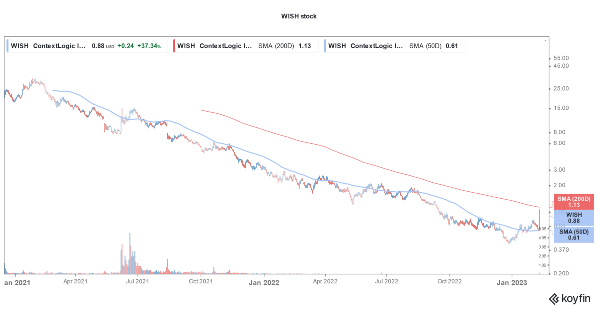

ContextLogic (NYSE: WISH), the one popular meme stock surged yesterday and is higher in US premarket price action today after Citron Research, which is led by Andrew Left tweeted about the company.

Citron Research is otherwise known for its short positions. The firm burned its fingers in GameStop in 2021 as it was short on the stock. There was a short squeeze rally in GameStop stock as retail traders took on Wall Street hedge funds.

In a series of four tweets, Citron said, “We were reluctant to mention $WISH until we saw the Super Bowl. The $Wish business model seemed terminal….and then everything changed!!! It has now become the most assymetrical opportunity in the market.”

Citron compared WISH to Temu, a subsidiary of Chinese company Pinduoduo. It tweeted, “The world has been reintroduced to the surprise discovery e-commerce model and it is being accepted.”

2/ Temu just had 2 Super Bowl ads and has recently been the #1 download app on the Apple platform. The world has been reintroduced to the surprise discovery e-commerce model and it is being acceptted. $PDD has done their homework which now finnally puts $WISH in play.

— Citron Research (@CitronResearch) February 13, 2023

Citron also pointed to the low valuation of WISH and said that it trades at a negative enterprise value of $450 million. The research firm pointed to the $832 million of cash that ContextLogic had on its balance sheet at the end of the third quarter.

WISH would release its Q4 earnings next week which might show that the cash pile has come down. Nonetheless, despite the recent surge, ContextLogic still has negative enterprise value.

WISH Stock Rises After Andrew Left’s Citron Terms It an “Opportunity”

Typically, stocks do not trade at a negative enterprise value. However, during the recent market crash, several companies, like Rivian Motors and Xpeng Motors, dropped below their enterprise value. Xpeng Motors’ valuation remains lower than other electric vehicle companies, and following the latest funding round, even Zeekr’s valuation has exceeded that of Xpeng Motors.

Zeekr is a much younger company and sold fewer cars than Xpeng last year. There is a guide on how to invest in startup companies.

Coming back to WISH, the company’s financials have deteriorated since it went public in 2020.

WISH reported revenues of $125 million in the third quarter of 2022. The revenues fell 66% YoY but were slightly ahead of estimates. The company’s core marketplace revenues fell 78% YoY to $40 million.

Its ProductBoost revenues came in at $11 million—70% lower than the corresponding quarter last year. Its Logistics revenues also fell 50% YoY to $74 million.

WISH’s net losses also widened to $124 million in the quarter, which is nearly twice the $64 million that it posted in the third quarter of 2021.

WISH has Been Posting Loses and Burning Cash

Its revenues are only a fraction of what they were at the time of the IPO. It has been posting losses and burning cash while there has been an exodus of users from the platform.

The company had 24 million MAUs in the third quarter which is only about a fourth of what it had at the time of the IPO.

There have been top-level exits at the company. Its founder and CEO Piotr Szulczewski, and CFO Rajat Bahri quit the company within months of the IPO. The turmoil did not end there and Vijay Talwar, who replaced Szulczewski last year, quit in September last year after only seven months.

Meme Stocks Have Plummeted

WISH expects to post a negative adjusted EBITDA of between $90-$110 million in the fourth quarter also. Notably, WISH went public in late 2020 and priced the IPO at $24. It had a tepid listing but rose above $31 in February 2021. The stock was once quite popular among meme stock traders.

However, meme stocks have also plummeted amid the market turmoil. Things have been tough for perennially loss-making companies like WISH and the slowing economy and rising interest rates are only compounding their problems.

WISH stock has surged on the bullish tweet by Citron. Also, despite the recent surge it still has negative enterprise value which some might see as a sign of undervaluation. However, the company’s falling user base and perennial losses and cash burn have made markets apprehensive about the company which shows in its low valuations.

Citron meanwhile believes that given the management reshuffle following which ContextLogic added several Google, Amazon, and Alibaba executives, it seems “hard to bet against considering the company’s coiled spring position.”

Incidentally, even GameStop hired executives from tech giants like Amazon and Alphabet. Many bears had then said that the move would not help as the company’s core business is in terminal decline.

Related stock news and analysis

- Best Platforms for Social Trading Cryptocurrency & Crypto Copy Trading

- Best Tech Stocks to Buy in 2023 – How to Buy Tech Stocks

- Watch Out for Inflation Data Next Week as Earnings Take a Backseat

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards