European automotive giant Volkswagen has announced a massive 180 billion euros ($192.6 billion) investment over the next five years as it looks to scale up its EV (electric vehicle) business.

Volkswagen said that two-thirds of the investments would go towards electric vehicles and digitization. In his prepared remarks, Volkswagen CEO Oliver Blume said, “We have set clear and ambitious targets and took necessary decisions to streamline processes in FY22. FY23 will be a decisive year for executing strategic goals and accelerating progress across the Group.”

Notably, other legacy automakers are also scaling up their EV production. Ford expects to spend around $50 billion through 2026 which would increase its annual EV production capacity to 2 million by the end of 2026.

General Motors also committed to invest $35 billion on EVs between 2020 and 2025 and forecast an annual EV production capacity of 1 million by 2025.

Last year, Volkswagen delivered 572,100 BEVs (battery electric vehicles) which was 26% higher than the previous year. EVs accounted for 6.9% of its total deliveries last year as compared to 5.1% in 2021.

Volkswagen Scales Up EV Investment amid Rising Competition

The company is the market leader in the European electric car market and with deliveries of 44,200, it was the fourth-largest EV seller in the US in 2022. However, its total market share in the US—the world’s most profitable automotive market—is only about 4%. The company is targeting a US market share of 10% by the end of this decade.

General Motors leads the US automotive market while Toyota held the second rank in 2022. Ford was the third-largest car seller in the US last year but was the second-largest EV seller even as its EV deliveries trailed market leader Tesla by a wide margin.

Tesla delivered 1.31 EVs in 2022 which was 40% higher YoY. The Elon Musk-run company expects to produce 1.8 million cars in 2023. It is the largest EV seller globally and is reportedly looking to launch a new lower-priced model to further increase its target market.

Meanwhile, Volkswagen sees US and China markets as key pillars of its growth. The company has been losing market share in China which is its biggest market. However, its China EV business is doing relatively well.

Volkswagen Sees US and China as Key Growth Drivers

Last year, its EV deliveries in China rose 68% YoY while sales of ID. family of vehicles more than doubled over the period.

Notably, BYD, which sells both BEVs and plug-in hybrid cars, is the market leader in China’s NEV (new energy vehicle) market. BYD sold 193,665 cars in February, 119% higher than the corresponding month in 2022.

The company had a market share of 37% in China’s NEV market in February while Tesla had only about a 9% market share.

Tesla and Ford have admitted that Chinese EV companies are tough competitors. Furthermore, Chinese EV companies including BYD, NIO, and Xpeng Motors are expanding in Europe.

Last year, Baillie Gifford also increased his stake in NIO. Many analysts see NIO as a worthy competitor to Tesla.

EV Competition Heats Up & So Does Cash Burn

Meanwhile, EV competition has increased as both legacy automakers and startup EV companies scramble to launch models. Things haven’t been too rosy at most startup EV companies and they are battling both execution woes as well as perennial cash burn.

Yesterday, British startup EV company Arrival announced a $300 million capital raise and said that it is considering a reverse stock split to meet the minimum exchange listing norms.

Many EV companies including Arrival, Lordstown Motors, Canoo, and Faraday Future, which went public through SPAC reverse merger trade below $1 and might sooner or later need to do a reverse stock split to meet the listing requirements.

Cash burn of startup EV companies has also ballooned and Rivian which went public in 2021 in a blockbuster IPO, burnt over $6 billion cash in 2022.

For legacy automakers like Volkswagen, cash flows from the ICE (internal combustion engine) business can support the ongoing capex towards EVs. However, startup EV companies might need to raise capital at regular intervals amid perennial cash burn.

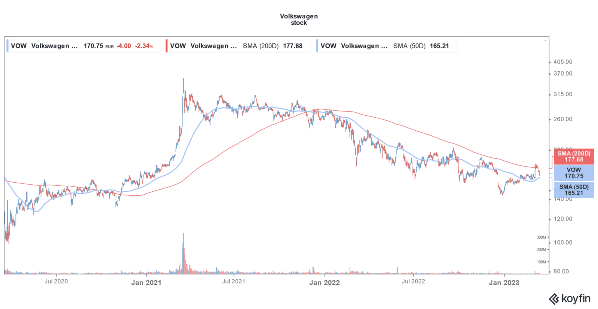

Related stock news and analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops