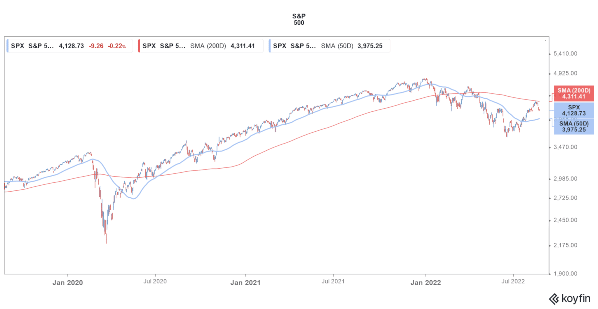

S&P 500, which is the world’s most popular index, has whipsawed in 2022. After the worst first half in decades, the index rebounded in July, making it the best month since 2020. Stocks jumped in July even as the Fed raised interest rates by 75 basis points that month.

However, the S&P 500 has looked weak in recent days, and has now closed in the red for three consecutive trading days after the minutes of the Fed’s July meeting were released last week. The minutes showed that the Fed is not looking at reversing its interest rate hike anytime soon and some Committee members favor an even tougher stance to tame inflation.

All said the S&P 500 is up sharply from its June lows when it had plunged into a bear market. Now, with markets looking on shaky ground, the view is quite divided. While some believe that the rally is over, others believe that S&P 500 should continue to rise.

Jim Cramer Believes S&P 500 Could Trend Higher

Jim Cramer believes that the S&P 500 could keep trending higher provided the job market remains strong. Despite the US economy having contracted in the first half, the employment situation has been quite strong. The economy added 528,000 jobs in July, which was over twice what analysts were expecting.

The strong job number pushed the unemployment rate to 3.5%, a nearly 50-year low. Fed’s July minutes also talked about the strong US job market. It, however, added that the Staff Economic Outlook says that “the unemployment rate was projected to start rising in the second half of 2022 and to reach the staff’s estimate of its natural rate at the end of next year.”

Morgan Stanley Finds Tesla Stock a Good Buy

While several S&P 500 constituents like Tesla and Netflix have announced layoffs, the overall job market has been strong. Analysts have a mixed view of Tesla stock. Bernstein believes that the stock is too overvalued. However, Morgan Stanley recently advised investors to buy Tesla stock.

Tesla has maintained its 50% delivery guidance despite the supply chain issues and production loss in China. On the other hand, Xpeng Motors guided for only 30,000 deliveries for the third quarter of 2022. Xpeng Motors stock fell after the tepid guidance and mixed second-quarter earnings.

Meanwhile, Morgan Stanley has a contrarian view of the markets. The brokerage was among the most bearish at the start of the year only and has reiterated its pessimistic views after the recent rally. It believes that investors might be better off in cash after the massive rally. It pointed to high yields on short-term debt investments to support its point,

Notably, Morgan Stanley’s 2022 S&P 500 target is the lowest among leading brokerages. JPMorgan is among the most bullish and expects US stocks to rise to a record high by the end of 2022.

Bank of America Says S&P 500 In a Bear Market Rally

Bank of America is also in the bearish camp and termed the rally in S&P 500 as a bear market rally. The S&P 500 rose over 17% from its June lows to August highs, which Bank of America said was similar to the average return in bear market rallies since 1929.

In July, Bank of America said that it believes that the S&P 500 would bottom in the fourth quarter, 19 October to be precise, and then we’ll see a bull market that would take the index to 6,000 by 2028.

Citing statistical data on previous bear markets, Bank of America predicted the S&P 500 to bottom at 3,000. It said that the average bear market lasts only about 289 days while stocks on average fall 37.3% between peak and trough. Bank of America also said that on average bull market lasted 64 months and stocks rise 198% over the period.

Coming back to Cramer, he dismissed the comparisons between current markets with 2001 and 2008 when stocks had crashed in the back half of the year, even as he admitted that the trajectory so far in 2022 is similar to those two years.

The S&P 500 plunged into a bear market in 2008. However, the bull market that started in 2009 lasted until 2020. It was the longest bull market on record but the COVID-19 pandemic broke the longest winning streak for US stocks.

Related posts

- Can You Buy Stocks With Credit Card? Beginner’s Guide

- ‘Recession Odds 50%’ With Inflation, Fed Hikes – Citigroup

- 10 Best Oil Stocks to Watch 2022

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption