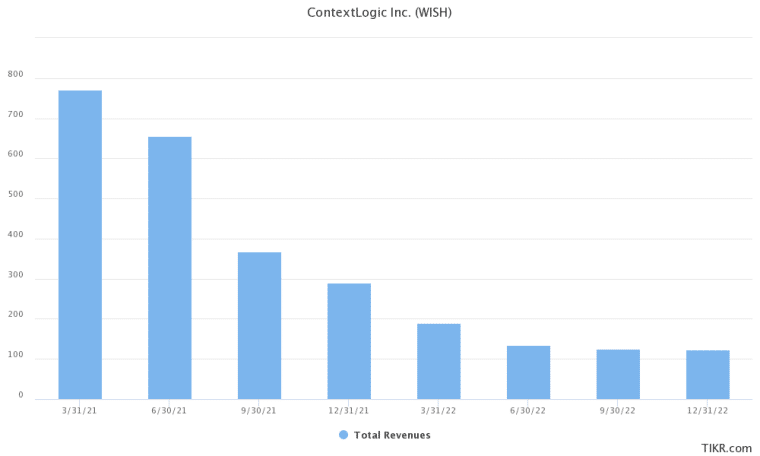

WISH reported revenues of $123 million in Q4 2022. Its sales fell 57% YoY and trailed analysts’ estimate of $152 million. Its revenues have been falling consistently and in the third quarter also sales fell 66% YoY.

The company’s revenues are a fraction of its previous highs. For instance, in Q4 2020, which was the first quarter for WISH as a publicly traded company it reported revenues of $794 million.

At the same time, its losses have widened and rose to $384 million last year as compared to $361 million in 2021.

Also, as a percentage of sales, the losses swelled to 67% in 2022 – as compared to 17% in the previous year.

ContextLogic to Report Q1 Earnings on May 4

WISH would report its Q1 2023 earnings on May 4 and previously forecast an adjusted EBITDA loss between $70 million-$80 million in the quarter.

Analysts polled by TIKR expect the company to post revenues of $123.09 million in the quarter – a YoY fall of 34.9%.

WISH has been working on lowering costs and also said off many employees. The company is working to get “back on the path to profitability and sustainable growth.”

All said, while the stock is rising on the news of the buyback, it is still a loss-making business burning millions of dollars every quarter.

Markets would next look forward to the company’s upcoming earnings for more insights into its financial health.

Related stock news and analysis

- How to Buy Wish Stock for Beginners in 2023

- Best Meme Coins to Buy in 2023

- Tesla Had Its Worst Day in Four Years but Cathie Wood Predicts Stock Hitting $2,000

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops